Web Developers

Company Overview

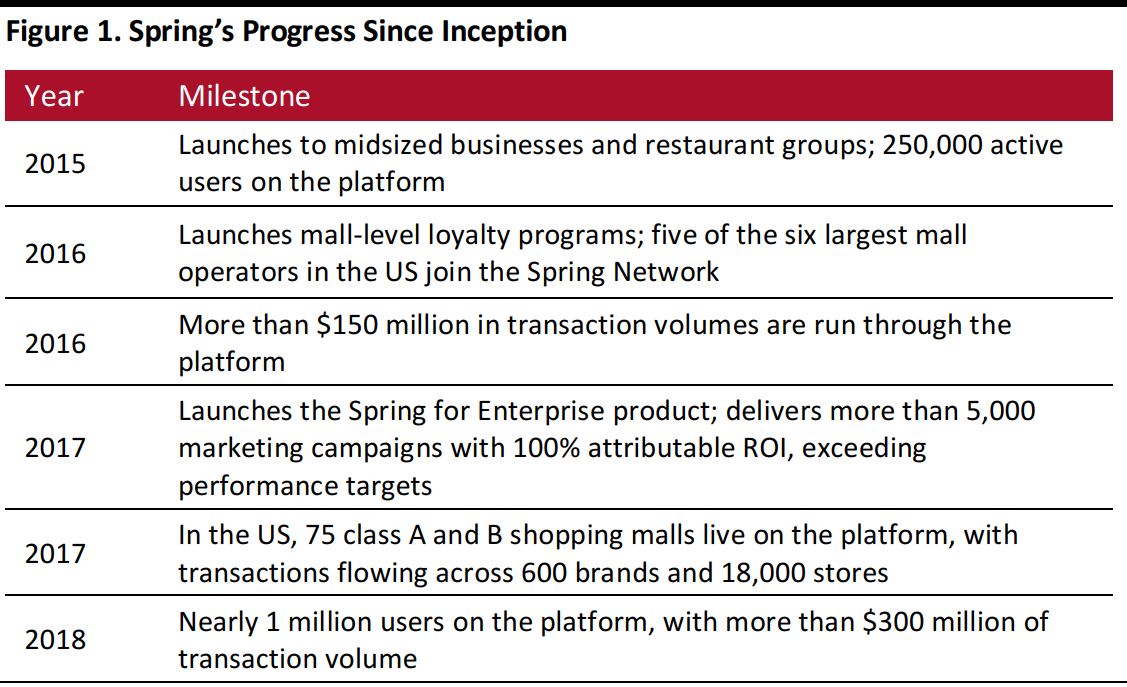

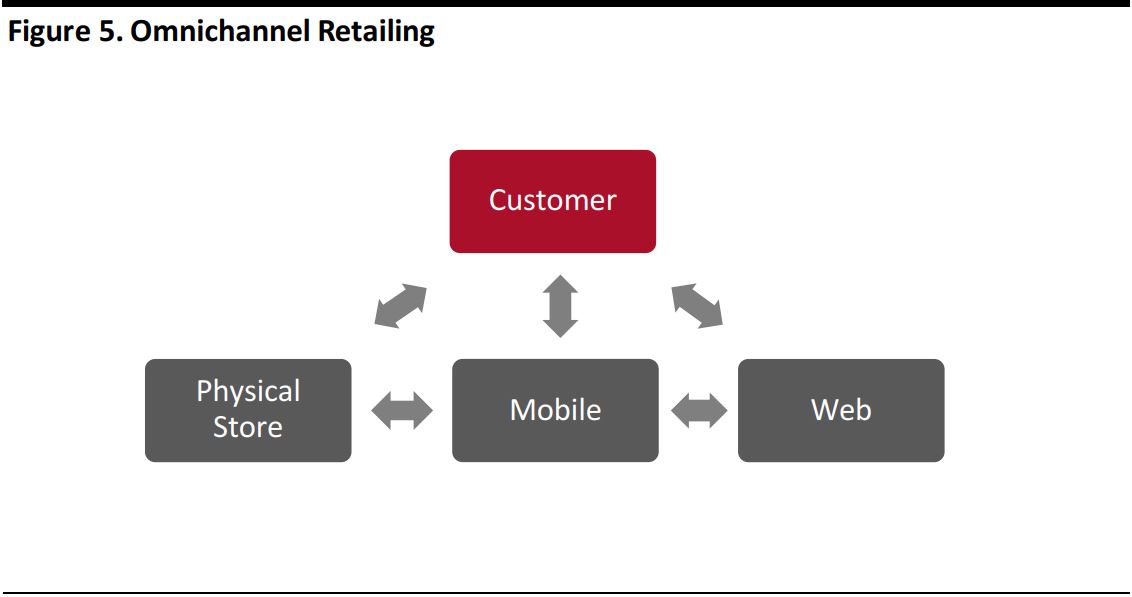

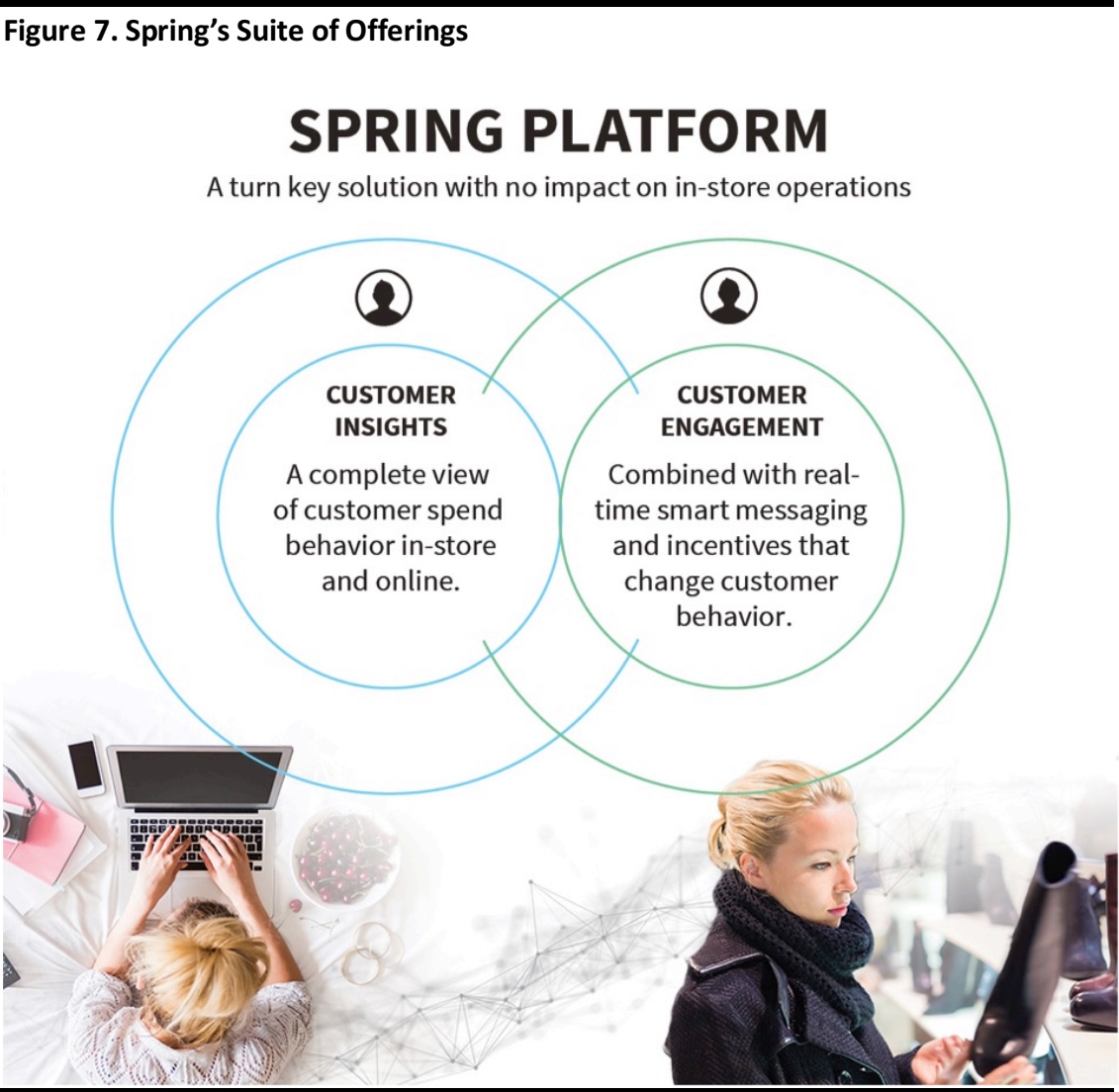

Omnichannel marketing is a priority for retailers and, given the rapid digitization of marketing, it is increasingly important for businesses to connect with their target audiences promptly and convey the right message in real time. But traditional CRM solutions are often inefficient and offer no connection to real-time purchase data on from physical stores, where approximately 80% of retail sales still occur. Spring Marketplace (Spring) operates at the intersection of retail, payments and digital marketing, helping companies gain insights into their customers’ purchase behavior and target their engagement strategies accordingly.Spring’s cloud-based marketing platform functions as an extension of retailers’ existing CRM solutions, providing analytics and engagement tools that enable merchants to track customer purchase data in real time, connect in-store and online commerce, and execute specific marketing strategies. The company’s platform leverages data from Visa, Mastercard and American Express to help client companies create customer profiles and track real-time purchase activity both online and offline. The data are connected to the Spring Reporting Dashboard to provide retailers with actionable marketing solutions. Spring offers services to its clients in two key areas:- Customer Insights: This feature enables retailers to gather visit and purchase activity data across websites, stores and malls nationwide for customers who have enrolled in a retail loyalty program, powered by Spring.Spring’s customer analytics and insights are designed to identify incremental revenue opportunities for retailers.

- Customer Engagement: Spring’s Customer Engagement services help retailers act on the data gathered by the Customer Insights tool. These insights are used to offer shoppers real-time,“smart” messaging that drives conversion with targeted incentives and to collect customer feedback.

