Nitheesh NH

The Rise of China’s Domestic Duty-Free Market in Response to Covid-19

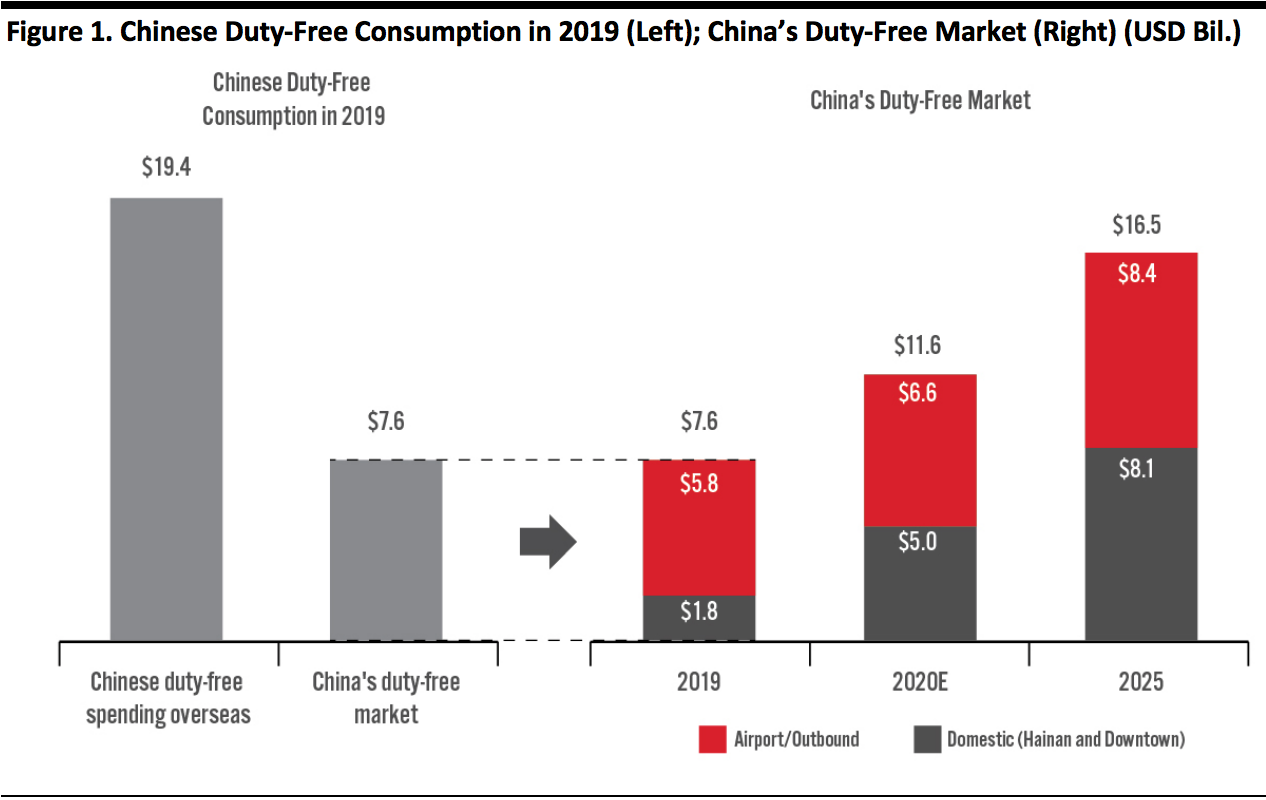

Chinese outbound travelers contributed one-third of global duty-free sales in 2019, according to Morgan Stanley. In our 2019 Chinese outbound tourists survey, we found that duty-free stores have been the top format for overseas shopping for the past three years. However, with the coronavirus crisis hitting China in early 2020, travel came to a standstill. Airport retail (including duty-free stores) depends entirely on passenger footfall, which has all but disappeared during the pandemic. Sales at two of the biggest global duty-free players plunged: Dufry reported a 61% decline in sales, and its French rival Lagardère announced that revenue was down 55% in the first half of 2020. By contrast, China’s domestic duty-free market is accelerating—especially offshore duty-free stores, thanks to a relaxation of government policy, which we discuss in the next section. China’s duty-free market reached $7.6 billion in 2019, accounting for 9% of the global market, according to Morgan Stanley. Outbound duty-free purchases made at Chinese international airports represented 76% of China’s market last year, with the share expected to decrease to roughly 50% in 2025. Domestic duty-free consumption, including at Hainan and downtown duty-free stores, is expected to grow at a 28.5% CAGR from 2019 to 2025, to make up the other 50% of the market in 2025. The overall Chinese duty-free market is expected to more than double to $16.5 billion in 2025, representing a CAGR of 13.8%; this estimate was made in June, so factors in the impact of the pandemic. Before the pandemic, Morgan Stanley had expected a 10% six-year CAGR in market size, with one-third coming from domestic duty-free purchases. There are three primary types of duty-free shops in China:- Outbound—Airport duty-free shop: This is the most common type of duty-free store, located in the separation area of international airports between entry and exit. These stores sell goods to people who have completed exit formalities, are about to travel abroad or have not yet completed entry procedures.

