Company Overview

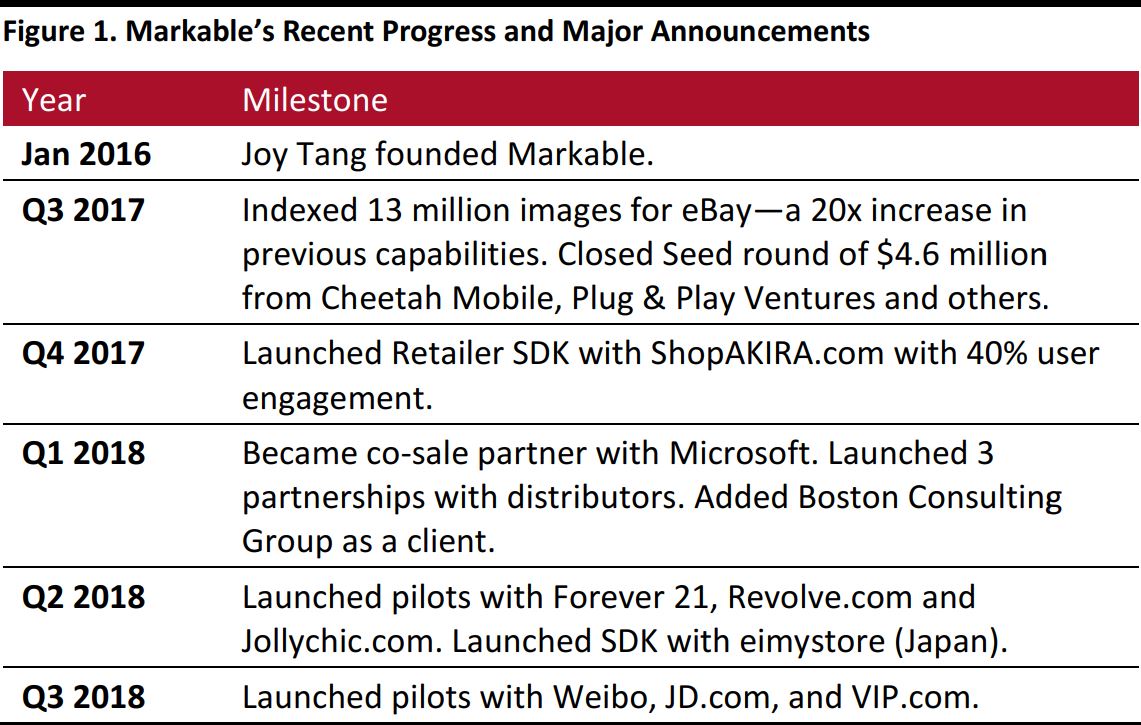

AI technology has been deployed in almost every major industry, including retail. Last year, the market research and strategy firm Global Market Insights reported that the AI in retail market size is expected to grow at a compound annual growth rate of about 40% between 2017 and 2024. Advances in machine learning, including deep learning, have led to developments in software ranging from logistical programs to recommendation-based AI programs. Computer vision has seen particularly rapid growth in the last few years, and companies such as Walmart and IKEA are implementing this technology in their stores, where it can provide information on foot traffic, shelf inventories and customers’ shopping habits that the retailers can use to solve logistics challenges and improve efficiency.

Online, computer vision technology provides shoppers with new avenues for exploring products and interacting with retailers and brands. According to a 2017 eMarketer study, nearly three-quarters of Internet users in the US say that they regularly or always search for visual content before completing a purchase, while only 3% state that they never do. Given these figures, it is imperative that retailers ensure that consumers can quickly search for and see images of products that are relevant to them.

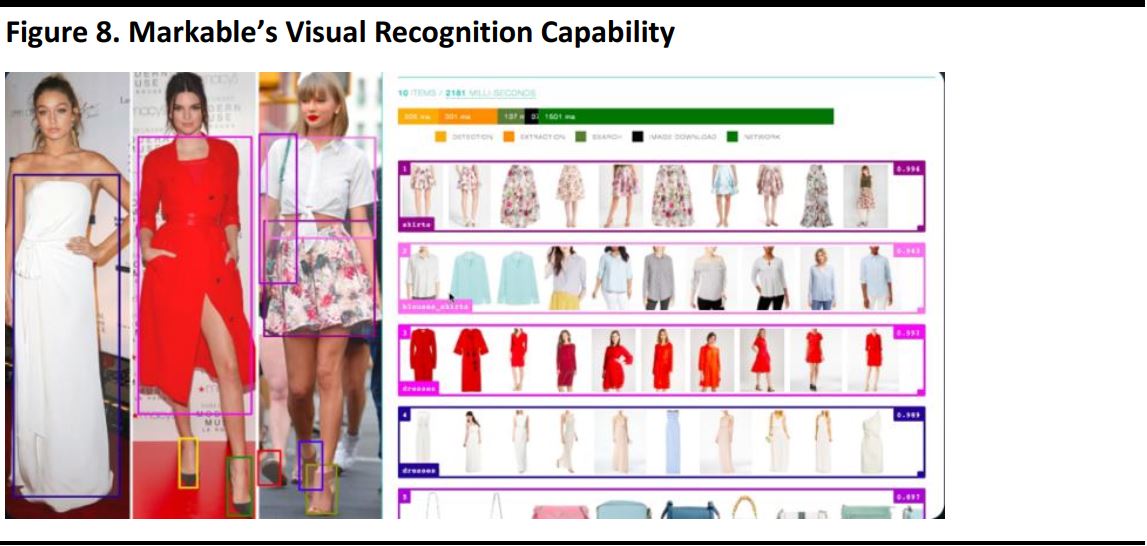

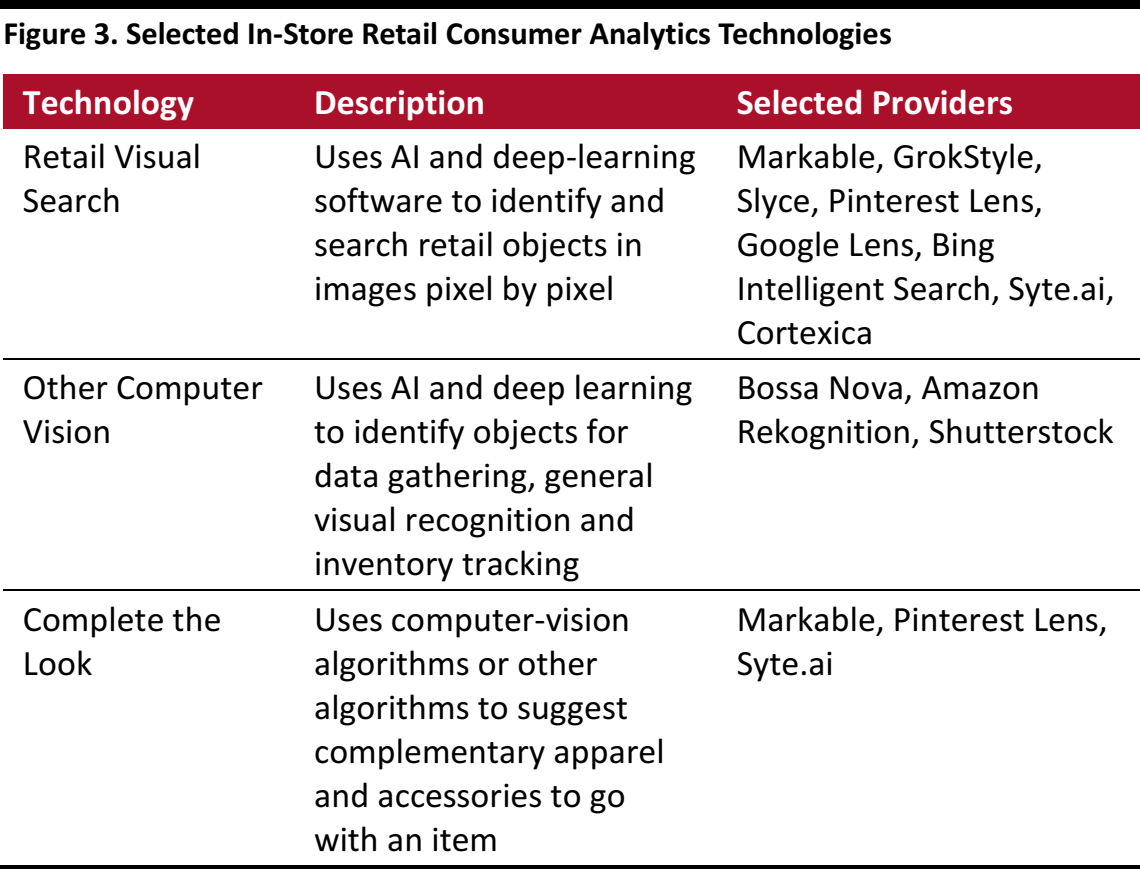

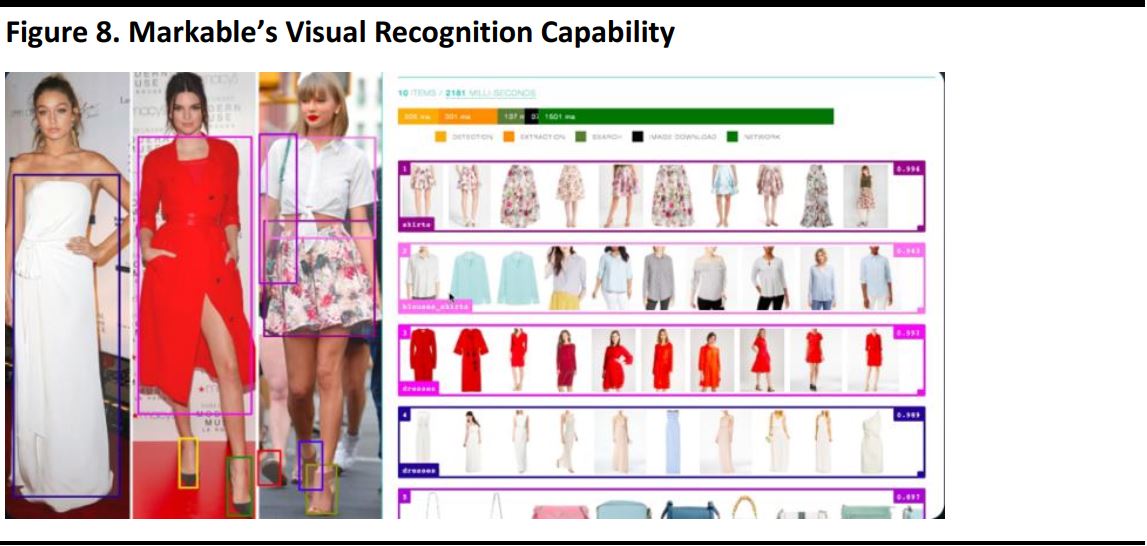

Markable operates in a unique position as one of a handful of companies offering true visual search capability. It provides retailers and brands with the tools they need to utilize visual search, visually similar product recommendations, lookbooks, style products, such as ‘How to Wear It’ or ‘Complete the Look’ and implement Markable’s AI-based attribute auto-tagging technology. The company’s software enables consumers to instantly find fashion items similar to those they see in passing and receive more accurate search results and improved recommendations.