Source: Spring Marketplace

Industry Overview

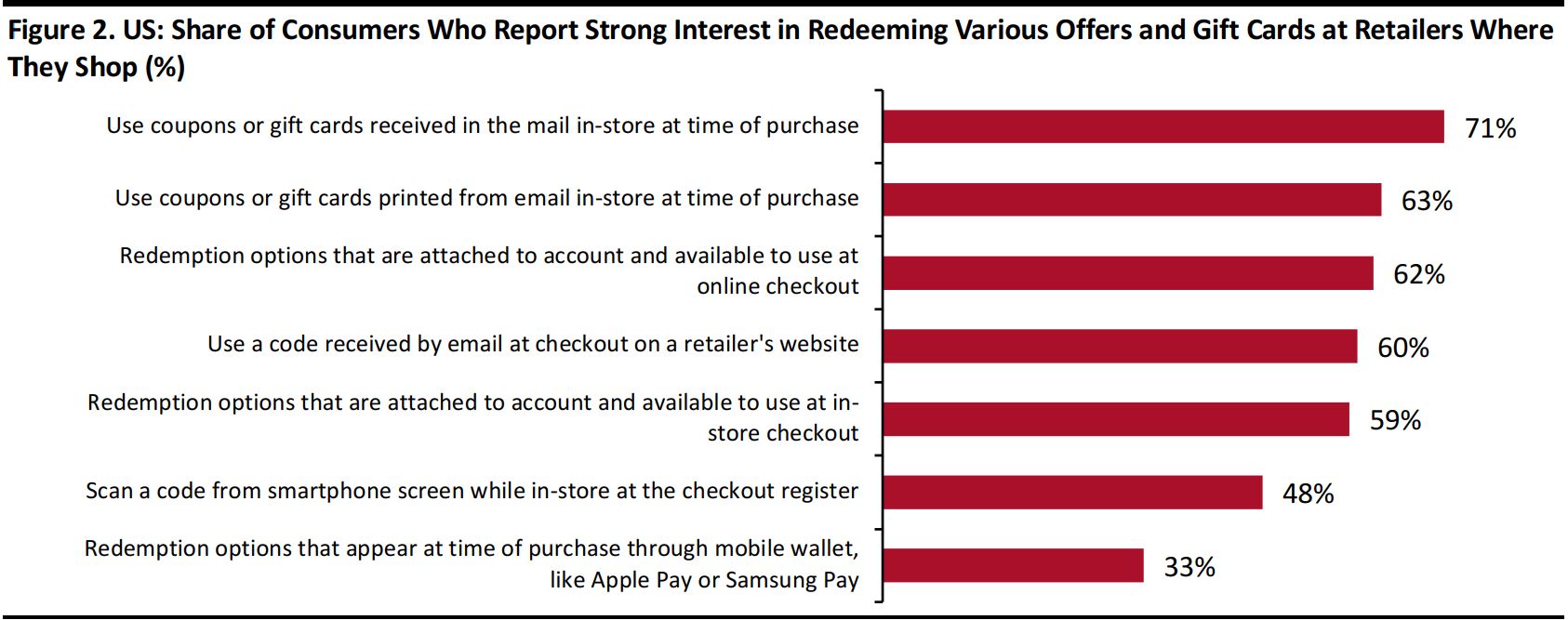

Promotions, Loyalty Cards, Rewards and Other Incentives Are Still Popular In 2017, digital ad spending in the US grew by 15.8% year over year, to $83 billion, and it accounted for 40.5% of total ad spending, according to market research firm eMarketer. The firm expects digital channels to account for more than 51% of total ad spending by 2021. In the US, promotions, loyalty cards, rewards and other incentives remain popular among consumers. According to a 2016 survey by market research company Socratic Technologies and payments-processing firm Worldpay (formerly known as Vantiv), more than 60% of US shoppers are interested in redeeming rewards in-store. The survey also found that a higher proportion of shoppers are interested in using coupons and gift cards that they receive by email or regular mail at physical stores than are interested in redeeming them online, indicating strong consumer interest in shopping in-store.

Base: 492 US consumers ages 25 and older, surveyed in September 2016 Redemption options include gift cards, loyalty points and credits. Source: Socratic Technologies/Worldpay (formerly Vantiv)

Trends in US Brick-and-Mortar Retail and Shopping Centers

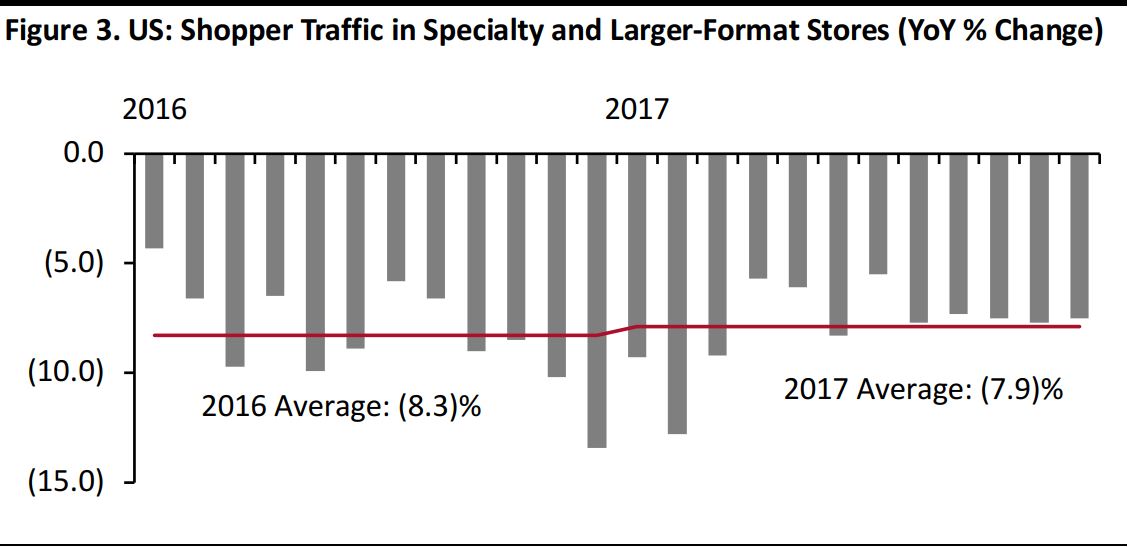

Store closures by apparel and department store retailers have fueled negative headlines since 2017. These closures have heavily impacted regional malls, which tend to skew toward apparel and, so, have seen a concentration of store closures. In addition, shopper traffic declined sharply across specialty and larger-format stores in 2017, according to data from RetailNext. These types of stores saw traffic fall by an average of 7.9% over the year, after falling by 8.3% across 2016.

