Introduction

What’s the Story?

The Coresight Research team will attend and participate in this year’s Shoptalk conference, which will be held on March 27–30, 2022, in Las Vegas, US. Shoptalk 2022 will address the sudden transformation in the retail environment since the outbreak of Covid-19, as the industry is looking to embrace technology and innovation to address new challenges.

On March 27, 2022, Deborah Weinswig, CEO and Founder of Coresight Research, will emcee and feature on the judging panel of Shoptalk 2022’s “Shark Reef” startup pitch competition, which will see 15 early-stage US retail-technology innovators compete to win the Shark’s Choice and Audience Choice awards. In the lead-up to the event, we are profiling the participating innovators.

This report forms part of our

Innovator Profile series, which focuses on emerging technologies that are disrupting traditional retail and fueling innovation across the retail value chain. We present Re/tell, a technology startup that helps e-commerce players expand into brick-and-mortar retail. Coresight Research collaborated with Re/tell to offer insights into its service capabilities and offerings.

Why It Matters

Coresight Research categorizes the 15 participating innovators into four areas of disruption in retail. Re/tell falls under “forward-looking physical experiences.” Brands and retailers across multiple sectors are looking to reimagine the brick-and-mortar retail experience to remain competitive in an increasingly digital world. Forward-looking concepts cover order delivery and pickup enhancements, retail space optimization and store traffic analytics. Technology innovators focusing on forward-looking physical experiences can assist retailers in creating a more engaging and convenient store-based shopping experience for their customers.

Re/tell: In Detail

Headquarters

Headquarters

New York, New York, US

Funding Stage

Pre-seed stage

Total funding amount: $450,000

Company Description

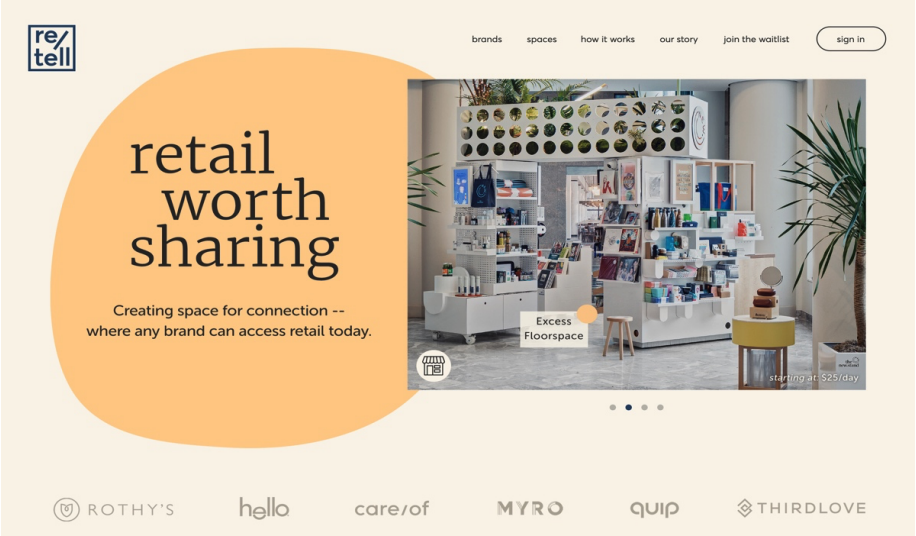

Founded in 2020, Re/tell is a technology innovator that helps online brands and retailers expand their marketing footprint and have a physical presence. The company deploys artificial intelligence (AI) and open-chat technology to help e-commerce players find spaces in brick-and-mortar stores that other retailers are not using. These spaces can include excess wall, floor or shelf spaces in high-traffic destinations. The concept also offers individuals or businesses with extra space an opportunity to share their operating costs and diversify the offerings within their space.

[caption id="attachment_143116" align="aligncenter" width="700"]

Source: Company website

Source: Company website[/caption]

What Problem Is the Company Solving?

