DIpil Das

On May 18, 2021 Deborah Weinswig, CEO and Founder of Coresight Research, spoke at Engage Reimagined 2021, Aptos’ annual client event that dives into innovation in the technology and retail industries. Aptos is an enterprise retail technology provider that works with over 1,000 retail brands in 65 countries.

During the session, Weinswig spoke with Dave Bruno, Director of Retail Industry Insights at Aptos, about the state of US retail today, what retailers can expect to see over the rest of the year, and key trends that stakeholders in the industry must watch going forward.

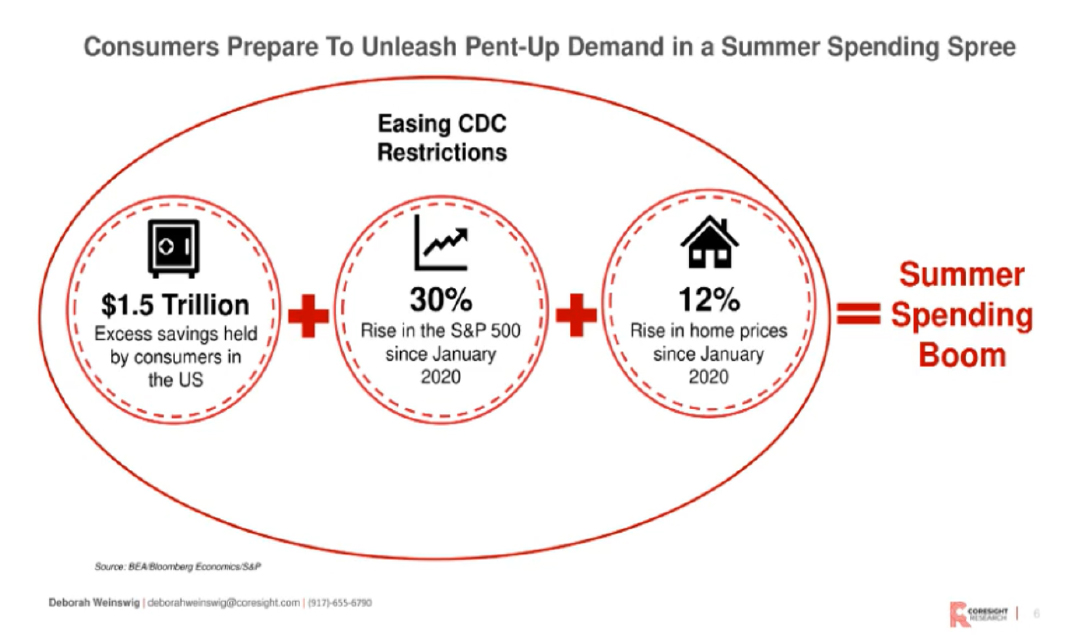

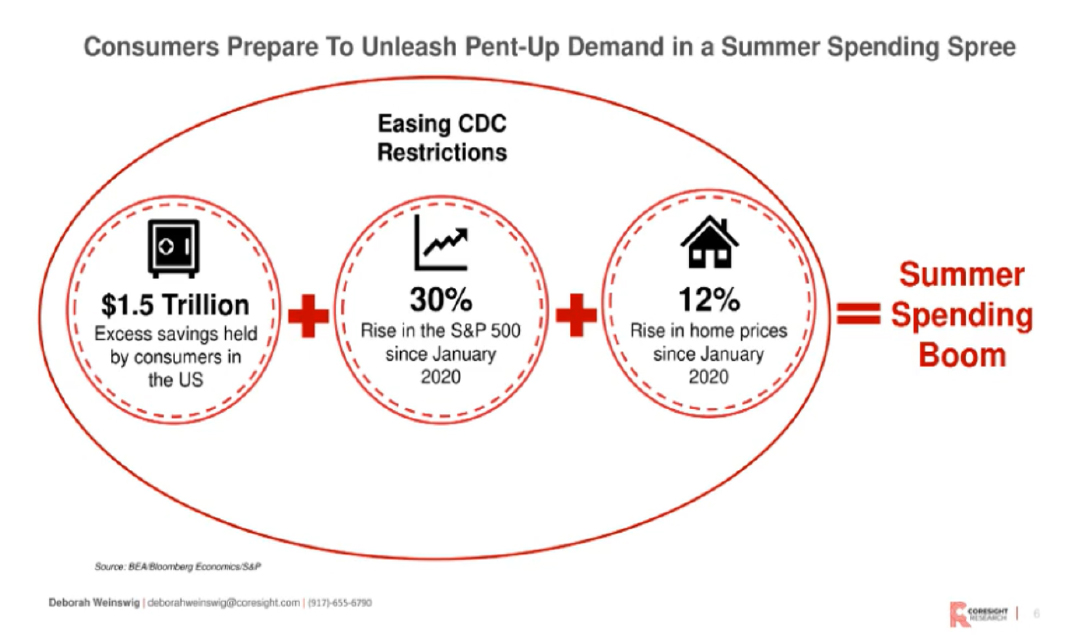

Weinswig argues that this summer will see a retail spending surge thanks to a combination of positive macro indicators

Weinswig argues that this summer will see a retail spending surge thanks to a combination of positive macro indicators

Source: Coresight Research [/caption] Eight Key Retail Trends Through 2021 After providing a backdrop to contextualize the current retail environment, Weinswig laid out eight key retail trends that retailers must be conscious of to succeed in the continually volatile world of retail through the remainder of 2021. 1. Social Commerce and Livestreaming Weinswig highlighted the increasingly important role that social commerce and livestreaming are playing in retail. She and Bruno discussed the role that store associates can play in the livestreaming ecosystem, agreeing that associates are often a good way for retailers to livestream at lower costs compared to working with mainstream influencers. With associates, Weinswig said, “You can be [livestreaming] out of the basement of your home—it’s just a smartphone, a stand and a light!” Store associates also help brands and retailers to create a more authentic and personal experience for viewers than celebrities or influencers, with content that can be crafted to local target markets, such as an individual store or area. [caption id="attachment_127780" align="aligncenter" width="725"] Weinswig explains that opportunity for retailers lies in having store associates host livestreaming sessions

Weinswig explains that opportunity for retailers lies in having store associates host livestreaming sessions

