DIpil Das

Introduction: The Growing Popularity of Short-Video Platforms

Short-video platforms started emerging in China as early as 2012, but they began to gain momentum in 2017. Today, these platforms are rising rapidly and evolving into social commerce sites with new features. According to third-party data firm QuestMobile, the total number of users of short-video platforms reached 810 million as of September 2019, implying that seven out of 10 Chinese Internet users are using these apps. The two leading players in this sector are Bytedance’s Douyin (China’s TikTok) and Kuaishou (China’s Kwai).

To build brand awareness and market their products, brands can select a short-video platform to leverage based on their target audience and goal. For example, Douyin has more users from first- and second-tier cities than Kuaishou, whose main users reside in lower-tier cities. The way each platform displays and distribute its content is also different. Therefore, creative content on Douyin can quickly draw massive attention, while Kuaishou typically sees better engagement from users with content posted by key opinion leaders (KOLs). In this report, we compare each platform in detail in terms of user base, content distribution model, e-commerce capabilities and marketing opportunities.

Douyin vs. Kuaishou: User Profile

As the short-video market is becoming increasingly saturated, the race between Douyin and Kuaishou is heating up, with their user bases continuing to overlap. QuestMobile reported in June 2019 that the number of overlapping users on these two leading platforms more than doubled year over year.

