DIpil Das

What’s the Story?

The Covid-19 pandemic has led to a rapid acceleration of e-commerce growth as people continue to limit physical interactions. This perfect storm has created an unparalleled opportunity within the virtual space. Retailers have been quick to introduce omnichannel initiatives such as BOPIS (buy online, pick up in store) solutions, and have introduced virtual storefronts to improve the overall customer experience. We estimate that there was an approximate 27% increase in US online apparel and footwear sales in 2020, amid a declining overall apparel and footwear market. However, with increased order volumes, retailers continue to grapple with the negative impact of returns—which are more severe in some industries than others. In fact, clothing was the number-one product category that US consumers returned, with 51.5% of respondents who returned an unwanted purchase in the past 12 months reporting that they returned apparel, according to a recent Coresight Research survey. Virtual try-on technologies can help online apparel retailers to reduce overall return quantities, which may arise due to the consumer deciding that the item does not suit them—among other reasons such as sizing issues and damaged products. In addition, by creating an easy-to-use virtual try-on solution, retailers can enhance the overall experience for shoppers whilst facilitating opportunities including cross-selling, upselling and personalized recommendations. In this report, which is sponsored by virtual try-on technology provider SeeItFit, we analyze the key industry trends that impact the need for virtual try-on solutions and consider how retailers can deliver an optimal and user-friendly experience to apparel shoppers that enables them to try on clothes virtually. We also discuss SeeItFit’s offering and how its solution can benefit retailers.Why It Matters

For 2020 overall, we estimate that US e-commerce sales reached $752 billion—having grown 35% from 2019—accounting for 19% of total retail sales. Consumers switching spending online due to the coronavirus pandemic has fueled the already fast-growing e-commerce sector. We expect this surge in e-commerce to underline the importance of technologies such as virtual try-on, which will play an important role in improving online customer experiences. Whilst Covid-19 has had a substantial negative impact on the retail industry, it has also created a lot of opportunities for retailers to innovate and prove their resilience to challenges. In addition to a surge in purchasing via e-commerce sites, we expect the influence of social media on shopping to deepen in the coming months. Changes in shopper behavior and the overall retail landscape have been rapid. In such an environment, it becomes more important than ever for retailers to adapt quickly to the changing needs of consumers. In the lead-up to the holiday season in 2020, we observed shoppers switching spending online—even more so in December, which was indicative of strong online demand for holiday shopping this year, as supported by findings from a recent Coresight Research survey of US consumers, undertaken on December 8, 2020. We highlight the key insights from our survey in Figure 1.Figure 1. US Shoppers: Key Behavioral Attributes [caption id="attachment_121639" align="aligncenter" width="700"]

Base: 463 US adults aged 18+ surveyed on December 8, 2020

Base: 463 US adults aged 18+ surveyed on December 8, 2020 Source: Coresight Research [/caption]

