Saumya Sharma

Introduction

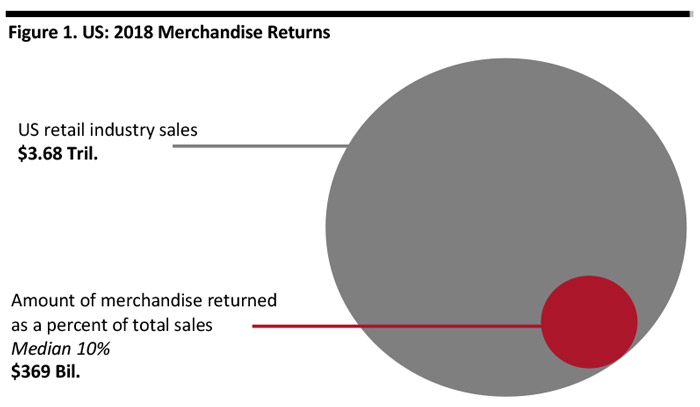

Returns are a costly and growing headache for retailers. As e-commerce continues to grab a greater share of the retail market, the overall return rate will continue to climb, especially the rate of goods returned via free shipping, adding significant pressure to retailers’ bottom lines. Products bought at brick-and-mortar stores are returned around 10% of the time: Shoppers returned $369 billion worth of purchases in 2018, according to the National Retail Federation (NRF). [caption id="attachment_91987" align="aligncenter" width="700"] Source: NRF[/caption]

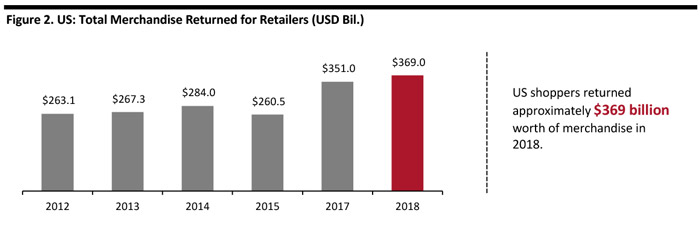

Return rates jump even higher when looking at online purchases: The return rate for online purchases is nearly three times higher at around 30%, according to industry estimates.

For example, online fashion marketplace Revolve saw $385 million of returns in 2017, almost equivalent to its $400 million sales net of returns, according to the company's IPO filing. This implies a roughly 49% return rate and does not include the cost of return shipping.

Though returns pose substantial challenges, retailers find it difficult to limit them because customers increasingly see free returns as a critical part of the online shopping experience. To control the associated costs and improve the customer experience, retailers are continually looking for solutions to stop purchases from being returned in the first place.

Apparel retailers, for instance, may use software that prevents fit or style mistakes. True Fit, for example, has collected data from Lord & Taylor, Ralph Lauren and several others to create an artificial intelligence (AI)-based solution that makes size and style recommendations to online shoppers based on previous purchases.

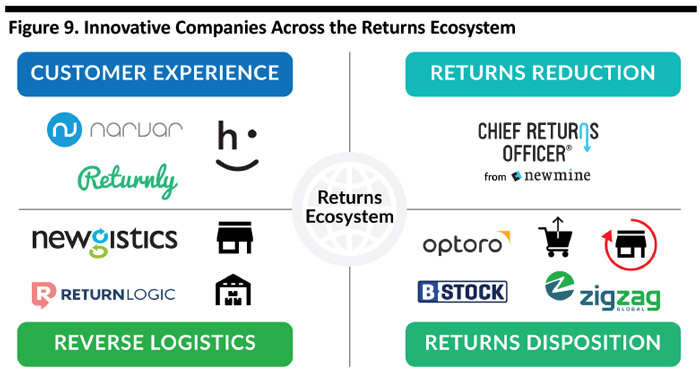

In this report, we present an analysis of the US retail returns market and introduce an innovative solution by Newmine, a company that specializes in retail commerce optimization and returns reduction. Newmine has developed an AI-powered returns reduction platform called Chief Returns Officer. Several luxury and specialty brands have worked with Newmine to better understand the underlying reasons for returns and identify in-season solutions to address them.