- Domestic—Offshore duty-free shop: Only Hainan, China’s southern island province, operates this type of duty-free stores. Passengers who depart the island (excluding departing national border) by plane, train or ship can purchase duty-free products within limited value, limited quantity and limited varieties.

- Domestic—In-city downtown duty-free shop: This type of in-city store is for inbound foreign travelers and Chinese tourists who hold valid documents such as Chinese passports and have returned from international destinations to China within the past 180 days.

Estimates are made in June

Estimates are made in JuneSource: Morgan Stanley[/caption]

Three Key Drivers of Market Growth

1. Hainan’s New Duty-Free Policy Hainan has become the new destination for a shopping spree without the need to fly overseas. The Chinese government released a set of new policies in late June 2020 for duty-free shopping in Hainan in a bid to boost domestic travel and spending in the wake of the pandemic.- Effective from July 1, the annual tax-free shopping quota for each customer has been raised from ¥30,000 ($4,370) to ¥100,000 ($14,570), with no limit to the number of store visits.

- The number of duty-free product categories has also expanded from 38 to 45, with the seven newly added categories including liquor, mobile phones and laptops.

- The previous ¥8,000 ($1,165) limit for a single item has been removed, and the number of categories with a single-purchase quantity limit has also been reduced. Taking cosmetics as an example, the single purchase limit has been increased from 12 to 30 items.

Chinese tourists shop at the Sanya International Duty-Free Shopping Complex in Hainan