Source: RetailNext/Coresight Research

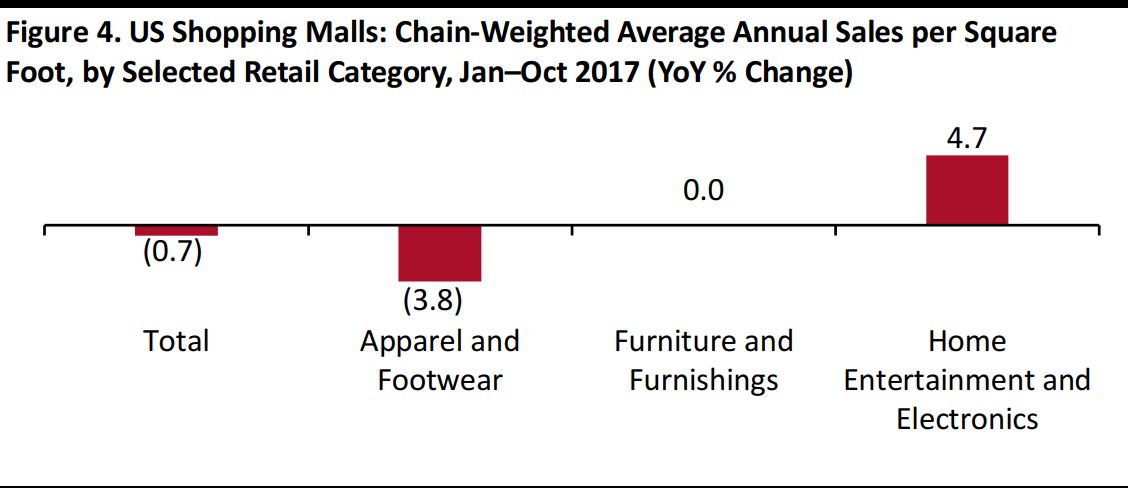

Meanwhile, total growth figures for US shopping malls (shopping centers and superregional malls) conceal that growth was mixed in 2017, varying significantly depending on type of retailer and location. According to our analysis of mall data from the International Council of Shopping Centers (ICSC):- Real sales per square foot in US malls declined by 0.7% year over year during the January–October 2017 period (latest data available).

- The apparel and footwear category saw a more severe contraction in mall-based sales densities.

- Regional malls, which focus on apparel retailers, have experienced severe attrition in occupancy rates since mid-2016 in the wake of poor traffic trends, bankruptcies and store closures.

Source: ICSC/Coresight Research

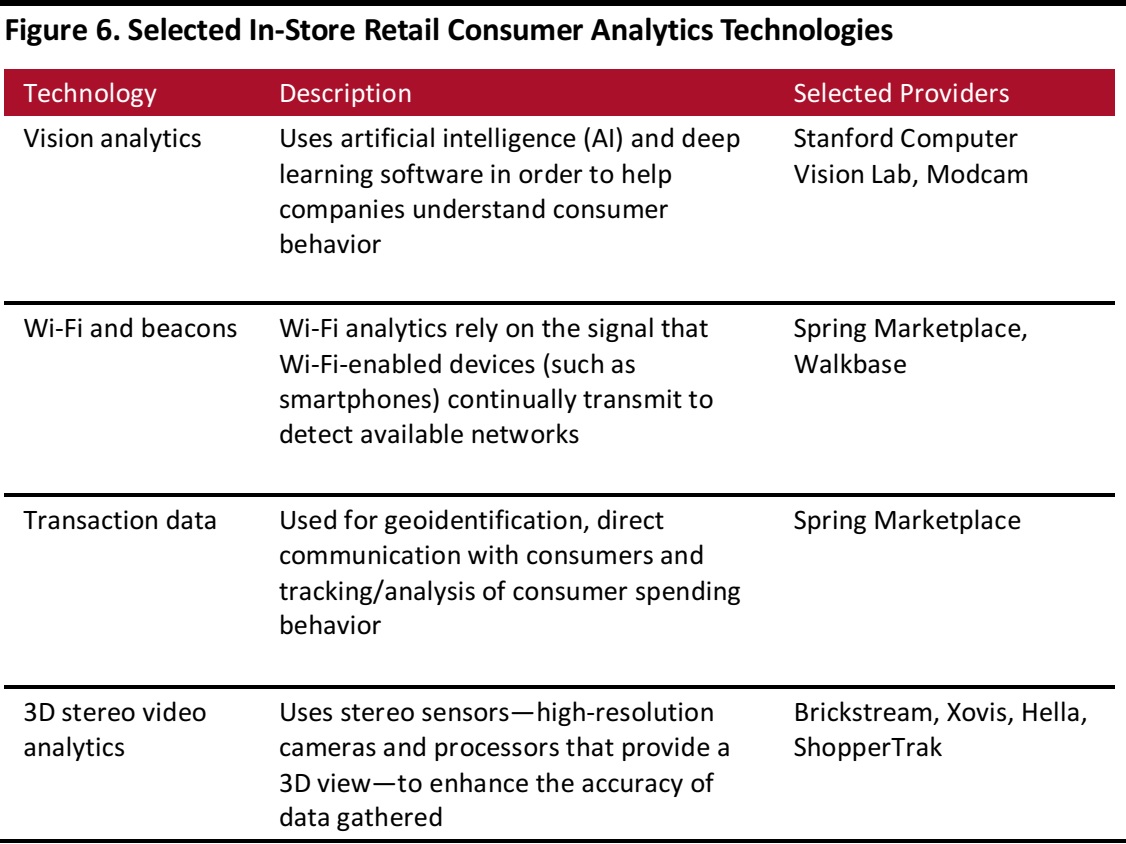

In the wake of challenging traffic and store closure trends, a number of mall owners and retailers are adopting in-store consumer analytics and tracking technologies that augment their customer communication and engagement efforts:- We expect more retailers will seek to close the gap between the insights they are able to gather from consumers’ behavior online and those they are able to gather from consumers’ behavior in physical stores.

- Retail real estate firms will also likely seek further insights into how consumers are using physical retail environments and who is visiting their shopping centers.

Leveraging In-Store Technology to Optimize Omnichannel Retailing

E-commerce has long gifted retailers an abundance of data on consumers’ visiting, browsing and buying behavior, but physical stores have traditionally been a data black hole for retailers:beyond traditional footfall measurements,robust and granular data on in-store visitors and shopper behavior have been limited. New in-store retail consumer analytics technologies, however, are providing store-based retailers and mall operators with ways to track and analyze in-store behavior that are similar to online tracking tools. Modern customer analytics solutions enable companies to bring all these data together into a single, big-picture view of the customer journey, at both the individual and aggregate levels.Companies can collect data that show who their customers are, where they are in the buying journey, what they want and which marketing strategies affect them most. Historically, the trouble has been connecting data from different channels, devices and departments. When customer data are fragmented, so, too, are customer profiles.

