DIpil Das

What’s the Story?

The global Covid-19 pandemic has massively impacted the retail industry—most notably accelerating a shift to e-commerce. In response to pandemic-driven changes in consumer behavior, retailers have been forced to adopt innovative new technologies to effectively meet demand and remain competitive in a challenging environment. In many cases, retailers have been collaborating with technology startups to develop new capabilities. In this report, we outline eight key innovator tech trends that we believe companies across retail sectors should be cognizant of while framing their strategies moving forward, as these trends will continue to reshape the retail landscape in 2021 and beyond. For each trend, we present examples of related initiatives by retailers globally as well as selected innovators that are enabling technological advancements in each space.Innovator Trends That Are Reshaping the Retail Industry: A Deep Dive

Figure 1. Innovator Trends That Are Reshaping the Retail Industry

1. Contact-Light Shopping Drives Growth in Contactless Payments

The shift toward contact-light shopping is most likely to stay even after the world settles into a “new normal” post pandemic. Coresight Research’s weekly surveys of US consumers regularly find that respondents are avoiding public places, including retail locations.

Consumer acceptance of, and demand for, contactless payment options are set to continue to grow. According to Statista, through 2023, around 80.1 million users in the US are expected to use proximity payments—another term for transactions carried out through mobile devices at points of sale.

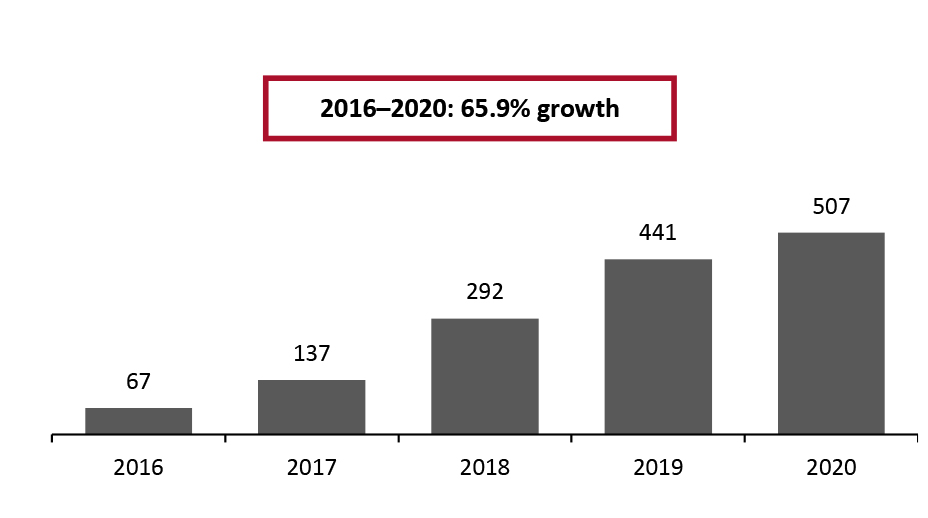

Apple Inc. is one of the leaders in contactless payments. According to LoupVentures, a US-based venture capital firm, the number of Apple Pay users worldwide is estimated to have increased by 65.9% from September 2016 to September 2020 (see Figure 2).

1. Contact-Light Shopping Drives Growth in Contactless Payments

The shift toward contact-light shopping is most likely to stay even after the world settles into a “new normal” post pandemic. Coresight Research’s weekly surveys of US consumers regularly find that respondents are avoiding public places, including retail locations.

Consumer acceptance of, and demand for, contactless payment options are set to continue to grow. According to Statista, through 2023, around 80.1 million users in the US are expected to use proximity payments—another term for transactions carried out through mobile devices at points of sale.

Apple Inc. is one of the leaders in contactless payments. According to LoupVentures, a US-based venture capital firm, the number of Apple Pay users worldwide is estimated to have increased by 65.9% from September 2016 to September 2020 (see Figure 2).

Figure 2. Number of Apple Pay Users Worldwide, 2016–2020 (Mil.) [caption id="attachment_127027" align="aligncenter" width="725"]

Source: Loup Ventures[/caption]

Source: Loup Ventures[/caption]

- Read our separate report on smart checkout technologies in the grocery sector.