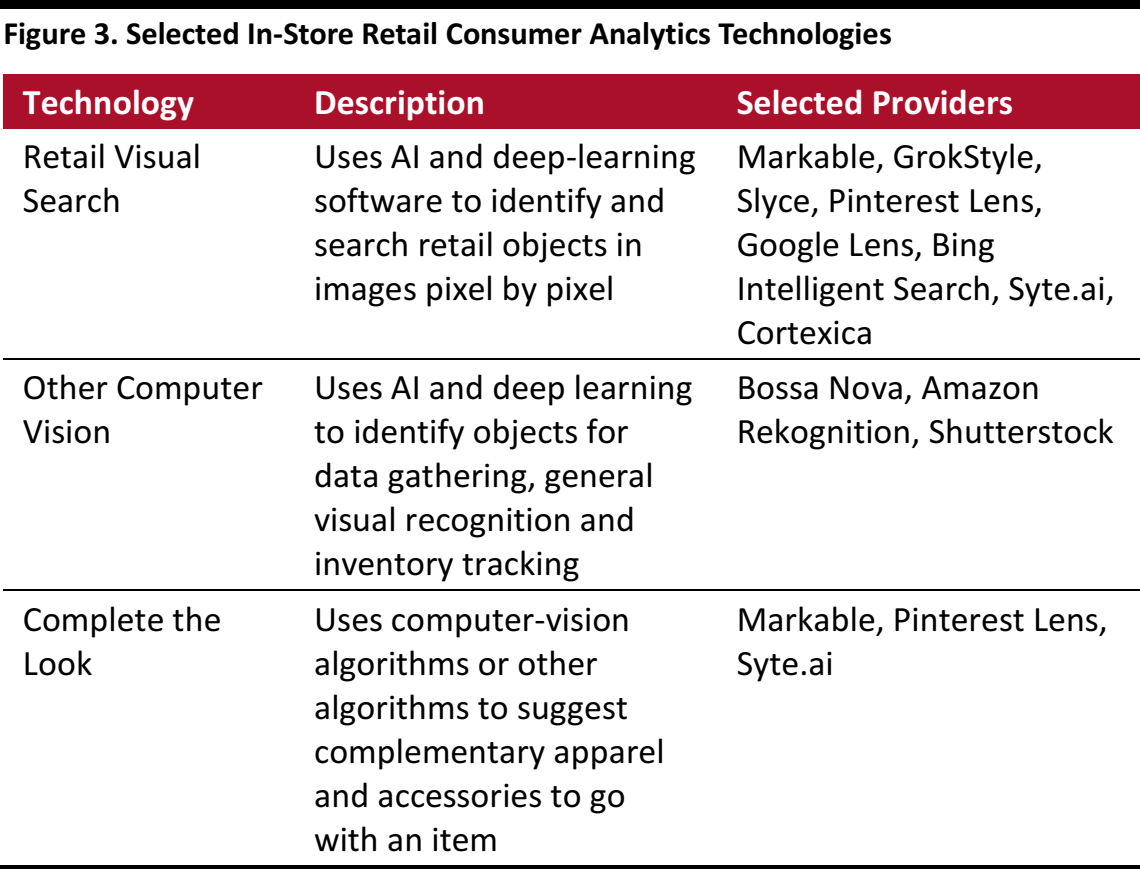

While computer vision software companies such as Trax and GrokStyle and robotics companies such as Bossa Nova are focusing on in-store retail applications of their products, few are pioneering online and mobile computer vision technology for retail. Tech giants Amazon, Google and Microsoft are in what appears to be an AI race to create the best visual search tools, but their products incorporate retail-specific features as an offshoot of their main functionality.

Generally, retailers and brands tag individual items manually when cataloging them online, assigning each item keywords corresponding to the model name or number, size, color and other specifications. Markable’s software can be embedded into websites to detect and analyze video and static images. The company’s programs analyze images pixel by pixel, instead of analyzing the metadata associated with the images.

Markable helps retailers tackle two major problems:

- Engaging consumers: The visual search technology allows for faster identification of similar items that are in stock on a retailer’s website. It also enables retailers to organize products better than they can by manually tagging them with keywords. Since the products surfaced are directly related to the actual images searched, the items shown are more likely to interest shoppers.

- Expensive traffic: Markable offers retailers the ability to target ads based on the visual content displayed online. Such ads can supplement expensive, blanket ads that are targeted based on predictive metrics.

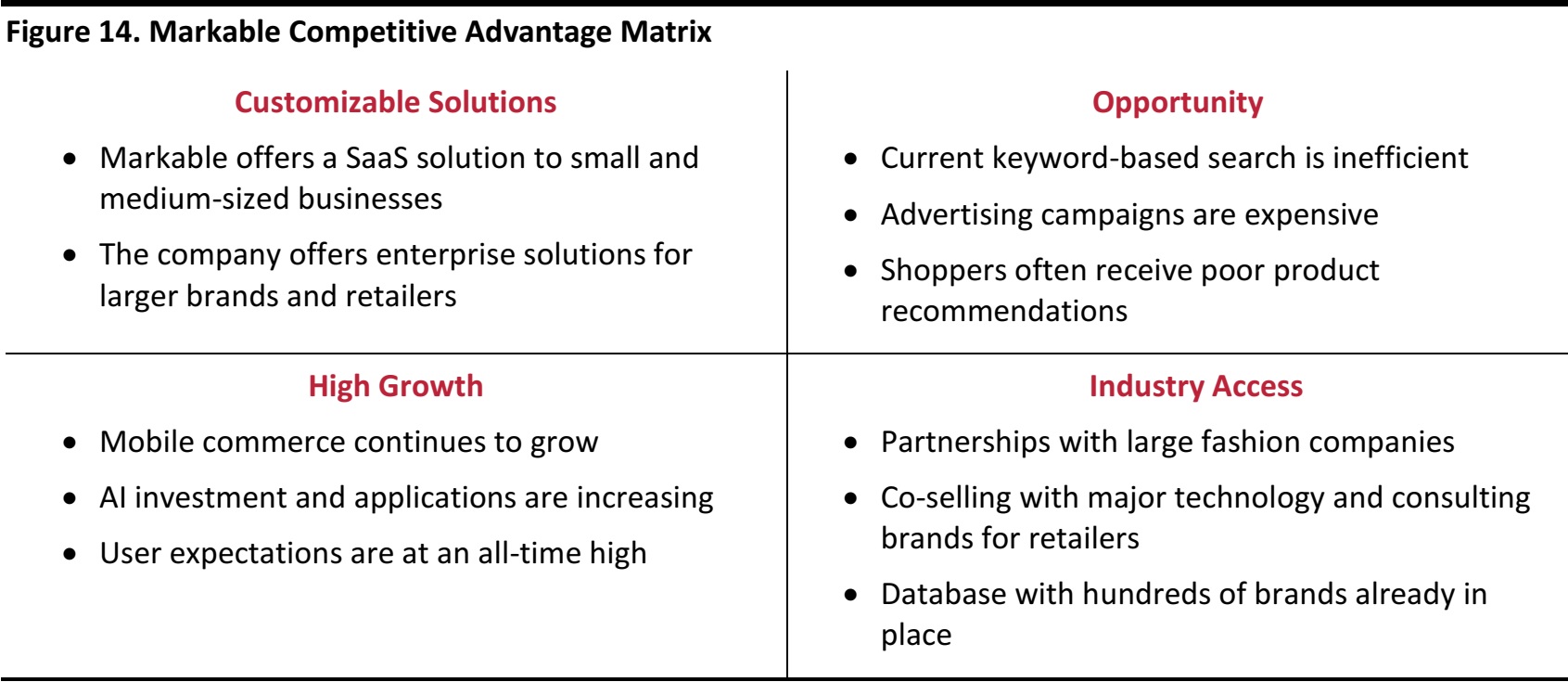

Markable offers a software-as-a-service (SaaS) model for its APIs and SDKs for small and medium-sized retailers. For larger companies, it provides an enterprise solution through which clients can license the software and integrate it into their servers. In addition, the company can provide AI engineers and scientists to help clients integrate the software.

Markable claims that its software helped Akira, a trendy Chicago-based fashion retailer, boost its online store revenue by approximately 15%. ShopAkira.com garners more than 5 million page views per month, and has been the subject of more than a million online searches since November 2017. About 45% of the company’s unique shoppers have used visual search, which led to a 27% click-through rate for those users. Once directed by a visual search, about 29% of shoppers subsequently clicked “Add to Cart.”

Markable works with major content platforms, including Weibo.com and Vevo, providing them with more than 300 million end users. The company also works with major fashion suppliers and retailers, including eBay, JD.com, Li & Fung and Rakuten, giving them access to more than 200 million SKUs. In addition, Markable has connections to retailers through distributors and co-sellers such as Baidu, Microsoft and Boston Consulting Group.

The analyst firm App Annie estimated that the global gross consumer spend on mobile apps was $1.3 trillion in 2016, and that that number is expected to grow by 385% by 2021. MarketsandMarkets, a global market research firm, predicts that the image recognition market will grow from $9.65 billion in 2014 to $25.65 billion in 2019, a growth of 216%.

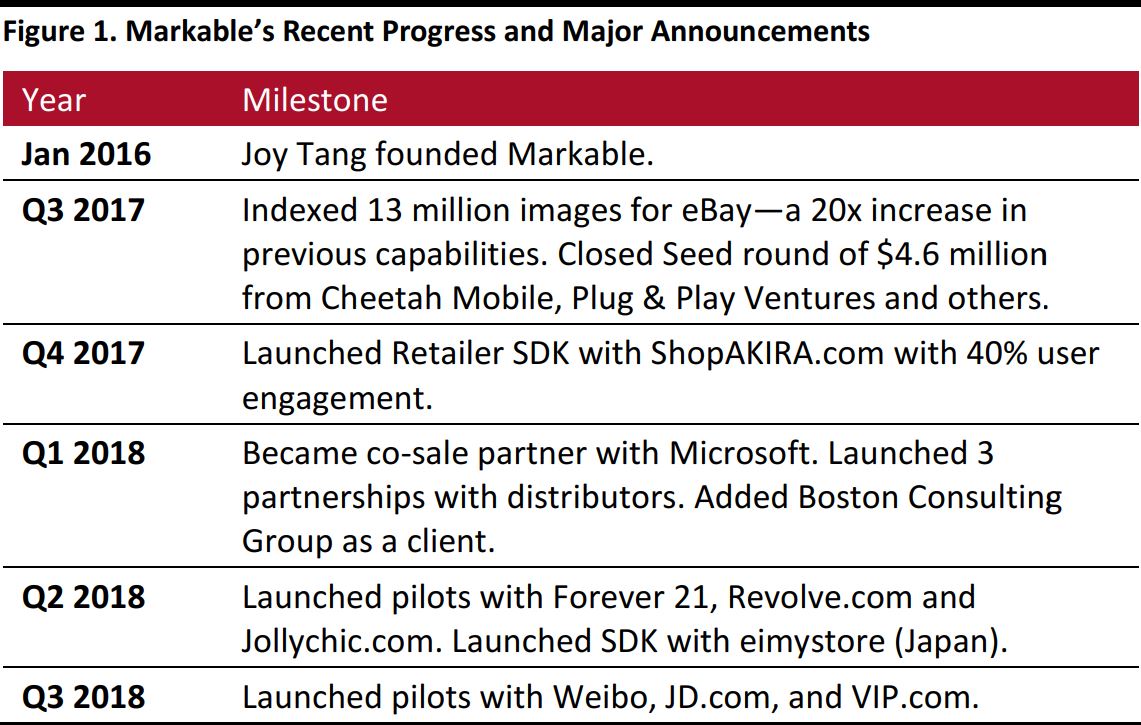

Source: Markable

Industry Overview

Retailers Lagging in Terms of Search

As noted above, many retailers and brands manually catalog products online by tagging them with appropriate keywords corresponding to their specifications. This is especially true for legacy retailers and small companies that have not attempted to optimize their online search capability. This form of search engine requires consumers to type at least one of the keywords before the desired item is displayed. Most retailers have attempted to augment basic keyword searches by adding filtering and weighting functionality to their website search engines. Filtering or weighting by date, for example, can narrow search results and provide more precise answers for shoppers.