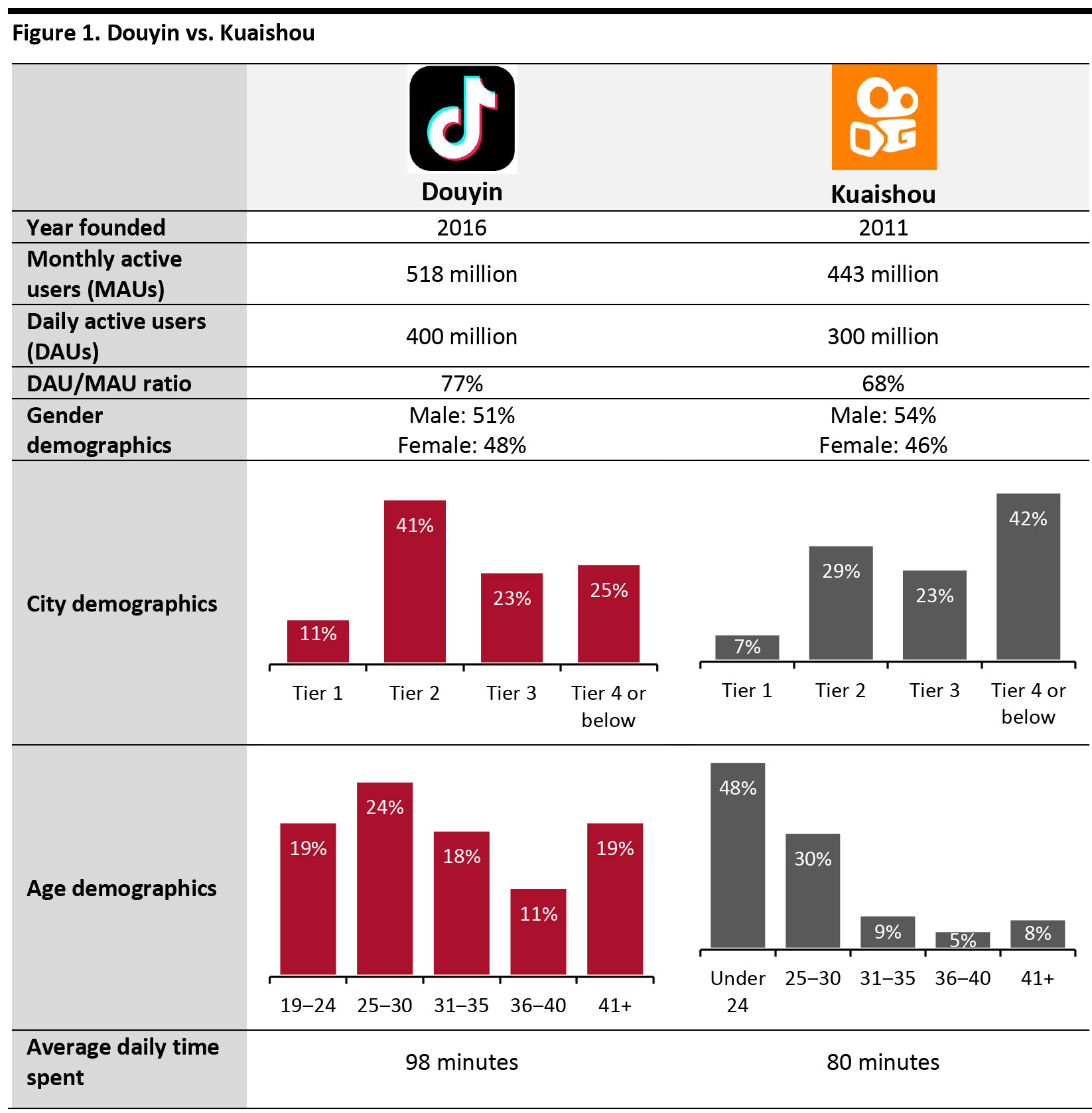

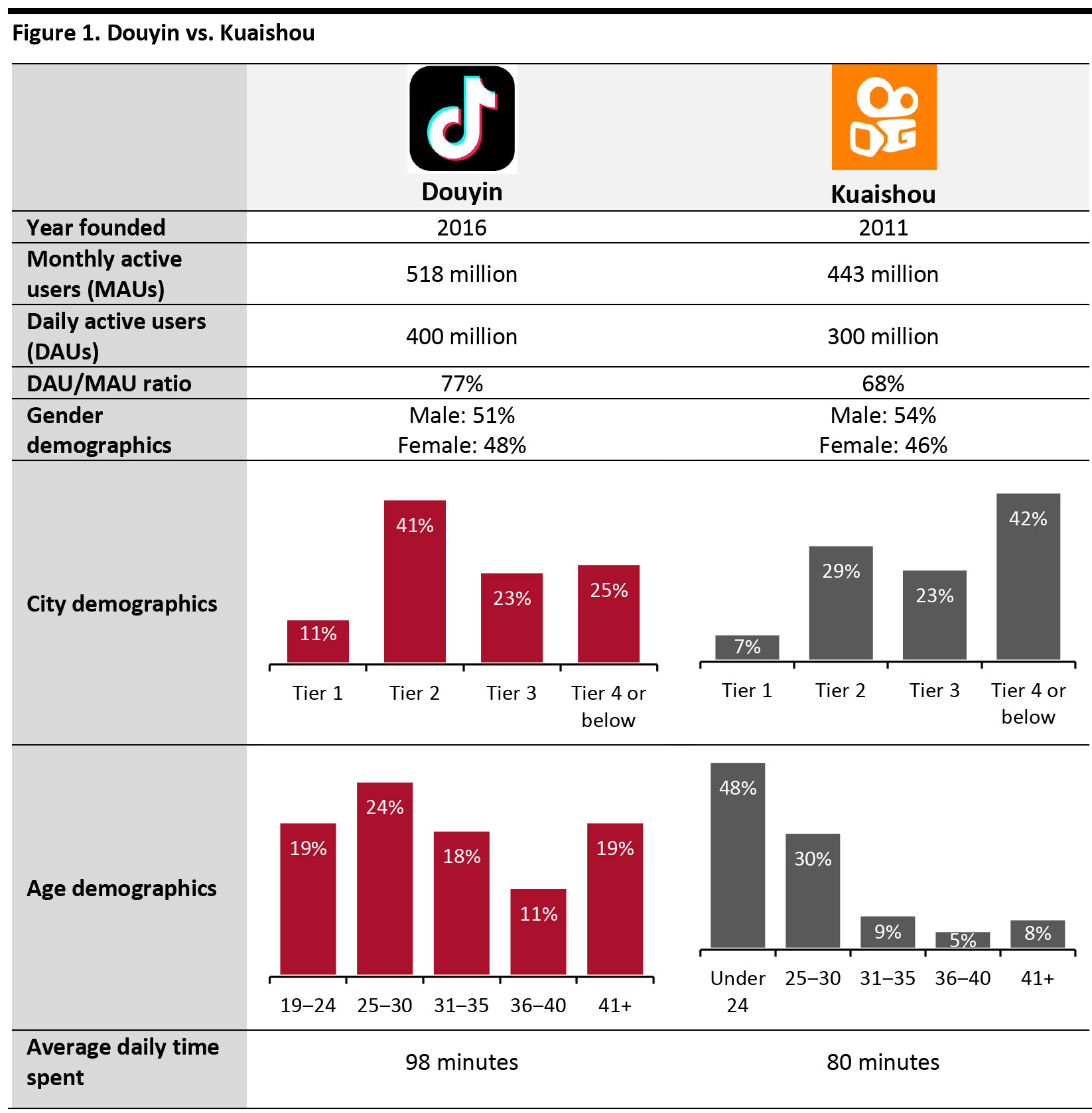

As shown in Figure 1, the gender split of both platforms’ user base is relatively even. However, in terms of age, although both Kuaishou and Douyin have a strong base of younger users—with Kuaishou seeing 78% under the age of 24 compared to Douyin’s 43%—the latter more effectively penetrates the older audience segment, aged 31 and above.

The major difference in the user base of these two platforms is that a large proportion of Kuaishou’s users come from lower-tier markets, while over half of Douyin’s users reside in first- and second-tier cities. Brands and retailers that are aiming to expand in lower-tier cities should therefore choose to focus more on having a presence on Kuaishou.

