Nitheesh NH

Alipay and WeChat Pay Expand Beyond Borders

Mobile payments have done extremely well in China. China-based consultancy iResearch estimates nearly 63% of all of China’s third-party payments will be made using a mobile payment system in 2019 – up from just 9% in 2013.

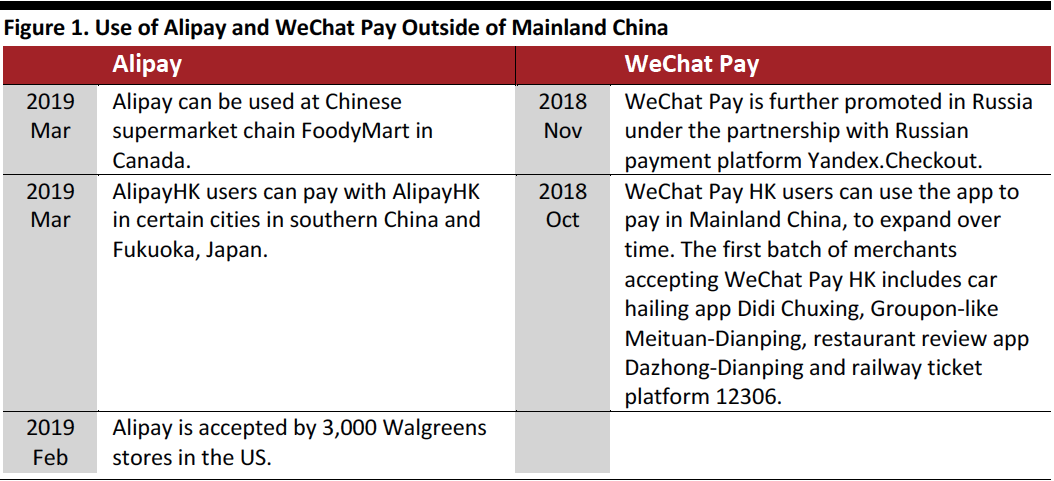

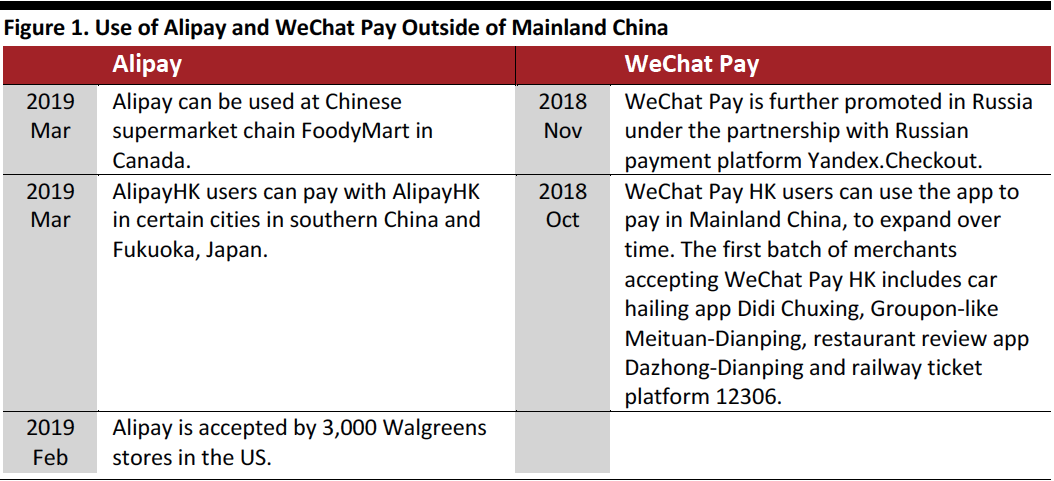

Flush with success at home, Alibaba and Tencent have been working to get overseas merchants to accept Alipay and WeChat payments. The Hong Kong versions of these e-wallets — AlipayHK and WeChat Pay HK – are also gaining traction with merchants outside Hong Kong.

The table below shows how Alipay and WeChat Pay have expanded acceptance outside Mainland China.

[caption id="attachment_81959" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

Alipay and WeChat Pay’s overseas forays are getting a huge boost from booming outbound Chinese tourism: According to China’s Ministry of Culture and Tourism, Chinese tourists made around 150 million overseas trips in 2018, up 14.7% year over year.

And, according to a survey by Nielsen and Alibaba on overseas travel conducted in 2017, the average Chinese tourist spends over $3,000 on location when traveling abroad. The same survey showed that 93% of Chinese tourists would use mobile payments when traveling if more overseas merchants accepted them, while 91% would spend and shop more if overseas merchants accepted Chinese mobile payments.

A Potential Payment Tool for Guangdong’s Greater Bay Area

The Chinese government is driving greater integration of the cities in southern China’s Pearl River Delta region, envisioning a Greater Bay Area that encompasses nine Chinese cities in Guangdong province and two special administrative regions, Hong Kong and Macau. The increased use of Alipay and WeChat Pay in the Greater Bay Area may help this integration by making it easier to pay for goods and services in locations that use different currencies (the Hong Kong dollar, Macanese pataca and Chinese yuan).