Keyword searching is designed to cut out the least important terms in a search, such as question words and articles. This generally leaves nouns, and the more specific the noun, the more accurate the search return. For shoppers, this limits their searches to products they already know exist, which means they are not presented with items that they may want, but do not know about.

Furthermore, sorting products by keywords means that recommendations must stem from related keywords or from user activity related to the product. The products that appear either directly correspond to the keywords or are surfaced by a separate network via online tracking data or marketing algorithms. The aesthetics of the products that are shown to shoppers hardly come into play, and shoppers’ choices are limited based on the retailer’s or outside firm’s discretion.

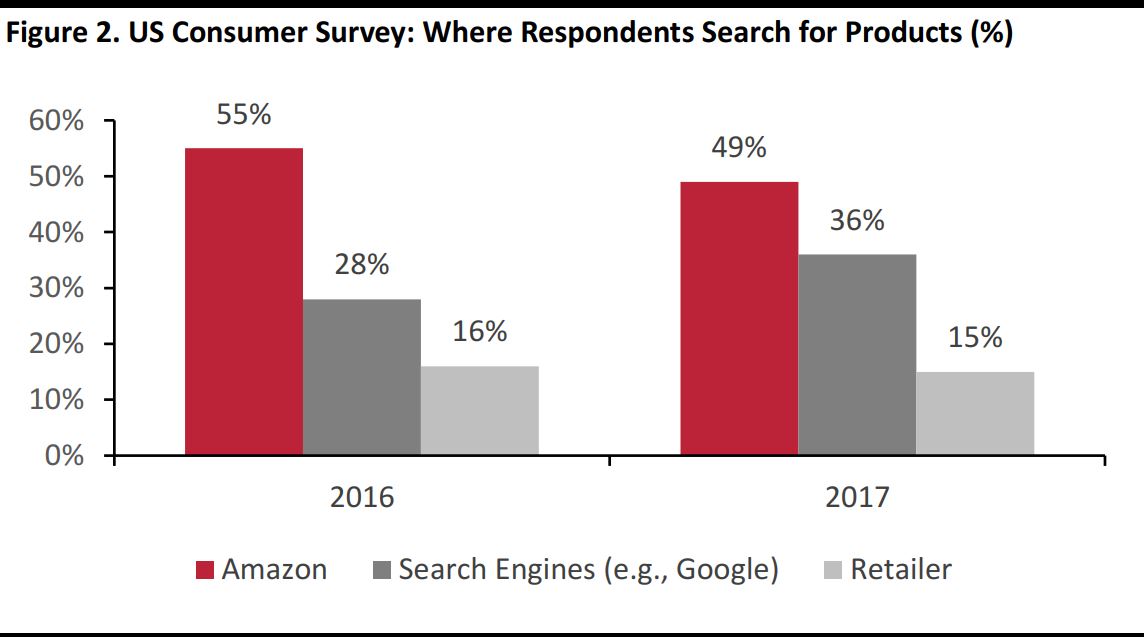

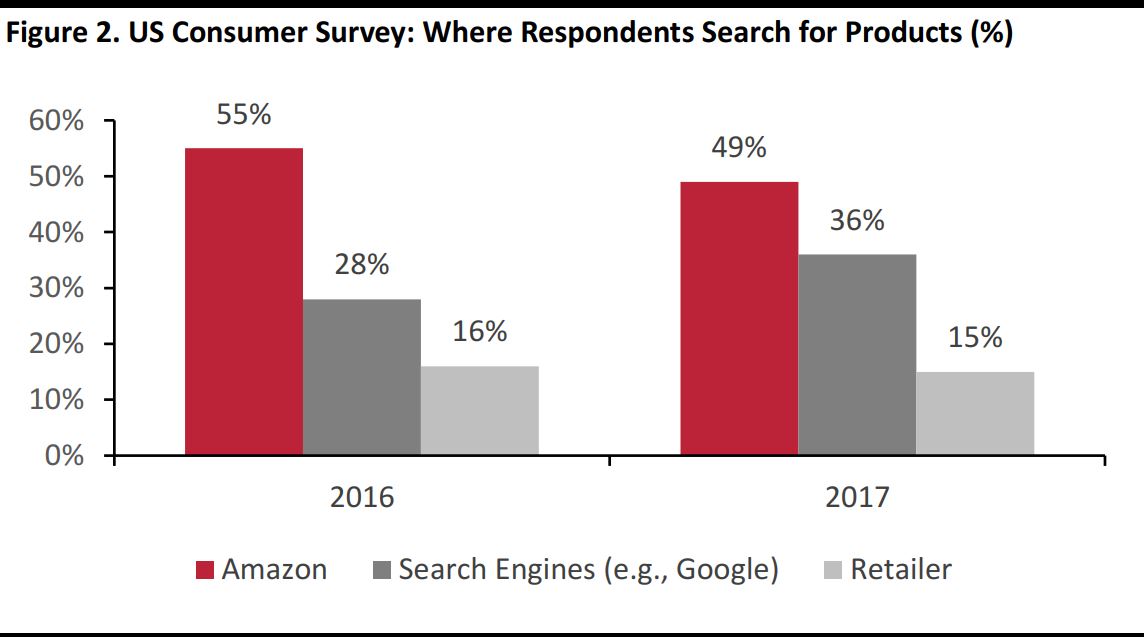

Companies have tried to make online search as intuitive as possible for consumers by using broad categories, but shoppers will often work around the antiquated system by using Google or Amazon to look up a specific product before searching for it on retailers’ websites. In 2017, Survata surveyed 2,000 US consumers and found that only 15% of them said that they searched for products on retailers’ websites. That rate was down 1% from the previous year’s survey. Search engines are gaining momentum as the first touch point for consumers looking for products, but Amazon still leads: in Survata’s 2017 survey, 49% of respondents reported using Amazon to search for items first, down from 55% the prior year, and 36% reported using search engines such as Google first, up from 28% in 2016.

Base: 2,000 US consumers surveyed in 2016 and 2017

Source: Survata

Current Trends in AI and Computer Vision

Inserting algorithms into search engines can make using them easier and more intuitive for humans. Engines that employ AI enable users to search online using complete sentences, and they do not require that developers hard code associated terms into them. Tech companies such as Google and Microsoft already incorporate natural language processing (NLP) tools in their engines to make searches more intuitive, so that question words, prepositions, articles, synonyms and colloquialisms are factored in. NLP can also help fill in search boxes with predictive text, guiding users as they search.

Another advance in search capability is the use of computer vision software to analyze searches on a pixel-by-pixel basis. Recently, large tech companies have made strides in using computer vision algorithms for both text-based and camera-based searches. Google’s Lens technology and Microsoft’s Bing Intelligent Search both enable smartphone cameras to identify and search for objects based on how they look. The two companies are in an apparent race to offer the most comprehensive and effective computer vision search capabilities. Image-focused websites such as Pinterest and Shutterstock have also launched computer vision applications. Pinterest raised $150 million at a $12.3 billion valuation last year, and used part of the funds to develop its visual search functionality.

Google’s computer vision software previously focused on plants, animals and nature in general, but retail objects are likely the next hurdle that the company will seek to overcome. Digitally native retailers such as Amazon and eBay have incorporated computer vision software that is marketed specifically for apparel and accessories, but that also works with other items. Innovating image-related search has become so popular that even Kim Kardashian is affiliated with a computer vision app: the ScreenShop app enables users to find products shown in social media images, primarily images on Instagram, so that they can buy the items.

However, retailers, especially those with large brick-and-mortar footprints, are lagging in terms of implementing AI-based search functionality. While many retailers have begun integrating AI chatbots into their sites, few have integrated computer vision. Those that have include Target, which partnered with Pinterest to utilize its Pinterest Lens technology on the Target mobile app, and IKEA, which recently partnered with GrokStyle, an app that focuses on identifying home décor and furniture and that received $2 million in funding last year. According to TechCrunch, there are indications of a partnership between Snapchat and Amazon embedded in Snapchat’s code. This partnership would likely redirect Snapchat users to products on Amazon based on images taken through the app. Shazam, a music recognition software, had a similar partnership with Snapchat in 2016. Brands are also looking to take advantage of this burgeoning technology: Slyce, a visual recognition company, has partnered with at least 50 companies to date, including Tommy Hilfiger.

Software from Markable and other companies enables shoppers to engage with brands and retailers through any form of camera-recorded media: the technology allows consumers to find products similar to those featured not only in static images, but also in live videos. That means a consumer looking to find an outfit a particular celebrity wore on the red carpet is not limited to visual search on an app such as Instagram, but can search for it via YouTube, too.

Source: Coresight Research

Mobile Shopping and AI Investment Continues to Grow

Shoppers are increasingly using their mobile phones to search for and purchase products, prompting retailers to seek ways to enhance mobile payment systems and product discovery functionality. Swedish networking and telecommunications company Ericsson surveyed 5,048 advanced Internet users from cities around the world this year and found that 43% of them make purchases directly through their smartphone every week, while 67% regularly pay via smartphone in stores.

