Introduction

Many retailers live in an isolated data bubble, in which they have access to, but do not always take advantage of, customer data—yet they have little knowledge of what their customers buy inside their stores or via their e-commerce sites.

Point-of-sale (POS) terminals contribute to the information gap, as they still largely act like cash registers. Although many current-day POS systems are capable of collecting customer information by connecting to a source of payment information, this ability is lost if the consumer happens to pay with cash or a different card. Leading POS systems can capture an e-mail address or a phone number to link to a purchase, but collecting this information may inconvenience the customer through friction in the shopping process—resulting in many shoppers choosing to skip this step and therefore depriving the retailer of the opportunity to link the data.

If brick-and-mortar retailers had a higher level of understanding of their customers and what they are buying in stores, they could better compete with data-armed e-commerce retailers, while also enhancing the customer experience, building loyalty and offering new payment products and personalized offers.

This report discusses the current shortcomings in how retailers approach the collection and analysis of consumer data and how they could improve this process. We also present the benefits of taking a 360-degree view of data and explore a solution by technology company Banyan, which seeks to bridge the gap between POS data and consumer data.

This report is sponsored by Banyan.

Industry Trends

Retail data capture has benefited from many recent technological advances, yet retailers still suffer from a data deficit. However, retailers can develop a strategy for data capture, create data infrastructure and develop a data culture; taking a 360-degree view of data can unleash numerous benefits.

The Evolution of Retail Data Capture

The data available to retailers has evolved positively alongside developments in retailing and commerce, largely prompted by competition from e-commerce retailers and technology, which have been data-driven from the outset.