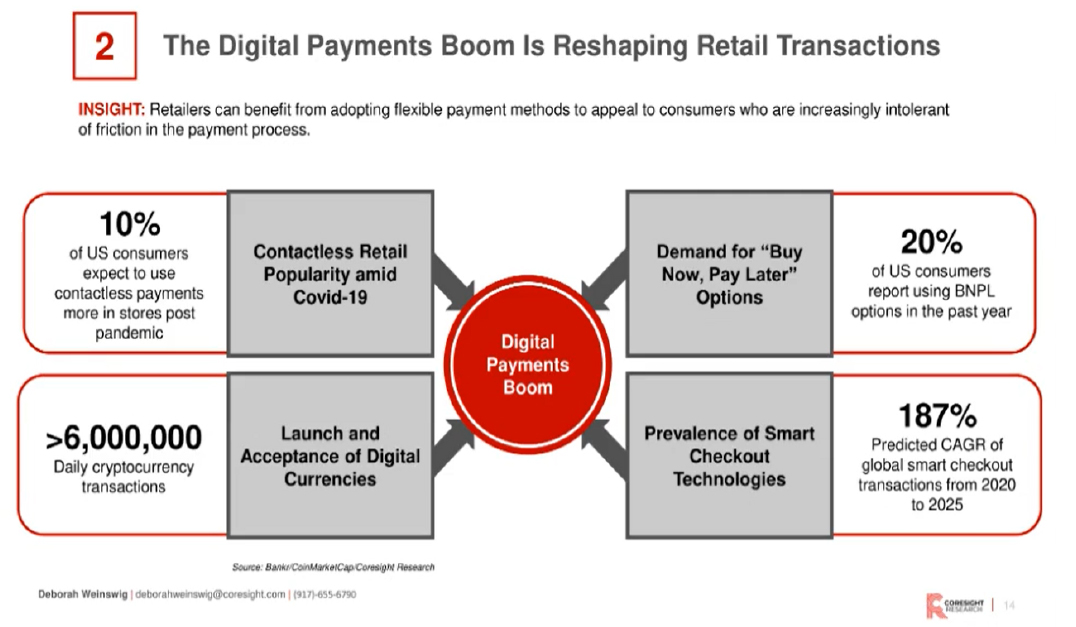

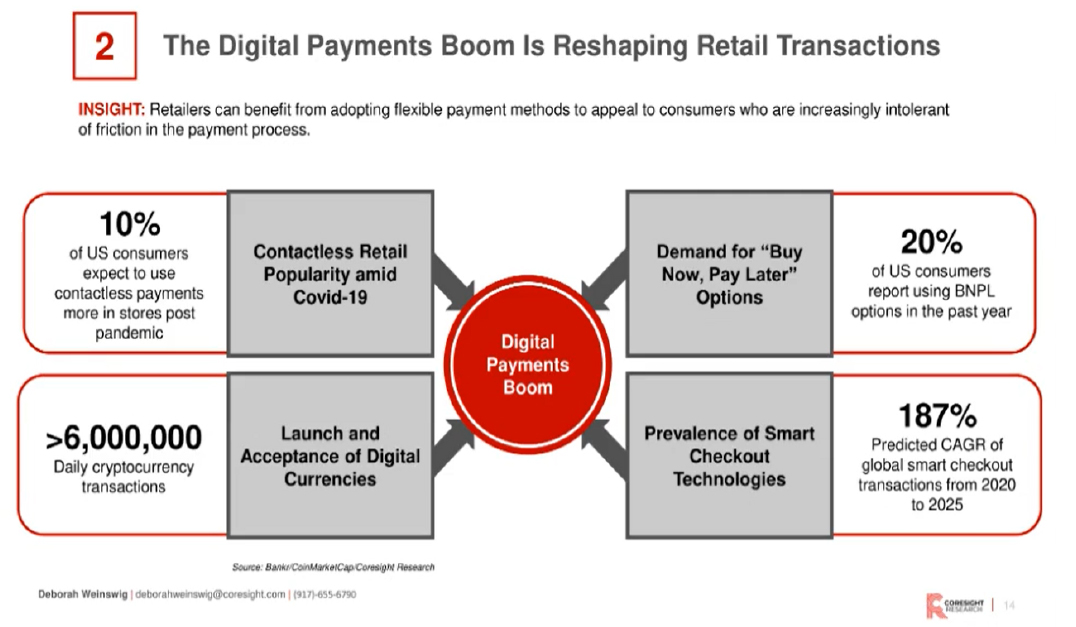

Source: Coresight Research [/caption] 2. Digital Payments Another digital retail innovation that Weinswig highlighted is BNPL. The importance of new digital payment technologies is increasing, as consumers are becoming more intolerant of friction in the payment process and are always looking for convenience in the shopping experience. In particular, Weinswig reiterated how beneficial and low-cost it can be to implement BNPL services, indicating that most retailers she has talked to that have implemented BNPL technology have seen “double-digit sales growth” as a result. Bruno agreed, adding, “There is no reason not to do it [implement BNPL services]. It is basically the same price as a credit card, and all the clients I talk to say they love it.” [caption id="attachment_127781" align="aligncenter" width="725"] Weinswig and Bruno emphasize the benefits of implementing BNPL services