[caption id="attachment_110987" align="aligncenter" width="700"] Source: Company reports/QuestMobile/Caasdata/iiMedia[/caption]

Douyin vs. Kuaishou: Content Distribution

Douyin uses a recommendation algorithm to push content to users’ feeds based on their viewing habits, meaning that videos that go viral are not necessarily created by top influencers or celebrities. When a video becomes popular, Douyin’s algorithm will help it to gain even more exposure. The platform also offers a range of content-generation tools—including beauty filters, special effects and background music—to enhance the attractiveness and quality of videos.

Kuaishou, on the other hand, focuses more on the social element, using a different algorithm to recommend videos to users. After a video reaches a certain amount of exposure, Kuaishou will push other less-watched videos on the feed. The platform’s “Follow” page is also its main content hub and distributes content based on the accounts or influencers that users are following. Users on Kuaishou are generally more sticky and engaged with KOLs, compared to Douyin users: The ratio of likes to comments for KOL content on Kuaishou (13:1) is much lower than on Douyin (42:1), suggesting that Kuaishou viewers are more likely to comment on videos and engage with KOLs, according to a March 2020 report from Chinese firm Caasdata.

Both platforms started to allow longer videos in 2019, hoping the extended form can generate more content-rich and better-quality videos. Douyin allows users to create videos up to 15 minutes and videos on Kuaishou can run as long as 10 minutes.

Douyin vs. Kuaishou: E-Commerce Capabilities

Douyin and Kuaishou started incorporating e-commerce functions in 2018. Douyin was the first to offer embeddedthird-party links within videos that direct users to brand stores on Alibaba’s Taobao/Tmall platforms. Today, users or brands can add links to multiple e-commerce platforms, including JD.com, Pinduoduo, Suning.com, Taobao/Tmall and Youzan.

Douyin and Kuaishou also have their own e-commerce ecosystem and have been focusing on livestreaming to facilitate more transactions. The two short-video platforms are the second and third players in the livestreaming e-commerce market, after Alibaba’s Taobao Live.

Recent e-commerce developments include the following:

Source: Company reports/QuestMobile/Caasdata/iiMedia[/caption]

Douyin vs. Kuaishou: Content Distribution

Douyin uses a recommendation algorithm to push content to users’ feeds based on their viewing habits, meaning that videos that go viral are not necessarily created by top influencers or celebrities. When a video becomes popular, Douyin’s algorithm will help it to gain even more exposure. The platform also offers a range of content-generation tools—including beauty filters, special effects and background music—to enhance the attractiveness and quality of videos.

Kuaishou, on the other hand, focuses more on the social element, using a different algorithm to recommend videos to users. After a video reaches a certain amount of exposure, Kuaishou will push other less-watched videos on the feed. The platform’s “Follow” page is also its main content hub and distributes content based on the accounts or influencers that users are following. Users on Kuaishou are generally more sticky and engaged with KOLs, compared to Douyin users: The ratio of likes to comments for KOL content on Kuaishou (13:1) is much lower than on Douyin (42:1), suggesting that Kuaishou viewers are more likely to comment on videos and engage with KOLs, according to a March 2020 report from Chinese firm Caasdata.

Both platforms started to allow longer videos in 2019, hoping the extended form can generate more content-rich and better-quality videos. Douyin allows users to create videos up to 15 minutes and videos on Kuaishou can run as long as 10 minutes.

Douyin vs. Kuaishou: E-Commerce Capabilities

Douyin and Kuaishou started incorporating e-commerce functions in 2018. Douyin was the first to offer embeddedthird-party links within videos that direct users to brand stores on Alibaba’s Taobao/Tmall platforms. Today, users or brands can add links to multiple e-commerce platforms, including JD.com, Pinduoduo, Suning.com, Taobao/Tmall and Youzan.

Douyin and Kuaishou also have their own e-commerce ecosystem and have been focusing on livestreaming to facilitate more transactions. The two short-video platforms are the second and third players in the livestreaming e-commerce market, after Alibaba’s Taobao Live.

Recent e-commerce developments include the following:

Source: Douyin[/caption]

Source: Douyin[/caption]

