albert Chan

Alibaba Invests in STO Express

In March, Alibaba invested ¥4.66 billion ($693 million) in Shanghai-based courier company STO Express to acquire a roughly 15% stake in the company. Alibaba has since gained minority stakes in other major courier companies including YTO Express, Best Inc. and ZTO Express.

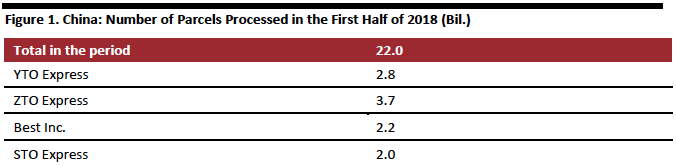

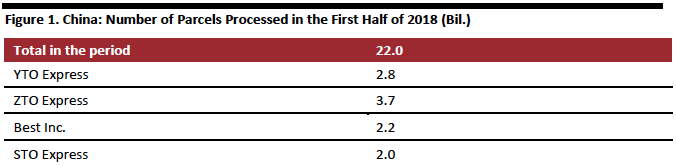

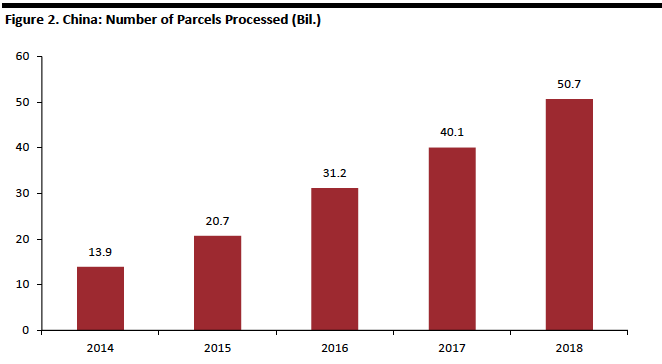

The total number of parcels processed by all carriers for the first half of 2018 in China was around 22 billion, according to China’s State Post Bureau. In the same period, courier firms YTO Express, Best Inc., ZTO Express and STO Express processed a total of 10.7 billion packages, representing 49% of the market. Alibaba’s investments in these four courier companies will consolidate its market power in the logistics space.

[caption id="attachment_81382" align="aligncenter" width="676"] Source: State Post Bureau/company reports/Coresight Research[/caption]

Delivering 24-Hour Domestically and 72-Hour Globally

Alibaba’s goal is to deliver online orders in 24 hours for the domestic market and 72 hours for cross-border purchases through its logistics subsidiary Cainiao Network. Cainiao Network was founded in 2013 and is an alliance of over 10 Chinese courier companies, including the four in which Alibaba invested. Cainiao Network offers warehousing, courier and cloud-based logistics solutions.

The biggest competitor for Alibaba in the logistics race is JD.com, which offers retail-as-a-service to support merchants’ operations in the supply chain. Its logistics subsidiary JD Logistics can already offer same-day delivery for the majority cities in China:

Source: State Post Bureau/company reports/Coresight Research[/caption]

Delivering 24-Hour Domestically and 72-Hour Globally

Alibaba’s goal is to deliver online orders in 24 hours for the domestic market and 72 hours for cross-border purchases through its logistics subsidiary Cainiao Network. Cainiao Network was founded in 2013 and is an alliance of over 10 Chinese courier companies, including the four in which Alibaba invested. Cainiao Network offers warehousing, courier and cloud-based logistics solutions.

The biggest competitor for Alibaba in the logistics race is JD.com, which offers retail-as-a-service to support merchants’ operations in the supply chain. Its logistics subsidiary JD Logistics can already offer same-day delivery for the majority cities in China:

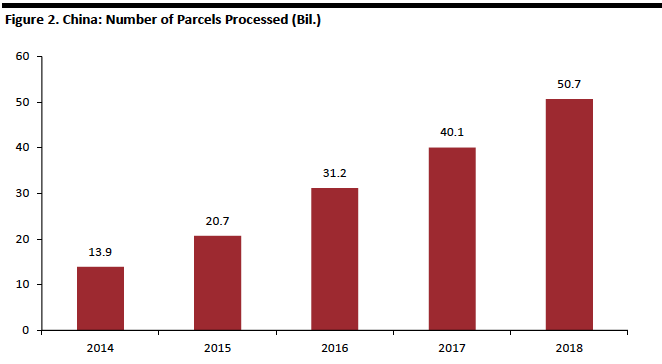

Source: State Post Bureau/Coresight Research[/caption]

[caption id="attachment_81384" align="aligncenter" width="666"]

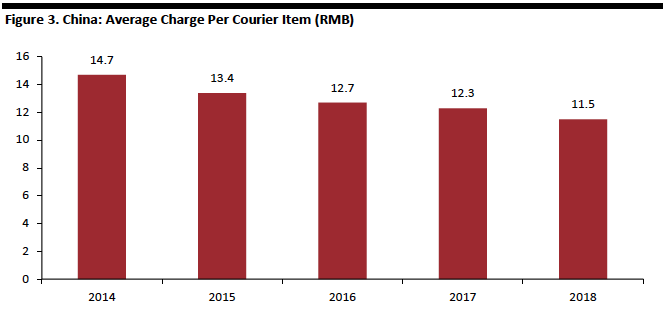

Source: State Post Bureau/Coresight Research[/caption]

