Nitheesh NH

Introduction

The world of fashion design has changed rapidly as brands and retailers have been forced to adapt to shifting consumer behavior and demand. Consumers are increasingly demanding a wider assortment of products to be delivered to them with higher frequency, leading to the rise of fast fashion and an ongoing struggle to reduce fashion lead times. At the same time, calls for sustainability and inclusivity in apparel have pushed back on the fast-fashion model, due to the associated waste and the one-size-fits-all mentality that fashion designers with extremely limited timeframes have come to adopt. As a result, fashion brands and retailers have begun to explore creative solutions to adhere to sustainable practices while also designing quickly for a multitude of body shapes and sizes. Advanced analytics and digital design and ideation technologies will likely become must-haves for retailers in the fashion industry moving forward. In this report, we examine the current pain points and areas of opportunity for fashion brands, retailers and designers to improve the efficiency and creativity with which they design. We profile Savitude, an AI-driven digital fashion design solutions provider that helps designers leverage their creativity to ideate and design quickly. This report is sponsored by Savitude.The Shifting Design Landscape: Three Challenges

Almost every area of the fashion industry is undergoing rapid change, from production to distribution to marketing, but perhaps the most pivotal change in the fashion industry is occurring at the very first step in the fashion cycle: design. We explore three key trends that are shaping the ways in which fashion brands are designing their products and are consequently affecting the industry as a whole.- Consumer-driven fashion cycles require greater design speed and flexibility, along with data-driven insights

- Consumers and designers are reducing their focus on the hourglass shape and are increasingly emphasizing designs for multiple body types, aided by advances in design technology and analytics.

- Sustainability is emerging as a key value proposition, propelled by advances in analytics and stakeholder demands.

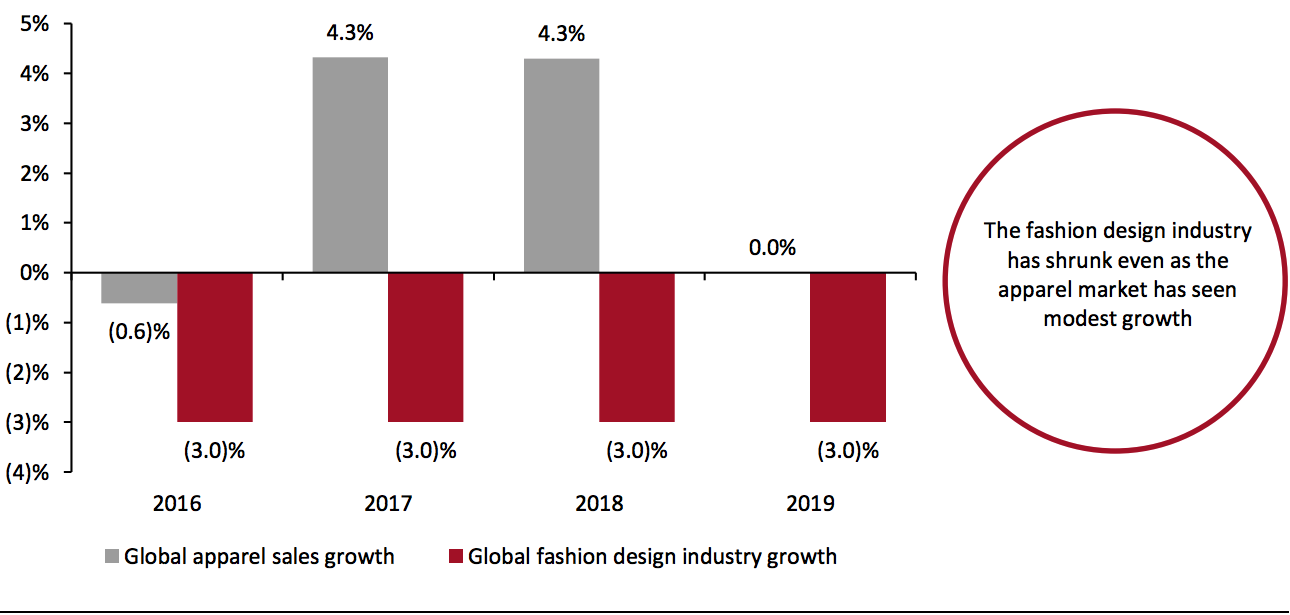

Figure 1. Global Apparel and Design Market: YoY % Change [caption id="attachment_121874" align="aligncenter" width="700"]

Source: IBISWorld/Statista[/caption]

While fast-fashion brands that focus more on speed than complex, novel designs have been able to leverage real-time consumer data effectively, many higher-end, design-focused brands have found it more challenging to effectively leverage real-time insights, hampered by long lead times and intensive physical, non-digital design processes. The delays caused by long design processes matter: A 2019 survey by Salesforce revealed that 40% of global consumers are willing to pay more for a product or service that is first to the market.

