DIpil Das

Tapping into the China Market Using KOLs and KOCs

The growing power of social media in China has been driven by the rise of key opinion leaders (KOLs), who are celebrities and Internet influencers that hold sway in particular sectors and domains, and key opinion consumers (KOCs), who are micro-influencers. Leveraging these types of resource is a popular soft-selling strategy in China to penetrate the lucrative but competitive consumer market. Some 67% of advertisers said that KOLs became their preferred method of advertising in China in 2019, according to a survey by Chinese marketing firms AdMaster and TopMarketing. Chinese data firm TopKlout estimated that the influencer industry will be worth ¥300 billion ($43 billion) in 2020.

Chinese consumers have a long history of mistrusting companies and their products, often doubting a brand’s self-proclaimed image. As a result, they turn to influencers as a credible source for reliable opinions about brands. Influencers build a strong connection with their audience through the personable content they post on social media, fostering trust. According to management consultancy A.T. Kearney, more than 60% of Chinese consumers are receptive to online influencers, compared to 49% in the US and 38% in Japan.

KOCs Are On the Rise

KOCs are gaining popularity as a marketing strategy in China. Unlike KOLs, KOCs are regular consumers who share their reviews of products with their friends and family via videos and posts, similar to word-of-mouth marketing. Many Chinese consumers today, especially younger generations, are increasingly aware that recommendations from widely known influencers tend to be commercially driven. KOCs, on the other hand, are more akin to everyday consumers and provide opinions based on products they have used themselves—posting content that is seen as honest rather than promotional.

KOCs are different from KOLs in three ways:

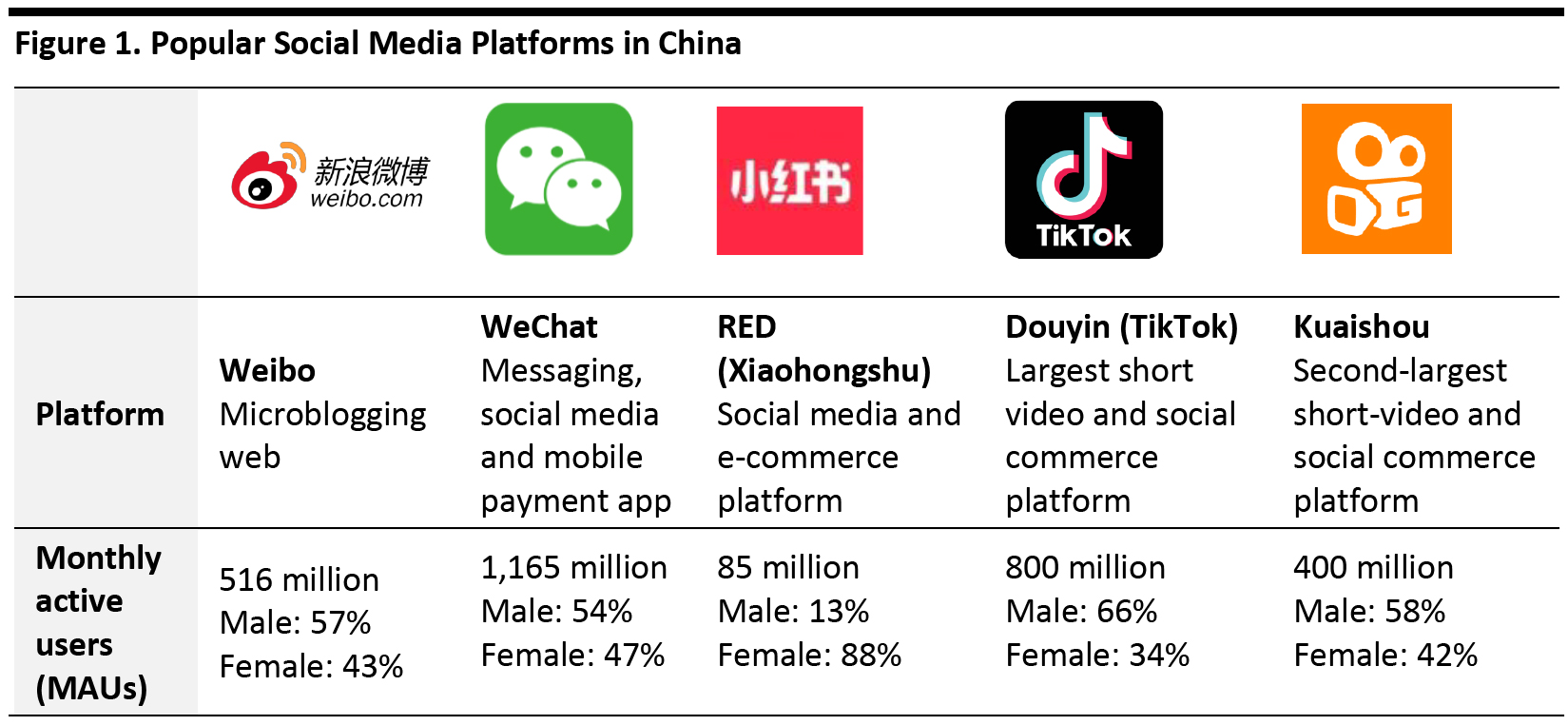

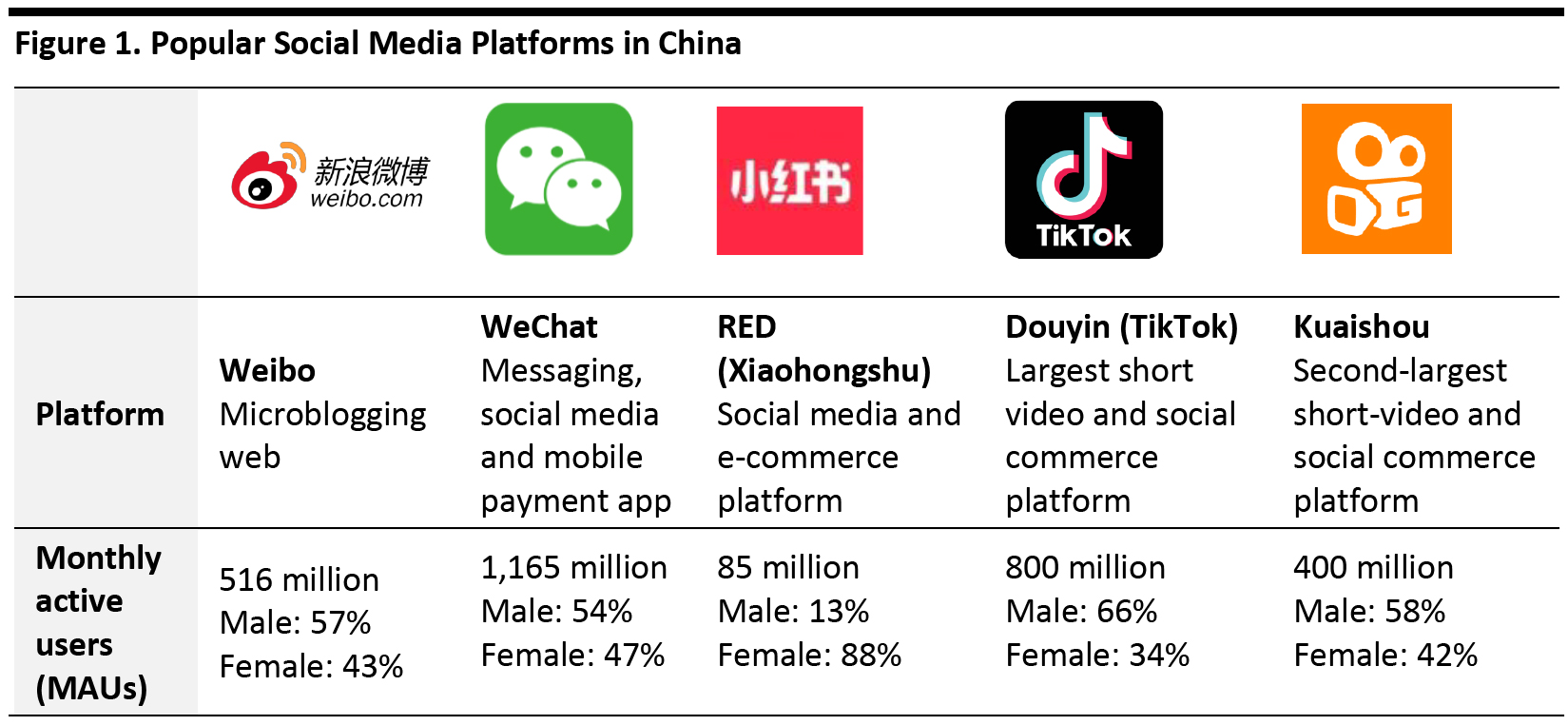

Source: Company reports/QuestMobile/Dragon Social[/caption]

Besides WeChat, Douyin and RED have features that make them suitable for KOC marketing. RED’s search algorithms would show themes and hashtags related to the content a user searches for, thus increasing the exposure of posts from KOCs who might only have few hundred followers. The more users are talking about a product or brand, the more likely the topic will appear in the search results of that product category. Douyin also uses a powerful recommendation algorithm to learn users’ interests and show them tailored content regardless of whether they follow that influencers or not.

KOC marketing has been implemented by Chinese brands to increase customers’ lifetime value beyond one-time purchases.

Source: Company reports/QuestMobile/Dragon Social[/caption]

Besides WeChat, Douyin and RED have features that make them suitable for KOC marketing. RED’s search algorithms would show themes and hashtags related to the content a user searches for, thus increasing the exposure of posts from KOCs who might only have few hundred followers. The more users are talking about a product or brand, the more likely the topic will appear in the search results of that product category. Douyin also uses a powerful recommendation algorithm to learn users’ interests and show them tailored content regardless of whether they follow that influencers or not.

KOC marketing has been implemented by Chinese brands to increase customers’ lifetime value beyond one-time purchases.

Source: Douyin[/caption]

KOLs Remain Popular

Although KOCs are gaining traction, KOL marketing remains a popular option for brands to reach wider audiences, due to the typically huge follower base of these individuals. An effective approach is therefore to work with a few top KOLs and many different KOCs, to leverage the advantages and consumer appeal of each type of influencer. Below, we discuss some of the top KOLs in China:

Source: Douyin[/caption]

KOLs Remain Popular

Although KOCs are gaining traction, KOL marketing remains a popular option for brands to reach wider audiences, due to the typically huge follower base of these individuals. An effective approach is therefore to work with a few top KOLs and many different KOCs, to leverage the advantages and consumer appeal of each type of influencer. Below, we discuss some of the top KOLs in China:

Viya’s livestreaming selling KKW products (left) and rockets (right)

Viya’s livestreaming selling KKW products (left) and rockets (right)

Source: Taobao[/caption]

- Follower base: KOCs tend to have far fewer followers than KOLs, but they are more relatable to their followers.

- Promotional costs: KOCs are typically unpaid or paid little by brands, making them a budget-friendly marketing option for smaller brands. In most cases, brands send free products to KOCs in exchange for their reviews on social media.

- Traffic source: One common approach used by KOCs is to leverage private domains to reach consumers, such as WeChat private groups, which set a limit of up to 500 participants. These types of private-channel traffic enable users in the group to stay engaged with the KOC and made aware of brand promotions or product launches as they happen.

Source: Company reports/QuestMobile/Dragon Social[/caption]

Besides WeChat, Douyin and RED have features that make them suitable for KOC marketing. RED’s search algorithms would show themes and hashtags related to the content a user searches for, thus increasing the exposure of posts from KOCs who might only have few hundred followers. The more users are talking about a product or brand, the more likely the topic will appear in the search results of that product category. Douyin also uses a powerful recommendation algorithm to learn users’ interests and show them tailored content regardless of whether they follow that influencers or not.

KOC marketing has been implemented by Chinese brands to increase customers’ lifetime value beyond one-time purchases.

