Company Overview

While US retail has been thriving since late 2017 and retail forecasts remain positive, traditional retailers and brands are still in danger of losing their customer bases if they do not adapt to the ever-encroaching e-commerce marketplace. First and foremost, e-commerce is here to stay — and having an effective, lasting online strategy will make or break many retailers in the years to come. While in-store sales still may make up more than 80% of retail sales, e-commerce sales have been making steady inroads. More importantly, changing online shopping habits shift and these shifts alter customer journeys, both on- and offline.

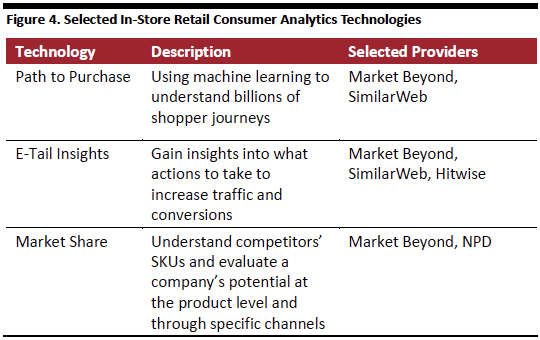

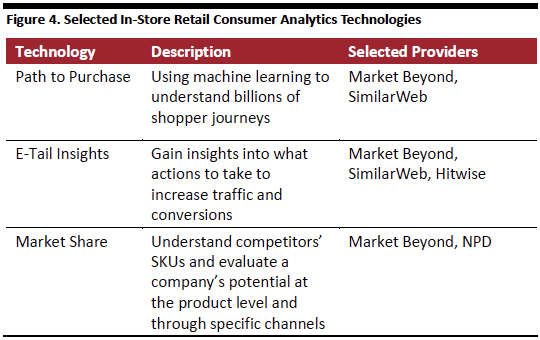

Retailers continue to invest heavily in e-commerce, but generally develop their e-commerce strategies without much information about competitors, and with few insights into their actual market share. Discovering how customers view products in relation to one another and which products they ultimately choose is paramount for e-commerce retailers. Market Beyond helps retailers and brands in these areas:

- E-Tail Insights: Optimizing funnel inefficiencies at the product level by providing actionable product insights. Correcting deficiencies in product assortments, pricing models, website traffic and other conversion factors.

- Market Share: Revealing competitors’ SKU intelligence, market share and the business potential for products, down to specific channels.

Retailers and brands have endless options for avenues to sell online. Companies can use Magento or Shopify, create their own website, sell on Amazon, Alibaba or any of the other major platforms. A company will likely go through multiple, or all, of these paths to reach as many customers as possible. However, this makes tracking customer journeys, specific product engagement and following online trends nearly impossible.

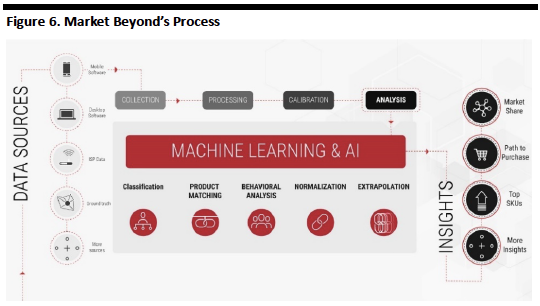

Market Beyond uses machine learning and other forms of artificial intelligence (AI) to tackle these e-commerce complexities, tracking millions of online shoppers and analyzing billions of shopping journeys, while giving real-time insights. The company uses a diverse set of data sources, including “mobile, desktop, ISPs, ad networks and ground truth data,” according to the company, from which the algorithm can determine and display patterns. The company’s software automatically classifies and categorizes products across multiple e-commerce channels. It then analyzes relationships between a user’s actions and preferences to conversion in any category. This removes response bias, eliminates selection bias and validates ground truth data.

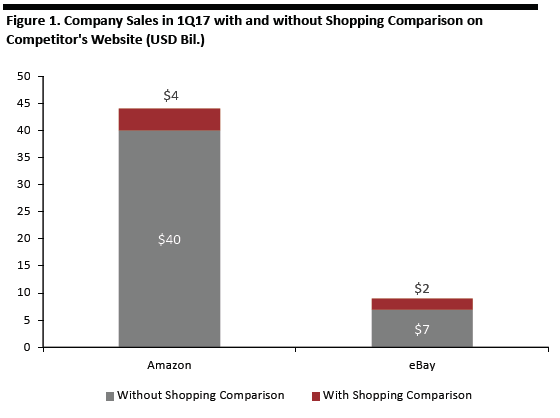

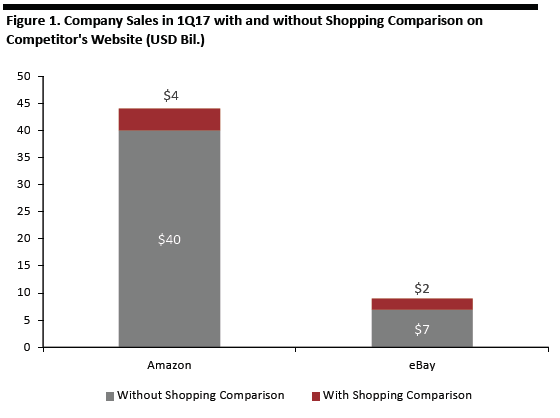

Market Beyond performed a case study on eBay’s and Amazon’s retail sales involving overlapping customers, which it found to be roughly $6 billion each quarter based on the first quarter of 2017. According to the study, Amazon wins roughly $4 billion sales worth of shopping comparisons, while eBay wins about $2 billion.

eBay is significantly more sensitive to shopping comparisons than Amazon. The roughly $2 billion of sales for eBay that included comparisons on Amazon comprise 20% of its total sales for that quarter, while only 10% of retail sales on Amazon are affected by comparison on eBay — although that 10% amounts to almost $4 billion. Amazon is much more resilient than eBay, and constantly strives to retain users with consistently lower prices, faster shipping and Prime discounts.