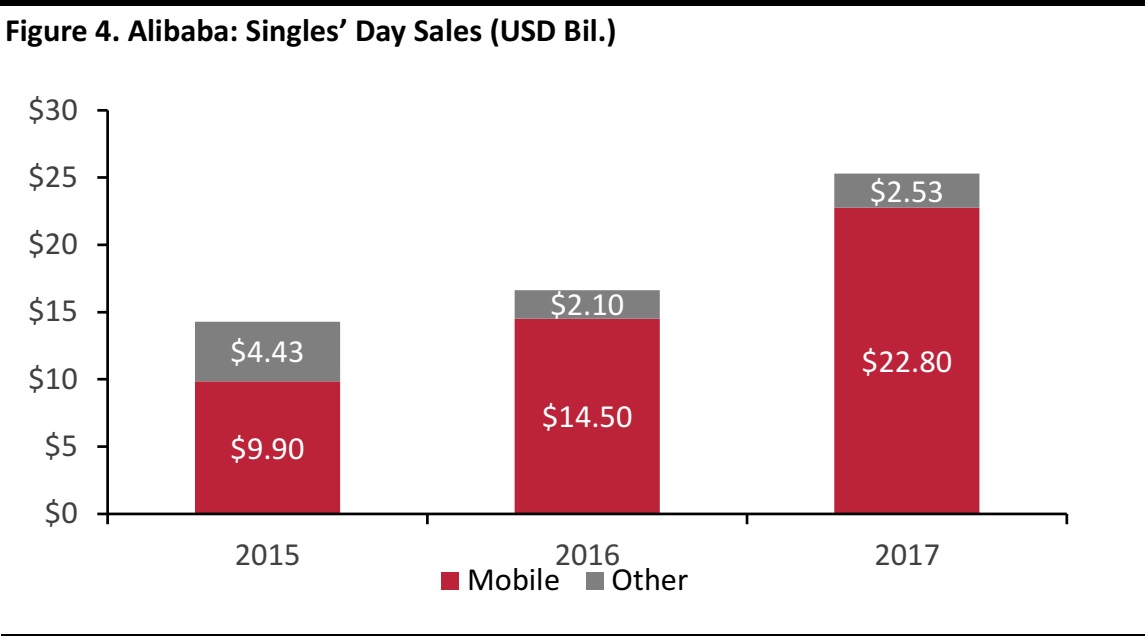

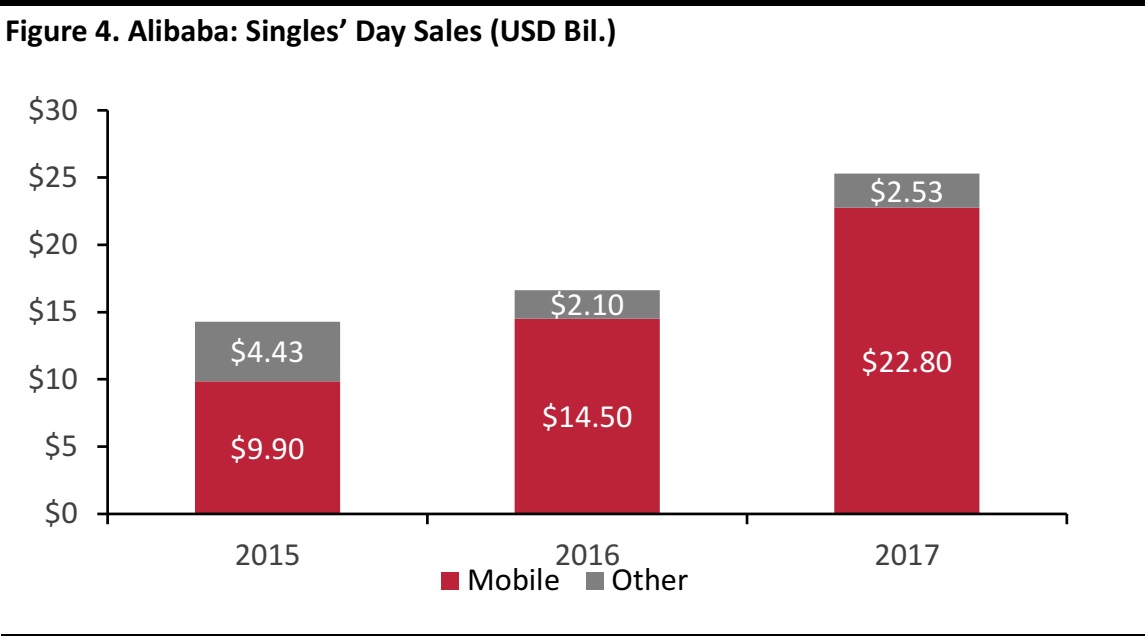

Chinese consumers are much more accustomed to using smartphones for shopping than are their US counterparts. According to Business Insider, mobile sales accounted for 90% of Alibaba’s 11.11 Global Shopping Festival (Singles’ Day) sales, by volume, last year. And unstaffed stores, which rely entirely on mobile payment platforms, have been growing in popularity in China. BingoBox operates 200 staffless stores in China and hopes to reach 5,000 outlets by 2019, while Xioami operates 200 Mi Home stores in China and India and plans to operate 100 stores in India by 2019.

Source: Business Insider

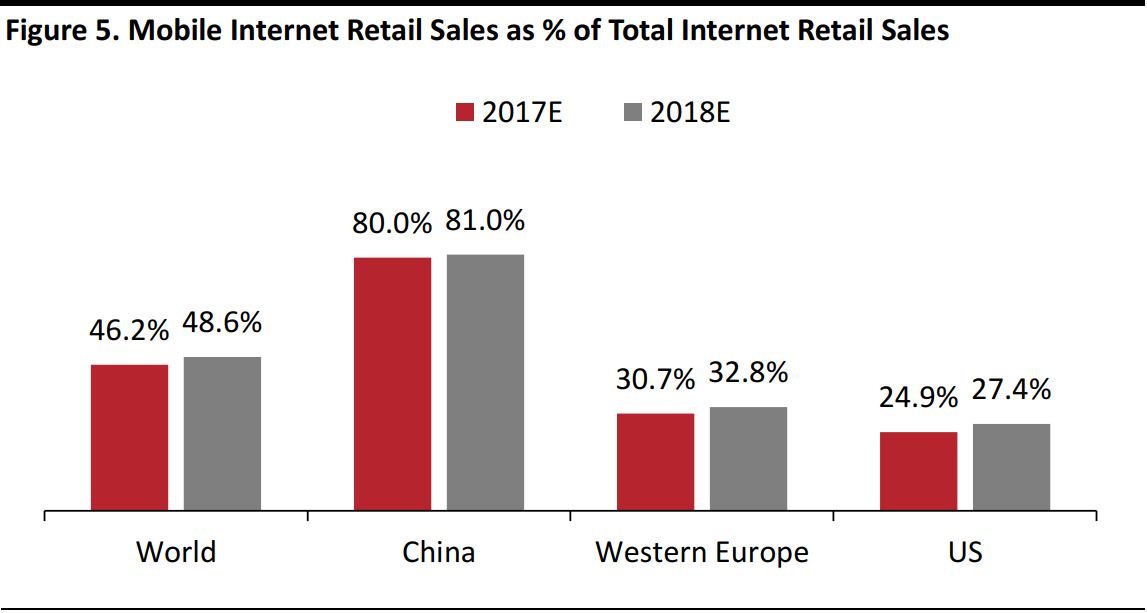

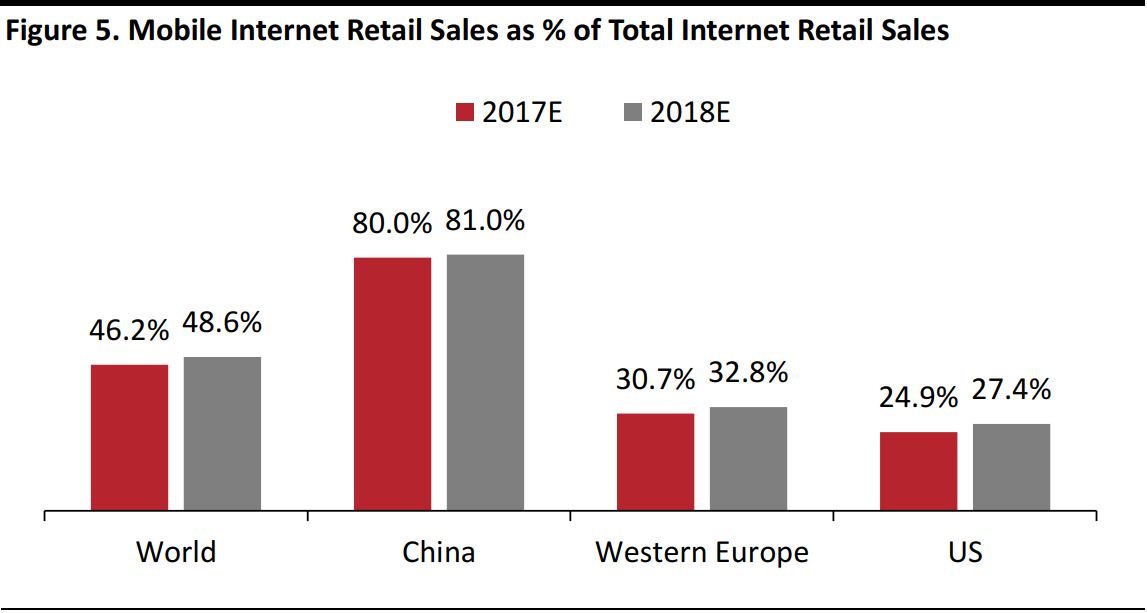

Research firm Forrester recently forecast that US retail sales made via smartphone will grow at an 18% CAGR over the next five years and that more than one-third of US retail sales will be impacted by smartphones at some point in the customer journey. Based on data from Euromonitor International, we predict that the use of mobile devices in retail will grow by nearly 2.5% in 2018 in the US, where mobile sales account for roughly a quarter of total Internet sales.

Source: Euromonitor International/Coresight Research

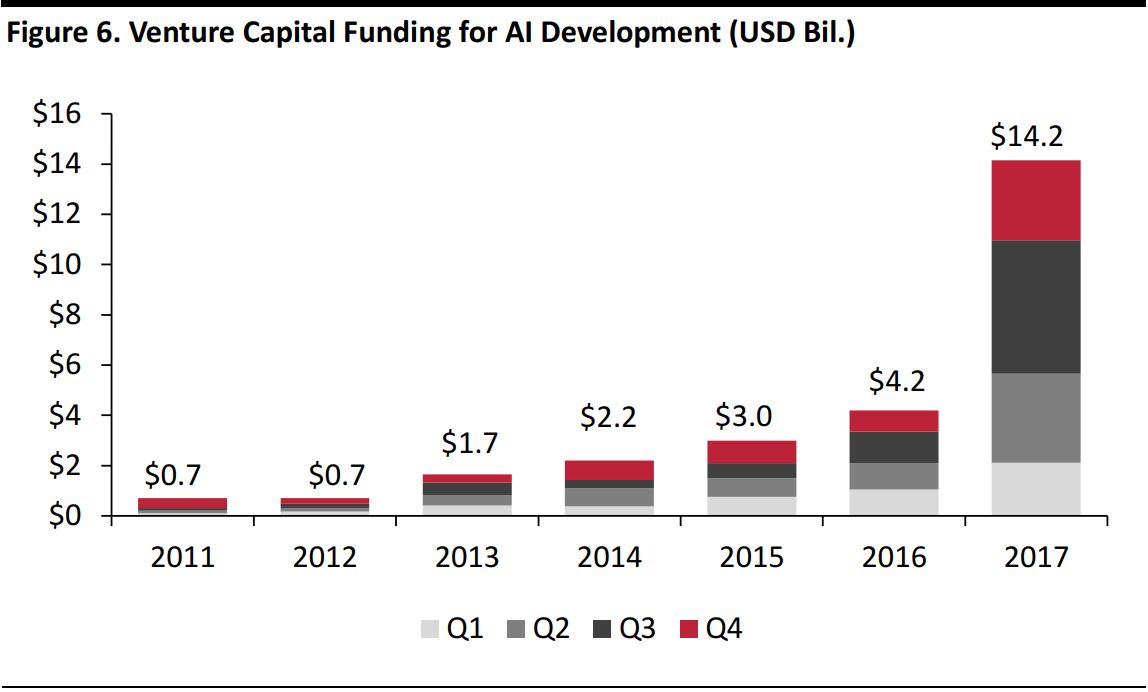

AI is being woven into all forms of search, from chatbots that mimic human customer assistants to visual search that breaks down objects pixel by pixel. According to a report by design and development firm PointSource, 34% of consumers end up spending more when AI technology is effectively used online.