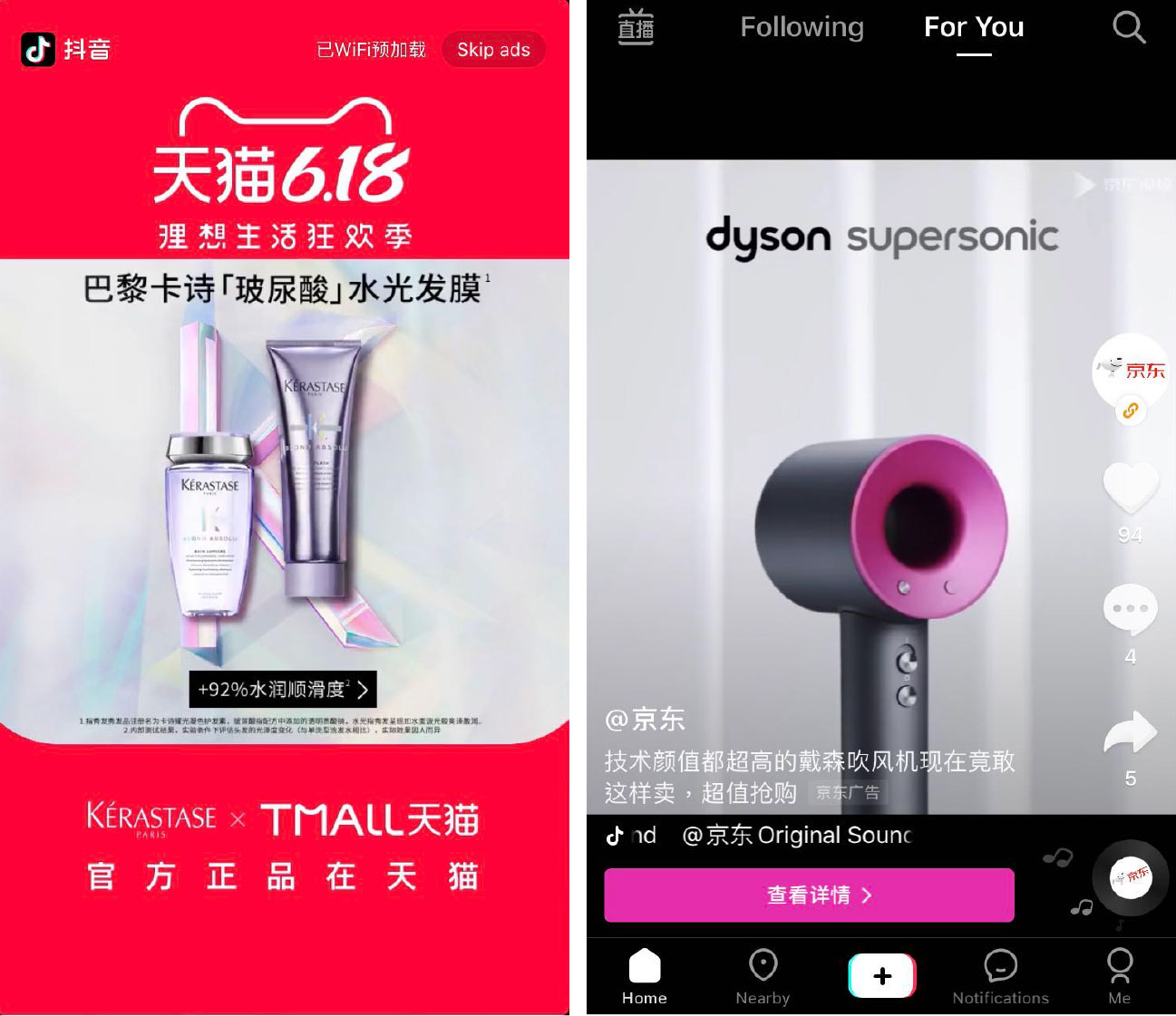

Douyin’s splash ad (left) and feed ad (right)

Douyin’s splash ad (left) and feed ad (right)

Source: Douyin [/caption] Implications for Brands and Retailers With Douyin and Kuaishou scaling up their businesses and growing user bases, the marketing potential for brands on short-video platforms is hard to ignore. Today, content on these platforms are not only fun and eye-catching but also allow consumers to discover a brand and new products. Brands should choose a short-video platform based on their business needs. A large proportion of Douyin’s user base is from first- and second-tier cities in China, and its content is more vibrant and creative. A compelling campaign on Douyin is able to reach a significant number of users due to its recommendation algorithm. On the other hand, Kuaishou’s users largely reside in lower-tier cities, are more price sensitive and have lower spending power. However, the platform has stronger user engagement with KOL content, which would likely translate to higher e-commerce conversion rates. Short-video platform could provide a suitable channel for fast-moving consumer goods brands looking to promote affordable product lines. With various advertising tools available on both platforms, brands can combine different marketing strategies to maximize results.

Source: Company reports/QuestMobile/Caasdata/iiMedia[/caption]

Douyin vs. Kuaishou: Content Distribution

Douyin uses a recommendation algorithm to push content to users’ feeds based on their viewing habits, meaning that videos that go viral are not necessarily created by top influencers or celebrities. When a video becomes popular, Douyin’s algorithm will help it to gain even more exposure. The platform also offers a range of content-generation tools—including beauty filters, special effects and background music—to enhance the attractiveness and quality of videos.