[caption id="attachment_78558" align="aligncenter" width="560"]

Source: Market Beyond

Source: Market Beyond[/caption]

Industry Overview

E-Commerce Continues to Grow Rapidly in the US

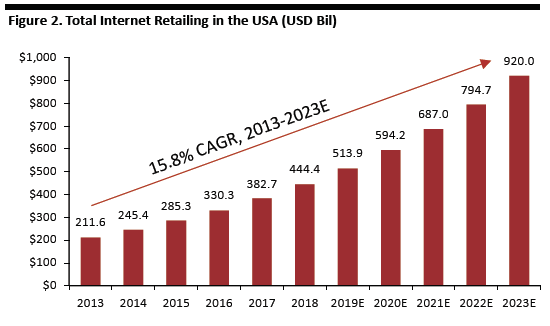

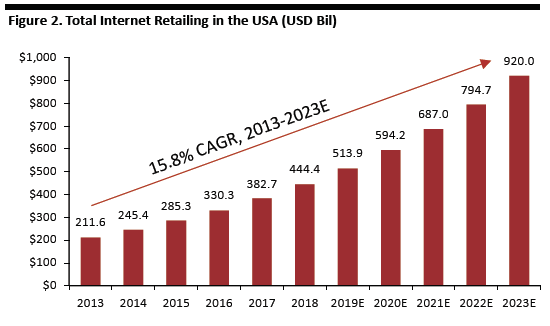

E-commerce shopping shows no signs of slowing any time soon. According to Euromonitor International, total internet retailing in the US is estimated to have been around $444 billion in 2018, growing at a 16.0% CAGR between 2013 and 2018. This growth rate has remained relatively steady over the last few years, and Euromonitor forecasts CAGR will be between 15.5% and 16.0% for the years to come.

[caption id="attachment_78559" align="aligncenter" width="550"]

Source: Euromonitor International/Coresight Research

Source: Euromonitor International/Coresight Research[/caption]

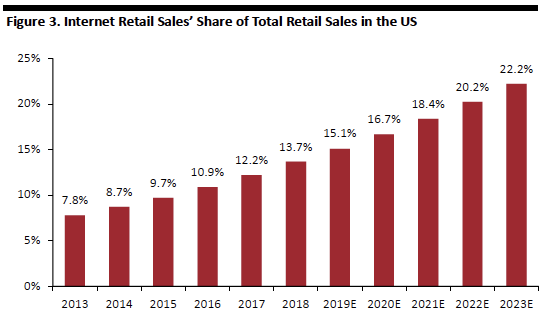

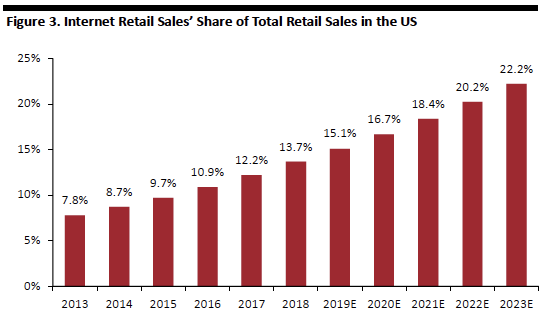

According to Euromonitor International, e-commerce sales accounted for roughly 13.7% of total retail sales in the US in 2018. It further estimates that e-commerce sales will grow to 22.2% of total retail sales by 2023.

[caption id="attachment_78560" align="aligncenter" width="546"]

Source: Euromonitor International

Source: Euromonitor International[/caption]

However, this means that over 80% of retail sales still occur in stores. Shoppers may like to see and purchase a product in person, they often use online platforms as a research tool, so a company’s online strategy can affect physical store sales. A report by Mintel in April 2018 found that only three in 10 respondents said they do not use online channels for product discovery. The study also found that nearly all consumers are shopping online.

Online Sales are Growing Fast, but Not Fast Enough

A study by Bain & Company in September 2018 revealed an often-overlooked danger for retailers and brands entering the e-commerce market: Simply growing e-commerce sales should not be the sole aim, companies need to focus on variables beyond internal sales growth numbers. Companies often engage online with customers predisposed to buying their products, while losing online market share to competitors.

The report highlights nearly half of all online US shoppers begin their searches on Amazon, and that 70% of Amazon shoppers never go beyond the first page of results, giving an advantage to companies that optimize online search results. It also discusses the harm associated with hiring outside firms to handle online marketing campaigns. Bain suggests creating an in-house team that can analyze online product performance — which aligns with Market Beyond’s capabilities to provide actionable insights.

Amazon’s retail revenue in North America this year, excluding marketplace sales and cloud services, equated to just under one-third of the US’s total online retail for 2018 according to our analysis. In 2017, Amazon North America revenues equated to 27% of the US’s total online retail sales. Similar platforms are struggling to capture as much of the market as Amazon, but are still gaining greater shares of total retailing. With the e-commerce landscape shifting so rapidly, retailers and brands need to figure out how to navigate the changing environment.