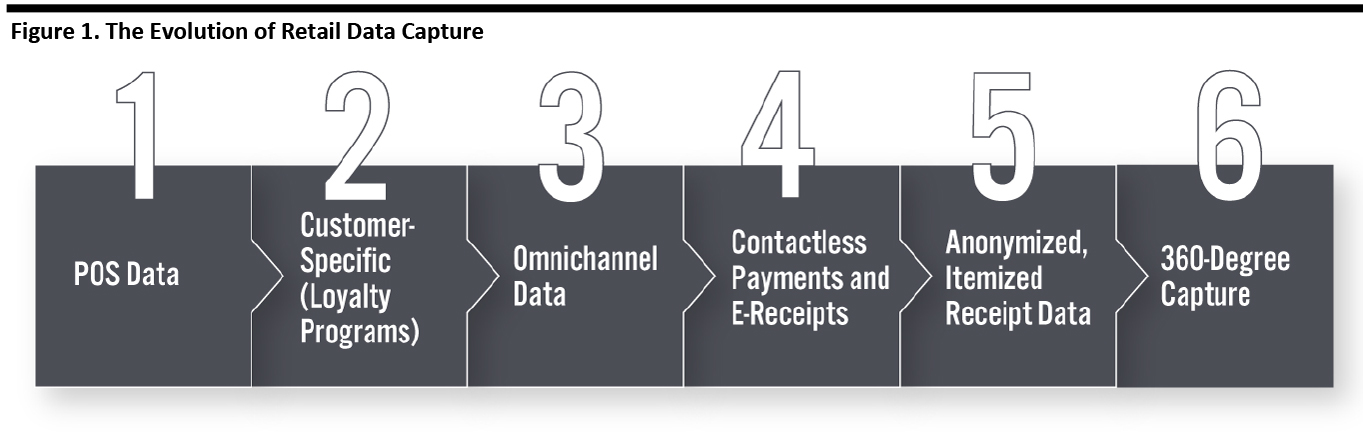

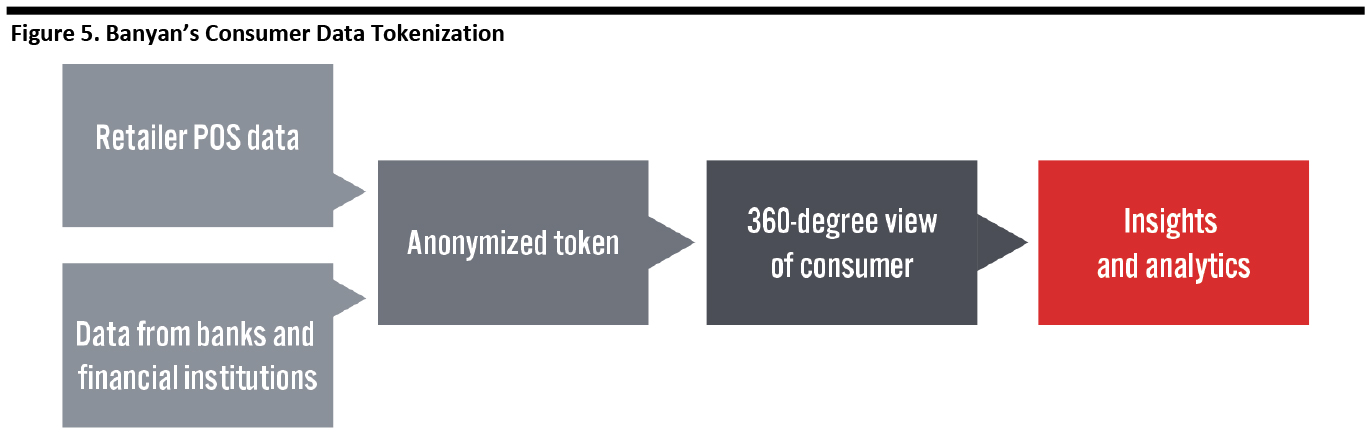

This evolution of retail data capture comprises six key stages, which we detail below and summarize in Figure 1.

- Cash registers have evolved significantly since their invention in 1883, with information technology advances enabling the development of current POS systems. Today’s simple POS systems track the SKU (stock-keeping unit) number, date and time, store location and total purchase amount, plus any additional information the customer provides, such as name, address and e-mail.

- Consumer loyalty programs benefit retailers in two ways: The gamification aspects of the programs incentivize consumers to concentrate their spending with a specific retailer, driving sales and repeat business; and loyalty programs provide data collection opportunities that are perhaps even more valuable than the sales lift.

- Launching e-commerce sites provides physical retailers with additional omnichannel data from online transactions plus new insights from comparing online versus offline consumer purchases.

- The outbreak of Covid-19 prompted many retailers whose physical stores were temporarily closed to upgrade their e-commerce capabilities as well as provide contactless ordering, payment and fulfillment services for consumers—each of these functions creates new data sources for retailers.

- Data providers create anonymized, item-by-item receipt data across a broad spectrum of retailers. This valuable source of data outside a specific retailer’s stores (cross-anonymized, cross-retailer item data) can be used for future product ideas and to determine demand trends.

- Pulling all these data sources together—360-degree data capture—allows retailers to build a full picture of consumers and their purchases, which can inform decision-making and enable retailers to better target the consumer’s wants and needs.

[caption id="attachment_120787" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Retailers Face a Data Deficit

Retailers take a variety of approaches to collecting customer data: Some do not collect customer data at all; some have partial collection methods; and some collect data through a loyalty program and use permission-based marketing. These practices often make it difficult to link a purchase to an individual shopper. Retailers seeking to leverage in-store customer data face the following challenges:

- Integrating customer data. Retailers may be maintaining data in separate silos—for example, not integrating POS data with customer and e-commerce data. Other common occurrences keep data separated, such as a customer making a purchase with a card that is not linked to their customer data. Many point-based programs only capture around half of customer transactions.

- Privacy and security issues. Secure data collection and storage are at odds with the analysis of data for the benefit of the retailer and consumers. Retailers are likely to view these issues conservatively so as not to see their name join the headlines on notorious data breaches. Moreover, consumers are often reluctant to share personal information for fear of being deluged with unwanted marketing communications, such as spam emails.

- High initial costs. Creating and integrating data sets potentially requires upfront purchases of hardware and software and expenditure on hiring IT professionals, in addition to ongoing costs, thus expense may be a deterrent for many financial officers.

- Friction in the data-collection process. Manual steps in the data-entry and customer-identification process, such as consumers having to dictate or enter a phone number or e-mail address when making an in-store purchase, may result in consumers choosing not to identify themselves or skipping the purchase altogether, and busy store employees may not request customer information. This is a lost data collection opportunity for the retailer.

- Limited internal capabilities. Obtaining useful data is just half the battle; retailers also need to hire internally or locate qualified external staff to turn data into relevant, actionable insights.

Retailers’ Data Strategy: A Core Focus for Winning in the Digital Era

Whereas retailers’ success used to be tied to visually appealing stores, good in-person customer service and carefully curated assortments, data has now become an essential part of retail—and retailers seeking to survive and excel need to leverage data to enhance the customer experience and drive conversion.