Weinswig and Bruno emphasize the benefits of implementing BNPL services

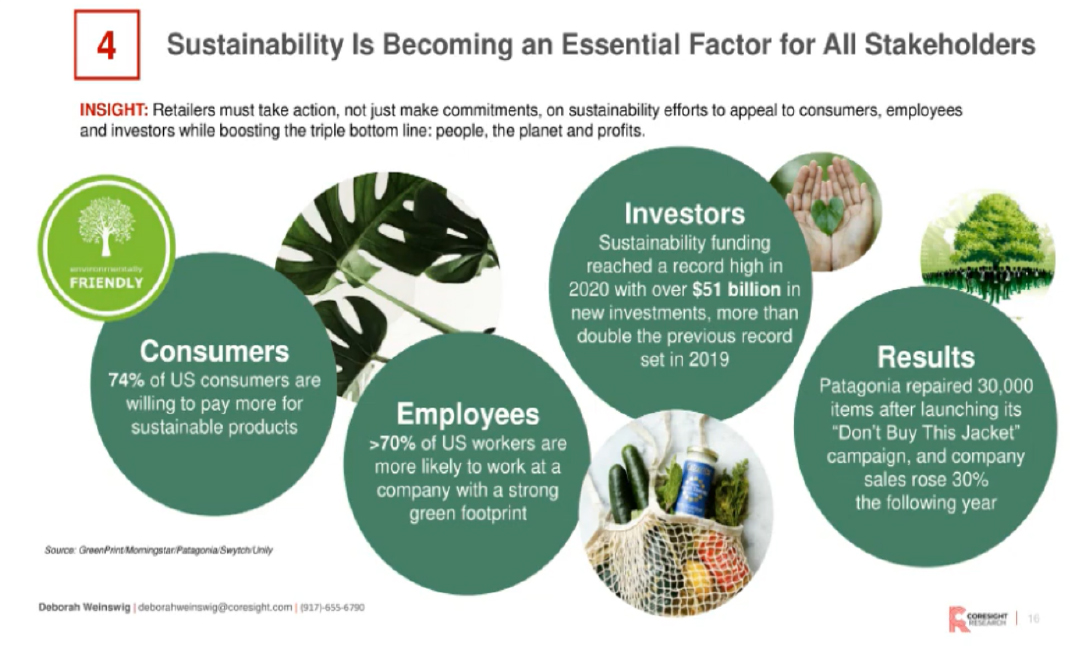

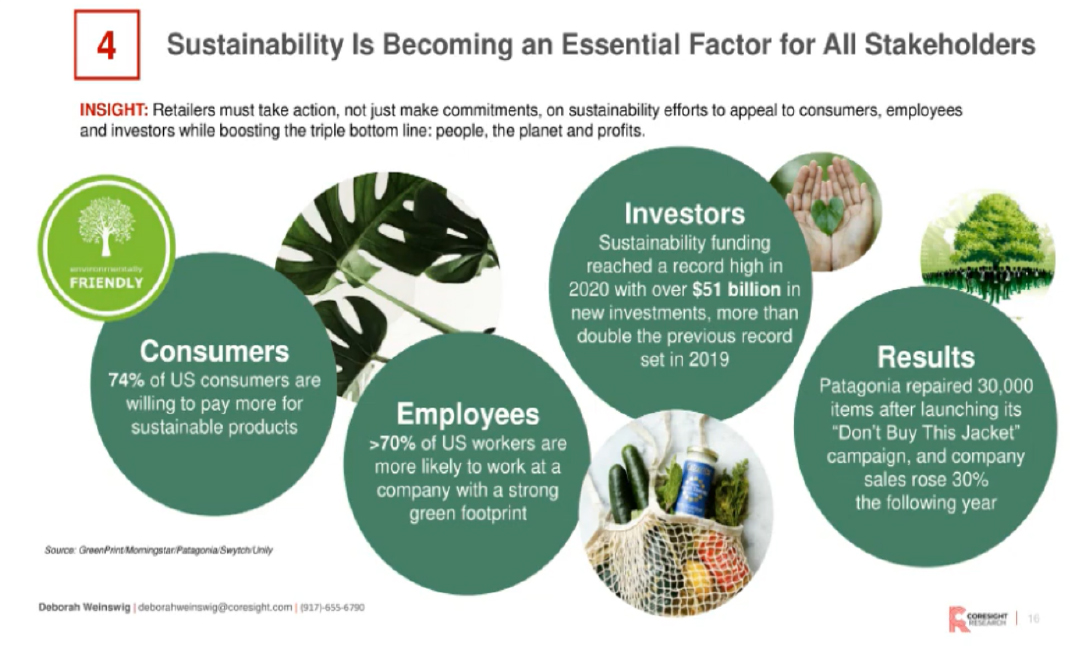

Source: Coresight Research [/caption] 1. Retail Media The rise of retail media has been accelerated by the pandemic. Online channels are the most obvious vehicles for retail media, with retailers such as Best Buy, Target and Walmart all taking advantage, Weinswig said. However, Bruno also noted the opportunities for driving revenue that retail media provides brick-and-mortar stores. “Look at all the money that Kohl’s invests in screens all over their stores. Think about all of that advertising revenue that could be made available to them [by advertising on those screens]—it expands [retail media] beyond online channels,” he said. 2. Sustainability Coresight Research believes that sustainability has become a crucial component of any strong retail strategy, with all stakeholders—consumers, employees and investors—taking sustainability increasingly seriously since the outbreak of Covid-19. Retailers should ensure their stakeholders understand that sustainability is a critical part of their path ahead, and consumers must be able to easily understand retail sustainability efforts for them to be most effective, Weinswig said. Weinswig emphasizes that all retail stakeholders are now prioritizing sustainability

Weinswig emphasizes that all retail stakeholders are now prioritizing sustainability

Source: Coresight Research [/caption] 5. Last-Mile Logistics Retailers, brands and malls are innovating in last-mile logistics to appeal to consumers who prioritize speedy delivery and are buying online at record rates. Autonomous delivery vehicles, smart lockers and BOPIS (buy online, pick up in-store) services are all reshaping last-mile fulfillment. Weinswig focused on the potential for malls to serve as platforms for online orders. Kimco now operates 300 centers that feature curbside-pickup options, while Simon Property Group works with returns-as-a-service provider Fillogic to turn its malls into reverse logistics centers. Weinswig believes that this will continue to be a good option for malls, as they can leverage the emotional attachment that consumers have with their favorite shopping centers to make them attractive omnichannel platforms. 6–8. Healthcare, Resale/Rental Models and Supply Chain Shortages With time running low, Weinswig briefly presented the final three trends that Coresight Research has identified as key for this year:

Aptos Engage Reimagined 2021: Coresight Research’s Session Insights

