Nitheesh NH

In our monthly series, Insights from China, we examine issues that affect international brands and retailers in China. We cover areas such as policy, consumer behavior, consumer sentiment, government regulations and the competitive landscape—as they affect business operations and the future outlook.

In this report, we take a look at Alibaba’s grocery chain Freshippo and discuss the strategies and innovations behind its success in China’s highly competitive grocery market.

Source: China Chain Store & Franchise Association[/caption]

The Covid-19 pandemic has been a tailwind for Freshippo, as consumers flocked online to purchase grocery products. E-commerce penetration of Freshippo’s sales remained high, at above 60%, even after lockdowns ended: 65% of GMV in the second quarter came from online sales. In cities such as Beijing and Shanghai, online sales accounted for 75% of total revenue, according to Hou Yi, President of Freshippo. Freshippo also saw more loyal customers, contributing higher wallet share. The proportion of core customers—defined as those who shopped four days or more per month—increased to 31% in June, year over year, and average monthly spending by core customers surged 12% in June.

We identify three key innovations that have driven Freshippo’s early success in China, which we discuss below.

1. New Store Formats

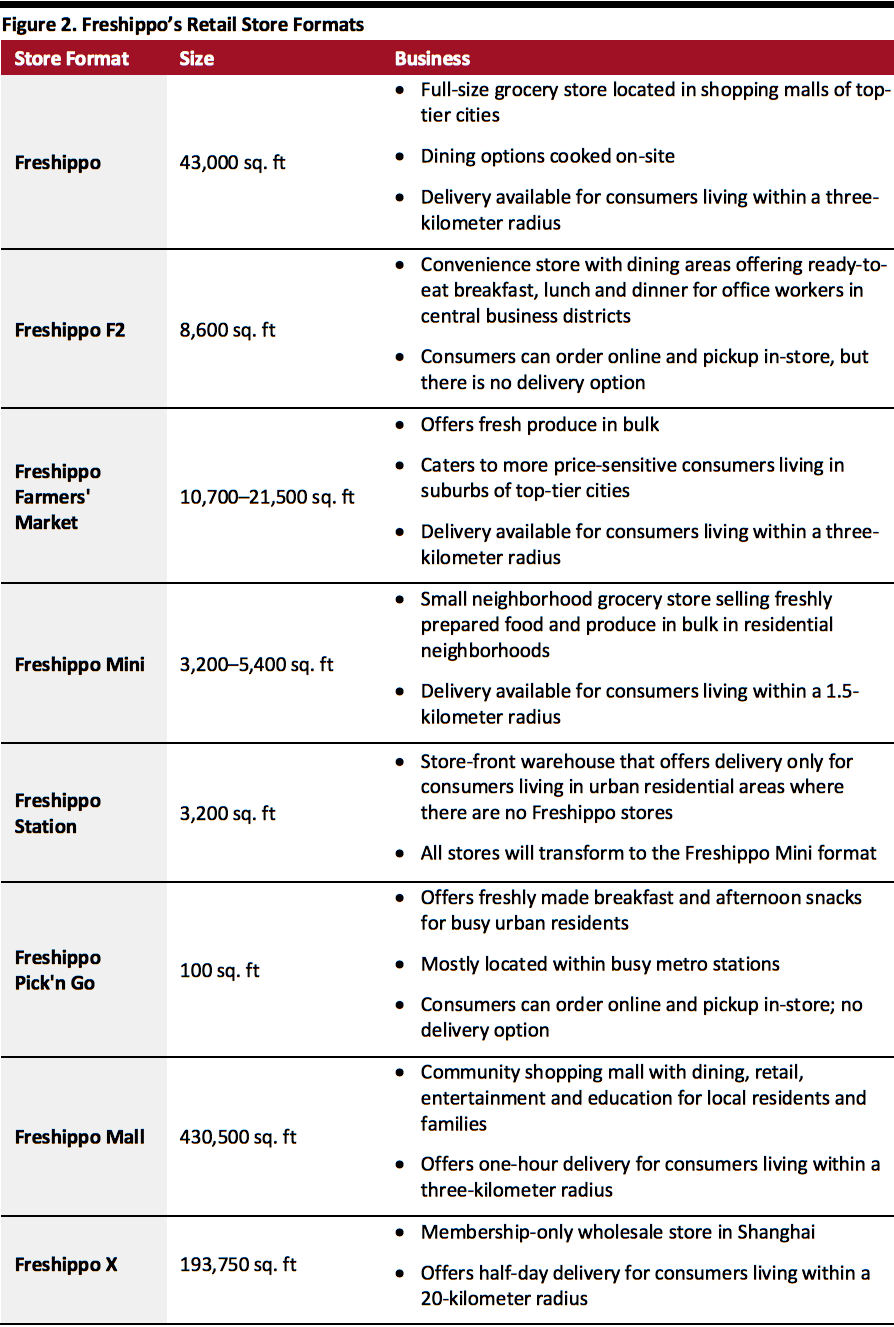

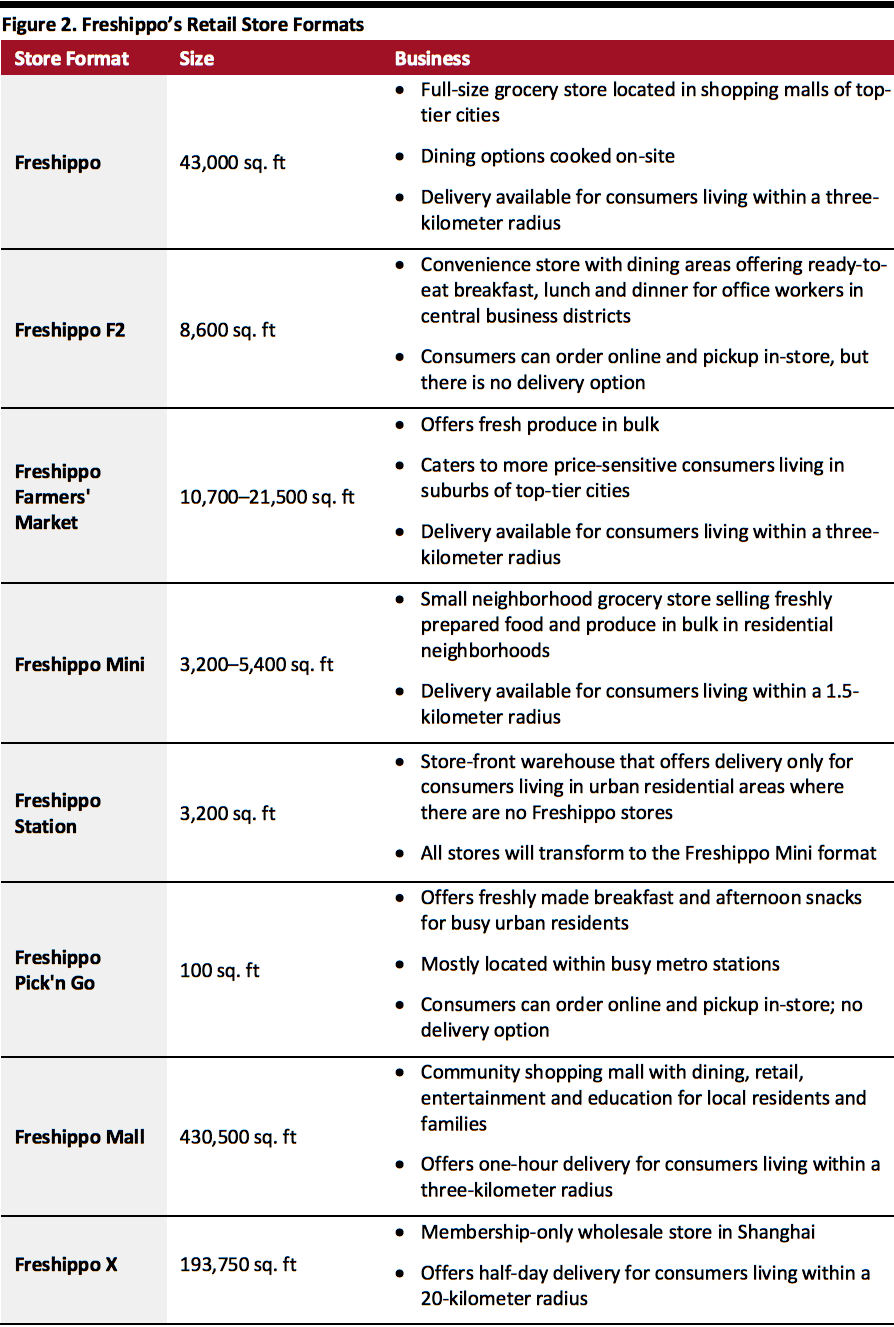

To cater to different consumer needs in different regions or cities, Freshippo has been actively rolling out new store formats, with the goal of acquiring new customers, both online and offline. Freshippo currently has eight types of physical store formats (see Figure 2).

In March, the retailer announced that it would transform all Freshippo Stations to Freshippo Mini stores. Freshippo Mini offers more product SKUs (stock keeping units) and lower delivery costs for online orders, thanks to a smaller delivery radius and higher operational efficiency.