Source: NRF[/caption]

Return rates jump even higher when looking at online purchases: The return rate for online purchases is nearly three times higher at around 30%, according to industry estimates.

For example, online fashion marketplace Revolve saw $385 million of returns in 2017, almost equivalent to its $400 million sales net of returns, according to the company's IPO filing. This implies a roughly 49% return rate and does not include the cost of return shipping.

Though returns pose substantial challenges, retailers find it difficult to limit them because customers increasingly see free returns as a critical part of the online shopping experience. To control the associated costs and improve the customer experience, retailers are continually looking for solutions to stop purchases from being returned in the first place.

Apparel retailers, for instance, may use software that prevents fit or style mistakes. True Fit, for example, has collected data from Lord & Taylor, Ralph Lauren and several others to create an artificial intelligence (AI)-based solution that makes size and style recommendations to online shoppers based on previous purchases.

In this report, we present an analysis of the US retail returns market and introduce an innovative solution by Newmine, a company that specializes in retail commerce optimization and returns reduction. Newmine has developed an AI-powered returns reduction platform called Chief Returns Officer. Several luxury and specialty brands have worked with Newmine to better understand the underlying reasons for returns and identify in-season solutions to address them.

Industry Overview

Customer expectations are reshaping the online experience. Where e-commerce returns were once seen as a privilege, customers increasingly consider fast, free and easy returns to be a basic right of online shopping. Making returns free and easy for customers has driven up return expenses to become one of retail’s most expensive problems. According to the NRF’s Annual 2018 Return Fraud Survey, US shoppers returned approximately $369 billion worth of merchandise in 2018. [caption id="attachment_91988" align="aligncenter" width="700"] Source: NRF[/caption]

The total cost to retailers is likely to be even higher, as only about 30% of the country’s largest retailers quantify the full cost of returns, according to reverse logistics technology company Optoro.

In-store returns have steadily increased from an average of 8% in 2015 to nearly 10% in 2018, according to the NRF. For online shoppers that number was considerably higher: a staggering 30%. Moreover, Buy Online Return in Store (BORIS) has also been growing: 38% of retailers report an increase in BORIS returns in 2018, in addition to the 11% of online sales returned to brick-and-mortar stores in 2017.

[caption id="attachment_91990" align="aligncenter" width="700"]

Source: NRF[/caption]

The total cost to retailers is likely to be even higher, as only about 30% of the country’s largest retailers quantify the full cost of returns, according to reverse logistics technology company Optoro.

In-store returns have steadily increased from an average of 8% in 2015 to nearly 10% in 2018, according to the NRF. For online shoppers that number was considerably higher: a staggering 30%. Moreover, Buy Online Return in Store (BORIS) has also been growing: 38% of retailers report an increase in BORIS returns in 2018, in addition to the 11% of online sales returned to brick-and-mortar stores in 2017.

[caption id="attachment_91990" align="aligncenter" width="700"] Source: NRF/Coresight Research/eMarketer[/caption]

Free Returns Weigh on Retailers

E-commerce businesses such as Amazon and Zappos have spoiled the consumer with fast, easy and free shipping and returns. Brick-and-mortar retailers have a hard time competing. Rising e-commerce return rates are weighing on retailers, as they impact all facets of the business, from operations, to supply chain, inventory and customer experience. On average, every return is handled by more than seven people, according to Newmine.