One of the biggest problems that retailers face today is the high costs associated with renting commercial real estate to physically sell their offerings in high-traffic retail destinations. The cost of rent rose by more than 4% in 2021, compared to an average of 3.3% in annual increases in the five years prior to the pandemic, according to the US Bureau of Labor Statistics. By connecting property renters and physical retailers with e-commerce players interested in their space, renters will be able to diversify their revenue stream and share operating costs to make renting the real estate more affordable.

For online-only brands and retailers, product discovery can present challenges. We are seeing e-commerce players increase their investments in online marketing to stand out in a saturated market. In 2021, year-over-year growth in global advertisement spending was approximately 15%–22%, according to S&P Global estimates. The cost of digital customer acquisition has also risen, as many retailers offer benefits such as free shipping, free returns and trial periods to remain competitive online. Online brands and retailers can utilize Re/tell’s solution to strategically find high-traffic retail destinations that their consumers are likely to visit, increasing the likelihood of product discovery while also expanding their marketing footprint into new, physical channels.

Market Opportunity

A growing trend in physical retail is creating mini experiences via shop-in-shop locations. Major US retailers such as Nordstrom, Target and Walmart have already begun to experiment with this concept to keep the physical shopping experience fresh and exciting—and having an offline presence enables online brands and retailers to capture share of physical and omnichannel shoppers.

Partnerships between physical and digital retailers can boost foot traffic and conversion, as well as enabling them to access each other’s existing customer base and benefit from the popularity/status of the other company.

What We Think

We believe that both e-commerce and the brick-and-mortar channel will play a big role in the future of retail as consumers seek convenient and engaging shopping experiences. Retailers, both online and offline, should be open to the benefits of expanding their footprint across channels. Space-sharing partnerships present low-risk opportunities to explore new channels and attract a broader consumer base while sharing real estate costs.

Headquarters

New York, New York, US

Funding Stage

Pre-seed stage

Total funding amount: $450,000

Company Description

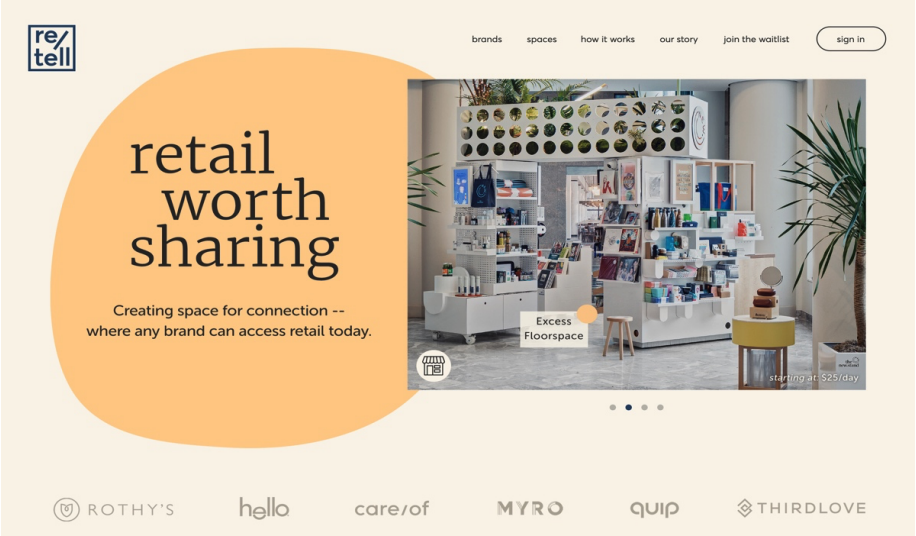

Founded in 2020, Re/tell is a technology innovator that helps online brands and retailers expand their marketing footprint and have a physical presence. The company deploys artificial intelligence (AI) and open-chat technology to help e-commerce players find spaces in brick-and-mortar stores that other retailers are not using. These spaces can include excess wall, floor or shelf spaces in high-traffic destinations. The concept also offers individuals or businesses with extra space an opportunity to share their operating costs and diversify the offerings within their space.