[caption id="attachment_119669" align="aligncenter" width="700"]

Source: China Chain Store & Franchise Association[/caption]

The Covid-19 pandemic has been a tailwind for Freshippo, as consumers flocked online to purchase grocery products. E-commerce penetration of Freshippo’s sales remained high, at above 60%, even after lockdowns ended: 65% of GMV in the second quarter came from online sales. In cities such as Beijing and Shanghai, online sales accounted for 75% of total revenue, according to Hou Yi, President of Freshippo. Freshippo also saw more loyal customers, contributing higher wallet share. The proportion of core customers—defined as those who shopped four days or more per month—increased to 31% in June, year over year, and average monthly spending by core customers surged 12% in June.

We identify three key innovations that have driven Freshippo’s early success in China, which we discuss below.

1. New Store Formats

To cater to different consumer needs in different regions or cities, Freshippo has been actively rolling out new store formats, with the goal of acquiring new customers, both online and offline. Freshippo currently has eight types of physical store formats (see Figure 2).

In March, the retailer announced that it would transform all Freshippo Stations to Freshippo Mini stores. Freshippo Mini offers more product SKUs (stock keeping units) and lower delivery costs for online orders, thanks to a smaller delivery radius and higher operational efficiency.

[caption id="attachment_119669" align="aligncenter" width="700"] Source: Company reports[/caption]

Freshippo Mall and Freshippo X are two of the newest store formats. The first Freshippo Mall opened in Shenzhen in November 2019 and enables shoppers to order products on the Freshippo app from over 60 merchants—including restaurants, clothing shops and drug stores in the mall—and have them delivered in one hour within a three-kilometer radius.