Industry Overview

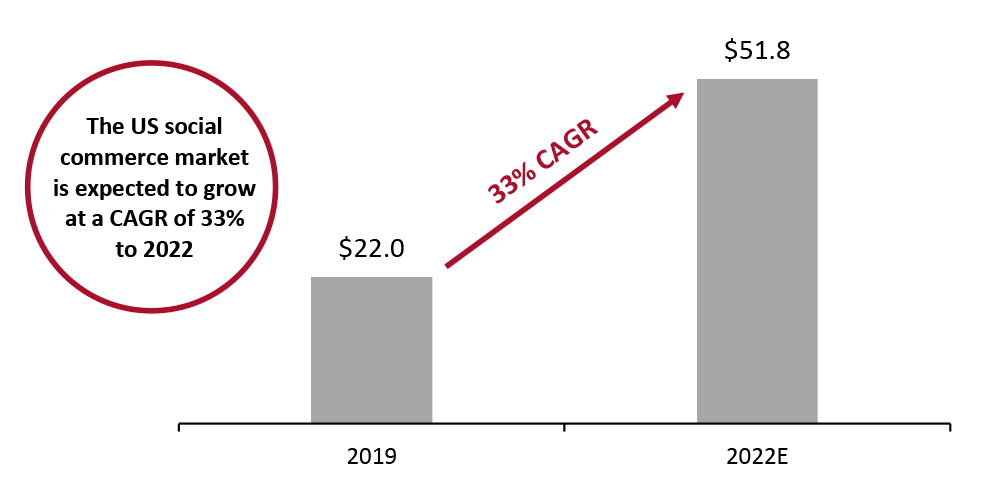

Social Media Has a Huge Impact on Shoppers’ Purchase Behavior Social media plays a pivotal role in shaping consumer behavior and purchase decisions, given the scope and ease of exposure to products. Retailers and brands understand the importance of social commerce and have taken initiatives to bolster their social commerce efforts. For example, American denim brand Levi’s partnered with social media platform TikTok on its “Shop Now” program in April 2020, allowing its customers to buy directly from the social platform. Online apparel retailers can leverage the growing popularity of social commerce and augment their existing offering with engaging technologies such as virtual try-on—in turn improving the overall shopping experience. Although social commerce makes a small contribution to the overall US e-commerce market, it holds huge potential over the next few years as the number of social commerce buyers increases: There were 65.2 million social shoppers in the US in 2019, and over 75 million social shoppers were expected to make at least one purchase from social platforms in 2020, according to market research company eMarketer. In terms of overall value, the US social commerce market is projected to grow from $22 billion in 2019 to $51.8 billion in 2022, according to research firm Technavio.Figure 2. US Social Commerce Market Size (USD Bil.) [caption id="attachment_121640" align="aligncenter" width="550"]

Source: Technavio[/caption]

In the coming years, we expect social commerce to pick up pace in the US as it has in Asia, and especially China, over the past few years. Coresight Research surveyed 1,509 US Internet users aged 18 or above in November 2019 and found that:

Source: Technavio[/caption]

In the coming years, we expect social commerce to pick up pace in the US as it has in Asia, and especially China, over the past few years. Coresight Research surveyed 1,509 US Internet users aged 18 or above in November 2019 and found that:

- Some 92% of all respondents use social media, while 57% of respondents use social media as a part of the shopping process.

- Some 48% of all respondents make purchases on social media.

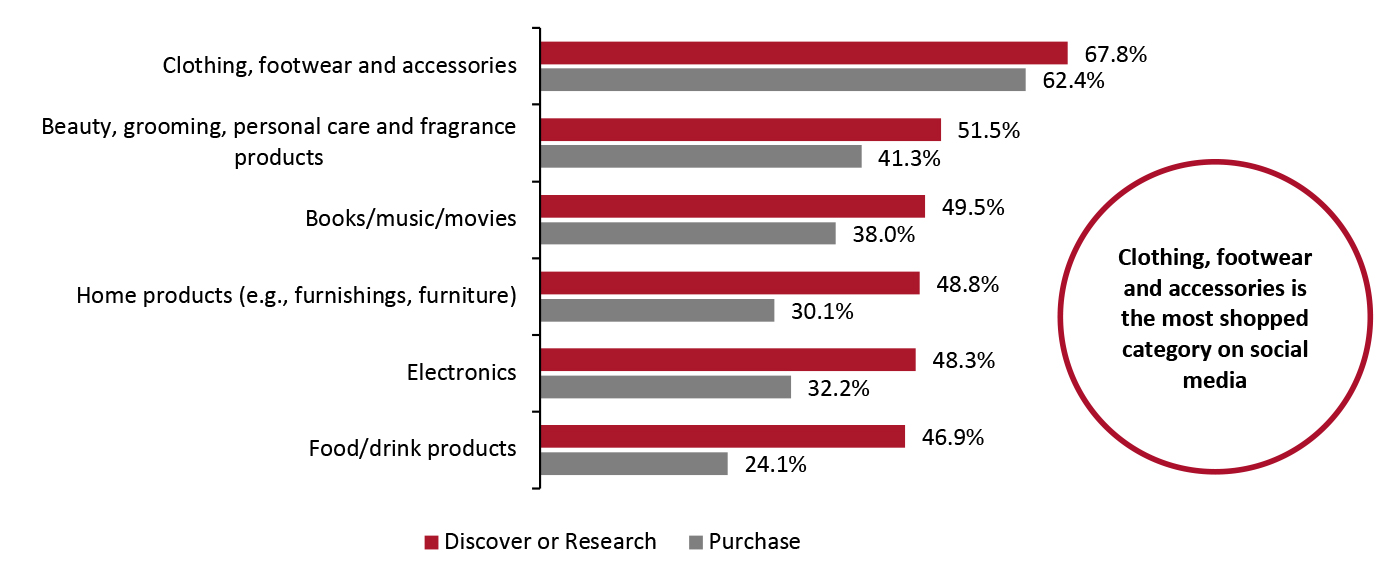

Figure 3. US Shoppers: Product Categories Discovered or Researched and Categories Purchased on Social Media (% of Respondents) [caption id="attachment_121641" align="aligncenter" width="700"]

Base: 851 US Internet respondents aged 18+ who use social media to discover products or research purchases, and 731 US Internet users aged 18+ who use social media to purchase products