Kuaishou, on the other hand, focuses more on the social element, using a different algorithm to recommend videos to users. After a video reaches a certain amount of exposure, Kuaishou will push other less-watched videos on the feed. The platform’s “Follow” page is also its main content hub and distributes content based on the accounts or influencers that users are following. Users on Kuaishou are generally more sticky and engaged with KOLs, compared to Douyin users: The ratio of likes to comments for KOL content on Kuaishou (13:1) is much lower than on Douyin (42:1), suggesting that Kuaishou viewers are more likely to comment on videos and engage with KOLs, according to a March 2020 report from Chinese firm Caasdata.

Both platforms started to allow longer videos in 2019, hoping the extended form can generate more content-rich and better-quality videos. Douyin allows users to create videos up to 15 minutes and videos on Kuaishou can run as long as 10 minutes.

Douyin vs. Kuaishou: E-Commerce Capabilities

Douyin and Kuaishou started incorporating e-commerce functions in 2018. Douyin was the first to offer embeddedthird-party links within videos that direct users to brand stores on Alibaba’s Taobao/Tmall platforms. Today, users or brands can add links to multiple e-commerce platforms, including JD.com, Pinduoduo, Suning.com, Taobao/Tmall and Youzan.

Douyin and Kuaishou also have their own e-commerce ecosystem and have been focusing on livestreaming to facilitate more transactions. The two short-video platforms are the second and third players in the livestreaming e-commerce market, after Alibaba’s Taobao Live.

Recent e-commerce developments include the following:

Source: Company reports/QuestMobile/Caasdata/iiMedia[/caption]

Douyin vs. Kuaishou: Content Distribution

Douyin uses a recommendation algorithm to push content to users’ feeds based on their viewing habits, meaning that videos that go viral are not necessarily created by top influencers or celebrities. When a video becomes popular, Douyin’s algorithm will help it to gain even more exposure. The platform also offers a range of content-generation tools—including beauty filters, special effects and background music—to enhance the attractiveness and quality of videos.

Kuaishou, on the other hand, focuses more on the social element, using a different algorithm to recommend videos to users. After a video reaches a certain amount of exposure, Kuaishou will push other less-watched videos on the feed. The platform’s “Follow” page is also its main content hub and distributes content based on the accounts or influencers that users are following. Users on Kuaishou are generally more sticky and engaged with KOLs, compared to Douyin users: The ratio of likes to comments for KOL content on Kuaishou (13:1) is much lower than on Douyin (42:1), suggesting that Kuaishou viewers are more likely to comment on videos and engage with KOLs, according to a March 2020 report from Chinese firm Caasdata.

Both platforms started to allow longer videos in 2019, hoping the extended form can generate more content-rich and better-quality videos. Douyin allows users to create videos up to 15 minutes and videos on Kuaishou can run as long as 10 minutes.

Douyin vs. Kuaishou: E-Commerce Capabilities

Douyin and Kuaishou started incorporating e-commerce functions in 2018. Douyin was the first to offer embeddedthird-party links within videos that direct users to brand stores on Alibaba’s Taobao/Tmall platforms. Today, users or brands can add links to multiple e-commerce platforms, including JD.com, Pinduoduo, Suning.com, Taobao/Tmall and Youzan.

Douyin and Kuaishou also have their own e-commerce ecosystem and have been focusing on livestreaming to facilitate more transactions. The two short-video platforms are the second and third players in the livestreaming e-commerce market, after Alibaba’s Taobao Live.

Recent e-commerce developments include the following:

- Kuaishou announced a strategic partnership with JD.com in late May 2020. JD.com provides selected products to Kuaishou’s own e-commerce ecosystem and allows Kuaishou users to purchase JD.com’s products directly within the video app. Shoppers can access logistics and after-sales services backed by JD.com while enjoying a frictionless shopping experience. Kuaishou also plans to strengthen brand-marketing capabilities.

- Douyin has been actively looking for e-commerce vendors in content production, business operations and branding since early April 2020. It has also relaxed previous restrictions to encourage more users to sell through its own e-commerce site.