Figure 3. Contactless Payments—Selected Initiatives by Retailers Globally [wpdatatable id=919 table_view=regular]

Source: Company reports

Figure 4. Contactless Payments—Innovators in the Global Market [wpdatatable id=920 table_view=regular]

Source: Company reports 2. Brands and Retailers Leverage Contextual Data To Offer Personalized Shopping Experiences Going forward, we expect hyper-personalization to become a must-have for retailers across sectors and from physical retail to e-commerce. Hyper-personalization involves understanding the needs and wants of consumers by leveraging real-time contextual data—such as location, purchase history, browsing data and social media data—and adapting marketing strategies to align with consumer insights. Creating a personalized experience for customers allows companies to build a loyal customer base and extend their reach through digital channels. AI and ML are the driving technologies behind hyper-personalization in retail, enabling custom homepages on e-commerce sites (such as on Amazon) that tailor promotions and product recommendations to individual consumer preferences. In order to create a highly personalized shopping experience that drives sales and enhances customer satisfaction, retailers need to marry product, customer and behavioral data across various channels.

- Read our separate Retail-Tech Landscape on personalization in retail.

Figure 5. Personalized Shopping Experiences—Selected Initiatives by Retailers Globally [wpdatatable id=921 table_view=regular]

Source: Company reports

Figure 6. Personalized Shopping Experiences—Innovators in the Global Market [wpdatatable id=922 table_view=regular]