How AI Can Help Make Sense of E-Commerce

IBM surveyed 1,900 retail and consumer product goods companies across 23 countries, finding that 79% of retailers and consumer product companies expect to use intelligent automation — IBM’s term for AI — for customer intelligence, and that retail and consumer product executives expect intelligent automation to help raise revenue by up to 10%. While supply chain planning was the most mentioned application of AI in retail, at 85% of retail and consumer products executives who responded, 79% said demand forecasting, 79% said that customer intelligence and 75% said that marketing, advertising and campaign management would be the next three most likely applications of AI. AI is clearly on the mind of major retail executives across the board — the only question is when the technology will be implemented.

AI, especially machine learning and deep learning, are best applied to large datasets that have difficult-to-spot correlations between data points. According to eMarketer there were an estimated 1.79 billion online shoppers globally in 2018, and there could be 2.14 billion by 2021. This could add up to trillions of trackable shopping journeys. Collecting this data, organizing it and churning out useful insights is a task made for AI. Market Beyond has access to millions of these consumers and can analyze billions of shopper journeys and give companies the information they need to optimize individual products’ e-commerce strategies.

[caption id="attachment_78561" align="aligncenter" width="540"]

Source: Coresight Research

Source: Coresight Research[/caption]

Market Beyond’s Solutions for Retailers and Brands

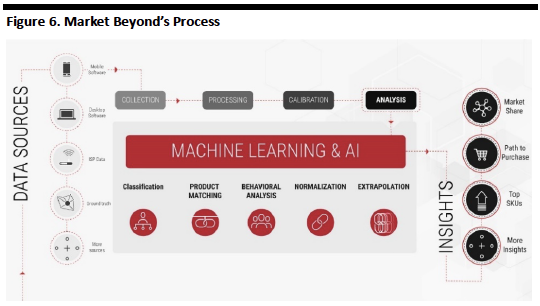

Market Beyond offers a Software as a Service (SaaS) solution to retailers and brands and access to its Application Programming Interface (API). Companies can work with Market Beyond to discover and understand product-level e-commerce insights for millions of SKUs. These insights are based on real shopper journeys and are available in real-time. Market Beyond collects data from mobile software, desktop services, internet service providers, ground truth sources and other additional sources to create and verify insights.

Market Beyond Technology

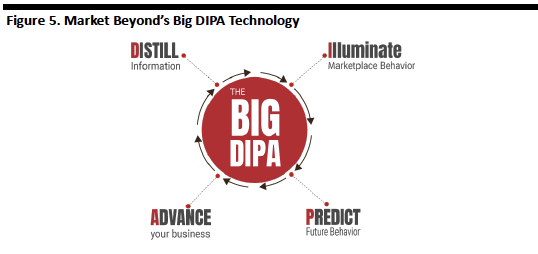

Market Beyond uses what it describes as its “Big DIPA” technology. It uses machine learning and general AI to distill information, illuminate behavior in e-markets, predict future behavior and help marketers. The company collects information from an assortment of rich data sets. It then uses machine learning, deep learning and AI to match, classify and categorize products across various e-commerce websites. Market Beyond then uses its machine learning software to predict the relationships between observed user actions and preferences, particularly ones that lead to conversions in any given category. Automating this process eliminates response and selection biases, and validates information against ground truth data.

The figure below shows how Market Beyond breaks down its “Big DIPA” technology into its core strategic processes.

[caption id="attachment_78562" align="aligncenter" width="538"]

Source: Market Beyond

Source: Market Beyond[/caption]

Through millions of online shoppers worldwide, Market Beyond has access to billions of shopper journeys. After applying its machine learning-based processes on these journeys, Market Beyond can help determine four primary insights for its clients: purchase signals, optimal traffic sources, sales channels and shopper behavior.

The following figure shows an abstract diagram describing the process.

[caption id="attachment_78563" align="aligncenter" width="540"]

Source: Market Beyond

Source: Market Beyond[/caption]

Market Beyond Insights

- Revenue Leakage: Identify where retailers are losing money by pinpointing where revenue is leaking, by which products and to which retailers. The information is highly granular, provided down to the category and product level.

- SKU Level Insights: Highlight why revenue is lost in real time and pinpoint the inefficiencies at the product level across: pricing, search, inventory, traffic channels and other factors. Market Beyond also reveals recoverable revenues and offers actionable insights from this information, optimizing media, online presence, search engine optimization (SEO), landing pages, pricing and more.

- Top SKUs: Listing the top SKUs for each retailer, in every category. Report the total GMV, revenue loss and pricing data for each of the top SKUs.

- “True” Online Market Share: To shed light on companies’ real online market shares, as opposed to fragmented views or skewed sales metrics, Market Beyond gives companies competitors’ SKU-level intelligence. Retailers and brands can better understand product-level business potential through specific channels, thus better understanding their online market share. Market Beyond’s software provides real-time actionable insights, and its self-learning system allows it to enter into new verticals and markets quickly.

- Path to Purchase: Retailers and brands can use Market Beyond’s software to understand how their customers decide to purchase the products they desire. Market Beyond gives transparency to billions of shopper journeys and can highlight important paths and pivots within those journeys. This allows retailers and brands to not only understand their customers better, but also see how competitors are successful or failing along those paths.