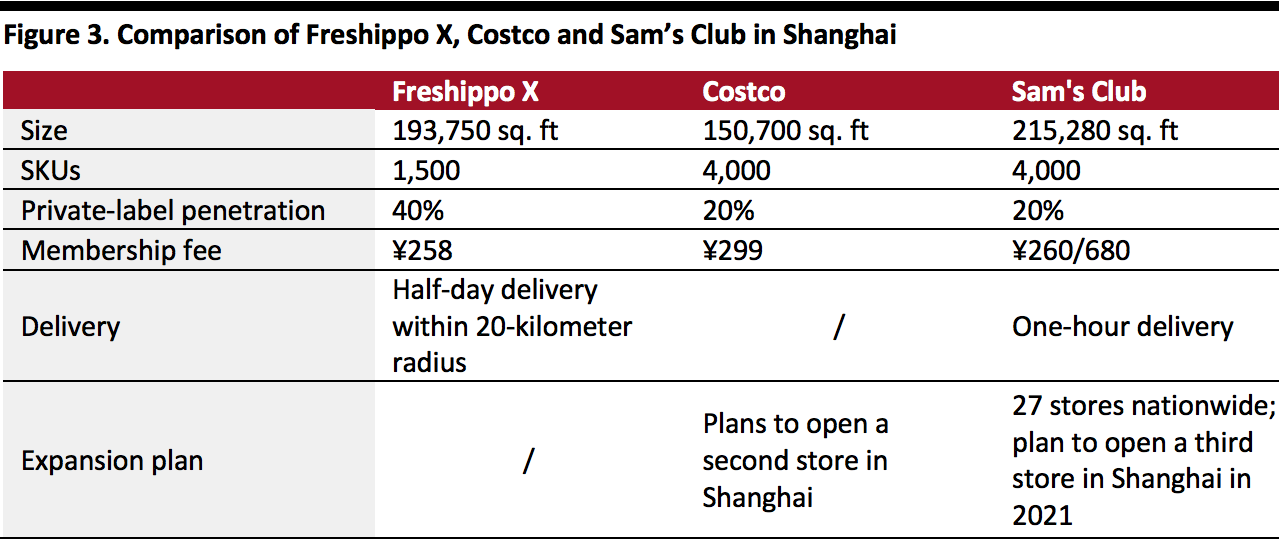

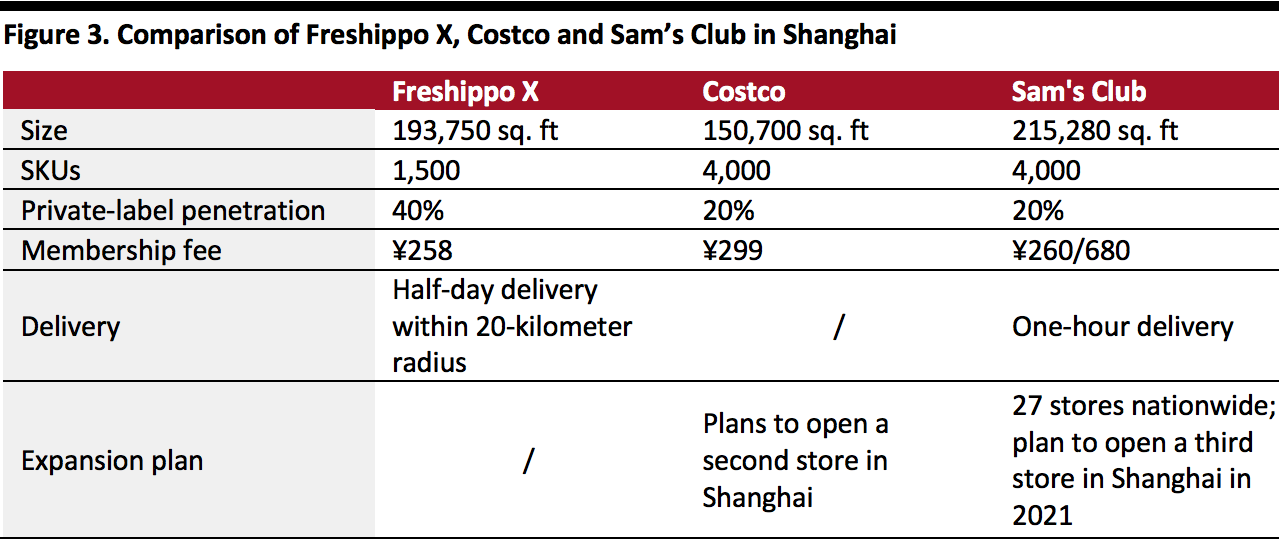

The Freshippo X store opened in October in Shanghai. Similar to Costco and Sam’s Club, it is a wholesale store for members only. Back in 2018, Freshippo launched its X membership plan, priced at ¥258 ($58) per year, and has since accumulated 500,000 members in Shanghai alone. X members can enjoy a variety of benefits, such as 12% discounts on orders on the weekly membership day, free vegetables when shopping in-store for orders above ¥9.90 (around $1.50) and member-exclusive daily deals. Compared to Costco and Sam’s Club, Freshippo X has far fewer SKUs but higher private-label penetration. Freshippo claims that its merchandise is offered at prices 30–50% lower than market price.

[caption id="attachment_119670" align="aligncenter" width="700"]

Source: Company reports[/caption]

Freshippo Mall and Freshippo X are two of the newest store formats. The first Freshippo Mall opened in Shenzhen in November 2019 and enables shoppers to order products on the Freshippo app from over 60 merchants—including restaurants, clothing shops and drug stores in the mall—and have them delivered in one hour within a three-kilometer radius.