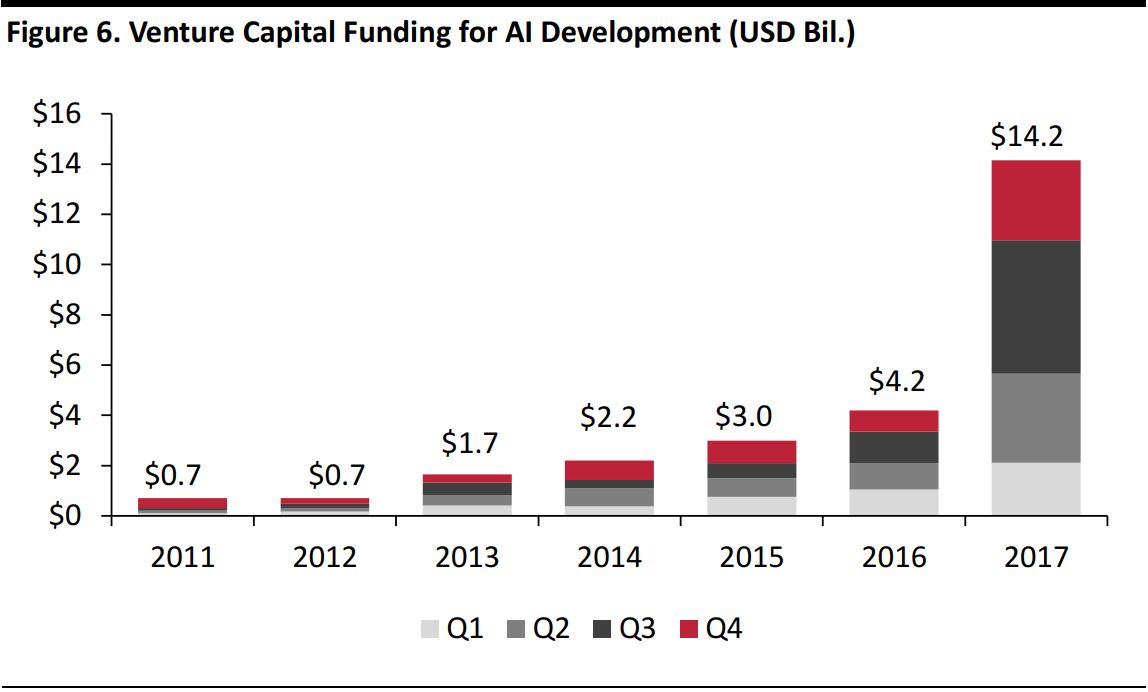

Research firm Venture Scanner found that venture capital funding for AI development was up 240% in 2017, and the trend seems to be strengthening. Juniper Research estimates that annual spending on AI by global retailers will grow from $2 billion in 2018 to $7.3 billion by 2022, suggesting that retailers think online and mobile retail spending will continue to increase.

Source: Venture Scanner

Research firm MarketsandMarkets predicts that the global retail AI market will grow at a CAGR of 38.3% from 2017 to 2022, from approximately $994 million to more than $5 billion. The firm further estimates that visual search will have the highest CAGR over the period and that North America will hold the largest market share of all global regions. These figures suggest that retailers that do not adopt these new technologies risk being left behind in the coming years.

Markable’s Solutions for Retailers and Brands

Markable offers small and medium-sized retailers its software as a monthly service and offers larger retailers enterprise services that enable them to integrate advanced computer vision technology into their online and mobile platforms. Markable specializes in solving complex AI problems that retailers would have to invest considerable time and money in if they were to address them independently. The company also provides engineers and scientists to help client companies integrate the technology and troubleshoot it.

Markable’s visual search software can be embedded into websites to detect and analyze video and static images. This means that an image from Instagram, Facebook, a camera or even a video can be uploaded to Markable’s software, which can then return information about the items pictured. Markable offers solutions to two main problems for retailers online: expensive traffic and poor user experiences finding products. The company’s software creates attributes for data analysis, recommendations, complete the look and lookbook functionality, camera searches and customizable computer vision SDKs.

Source: Markable

Visual Search Technology

Visual search utilizes deep-learning AI, a data-intensive subset of machine learning. Such programs analyze images pixel by pixel, instead of analyzing the metadata associated with them. This eliminates many of the negatives inherent to keyword searches and offers results that are six times more accurate than Google text searches, according to Markable’s research. There is no significant increase in search time with visual search, as accurate results appear in 0.1–0.5 seconds.

Source: Markable

Benefits of Computer Vision Beyond Search

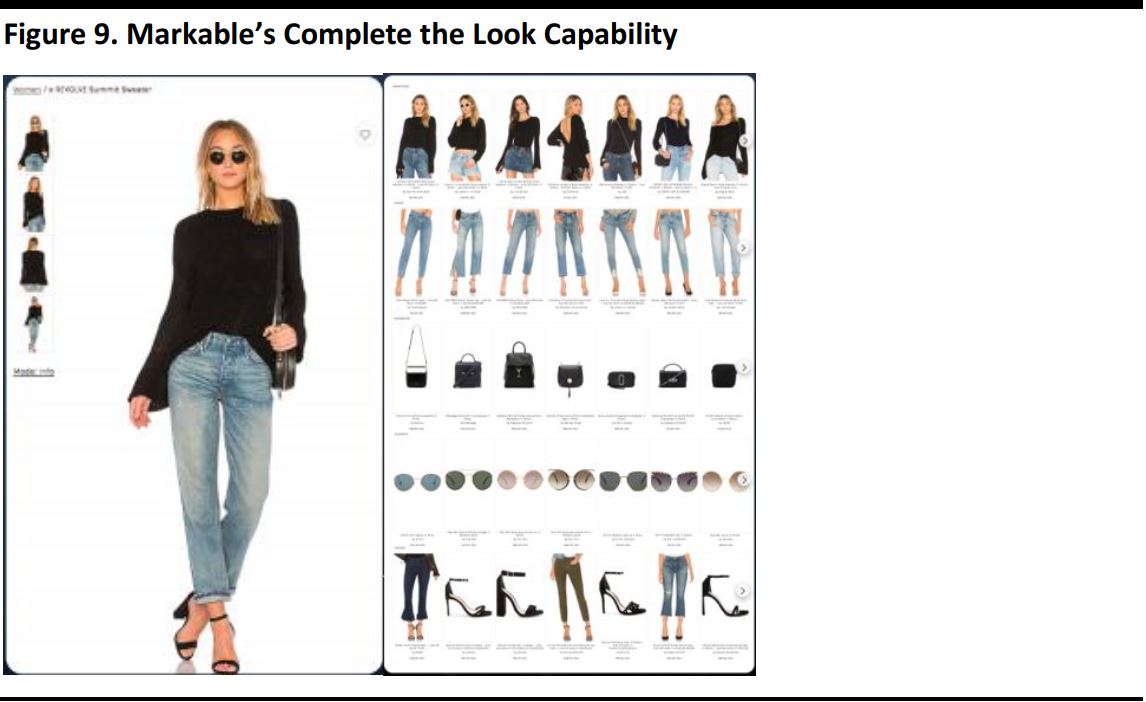

Markable’s technology provides four primary applications for retailers: it creates attributes, provides relevant product recommendations, offers a complete-the-look function and enables shoppers to create lookbooks.

Source: Markable

1. The Attributes API: Using Deep-Learning Technology for Better Analysis

Markable uses its deep-learning software to create more in-depth attributes for retailers:

- In-depth fashion attributes help form the basis of social media trend analyses.

- They allow for better catalog organization of products.

- They also provide sales trend analysis for retailers.

- They help optimize visual search engines.