Base: 851 US Internet respondents aged 18+ who use social media to discover products or research purchases, and 731 US Internet users aged 18+ who use social media to purchase products Source: Coresight Research [/caption] Returns Are Costly and Complicated for Retailers Returns continue to be among the topmost pain points for brick-and-mortar and online retailers alike. US shoppers returned approximately $309 billion in merchandise in 2019, accounting for 8.3% of total retail sales, according to Appriss Retail and the NRF. Online returns in the US amounted to an estimated $41 billion in 2019, according to Appriss Retail. While returns are an industry-wide problem, there are some disparities across sectors: Both online and offline, the overall returns rate is very high for footwear retailers at 15.8%, but is just 5.3% for beauty retailers, according to Appriss Retail. It is also important to note that the most returned category of clothing, footwear and accessories also emerged as the top gifting category for holiday gift shoppers in 2020, with 44.2% of survey respondents reporting that they expected to spend on such products, according to our recent consumer survey.

Figure 4. Selected Retail Categories, US Returns Rate (% of Total Orders) [wpdatatable id=679 table_view=regular]

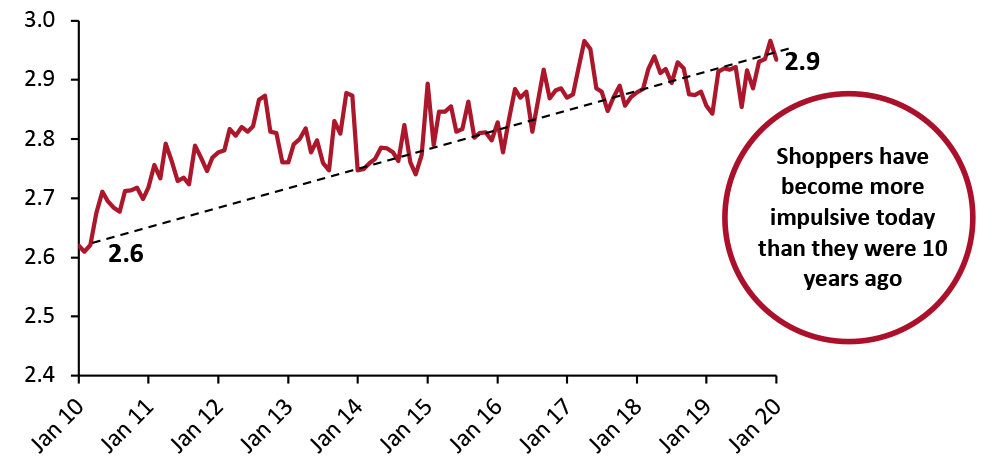

*Calculated by Appriss Retail by analyzing e-commerce and point-of-sale data from 40,000 stores in the specialty and general merchandise segment Source: Appriss Retail Returned goods lose much of their value by the time they are returned, in part due to seasonality, which could make returned products redundant to retailers for as long as eight to 12 months before they are back in season. Shoppers Are Impulsive and Impatient E-commerce has presented shoppers with nearly unlimited product choice and rapid delivery. Online marketplaces and retailers such as Amazon have invested large amounts of money in building logistics services that deliver products at record speeds: With its Prime Now offering, Amazon enables customers in the US to receive grocery deliveries within two hours of placing an order. As a result, shoppers have higher expectations of virtually instant results. This more impulsive and impatient consumer nature suggests that technologies such as virtual try-on have greater potential than ever to drive incremental sales. Below, we chart the Prosper Impulsivity Score from Prosper Insights & Analytics, which indicates how much or how little consumers are living in the moment when it comes to their spending habits. This measure of shopper impulsivity is based on monthly surveys that ask consumers to what extent they agree with the statement, “Live for today because tomorrow is so uncertain.”

Figure 5. Prosper Impulsivity Score, 2010–2020 [caption id="attachment_121642" align="aligncenter" width="550"]

The Prosper Impulsivity Score is calculated using a weighted average based on a five-point scale: The closer the score is to five, the more consumers agree with the statement, “Live for today because tomorrow is so uncertain;” and the closer the score is to one, the more they disagree.