Source: Coresight Research

In-store consumer analytics technologies track, measure and analyze shoppers’ activities in brick-and-mortar stores and shopping centers. The information gathered can be used to understand the specific shopping patterns and preferences of individual consumers in order to provide more targeted and personalized content and marketing. Wi-Fi analytics are one example of this kind of in-store technology that makes it possible for retailers to track customer store visits, engage shoppers and sign them up to loyalty programs. Wi-Fi analytics rely on the signal that Wi-Fi-enabled devices(such as smartphones)continually transmit to detect available networks. The signal enables sensors to detect the device and gather information about the movement of the smartphone owner as he or she browses through a store. Retailers and retail real estate owners will likely continue to use a combination of different technologies that span Wi-Fi,IoT, Bluetooth, beacons and video to track and analyze in-store consumer behavior.The table below shows some examples of tracking and analytics technologies that retailers are deploying in brick-and-mortar environments.

Source: BehaviorAnalyticsRetail.com/Coresight Research

Spring’s Solutions for Retailers

The Spring platform extends a company’s existing marketing infrastructure via cloud technology, so there is no need for retailers to buy additional hardware or change software. Spring says that integration requires minimal training for in-store and point-of-sale teams and only a limited amount of time from the corporate marketing team. Spring’s partnerships with malls enable retailers in the malls’ networks to see customer purchase activities beyond their own stores, meaning they can see which other retailers’ stores (within Spring’s network) their own customers have purchased from. Retailers can choose to use Spring’s services separately, rather than joining through a mall network,and the company has a simple, two-page onboarding service agreement for its clients. However, clients that sign up separately do not have access to data on their customers’ purchases at other retailers’ stores, and other retailers have no access to those clients’ customer transaction data, either. Spring’s platform offers two core tool sets: Customer Insights and Customer Engagement.

Source: Spring Marketplace

Customer Insights

Using real-time purchase activity across online and store channels, Spring creates an identified customer profile that is connected to an actionable marketing platform. Online data are captured from a retailer’s checkout page, where customers are asked if they would like to join the retailer’s loyalty program supported by Spring. Offline, shoppers can enroll in Spring’s network through sign-up kiosks in malls and at stores via Wi-Fi or at checkout. The Spring platform collects each customer’s identifying information as well as where the customer shops and how much she spends. It then identifies opportunities to increase revenue and customer engagement. The platform is designed to collect the following information:- Identified profile with contact information and permission.

- Online and in-store purchase activity.

- Purchase activity outside the retailer’s own store across malls in the Spring Network nationwide.

- Geolocation information (through Wi-Fi and phone ID).

- Each of these customers visits a mall 8.4 times per year.

- Each customer spends $109.43 per visit at other retailers, for a total annual expenditure of $9.2 billion.

Customer Engagement

Spring engages customers in five primary ways, based on the data and analytics derived from the Customer Insights platform: 1) Soliciting Customer Feedback Leveraging Real-Time Purchase Data- Spring uses real-time, transaction-triggered emails and text messages to gather feedback from customers in-store(or online) at the time of sale.

- The convenient, low-friction nature of the interface engages more customers. The company says that emails and text messages triggered by Spring transactions have 40%–50% open rates.

- Customer feedback is tied to the customer’s profile along with purchase activity, so retailers can distinguish when the feedback is from a top 10% spender versus a $10 spender.

- Spring has the ability to target surveys based on customer segment.

- No point-of-sale or other operational integration is needed.

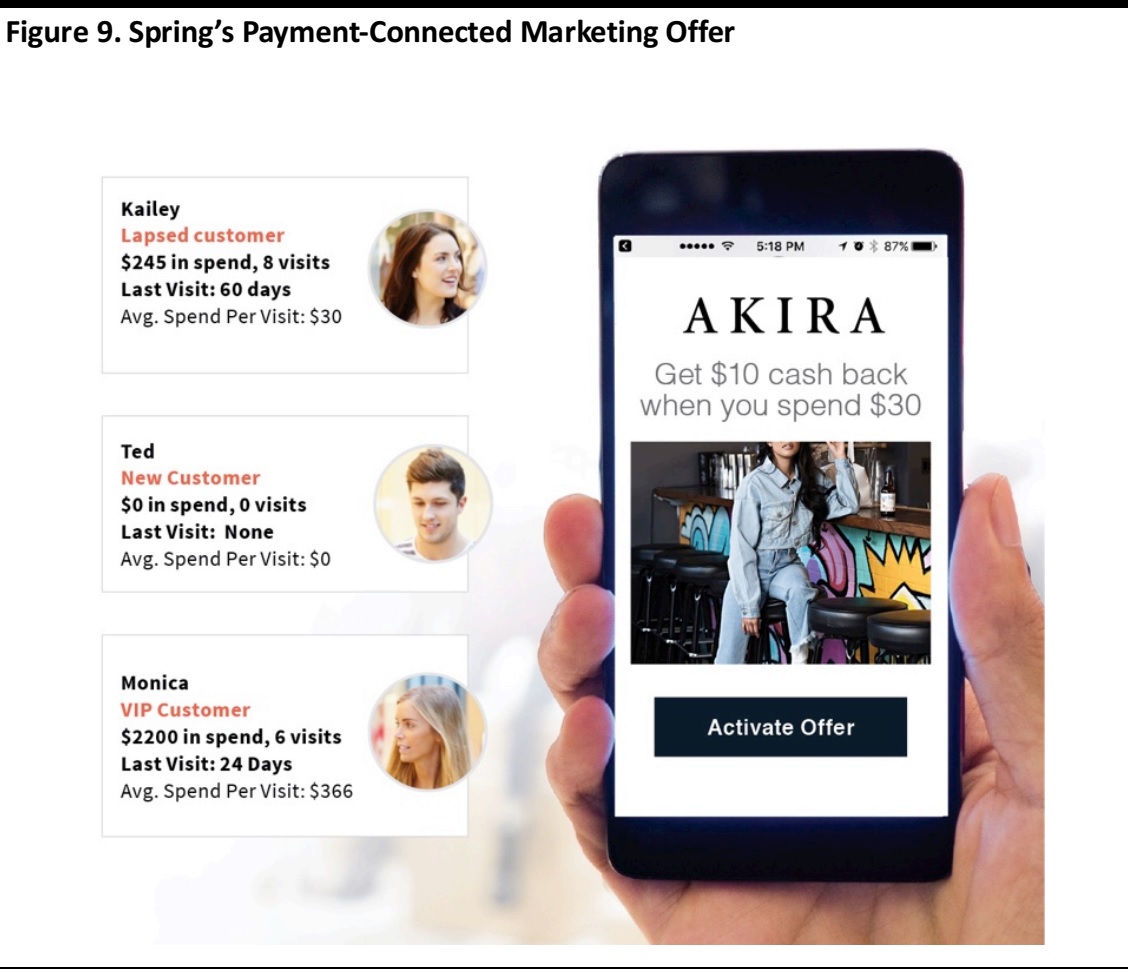

- The incentives tie purchase activity directly back to media and offer activation.