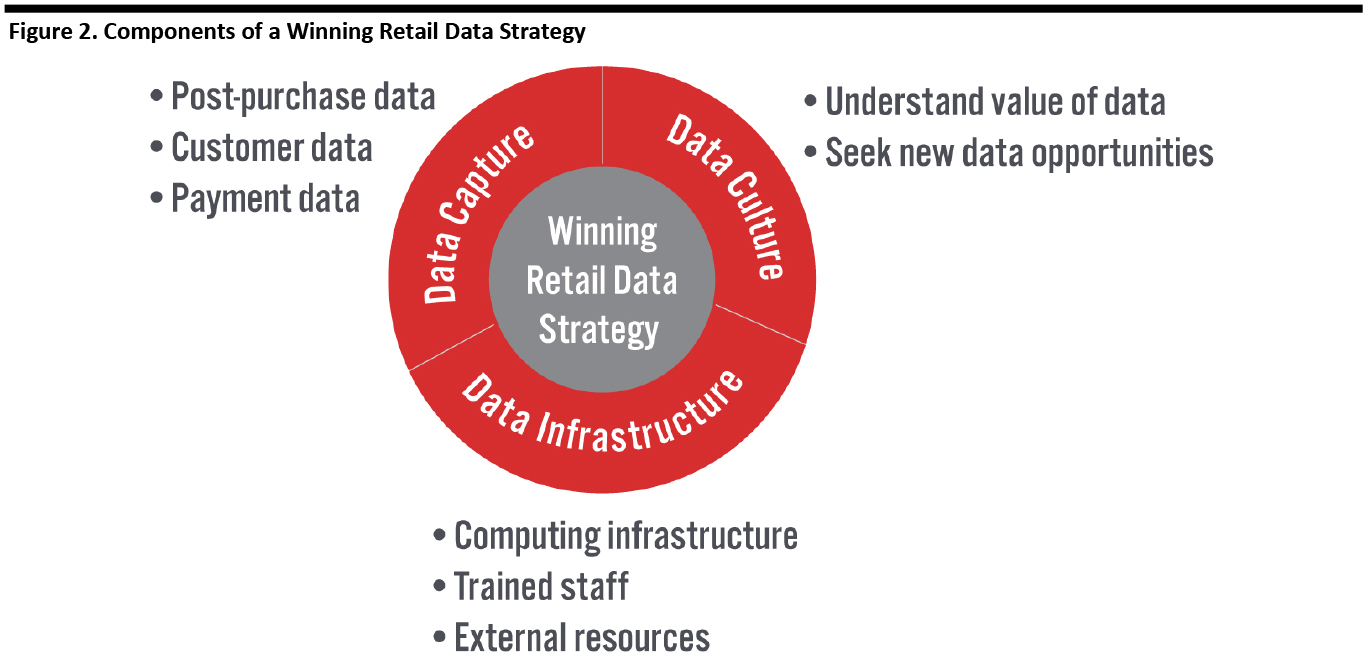

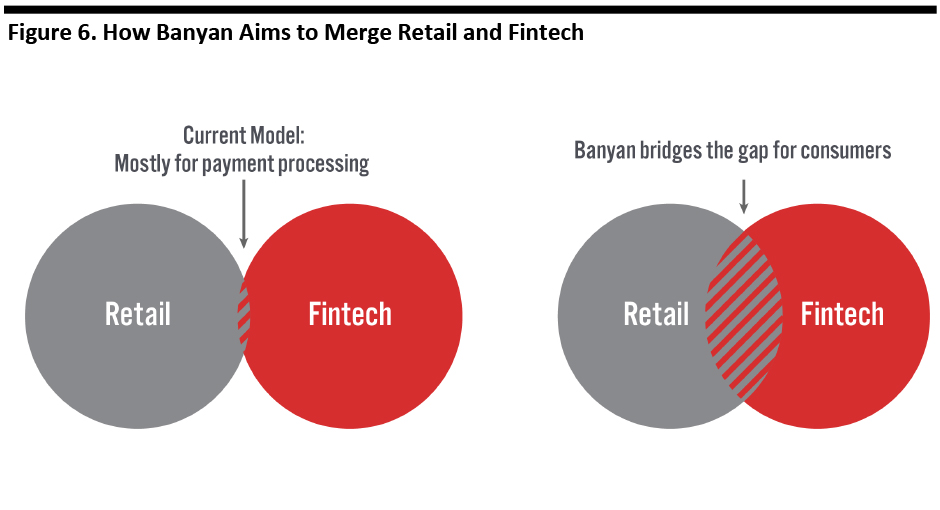

As data is critical to brick-and-mortar retailers looking to compete with e-commerce, retailers need a data strategy that comprises three main parts: data capture, data infrastructure and building and maintaining a data culture (see Figure 2).

[caption id="attachment_120788" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Data Capture

Retailers can improve offline data collection during checkout, during payment and during the lifetime of the customer relationship.

Many legacy POS systems do not collect much customer information during checkout; they possibly collect the last four digits of the customer’s credit card or hash the entire credit card number to create an identification code. Retailers can improve the quality and depth of first-party data collection using current-day POS systems that collect additional data such as customer names, e‑mail addresses, phone numbers or other loyalty-program information to link the customer to their purchase history.

The payment process offers additional data and data-gathering opportunities for retailers. Several large retailers such as Amazon, Target and Walmart have introduced their own payment platforms, including cobranded credit cards and payment apps, which collect data and connect to loyalty programs.

