albert Chan

What’s the Story?

This report forms part of our Innovator Profile series, which focuses on emerging technologies that are disrupting traditional retail and fueling innovation across the retail value chain. Coresight Research collaborated with each covered company to offer insights into their business models and offerings.

In this report, we profile Newmine, a retail-tech innovator that is disrupting the returns management market with AI-driven returns solutions. The company, comprised of former retail and supply chain executives with deep experience in retail strategy, operations and technology, also aims to ensure retailers thrive in a transforming world through its operations and technology consulting practice.

Why It Matters

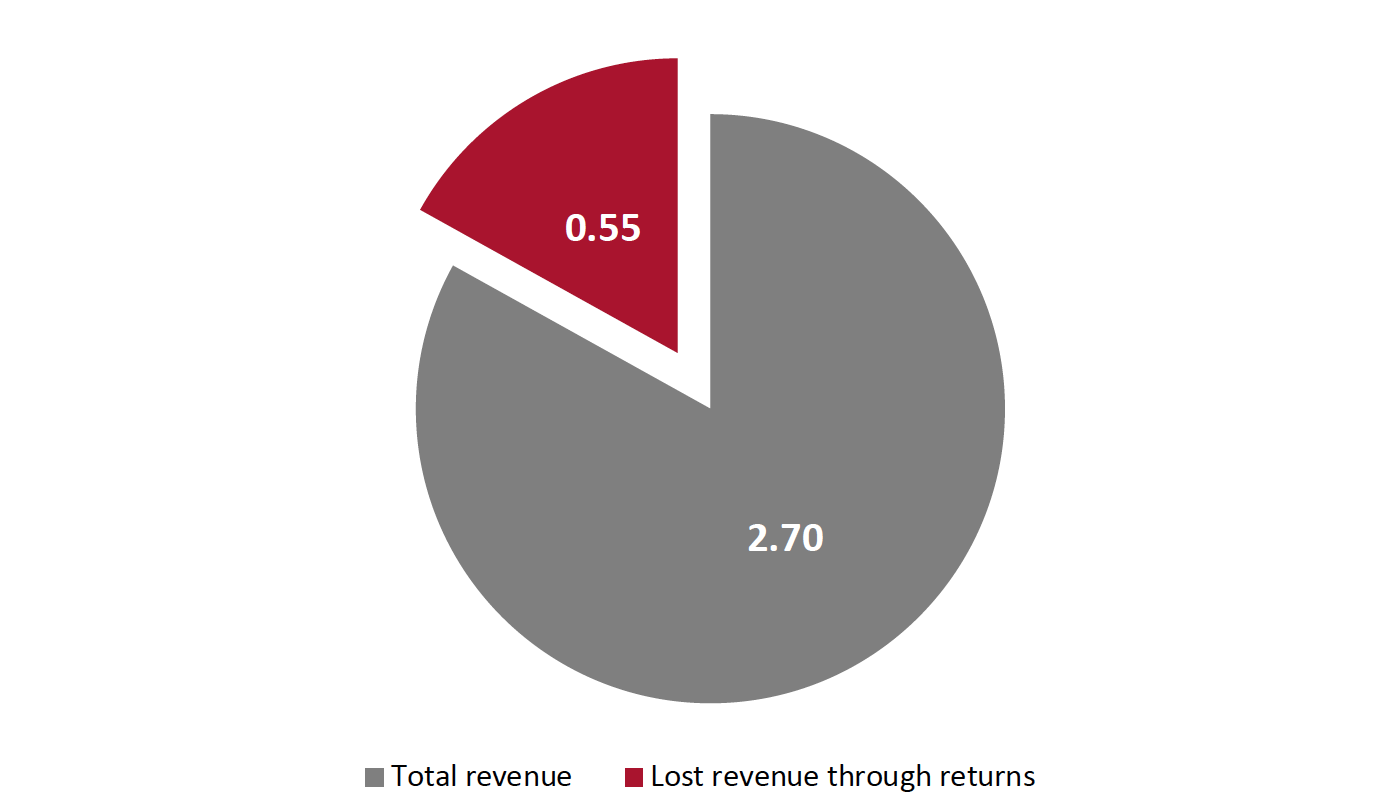

Newmine’s solutions can be employed by all global retailers, with the exception of grocers and CPG retailers. The company estimates that there will be a $1.1 billion total addressable market for returns reduction in the global e-commerce industry by 2023, thanks to the huge proportion of lost revenue through returns (see Figure 1).

Figure 1. Global E-Commerce Market: Total Revenue and Lost Revenue Through Returns, 2021E (USD Tril.)

[caption id="attachment_122161" align="aligncenter" width="700"] Source: Shopify/Statista[/caption]

Source: Shopify/Statista[/caption]

Newmine: In Detail

What Problem Is the Company Solving?

Returns are a cost driver prevalent across the retail industry. Newmine estimates that products bought at brick-and-mortar stores are returned around 10% of the time, and the returns rate jumps even higher in e-commerce, to around 30% of online nonfood orders being returned, according to industry estimates. Returns are becoming increasingly costly to retailers as they are pressured to provide fast, free delivery and returns options now more than ever.

Data from Coresight Research’s US Consumer Tracker indicate that returns are growing increasingly common and costly for retailers: Our survey in late November 2020 found that 42.6% of US consumers who had returned products in the past 12 months said they prefer to return online orders by mail, while just 25.4% reported a preference for returning online orders in-store.

Despite the high cost of lenient online returns policies, retailers cannot simply make their policies more stringent to improve the bottom line: 39.1% of US consumers in the same Coresight Research survey reported that retailers’ returns policies influence where they shop. Furthermore, the Covid-19 pandemic has raised consumers’ returns expectations even further: 41.7% of US consumers agreed with the statement, “I think retailers should offer longer returns windows this year, because of the pandemic.”

Newmine’s Chief Returns Officer is an AI-powered platform that provides analysis and prescriptive actions across the value chain, enabling retail organizations to work collaboratively to minimize product returns, by identifying the root cause, and save costs to improve the bottom line.

How the Covid-19 Pandemic Has Impacted Business

Newmine has benefited from the growth in e-commerce over the course of the pandemic. As consumers buy more online and maintain high delivery and returns expectations, the company expects retailers to continue investing more in returns management and reduction.

Competitive Advantages

Unlike other solution providers in the returns space that focus on reactive returns handling and processing, Newmine’s Chief Returns Officer empowers retailers to proactively reduce returns in season. Chief Returns Officer is powered by AI and uses anomaly detection and natural language processing to identify the root cause of returns, prescribe corrective actions that retailers can take to reduce future returns, and empower teams in different departments to collaborate seamlessly. The image below depicts the benefits that retailers can realize by employing Newmine’s Chief Returns Officer.

[caption id="attachment_122273" align="aligncenter" width="700"] Source: Newmine[/caption]

Source: Newmine[/caption]

Upcoming Developments

In 2021, Newmine will be launching KeepScore, a success benchmark that enables retailers to quickly identify their most profitable products, suppliers and customers by understanding which products customers chronically return and which they keep.

What We Think

Newmine’s business model is positioned well to capitalize on the changes in consumer behavior brought on by the pandemic. Coresight Research estimates that US e-commerce sales grew by around one-third in 2020—to comprise around 19% of total retail sales—and that this growth will continue in 2021, by a mid-to-high-single-digit percentage. As consumers continue to shop and return orders more online, Newmine is likely poised for growth in the year ahead.