[caption id="attachment_81384" align="aligncenter" width="666"] Source: BigData-Research/Coresight Research[/caption]

Insights

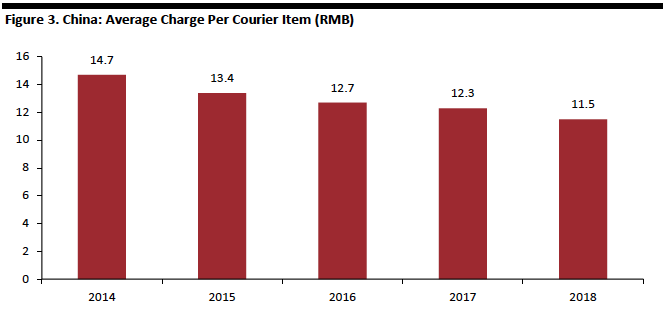

China’s logistics race has stepped up further. Following Alibaba’s investment in STO Express, we expect to see a more coordinated network of logistics partners under the banner of Cainiao Network to deliver online orders more quickly. Besides speed, it is also important to diversify the logistics solutions to accommodate needs of different types of merchandise and regions. China has been pushing domestic consumption and is allowing in more imported goods: Demand for logistics services will continue to rise.

Source: BigData-Research/Coresight Research[/caption]

Insights

China’s logistics race has stepped up further. Following Alibaba’s investment in STO Express, we expect to see a more coordinated network of logistics partners under the banner of Cainiao Network to deliver online orders more quickly. Besides speed, it is also important to diversify the logistics solutions to accommodate needs of different types of merchandise and regions. China has been pushing domestic consumption and is allowing in more imported goods: Demand for logistics services will continue to rise.

Source: State Post Bureau/company reports/Coresight Research[/caption]

Delivering 24-Hour Domestically and 72-Hour Globally

Alibaba’s goal is to deliver online orders in 24 hours for the domestic market and 72 hours for cross-border purchases through its logistics subsidiary Cainiao Network. Cainiao Network was founded in 2013 and is an alliance of over 10 Chinese courier companies, including the four in which Alibaba invested. Cainiao Network offers warehousing, courier and cloud-based logistics solutions.

The biggest competitor for Alibaba in the logistics race is JD.com, which offers retail-as-a-service to support merchants’ operations in the supply chain. Its logistics subsidiary JD Logistics can already offer same-day delivery for the majority cities in China:

Source: State Post Bureau/company reports/Coresight Research[/caption]

Delivering 24-Hour Domestically and 72-Hour Globally

Alibaba’s goal is to deliver online orders in 24 hours for the domestic market and 72 hours for cross-border purchases through its logistics subsidiary Cainiao Network. Cainiao Network was founded in 2013 and is an alliance of over 10 Chinese courier companies, including the four in which Alibaba invested. Cainiao Network offers warehousing, courier and cloud-based logistics solutions.

The biggest competitor for Alibaba in the logistics race is JD.com, which offers retail-as-a-service to support merchants’ operations in the supply chain. Its logistics subsidiary JD Logistics can already offer same-day delivery for the majority cities in China:

- Orders received before 11:00 AM will be delivered the same day, except in Tianjin, Shenzhen, Chongqing, Hangzhou, Dongguan and Zhangzhou, where the cut-off time is 10:00 AM.

- Orders received before 11:00 PM will be delivered the next day before 3:00 PM.

- JD Luxury Express, a “white-glove” delivery service that offers personalized delivery of luxury goods to replicate the high-end experience of shopping for luxury brands offline.

- Drone delivery to send parcels to remote and less accessible areas.

Source: State Post Bureau/Coresight Research[/caption]

[caption id="attachment_81384" align="aligncenter" width="666"]

Source: State Post Bureau/Coresight Research[/caption]

[caption id="attachment_81384" align="aligncenter" width="666"] Source: BigData-Research/Coresight Research[/caption]

Insights

China’s logistics race has stepped up further. Following Alibaba’s investment in STO Express, we expect to see a more coordinated network of logistics partners under the banner of Cainiao Network to deliver online orders more quickly. Besides speed, it is also important to diversify the logistics solutions to accommodate needs of different types of merchandise and regions. China has been pushing domestic consumption and is allowing in more imported goods: Demand for logistics services will continue to rise.

Source: BigData-Research/Coresight Research[/caption]

Insights

China’s logistics race has stepped up further. Following Alibaba’s investment in STO Express, we expect to see a more coordinated network of logistics partners under the banner of Cainiao Network to deliver online orders more quickly. Besides speed, it is also important to diversify the logistics solutions to accommodate needs of different types of merchandise and regions. China has been pushing domestic consumption and is allowing in more imported goods: Demand for logistics services will continue to rise.