- Spring promises ROI above the unit margin that the retailer sets.

- Promotions are based on location, time spent shopping and spend.

- The solution provides marketing with continuity versus one-and-done advertising—retailers gain a CRM profile that tracks the customer’s purchase activity on an ongoing basis.

- Targeting is based on purchase activity, enabling retailers to use promotions to reach only those segments that add revenue lift.

- Retailers can easily target shoppers who rarely buy in-store with an in-store incentive such as “Get $10 cash back on your next store visit.”

- Because Spring smart incentives work on customers’ payment cards, they are far more effective in driving conversions and far easier to track than promo codes.

- Increased visibility into the customer base.

- No conflict with existing loyalty programs.

- Operation across offline and online stores.

- A connected loyalty and marketing solution.

- The ability to recognize, protect and drive customer engagement.

- An automatic, real-time, convenient customer experience that requires no paper vouchers or promo codes.

- Customers are able to join a Spring-supported program within the normal purchase flow online.

- Spring has a patent-pending sign-up tablet through which users can create a profile and enroll a card with a swipe on the card reader;no point-of-sale integration is needed.

- Retailers can promote enrollment with in-store collateral that prompts shoppers to send a text to receive a link to enroll their payment card through a Spring-enabled mobile page.

- Turn Wi-Fi log-ons into member profiles: Retailers can collect email, mobile number and phone ID, plus a payment card,when customers logon or later, when customers are presented with downstream promotions.

- Tracking and analytics across channels: Retailers gain visibility into in-store conversion rates and online sales that are influenced by store visits.They can also track customers across malls nationwide that use Spring and gain profiles from Spring’s mall network.

- Engagement and personalization: Retailers can identify and engage users in real time to enhance the shopping experience and increase revenue.

Source: Spring Marketplace

Source: Spring Marketplace

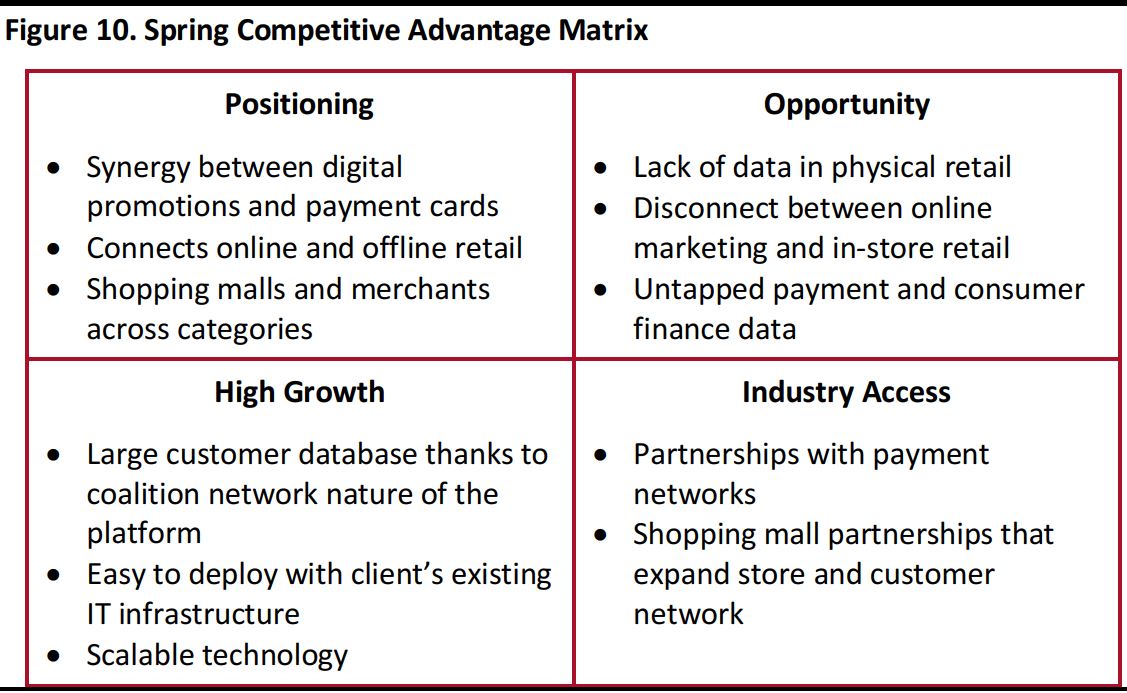

Competitive Advantages

Spring believes that it benefits from the following competitive advantages:- Its platform’s ability to capture and track real-time transaction data: Spring says that this is the most important aspect of its offering, as its platform converts transaction data into targeted marketing strategies almost instantly.

- Its existing network of malls: Spring’s mall clients provide retail tenants with access to customer data from all the retailers in the mall network that choose to participate in the program.

- Its payment network support: Partnerships with payment networks help Spring leverage transaction data that can provide valuable insights into customer purchase behavior.

- Its services are easy to deploy: Spring’s services do not require additional infrastructure or integration.

- It faces little to no friction in expanding the customer base: New customers can easily enroll in a Spring-supported program by providing their details at online checkout or a mall kiosk. Shoppers need only provide an email address or a mobile phone number. Also, rewards are displayed in dollars rather than points, making the program easy for shoppers to understand.