After purchases, loyalty programs enable data collection and use, keep the consumer connected to the retailer and also offer opportunities for personalized marketing and continuous communication with the consumer, including information on discounts and promotions, both online and offline.

Data Infrastructure

Retailers must have technology infrastructure to benefit from existing and new sources of data: As well as the ability to collect data from a variety of sources, retailers need cloud-based or local storage to retain it and trained data scientist staff to turn data into insights that they can act upon.

Much of the data that is beneficial to retailers is located outside of retailers’ doors, in third-party databases of consumer, financial and weather data, as well as other types of data, such as social media posts. Retailers are unlikely to have the necessary expertise in-house to handle these diverse sources of data and will likely have to work with third-party analytics providers. The value of consumer data increases when it is linked to multiple sources, such as demographic data, location-based mobile data, and social media or other digital data.

Data Culture

Retailers also need to create a data-focused culture throughout the organization, not just in the marketing department, but also in finance, IT and operations. Employees need to understand the crucial importance of data so as to exercise discipline in collecting it and constantly remaining vigilant for new opportunities to leverage data.

The Power of 360-Degree Data: Transforming the Future of Retail

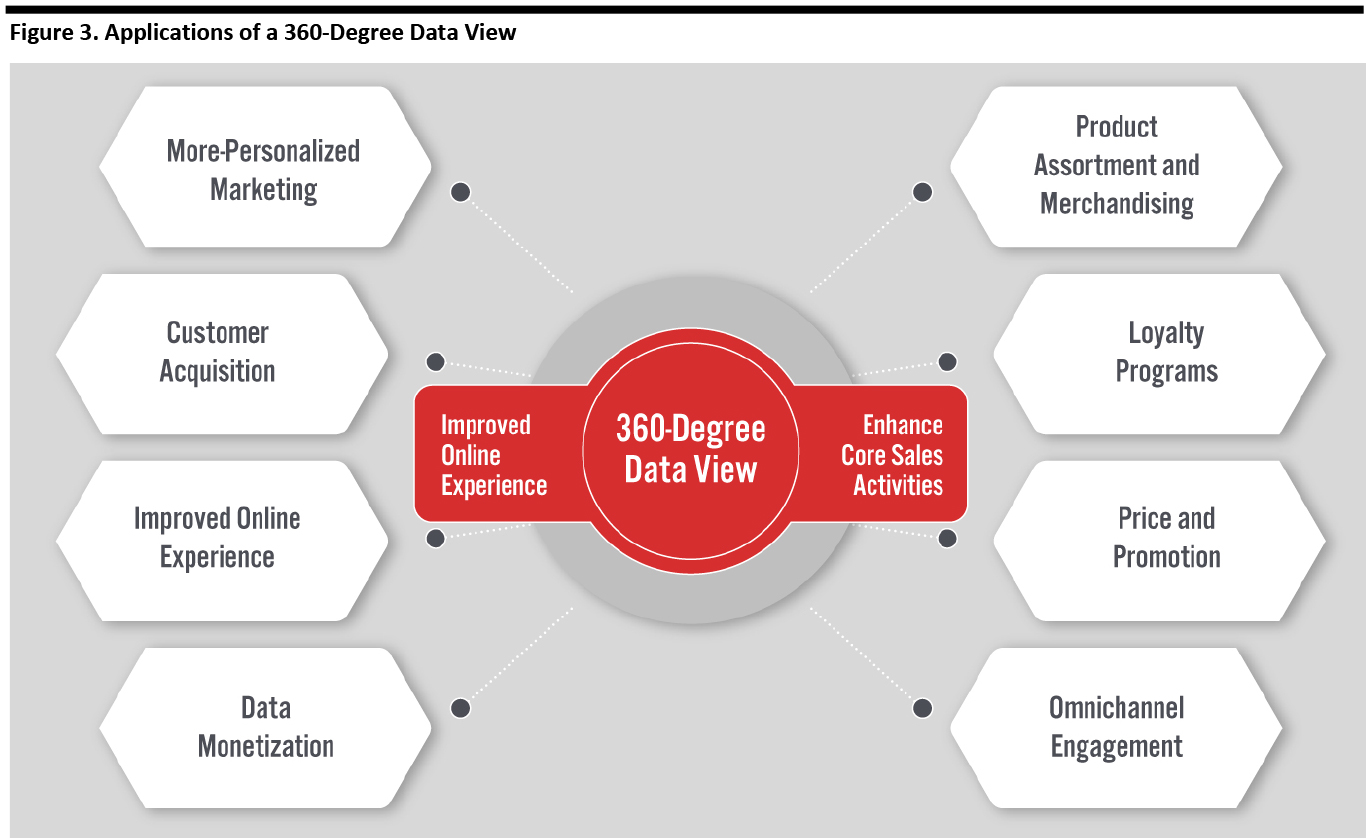

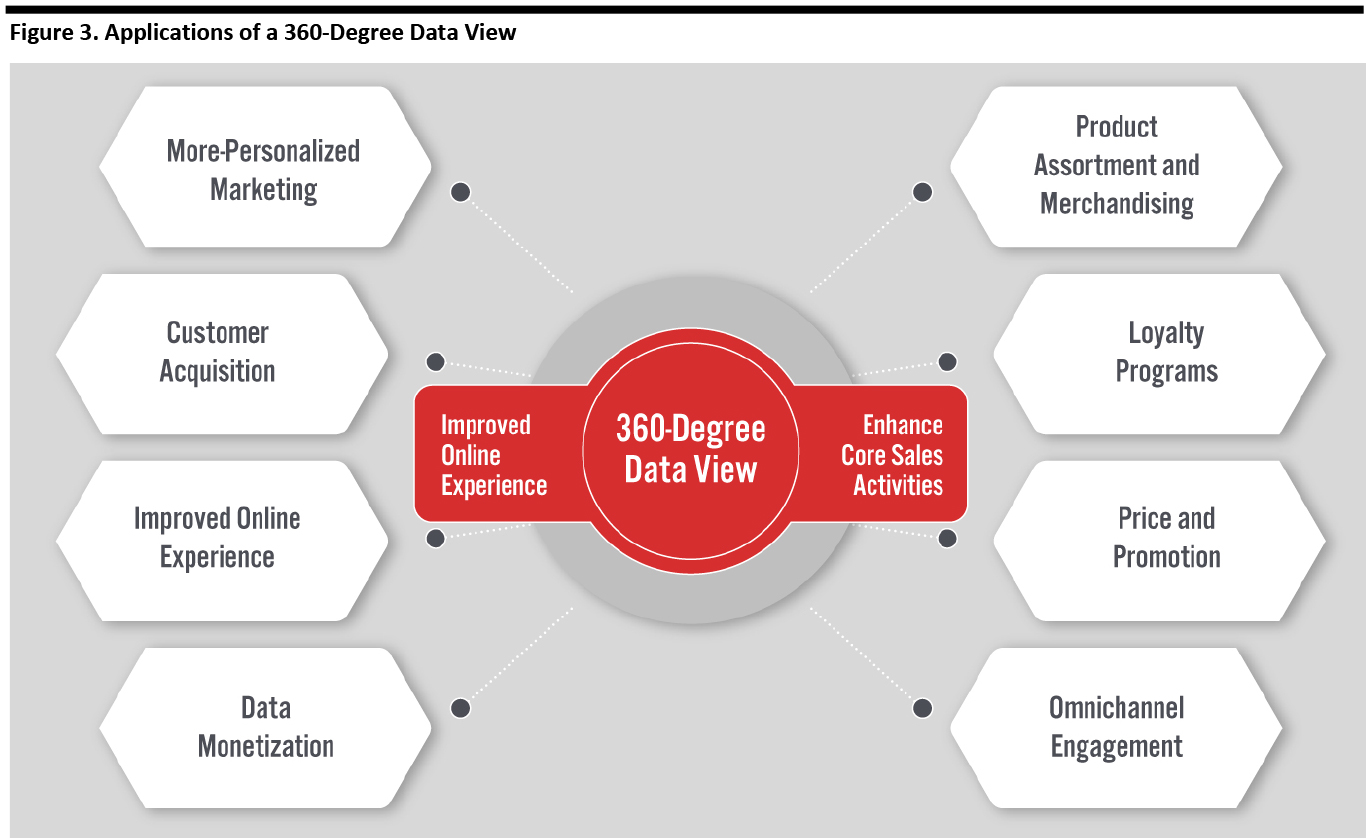

Retailers can overcome their data deficits and hone their data strategy by taking a holistic, 360-degree approach to data. Embracing 360-degree data can benefit retailers by improving engagement opportunities and customer relationships, as well as enhancing core sales activities, as illustrated in Figure 3 and discussed thereafter.