Tourists from Mainland China have long been able to pay with WeChat Pay or Alipay when traveling in Hong Kong — paying in Chinese yuan for Hong Kong dollar-denominated goods and services based on real-time exchange rates. Last year, WeChat Pay HK began to be accepted on the Mainland. And starting March, AlipayHK is accepted by merchants in some cities in neighboring Guangdong province.

People can use mobile payment services not only in retail locations, but also to pay for transportation services:

Source: Company reports/Coresight Research[/caption]

Alipay and WeChat Pay’s overseas forays are getting a huge boost from booming outbound Chinese tourism: According to China’s Ministry of Culture and Tourism, Chinese tourists made around 150 million overseas trips in 2018, up 14.7% year over year.

And, according to a survey by Nielsen and Alibaba on overseas travel conducted in 2017, the average Chinese tourist spends over $3,000 on location when traveling abroad. The same survey showed that 93% of Chinese tourists would use mobile payments when traveling if more overseas merchants accepted them, while 91% would spend and shop more if overseas merchants accepted Chinese mobile payments.

A Potential Payment Tool for Guangdong’s Greater Bay Area

The Chinese government is driving greater integration of the cities in southern China’s Pearl River Delta region, envisioning a Greater Bay Area that encompasses nine Chinese cities in Guangdong province and two special administrative regions, Hong Kong and Macau. The increased use of Alipay and WeChat Pay in the Greater Bay Area may help this integration by making it easier to pay for goods and services in locations that use different currencies (the Hong Kong dollar, Macanese pataca and Chinese yuan).

Tourists from Mainland China have long been able to pay with WeChat Pay or Alipay when traveling in Hong Kong — paying in Chinese yuan for Hong Kong dollar-denominated goods and services based on real-time exchange rates. Last year, WeChat Pay HK began to be accepted on the Mainland. And starting March, AlipayHK is accepted by merchants in some cities in neighboring Guangdong province.

People can use mobile payment services not only in retail locations, but also to pay for transportation services:

Source: Company reports/Coresight Research[/caption]

Alipay and WeChat Pay’s overseas forays are getting a huge boost from booming outbound Chinese tourism: According to China’s Ministry of Culture and Tourism, Chinese tourists made around 150 million overseas trips in 2018, up 14.7% year over year.

And, according to a survey by Nielsen and Alibaba on overseas travel conducted in 2017, the average Chinese tourist spends over $3,000 on location when traveling abroad. The same survey showed that 93% of Chinese tourists would use mobile payments when traveling if more overseas merchants accepted them, while 91% would spend and shop more if overseas merchants accepted Chinese mobile payments.

A Potential Payment Tool for Guangdong’s Greater Bay Area

The Chinese government is driving greater integration of the cities in southern China’s Pearl River Delta region, envisioning a Greater Bay Area that encompasses nine Chinese cities in Guangdong province and two special administrative regions, Hong Kong and Macau. The increased use of Alipay and WeChat Pay in the Greater Bay Area may help this integration by making it easier to pay for goods and services in locations that use different currencies (the Hong Kong dollar, Macanese pataca and Chinese yuan).

Tourists from Mainland China have long been able to pay with WeChat Pay or Alipay when traveling in Hong Kong — paying in Chinese yuan for Hong Kong dollar-denominated goods and services based on real-time exchange rates. Last year, WeChat Pay HK began to be accepted on the Mainland. And starting March, AlipayHK is accepted by merchants in some cities in neighboring Guangdong province.

People can use mobile payment services not only in retail locations, but also to pay for transportation services:

Source: Company reports/Coresight Research[/caption]

Alipay and WeChat Pay’s overseas forays are getting a huge boost from booming outbound Chinese tourism: According to China’s Ministry of Culture and Tourism, Chinese tourists made around 150 million overseas trips in 2018, up 14.7% year over year.

And, according to a survey by Nielsen and Alibaba on overseas travel conducted in 2017, the average Chinese tourist spends over $3,000 on location when traveling abroad. The same survey showed that 93% of Chinese tourists would use mobile payments when traveling if more overseas merchants accepted them, while 91% would spend and shop more if overseas merchants accepted Chinese mobile payments.

A Potential Payment Tool for Guangdong’s Greater Bay Area

The Chinese government is driving greater integration of the cities in southern China’s Pearl River Delta region, envisioning a Greater Bay Area that encompasses nine Chinese cities in Guangdong province and two special administrative regions, Hong Kong and Macau. The increased use of Alipay and WeChat Pay in the Greater Bay Area may help this integration by making it easier to pay for goods and services in locations that use different currencies (the Hong Kong dollar, Macanese pataca and Chinese yuan).

Tourists from Mainland China have long been able to pay with WeChat Pay or Alipay when traveling in Hong Kong — paying in Chinese yuan for Hong Kong dollar-denominated goods and services based on real-time exchange rates. Last year, WeChat Pay HK began to be accepted on the Mainland. And starting March, AlipayHK is accepted by merchants in some cities in neighboring Guangdong province.

People can use mobile payment services not only in retail locations, but also to pay for transportation services:

- Both Alipay and WeChat Pay and their Hong Kong versions can be used to purchase railway tickets on the Guangzhou-Shenzhen-Hong Kong Express Rail Link.

- Two pilot minibus routes in Hong Kong began accepting AlipayHK, the city’s first-ever mobile payment method for minibuses.