The Prosper Impulsivity Score is calculated using a weighted average based on a five-point scale: The closer the score is to five, the more consumers agree with the statement, “Live for today because tomorrow is so uncertain;” and the closer the score is to one, the more they disagree. Source: Prosper Insights & Analytics/Coresight Research [/caption] Virtual Stores: A New Reality for Online Shoppers Retailers are increasingly turning towards virtual storefronts to attract shoppers while making online shopping more entertaining. Using augmented reality (AR) technologies, shoppers can navigate inside different store areas. With virtual stores, retailers are able to provide shoppers with experiences similar to those in physical stores. Focusing on engaging and useful virtual try-on technologies can improve the overall shopper experience even further. In addition, virtual try-on technology can help retailers showcase apparel products based on what the shoppers “try-on” and in turn, upsell their products. The recent uptake in the launch of virtual stores implies retailers’ urgency to reach out to their shoppers in different innovative ways. Although virtual stores are a great medium to offer a store-like experience to shoppers, there is room to incorporate technologies such as virtual try-on to complete the overall experience of online apparel shoppers. Below, we underline two key opportunities that brands and retailers can capitalize on through their virtual storefronts.

- Cross-selling: Virtual storefronts help retailers showcase their products to shoppers in a similar way to in their physical stores. With strong visual merchandising execution, retailers can allow shoppers to look at complementary designs when navigating through the store and, in turn, bolster cross-selling opportunities.

- Personalization: A surge in e-commerce has led to an equivalent surge in shopper data. With newer initiatives such as virtual storefronts, retailers can access shopper engagement data and also identify the most popular store spaces. Retailers can harness customer data and build meaningful personalization campaigns around it.

Figure 6. Selected Brands/Retailers: Key Virtual Storefront Initiatives [wpdatatable id=680 table_view=regular] Source: Company reports

Company Overview: SeeItFit

SeeItFit is a virtual try-on solution provider. SeeItFit enables retailers to enhance the overall online shopping experience for shoppers, as they can see how the apparel would look on them before they checkout. It offers retailers an option to add a widget to their website, which is as easy as adding any other social media icon. The “SeeItFit” icon allows shoppers to drag and drop apparel items from the retailer’s website onto their own picture, enabling customers to see items on themselves before making a purchase, without ever leaving the retailer’s website.. This technology increases social engagement and can also help reduce returns and improve consumer confidence in their purchase. [caption id="attachment_121643" align="aligncenter" width="700"] A shopper trying on apparel using SeeItFIt’s solution