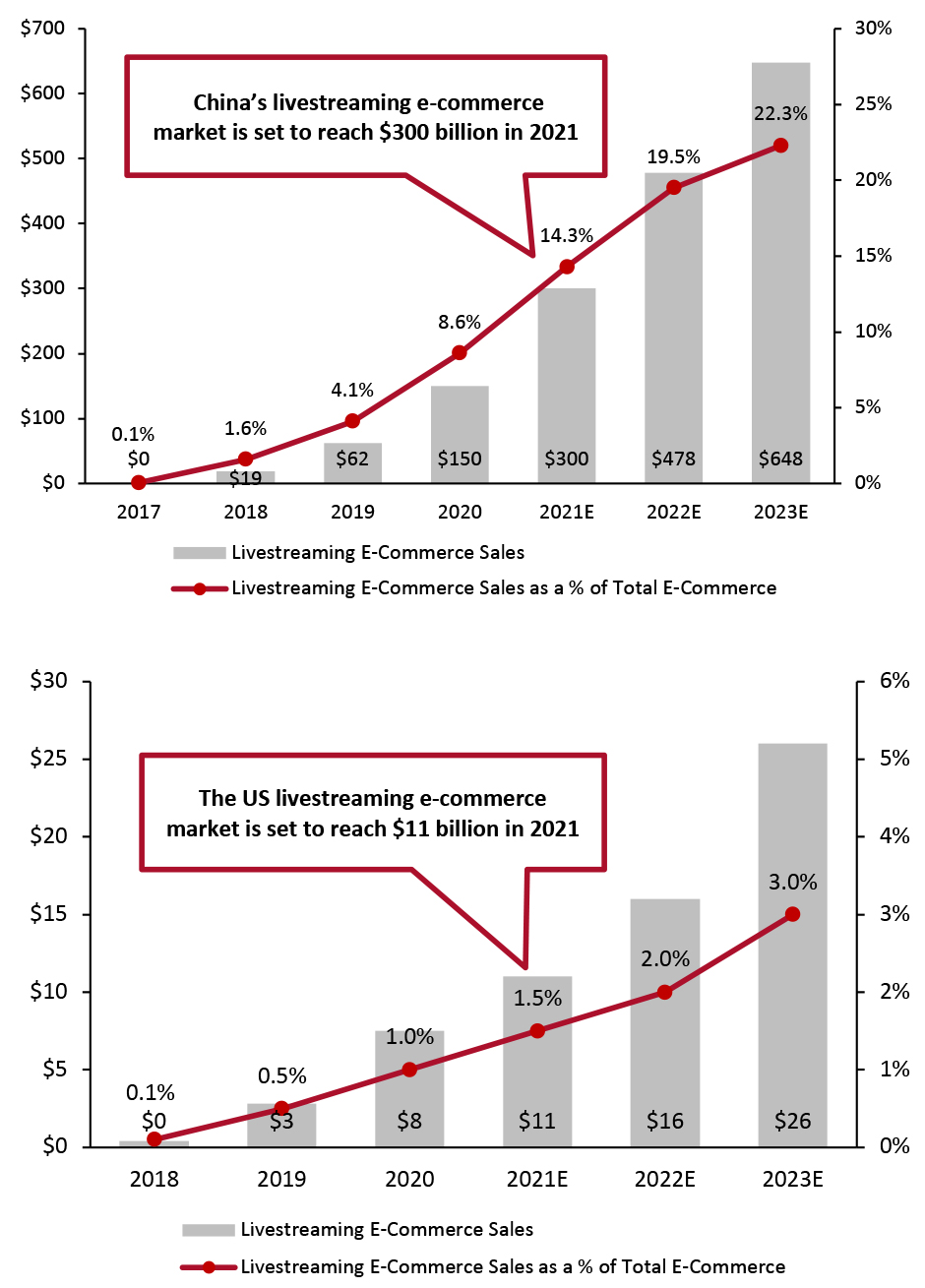

Source: Company reports 3. Social and Livestream E-Commerce Are Set To Boom We expect the social and livestream e-commerce markets to see significant growth as more retailers look to engage shoppers online. The Covid-19 pandemic has amplified the use of social media among US adults. According to Coresight Research survey conducted in March 2021, 81% of US consumers use at least one social media platform. Consumers use social media channels extensively to research and discover products through reviews and advertisements. Livestreaming e-commerce—in which shopping functionality is integrated into video streaming—has huge potential for growth in the US, based on its popularity in China. Coresight Research estimates that the livestreaming e-commerce market will grow at a CAGR of 120.0% to reach $300 billion in China, and at a CAGR of 91.5% to reach $11 billion in the US, in 2021. Our survey found that 31.5% of US consumers have watched a shoppable livestream.

Figure 7. Livestreaming E-Commerce Market Size (USD Bil.; Left Axis) and Penetration (% of Total E-Commerce; Right Axis) in China (Top) and the US (Bottom) [caption id="attachment_127028" align="aligncenter" width="689"]

Source: Coresight Research [/caption]

The global pandemic saw brands around the world turn to livestreaming as a channel to engage with consumers and drive sales amid temporary store closures—including L’Oreal, Levi’s and Tommy Hilfiger. QiLive, the private-label electronics brand of France-based retailer Auchan, started using AliExpress as an experimental platform for livestreaming e-commerce in Europe in mid-2020.

Retailers are also exploring advanced technologies to enhance their livestreaming capabilities. Ulta Beauty partnered with Perfect Corp., an augmented reality technology provider, in 2019, to improve and expand its Beauty School livestreams into a more engaging online shopping experience.

Walmart launched shoppable livestreams on the short-video app TikTok in December 2020, through which viewers could shop for fashion items curated by TikTok creators without leaving the app. The livestream was specially designed to offer a seamless shopping experience that directly linked creator-driven video content to sales. According to Walmart’s Chief Marketing Officer, William White, “It gives us a new way to engage with users and reach potential new customers, while bringing our own brand of fun—with the help of fashion-loving TikTok creators—to the platform."

Source: Coresight Research [/caption]

The global pandemic saw brands around the world turn to livestreaming as a channel to engage with consumers and drive sales amid temporary store closures—including L’Oreal, Levi’s and Tommy Hilfiger. QiLive, the private-label electronics brand of France-based retailer Auchan, started using AliExpress as an experimental platform for livestreaming e-commerce in Europe in mid-2020.