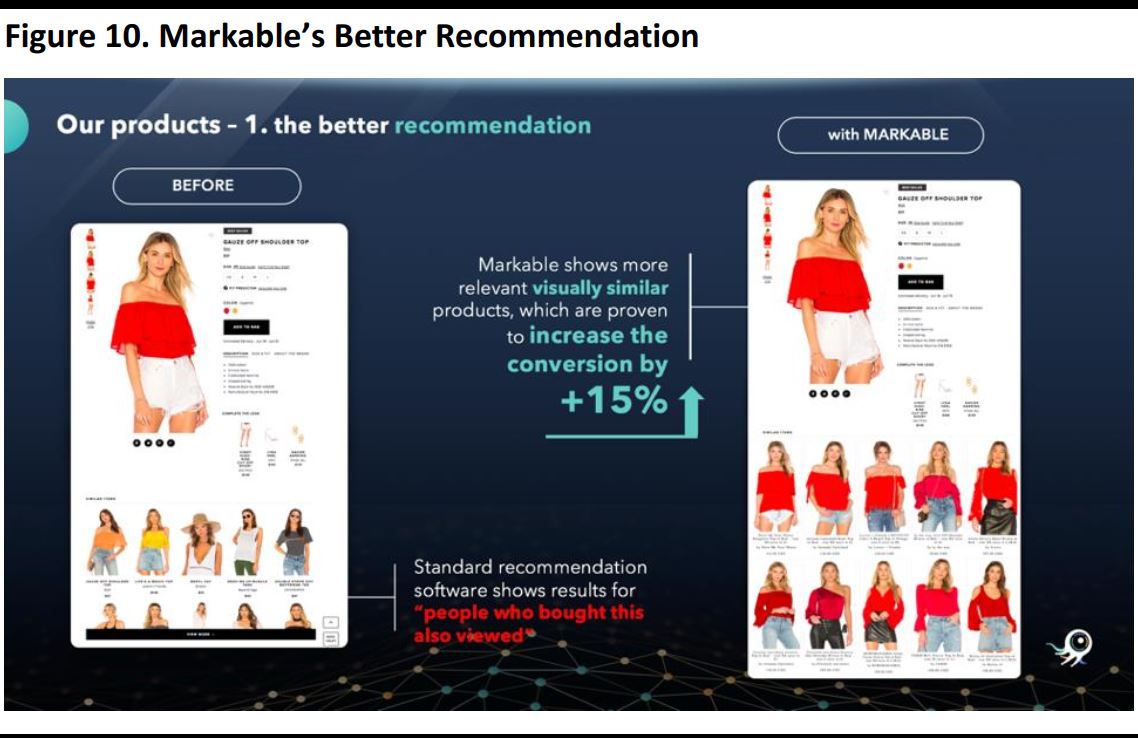

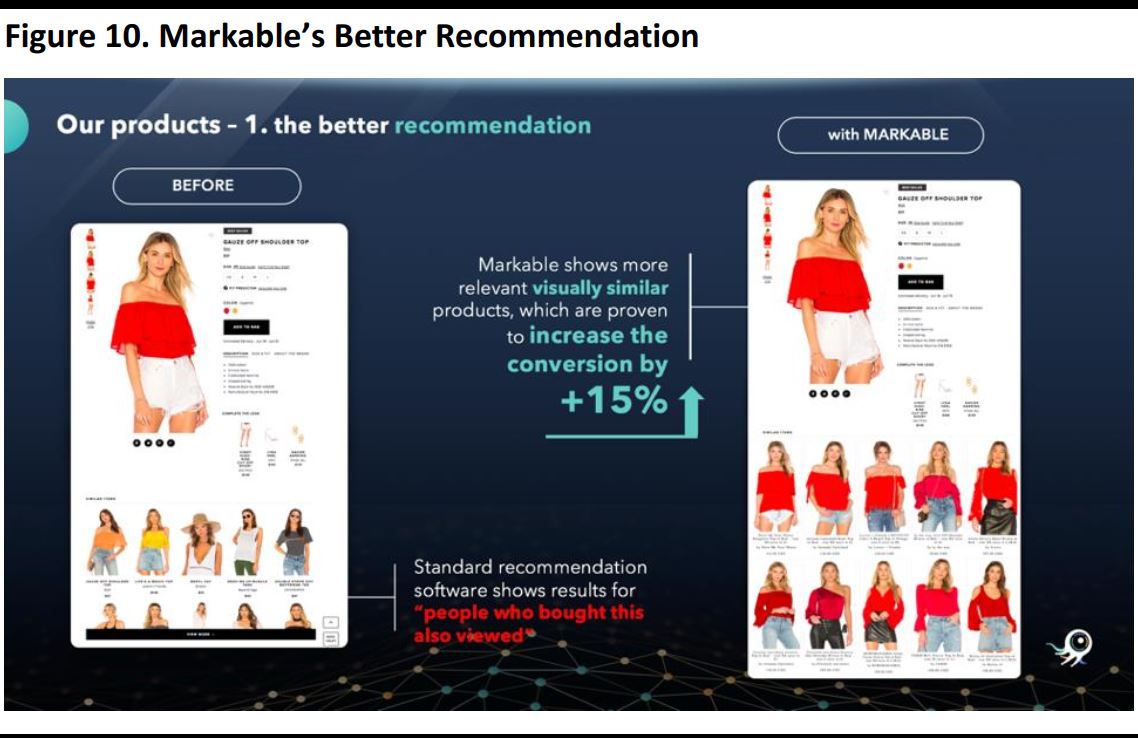

2. Better Recommendations: Increasing User Engagement

On retailers’ websites and in ads, related products are generally suggested based on marketing algorithms and searches made by customers who viewed similar items. These methods assume that consumers all follow the same shopping patterns; they do not result in recommendations of items that are intrinsically linked. Markable’s software can recommend products, directing customers to similar items in ways that resemble in-store browsing and shopping experiences . Being able to compare similarly designed products is more intuitive for shoppers than viewing items with no visual relationship. Markable has found that switching recommendations to visually similar products can increase conversion by 15%.

The company’s technology also helps create a better customer experience. Often, retailers’ sites will suggest items that are out of stock, as average recommendation algorithms do not adapt to inventory changes. However, Markable’s software can take supply into account and direct shoppers to the most visually similar item that is in stock.

Source: Markable

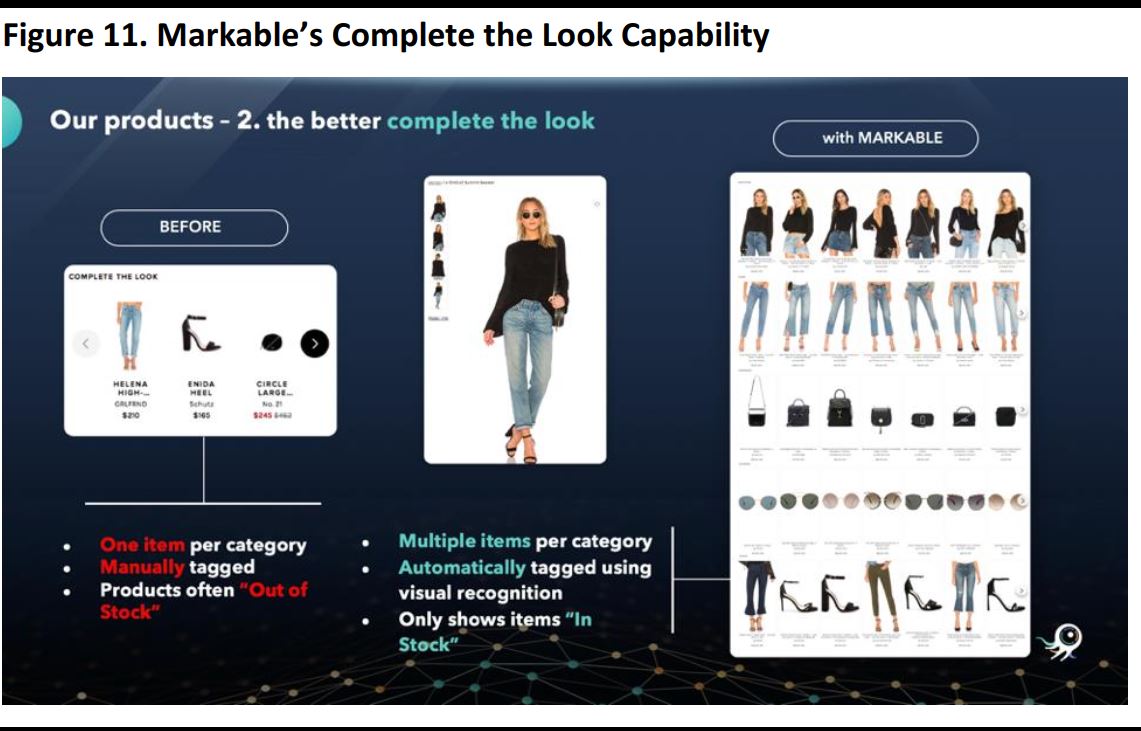

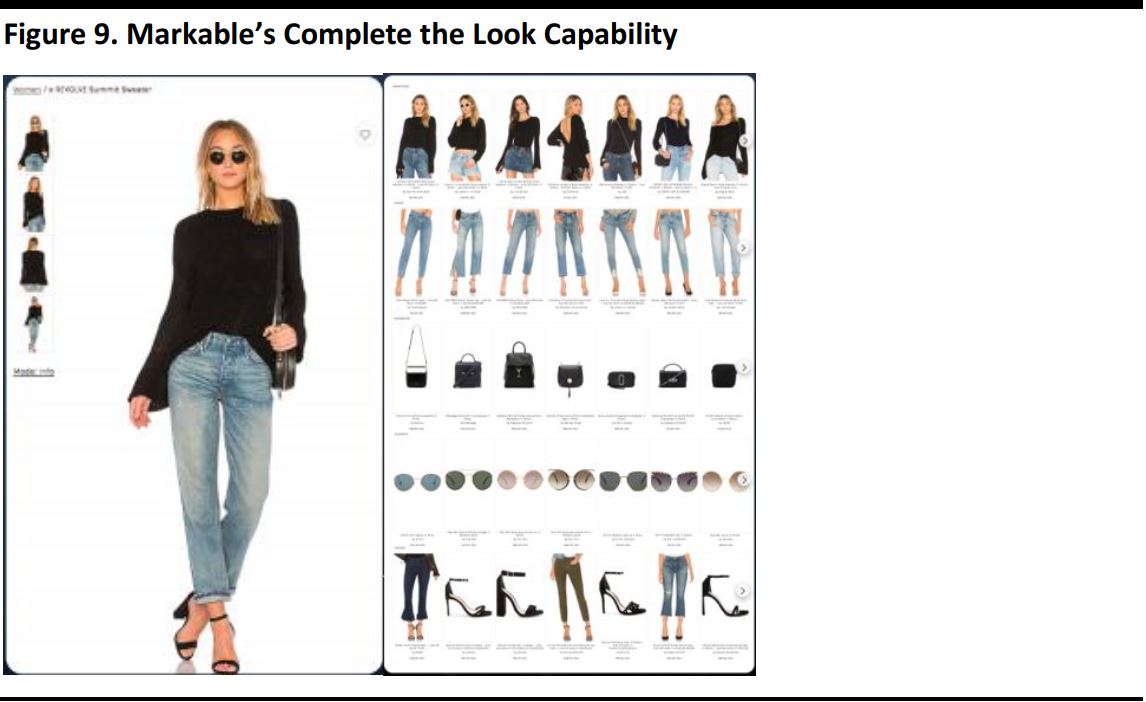

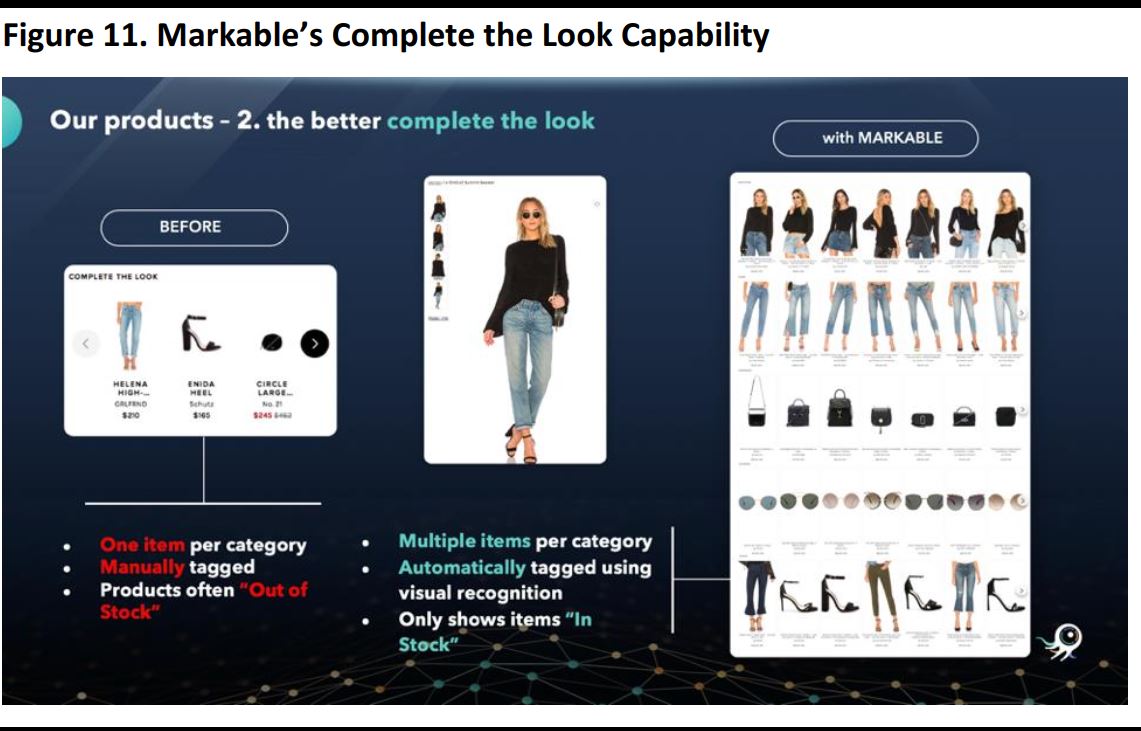

3. Improved Complete the Look: Automating Curation

Retailers’ and brands’ online complete-the-look features often rely on information that developers input and hard coded manually. This can create challenges: individual items suggested may be out of stock (resulting in an incomplete look) and a shopper may not like one or more of the options given.

With Markable’s software, these recommendations are automated by an AI algorithm, which means the program can prioritize items that are in stock. Also, since there is no extra work associated with including more items, retailers can easily provide multiple recommendations. Shoppers are provided with more choices and, more importantly, with suggestions of items that are in stock.