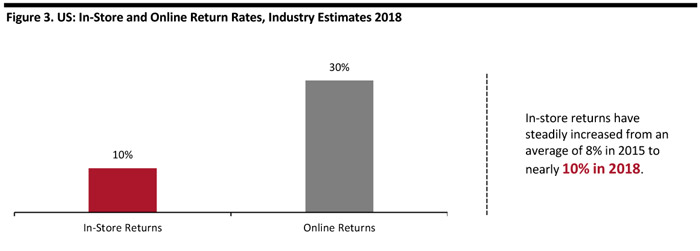

Retailers are working to encourage store returns for online purchases to manage reverse logistics costs. However, shoppers prefer to ship items to the retailer instead of bringing them to a store. Nearly 75% of Americans who returned an online purchase shipped it back to the retailer rather than taking it to a store, according to the UPS Pulse of the Online Shopper June 2017 report. This costs retailers twice as much as store returns.

[caption id="attachment_91991" align="aligncenter" width="700"]

Source: NRF/Coresight Research/eMarketer[/caption]

Free Returns Weigh on Retailers

E-commerce businesses such as Amazon and Zappos have spoiled the consumer with fast, easy and free shipping and returns. Brick-and-mortar retailers have a hard time competing. Rising e-commerce return rates are weighing on retailers, as they impact all facets of the business, from operations, to supply chain, inventory and customer experience. On average, every return is handled by more than seven people, according to Newmine.

Retailers are working to encourage store returns for online purchases to manage reverse logistics costs. However, shoppers prefer to ship items to the retailer instead of bringing them to a store. Nearly 75% of Americans who returned an online purchase shipped it back to the retailer rather than taking it to a store, according to the UPS Pulse of the Online Shopper June 2017 report. This costs retailers twice as much as store returns.

[caption id="attachment_91991" align="aligncenter" width="700"] Source: UPS[/caption]

On average, the store return process costs retailers $3 per package or up to $6 per return when shipped to a distribution center, a study by Alix Partners shows. It can cost up to $8 per return when returned to a third-party processor.

Despite companies’ investment in customer service and retention, however, an IBM study shows 80% of first-time customers who return their order will never buy from that company again. Retailers spend millions of dollars to make a sale: Returns represent a loss in capital spent on marketing, merchandising and advertising.

As E-Commerce Grows, So Grow Reverse Logistics Costs

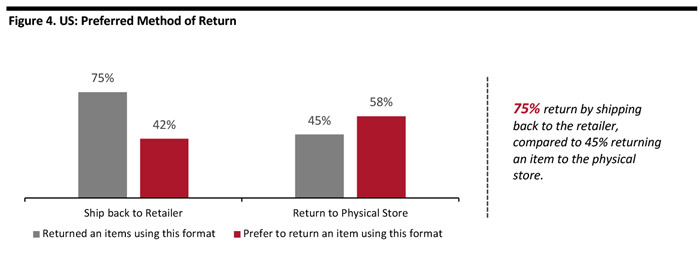

Reverse logistics is the movement of goods from place of use to place of manufacture, sale or disposal. Reverse logistics has taken on greater importance in recent years thanks to the rise of e-commerce – and returns. Online retail sales in the US hit $452 billion in 2017, an increase of roughly 16% from the previous year, according to the US Census Bureau’s Quarterly Retail E-Commerce Sales report. Globally, e-commerce grew 25% in 2017, according to eMarketer’s Worldwide Retail and Ecommerce Sales report.

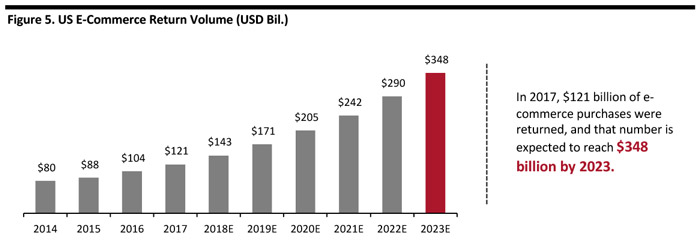

As online retail sales continue to grow at a rapid pace, retailers must address the rising volume of online returns. In 2017, $121 billion of e-commerce purchases were returned, and that number is expected to reach $348 billion by 2023.

