albert Chan

In our weekly series Insights from China, we examine issues that affect international brands and retailers in China. We cover areas such as policy, consumer behavior, consumer sentiment, government regulations and the competitive landscape — as they affect the business operations and the future outlook.

This week, we look at Generation Z’s shopping behavior in China, and the implications for retailers. China’s Gen Z prefers buy now, pay later, and wants fast delivery for online orders.

Gen Z Opts for Buy Now, Pay Later Services

While there are multiple definitions of Gen Z, it can refer to those born between the mid-1990s and 2015. An April 2019 survey by Southern Metropolis Daily, a well-known Chinese newspaper, revealed that those ages 22-25 like to pay differently from older generations: Around 56% of respondents said they will use instalment services to pay for purchases, compared with just 47% of respondents aged between 26 and 29. The survey gathered data from 2,319 participants whose age ranged from 19 to 34 years old.

Installment-ecommerce platform Fenqile, a partner of the survey, also reported that Gen Zers accounted for more than half of the sales on its platform the during the Singles’ Day shopping festivals from 2016-18.

Enhancing quality of life is the top reason people gave for taking on debt to fund purchases, with 58% of the respondents indicating this as the main reason. This represents a huge shift in China’s cultural norms, as taking on debt was traditionally avoided.

Gen Z Shop via Social Media and Demand Quick Delivery

Gen Zers shop via different channels, too. They are the age group that most likely to use a brand’s social media page as a source of inspiration for most recent purchases (20%)compared to Gen X aged 38-53 (13%) and Baby Boomers aged 54-72 (8%), according to an August 2018 OC&C Strategy Consultants survey of 15,500 respondents spanning four generations and nine countries, of which 2,000 were from China.

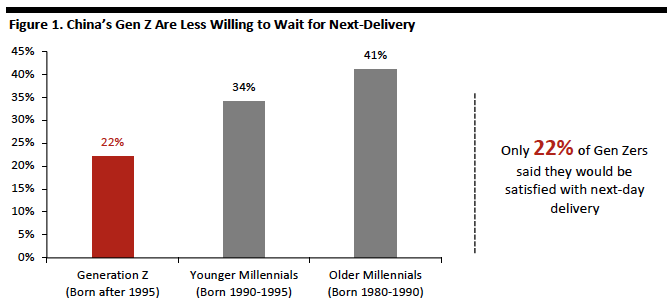

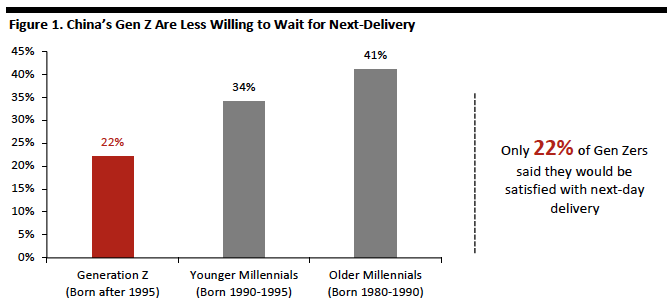

Same-day delivery is also high on the priority list for Gen Zers, with 34% saying they prefer same-day delivery, according to a 2017 Accenture survey of 10,000 consumers in 13 markets, of which 1,000 were from China. Only 22% of Gen Zers said they would be satisfied with next-day delivery, compared to 41% of older millennial customers born 1980 – 1990 who are willing to wait for next-day delivery.

[caption id="attachment_85875" align="aligncenter" width="672"] Source: Accenture[/caption]

What are the Implications for Retailers?

Retailers wanting to attract China’s Gen Z shoppers can consider offering buy now, pay later options for online, in-store and mobile transactions. Alibaba’s Huabei Pay or Just Spend, a virtual credit card launched in 2015, allows its 100 million users (as of May 2017) to pay with the Huabei instalment plan on Taobao and Tmall. With Huabei, customers can spend up to ¥50,000 (around $7,431) with the option to pay over a period of three to 12 months at different interest rates.

Retailers also need to use appropriate social media platforms to reach Gen Zers. Brands can leverage platforms such as TikTok for broadcasting and livestreaming campaigns. TikTok has approximately 500 million monthly active users – and 70% are under 24.Companies will also need to offer fast delivery —same day if possible.

Key Insights

Gen Zers in China are digitally native, rather impatient and open to taking on debt to pay the things they want. Retailers can tap this trend by offering instalment plans, such as Alibaba’s Huabei Pay. Retailers can look to social media platforms to reach Gen Z consumers.

Source: Accenture[/caption]

What are the Implications for Retailers?

Retailers wanting to attract China’s Gen Z shoppers can consider offering buy now, pay later options for online, in-store and mobile transactions. Alibaba’s Huabei Pay or Just Spend, a virtual credit card launched in 2015, allows its 100 million users (as of May 2017) to pay with the Huabei instalment plan on Taobao and Tmall. With Huabei, customers can spend up to ¥50,000 (around $7,431) with the option to pay over a period of three to 12 months at different interest rates.

Retailers also need to use appropriate social media platforms to reach Gen Zers. Brands can leverage platforms such as TikTok for broadcasting and livestreaming campaigns. TikTok has approximately 500 million monthly active users – and 70% are under 24.Companies will also need to offer fast delivery —same day if possible.

Key Insights

Gen Zers in China are digitally native, rather impatient and open to taking on debt to pay the things they want. Retailers can tap this trend by offering instalment plans, such as Alibaba’s Huabei Pay. Retailers can look to social media platforms to reach Gen Z consumers.

Source: Accenture[/caption]

What are the Implications for Retailers?

Retailers wanting to attract China’s Gen Z shoppers can consider offering buy now, pay later options for online, in-store and mobile transactions. Alibaba’s Huabei Pay or Just Spend, a virtual credit card launched in 2015, allows its 100 million users (as of May 2017) to pay with the Huabei instalment plan on Taobao and Tmall. With Huabei, customers can spend up to ¥50,000 (around $7,431) with the option to pay over a period of three to 12 months at different interest rates.

Retailers also need to use appropriate social media platforms to reach Gen Zers. Brands can leverage platforms such as TikTok for broadcasting and livestreaming campaigns. TikTok has approximately 500 million monthly active users – and 70% are under 24.Companies will also need to offer fast delivery —same day if possible.

Key Insights

Gen Zers in China are digitally native, rather impatient and open to taking on debt to pay the things they want. Retailers can tap this trend by offering instalment plans, such as Alibaba’s Huabei Pay. Retailers can look to social media platforms to reach Gen Z consumers.

Source: Accenture[/caption]

What are the Implications for Retailers?

Retailers wanting to attract China’s Gen Z shoppers can consider offering buy now, pay later options for online, in-store and mobile transactions. Alibaba’s Huabei Pay or Just Spend, a virtual credit card launched in 2015, allows its 100 million users (as of May 2017) to pay with the Huabei instalment plan on Taobao and Tmall. With Huabei, customers can spend up to ¥50,000 (around $7,431) with the option to pay over a period of three to 12 months at different interest rates.

Retailers also need to use appropriate social media platforms to reach Gen Zers. Brands can leverage platforms such as TikTok for broadcasting and livestreaming campaigns. TikTok has approximately 500 million monthly active users – and 70% are under 24.Companies will also need to offer fast delivery —same day if possible.

Key Insights

Gen Zers in China are digitally native, rather impatient and open to taking on debt to pay the things they want. Retailers can tap this trend by offering instalment plans, such as Alibaba’s Huabei Pay. Retailers can look to social media platforms to reach Gen Z consumers.