[caption id="attachment_120789" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Enhance Core Sales Activities

Retailers taking a 360-degree view of data can enhance core sales activities in the following areas:

- Product assortment and merchandising—Understanding local events and ensuring that the assortment is well-suited to the local customer base

- Loyalty programs—Enhancing the offerings of loyalty programs to boost consumer engagement

- Price and promotion—Understanding what customers buy and how often they buy, to create dynamic promotions and optimal pricing

- Omnichannel engagement—Understanding in-store consumer purchases to monetize offline-to-online opportunities

- Physical store planning and execution—Understanding consumer buying behavior to optimize store location and design

Improve Engagement Opportunities and Customer Relationships

Retailers taking a 360-degree view of data can improve engagement opportunities and customer relationships in the following areas:

- More-personalized marketing—Engaging existing customers with targeted advertisements and promotions

- Customer acquisition—Creating detailed profiles of existing customers and targeting similar shopper bases

- Improved online experience—Creating personalized online experiences, assortments and displays, as well as offering deals and promoting items specifically to individual consumers

- Data monetization—Licensing data for merchandising, pricing and promotion, as well as for internal media divisions

Banyan: Company Overview and Solution

Banyan seeks to help retailers overcome their data deficit and implement their data strategy by creating a 360-degree data view.

Company Overview

Banyan (the company’s legal name is RotoMaire, Inc.) was founded in 2019 and is headquartered in New York City. The company offers a powerful, transparent interchange platform between banks and merchants to better collect and analyze SKU data, helping retailers to improve understanding of their customers while also eliminating paper receipts.

Banyan’s proprietary API (application program interface) closes the gap between retail and financial customer data to create a unified, SKU-level view of a customer’s transactions across multiple merchants over time. It puts privacy at the forefront and delivers accurate SKU-level data for analytics and insights to unlock the value of data.

Led by CEO Jehan Luth, Banyan’s management team members have backgrounds in artificial intelligence/machine learning, corporate research and development, health data and IT analytics.

Banyan is currently in “stealth mode” but has signed up several large, global retailers as customers (including one of the top five). The company’s financial application partners (that serve more than 180 million customers) include many leading global banks, payment companies and financial technology firms.

To facilitate and speed up retail data collection, Banyan has developed several pre-built integration modules with many leading payment, e-commerce and software platforms.

Banyan’s Products

Banyan currently offers the following product categories:

- Banyan Core—Provides full access to merchant SKU data via an API for fintech companies and card issuers, once an app has a user’s consent. This product is typically used by mobile and banking apps.

- Banyan Analytics—Provides full access to normalized and labeled merchant SKU data for analytics partners. This data is only made available once the retailer approves the request.

- Banyan Lookup—Provides access to SKU data for a specific product or transaction (e.g., “Was item XYZ purchased?”), for card-linked offers and fraud prevention. The application must have a user’s consent to use this service.

Banyan’s Solution

Banyan offers banks and merchants a powerful and transparent platform to capture unified, real-time SKU transaction data to help physical retailers better understand their customers.

The platform offers the following major benefits:

- It unifies internal data sources to create a single view of the customer.

- It works outside of the merchant ecosystem to deepen customer engagement and analytics.

- It generates significant savings by reducing chargebacks (i.e., friendly fraud).