The Current US Retail Landscape: Set for a Summer Spending Spree Weinswig highlighted several demographic shifts taking place in the US that will have a major impact on the retail environment through the remainder of 2021 and beyond. We expect to see a major decline in the US birth rate this year, with research group Brookings estimating 300,000 fewer births. This will be a result of the Covid-19 pandemic compounding an already sharp decline in 2020 in the US, mirroring a trend that is also taking place in other countries around the world, from Italy to China to India. Also altering the US demographic environment has been a trend toward more 18–29-year-olds living with their parents, office workers’ continuation of the working-from-home trend, and consumer migration out of major cities. Weinswig explained that the migration out of cities will likely be a boon for retail spending, as costs of living will be lower, freeing up disposable income. The potential ability to spend more due to migration patterns is coupled with $1.5 trillion in excess savings, according to Bloomberg Economics—with personal savings having been boosted by government stimulus and limited spending opportunities amid pandemic-led store and foodservice closures. Many consumers are beginning to spend more freely as virus fears fade moving into the summer—and positive macro indicators are likely to result in a retail spending surge in the summer, Weinswig said (see image below). However, Weinswig said that in the current environment, excess savings and pent-up demand are actually somewhat worrisome. Supply chain issues are causing shortages of all kinds of products across the US, in some cases hiking prices and fueling fears of inflation that appear increasingly real and immediately relevant to retailers. [caption id="attachment_127779" align="aligncenter" width="725"] Weinswig argues that this summer will see a retail spending surge thanks to a combination of positive macro indicators

Weinswig argues that this summer will see a retail spending surge thanks to a combination of positive macro indicators Source: Coresight Research [/caption] Eight Key Retail Trends Through 2021 After providing a backdrop to contextualize the current retail environment, Weinswig laid out eight key retail trends that retailers must be conscious of to succeed in the continually volatile world of retail through the remainder of 2021. 1. Social Commerce and Livestreaming Weinswig highlighted the increasingly important role that social commerce and livestreaming are playing in retail. She and Bruno discussed the role that store associates can play in the livestreaming ecosystem, agreeing that associates are often a good way for retailers to livestream at lower costs compared to working with mainstream influencers. With associates, Weinswig said, “You can be [livestreaming] out of the basement of your home—it’s just a smartphone, a stand and a light!” Store associates also help brands and retailers to create a more authentic and personal experience for viewers than celebrities or influencers, with content that can be crafted to local target markets, such as an individual store or area. [caption id="attachment_127780" align="aligncenter" width="725"]

