albert Chan

The Significant Growth of China’s Pet Economy

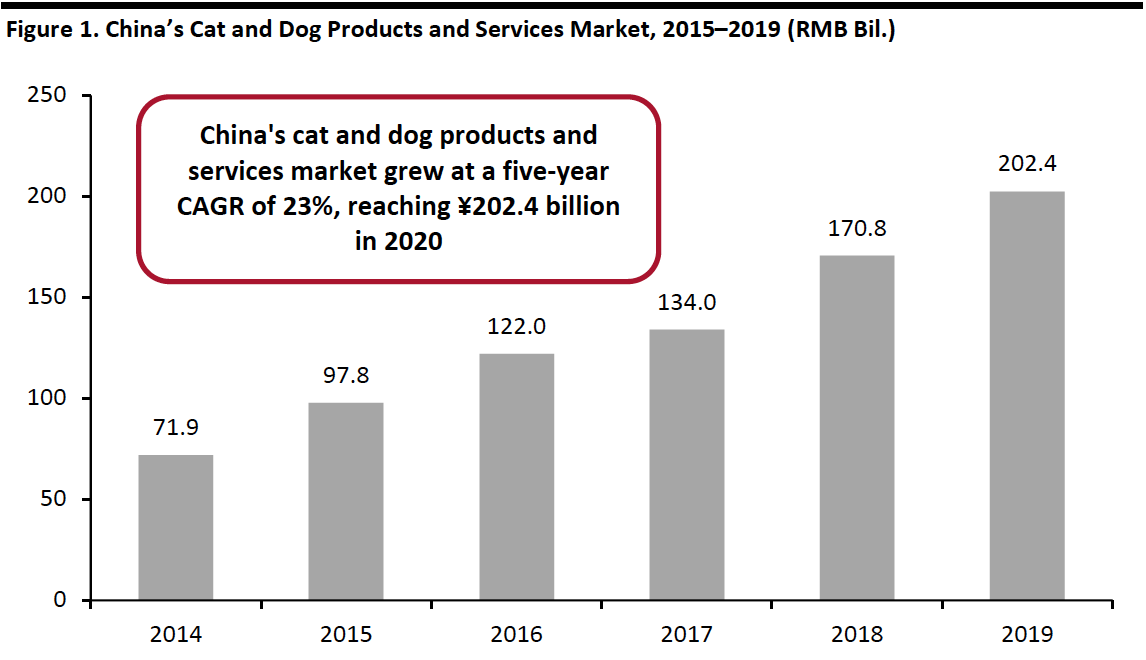

The rising popularity of raising pets in China is fueling the growth of the Chinese pet market, which includes everything from pet food and products to pet-related services. According to Goumin.com, a Chinese social platform for pet owners, China’s cat and dog products and services market reached ¥202.4 billion (around $28.8 billion) in 2019, with an 18.5% year-over-year growth rate. The market expanded at a CAGR of 23.0% between 2014 and 2019.

Despite this strong growth rate, pet ownership in Chinese households remains low compared to Western countries, and there is huge potential for expansion. Goumin.com reported that the penetration rate of Chinese household pet ownership in 2019 was only 23%. This is much lower than the rate in the US, where 67% of US households own a pet, according to the American Pet Products Association.

[caption id="attachment_112814" align="aligncenter" width="700"] Source: Goumin.com[/caption]

Source: Goumin.com[/caption]