[caption id="attachment_143116" align="aligncenter" width="700"]

Headquarters

New York, New York, US

Funding Stage

Pre-seed stage

Total funding amount: $450,000

Company Description

Founded in 2020, Re/tell is a technology innovator that helps online brands and retailers expand their marketing footprint and have a physical presence. The company deploys artificial intelligence (AI) and open-chat technology to help e-commerce players find spaces in brick-and-mortar stores that other retailers are not using. These spaces can include excess wall, floor or shelf spaces in high-traffic destinations. The concept also offers individuals or businesses with extra space an opportunity to share their operating costs and diversify the offerings within their space.

[caption id="attachment_143116" align="aligncenter" width="700"] Source: Company website[/caption]

What Problem Is the Company Solving?

One of the biggest problems that retailers face today is the high costs associated with renting commercial real estate to physically sell their offerings in high-traffic retail destinations. The cost of rent rose by more than 4% in 2021, compared to an average of 3.3% in annual increases in the five years prior to the pandemic, according to the US Bureau of Labor Statistics. By connecting property renters and physical retailers with e-commerce players interested in their space, renters will be able to diversify their revenue stream and share operating costs to make renting the real estate more affordable.

For online-only brands and retailers, product discovery can present challenges. We are seeing e-commerce players increase their investments in online marketing to stand out in a saturated market. In 2021, year-over-year growth in global advertisement spending was approximately 15%–22%, according to S&P Global estimates. The cost of digital customer acquisition has also risen, as many retailers offer benefits such as free shipping, free returns and trial periods to remain competitive online. Online brands and retailers can utilize Re/tell’s solution to strategically find high-traffic retail destinations that their consumers are likely to visit, increasing the likelihood of product discovery while also expanding their marketing footprint into new, physical channels.

Market Opportunity

A growing trend in physical retail is creating mini experiences via shop-in-shop locations. Major US retailers such as Nordstrom, Target and Walmart have already begun to experiment with this concept to keep the physical shopping experience fresh and exciting—and having an offline presence enables online brands and retailers to capture share of physical and omnichannel shoppers.

Partnerships between physical and digital retailers can boost foot traffic and conversion, as well as enabling them to access each other’s existing customer base and benefit from the popularity/status of the other company.

Source: Company website[/caption]

What Problem Is the Company Solving?

One of the biggest problems that retailers face today is the high costs associated with renting commercial real estate to physically sell their offerings in high-traffic retail destinations. The cost of rent rose by more than 4% in 2021, compared to an average of 3.3% in annual increases in the five years prior to the pandemic, according to the US Bureau of Labor Statistics. By connecting property renters and physical retailers with e-commerce players interested in their space, renters will be able to diversify their revenue stream and share operating costs to make renting the real estate more affordable.

For online-only brands and retailers, product discovery can present challenges. We are seeing e-commerce players increase their investments in online marketing to stand out in a saturated market. In 2021, year-over-year growth in global advertisement spending was approximately 15%–22%, according to S&P Global estimates. The cost of digital customer acquisition has also risen, as many retailers offer benefits such as free shipping, free returns and trial periods to remain competitive online. Online brands and retailers can utilize Re/tell’s solution to strategically find high-traffic retail destinations that their consumers are likely to visit, increasing the likelihood of product discovery while also expanding their marketing footprint into new, physical channels.

Market Opportunity

A growing trend in physical retail is creating mini experiences via shop-in-shop locations. Major US retailers such as Nordstrom, Target and Walmart have already begun to experiment with this concept to keep the physical shopping experience fresh and exciting—and having an offline presence enables online brands and retailers to capture share of physical and omnichannel shoppers.

Partnerships between physical and digital retailers can boost foot traffic and conversion, as well as enabling them to access each other’s existing customer base and benefit from the popularity/status of the other company.