DIpil Das

On October 16 at the China Retail 2019 event in Shanghai, the Coresight Research team attended a research-sharing session, which was organized by the China Commerce Association for General Merchandise and led by Ding Jun, Founder of Heyi Consulting, a China-based company that provides strategic advice for Chinese retailers. Ding shared his observations on the latest retail trends and consumer shopping behaviors in China. Below, we summarize the key insights from the session.

Chinese Cities Spur Night-Time Commerce To Drive Economic Growth

Originating from the UK, the night-time economy refers to commerce activities between the hours of 6pm and 6am. This is undergoing a boom in China—with 60% of consumption occurring overnight, according to the Chinese Ministry of Commerce—driving economic growth in the nation. Many cities have unveiled plans to stimulate night-time consumption, including Shanghai, Beijing, Tianjin and Xian. Many shopping malls, restaurants, supermarkets and tourist spots have extended their operating hours. For example, CSF Market, a local supermarket chain in Beijing, has 24-hour operation in select locations. Local governments are also encouraging more interactive night-time indoor and outdoor events, such as concerts, night markets and light shows.

The night-time economy in China is still in its early stages, but has huge potential to grow due to the following factors:

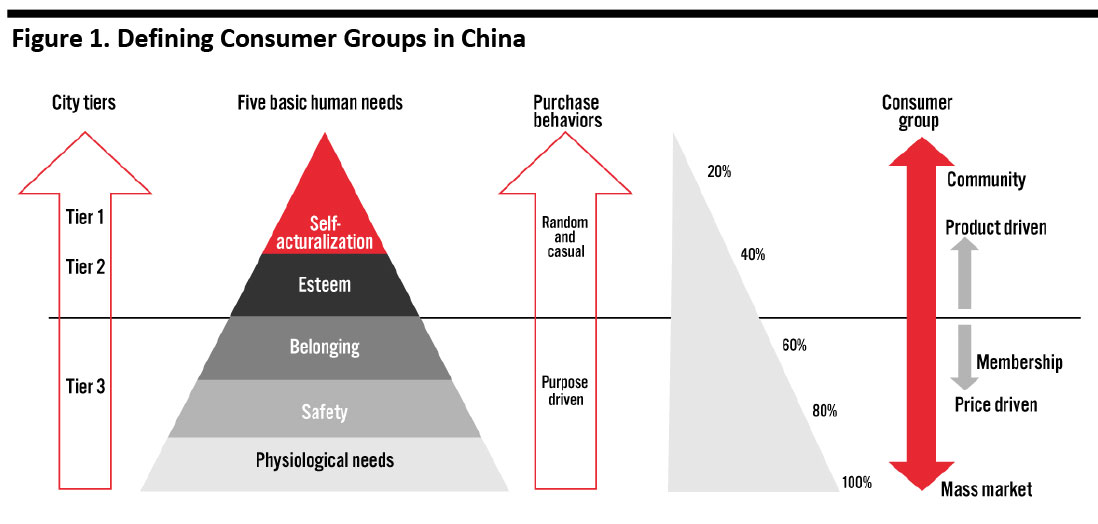

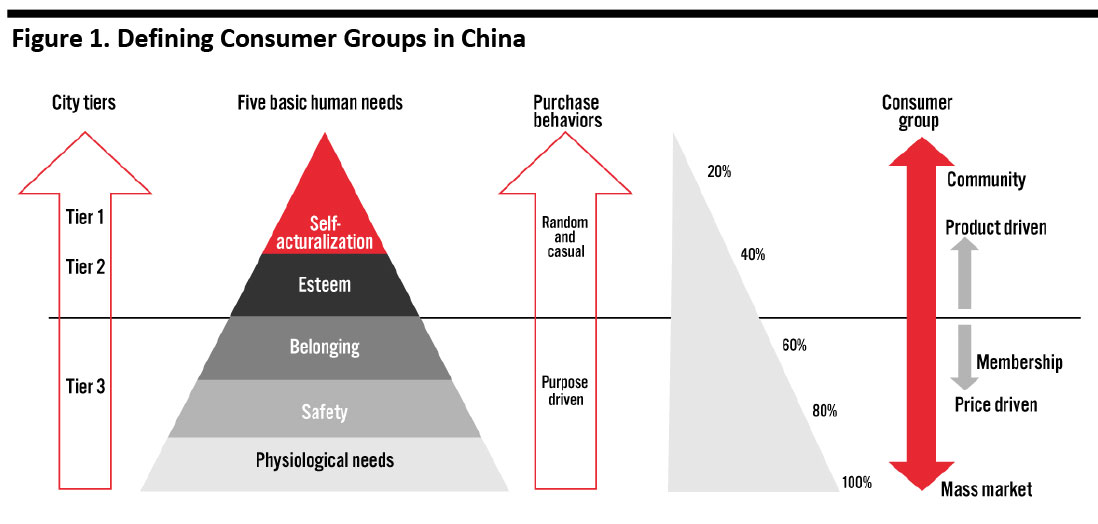

Three consumer groups can be defined based on their price sensitivity and purchase behaviors.

Three consumer groups can be defined based on their price sensitivity and purchase behaviors.

Source: Heyi Consulting/Coresight Research [/caption] Transitioning from Building Omnichannel to Improving Efficiency Ding stated that China’s retail market is about to transform from building omnichannel to improving efficiency, by leveraging technology. He suggested that retailers in China are now looking to adopt technologies such as facial recognition, the Internet of Things and data warehousing to capture consumer data both online and offline. By standardizing data collection and employing analytics, brands are able to implement strategies to improve operational efficiency. For example, German supermarket operator Aldi noted that consumers typically only choose two to three brands in each product category—the retailer therefore limits the variety of its product offerings to ensure stronger bargaining power and to enable it to order larger quantities of each stock keeping unit and thus lower the total cost.