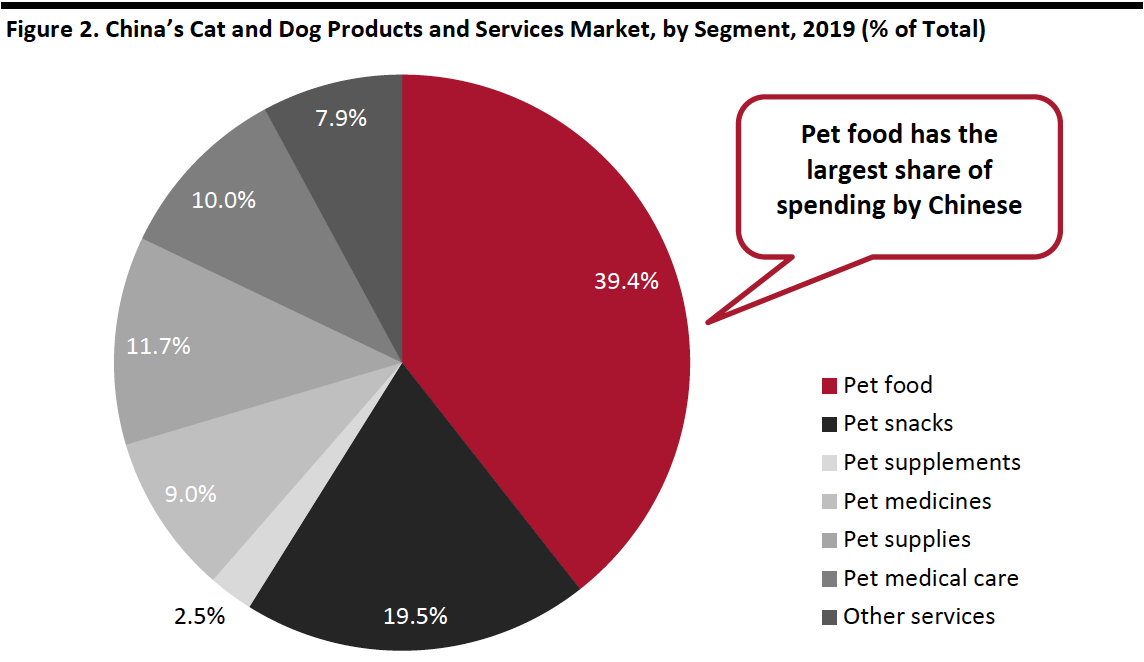

Together, pet food, snacks and supplements comprised the largest share, accounting for over 60% of the cat and dog products and services market in 2019, according to Goumin.com. Among all segments, pet snacks experienced the highest growth, as shares increased by eight percentage points year over year.

[caption id="attachment_112815" align="aligncenter" width="700"] Source: Goumin.com[/caption]

Source: Goumin.com[/caption]

Chinese consumers are accustomed to online shopping. For pet lovers, e-commerce platforms are an appealing and trusted channel, given the wide variety of brands and products available and the convenience they offer. Online penetration of pet products in China hit 42.9% in 2019, according to the research firm InternetRetailing. This is much higher than the overall online retail penetration rate of 20.7%, based on data from the National Bureau of Statistics of China. In addition to Chinese e-commerce giants Alibaba and JD.com, a wave of vertical e-commerce platforms have also emerged in the past few years—such as Boqii, epet.com and Molly Box.

What Drives the Pet Market?

There are several factors contributing to the growth of China’s pet economy, including an emerging middle class, a high degree of urbanization, declining birth rates, higher disposable incomes, and demographic changes.

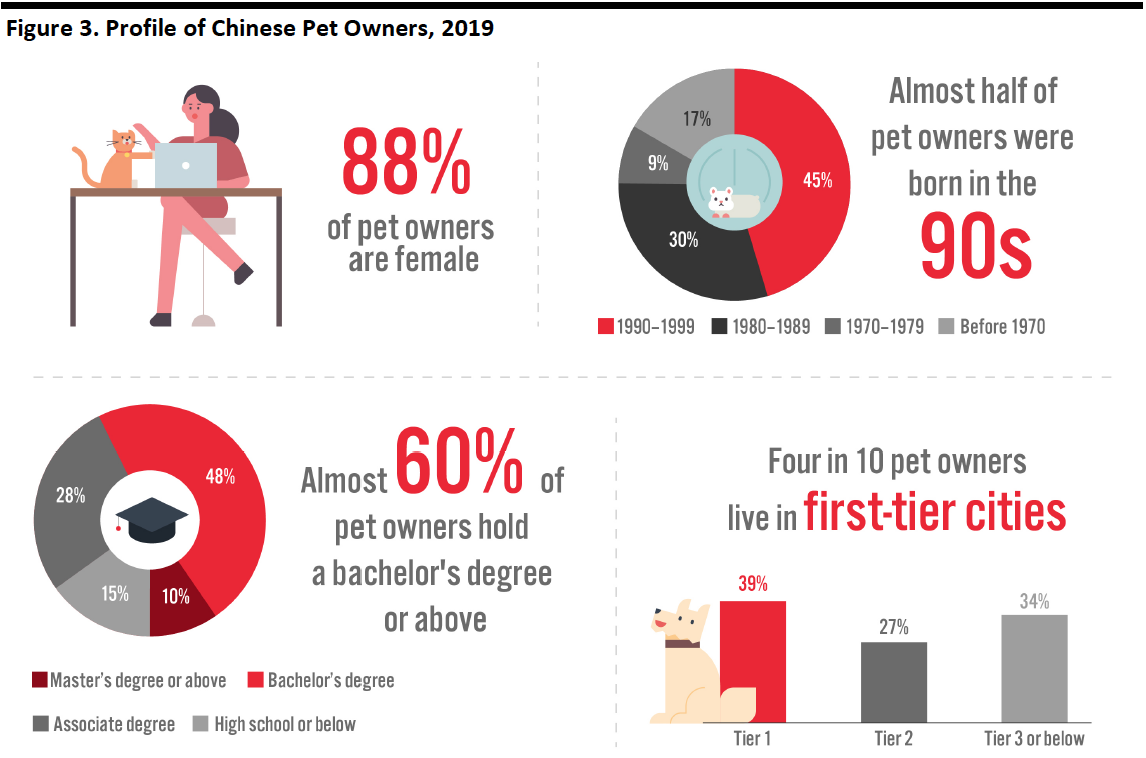

Looking at the portrait of Chinese pet owners, almost half were born in or after 1990, and 30% were born between 1980 and 1989. These two generations, who are now largely in their 20s or 30s, with the oldest among them hitting 40 this year, are typically the only child in the family due to China’s previous one-child policy. In addition, with rising urbanization, more elderly people are not living with their children and a growing number of young people are living alone in cities.