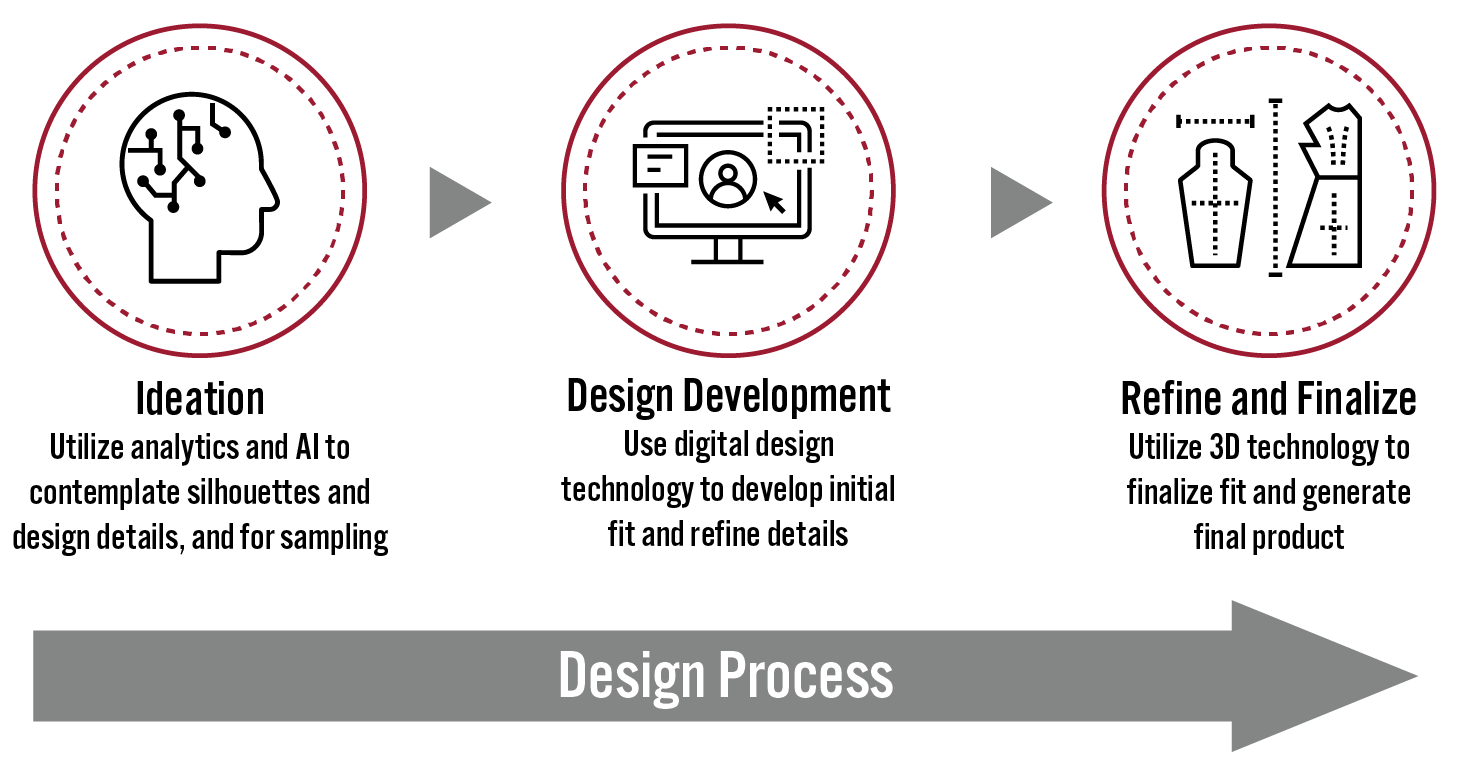

Along with nearshoring production, digital design and ideation in the fashion industry will likely be necessary for these brands to make the most of the growing library of consumer analytics that can inform inventory and design decisions. These analytics can be paired with new product creation technologies throughout the entire design process to optimize the modern design journey, illustrated in Figure 2.

Source: IBISWorld/Statista[/caption]

While fast-fashion brands that focus more on speed than complex, novel designs have been able to leverage real-time consumer data effectively, many higher-end, design-focused brands have found it more challenging to effectively leverage real-time insights, hampered by long lead times and intensive physical, non-digital design processes. The delays caused by long design processes matter: A 2019 survey by Salesforce revealed that 40% of global consumers are willing to pay more for a product or service that is first to the market.

Along with nearshoring production, digital design and ideation in the fashion industry will likely be necessary for these brands to make the most of the growing library of consumer analytics that can inform inventory and design decisions. These analytics can be paired with new product creation technologies throughout the entire design process to optimize the modern design journey, illustrated in Figure 2.

Figure 2. Components of the Modern Design Process [caption id="attachment_121937" align="aligncenter" width="700"]

Source: Savitude/Coresight Research[/caption]

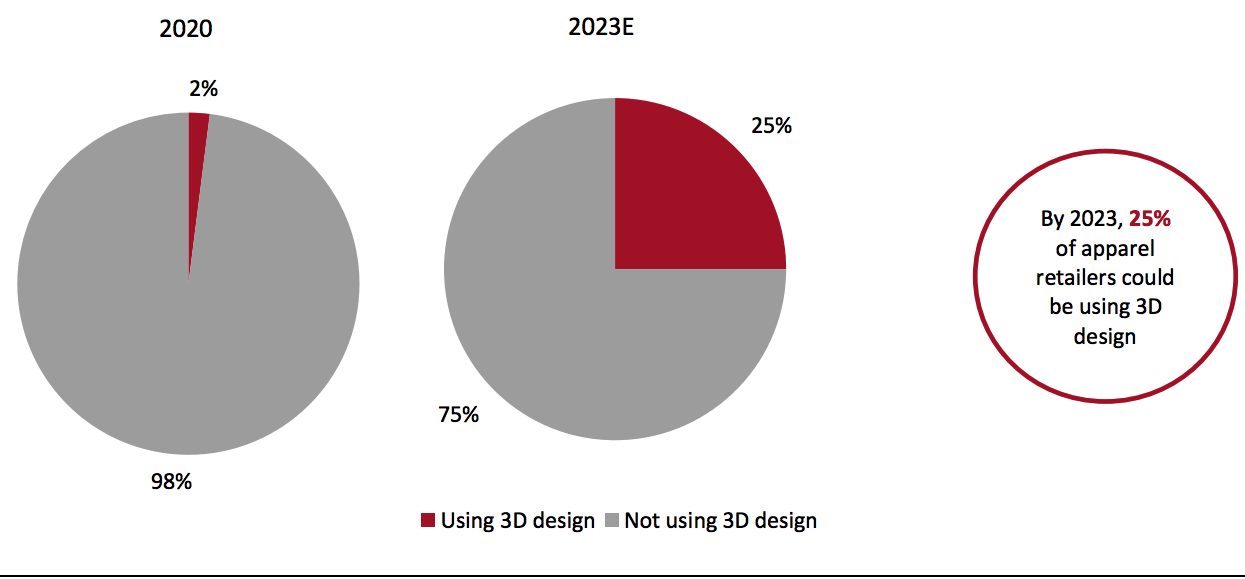

3D design and other digital design and ideation technology can help brands get their products to market significantly faster, enabling them to cater to increasingly demanding consumers and leverage inventory, sales and consumer behavior insights. Despite the advantages, many fashion retailers have yet to embrace these technologies- potentially to their detriment. 3D design remains something of an outlier in the fashion world: Only 2% of retailers worldwide are currently using 3D design, according to Sean Coxall, President of Supply Chain Solutions at Li & Fung, one of the world’s largest supply chain management companies. However, Coxall expects this proportion to grow rapidly in the near future, with 25% of retailers using 3D design by 2023, as depicted in Figure 3.

Source: Savitude/Coresight Research[/caption]

3D design and other digital design and ideation technology can help brands get their products to market significantly faster, enabling them to cater to increasingly demanding consumers and leverage inventory, sales and consumer behavior insights. Despite the advantages, many fashion retailers have yet to embrace these technologies- potentially to their detriment. 3D design remains something of an outlier in the fashion world: Only 2% of retailers worldwide are currently using 3D design, according to Sean Coxall, President of Supply Chain Solutions at Li & Fung, one of the world’s largest supply chain management companies. However, Coxall expects this proportion to grow rapidly in the near future, with 25% of retailers using 3D design by 2023, as depicted in Figure 3.