Weinswig explains that opportunity for retailers lies in having store associates host livestreaming sessions

Weinswig explains that opportunity for retailers lies in having store associates host livestreaming sessions Source: Coresight Research [/caption] 2. Digital Payments Another digital retail innovation that Weinswig highlighted is BNPL. The importance of new digital payment technologies is increasing, as consumers are becoming more intolerant of friction in the payment process and are always looking for convenience in the shopping experience. In particular, Weinswig reiterated how beneficial and low-cost it can be to implement BNPL services, indicating that most retailers she has talked to that have implemented BNPL technology have seen “double-digit sales growth” as a result. Bruno agreed, adding, “There is no reason not to do it [implement BNPL services]. It is basically the same price as a credit card, and all the clients I talk to say they love it.” [caption id="attachment_127781" align="aligncenter" width="725"]

Weinswig and Bruno emphasize the benefits of implementing BNPL services

Weinswig and Bruno emphasize the benefits of implementing BNPL services Source: Coresight Research [/caption] 1. Retail Media The rise of retail media has been accelerated by the pandemic. Online channels are the most obvious vehicles for retail media, with retailers such as Best Buy, Target and Walmart all taking advantage, Weinswig said. However, Bruno also noted the opportunities for driving revenue that retail media provides brick-and-mortar stores. “Look at all the money that Kohl’s invests in screens all over their stores. Think about all of that advertising revenue that could be made available to them [by advertising on those screens]—it expands [retail media] beyond online channels,” he said. 2. Sustainability Coresight Research believes that sustainability has become a crucial component of any strong retail strategy, with all stakeholders—consumers, employees and investors—taking sustainability increasingly seriously since the outbreak of Covid-19. Retailers should ensure their stakeholders understand that sustainability is a critical part of their path ahead, and consumers must be able to easily understand retail sustainability efforts for them to be most effective, Weinswig said.

- Read more about sustainability in retail from Coresight Research.

Weinswig emphasizes that all retail stakeholders are now prioritizing sustainability

Weinswig emphasizes that all retail stakeholders are now prioritizing sustainability Source: Coresight Research [/caption] 5. Last-Mile Logistics Retailers, brands and malls are innovating in last-mile logistics to appeal to consumers who prioritize speedy delivery and are buying online at record rates. Autonomous delivery vehicles, smart lockers and BOPIS (buy online, pick up in-store) services are all reshaping last-mile fulfillment. Weinswig focused on the potential for malls to serve as platforms for online orders. Kimco now operates 300 centers that feature curbside-pickup options, while Simon Property Group works with returns-as-a-service provider Fillogic to turn its malls into reverse logistics centers. Weinswig believes that this will continue to be a good option for malls, as they can leverage the emotional attachment that consumers have with their favorite shopping centers to make them attractive omnichannel platforms. 6–8. Healthcare, Resale/Rental Models and Supply Chain Shortages With time running low, Weinswig briefly presented the final three trends that Coresight Research has identified as key for this year:

- Weinswig expects the convergence of retail and healthcare to pick up steam moving forward, with major players such as Amazon and Walmart increasingly moving into the health market.

- Read our Market Outlook on US drugstore retail for more on the convergence on retail and healthcare.

- Resale and rental models will grow, with retailers and consumers alike looking to lengthen the lifespan of products—particularly in the apparel sector. Repair services are also an avenue of opportunity for retailers.

- For more on this topic, read our separate report on the US resale market and our Playbook on alternative models in retail.

- Weinswig explained that supply chain shortages, particularly of microchips, could lead to shortages in a wide variety of products later this year, making it an unfortunate but pertinent trend that retailers must keep their eyes on over the rest of the year.

- Read more about retail supply chains from Coresight Research.