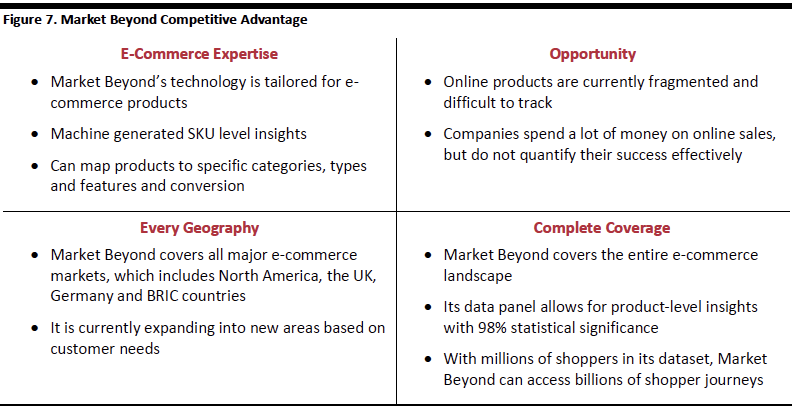

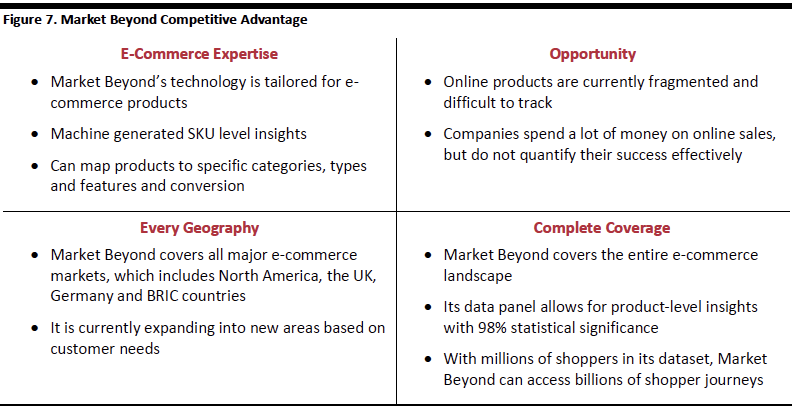

Competitive Advantages

Market Beyond believes it is uniquely positioned as an online retail analytics company for brands and retailers, because its systems are specifically tailored for e-commerce. Its software and algorithms are optimized for only the world of online shopping, and the company can therefore map products to category, type and feature. Market Beyond’s services provide e-commerce analysis at the product-level for millions of SKUs based on real shoppers’ journeys across the entire online market.

The company says it covers all major e-commerce markets and the entire e-commerce landscape. Its data panel provides product-level insights with 98% statistical accuracy, according to the company.

This figure describes Market Beyond’s major competitive advantages:

[caption id="attachment_78564" align="aligncenter" width="700"]

Source: Market Beyond/Coresight Research

Source: Market Beyond/Coresight Research[/caption]

Business Model

Market Beyond offers clients a SaaS solution. Its insights are made available for immediate use and do not require special, direct integration.

Snapshot of Walmart Canada’s Market Beyond Campaign

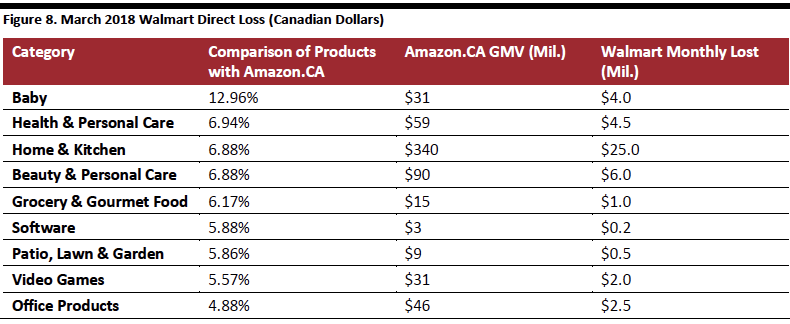

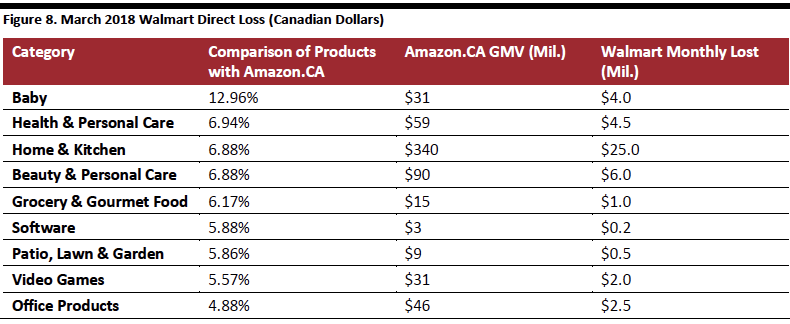

Market Beyond worked with Walmart Canada to review competitors and provide insights into top selling SKUs, Walmart direct loss and actionable insights. Some highlights from the case study are below:

- $60M/month Walmart direct monthly loss to Amazon

- $100M/month Walmart indirect monthly loss to Amazon

- $20M/month recoverable direct revenues

- $40M/month additional potential revenues

Market Beyond breaks down the main competition into specific categories in which Walmart Canada directly lost revenue to Amazon. Walmart Canada lost a total of $45 million to Amazon in these categories combined.