The Freshippo X store opened in October in Shanghai. Similar to Costco and Sam’s Club, it is a wholesale store for members only. Back in 2018, Freshippo launched its X membership plan, priced at ¥258 ($58) per year, and has since accumulated 500,000 members in Shanghai alone. X members can enjoy a variety of benefits, such as 12% discounts on orders on the weekly membership day, free vegetables when shopping in-store for orders above ¥9.90 (around $1.50) and member-exclusive daily deals. Compared to Costco and Sam’s Club, Freshippo X has far fewer SKUs but higher private-label penetration. Freshippo claims that its merchandise is offered at prices 30–50% lower than market price.

[caption id="attachment_119670" align="aligncenter" width="700"] Source: CBN Data/company reports[/caption]

[caption id="attachment_119671" align="aligncenter" width="700"]

Source: CBN Data/company reports[/caption]

[caption id="attachment_119671" align="aligncenter" width="700"] Freshippo X membership store in Shanghai

Freshippo X membership store in Shanghai

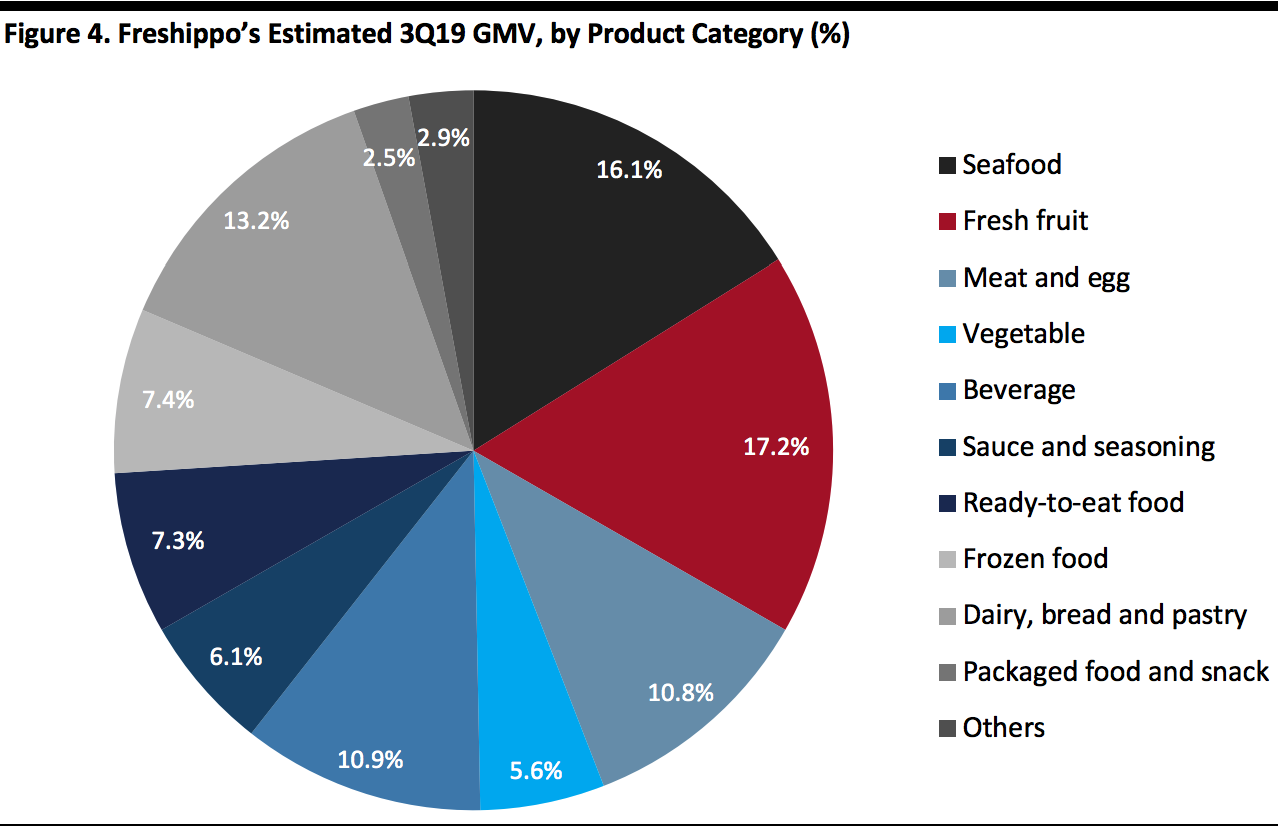

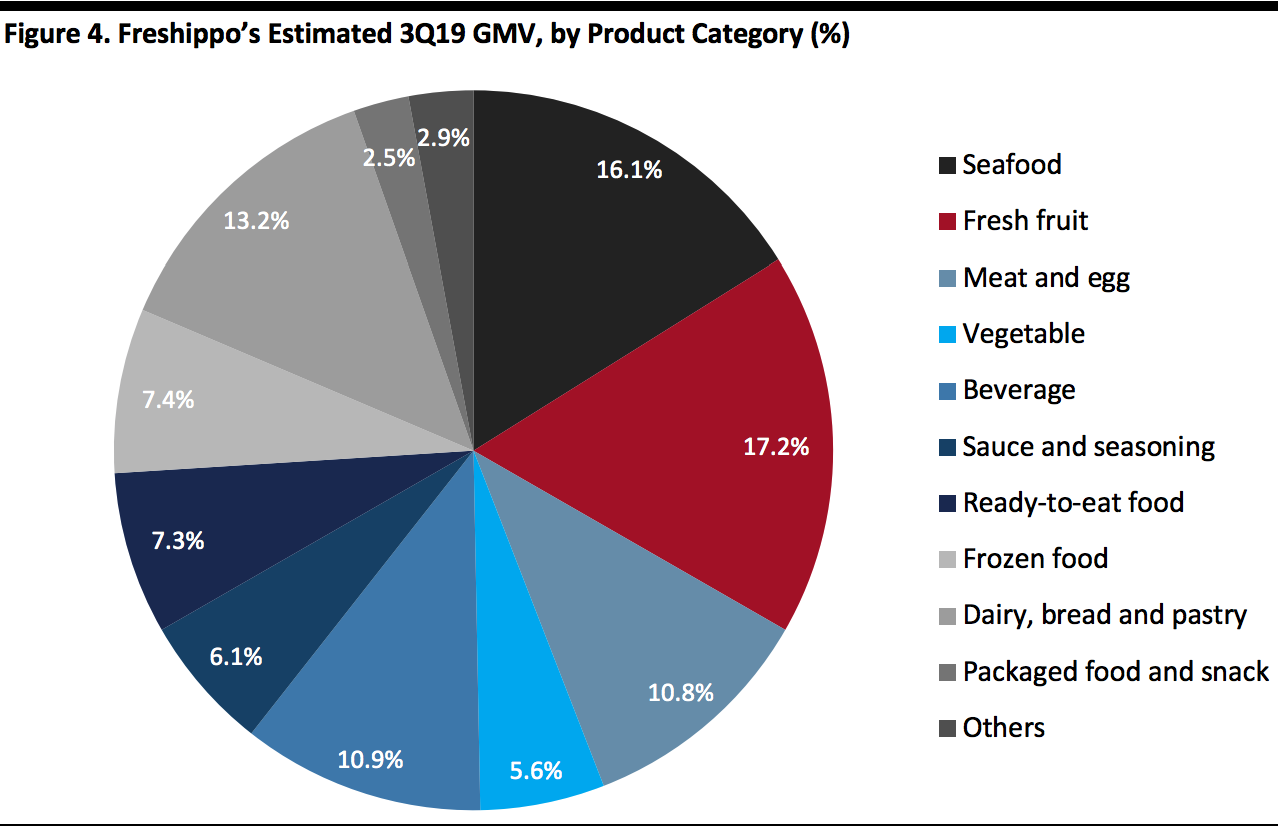

Source: Freshippo[/caption] 2. Differentiated Product Offerings Freshippo continues to strengthen and enrich its product offerings by analyzing customer data. In the 12-month period ended June 2020, Freshippo introduced more than 6,000 brands. As its stores are mainly located in top-tier cities, demand for imported food is soaring among middle-class consumers. Management consultancy firm McKinsey & Company expects China’s middle class to reach 550 million by 2022, comprising 75% of urban households in the country. To meet their demand, Freshippo imports products from more than 100 countries and regions; imported products account for roughly 40% of the grocery chain’s total goods, according to Alibaba. Chinese consumers also have a strong appetite for fresh produce, especially fruit and seafood. According to Chinese data firm DataBurning, fresh produce contributes half of Freshippo’s GMV, led by fresh fruit, seafood, and meat and egg. Freshippo has increasing the number of its direct procurement sources to improve food quality and freshness: The chain now has 555 such sources, as of June 2020. Moreover, Freshippo leverages nationwide cold-chain networks and logistics capabilities to deliver the freshest food to its customers. Private label is a key focus for Freshippo, which aims to offer