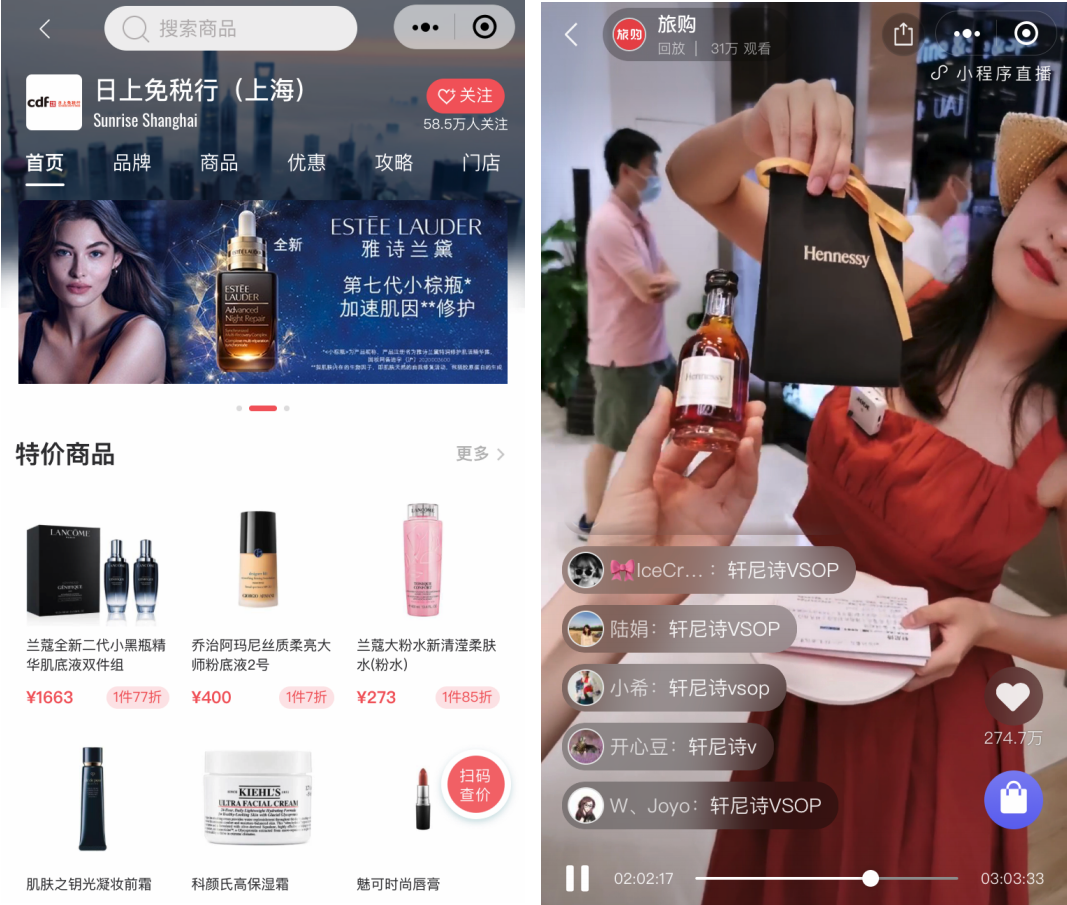

Chinese tourists shop at the Sanya International Duty-Free Shopping Complex in HainanSource: Weibo[/caption] 2. Downtown Duty-Free on the Rise Compared to Japan and South Korea, China’s downtown duty-free shops had not gained much traction until this year. There are 13 duty-free shops across 12 cities in China as of July, while the number of downtown duty-free stores in South Korea are double that, thanks to the relaxation in granting duty-free licenses. As domestic spending has been pressured by Covid-19, the Chinese government plans to ease control of the duty-free market and develop more downtown stores in cities to attract consumers. Multiple department store retailers and local tourism providers have applied for duty-free licenses. Wangfujing Group, one of China’s largest department store chains, announced in June that it has been granted such a license, making it the eighth company in China to have one. Existing downtown duty-free stores have seen strong growth during the pandemic. The eligibility for duty-free shopping has also been extended beyond the previous restriction (to only those who have traveled within the past 180 days) to encourage consumer spending in the wake of the Covid-19 crisis: From July 1, Chinese travelers who went abroad between August 1, 2019 and June 1, 2020 are eligible to shop at downtown duty-free stores before December 31, 2020. Downtown duty-free stores are better positioned for the current market. They offer more favorably priced products than traditional department stores and boast more space and increased product variety than in-airport shops. The shopping experience is also better than in airports, as consumers are not under time pressure. 3. Growth in Online Duty-Free Channel The pandemic sparked a shift in spending to online, including in the duty-free market. Eligible consumers who have returned to China in the past six months can purchase online for home delivery of orders. Consumers who traveled to Hainan can also pick up online orders in the airport. In its latest quarterly report, China International Travel Services, the parent company of CDFG, reported that half of its sales came from the online channel, and this share is expected to increase going forward. CDFG has extended its contract with digital platform TripurX to enhance retailers’ online capabilities. Several CDFG duty-free shops have launched on the TripurX WeChat mini-program, through which consumers can search and purchase products and even experience the store virtually through the “Discovery Tours” offering. TripurX has gained new users during the crisis—with the total user base increasing to 4.1 million as of June 1 from 2.2 million on January 30. CDFG also embraced livestreaming to attract Chinese consumers. Via TripurX, CDFG livestreamed in its store in Sanya, Hainan, on August 21, which generated 307,000 views. [caption id="attachment_116259" align="aligncenter" width="480"]

Source: TripurX WeChat mini-program[/caption]

Source: TripurX WeChat mini-program[/caption]