[caption id="attachment_78565" align="aligncenter" width="700"]

Source: Market Beyond

Source: Market Beyond[/caption]

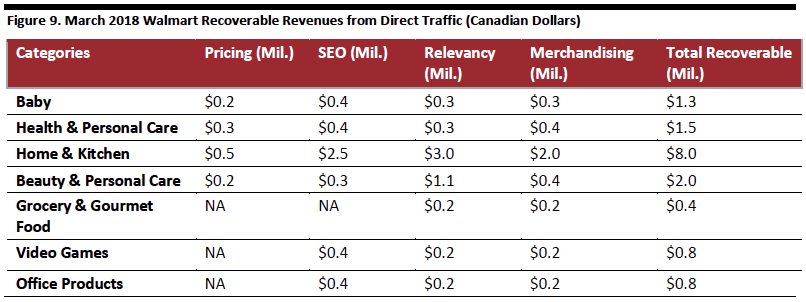

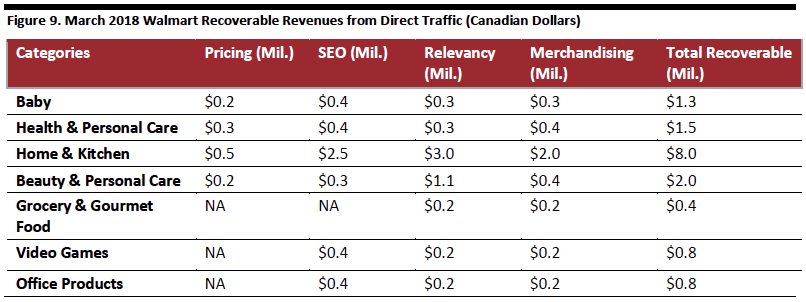

Market Beyond is also able to narrow the information to key conversion factors for each category. It found there is $20 million in recoverable revenue in the combined categories. Market Beyond also says Walmart Canada could generate an additional $40 million in revenue by driving traffic to key categories.

[caption id="attachment_78566" align="aligncenter" width="700"]

Source: Market Beyond

Source: Market Beyond[/caption]

Competitive Landscape

Since the beginnings of online shopping, companies have sought to analyze customer engagement and optimize strategies. Once online analytics company, Hitwise, has been around for over 20 years. Unlike Market Beyond, however, it has a much broader range of industries to examine. Market Beyond offers more flexibility within the e-commerce industry, because of its smaller scale and direct focus on retail. While also offering a greater range of industries, The NPD Group, another similar company, focuses more on point-of-sale data and consumer surveys. SimilarWeb works across at least seven industries, focused more on individual metrics. Market Beyond is unique in its focus on helping retailers and brands understand the e-commerce shopper’s journey as a whole.

Key Management

Market Beyond’s team has a deep understand of artificial intelligence algorithms and of the retail industry. Its key management team include:

CEO and Co-Founder Yuval Yifrach has led multiple software teams, and later moved into product management. He led Amdocs’ mediation product line to market leadership, generating over $30 million in annual revenues. He co-founded Deals Way, which helps shoppers find the best deals and discover great products online, and Myze, a smart shopping companion. Yuval holds a BSc in Computer Science from The Academic College of Tel Aviv-Yaffo and an MBA from IE Business School.

CTO and Co-Founder Eran Dror founded SecureTeam Software Ltd. He later co-founded Deals Way, which helps shoppers find the best deals and discover great products online, and Myze, a smart shopping companion. Before this, Eran spent 10 years leading software teams. Eran holds both a BSc and MSc in Information Systems from the prestigious Technion – Israel Institute of Technology.

CMO and Co-Founder Shachar Baryamin has over 15 years’ experience in marketing a wide range of products from concept to launch. Shachar led product line management for the Revenue Management and Digital product in Amdocs. Shachar has held various leadership roles including Head of Product Management and Head of Marketing at Myze, a smart shopping companion. Shachar holds a BA in Computer Science from Queens College, and an MBA from Tel Aviv University.

Company Outlook/Upcoming Announcements

Founded in June 2015 by Yuval Yifrach, Shachar Baryamin and Eran Dror, Market Beyond has steadily grown and is at an optimal time of expansion. In October 2018, Hetz Ventures led a $4 million funding round for the company.

Market Beyond plans to release its E-Tail Insights Dashboard by March 2019. By the fourth quarter of 2019, it plans to expand its e-tail insights to the fashion business more broadly, then, in the second quarter of 2020, to expand those insights to grocery. In 2019, Market Beyond expects to cover all of North America, the UK, Germany, France, Italy, Russia and Australia. In 2020 and after, it will grow its reach into India, China, Brazil and Mexico.

Coresight Research’s View

Whether or not shoppers are currently buying more product on- or offline, almost every consumer interacts with an online product at some point in his or her shopping journey before purchasing it. E-commerce continues to grow and take a greater percentage of the total retail market every year, but most retailers and brands continue to outsource their online strategy with minimal insights into the reality of their products’ online performances.

Market Beyond can equip retailers and brands with the tools and direct actionable insights to optimize product marketing and sales online. Retailers and brands will gain visibility about the e-commerce market through billions of unique shopper journeys through Market Beyond. In-house teams can particularly benefit from these insights, crafting specific strategies for all available e-commerce platforms. Market Beyond’s smaller scale and retail-centric software makes it an agile and flexible choice to discover patterns in e-commerce shoppers’ behaviors.

Source: Market Beyond[/caption]

Source: Market Beyond[/caption]

Source: Euromonitor International/Coresight Research[/caption]

According to Euromonitor International, e-commerce sales accounted for roughly 13.7% of total retail sales in the US in 2018. It further estimates that e-commerce sales will grow to 22.2% of total retail sales by 2023.

[caption id="attachment_78560" align="aligncenter" width="546"]

Source: Euromonitor International/Coresight Research[/caption]

According to Euromonitor International, e-commerce sales accounted for roughly 13.7% of total retail sales in the US in 2018. It further estimates that e-commerce sales will grow to 22.2% of total retail sales by 2023.