Source: Spring Marketplace/Coresight Research

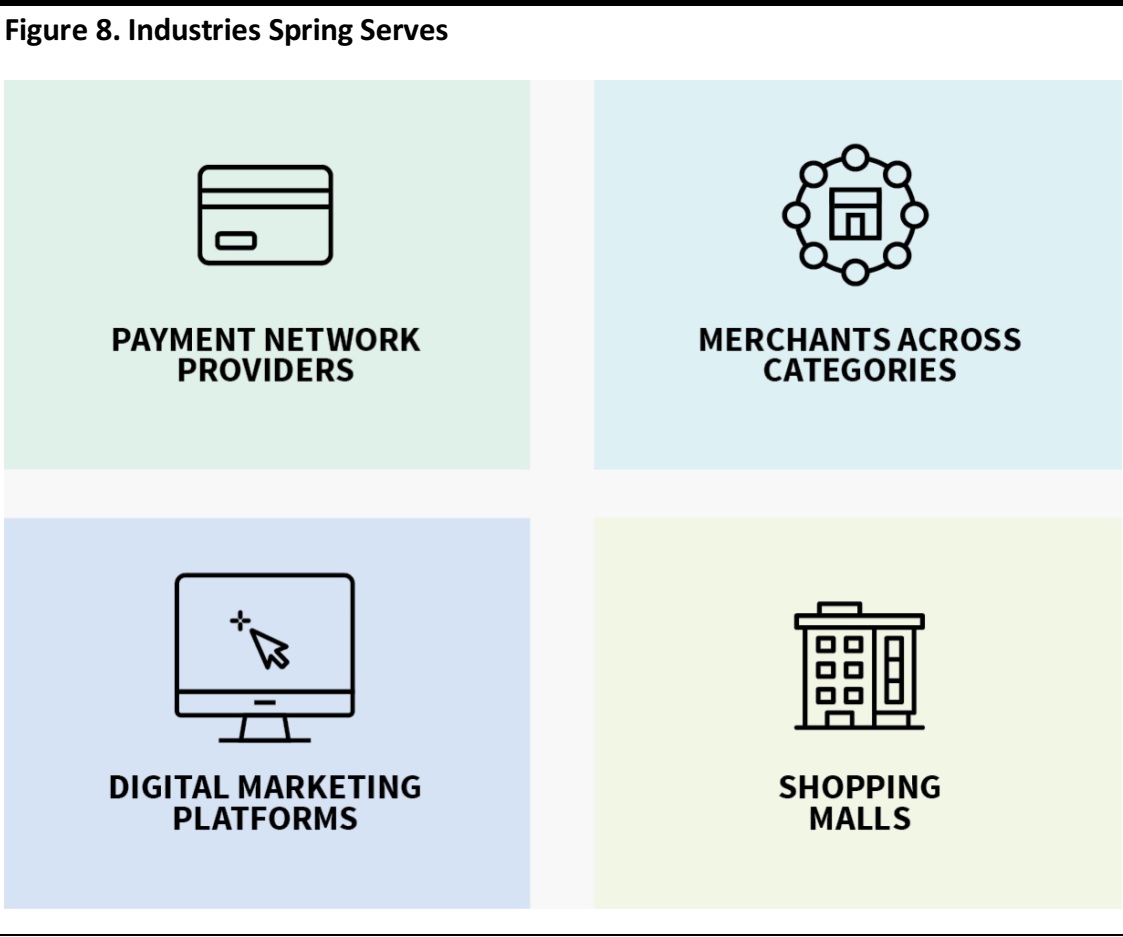

Business Model

Spring generates revenue through a recurring subscription SaaS model as well as through performance-based fees:- Data, analytics and retailer programs: Retailers pay SaaS subscription fees, including fees per store location for tracking, engagement, analytics and data.For loyalty programs, Spring charges monthly for SaaS or fees based on a percentage of loyalty member spend.

- Performance-based media: Spring charges retailers a fee based on revenue earned from redeemed offers that are part of marketing campaigns it runs.

- Mall program fees: Mall operators pay Spring a fee to onboard the stores in their malls and to manage loyalty programs, powered by Spring.

Go-to-Market Strategy

Spring is reaching its target market through two avenues:- Direct-to-merchant execution: Spring is using its industry partnerships and access to senior retail executives to make its differentiated offering available to major merchants.

- Mall network expansion: Spring continues to expand its mall network, which will catalyze retailer adoption. The company is onboarding more than 400 malls across the portfolios of the largest REITs in the US.

Snapshot of a Campaign Spring Executed for a Specialty Retailer

Spring successfully executed a campaign for a specialty retailer across 22 stores over several months.The campaign resulted in:- ROI of 6.5 times versus the targeted ROI of 4.0 times.

- Unit margins of 45.5% versus the target of 20%.

- Average order net lift of 15.7% and average order net value of $63.68, versus average order value of $55.05.

- A 52% increase in new customers visiting the 22 stores.