Figure 3. Estimated Proportions of Retailers Worldwide Using 3D Design [caption id="attachment_121876" align="aligncenter" width="700"]

Source: Li & Fung[/caption]

Li & Fung estimated in 2020 that 3D design tools can reduce design labor costs by 68% and reduce waste by 55%, but 3D design tools can only be fully effective when combined with ideation technologies that enable designers to ensure product details and fit throughout the creation process. Combined with AI-driven product-ideation software—which can use consumer data to help suggest potential new designs to designers—we anticipate that digital and automated design and ideation technology will continue to become more prevalent in the fashion industry. It will likely be imperative for brands and retailers to use ideation and 3D technology in tandem with advanced analytics that can help them analyze designs not just for fit, but also for suitability in different regions of the world and in the context of different trends.

2. Consumers and Designers Are Reducing Their Focus on the Hourglass Shape and Are Increasingly Emphasizing Designs for Multiple Body Types

In recent years, inclusive fashion has become more mainstream, with brands and retailers targeting and focusing on numerous specific body types, such as plus-size, petite and tall, not just those who fit the traditional hourglass shape. The plus-size market in the US had seen solid growth in recent years, before declining along with the rest of the US apparel market in 2020. However, the plus-size apparel market has weathered the pandemic slightly better than the market as a whole: We project the plus-size market to have declined by 11% in 2020 from 2019, a slightly smaller decline than our projected 12% decline in the total US apparel market.

There remains further opportunity in the US plus-size market. The rate of obesity among adult women (aged 20 and above) in the US is around 41.9%—approximately 52 million women—according to the Behavioral Risk Factor Surveillance System at the Centers for Disease Control and Prevention (CDC). That number has grown substantially over the last several decades, and it is likely that the pandemic will lead to a continued rise in obesity rates, as consumers have been confined to their houses and rates of alcohol consumption have climbed.

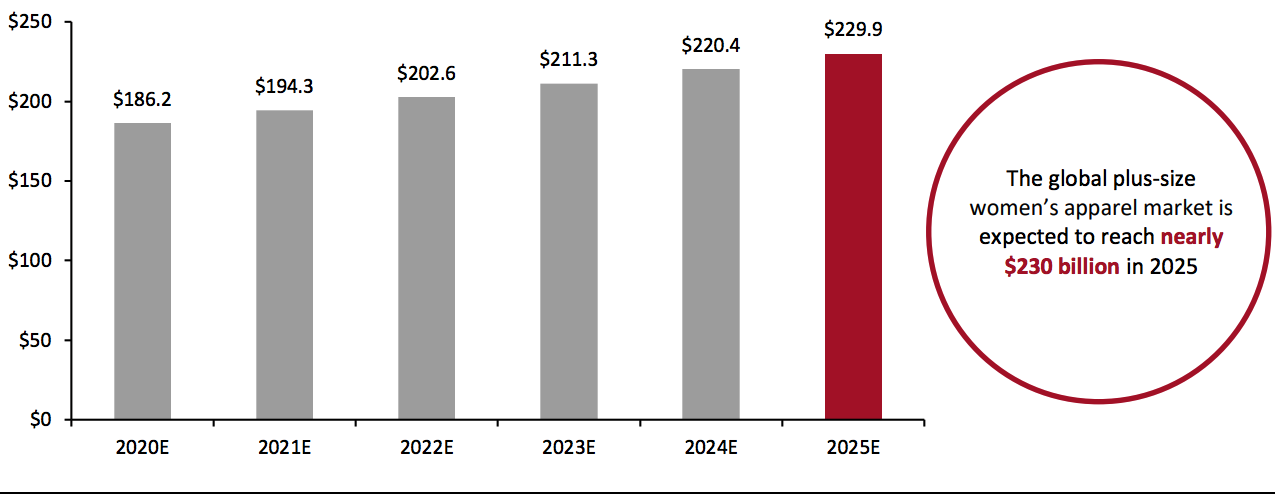

In the US, the plus-size market is well developed. Elsewhere around the world, there remains greater space for expansion in women’s plus-size apparel. Figure 4 illustrates the projected growth of the global women’s plus-size apparel market from 2019 to 2025.

Source: Li & Fung[/caption]

Li & Fung estimated in 2020 that 3D design tools can reduce design labor costs by 68% and reduce waste by 55%, but 3D design tools can only be fully effective when combined with ideation technologies that enable designers to ensure product details and fit throughout the creation process. Combined with AI-driven product-ideation software—which can use consumer data to help suggest potential new designs to designers—we anticipate that digital and automated design and ideation technology will continue to become more prevalent in the fashion industry. It will likely be imperative for brands and retailers to use ideation and 3D technology in tandem with advanced analytics that can help them analyze designs not just for fit, but also for suitability in different regions of the world and in the context of different trends.

2. Consumers and Designers Are Reducing Their Focus on the Hourglass Shape and Are Increasingly Emphasizing Designs for Multiple Body Types

In recent years, inclusive fashion has become more mainstream, with brands and retailers targeting and focusing on numerous specific body types, such as plus-size, petite and tall, not just those who fit the traditional hourglass shape. The plus-size market in the US had seen solid growth in recent years, before declining along with the rest of the US apparel market in 2020. However, the plus-size apparel market has weathered the pandemic slightly better than the market as a whole: We project the plus-size market to have declined by 11% in 2020 from 2019, a slightly smaller decline than our projected 12% decline in the total US apparel market.

There remains further opportunity in the US plus-size market. The rate of obesity among adult women (aged 20 and above) in the US is around 41.9%—approximately 52 million women—according to the Behavioral Risk Factor Surveillance System at the Centers for Disease Control and Prevention (CDC). That number has grown substantially over the last several decades, and it is likely that the pandemic will lead to a continued rise in obesity rates, as consumers have been confined to their houses and rates of alcohol consumption have climbed.

In the US, the plus-size market is well developed. Elsewhere around the world, there remains greater space for expansion in women’s plus-size apparel. Figure 4 illustrates the projected growth of the global women’s plus-size apparel market from 2019 to 2025.

Figure 4. Global Women’s Plus-Size Apparel Market (USD Bil.) [caption id="attachment_121877" align="aligncenter" width="700"]

Source: Acute Market Reports[/caption]

Across the world, more than 1.9 billion adults were overweight in 2016—more than 25% of the global population—and worldwide obesity has almost tripled since 1975. The market for plus-size apparel remains underserved. In the US, we estimate that the plus-size clothing market comprises 20.7% of the total women’s clothing market, in a country where 41.9% are obese. There is room for expansion, as indicated by the nearly 20 percentage point gap between the obesity rate and plus-size market penetration in the US.