[caption id="attachment_78560" align="aligncenter" width="546"] Source: Euromonitor International[/caption]

However, this means that over 80% of retail sales still occur in stores. Shoppers may like to see and purchase a product in person, they often use online platforms as a research tool, so a company’s online strategy can affect physical store sales. A report by Mintel in April 2018 found that only three in 10 respondents said they do not use online channels for product discovery. The study also found that nearly all consumers are shopping online.

Online Sales are Growing Fast, but Not Fast Enough

A study by Bain & Company in September 2018 revealed an often-overlooked danger for retailers and brands entering the e-commerce market: Simply growing e-commerce sales should not be the sole aim, companies need to focus on variables beyond internal sales growth numbers. Companies often engage online with customers predisposed to buying their products, while losing online market share to competitors.

The report highlights nearly half of all online US shoppers begin their searches on Amazon, and that 70% of Amazon shoppers never go beyond the first page of results, giving an advantage to companies that optimize online search results. It also discusses the harm associated with hiring outside firms to handle online marketing campaigns. Bain suggests creating an in-house team that can analyze online product performance — which aligns with Market Beyond’s capabilities to provide actionable insights.

Amazon’s retail revenue in North America this year, excluding marketplace sales and cloud services, equated to just under one-third of the US’s total online retail for 2018 according to our analysis. In 2017, Amazon North America revenues equated to 27% of the US’s total online retail sales. Similar platforms are struggling to capture as much of the market as Amazon, but are still gaining greater shares of total retailing. With the e-commerce landscape shifting so rapidly, retailers and brands need to figure out how to navigate the changing environment.

How AI Can Help Make Sense of E-Commerce

IBM surveyed 1,900 retail and consumer product goods companies across 23 countries, finding that 79% of retailers and consumer product companies expect to use intelligent automation — IBM’s term for AI — for customer intelligence, and that retail and consumer product executives expect intelligent automation to help raise revenue by up to 10%. While supply chain planning was the most mentioned application of AI in retail, at 85% of retail and consumer products executives who responded, 79% said demand forecasting, 79% said that customer intelligence and 75% said that marketing, advertising and campaign management would be the next three most likely applications of AI. AI is clearly on the mind of major retail executives across the board — the only question is when the technology will be implemented.

AI, especially machine learning and deep learning, are best applied to large datasets that have difficult-to-spot correlations between data points. According to eMarketer there were an estimated 1.79 billion online shoppers globally in 2018, and there could be 2.14 billion by 2021. This could add up to trillions of trackable shopping journeys. Collecting this data, organizing it and churning out useful insights is a task made for AI. Market Beyond has access to millions of these consumers and can analyze billions of shopper journeys and give companies the information they need to optimize individual products’ e-commerce strategies.

[caption id="attachment_78561" align="aligncenter" width="540"]

Source: Euromonitor International[/caption]

However, this means that over 80% of retail sales still occur in stores. Shoppers may like to see and purchase a product in person, they often use online platforms as a research tool, so a company’s online strategy can affect physical store sales. A report by Mintel in April 2018 found that only three in 10 respondents said they do not use online channels for product discovery. The study also found that nearly all consumers are shopping online.

Online Sales are Growing Fast, but Not Fast Enough

A study by Bain & Company in September 2018 revealed an often-overlooked danger for retailers and brands entering the e-commerce market: Simply growing e-commerce sales should not be the sole aim, companies need to focus on variables beyond internal sales growth numbers. Companies often engage online with customers predisposed to buying their products, while losing online market share to competitors.

The report highlights nearly half of all online US shoppers begin their searches on Amazon, and that 70% of Amazon shoppers never go beyond the first page of results, giving an advantage to companies that optimize online search results. It also discusses the harm associated with hiring outside firms to handle online marketing campaigns. Bain suggests creating an in-house team that can analyze online product performance — which aligns with Market Beyond’s capabilities to provide actionable insights.

Amazon’s retail revenue in North America this year, excluding marketplace sales and cloud services, equated to just under one-third of the US’s total online retail for 2018 according to our analysis. In 2017, Amazon North America revenues equated to 27% of the US’s total online retail sales. Similar platforms are struggling to capture as much of the market as Amazon, but are still gaining greater shares of total retailing. With the e-commerce landscape shifting so rapidly, retailers and brands need to figure out how to navigate the changing environment.

How AI Can Help Make Sense of E-Commerce

IBM surveyed 1,900 retail and consumer product goods companies across 23 countries, finding that 79% of retailers and consumer product companies expect to use intelligent automation — IBM’s term for AI — for customer intelligence, and that retail and consumer product executives expect intelligent automation to help raise revenue by up to 10%. While supply chain planning was the most mentioned application of AI in retail, at 85% of retail and consumer products executives who responded, 79% said demand forecasting, 79% said that customer intelligence and 75% said that marketing, advertising and campaign management would be the next three most likely applications of AI. AI is clearly on the mind of major retail executives across the board — the only question is when the technology will be implemented.

AI, especially machine learning and deep learning, are best applied to large datasets that have difficult-to-spot correlations between data points. According to eMarketer there were an estimated 1.79 billion online shoppers globally in 2018, and there could be 2.14 billion by 2021. This could add up to trillions of trackable shopping journeys. Collecting this data, organizing it and churning out useful insights is a task made for AI. Market Beyond has access to millions of these consumers and can analyze billions of shopper journeys and give companies the information they need to optimize individual products’ e-commerce strategies.

[caption id="attachment_78561" align="aligncenter" width="540"] Source: Coresight Research[/caption]

Market Beyond’s Solutions for Retailers and Brands

Market Beyond offers a Software as a Service (SaaS) solution to retailers and brands and access to its Application Programming Interface (API). Companies can work with Market Beyond to discover and understand product-level e-commerce insights for millions of SKUs. These insights are based on real shopper journeys and are available in real-time. Market Beyond collects data from mobile software, desktop services, internet service providers, ground truth sources and other additional sources to create and verify insights.