consumers value products. The chain has more than 1,000 private-label and exclusive products, contributing 10% of total GMV. Its private labels cover everything from fresh food and organic goods to household products. Freshippo expects private labels to generate over half of its GMV in 2021. [caption id="attachment_119672" align="aligncenter" width="700"] Source: DataBurning[/caption]

3. Integration of Technology and Data

As one of the first digital-driven grocery stores, Freshippo has been using technology and data to enhance sales and in-store operations.

To improve the consumer experience, Freshippo uses AI and big data to personalize product recommendations on its app and to plan the most efficient delivery routes. Each store has different merchandise assortments, based on geographic consumer data. AI also helps manage store inventory. Freshippo’s system detects fresh goods that have shorter shelf lives and automatically put them on sale when necessary.

To provide a high level of transparency and gain consumer trust, Freshippo also use blockchain, so shoppers can easily track the farm-to-shelf journey of their food products.

In addition, based on location-based services, Freshippo encourages customers living in close proximity to form social groups, leveraging user-generated content to drive sales. Its app has incubated over 7,000 key opinion consumers, boosting sales of top products by up to 30%.

Technology and data also help optimize labor and improve cost and operational efficiency. In addition to product barcodes, the conveyor belt system and self-checkout stations in stores, Freshippo also highlights the following:

Source: DataBurning[/caption]

3. Integration of Technology and Data

As one of the first digital-driven grocery stores, Freshippo has been using technology and data to enhance sales and in-store operations.

To improve the consumer experience, Freshippo uses AI and big data to personalize product recommendations on its app and to plan the most efficient delivery routes. Each store has different merchandise assortments, based on geographic consumer data. AI also helps manage store inventory. Freshippo’s system detects fresh goods that have shorter shelf lives and automatically put them on sale when necessary.

To provide a high level of transparency and gain consumer trust, Freshippo also use blockchain, so shoppers can easily track the farm-to-shelf journey of their food products.