[caption id="attachment_91992" align="aligncenter" width="700"]

Source: UPS[/caption]

On average, the store return process costs retailers $3 per package or up to $6 per return when shipped to a distribution center, a study by Alix Partners shows. It can cost up to $8 per return when returned to a third-party processor.

Despite companies’ investment in customer service and retention, however, an IBM study shows 80% of first-time customers who return their order will never buy from that company again. Retailers spend millions of dollars to make a sale: Returns represent a loss in capital spent on marketing, merchandising and advertising.

As E-Commerce Grows, So Grow Reverse Logistics Costs

Reverse logistics is the movement of goods from place of use to place of manufacture, sale or disposal. Reverse logistics has taken on greater importance in recent years thanks to the rise of e-commerce – and returns. Online retail sales in the US hit $452 billion in 2017, an increase of roughly 16% from the previous year, according to the US Census Bureau’s Quarterly Retail E-Commerce Sales report. Globally, e-commerce grew 25% in 2017, according to eMarketer’s Worldwide Retail and Ecommerce Sales report.

As online retail sales continue to grow at a rapid pace, retailers must address the rising volume of online returns. In 2017, $121 billion of e-commerce purchases were returned, and that number is expected to reach $348 billion by 2023.

[caption id="attachment_91992" align="aligncenter" width="700"] Source: US Census Bureau/eMarketer/Ecommerce Foundation/Business Insight Intelligence [/caption]

Some companies just accept that returns happen and focus on cost-effectively moving them around. The complex costs of reverse logistics often go unchecked, diminishing margins. Inbound logistics costs are typically dispersed across the entire organization instead of being assigned to a cost center as would other manufacturing and selling costs. Reverse logistics costs can typically be broken down into four main areas:

Source: US Census Bureau/eMarketer/Ecommerce Foundation/Business Insight Intelligence [/caption]

Some companies just accept that returns happen and focus on cost-effectively moving them around. The complex costs of reverse logistics often go unchecked, diminishing margins. Inbound logistics costs are typically dispersed across the entire organization instead of being assigned to a cost center as would other manufacturing and selling costs. Reverse logistics costs can typically be broken down into four main areas:

- Customer service

- Transportation and warehousing

- Repairs

- Reselling

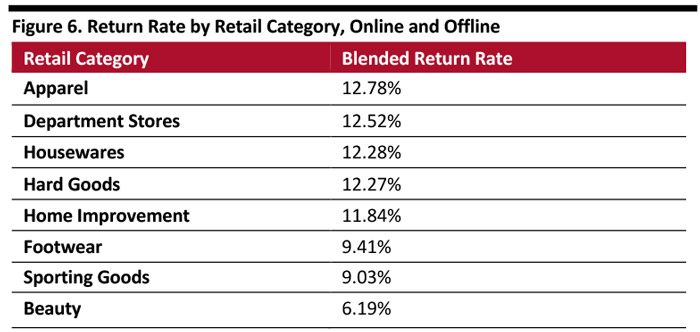

Retail category rates derived from Appriss Retail analysis of 40,000 stores in the specialty and general merchandise retail segments. Appriss Retail reviews data from e-commerce and POS T-Logs to build a blended return rate.