Source: Markable

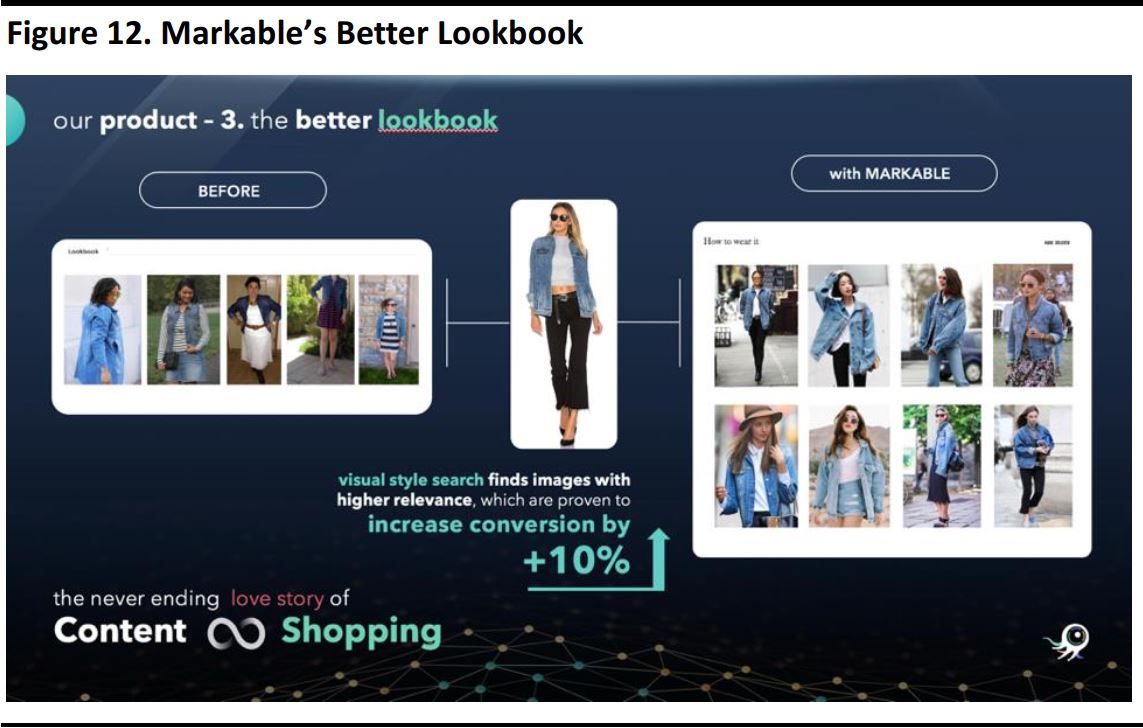

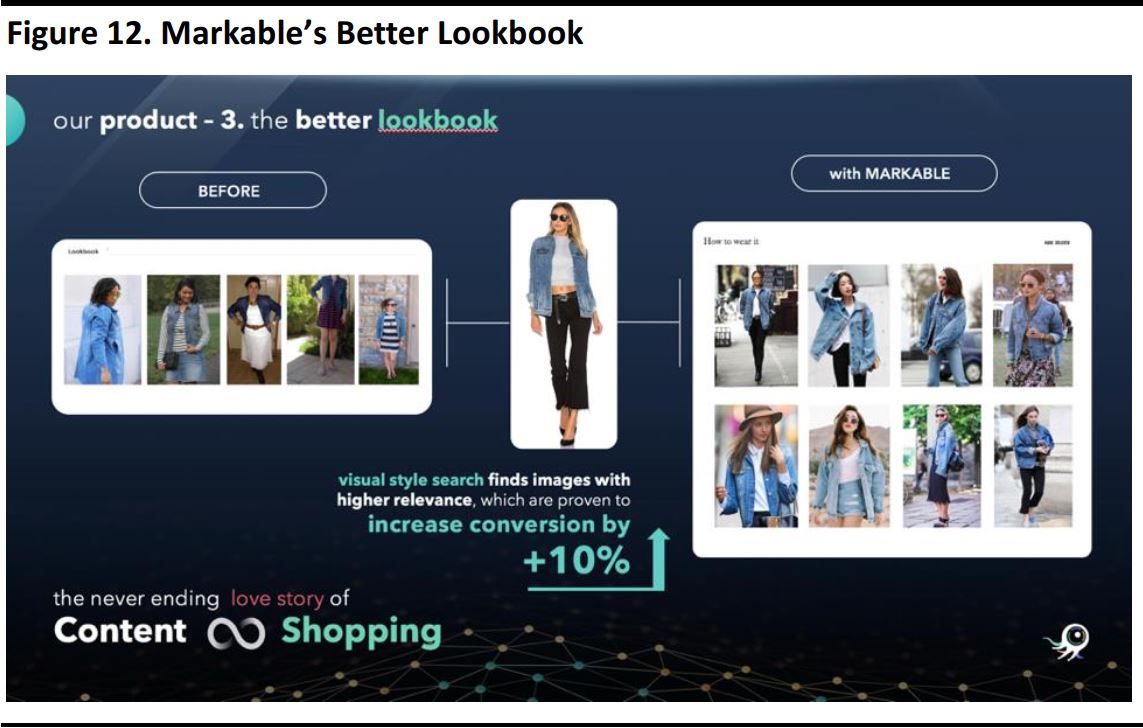

4. The AI Lookbook: Providing a Personal Stylist

Markable’s software can identify items in a lookbook and recommend items based on combinations of apparel and accessories. The software can provide a style guide for the user, elucidate trends and predict what items are likely to follow in trends. This visual style search capability is able to find images that are more relevant to a shopper and increase conversion by 10%.

Source: Markable

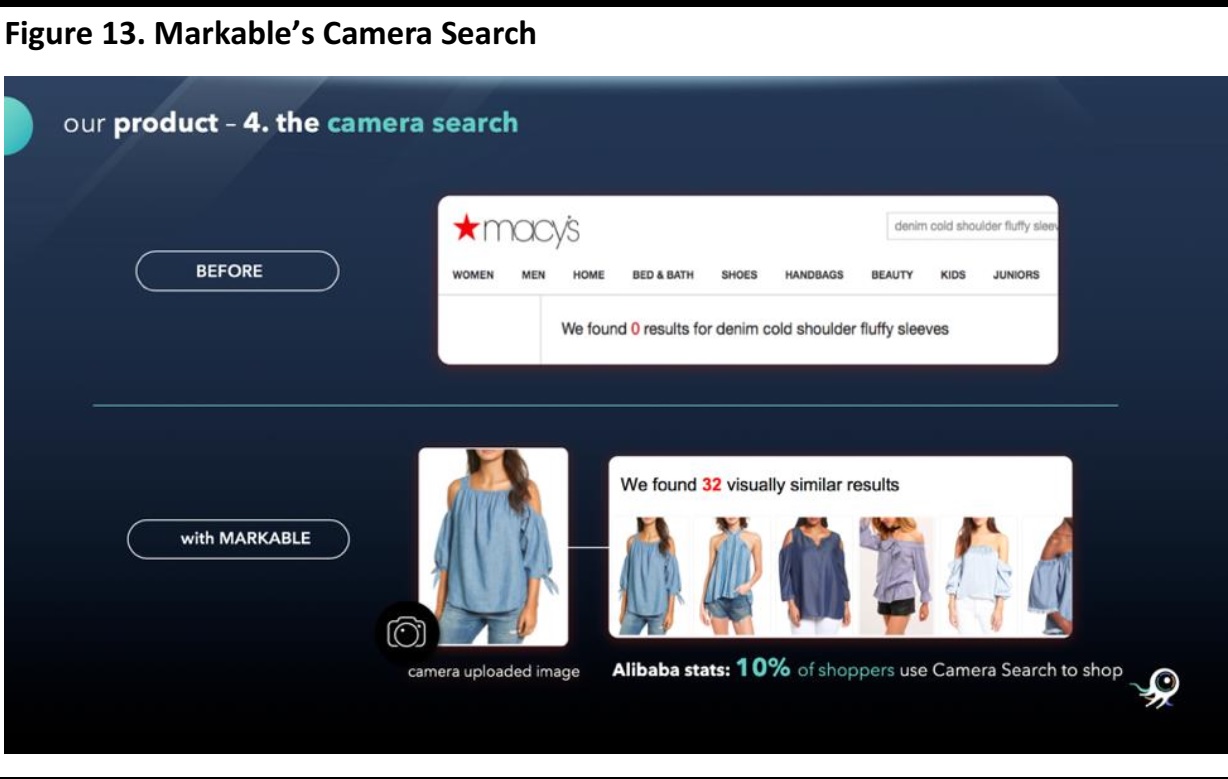

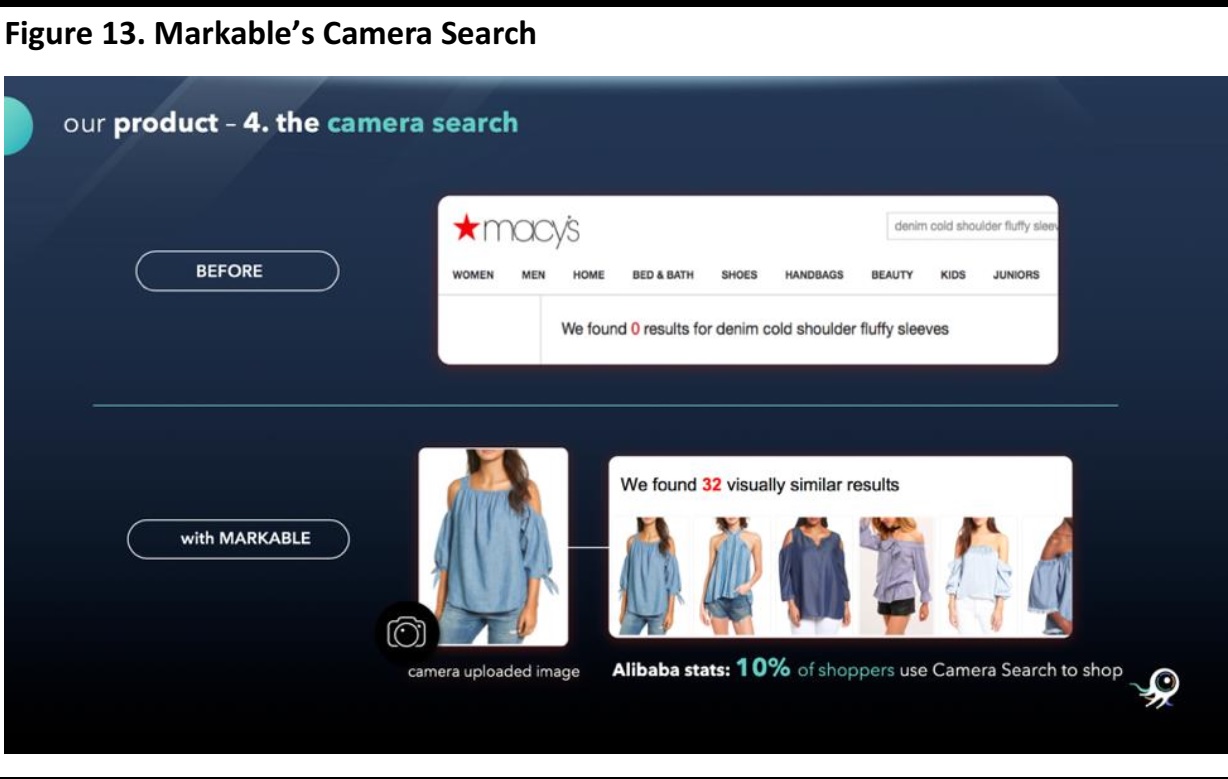

5. Camera Search: The Rise of Mobile and Intuitive Search

According to Alibaba, 10% of shoppers use camera search to shop for products. Difficult-to-search items, especially those that shoppers do not know the names of, represent a challenge for traditional search engines. Markable’s AI software helps solve this issue by interpreting images captured directly in an app or uploaded from a camera.Like the audio recognition app, Shazam, Markable makes searching non-verbal material simple for smartphone users.