Competitive Landscape

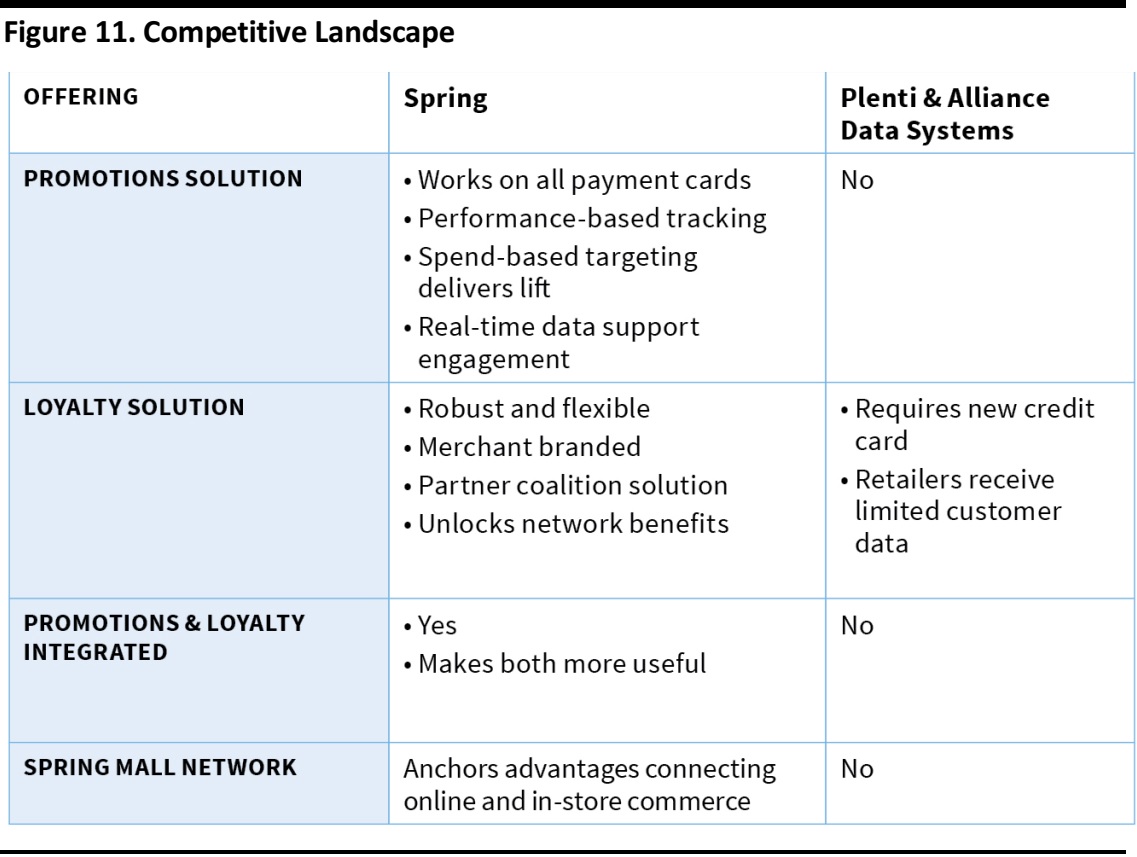

Spring believes its offering is unique, as it both collects customer insights and converts the data into suitable engagement tools to drive traffic to stores.Many other companies simply collect data. Springalso thinks its flexibility to scale and the ease with which retailers can integrate its platform into their existing programs help it stand apart from the competition. While some of its competitors, such as Plenti and Alliance Data Systems, provide loyalty programs, they do not have the ability to integrate promotions and loyalty services in the same way that Spring does.

Source: Spring Marketplace

Key Management

CEO and Cofounder Bruce Mitchell has 20 years of experience running Internet and e-commerce businesses. He previously founded and led Apartments.com, which had an exit enterprise value of nearly $600 million. Mitchell also previously worked at Classified Ventures, Yesmail, BigMove.com and Groupon. COO and Cofounder Jonathan Dyke formerly held several roles at Corporate Executive Board (CEB), including sales leader, executive director of technology and product development, and CIO. CEB was floated with a successful multibillion-dollar IPO. Dyke also cofounded and served as COO of Edo Interactive. His experience at CEB gave him insight into the masses of payment data that lie virtually unused after transactions and made him realize its potential in terms of marketing. Dyke believed that it was challenging for private networks of retailers, brands and merchants to leverage payments infrastructure on their own and that there needed to be a coalition network to solve these problems. This eventually led to the establishment of Spring.Company Outlook/Upcoming Announcements

Spring is expanding its platform across 75 additional malls in the US this summer. The company is also working on several cross-border partnerships in order to provide a unified shopping app through which foreign visitors can earn rewards for purchases they make across the Spring mall network. The app will provide new revenue opportunities for Spring clients.Coresight Research’s View

E-commerce’s share of retail continues to increase, but a majority of sales are still made in physical stores. To justify the commercial costs of keeping stores and malls running, retailers and retail real estate firms need to use creative methods to increase traffic and drive revenue. To help retailers rethink their approach to physical retail, we have outlined the BEST (brand building, experiences, services and technology) framework shown below.

Source: Coresight Research

Brand Building

In order to maximize the value of store assets, retailers must use them not only as distribution points, but also as a marketing channel. Many retailers note that online sales increase in a particular geographic area when they open a physical store in that area, indicating that physical stores serve a marketing purpose that delivers ROI. By connecting online and in-store retail, brands and retailers will be better positioned to drive customer loyalty.Experiences

More store-based retailers must bring events and experiences into their stores to deepen customer engagement.In-store events and experiences provide an opportunity for retailers to fight for dollars that consumers are directing toward leisure experiences. They can also excite shoppers with newness and create a sense of urgency by triggering shoppers’“fear of missing out.”Services

Store-based retailers must use services as a weapon in their fight against online-only rivals. A collection of service-based offerings can draw shoppers to a particular retailer and drive traffic and frequency of store visits. Retailers can also use services to deepen their connection with customers and drive loyalty based on hospitality.Technology

There is an evident data deficit in physical retail that technology can help correct. Online, software is able to track a customer’s journey from the research stage to purchase, and it can even provide details of the research path the customer took. This information allows retailers to personalize their online offering better than their offline offering. But offline, too, retailers can use tools to better understand and cater to their customers.They can use Wi-Fi and Bluetooth, for example to track where shoppers go on the sales floor when they visit stores—this is the informational equivalent of the cookie trail shoppers leave when browsing online.Outlook

Spring’s offering can help retailers build capabilities in the experiences and technology quadrants of the BEST framework. The company’s platform helps retailers increase customer engagement, which drives traffic, and reduce the in-store data deficit by tracking shoppers when they visit physical stores. As more retailers adopt Spring’s platform and become part of the company’s already expansive network, all members of the company’s network will benefit from economies of scale and have a wider view into customer category spending.Company Contact Details Jonathan Dyke, COO and Cofounder Jonathan@springmarketplace.com www.springmarketplace.com