Source: Company reports/QuestMobile/Dragon Social[/caption]

Besides WeChat, Douyin and RED have features that make them suitable for KOC marketing. RED’s search algorithms would show themes and hashtags related to the content a user searches for, thus increasing the exposure of posts from KOCs who might only have few hundred followers. The more users are talking about a product or brand, the more likely the topic will appear in the search results of that product category. Douyin also uses a powerful recommendation algorithm to learn users’ interests and show them tailored content regardless of whether they follow that influencers or not.

KOC marketing has been implemented by Chinese brands to increase customers’ lifetime value beyond one-time purchases.

- Perfect Diary, the first cosmetics brand to break ¥100 million ($14 million) in sales during Singles’ Day 2019, uses influencers on RED as part of its marketing campaigns, 80% of which are KOCs. The brand also drives consumers to its private-traffic WeChat group by offering discount vouchers. Perfect Diary created a virtual brand advocate called Xiaowanzi, who represents a similar profile to the brand’s target consumers and serves as a beauty adviser, friend and customer service resource in the group. There are hundreds of Xiaowanzi personal WeChat accounts run by the company’s employees that operate multiple WeChat groups; the character is used as an influencer to share product information and promotional material based on its fictional daily life and interests.

- Local Chinese cosmetics brand Proya launched a Douyin campaign in July 2019 by partnering with 200 influencers, mostly KOCs, to promote its Bubble Spa mask. Related videos went viral, and the company sold 1 million boxes of the product in one month, driving sales to surge from ¥20 million ($2.84 million) in June to ¥60 million ($8.52 million) in July 2019.

Source: Douyin[/caption]

KOLs Remain Popular

Although KOCs are gaining traction, KOL marketing remains a popular option for brands to reach wider audiences, due to the typically huge follower base of these individuals. An effective approach is therefore to work with a few top KOLs and many different KOCs, to leverage the advantages and consumer appeal of each type of influencer. Below, we discuss some of the top KOLs in China:

Source: Douyin[/caption]

KOLs Remain Popular

Although KOCs are gaining traction, KOL marketing remains a popular option for brands to reach wider audiences, due to the typically huge follower base of these individuals. An effective approach is therefore to work with a few top KOLs and many different KOCs, to leverage the advantages and consumer appeal of each type of influencer. Below, we discuss some of the top KOLs in China:

- One of the most influential KOLs, Austin Li, also known as “Lipstick King,” uses livestreaming to sell primarily beauty products. He once sold 15,000 lipsticks in five minutes through livestreaming on Taobao. Li’s selling power also extends beyond beauty: In early January 2020, Chinese food company Jinzi Ham partnered with him to promote its spicy sausage, and sales volume spiked to 100,000 in just five minutes. During the coronavirus outbreak, Li has hosted multiple charity livestreaming sessions to raise funds to fight the pandemic; one was dedicated to selling products solely from companies in Hubei province.

- Viya is also a popular livestreaming KOL on Taobao Live; she has over 18 million followers on Taobao. On April 1, 2020, Viya hosted a livestreaming session through which she sold the opportunity to launch a rocket for ¥45 million ($6.7 million). The service comes from Wuhan-headquartered firm ExPace, a subsidiary of China Aerospace Science & Industry Corporation. Viya noted that this livestreaming was not about sales, but an act to support Wuhan, Hubei province, the origin of the coronavirus. The deposit was ¥500,000 ($70,000) and was sold minutes after being broadcasted online. She has previously hosted a livestreaming session with celebrity Kim Kardashian to promote the launch of Kardashian’s KKW brand on Tmall—all 15,000 bottles of KKW perfumes sold out within five minutes.

Viya’s livestreaming selling KKW products (left) and rockets (right)

Viya’s livestreaming selling KKW products (left) and rockets (right) Source: Taobao[/caption]

- One of China’s top fashion bloggers is Becky Li, who has more than 10 million combined followers on WeChat and Weibo. Li is particularly popular among females in their thirties who reside in tier-1 cities. She partnered with automotive manufacturer MINI in 2017 and sold 100 limited edition MINI Cooper cars within five minutes. During the coronavirus crisis, she teamed up with Tmall to donate feminine hygiene products such as tampons and hand creams to female workers in Wuhan.