As a result, these younger consumers are turning to their furry friends for companionship, comfort and emotional support. This trend has been further accelerated by the coronavirus outbreak, as people were prompted to take in pets while they isolated at home. Over half of Chinese pet owners consider their pets as their children, according to Goumin.com, and they are willing to splurge on pet products and services. Goumin.com published that, in 2019, annual spending on a single pet reached ¥5,561 (around $790) on average, up 10.9% from the previous year.

[caption id="attachment_112816" align="aligncenter" width="700"] Source: Goumin.com[/caption]

Source: Goumin.com[/caption]

Three Key Trends in China’s Pet Economy

1. Increasing Demand for Premium and Healthier Pet ProductsTreating pets as their children and family members, Chinese pet owners are inclined to purchase imported and premium products from international brands. They are also paying more attention to the health and wellbeing of their pets, driving sales of natural or organic pet food, pet health supplements and pet disinfectant products. Cross-border e-commerce platforms have become a popular shopping channel to fulfill demand for a variety of high-quality pet products that are not widely available offline in China.

According to Tmall Global, Alibaba’s cross-border marketplace, cat food was the top-selling category during last year’s Singles’ Day. In the recent 6.18 Shopping Festival, pet snacks and pet supplements on Tmall Global experienced year-over-year sales growth of 634% and 208%, respectively. Similarly, JD.com also witnessed strong growth of pet items on its cross-border platform JD Worldwide, with sales of imported pet products increasing 400% year over year from June 2018.

2. Smart Pet-Care Devices on the RiseBesides pet essentials, smart pet-care devices—such as intelligent pet toilets, automatic water fountains and wearable GPS trackers—have been gaining traction among Chinese pet owners in recent years. These innovative devices help to care for pets while they are left alone at home. With automatic feeders, owners can feed their pets remotely, and cameras allow owners to keep an eye on their pet from their smartphone.

Consumers can easily purchase an array of smart pet products that range in price from hundreds to thousands of Chinese yuan (tens to hundreds of US dollars) on e-commerce platforms. During JD.com’s 6.18 Shopping Festival, sales of smart pet devices increased eightfold year over year. On Taobao, approximately 500 dust-free and self-cleaning cat toilets are sold each month, according to the platform; these devices each cost ¥2,500 (around $362).

[caption id="attachment_112817" align="aligncenter" width="550"] An automatic feeder (left) and an intelligent cat toilet (right)

An automatic feeder (left) and an intelligent cat toilet (right)Source: Taobao[/caption] 3. Emergence of a New Array of Pet-Related Businesses

The growing love of pets in China has sparked other forms of related businesses. As owners continue to humanize their pets, many fashion and luxury brands have capitalized on the trend by launching pet clothes and accessories. H&M collaborated with heritage brand Pringle of Scotland to launch a collection of knitwear, including two adult sweaters with matching dog versions. Luxury fashion brand Moncler collaborated with Poldo Dog Couture to introduce a collection of dog clothes, including a replica of their iconic puffer jacket.

[caption id="attachment_112818" align="aligncenter" width="550"] Dog clothes from H&M (left) and Moncler (right)

Dog clothes from H&M (left) and Moncler (right)Source: H&M, Moncler[/caption]

Chinese social media platforms have become a place for “cloud pet-raising,” a phenomenon allowing Chinese Internet users to engage with images and videos of dogs or cats for entertainment and to experience virtual pet ownership. According to Alibaba’s livestreaming platform Taobao Live, the number of pet-related livestreaming sessions saw 375% year-over-year growth in February 2020. Pets are becoming influencers, and pet ownership is cultivating a new commercial model.

In March 2020, beauty brand Perfect Diary cast Never, a puppy that is popular on Chinese social media and belongs to key influencer and livestreamer Austin Li, to launch one of the brand’s pet-themed eyeshadow palettes. The first batch of 160,000 dog-themed eyeshadow palettes sold out in 10 seconds.

[caption id="attachment_112819" align="aligncenter" width="550"] Source: Perfect Diary[/caption]

Source: Perfect Diary[/caption]

Implications for Brands and Retailers

China’s booming pet products and services economy provides varied opportunities for brands and retailers, as Chinese pet owners are willing to spend significant amounts of money on their furry friends. Reputable international pet food and care brands are particularly popular as they meet consumers’ demand for premium and quality pet products. Brands and retailers who are not specialized in pet products could still capitalize on the trend by expanding into pet-related or pet-themed products, as well as by forming collaborations with pet-related brands.