Nitheesh NH

The Booming Health and Wellness Market in China

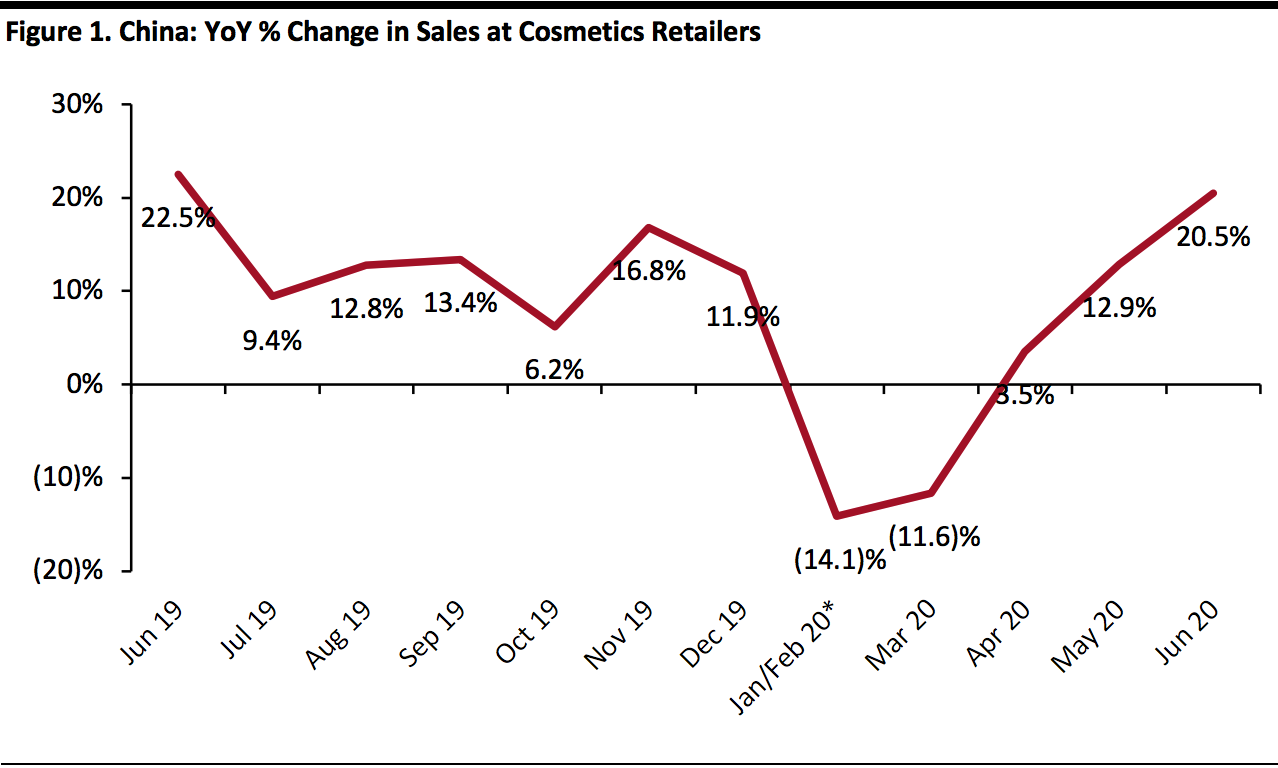

As China’s middle class continues to expand and gain more purchasing power, its consumers are placing increasing focus on health and wellness. This trend has been bolstered by the coronavirus pandemic, as consumers are looking for ways to boost their immune systems and overall wellbeing—translating to huge commercial potential for brands and retailers. Although there is no exact translation or cultural equivalent of the word “wellness” in China, categories relating to nutrition, supplements, fitness and skin care have all been well received by the nation’s consumers—especially by young shoppers in the coronavirus-impacted environment. The wellness trend was gaining traction even before the Covid-19 pandemic. According to a 2019 survey conducted by Agility Research, living a healthy lifestyle was listed as the top priority for both millennials and Gen Z consumers in China—ranking higher than finding love or achieving financial success. In addition, the survey found that 60% of millennial and Gen Z respondents spent three to nine hours per week on wellness-related activities. Health-conscious Chinese consumers are looking for high-quality products and broader approaches to help them achieve a holistic state of wellness. With a particular focus on skin care, beauty is an integral part of wellness and is one of the fastest-growing segments in China’s retail industry—and is one of the few discretionary segments to have rebounded quickly post crisis. Since April, cosmetics retailers’ sector sales have returned to growth, with sales increasing by 20.5% year over year in June. [caption id="attachment_114319" align="aligncenter" width="700"] *The National Bureau of Statistics reported January and February statistics in aggregate as it did in prior years, due to the impact of the Chinese New Year holiday