Source: Markable

6. Customizable SDKs: Targeted Implementations of Computer Vision

Markable can integrate its program into various media players, so that customers can search for items across multiple forms of media, including popular images, video and even livestreams. Markable has seven patents pending and can help craft unique solutions that enable individual retailers to implement visual search capabilities in the way that is most effective for them.

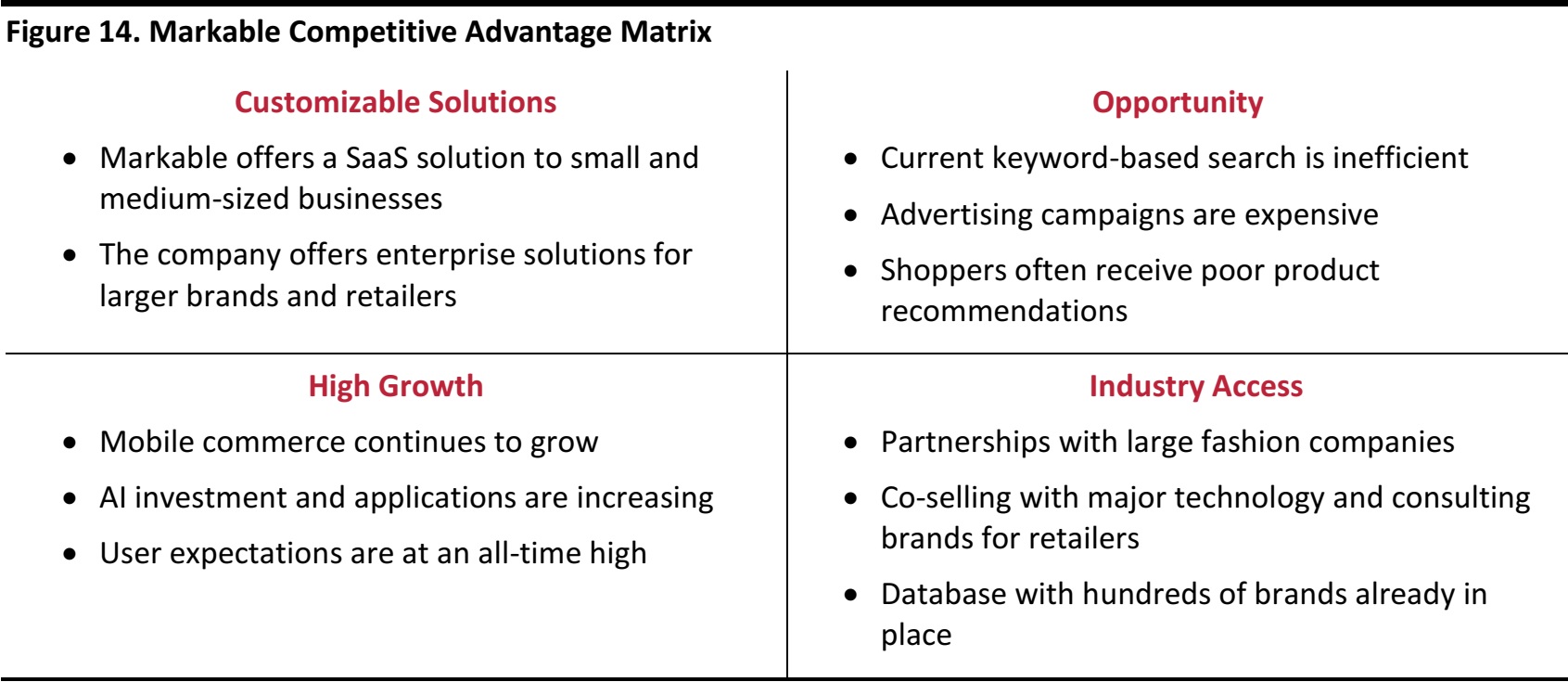

Competitive Advantages

Markable believes that it benefits from the following competitive advantages:

- Its software can be integrated into a customizable configuration: Markable offers visual search APIs and SDKs for its clients, allowing them to choose the applications that work best for them.

- Its existing clients: Markable partners with two of the largest global fashion companies.

- Its team and performance: Markable has four engineers with PhDs working on its patented technology, and its algorithm is reported to outperform those of Pinterest, Microsoft and Google.

- Strong e-commerce growth: E-commerce growth shows no sign of slowing down, and the struggles of traditional brick-and-mortar retailers only reaffirm this. Retailers must find new ways to market products and provide higher-quality customer experiences.

- More engaging search: Visual search technology allows shoppers to look for items they find visually appealing, even if they are unsure how to describe the products in words. Markable’s software also recommends products intrinsically related to the original item a user searched for.

- Growing mobile use: Consumers are increasingly turning to their phones to shop. Chinese shoppers are leading this trend, but it is strengthening in the US, too.

Source: Markable/Coresight Research

Business Model

Markable generates revenue through two avenues, depending on the size of the client, as well as by providing other optional services:

- Small and medium-sized retailers: These clients pay SaaS fees, including fees for the various APIs and SDKs that they require. For example, clients may choose to use the Attributes API, the Recommendation API, the Complete the Look API, the Lookbook API, the Camera Search API or the Shoppable SDK.

- Enterprise solutions: Retailers can integrate the Markable Deep Learning Model to their servers for unlimited usage, licensing out the software. There are four options for this: the Detector Model, the Detector and Attributes Model, the Detector and Visual Search Model, and Full Service.

- Optional services: Markable also provides additional AI consultation services, with varying fees for assistance provided by AI engineers and scientists.

- Discounts: For clients that make an annual payment up front, Markable provides a discount worth two months’ fees and waives its onetime implementation fee.

Go-to-Market Strategy

Markable has a relatively small-scale go-to-market strategy, mainly spreading its message by word of mouth and by reaching out independently. In China, companies such as JD.com and Weibo act as distributors. In the US, Markable has yet to create distributor deals, but Microsoft and Boston Consulting Group co-sell Markable’s products.

Snapshot of a Campaign Markable Executed for Akira

Akira is a trendy Chicago fashion retailer with 27 stores and 500 employees. Its retail website, ShopAkira.com, garners more than 5 million page views a month. Markable implemented its software on the retailer’s site, and Akira saw the following results:

- 15% total estimated increase in revenue.

- 45% of unique shoppers used visual search.

- 27% click-through rate for shoppers who used visual search.

- 29% of shoppers clicked “Add to Cart” after directed to a product from visual search.

These data were based on more than a million searches on ShopAkira.com since November 2017. Akira also utilized Markable’s Camera Search SDK and Search Similar SDK on its website.

Competitive Landscape

Markable believes that its computer vision software fills in many of the technological gaps traditional retailers face in terms of search and marketing. Google, Pinterest, Microsoft and some smaller tech companies are developing software that is similar to Markable’s visual search software, but Markable claims that it offers higher accuracy and better integration capabilities as well as packages that can be customized to meet the needs of any client. The company says that much of this efficiency stems from its fashion focus and its attributes API.

Key Management

Markable benefits from a management team that has extensive experience in data-intensive AI professions and online retailing.

CEO and Founder Joy Tang holds a BS in mathematics and economics from the Massachusetts Institute of Technology. Prior to founding Markable, she worked in high-frequency trading for seven years. Tang is a winner of the China Math Olympics Gold Medal.

CTO Jonas Grimfelt has more than seven years of CTO experience. He previously worked in e-commerce and advertising software development.

COO Balaji Ravindran previously served as a product executive at Intuit, Amazon, Nielsen and Yahoo. He also received an MS in Management from the University of New Orleans and Executive Education from the Northwestern Kellogg School of Management.

Deep Learning Scientist Dr. Rui Zheng has developed multiple computer vision mobile apps, including a visual privacy control system for face, scene and gesture recognition.

Company Outlook/Upcoming Announcements

Markable is currently piloting its software with Forever 21, Revolve.com and Jollychic.com and recently launched its SDK with Eimy Istoire in Japan. The company is also looking to launch pilots with Weibo, WeChat, LiveMe.com and Xiaomi in China.

Coresight Research’s View

E-commerce’s share of retail continues to increase, but the vast majority of sales are still made in physical stores. To justify the commercial costs of keeping stores and malls running, retailers and retail real estate firms need to use creative methods to increase traffic and drive revenue. To help retailers rethink their approach to physical retail, we have outlined the BEST (brand building, experiences, services and technology) framework, shown below.

Source: Coresight Research

To help retailers rethink their approach to physical retail, we have outlined the BEST (brand building, experiences, services and technology) framework.

Brand Building

In order to maximize the value of store assets, retailers must use them not only as distribution points, but also as a marketing channel. Many retailers note that online sales increase in a particular geographic area when they open a physical store in that area, indicating that physical stores serve a marketing purpose that delivers ROI. By connecting online and in-store retail, brands and retailers will be better positioned to drive customer loyalty.

Experiences

More store-based retailers must bring events and experiences into their stores to deepen customer engagement. In-store events and experiences provide an opportunity for retailers to fight for dollars that consumers are directing toward leisure experiences. They can also excite shoppers with newness and create a sense of urgency by triggering shoppers’ “fear of missing out.”

Services

Store-based retailers must use services as a weapon in their fight against online-only rivals. A collection of service-based offerings can draw shoppers to a particular retailer and drive traffic and frequency of store visits. Retailers can also use services to deepen their connection with customers and drive loyalty based on hospitality.

Technology

There is an evident data deficit in physical retail that technology can help correct. Online, software is able to track a customer’s journey from the research stage to purchase, and it can even provide details of the research path the customer took. This information allows retailers to personalize their online offering better than their offline offering. But offline, too, retailers can use tools to better understand and cater to their customers. They can use Wi-Fi and Bluetooth, for example, to track where shoppers go on the sales floor when they visit stores—this is the informational equivalent of the cookie trail shoppers leave when browsing online.

Conclusion

Shoppers’ expectations are at an all-time high, and mobile commerce is becoming the norm for online shopping. To meet increased consumer demand for efficiency and convenience, traditional retailers must expand as quickly as they can into as many channels as they can, and offer shoppers new and engaging experiences.

Markable’s software can help retailers expand their search capabilities and provide consumers with a new way to discover products that is often more intuitive than searching by keywords. Retailers and brands of all sizes can integrate the combination of Markable’s visual search products and services that best suits them, knowing that the company’s AI engineers and scientists are available to assist in the process.