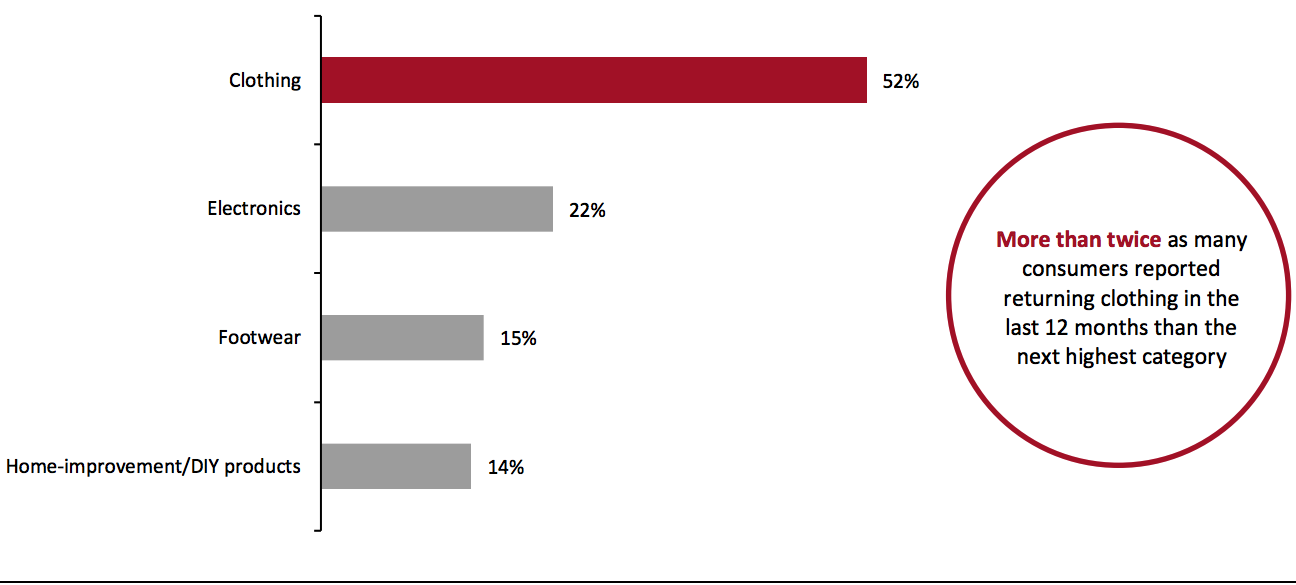

Designing inclusively is not just about size inclusivity– it is also about designing with different body shapes and fit preferences in mind. In Coresight Research’s November 2020 survey of US consumers, we found that four in 10 consumers had returned an unwanted purchase in the past 12 months. Of those consumers, 51.5% indicated that they had returned a clothing purchase in the past 12 months—more than twice the returns rate of any other product, as shown in Figure 5.

Source: Acute Market Reports[/caption]

Across the world, more than 1.9 billion adults were overweight in 2016—more than 25% of the global population—and worldwide obesity has almost tripled since 1975. The market for plus-size apparel remains underserved. In the US, we estimate that the plus-size clothing market comprises 20.7% of the total women’s clothing market, in a country where 41.9% are obese. There is room for expansion, as indicated by the nearly 20 percentage point gap between the obesity rate and plus-size market penetration in the US.

Designing inclusively is not just about size inclusivity– it is also about designing with different body shapes and fit preferences in mind. In Coresight Research’s November 2020 survey of US consumers, we found that four in 10 consumers had returned an unwanted purchase in the past 12 months. Of those consumers, 51.5% indicated that they had returned a clothing purchase in the past 12 months—more than twice the returns rate of any other product, as shown in Figure 5.

Figure 5. US Consumers That Had Returned Any Unwanted Purchases in the Past 12 Months: Product Categories They Had Returned (% of Respondents) [caption id="attachment_121878" align="aligncenter" width="700"]

Base: 169 US respondents aged 18+ that had returned a product in the past 12 months, surveyed in November 2020

Base: 169 US respondents aged 18+ that had returned a product in the past 12 months, surveyed in November 2020Source: Coresight Research[/caption] Poor fit is one of the leading reasons for apparel returns—the wrong size as well as the fit of a product not suiting a consumer’s body shape. Returns sparked by fit issues come at vast expense to retailers: According to estimates from IHL group, retailers lose more than $600 billion worldwide each year to returns. Consumers with less traditional body shapes likely return products more often, as it has traditionally been difficult for designers to create clothes that fit well on certain body shapes. The lack of analytics available to help designers ensure they can design for multiple body types makes it difficult for brands and retailers to produce clothes that fit well across consumers of different shapes and sizes. As a result, these consumers can be the toughest for fashion retailers to convert. Furthermore, during the pandemic, many consumers have preferred to return items through the mail. Some 42.6% of US consumers reported preferring to return online orders by mail, versus just 25.4% who prefer to return them in store, according to our November 2020 consumer survey. Combined with the increased penetration of online shopping, this preference puts further strain on already taxed retail logistics networks. ShipMatrix Inc. estimates that the total holiday shipping capacity of US logistics providers in 2020 between Thanksgiving and Christmas was 79.1 million parcels per day. That is a 21% increase over 2019’s 65.3 million parcel capacity, but still not enough to handle all of the 86.3 million parcels looking for space daily—a 27% increase over the number of packages looking for space in the 2019 holiday season. All retailers are increasingly understanding the importance of reducing returns. In fashion, they can do so in large part by leveraging technology to design for a more diverse array of body shapes and sizes. 3. Sustainability Is Emerging as a Key Value Proposition, Propelled by Advances in Analytics and Stakeholder Demands Fashion accounts for 10% of the world’s emissions, according to data from the Intergovernmental Panel on Climate Change. For long periods of time, consumers, investors and employees have been willing to shrug off the harmful effects fashion design, manufacturing and consumption have on the planet, but the increasing evidence of fashion’s impact on the natural world has led all stakeholders to pay more attention to sustainability. Although fast fashion remains a large subset of the market, more brands are becoming aware of how their decisions and actions impact the world around them. Advances in analytics that help fashion retailers optimize the sustainability of their design process and operations have opened up a new frontier of possibilities for companies to make more of an impact with sustainability initiatives. As part of efforts to promote sustainability, Coresight Research has introduced the EnCORE framework, a methodology to help retailers and brands frame their sustainability efforts. The EnCORE framework is made up of five key components:

- Being environmentally engaged: Retailers should start with understanding how their own operations and supply chain impact the environment along with peer standards and industry shifts.