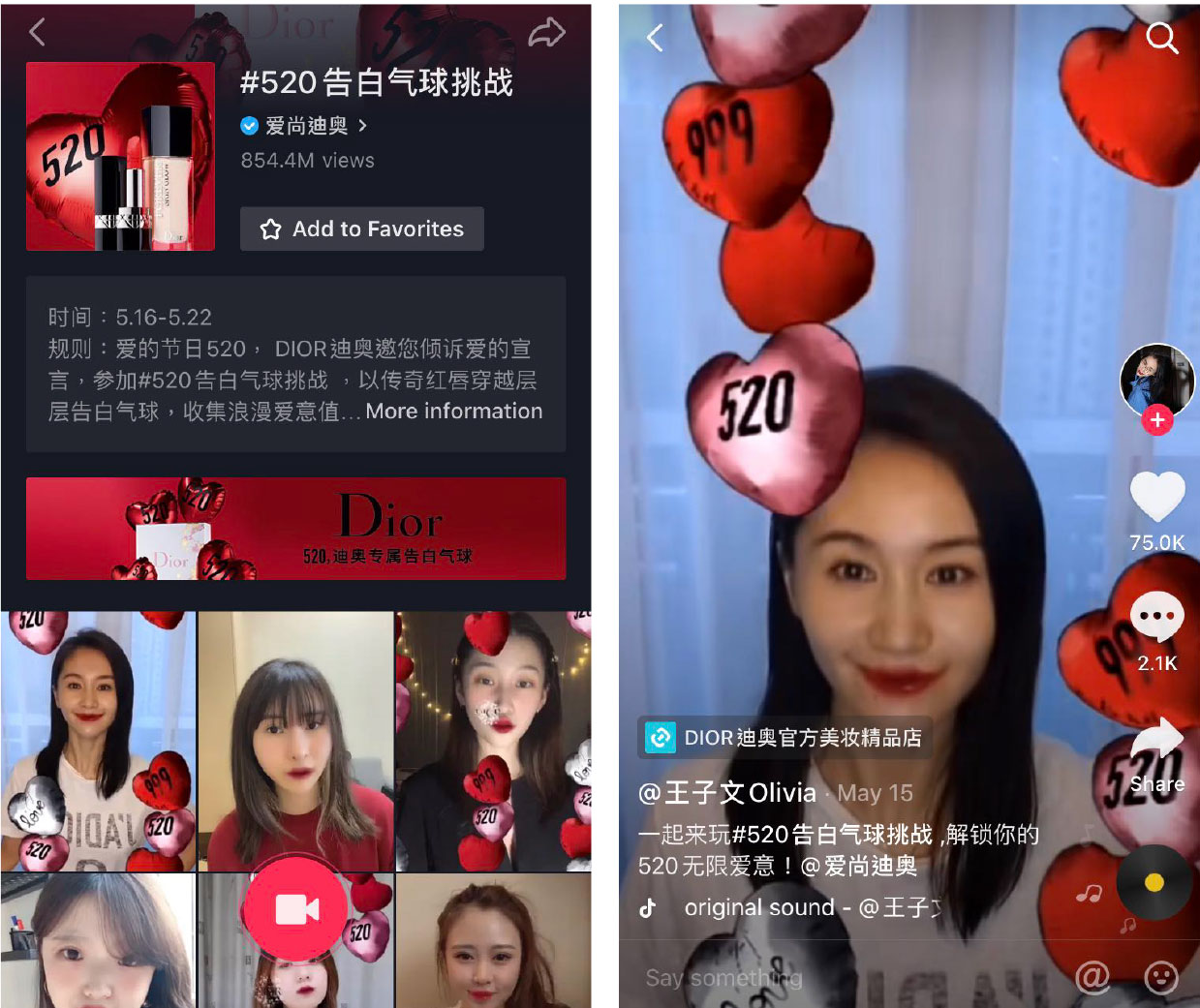

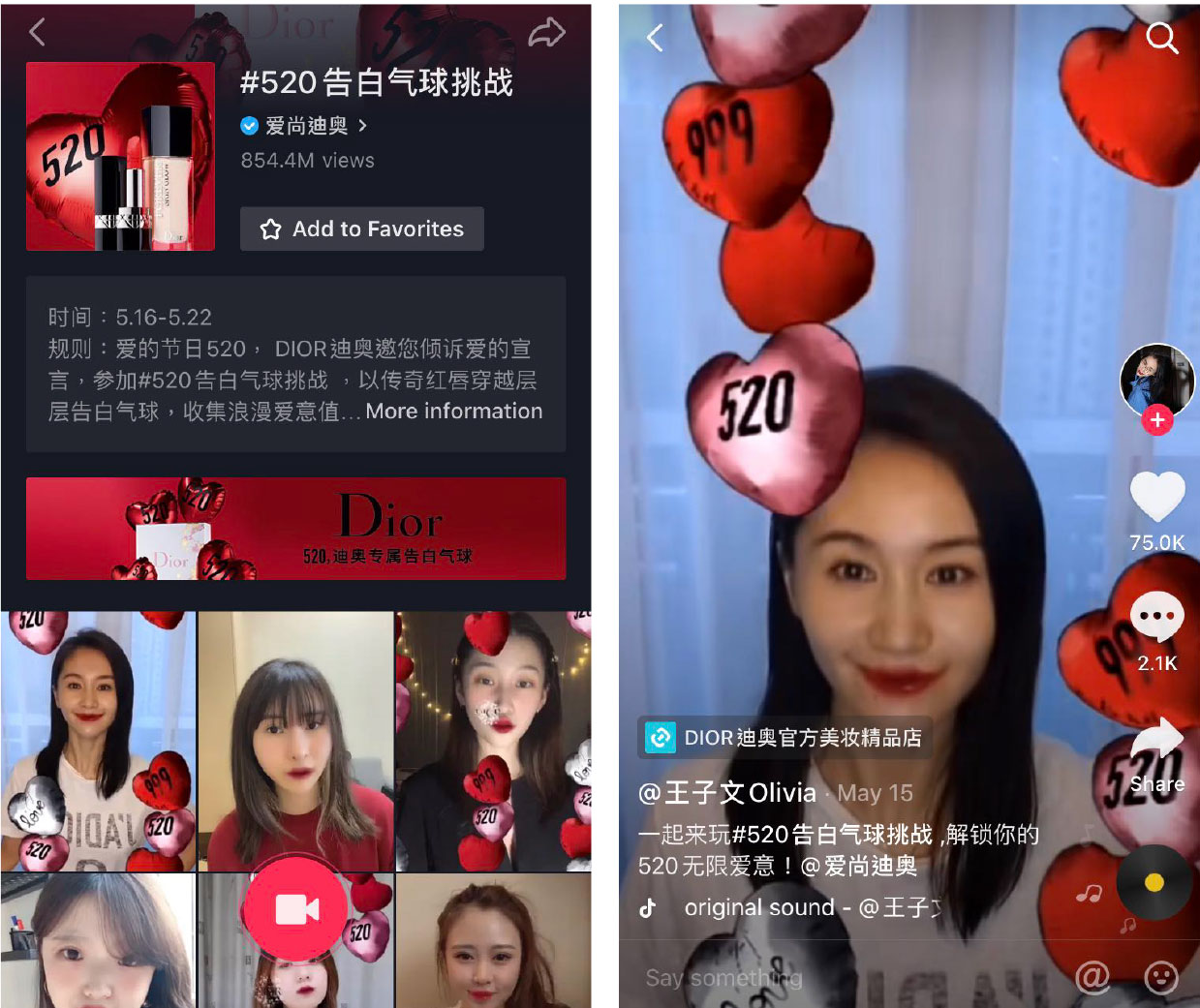

- Dior launched a “520 Love Balloon” challenge on May 16, 2020, to promote its 520 gift set. “520” in Mandarin sounds similar to “I love you,” and this romance-themed day is even more popular than Valentine’s Day in China. Dior created a digital balloon game with a filter that allows participants to virtually try on its iconic 999 red lipstick. Videos using the “520 Love Balloon” challenge had collectively drawn over 850 million views as of June 1, 2020.

Source: Douyin[/caption]

Source: Douyin[/caption]

- Beauty brand Estée Lauder unveiled a hashtag topic called “Girls’ Summer Must-Have” on May 18, 2020, to promote its Double Wear foundation. The campaign leverages influencers, who share their reviews of the foundation and invite users to upload a video imitating a finger dance that Estée Lauder created. The top 10 users whose videos receive the most likes will receive a full-size Double Wear foundation as a prize. Since the launch, related videos have attracted 33 million views in total.

On Kuaishou, brands do not necessarily need to operate an official account on the platform to launch a campaign. For brands and retailers who target lower-tier markets, partnering with influencers to initiate challenges or livestreaming is an effective marketing strategy. - In mid-April, Chinese electronic-appliance brand Midea invited Kuaishou users to take part in the Midea Cooking Challenge by sharing their videos of their home cooking. In less than one week, there were more than 1,300 user-generated videos responding to the challenge. Midea then teamed up with top KOLs on the platform to livestream a cooking competition using Midea cooking appliances. Even though the brand only had 2,000 followers at the time, the livestreaming session drew 4.8 million views.The combination of livestreaming with short-video content has been widely adopted by Douyin and Kuaishou. The latter platform is aiming to increase its GMV from livestreaming fivefold in 2020, to ¥250 billion ($35.2 billion). Douyin, which did not disclose its livestreaming GMV in 2019, has set a goal of ¥200 billion ($28.2 billion) for this year. Both platforms are actively working with celebrities, influencers and company executives to host livestreaming sessions.