In addition, based on location-based services, Freshippo encourages customers living in close proximity to form social groups, leveraging user-generated content to drive sales. Its app has incubated over 7,000 key opinion consumers, boosting sales of top products by up to 30%.

Technology and data also help optimize labor and improve cost and operational efficiency. In addition to product barcodes, the conveyor belt system and self-checkout stations in stores, Freshippo also highlights the following:

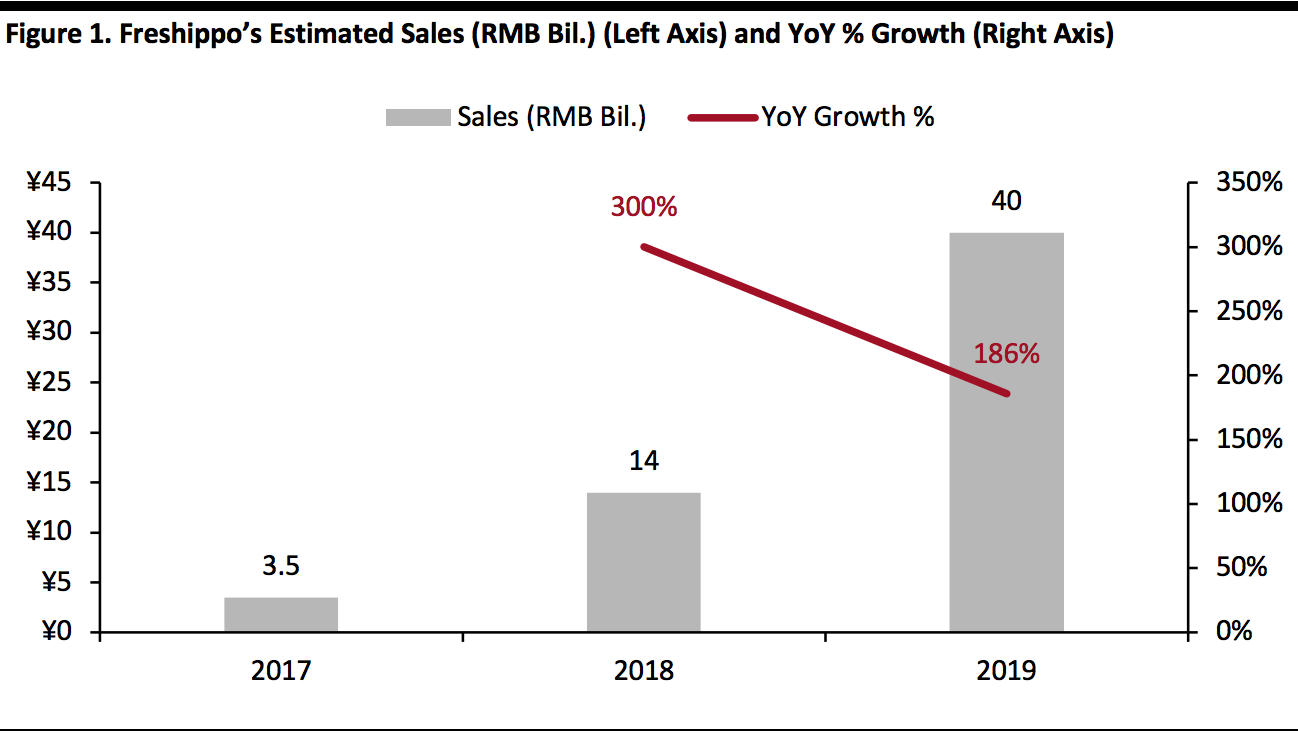

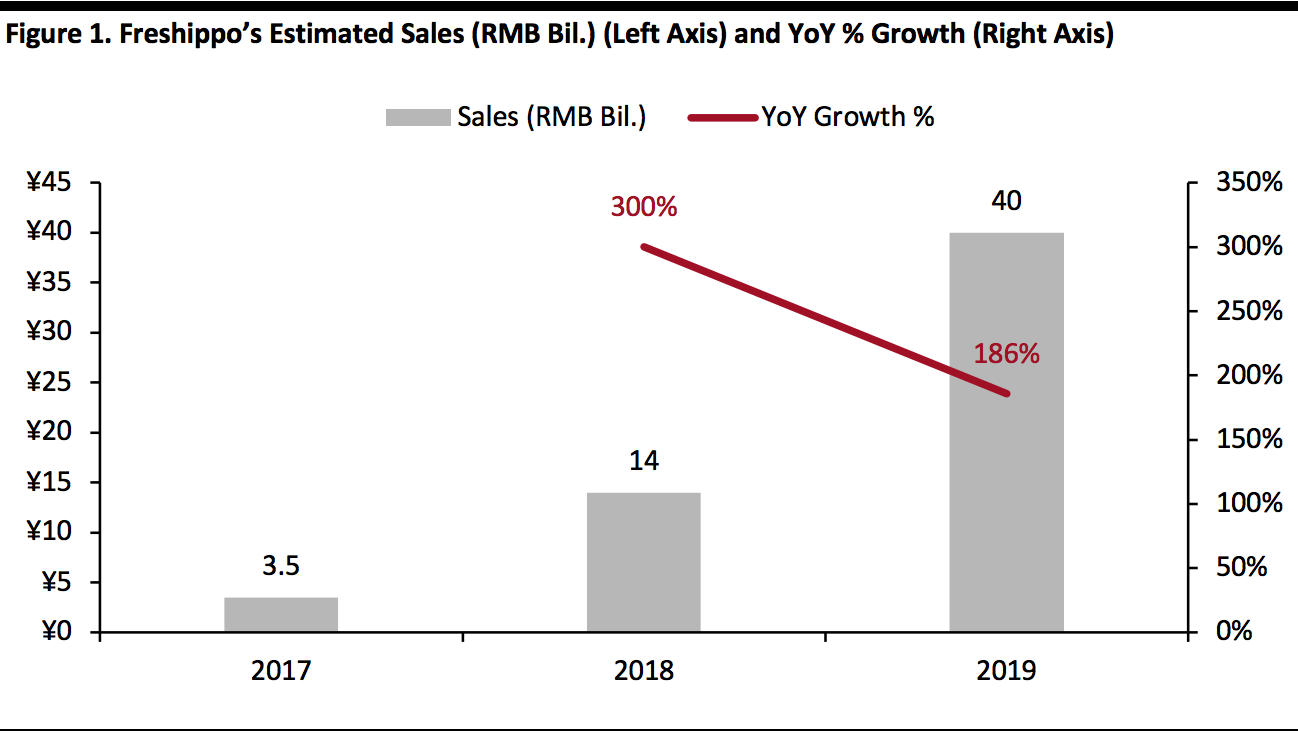

Freshippo Innovates China’s Grocery Market

Freshippo, previously known as Hema, is Alibaba’s New Retail solution for grocery. First launched in 2016, Freshippo aims to provide customers with a seamless shopping experience by integrating online and offline activities. Shoppers can purchase a variety of fresh produce, packaged food and daily necessities both in-store and online via the app. According to the company, Freshippo’s proprietary in-store fulfillment system can deliver online orders from stores within 30 minutes to customers living within a radius of three kilometers. As of June 2020, Freshippo operates 227 stores across more than 20 cities, primarily in Tier 1 and Tier 2 cities in China. In the 12-month period ended June 2020, annual active consumers of Freshippo reached 25 million, up from 20 million the prior year, according to Alibaba. Mature stores achieved solid performance: For the 130 stores that opened before April 2019, same-store sales jumped by 32% year over year in the second quarter of 2020 (ended June 30), and annualized sales per square meter grew 32% in the same period. Including new store openings, Freshippo’s total sales rose 186% year over year to ¥40 billion (around $5.9 billion) in 2019, according to estimates by China Chain Store & Franchise Association. [caption id="attachment_119668" align="aligncenter" width="700"] Source: China Chain Store & Franchise Association[/caption]

The Covid-19 pandemic has been a tailwind for Freshippo, as consumers flocked online to purchase grocery products. E-commerce penetration of Freshippo’s sales remained high, at above 60%, even after lockdowns ended: 65% of GMV in the second quarter came from online sales. In cities such as Beijing and Shanghai, online sales accounted for 75% of total revenue, according to Hou Yi, President of Freshippo. Freshippo also saw more loyal customers, contributing higher wallet share. The proportion of core customers—defined as those who shopped four days or more per month—increased to 31% in June, year over year, and average monthly spending by core customers surged 12% in June.