- Adopting circular models that minimize the environmental impact of products and maximize the circulation of materials back into use.

- Optimizing operations through resource-efficient infrastructure and decarbonization technologies.

- Creating and maintaining a responsible supply chain that includes processes that are less resource-intensive and provide transparency to the customer.

- Committing to excellence in reporting and communicating about sustainability, including stakeholder engagement and being a role model within the industry.

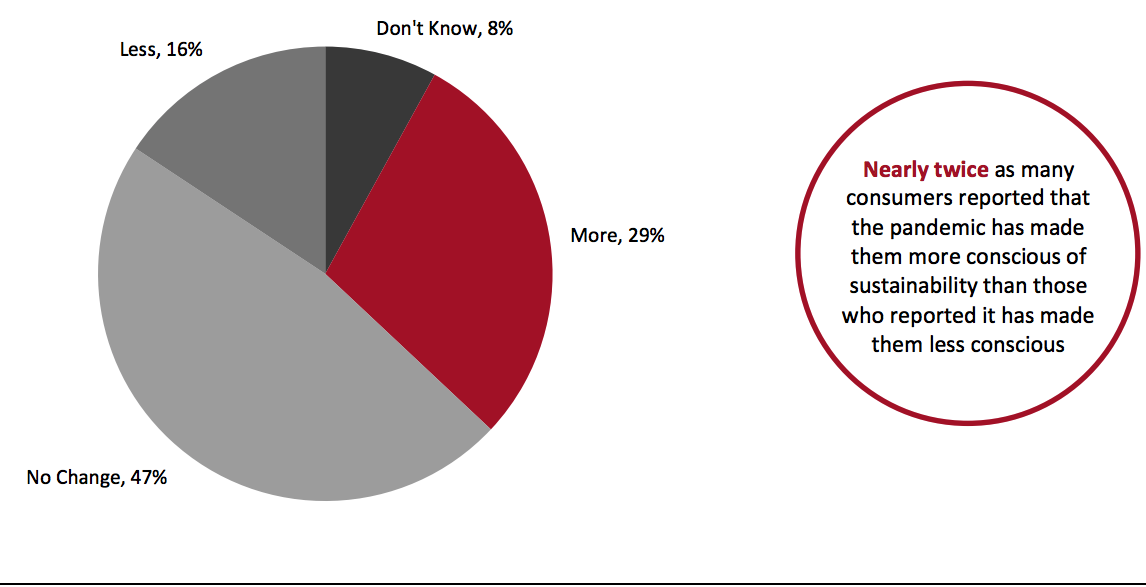

Figure 6. Whether the Pandemic Has Made Sustainability More or Less of a Factor for US Consumers When Shopping (% of Respondents) [caption id="attachment_121879" align="aligncenter" width="700"]

Base: US Internet users aged 18+

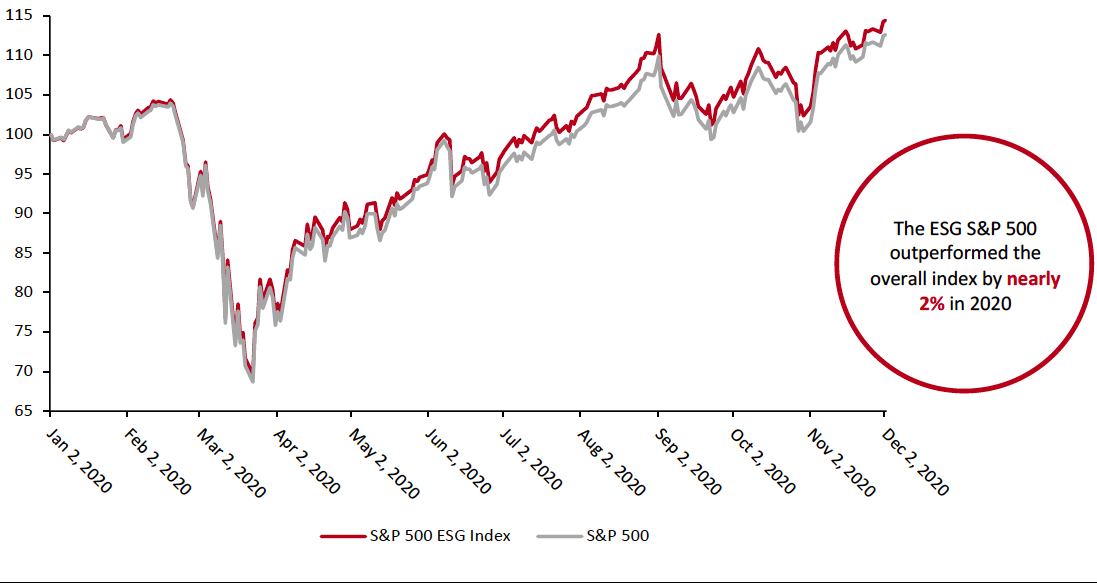

Base: US Internet users aged 18+Source: Coresight Research[/caption] Increased consumer consideration of sustainability has been driven by the growing understanding of how behaviors affect the world. Of those in our survey who said the crisis has made sustainability more of a factor, 45% told us that it was because the lockdowns had showed them the immediate impact that changed behaviors can have on the planet, citing how fewer cars on the road, grounded flights and closed factories had immediate positive impacts on environmental factors such as air quality. Furthermore, over 42% said they were more concerned about sustainability because they now had a greater awareness of global risks and threats. Fashion retailers are already beginning to capitalize on consumers’ preference for sustainability. The North Face has seen success with its “Renewed” program, where the retailer takes a damaged or returned product, cleans it, fixes it and then sells it. In a recent webinar with Coresight Research, Dan Goldman, then Head of Strategy at The North Face, indicated that the company believes sustainability will be the next great feature of apparel that consumers will want to show off, rather than flashy logos or name brands. Sales numbers support Goldman’s assertion: ThredUP, an online secondhand apparel retailer, maintained 20% year-over-year growth rate through the height of the pandemic (mid-March to May 31), indicating that sustainably focused fashion retailers can thrive even in crisis. Moving forward, we anticipate that consumers will continue to look to buy from brands that represent their values and have a positive impact on the planet. Investors Investors have also become increasingly conscious of the power they have to influence the fate of the planet. As of 2018, more than 25% of money under professional management was invested in sustainable assets, according to US SIF: The Forum for Sustainable and Responsible Investment, roughly triple the proportion in 2013. Furthermore, the coronavirus pandemic has illustrated how important it is to have a resilient supply chain capable of withstanding major global shocks, be they health related, political or environmental. Just as consumers are now increasingly aware of global threats, investors have a heightened awareness of the volatility of assets without a sustainable model. Over the course of the current crisis, investors’ preference for sustainable companies has become more apparent than ever. Through 2020, the ESG S&P 500 index (a sub-index of the S&P 500 cataloguing the performance of companies that are committed to environmental, social justice and governance values) consistently outperformed the overall S&P 500 index, as shown in Figure 7.