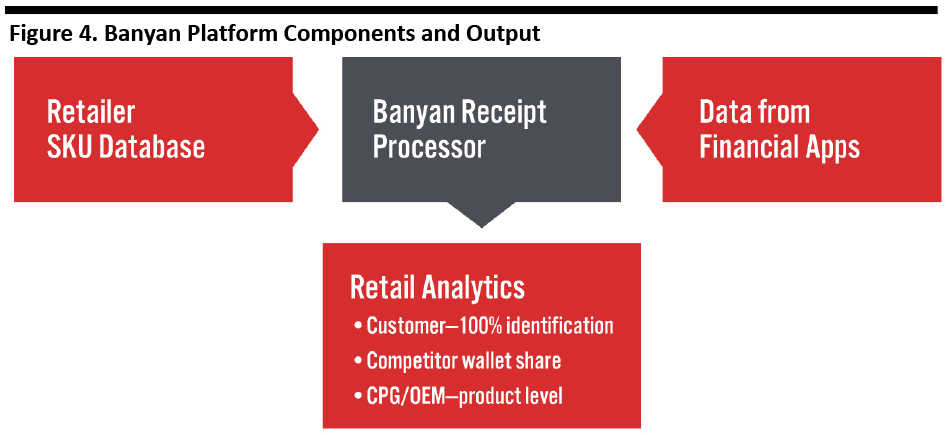

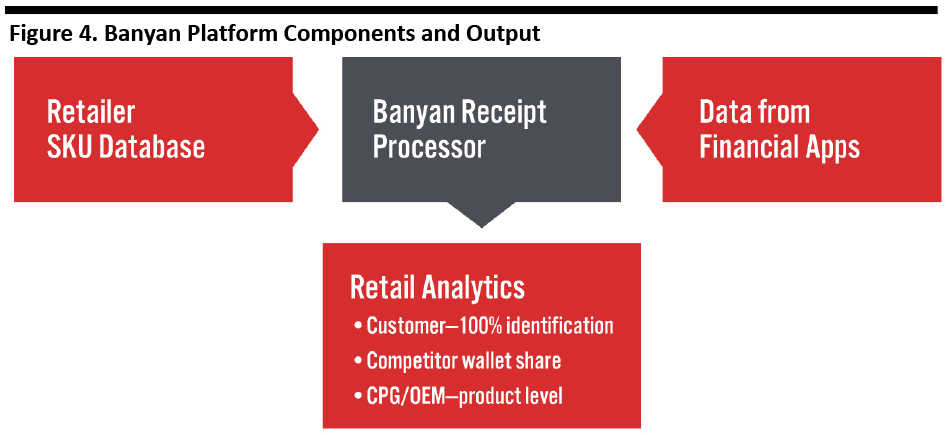

Through its partnership with financial apps, the Banyan platform is able to access a broad spectrum of consumer purchase data, bridging the information gap left by traditional POS systems. Figure 4 shows how Banyan combines a retailer’s SKU data with other data obtained from financial apps to generate a 360-degree view of the consumer, unlocking a variety of insights for retailers and CPG companies.

[caption id="attachment_120790" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

The resulting data can be analyzed and interpreted by a retailer’s internal data-analytics team or an external analytics company.