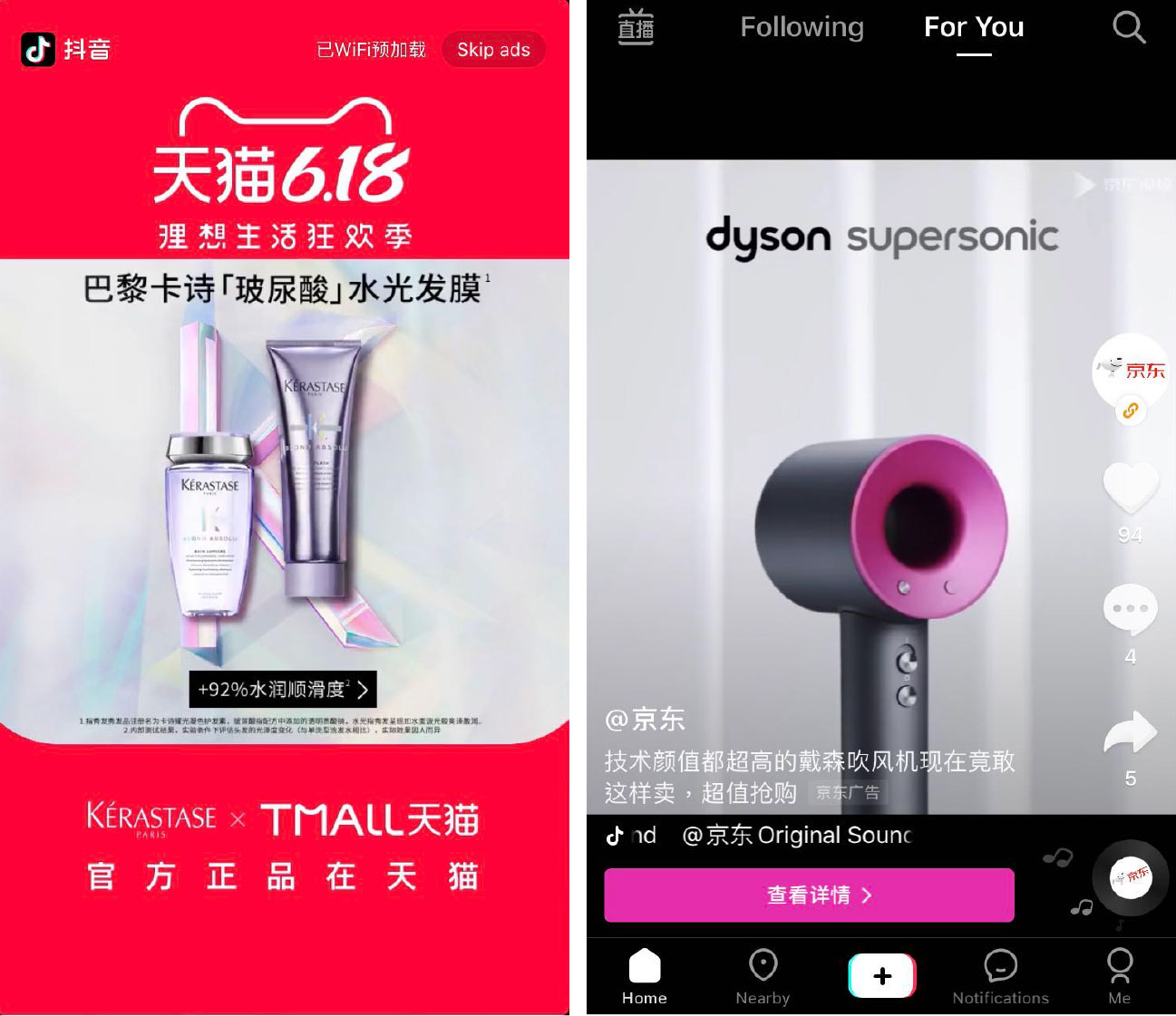

- Open up/Splash ads: Only Douyin provides this type of ad. A splash ad is a full-screen static or dynamic digital advert that pops up for three to five seconds when a user opens the app. Newer brands on Douyin can use this type of ad to quickly gain impressions.

- Feed ads: These 15- to 60-second videos are the most widely used ad format for both Douyin and Kuaishou. On Douyin, feed ads are displayed in the fourth position of a user’s newsfeed. Due to the intuitive design of Douyin’s interface, which allows users to easily scroll through videos that automatically play without the need to click anything, users are more receptive to watching feed ads. Kuaishou’s default main page consists of two rows of videos, and users need to click to view the whole video. In the video-viewing page, embedded links direct users to desired landing pages. Feed ads typically appear in the fifth position of every 20 videos on Kuaishou’s main page. As a result, the feed ads on Kuaishou are not able to generate as high exposure as those on Douyin.

Douyin’s splash ad (left) and feed ad (right)

Douyin’s splash ad (left) and feed ad (right) Source: Douyin [/caption] Implications for Brands and Retailers With Douyin and Kuaishou scaling up their businesses and growing user bases, the marketing potential for brands on short-video platforms is hard to ignore. Today, content on these platforms are not only fun and eye-catching but also allow consumers to discover a brand and new products. Brands should choose a short-video platform based on their business needs. A large proportion of Douyin’s user base is from first- and second-tier cities in China, and its content is more vibrant and creative. A compelling campaign on Douyin is able to reach a significant number of users due to its recommendation algorithm. On the other hand, Kuaishou’s users largely reside in lower-tier cities, are more price sensitive and have lower spending power. However, the platform has stronger user engagement with KOL content, which would likely translate to higher e-commerce conversion rates. Short-video platform could provide a suitable channel for fast-moving consumer goods brands looking to promote affordable product lines. With various advertising tools available on both platforms, brands can combine different marketing strategies to maximize results.