Market Beyond Technology

Market Beyond uses what it describes as its “Big DIPA” technology. It uses machine learning and general AI to distill information, illuminate behavior in e-markets, predict future behavior and help marketers. The company collects information from an assortment of rich data sets. It then uses machine learning, deep learning and AI to match, classify and categorize products across various e-commerce websites. Market Beyond then uses its machine learning software to predict the relationships between observed user actions and preferences, particularly ones that lead to conversions in any given category. Automating this process eliminates response and selection biases, and validates information against ground truth data.

The figure below shows how Market Beyond breaks down its “Big DIPA” technology into its core strategic processes.

[caption id="attachment_78562" align="aligncenter" width="538"]

Source: Coresight Research[/caption]

Market Beyond’s Solutions for Retailers and Brands

Market Beyond offers a Software as a Service (SaaS) solution to retailers and brands and access to its Application Programming Interface (API). Companies can work with Market Beyond to discover and understand product-level e-commerce insights for millions of SKUs. These insights are based on real shopper journeys and are available in real-time. Market Beyond collects data from mobile software, desktop services, internet service providers, ground truth sources and other additional sources to create and verify insights.

Market Beyond Technology

Market Beyond uses what it describes as its “Big DIPA” technology. It uses machine learning and general AI to distill information, illuminate behavior in e-markets, predict future behavior and help marketers. The company collects information from an assortment of rich data sets. It then uses machine learning, deep learning and AI to match, classify and categorize products across various e-commerce websites. Market Beyond then uses its machine learning software to predict the relationships between observed user actions and preferences, particularly ones that lead to conversions in any given category. Automating this process eliminates response and selection biases, and validates information against ground truth data.

The figure below shows how Market Beyond breaks down its “Big DIPA” technology into its core strategic processes.

[caption id="attachment_78562" align="aligncenter" width="538"] Source: Market Beyond[/caption]

Through millions of online shoppers worldwide, Market Beyond has access to billions of shopper journeys. After applying its machine learning-based processes on these journeys, Market Beyond can help determine four primary insights for its clients: purchase signals, optimal traffic sources, sales channels and shopper behavior.

The following figure shows an abstract diagram describing the process.

[caption id="attachment_78563" align="aligncenter" width="540"]

Source: Market Beyond[/caption]

Through millions of online shoppers worldwide, Market Beyond has access to billions of shopper journeys. After applying its machine learning-based processes on these journeys, Market Beyond can help determine four primary insights for its clients: purchase signals, optimal traffic sources, sales channels and shopper behavior.

The following figure shows an abstract diagram describing the process.

[caption id="attachment_78563" align="aligncenter" width="540"] Source: Market Beyond[/caption]

Market Beyond Insights

Source: Market Beyond[/caption]

Market Beyond Insights

Source: Market Beyond/Coresight Research[/caption]

Business Model

Market Beyond offers clients a SaaS solution. Its insights are made available for immediate use and do not require special, direct integration.

Snapshot of Walmart Canada’s Market Beyond Campaign

Market Beyond worked with Walmart Canada to review competitors and provide insights into top selling SKUs, Walmart direct loss and actionable insights. Some highlights from the case study are below:

Source: Market Beyond/Coresight Research[/caption]

Business Model

Market Beyond offers clients a SaaS solution. Its insights are made available for immediate use and do not require special, direct integration.

Snapshot of Walmart Canada’s Market Beyond Campaign

Market Beyond worked with Walmart Canada to review competitors and provide insights into top selling SKUs, Walmart direct loss and actionable insights. Some highlights from the case study are below:

Source: Market Beyond[/caption]

Market Beyond is also able to narrow the information to key conversion factors for each category. It found there is $20 million in recoverable revenue in the combined categories. Market Beyond also says Walmart Canada could generate an additional $40 million in revenue by driving traffic to key categories.

[caption id="attachment_78566" align="aligncenter" width="700"]

Source: Market Beyond[/caption]

Market Beyond is also able to narrow the information to key conversion factors for each category. It found there is $20 million in recoverable revenue in the combined categories. Market Beyond also says Walmart Canada could generate an additional $40 million in revenue by driving traffic to key categories.

[caption id="attachment_78566" align="aligncenter" width="700"] Source: Market Beyond[/caption]

Competitive Landscape

Since the beginnings of online shopping, companies have sought to analyze customer engagement and optimize strategies. Once online analytics company, Hitwise, has been around for over 20 years. Unlike Market Beyond, however, it has a much broader range of industries to examine. Market Beyond offers more flexibility within the e-commerce industry, because of its smaller scale and direct focus on retail. While also offering a greater range of industries, The NPD Group, another similar company, focuses more on point-of-sale data and consumer surveys. SimilarWeb works across at least seven industries, focused more on individual metrics. Market Beyond is unique in its focus on helping retailers and brands understand the e-commerce shopper’s journey as a whole.

Key Management

Market Beyond’s team has a deep understand of artificial intelligence algorithms and of the retail industry. Its key management team include:

CEO and Co-Founder Yuval Yifrach has led multiple software teams, and later moved into product management. He led Amdocs’ mediation product line to market leadership, generating over $30 million in annual revenues. He co-founded Deals Way, which helps shoppers find the best deals and discover great products online, and Myze, a smart shopping companion. Yuval holds a BSc in Computer Science from The Academic College of Tel Aviv-Yaffo and an MBA from IE Business School.