Figure 7. ESG S&P 500 and S&P 500 2020 Performance, Indexed to January 2, 2020 = 100 [caption id="attachment_121902" align="aligncenter" width="700"]

Source: S&P Global[/caption]

Indexed to 100 at the start of 2020, the ESG S&P 500 grew to 114.43 as of December 2, while the overall S&P 500 index grew to 112.62—a difference of almost 2%. Investors are putting their money where their mouths are and investing increasingly in sustainable assets, making it more vital than ever for fashion retailers—long considered among the least sustainable retailers—to appeal to the environmentally conscious.

Employees

As the workforce continues to become dominated by millennials and Gen Zers, sustainability is becoming an increasingly important factor that employees consider when choosing their career/employer. A Fast Company survey of 1,000 employees at large US companies in 2019 found that 40% of millennial respondents indicated that they had chosen a job in the past because a company performed better on sustainability than the alternative. More than 10% of all employees in the survey also indicated they would be willing to take a $5,000–$10,000 pay cut to work at a company more focused on sustainability.

In fashion, we expect companies that embrace design, manufacturing and distribution models that focus on sustainability—by relying on digital design technology and circular models—will have a distinct advantage in attracting millennial and Gen Z employees.

Source: S&P Global[/caption]

Indexed to 100 at the start of 2020, the ESG S&P 500 grew to 114.43 as of December 2, while the overall S&P 500 index grew to 112.62—a difference of almost 2%. Investors are putting their money where their mouths are and investing increasingly in sustainable assets, making it more vital than ever for fashion retailers—long considered among the least sustainable retailers—to appeal to the environmentally conscious.

Employees

As the workforce continues to become dominated by millennials and Gen Zers, sustainability is becoming an increasingly important factor that employees consider when choosing their career/employer. A Fast Company survey of 1,000 employees at large US companies in 2019 found that 40% of millennial respondents indicated that they had chosen a job in the past because a company performed better on sustainability than the alternative. More than 10% of all employees in the survey also indicated they would be willing to take a $5,000–$10,000 pay cut to work at a company more focused on sustainability.

In fashion, we expect companies that embrace design, manufacturing and distribution models that focus on sustainability—by relying on digital design technology and circular models—will have a distinct advantage in attracting millennial and Gen Z employees.

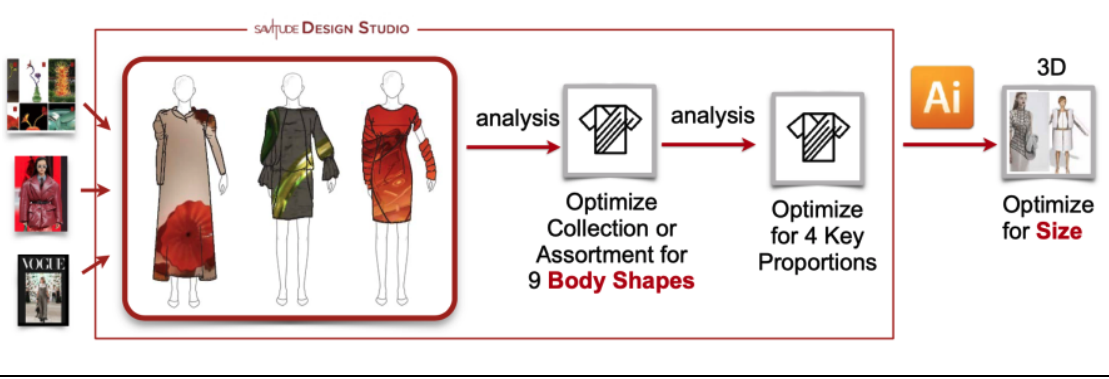

Savitude: Optimizing Design Efficiency and Creativity

Savitude is a digital design solutions provider that pairs analytics and efficiency with creativity to enable designers and brands to streamline the design process while maintaining strong aesthetics and creativity. The company’s software offers designers the ability to create personalized designs based on more than 700 body-type templates. Savitude’s solutions enable designers to incorporate different trends, inspirations and body types simultaneously while designing, speeding up the design process while still letting designers do what they do best. The image below outlines Savitude’s solution. [caption id="attachment_121881" align="aligncenter" width="700"] Source: Savitude[/caption]

Key Competitive Advantages

Below, we highlight three of Savitude’s key competitive advantages, focusing on how the company optimizes the design process and helps address numerous pain points along the fashion supply chain.

Enabling Designers, Influencers and Brands To Incorporate Trends, Inspiration and “Brand DNA” Seamlessly