Retailers are also exploring advanced technologies to enhance their livestreaming capabilities. Ulta Beauty partnered with Perfect Corp., an augmented reality technology provider, in 2019, to improve and expand its Beauty School livestreams into a more engaging online shopping experience.

Walmart launched shoppable livestreams on the short-video app TikTok in December 2020, through which viewers could shop for fashion items curated by TikTok creators without leaving the app. The livestream was specially designed to offer a seamless shopping experience that directly linked creator-driven video content to sales. According to Walmart’s Chief Marketing Officer, William White, “It gives us a new way to engage with users and reach potential new customers, while bringing our own brand of fun—with the help of fashion-loving TikTok creators—to the platform."

- Read our Playbook on livestreaming e-commerce in the US.

Figure 8. Social and Livestream E-Commerce—Innovators in the Global Market [wpdatatable id=923 table_view=regular]

Source: Company reports 4. Retailers Seek Highly Scalable and Autonomous Last-Mile Delivery Solutions We expect that e-commerce growth will drive retailers to further improve their delivery capabilities, particularly as consumer expectations around the last mile increased rapidly during the pandemic. Competition has been heightened, with delivery timelines for online orders being reduced considerably—from several days to as fast as same-day delivery in some cases. According to ReportLinker, the global last-mile delivery market will reach $53.4 billion by 2027 from $32.0 billion in 2020, growing at a CAGR of 7.6% over the seven-year period. Retailers are continually trying to innovate in the last mile by adopting technologies that increase efficiency while reducing costs. Autonomous robots can help in reducing the cost of last-mile deliveries from $1.60 per delivery (via human drivers) to $0.06 per delivery, according to Robotics Business Review. According to Lux Research, revenue generated from autonomous delivery technology is expected to reach $33–48.4 billion by 2030, while accounting for only 20% of total parcel deliveries. We expect that the introduction of 5G technology will further enhance the use of drones for deliveries due to improved network coverage and connectivity. Retail giants such as Amazon and Walmart have already introduced drone delivery services as part of their offerings. Other companies joining the bandwagon include CVS and grocery chain Rouses Market. According to research report by Frost and Sullivan, by 2025 there will be around 2.2 million drones in the sky, delivering products to consumers. Retailers are also likely to continue to invest in effective route planning and optimization solutions that leverage AI and ML to provide real-time re-routing based on traffic congestion, weather conditions and other obstacles that could delay delivery.

- Other notable Coresight Research reports on technology in the last mile include those in our Retail Reimagined and Reshaping the Supply Chain for the 2020s series, as well as our latest report on last-mile technological innovations in US retail.

Figure 9. Last-Mile Delivery—Selected Initiatives by Retailers Globally [wpdatatable id=924 table_view=regular]

Source: Company reports

Figure 10. Last-Mile Delivery—Innovators in the Global Market [wpdatatable id=925 table_view=regular]