CTO and Co-Founder Eran Dror founded SecureTeam Software Ltd. He later co-founded Deals Way, which helps shoppers find the best deals and discover great products online, and Myze, a smart shopping companion. Before this, Eran spent 10 years leading software teams. Eran holds both a BSc and MSc in Information Systems from the prestigious Technion – Israel Institute of Technology.

CMO and Co-Founder Shachar Baryamin has over 15 years’ experience in marketing a wide range of products from concept to launch. Shachar led product line management for the Revenue Management and Digital product in Amdocs. Shachar has held various leadership roles including Head of Product Management and Head of Marketing at Myze, a smart shopping companion. Shachar holds a BA in Computer Science from Queens College, and an MBA from Tel Aviv University.

Company Outlook/Upcoming Announcements

Founded in June 2015 by Yuval Yifrach, Shachar Baryamin and Eran Dror, Market Beyond has steadily grown and is at an optimal time of expansion. In October 2018, Hetz Ventures led a $4 million funding round for the company.

Market Beyond plans to release its E-Tail Insights Dashboard by March 2019. By the fourth quarter of 2019, it plans to expand its e-tail insights to the fashion business more broadly, then, in the second quarter of 2020, to expand those insights to grocery. In 2019, Market Beyond expects to cover all of North America, the UK, Germany, France, Italy, Russia and Australia. In 2020 and after, it will grow its reach into India, China, Brazil and Mexico.

Coresight Research’s View

Whether or not shoppers are currently buying more product on- or offline, almost every consumer interacts with an online product at some point in his or her shopping journey before purchasing it. E-commerce continues to grow and take a greater percentage of the total retail market every year, but most retailers and brands continue to outsource their online strategy with minimal insights into the reality of their products’ online performances.

Market Beyond can equip retailers and brands with the tools and direct actionable insights to optimize product marketing and sales online. Retailers and brands will gain visibility about the e-commerce market through billions of unique shopper journeys through Market Beyond. In-house teams can particularly benefit from these insights, crafting specific strategies for all available e-commerce platforms. Market Beyond’s smaller scale and retail-centric software makes it an agile and flexible choice to discover patterns in e-commerce shoppers’ behaviors.

Source: Market Beyond[/caption]

Competitive Landscape

Since the beginnings of online shopping, companies have sought to analyze customer engagement and optimize strategies. Once online analytics company, Hitwise, has been around for over 20 years. Unlike Market Beyond, however, it has a much broader range of industries to examine. Market Beyond offers more flexibility within the e-commerce industry, because of its smaller scale and direct focus on retail. While also offering a greater range of industries, The NPD Group, another similar company, focuses more on point-of-sale data and consumer surveys. SimilarWeb works across at least seven industries, focused more on individual metrics. Market Beyond is unique in its focus on helping retailers and brands understand the e-commerce shopper’s journey as a whole.

Key Management

Market Beyond’s team has a deep understand of artificial intelligence algorithms and of the retail industry. Its key management team include:

CEO and Co-Founder Yuval Yifrach has led multiple software teams, and later moved into product management. He led Amdocs’ mediation product line to market leadership, generating over $30 million in annual revenues. He co-founded Deals Way, which helps shoppers find the best deals and discover great products online, and Myze, a smart shopping companion. Yuval holds a BSc in Computer Science from The Academic College of Tel Aviv-Yaffo and an MBA from IE Business School.

CTO and Co-Founder Eran Dror founded SecureTeam Software Ltd. He later co-founded Deals Way, which helps shoppers find the best deals and discover great products online, and Myze, a smart shopping companion. Before this, Eran spent 10 years leading software teams. Eran holds both a BSc and MSc in Information Systems from the prestigious Technion – Israel Institute of Technology.

CMO and Co-Founder Shachar Baryamin has over 15 years’ experience in marketing a wide range of products from concept to launch. Shachar led product line management for the Revenue Management and Digital product in Amdocs. Shachar has held various leadership roles including Head of Product Management and Head of Marketing at Myze, a smart shopping companion. Shachar holds a BA in Computer Science from Queens College, and an MBA from Tel Aviv University.

Company Outlook/Upcoming Announcements

Founded in June 2015 by Yuval Yifrach, Shachar Baryamin and Eran Dror, Market Beyond has steadily grown and is at an optimal time of expansion. In October 2018, Hetz Ventures led a $4 million funding round for the company.

Market Beyond plans to release its E-Tail Insights Dashboard by March 2019. By the fourth quarter of 2019, it plans to expand its e-tail insights to the fashion business more broadly, then, in the second quarter of 2020, to expand those insights to grocery. In 2019, Market Beyond expects to cover all of North America, the UK, Germany, France, Italy, Russia and Australia. In 2020 and after, it will grow its reach into India, China, Brazil and Mexico.

Coresight Research’s View

Whether or not shoppers are currently buying more product on- or offline, almost every consumer interacts with an online product at some point in his or her shopping journey before purchasing it. E-commerce continues to grow and take a greater percentage of the total retail market every year, but most retailers and brands continue to outsource their online strategy with minimal insights into the reality of their products’ online performances.

Market Beyond can equip retailers and brands with the tools and direct actionable insights to optimize product marketing and sales online. Retailers and brands will gain visibility about the e-commerce market through billions of unique shopper journeys through Market Beyond. In-house teams can particularly benefit from these insights, crafting specific strategies for all available e-commerce platforms. Market Beyond’s smaller scale and retail-centric software makes it an agile and flexible choice to discover patterns in e-commerce shoppers’ behaviors.