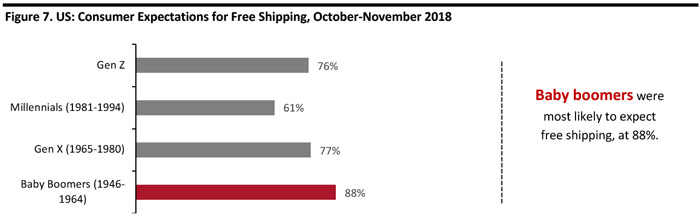

Retail category rates derived from Appriss Retail analysis of 40,000 stores in the specialty and general merchandise retail segments. Appriss Retail reviews data from e-commerce and POS T-Logs to build a blended return rate. Source: NRF [/caption] Shoppers Demand Free Shipping and the Rise of Bracketing Strongly encouraged by free shipping and free returns, a growing number of customers are “bracketing” – ordering several size and color options to try on at home, with the intention of purchasing only one item and returning the others. These so called “intentional returns” have become particularly common in fashion and footwear, where consumers have come to expect free returns. According to the quarterly Consumer View report released by the NRF in January 2019, consumers increasingly expect free delivery of items they buy online. Toluna Analytics surveyed 3,002 US adults 18 or older for the NRF during October-November 2018 and found that 75% of respondents expect free delivery even on orders under $50, up from 68% one year earlier. The survey found Baby Boomers demand free shipping the most, followed by Generation Xers, Generation Zers and Millennials. [caption id="attachment_91994" align="aligncenter" width="700"]

Source: NRF[/caption]

Retailers struggle with how to manage the cost without alienating shoppers. UPS research shows 95% of shoppers who are satisfied with a retailer’s return process will purchase there again. The question remains: How do retailers make it economically viable?

Digital Channels Fail to Deliver on Their Potential: Opportunity to Improve Customer Experience

With increased digitalization and retailers shifting focus to multichannel retail, consumer preferences are shifting so they expect service across media: web, mobile, text messaging and chatbots. And returns are a critical part of the digital customer experience. This doesn’t mean retailers have been able to bridge the gap between consumer preferences for digital channels and customer experience. In fact, it seems far from happening, and consumers are showing increasing dissatisfaction across various platforms on which they have received customer service.

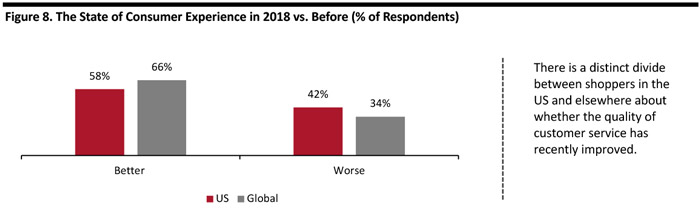

There is also a distinct divide between shoppers in the US and elsewhere about whether the quality of customer service has recently improved: 58% of US shoppers believed customer service in general had improved in 2018 compared to before, according to a survey by Microsoft. This was considerably lower than the 66% of respondents outside the US who said it had.

[caption id="attachment_91995" align="aligncenter" width="700"]

Source: NRF[/caption]

Retailers struggle with how to manage the cost without alienating shoppers. UPS research shows 95% of shoppers who are satisfied with a retailer’s return process will purchase there again. The question remains: How do retailers make it economically viable?

Digital Channels Fail to Deliver on Their Potential: Opportunity to Improve Customer Experience

With increased digitalization and retailers shifting focus to multichannel retail, consumer preferences are shifting so they expect service across media: web, mobile, text messaging and chatbots. And returns are a critical part of the digital customer experience. This doesn’t mean retailers have been able to bridge the gap between consumer preferences for digital channels and customer experience. In fact, it seems far from happening, and consumers are showing increasing dissatisfaction across various platforms on which they have received customer service.

There is also a distinct divide between shoppers in the US and elsewhere about whether the quality of customer service has recently improved: 58% of US shoppers believed customer service in general had improved in 2018 compared to before, according to a survey by Microsoft. This was considerably lower than the 66% of respondents outside the US who said it had.

[caption id="attachment_91995" align="aligncenter" width="700"] Base: 5,000 US and global consumers aged 18+

Base: 5,000 US and global consumers aged 18+ Source: Microsoft [/caption] Digital channels now have a greater impact on purchase decisions as more shoppers begin their shopping journey online. This also means the “pre-purchase” customer experience is as important as the experience during or after purchase. More than 50% of shopping journeys now start online, a growing number of which are on mobile devices, and the mobile figure will rise to 58% by 2022, according to Forrester Research. This means US retailers must fill in gaps for consumers who expect the shopping journey to spread uninterrupted across channels. We see opportunities for retailers focused on building the consumer experience at all stages of the shopping journey: before, during and after the consumer makes a purchase.