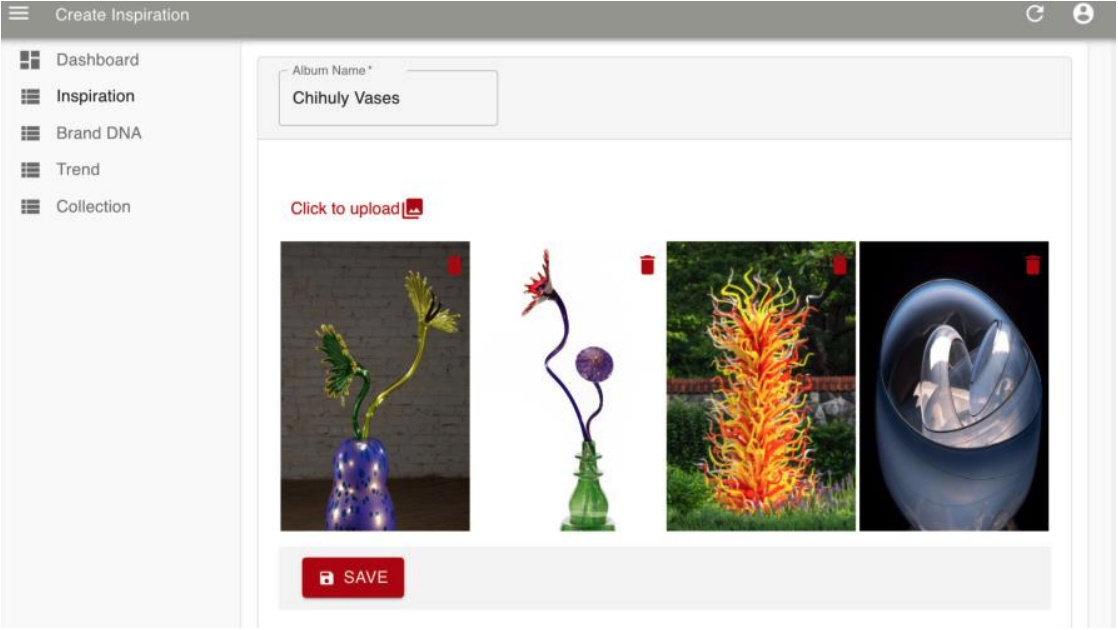

Savitude uses AI to help designers ideate even more creatively and efficiently by enabling them to simultaneously incorporate the latest trends, their own inspiration and what Savitude calls “brand DNA” (the unique look and feel that runs through all of a brand’s products) into hundreds of instantaneously generated designs. The Savitude online portal provides end-to-end solutions for designers to go directly from inputs (inspiration, trends, brand DNA) to first patterns. For their inspiration and trend images, designers can simply upload sketches or photos to the portal, as shown in the image below.

[caption id="attachment_121883" align="aligncenter" width="700"]

Source: Savitude[/caption]

Key Competitive Advantages

Below, we highlight three of Savitude’s key competitive advantages, focusing on how the company optimizes the design process and helps address numerous pain points along the fashion supply chain.

Enabling Designers, Influencers and Brands To Incorporate Trends, Inspiration and “Brand DNA” Seamlessly

Savitude uses AI to help designers ideate even more creatively and efficiently by enabling them to simultaneously incorporate the latest trends, their own inspiration and what Savitude calls “brand DNA” (the unique look and feel that runs through all of a brand’s products) into hundreds of instantaneously generated designs. The Savitude online portal provides end-to-end solutions for designers to go directly from inputs (inspiration, trends, brand DNA) to first patterns. For their inspiration and trend images, designers can simply upload sketches or photos to the portal, as shown in the image below.

[caption id="attachment_121883" align="aligncenter" width="700"] Adding inspiration images to the Savitude platform

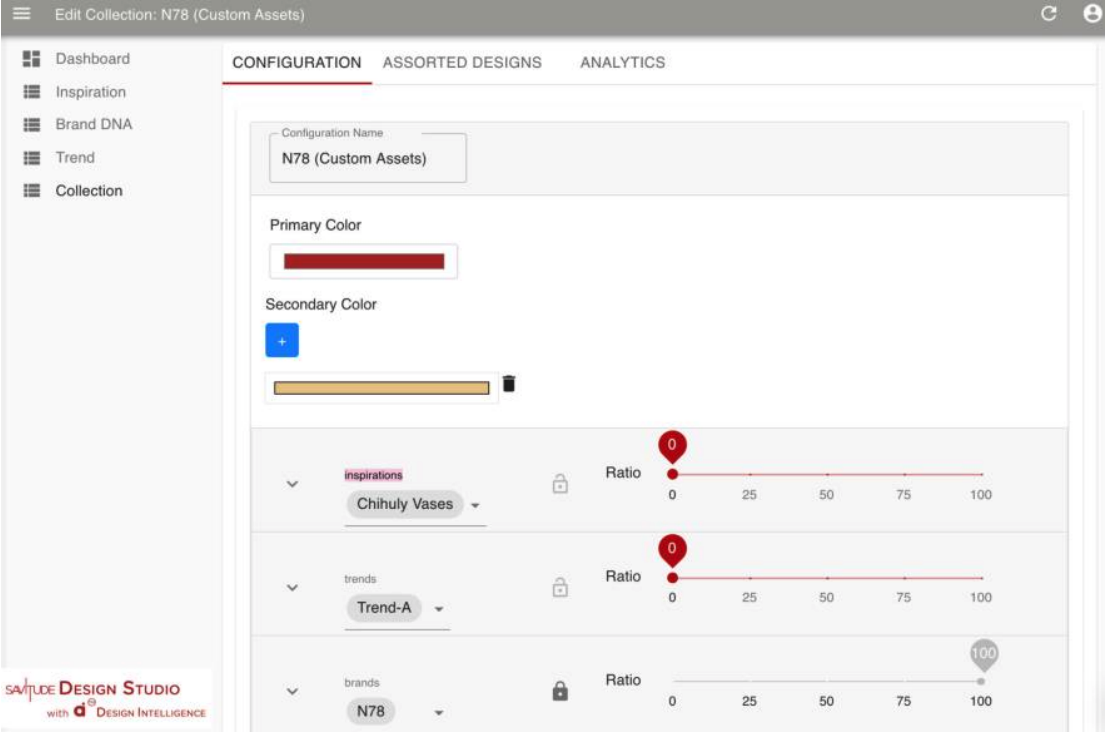

Adding inspiration images to the Savitude platformSource: Savitude[/caption] As indicated by the image above, designers have ample latitude to input inspiration of all kinds. Patterns, pictures from nature and other images can all be uploaded and integrated seamlessly into the ideation process. When designing a particular garment, users select which they would like the AI design feature to take into account when generating customized designs. The effect each of the three inputs—inspiration, trends and brand DNA—has on the output designs can be adjusted using a slider ranging from 0 to 100. Designers can then also integrate brand identity into the automatically generated designs by uploading similar sketches or images of the brand’s previous designs or archive. The designer can also select what percentage of the collection they wish to be printed vs solid. The printed portion will be inspired by the actual inspiration images. Finally, the designer can choose a primary and secondary color that they wish to be featured in the AI-generated designs. [caption id="attachment_121885" align="aligncenter" width="700"]

Adjusting sliders for inspiration, trends and “brand DNA” prior to generating AI-created designs on the Savitude platform