*The National Bureau of Statistics reported January and February statistics in aggregate as it did in prior years, due to the impact of the Chinese New Year holidaySource: National Bureau of Statistics of China[/caption]

Three Key Wellness Trends

1. Edible Beauty for Skin Wellness Within the Chinese retail market, beauty and health are being positioned as going hand in hand when it comes to wellness; brands are offering products that blur the boundaries between the two to appeal to consumers. As beauty wellness focuses on skin health, Chinese consumers are embracing beauty supplements and other forms of edibles as a new way to attain healthier skin. According to the Beijing Intelligence Research Group, the edible beauty market is expected to reach ¥23.8 billion ($3.4 billion) in 2022—equivalent to roughly 8% of the skincare market. Online demand for edible health products that boost beauty “inside and out” has been strong for some brands:- Australian wellness brand Swisse sells supplements and collagen beauty drinks designed to boost skin elasticity. During Singles’ Day 2019, the brand saw sales growth of 849% year over year on Tmall Global, making it one of the top 10 bestselling health brands during the festival.

- Beauty supplement brand HUM Nutrition, which launched on Tmall Global in November 2019, reported that it acheived extremely high sales during the pandemic.

- In May 2020, beverage conglomerate Coca-Cola launched a new line of beauty drinks exclusively for the Chinese market, called Zunxuan 28 Sleep-Recharged Face. The drink contains gamma-aminobutyric acid and collagen peptides that promise to boost skin health and improve sleeping patterns.

- Local Chinese food giants Mengniu and Yili have both recently moved into the edible beauty market by launching collagen drinks.