Identifying the Root Return Cause Is Critical

At any point in time a typical retailer has hundreds or thousands of products. It is humanly impossible for a retailer to keep track of every anomaly occurring within each product. Sourcing and merchandising teams plan nine months to a year before an item hits the shelf. By the time those products do hit the shelves, the team is already focused on the next season or may have moved on to another company. To address returns, retailers need to find the root cause during the selling season.

When consumers return online and are requested to check a box indicating the reason for the return, the majority will pick the easiest choice, leaving the retailer in the dark regarding the real issues, according to Newmine. Moreover, online reviews tend to be mostly positive as retailers generally don't want to show negative responses on the site. But negative reviews, when engaged properly and in a timely manner, offer valuable insights that can cut returns.

Newmine provides a SaaS-based solution that collects and analyzes data and applies machine learning to understand the primary reasons for returns in real time.

Learning how to recover financially and operationally from a return is key and no less relevant to a company’s bottom line than the initial logistics process. Well-managed reverse logistics translates to happier customers, lower resource investment levels, less storage and decreased distribution costs. Newmine focuses on resolving the issue at the source to avoid the reverse logistics process altogether.

[caption id="attachment_91996" align="aligncenter" width="700"] Source: Newmine[/caption]

Source: Newmine[/caption]

Company Overview: Newmine

Newmine was established as a global retail consulting firm in 2011, employing seasoned experts in the areas of retail operations and technology to help clients improve operational efficiencies and enhance revenue.

With expertise in retail applications and technology, customer experience, strategic project execution and change management, Newmine specializes in client-side support to successfully execute strategic value chain initiatives. The team also has a strong background in M&A, so they are well aware of the importance of a healthy bottom line. Their initiatives range from omnichannel readiness to operational business process optimization and cost reduction. Newmine’s mission is to help retailers and brands realize their omnichannel potential and build a better bottom line.

In 2017, Newmine set its sights on the growing problem of customer returns with the creation of its flagship software, Chief Returns Officer.

Chief Returns Officer

Newmine’s Chief Returns Officer uses analytical technology, AI, natural language processing (NLP) and machine learning to identify the root cause of returns and give retailers timely recommendations to curb negative trends. Newmine primarily targets retailers in the fashion, apparel and footwear sectors where returns are the highest, but the solution is agnostic and can easily be applied to other sectors, including hard goods, electronics and more.

To resolve the problem of growing returns in retail, Newmine devised a SaaS-based solution that focuses on the four key pillars of returns reduction:- Root cause: Identification of the underlying reason behind returns.

- Timeliness: Providing timely, in-season alerts to problems.

- Actionable: Identifying and prioritizing issues along with prescriptive actions to take to correct them.

- Collaborative: Generation of automated tasks and workflows that are distributed and managed in a centralized system.

Root Cause Identification

Identifying the true reason for the return is the single greatest challenge of returns reduction. The reality is that there is no single source of data that provides the 360-degree view necessary to determine why the customer is returning the product. Relevant data lives in disparate systems, can range over a long period of time, is voluminous and ever-changing.

Given this challenge, it is no surprise that when surveyed by Newmine and the Retail Value Chain Federation, retailers identified efficient access to data as one of the primary obstacles to identifying root cause and achieving returns reduction. Consolidation and organization are therefore essential.

Newmine’s Chief Returns Officer identifies the root causes of returns and prescribes corrective actions by importing and analyzing data from multiple retail systems, which can include merchandising, planning, PIM, PLM, OMS, WMS, CRM and product reviews.

As an example, the software’s sentiment analysis functionality uses NLP models to examine product review data to identify the customer’s real concerns, contribute to root cause analysis and diminish future returns.

