albert Chan

Introduction

What’s the Story?

The Coresight Research team will attend and participate in this year’s Shoptalk conference, which will be held on March 27–30, 2022, in Las Vegas, US. Shoptalk 2022 will address the sudden transformation in the retail environment since the outbreak of Covid-19, as the industry is looking to embrace technology and innovation to address new challenges.

On March 27, 2022, Deborah Weinswig, CEO and Founder of Coresight Research, will emcee and feature on the judging panel of Shoptalk 2022’s “Shark Reef” startup pitch competition, which will see 15 early-stage US retail-technology innovators compete to win the Shark’s Choice and Audience Choice awards. In the lead-up to the event, we are profiling the participating innovators.

This report forms part of our Innovator Profile series, which focuses on emerging technologies that are disrupting traditional retail and fuelling innovation across the retail value chain. We present Max Retail, a retail-technology company that helps retailers optimize their inventories through strategic retailer networks. Coresight Research collaborated with Max Retail to offer insights into its service capabilities and offerings.

Why It Matters

Coresight Research categorizes the 15 participating innovators into four areas of disruption in retail. Max Retail falls under “reducing waste and increasing sustainability.” Customers, employees and governments are increasingly demanding sustainability efforts from businesses, seeking transparency in sourcing, progress in environmental initiatives and the reporting of goals. Technology companies can assist retailers in achieving their sustainability goals, across carbon emissions reduction, waste management and more.

- Coresight Research believes that sustainability will remain one of the foremost multiyear trends to watch in retail. Read more Coresight Research coverage of sustainability in retail.

Max Retail: In Detail

Headquarters

Palm Beach Gardens, Florida, US

Funding Stage

Seed stage

Total funding amount: $2.5 million

Company Description

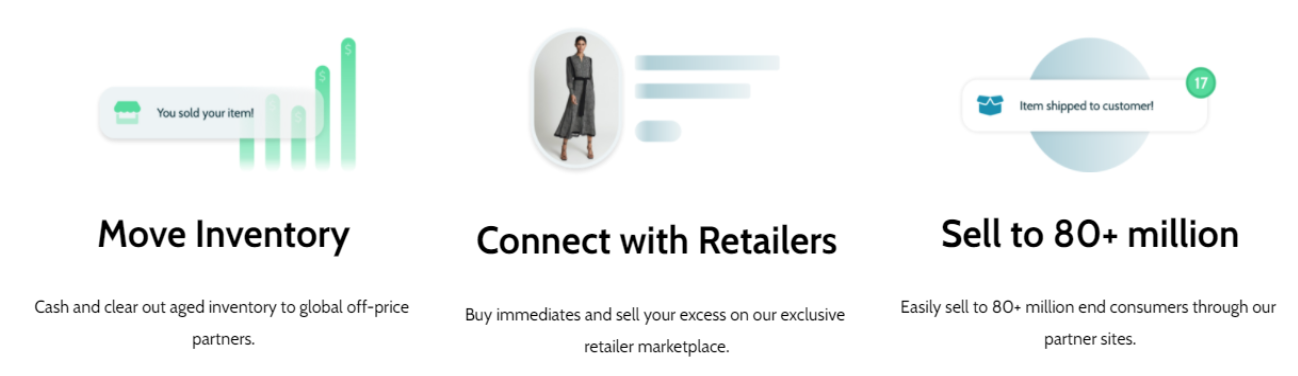

Max Retail is a retail-technology company that bridges the gap between retail supply and consumer demand to help retailers optimize their inventory levels. The company connects retailers that sell similar products and brands to create a marketplace that facilitates the fluid buying, selling and swapping of inventory. Retailers can use Max Retail’s platform to quickly restock on brands when they are selling quickly to meet consumer demand or sell off any unsold or unwanted inventory through business-to-business (B2B) channels. The company also helps retailers quickly liquidate their inventory through their relationships with off-price partners.

Max Retail aims to assist retailers in their journey to inventory optimization while simultaneously creating a strategic network of retailers that can build off each other’s inventories, brands and ideas.

[caption id="attachment_143727" align="alignnone" width="550"] Source: Company website[/caption]

Source: Company website[/caption]

What Problem Is the Company Solving?

There are many challenging issues retailers face today in optimizing their inventory. On the demand side, it can be challenging to maintain the optimal amount of stock to keep up with shifting consumer trends and demands. Not having enough stock can lead to lost revenue while overstocking can lead to inventory markdowns, inefficient store space occupation and waste of inventory altogether. On the supply side, it can be tough to find the right inventory when consumer trends change frequently and global supply chains are still facing shocks from Covid-19 pandemic-related disruptions.

By creating a strategic network of retailers and off-price partners that can fluidly buy, sell and swap with one another, Max Retail assists retailers by bridging the gap between supply and demand to more effectively manage their inventory levels. This network enables retailers to maximize their cash flow by restocking more quickly—buying from, and swapping with, retailers carrying similar brands—or by selling unwanted inventory to other retailers or off-price partners. By better managing their inventory, retailers will be able to optimize their store spaces more fluidly while also promoting sustainable commerce through reduced waste levels and the efficient use of consumer goods.

Market Opportunity

Driven by fast-paced shifts in consumer demand and supply chain issues stemming from the pandemic, retailers are more pressed than ever to properly manage their inventories to maximize output and cash flow, as retail spending in the US is set to remain strong. Coresight Research estimates that total US retail sales (excluding auto) totaled $4.5 trillion in 2021 and will reach $5.4 trillion in 2026, representing a CAGR of 3.7%. Despite supply chain issues, Coresight Research’s quarterly US Retail Inventory Tracker, which tracks inventories held by US retailers in the Coresight 100, found that inventory turnovers were higher in the third quarter of 2021 (latest data available) compared to the same quarter of 2019 (pre-pandemic period), highlighting strong sales and the need for inventory management optimization.

Alongside the rise of e-commerce and omnichannel retail, the inventory management and optimization software industry will grow, as it will be imperative that retailers have control of, and visibility into, their inventories.

What We Think

We expect retailers to increasingly look for innovative ways to manage and optimize their inventory levels to match rapid shifts in consumer trends and demand. The rise of omnichannel retail and e-commerce shopping will likely add to need for better inventory management systems. Retailers can leverage innovative software to optimize their inventory based on rapidly changing supply and demand dynamics.