Coca-Cola’s new beauty drinks

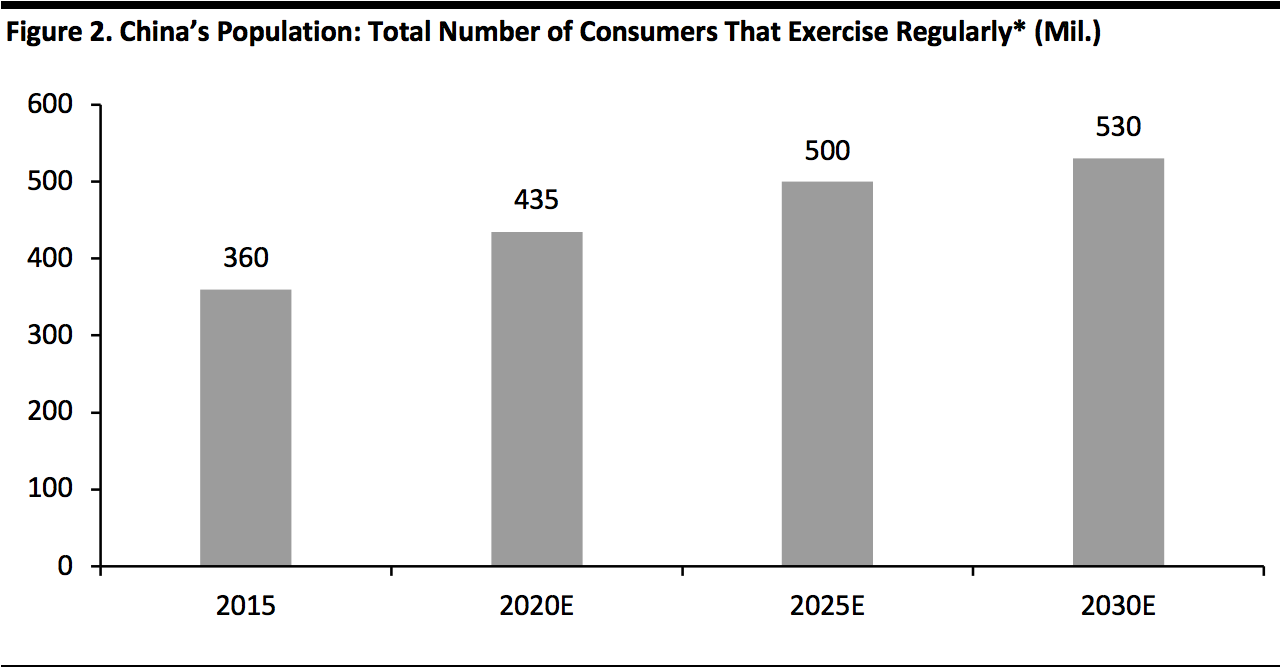

Coca-Cola’s new beauty drinksSource: Coca-Cola[/caption] 2. Physical Wellness Through Fitness China’s fitness market is witnessing rapid growth as rising numbers of Chinese consumers seek more active and healthier lifestyles. For many younger-generation consumers, fitness is not only about health, but also represents a social status symbol and an expression of self-improvement. More individuals are showcasing their healthy lifestyles on social media in China. According to China’s General Administration of Sports, the general fitness market is expected to reach ¥1.5 trillion ($223.2 billion) in 2020, with 435 million people in China exercising regularly (see Figure 2). However, this still means that less than 40% of the Chinese population report engaging in regular physical exercise—compared to 70% in the US—indicating huge potential for growth. [caption id="attachment_114321" align="aligncenter" width="700"]

*Regular exercise refers to exercising for at least 30 minutes, three times per week

*Regular exercise refers to exercising for at least 30 minutes, three times per weekSource: General Administration of Sports of China[/caption] As gyms were closed and outside exercise was limited during the coronavirus lockdown, consumers turned to home workout routines and so invested in home gym equipment. JD.com reported that for the period February 1–20, sales of yoga mats surged sixfold year over year. According to iResearch, China’s online fitness apps saw user numbers increase by 12% year over year in the first quarter of 2020, with Tencent-backed fitness app Keep leading the way—users on Keep jumped 23.2% year over year in the same period. Sports brands such as Lululemon and NIKE adapted to the changes by teaming up with fitness coaches to offer livestream classes via social apps Douyin and WeChat. Th athleisure and activewear industry are also reaping the benefits of increased consumer interest in fitness—with China representing a key driving force for the growth of many US activewear brands. Although disrupted by the pandemic, Lululemon and NIKE have seen their businesses return to growth in the second quarter of 2020 and remain confident in their long-term retail opportunities in China. Other fitness-related products, including wearables, are also well positioned for the physical wellness trend. [caption id="attachment_114322" align="aligncenter" width="700"]

Example of NIKE’s livestream fitness classes

Example of NIKE’s livestream fitness classesSource: WeChat[/caption] 3. Wellness for Mental Health Mental health is becoming a more recognized issue in China, with millions suffering from disorders such as anxiety and depression. However, many people are reluctant to admit concerns about their mental health or seek professional help, as open discussion surrounding these issues is still limited by the stigma of mental health as a sign of weakness in Chinese society. This issue was brought into the spotlight by the coronavirus pandemic. According to a survey by the Chinese Psychology Society, 42.6% of respondents tested positive for symptoms of anxiety related to Covid-19. As a result, the Chinese government has increased its attention on mental health concerns, and many local governments have started to offer free online mental health consultations. During the lockdown period in China, the number of people served by Xinli001.com, a paid online mental health counseling platform, increased by three to five times, year over year. Chinese consumers are also keen to spend more time and money to create a comfortable and relaxing environment at home to cope with stress. Content related to self-care and self-pampering routines on social media have been gaining popularity—for instance, the hashtag #UpMyHappiness on Xiaohongshu (RED) generated more than 60,000 posts as of the end of May. Items such as cozy home decorations, room fragrances, aroma diffusers and smart sleep gadgets have also seen strong demand: Sales of candles and home fragrance on Tmall jumped 75% year over year in the first half of 2020, according to Chinese data provider Taosj.

Implications for Brands and Retailers

- Chinese consumers’ growing focus on wellness unlocks many opportunities for brands and retailers. The wellness concept has expanded from physical health to include mental health, which benefits health-centric brands and may fuel new product innovation.

- Beauty continues to be one of the fastest-growing retail segments in China, and edible beauty has become an appealing concept to Chinese consumers. Health, beauty or food brands and retailers can develop beauty supplements or drinks that promise benefits that appeal to Chinese consumers, such as skin brightening, anti-aging and hydration.

- Sports and apparel brands are also seeing robust growth in China as consumers become more health-conscious and active. Fashion brands can consider expanding offerings into sports gear such as activewear, athleisure wear and sports shoes. Brands and retailers can also build digital health communities to better engage with consumers.

- The self-care and self-pampering trend among Chinese consumers presents opportunities for home decoration, lifestyle, fragrance and beauty brands.