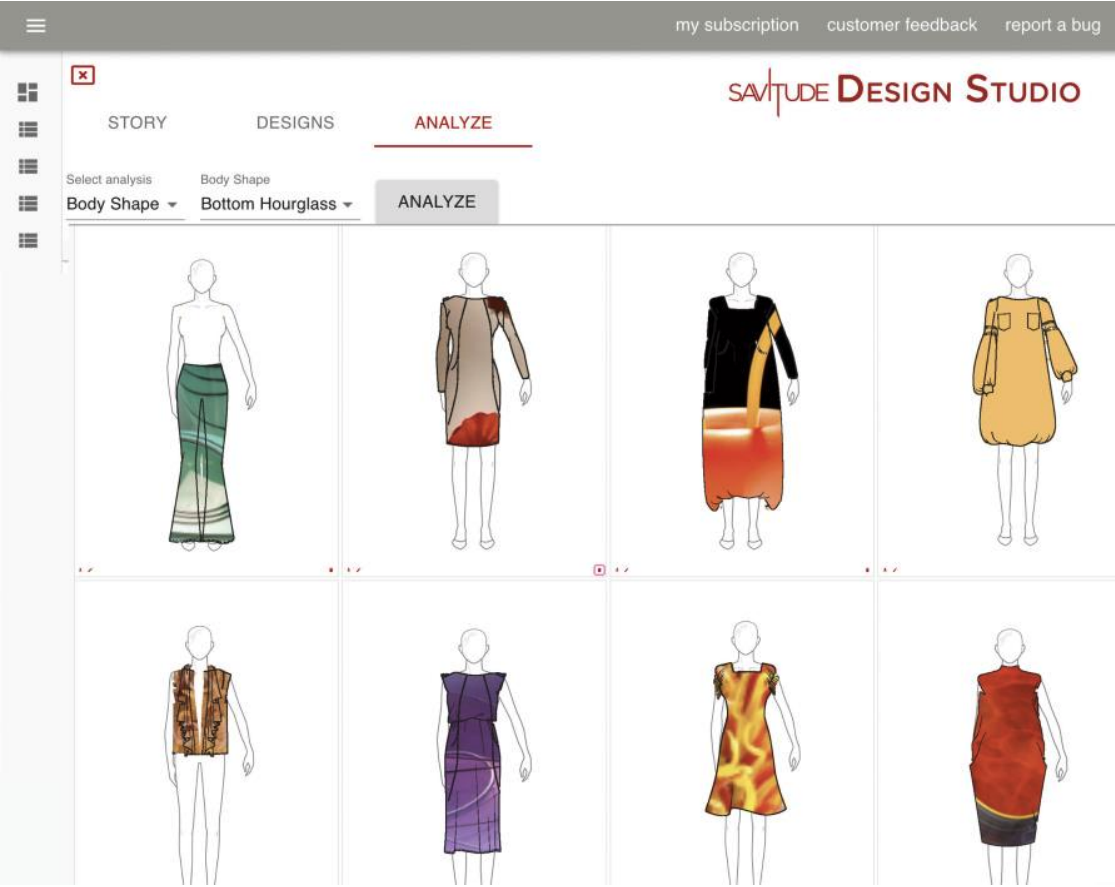

Adjusting sliders for inspiration, trends and “brand DNA” prior to generating AI-created designs on the Savitude platformSource: Savitude[/caption] The Savitude platform’s ease of use and seamless installation at the corporate level makes it possible for non-designers to also create unique, inspired designs. Savitude democratizes the fashion design process, making it easy for people who may not be design experts to create their own professional-quality designs. Ease of design is an especially valuable feature of Savitude’s platform today, when non-fashion brands are increasingly branching out into their own lines of apparel, and celebrity mashups are more prevalent than ever. With Savitude, brands working with influencers or celebrities can allow them to design products entirely on their own, reducing costs for the brand and enhancing the creative abilities of the celebrities that are the face of the products. Promoting Designs Tailored to a Multitude of Body Shapes Savitude enables designers to easily create products that will fit all body types, not just the traditional hourglass shape that fashion has long, almost exclusively, focused on. After creating designs based on inspiration, trends and brand DNA input, Savitude shows users hundreds of AI-generated designs to select from. The user can then choose on which of the nine body types they wish to understand the fit of their design. Once a body type is selected, the Savitude software enables the user to view how well each generated design fits on the selected body type, as a percentage (with 100 being a perfect fit), as shown in the image below. [caption id="attachment_121886" align="aligncenter" width="700"]

Viewing fit analytics on AI generated designs on the Savitude platform

Viewing fit analytics on AI generated designs on the Savitude platformSource: Savitude[/caption] This enables designers who use Savitude to focus on a variety of different body types and ensure that their designs fit well on all potential customers, not just those with the traditional hourglass shape. Savitude estimates that only 20% of women have the stereotypical hourglass shape, leading many consumers to be unsatisfied with the fit of products that are designed for this shape. This can lead to high rates of returns, which, as we discussed earlier in this report, can come at great expense to brands and retailers, along with large quantities of unusable excess inventory when products are designed only to fit a small segment of the population. Improving Design Efficiency and Reducing Waste By giving designers access to a powerful AI platform in their ideation process, Savitude can not only help them design better, but enable them to work faster and less wastefully. Savitude reports that its software generally saves designers at least four weeks, a crucial amount of time in a fashion world that is increasingly defined by on-demand fashion and short lead times. While existing design ideation alone usually takes between two and 12 weeks, Savitude estimates that its ideation process takes designers as little as five minutes and a maximum of five days. The Savitude platform can generate hundreds of designs in a matter of seconds, all based on customized parameters for inspiration, trends and brand DNA input by the designer. This not only reduces the time associated with the usual design trial and error process, but also the waste. By designing fully digitally, designers who use Savitude can visualize huge quantities of designs without ever leaving anything on the cutting-room floor.

Upcoming Announcements

Savitude will be adding the following features in the first quarter of 2021:- Custom asset libraries—When a new brand adopts the Savitude Design Studio, the first action will be to upload the brand’s archive. The Design Studio will automatically “disassemble” the design details in the earlier designs and form a unique library for this brand only. From that point, the brand will be working with familiar design details, in the hands of its own design team. This will greatly expand the details available and add familiarity for users.

- Unique design details—A new capability will look at inspiration images, extract patterns that will look like design details and reinterpret the pattern into cloth as an original design.

Coresight Research’s View

Digital design is likely to continue to grow rapidly as designers strive to find the perfect balance of efficiency and creativity, all while aiming to design for multiple body types and remain sustainable. We identify three areas of opportunity for brands and retailers to improve their design process:- As fashion design moves toward automation, it will be imperative for designers to balance the efficiency offered by design automation systems with the personal touch of designers. Savitude can offer brands a streamlined digital solution that maintains an emphasis on designers’ creativity.

- Inclusivity will continue to become mainstream in the fashion world, making the ability to design for a wide range of body types more important than ever.

- We expect fashion brands to continue to focus more on sustainability for the foreseeable future. Savitude’s digital design suite is one solution designers can use to promote sustainable practices without sacrificing other elements of the business.