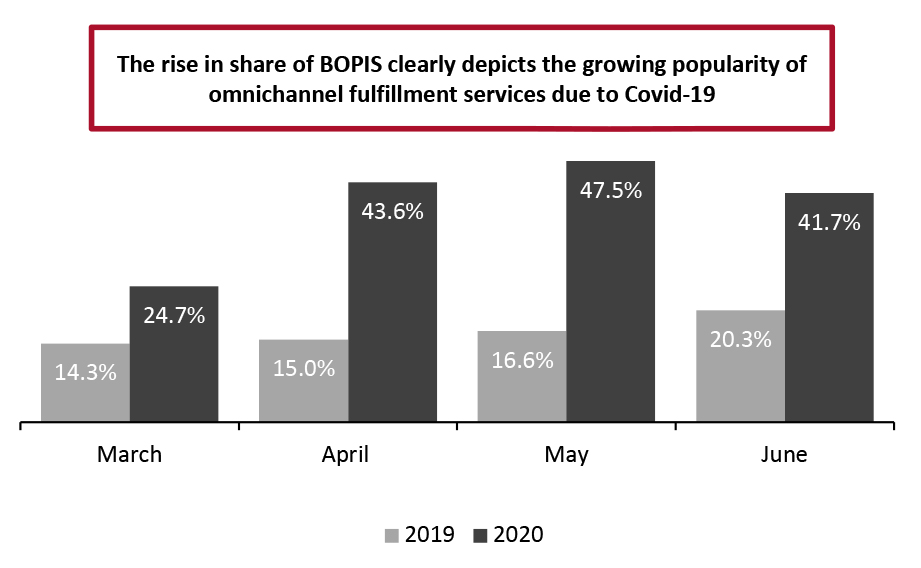

Source: Company reports 5. BOPIS and Curbside Pickup Become Preferred Delivery Modes for Customers In order to remain competitive, we expect retailers to continue to introduce and enhance BOPIS (buy online, pick up in store) and curbside-pickup services. The Covid-19 outbreak prompted a surge in popularity of such services in 2020, as consumers demanded convenience while being reluctant to visit stores. The speed, low or free delivery charges and contact-light nature of BOPIS and curbside pickup are likely to see the services remain popular among online shoppers moving forward. This type of delivery is also being extended through concepts such as “buy online, pick up in mall” (BOPIM). US-based Kibo Commerce, an online e-commerce platform provider, analyzed its 260 clients and concluded that BOPIS saw a year-over-year increase of 563% in April 2020, at the peak of the pandemic, indicating the accelerated adoption of this trend among US retailers due to the coronavirus pandemic.

Figure 11. BOPIS Share of Total Orders in the US Reported by Kibo Commerce (%), 2019-2020 [caption id="attachment_127029" align="aligncenter" width="725"]

Source: Kibo Commerce [/caption]

Retailers are increasingly innovating new ways to improve their BOPIS and curbside-pickup services. They are partnering with technology innovators to solve issues related to long wait times, unclear pickup messages and overall poor coordination between customers and retailers with respect to order collection. Other key focus areas to improve includes inventory management to ensure that products available for BOPIS on online channel are available in local retail outlets.

Source: Kibo Commerce [/caption]

Retailers are increasingly innovating new ways to improve their BOPIS and curbside-pickup services. They are partnering with technology innovators to solve issues related to long wait times, unclear pickup messages and overall poor coordination between customers and retailers with respect to order collection. Other key focus areas to improve includes inventory management to ensure that products available for BOPIS on online channel are available in local retail outlets.

- Read our Innovator Intelligence report on how technology can transform the overall BOPIS experience.

Figure 12. BOPIS and Curbside Pickup—Selected Initiatives by Retailers Globally [wpdatatable id=926 table_view=regular]

Source: Company reports

Figure 13. BOPIS and Curbside Pickup—Innovators in the Global Market [wpdatatable id=927 table_view=regular]

Source: Company reports 6. Automated Micro-Fulfillment Centers Enable Retailers To Meet Evolving Consumer Demand in a Hypercompetitive Marketplace An increase in e-commerce and online grocery sales, coupled with customer preference for faster delivery, is driving retailers to expand and manage their warehouses and fulfillment centers to deliver required volumes efficiently. Retail fulfillment automation helps these retailers deliver higher output with greater accuracy than a manual setup, at lower operating costs. One of the most prominent trends in this space is the establishment of micro-fulfillment centers—small-scale warehouse facilities located in urban areas that enable retailers to offer next-day or same-day delivery services. Micro-fulfillment centers usually measure 5,000–20,000 square feet and can maintain an inventory of 8,000–15,000 stock keeping units (SKUs). Retailers such as Ahold Delhaize, Kroger and Walmart are all leveraging micro-fulfillment capabilities to meet growing consumer demand for faster omnichannel fulfillment. Automation in micro-fulfillment centers will further enhance their efficiency and cost-effectiveness. New distribution and fulfillment technologies include automated storage/retrieval systems (AS/RS) that help retailers to move or retrieve goods from one location to another with limited or no human intervention, thus speeding up manufacturing and shipping tasks. There are multiple systems that are used in AS/RS technology, including shuttles, cranes, carousels, vertical lift modules, micro-loads, mini-loads and unit-loads. The recent pandemic-led surge in e-commerce makes it imperative for retailers to automate their warehouses to keep costs down and enhance operations.