- Improved infrastructure: Multiple cities are extending the hours of public transportation, and the government is focusing on providing a stable power supply.

- Better security environment: China is aiming to create a safe public environment by installing more surveillance systems and increasing security and police presence during weekends and major holidays.

- Cultural consumption upgrade: As Chinese consumers are becoming more sophisticated, first- and second-tier cities are introducing night-time cultural events, such as open museum exhibitions.

- Consumption from people who were born before 1990—including post-60s, -70s and -80s consumers—are more purpose-driven, typically planning their purchases in advance. Post-90s consumers, on the other hand, seemingly make random and casual purchases through impulse buying, for example.

- 70% of post-60s, -70s and -80s consumers are female, as they purchase products both for themselves and for male family members. For the post-90s consumers, men and women are driving consumption, with one influencing trend being that younger-generation males are increasingly buying products and services centered around their appearance.

- Following on from the above, although cosmetics purchases are more purpose-driven for other age groups, post-90s consumers are spurring cosmetics sales, especially for premium brands. This is driven by their higher spending power and the prevalence of social media. Apparel, streetwear and athleisure clothing has also gained popularity among the younger generation, while post-60s, -70s and -80s consumer shop more for traditional business wear.

Three consumer groups can be defined based on their price sensitivity and purchase behaviors.

Three consumer groups can be defined based on their price sensitivity and purchase behaviors. Source: Heyi Consulting/Coresight Research [/caption] Transitioning from Building Omnichannel to Improving Efficiency Ding stated that China’s retail market is about to transform from building omnichannel to improving efficiency, by leveraging technology. He suggested that retailers in China are now looking to adopt technologies such as facial recognition, the Internet of Things and data warehousing to capture consumer data both online and offline. By standardizing data collection and employing analytics, brands are able to implement strategies to improve operational efficiency. For example, German supermarket operator Aldi noted that consumers typically only choose two to three brands in each product category—the retailer therefore limits the variety of its product offerings to ensure stronger bargaining power and to enable it to order larger quantities of each stock keeping unit and thus lower the total cost.