Timeliness

Returns reduction requires the combination of near real-time data and a timely alert to the responsible business team to take action. In-season adjustments are the key. For example, if it happens that marketing copy is misleading, or product quality is not meeting expectations, Chief Returns Officer will identify, prioritize and communicate this information to the retailer in season – while the company still has time to take corrective action. It’s possible to create an in-season downward trajectory for customer returns with timely action.

Actionable

The combination of root cause identification, anomaly detection and prioritization becomes actionable intelligence. Retailers can establish a wide array of rules, such as return rate and value thresholds. This flexibility, in conjunction with machine learning, cuts through the noise to focus attention on problems that will move the needle. This logic triggers the addition of specific items to the system’s WatchList. From there, the anomaly detection engine identifies return spikes and prescribes actions based on the identified root cause. Again, machine learning steps in to measure success and learn which actions are most effective.

Collaborative

Chief Returns Officer provides an integrated workflow module to distribute, manage and track all returns reduction activities. Corrective actions are assigned based on a retailer-controlled hierarchy of the responsible business group based on a combination of product, product category, supplier and area of responsibility. For example, web content, quality, fit, operations, etc.

Summary

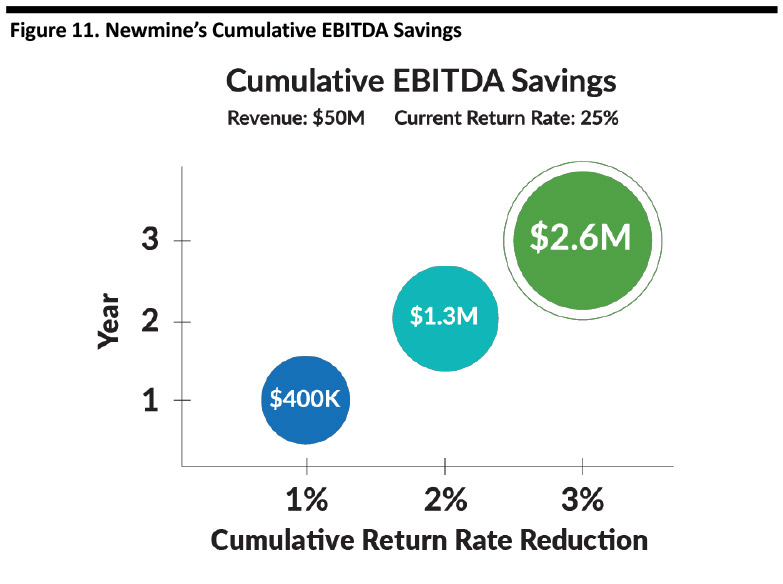

Chief Returns Officer helps online retailers and brands manage and reduce consumer returns, adding millions back to the bottom line. Chief Returns Officer helps mitigate the risk of lost brand loyalty and unhappy customers. By collecting internal and external data, incorporating data science for analysis, alerting the proper teams to root causes in near real time and managing resolutions, Chief Returns Officer provides AI-driven prescriptive insights that can deliver a one to five percentage-point reduction in return rates.

[caption id="attachment_91997" align="aligncenter" width="700"] Source: Newmine[/caption]

Source: Newmine[/caption]

Newmine’s Offerings and Competitive Advantages

Newmine’s offer provides enterprise-level benefits on the following four levels:- Financial: Every $1 million of returns reduction sends $500,000 to the bottom line.

- Inventory: Improved margins via fewer markdowns.

- Operational: Cost savings in labor, shipping and DC space.

- Customer experience: Increased brand loyalty through a better buying experience.

Competitive Advantages

By offering retailers a flexible, scalable and sustainable platform, Newmine’s solution allows retailers to reduce returns. This in turn supports improvements in EBITDA, improved customer experience, reverse logistics optimization and better overall inventory management. The data analysis that Chief Returns Officer performs also provides product, supplier and customer intelligence, leading to enhancements in product assortment and quality control, supplier performance visibility and customer returns intelligence.