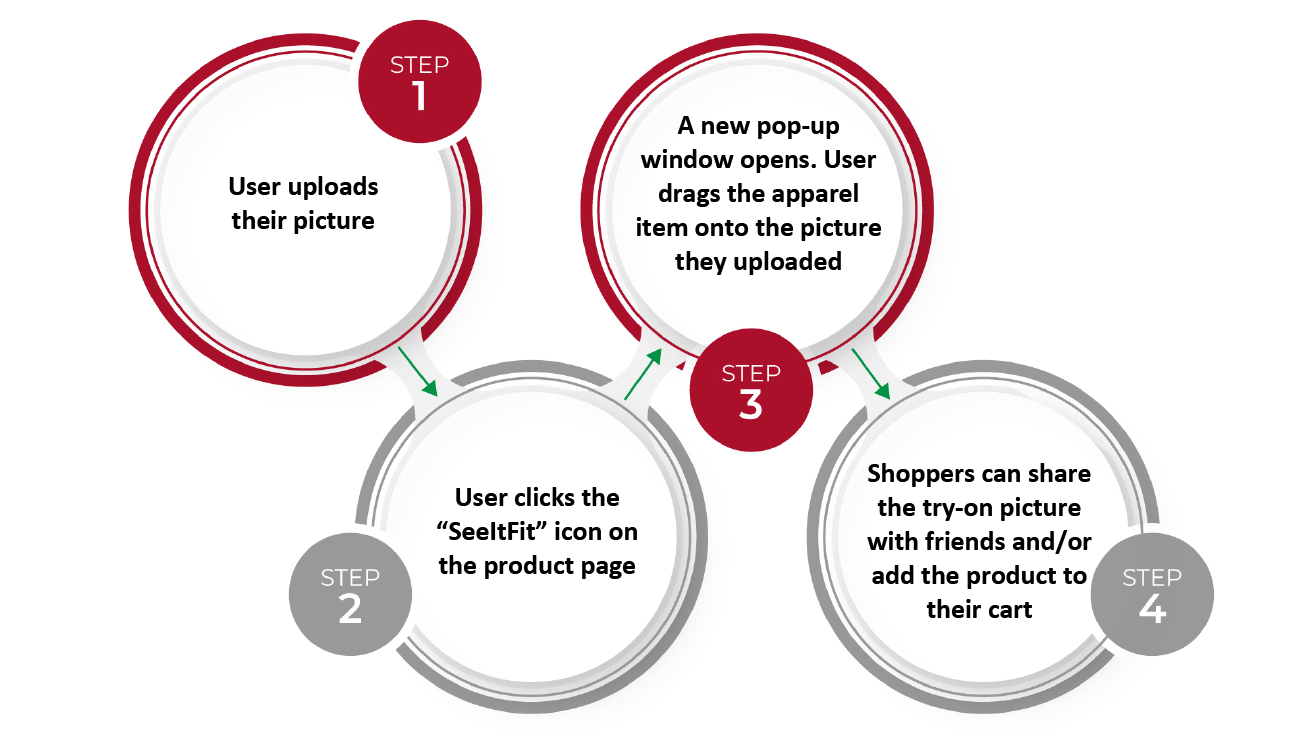

A shopper trying on apparel using SeeItFIt’s solution Source: SeeItFit [/caption] What Is SeeItFit? SeeItFit is a virtual try-on solution for online apparel retailers. It allows shoppers to see how clothes would look on them before they make a purchase. In addition to trying on clothes, shoppers can share outfits with friends and family and on social media. Furthermore, SeeItFit helps retailers to aggregate data, such as buying patterns and shopping preferences of individual shoppers, which can be used to offer a more personalized and seamless shopper experience both online and in-store. How Does SeeItFit Function? SeeItFit differentiates itself with its easy-to-use virtual try-on solution. The company’s focus is to help online retailers enhance the overall shopping experience in a simple and efficient way. In fact, there is an increased need for a simplified solution due to the difficulties involved in building a 3D apparel configurator—especially because of the nature of cloth materials and difficulties in determining how it would fold or fall on various body types. SeeItFit’s turnkey solution does not require advanced algorithms and it is easy to install. It functions as a widget add-on to any e-commerce website. After retailers share their online catalog with SeeItFit, the solution can be deployed within a few minutes. Shoppers can upload a picture of themselves and drag any apparel item onto the image of their body before making a purchase. They can share virtual try-on images with family and friends or on social media through SeeItFit’s inbuilt feature. Once shoppers see how a product looks on them, they can proceed to make a purchase. Figure 7 summarizes how the SeeItFit platform functions.

Figure 7. Functioning of the SeeItFit Platform [caption id="attachment_121644" align="aligncenter" width="700"]

Source: SeeItFit/Coresight Research[/caption]

How Do Retailers Benefit from SeeItFit?

SeeItFit’s platform can help retailers add a competitive edge to their online stores. SeeItFit does not require a cumbersome installation process and can be launched easily. We believe that SeeItFit’s technology can help retailers in the following three ways:

Source: SeeItFit/Coresight Research[/caption]

How Do Retailers Benefit from SeeItFit?

SeeItFit’s platform can help retailers add a competitive edge to their online stores. SeeItFit does not require a cumbersome installation process and can be launched easily. We believe that SeeItFit’s technology can help retailers in the following three ways:

- Reducing returns: The returns rates in the apparel industry are among the highest, primarily because shoppers are making purchases without trying clothing on. There is an evident gap to bridge between online and offline apparel retail. In fact, nearly half (48.6%) of respondents said that they have returned items because they looked different in person compared to online, according to a June 2019 survey of 2,000 US e-commerce shoppers conducted by e-commerce marketing company Yotpo. We believe virtual try-on technology can help retailers to bridge this gap and reduce returns.

- Building brand loyalty: Shoppers are more aware today, primarily due to the proliferation of digital channels. Additionally, shopper journeys have become more complex as shoppers leverage multiple channels to take inspiration, read reviews and search for cheaper and better alternatives. With technology such as SeeItFit, retailers can increase shopper engagement and retain their shoppers, which can help to build brand loyalty among shoppers.

- Strengthening gift offerings: SeeItFit’s platform allows users to upload a picture of their friend or relative and see how an item would look on them. This eliminates the guesswork from gift purchases and makes the gift buyers more confident about how the gift would look on the recipient.

SeeItFit: Market Positioning

In this section, we analyze SeeItFit’s market positioning, as well as current market opportunities in the market and key growth drivers. SeeItFit’s key competitive advantages include the following:- Ease of use: SeeItFit is easy to install and does not require retailers to make changes to their website. The SeeItFit widget appears on the product page where shoppers can readily access it.

- Time to market: Unlike advanced configurators, which take a lot of time to install, the SeeItFit solution can be deployed within a few minutes of retailers sharing their online catalog.

- Data and insights: SeeItFit captures important shopper data. Retailers can leverage consumer data and recommend newer products based on what shoppers try on and purchase.

- Limiting returns: SeeItFit allows shoppers to “see” how an apparel product would look on them before they make a purchase and also allows them to share it with their friends and family. This reduces the likelihood of returns.

Figure 8. SeeItFit: Competitive Advantage Matrix [wpdatatable id=681 table_view=regular]

Source: Coresight Research