- Read our separate Retail-Tech Landscape on warehouse automation.

Figure 14. Micro-Fulfillment Centers—Selected Initiatives by Retailers Globally [wpdatatable id=928 table_view=regular]

Source: Company reports

Figure 15. Micro-Fulfillment Centers—Innovators in the Global Market [wpdatatable id=929 table_view=regular]

Source: Company reports 7. Consumer Uncertainty Makes Demand Forecasting Paramount We expect demand forecasting to pick up pace after becoming a big talking point toward the end of 2020. Furthermore, among many ways that Covid-19 has altered retail strategies, building a pre-emptive approach to customer demand is second to none. In this context, we expect advanced machine learning technologies will gain prominence over the next few years—especially in 2021. Amid existing uncertainties in the current environment, retailers look to streamline the supply chains end-to-end, by effectively leveraging data. Accurately forecasting consumer demand can be a highly cumbersome task. In most cases, the estimates that are devoid of modern technologies such as Big Data, artificial intelligence (AI) and machine learning (ML), fail to paint the overall picture of customer demand. It is therefore necessary for retailers to use advanced technologies that leverage complex datasets to accurately forecast customer demand. With growing emphasis on sustainability and efficiency in planning on today’s retail category managers, effective demand forecasting becomes an indispensable tool. Retailers should focus on improving their assortment planning process in order to optimize merchandise category. Retailers are investing in retail assortment management tools that enable them to fulfil their inventories across multiple sales channels efficiently. Some of the popular retail assortment management tools/software available are Analyse2, First Insight, Oracle Retail Assortment and Item Planning, and Aptos Merchandise and Lifecycle Management. Covid-19 has led to shifts in consumer habits including switching spending online among others. This has added to already existing market forces such as multiple sales channels, digitally native brands, always-on shoppers and agile competitors. Figure 16. includes some of the disruptive startups to look out for.

- Read our separate report on category management.

Figure 16. Demand Forecasting—Innovators in the Global Market [wpdatatable id=930 table_view=regular]

Source: Company reports 8. Pandemic Highlights Need for Companies To Revisit Their Workforce Management and Execution Tools The Covid-19 pandemic accelerated the digitalization of the workplace, resulting in growing demand for mobile workforce management (WFM) tools. Going forward, we expect employers to continue to invest in WFM tools to enhance employee productivity and adapt to consumers’ changed ways of living and preferences for working. According to a recent survey by the US Census Bureau, 36% of US households had at least one adult substitute some or all of their typical in-person work for telework because of the coronavirus pandemic. Today, according to surveys conducted by Quinyx, 25% of global workers report that they would prefer a flexible schedule over a pay raise. Workers who do not have flexible schedules appear to be increasingly dissatisfied with the arrangement—some 31% of global employees admit to leaving a job because of scheduling challenges. A full 47% of workers report that they worry that switching shifts could get them fired. Businesses are leveraging WFM software tools to enhance employee productivity and improve profitability. WFM is an integrated set of processes aimed at optimizing employee productivity and involves labor forecasting and managing staff schedules and expectations—thus also cutting down administrative expenses. For example, WFM tools use historical data and AI to analyze and forecast store traffic and thus avoid understaffing or overstaffing. WFM tools can also be leveraged for retailers to communicate instructions clearly from headquarters to store associates to ensure that changes to the store layout and planograms are implemented in real time. The use of mobile devices to effectively manage WFM processes is likely to increase in the next few years. According to Statista, the global mobile WFM market is set to grow at a CAGR of 13% during 2017–2023, to reach $7.2 billion. Over the next few years, retailers are going to extensively invest in WFM tools to improve their profitability. Some of the key innovators that are helping businesses to efficiently manage and grow their talent pool are highlighted in Figure 17.

Figure 17. Workforce Management—Innovators in the Global Market [wpdatatable id=931 table_view=regular]

Source: Company reports