[caption id="attachment_91998" align="aligncenter" width="700"] Source: Newmine[/caption]

Source: Newmine[/caption]

Chief Returns Officer is a notable example of AI technology being used to solve a real business problem. As the company grows its database of client information and actions taken in the past, it gradually improves its ability to detect and classify problems, which increases its value to both its current and future clientele.

Case Studies

One designer footwear item carried by a luxury footwear retailer had a return spike of over 50%. Newmine ran Chief Returns Officer to perform a “look back analysis,” a retrospective of returns data, and identified anomalies that indicated the designer’s size/fit was inconsistent across the assortment. The retailer consulted with the shoe designer to better understand fit standards and modified the product fit advisory on the website, cutting returns 4% in the first 30 days.

Chief Returns Officer has become the centralized source of product returns information to support enterprise collaboration for a specialty retailer of women’s lifestyle fashion. Their retail stores are on the front line of customer feedback for product issues. When they experience a product returns issue or customer complaint, it is communicated to home office and Chief Returns Officer is the first stop for: 1) research across all channels, 2) validating the product issue, and 3) triggering corrective action across all channels after determining the root cause. Human intelligence contributes to corrective action, which has resulted in fewer returns. In addition, Chief Returns Officer prevents the silo-effect of chasing an isolated issue across the organization, saving valuable time and money.

Another fashion retailer leveraged product review data to learn that one customer had been buying the same shirts, but that recent purchases did not fit well. The retailer had changed vendors, and the sizing did not match, so the company changed the website copy to say “if you were buying size 6, you should be buying size 8.”

Business Model & Go-to-Market Strategy

Every retailer has at least a dozen systems in the enterprise. Harvesting data is key. But how can you harvest and integrate data from different systems, which may come from incompatible systems and in inconsistent formats? Newmine’s AI-driven solution not only resolves issues underlying returns, the SaaS-based solution does most of the heavy lifting of data collection, prescribing actions and auto-generating cross-departmental workflows so retailers can take corrective action on returns. Every retailer has implemented BI solutions, but none really use AI effectively to combat returns. Chief Returns Officer is a returns reduction platform that also offers powerful data visualization capabilities.

Key Management

The Newmine team is comprised of professionals with retail strategy, operations and IT systems experience. The executive team includes Navjit Bhasin, Founder & CEO; Janis Abbingsole, Partner & COO; and, Mark Lightbody, Partner.

Navjit has almost 20 years’ experience in technology and business integration focused on omnichannel retailers and consumer brands. Navjit is an active angel investor, with entrepreneurial and private equity experience.

Company Outlook

In the second half of 2019, Newmine will launch additional capabilities in Chief Returns Officer that enhance communication and collaboration with suppliers and vendors, as well as improve customer experience and personalization through a customer-centric returns intelligence. The same data given to retailers to curb returns can be leveraged to help the customer better understand the product and relieve the need for bracketing. One of the company’s main objectives will be to improve identification of bracketing transactions, to intercept them in a customer-friendly way and reduce their occurrence.

Newmine’s vision for Chief Returns Officer centers on three guiding principles:

- 1. Become the industry standard data/AI returns reduction platform for consumer brands and retailers.

- 2. Create enterprise value through expanded returns-centric knowledge about suppliers and customers.

- 3. Create a scalable and sustainable environment for returns reduction.

Coresight Research View

Returns in the retail industry continue to grow annually and are partially encouraged by an environment in which consumers increasingly expect and receive free shipping. Retailers struggle with reverse logistics, suffering financially to maintain their clientele. Few companies are actively involved in addressing the root cause of returns. Newmine is the only company offering a SaaS-based AI tool to help retailers identify the issues and deal with them in season. Given the complexity of the reverse logistics cycle, we believe Newmine’s Chief Returns Officer, which helps retailers understand the main pain points and address them within season, could be a real boon for the industry.

Company Contact Navjit Bhasin, CEO/Founder Newmine navjit@newmine.com 508-740-4101 www.newmine.com