We identify three key innovations that have driven Freshippo’s early success in China, which we discuss below.

1. New Store Formats

To cater to different consumer needs in different regions or cities, Freshippo has been actively rolling out new store formats, with the goal of acquiring new customers, both online and offline. Freshippo currently has eight types of physical store formats (see Figure 2).

In March, the retailer announced that it would transform all Freshippo Stations to Freshippo Mini stores. Freshippo Mini offers more product SKUs (stock keeping units) and lower delivery costs for online orders, thanks to a smaller delivery radius and higher operational efficiency.

[caption id="attachment_119669" align="aligncenter" width="700"]

Source: China Chain Store & Franchise Association[/caption]

The Covid-19 pandemic has been a tailwind for Freshippo, as consumers flocked online to purchase grocery products. E-commerce penetration of Freshippo’s sales remained high, at above 60%, even after lockdowns ended: 65% of GMV in the second quarter came from online sales. In cities such as Beijing and Shanghai, online sales accounted for 75% of total revenue, according to Hou Yi, President of Freshippo. Freshippo also saw more loyal customers, contributing higher wallet share. The proportion of core customers—defined as those who shopped four days or more per month—increased to 31% in June, year over year, and average monthly spending by core customers surged 12% in June.

We identify three key innovations that have driven Freshippo’s early success in China, which we discuss below.

1. New Store Formats

To cater to different consumer needs in different regions or cities, Freshippo has been actively rolling out new store formats, with the goal of acquiring new customers, both online and offline. Freshippo currently has eight types of physical store formats (see Figure 2).

In March, the retailer announced that it would transform all Freshippo Stations to Freshippo Mini stores. Freshippo Mini offers more product SKUs (stock keeping units) and lower delivery costs for online orders, thanks to a smaller delivery radius and higher operational efficiency.

[caption id="attachment_119669" align="aligncenter" width="700"] Source: Company reports[/caption]

Freshippo Mall and Freshippo X are two of the newest store formats. The first Freshippo Mall opened in Shenzhen in November 2019 and enables shoppers to order products on the Freshippo app from over 60 merchants—including restaurants, clothing shops and drug stores in the mall—and have them delivered in one hour within a three-kilometer radius.

The Freshippo X store opened in October in Shanghai. Similar to Costco and Sam’s Club, it is a wholesale store for members only. Back in 2018, Freshippo launched its X membership plan, priced at ¥258 ($58) per year, and has since accumulated 500,000 members in Shanghai alone. X members can enjoy a variety of benefits, such as 12% discounts on orders on the weekly membership day, free vegetables when shopping in-store for orders above ¥9.90 (around $1.50) and member-exclusive daily deals. Compared to Costco and Sam’s Club, Freshippo X has far fewer SKUs but higher private-label penetration. Freshippo claims that its merchandise is offered at prices 30–50% lower than market price.

[caption id="attachment_119670" align="aligncenter" width="700"]

Source: Company reports[/caption]

Freshippo Mall and Freshippo X are two of the newest store formats. The first Freshippo Mall opened in Shenzhen in November 2019 and enables shoppers to order products on the Freshippo app from over 60 merchants—including restaurants, clothing shops and drug stores in the mall—and have them delivered in one hour within a three-kilometer radius.

The Freshippo X store opened in October in Shanghai. Similar to Costco and Sam’s Club, it is a wholesale store for members only. Back in 2018, Freshippo launched its X membership plan, priced at ¥258 ($58) per year, and has since accumulated 500,000 members in Shanghai alone. X members can enjoy a variety of benefits, such as 12% discounts on orders on the weekly membership day, free vegetables when shopping in-store for orders above ¥9.90 (around $1.50) and member-exclusive daily deals. Compared to Costco and Sam’s Club, Freshippo X has far fewer SKUs but higher private-label penetration. Freshippo claims that its merchandise is offered at prices 30–50% lower than market price.

[caption id="attachment_119670" align="aligncenter" width="700"] Source: CBN Data/company reports[/caption]

[caption id="attachment_119671" align="aligncenter" width="700"]

Source: CBN Data/company reports[/caption]

[caption id="attachment_119671" align="aligncenter" width="700"] Freshippo X membership store in Shanghai

Freshippo X membership store in ShanghaiSource: Freshippo[/caption] 2. Differentiated Product Offerings Freshippo continues to strengthen and enrich its product offerings by analyzing customer data. In the 12-month period ended June 2020, Freshippo introduced more than 6,000 brands. As its stores are mainly located in top-tier cities, demand for imported food is soaring among middle-class consumers. Management consultancy firm McKinsey & Company expects China’s middle class to reach 550 million by 2022, comprising 75% of urban households in the country. To meet their demand, Freshippo imports products from more than 100 countries and regions; imported products account for roughly 40% of the grocery chain’s total goods, according to Alibaba. Chinese consumers also have a strong appetite for fresh produce, especially fruit and seafood. According to Chinese data firm DataBurning, fresh produce contributes half of Freshippo’s GMV, led by fresh fruit, seafood, and meat and egg. Freshippo has increasing the number of its direct procurement sources to improve food quality and freshness: The chain now has 555 such sources, as of June 2020. Moreover, Freshippo leverages nationwide cold-chain networks and logistics capabilities to deliver the freshest food to its customers. Private label is a key focus for Freshippo, which aims to offer consumers value products. The chain has more than 1,000 private-label and exclusive products, contributing 10% of total GMV. Its private labels cover everything from fresh food and organic goods to household products. Freshippo expects private labels to generate over half of its GMV in 2021. [caption id="attachment_119672" align="aligncenter" width="700"]

Source: DataBurning[/caption]

3. Integration of Technology and Data

As one of the first digital-driven grocery stores, Freshippo has been using technology and data to enhance sales and in-store operations.

To improve the consumer experience, Freshippo uses AI and big data to personalize product recommendations on its app and to plan the most efficient delivery routes. Each store has different merchandise assortments, based on geographic consumer data. AI also helps manage store inventory. Freshippo’s system detects fresh goods that have shorter shelf lives and automatically put them on sale when necessary.

To provide a high level of transparency and gain consumer trust, Freshippo also use blockchain, so shoppers can easily track the farm-to-shelf journey of their food products.

In addition, based on location-based services, Freshippo encourages customers living in close proximity to form social groups, leveraging user-generated content to drive sales. Its app has incubated over 7,000 key opinion consumers, boosting sales of top products by up to 30%.

Technology and data also help optimize labor and improve cost and operational efficiency. In addition to product barcodes, the conveyor belt system and self-checkout stations in stores, Freshippo also highlights the following:

Source: DataBurning[/caption]

3. Integration of Technology and Data

As one of the first digital-driven grocery stores, Freshippo has been using technology and data to enhance sales and in-store operations.

To improve the consumer experience, Freshippo uses AI and big data to personalize product recommendations on its app and to plan the most efficient delivery routes. Each store has different merchandise assortments, based on geographic consumer data. AI also helps manage store inventory. Freshippo’s system detects fresh goods that have shorter shelf lives and automatically put them on sale when necessary.

To provide a high level of transparency and gain consumer trust, Freshippo also use blockchain, so shoppers can easily track the farm-to-shelf journey of their food products.

In addition, based on location-based services, Freshippo encourages customers living in close proximity to form social groups, leveraging user-generated content to drive sales. Its app has incubated over 7,000 key opinion consumers, boosting sales of top products by up to 30%.

Technology and data also help optimize labor and improve cost and operational efficiency. In addition to product barcodes, the conveyor belt system and self-checkout stations in stores, Freshippo also highlights the following:

- An AI-powered loss prevention system reduces store shrinkage by 40%.

- The IoT energy-management system lowers store energy costs by 5%.

- The flexible staffing system decreases labor costs by 20% compared to using full-time staff.

- The real-time visualization of labor efficiency improves warehouse labor productivity by 40%.