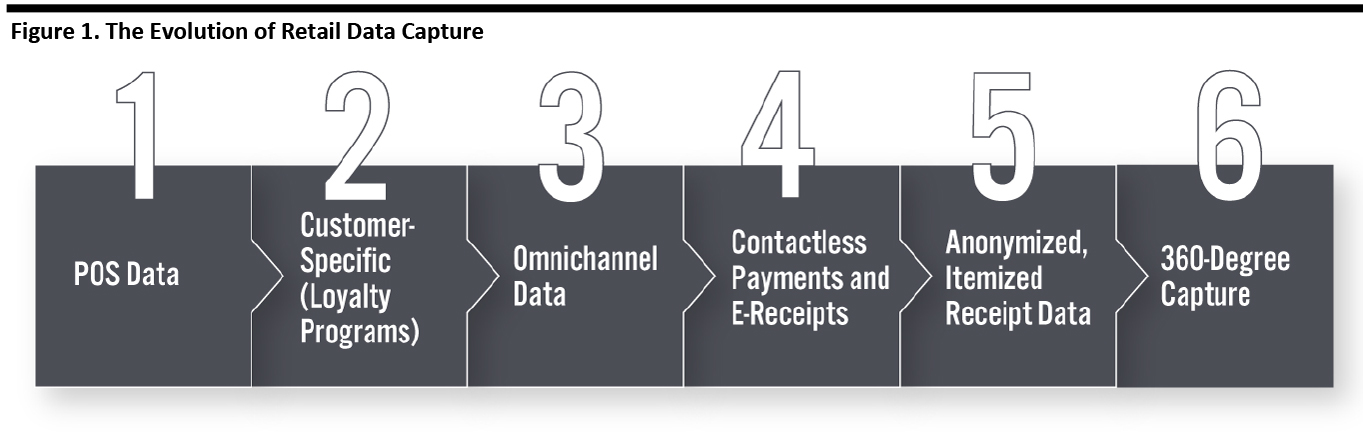

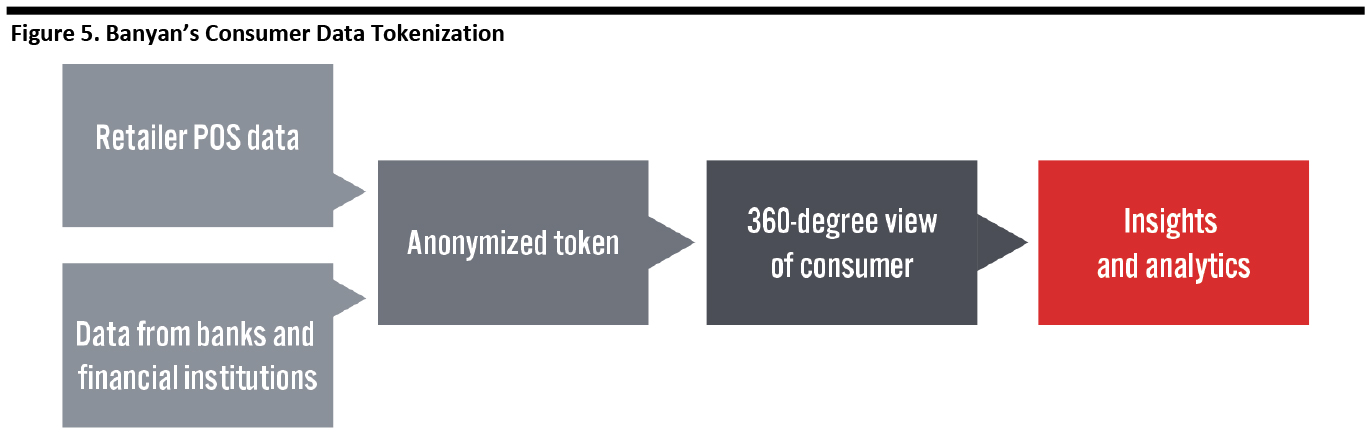

Banyan links the data it accesses via a token (i.e., a large, anonymous code) that it creates and owns, which does not include the consumer’s personal information, thereby protecting consumer privacy. Figure 5 illustrates how Banyan transforms consumer receipt data with data from financial institutions into an anonymized token, which can be used to develop a 360-degree of the consumer with insights and analytics.

[caption id="attachment_120791" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Creating a 360-degree view of the customer’s purchases presents the following benefits to retailers:

- Analytics and insights

- Card-linked offers

- Customer experience management

- Definition of customer audiences

- Enriched digital receipts

- Fraud detection

- Loyalty enhancement

- Purchase verification to eliminate chargeback fraud

Banyan has designed privacy and consumer data protection into its platform in the following ways:

- Customers not yet opted in to loyalty platforms can be engaged without knowing or disclosing their identity.

- Proprietary customer tokens power analytics software without increasing data-privacy risks.

- It leverages pre-existing consent given to financial applications.

- It does not require PCI/PII (payment card industry/personally identifiable information) certifications.

An additional benefit of Banyan’s platform is the offering of electronic receipts, which reside within the retailer’s apps and enable consumers to review their purchases and receive additional communications and promotions from retailers. These receipts also reside within the financial partner’s apps, offering them the opportunity to engage consumers beyond the retail domain with hyper-personalized messaging and targeted offers.

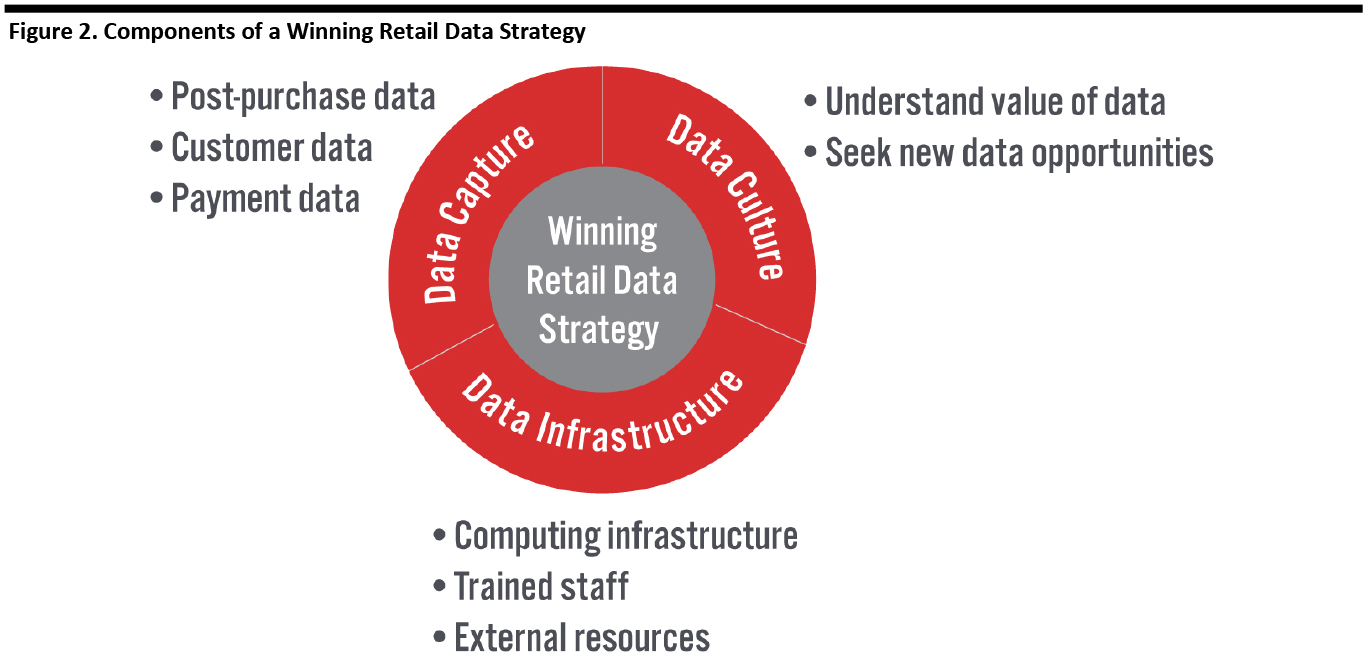

Banyan: Market Opportunity

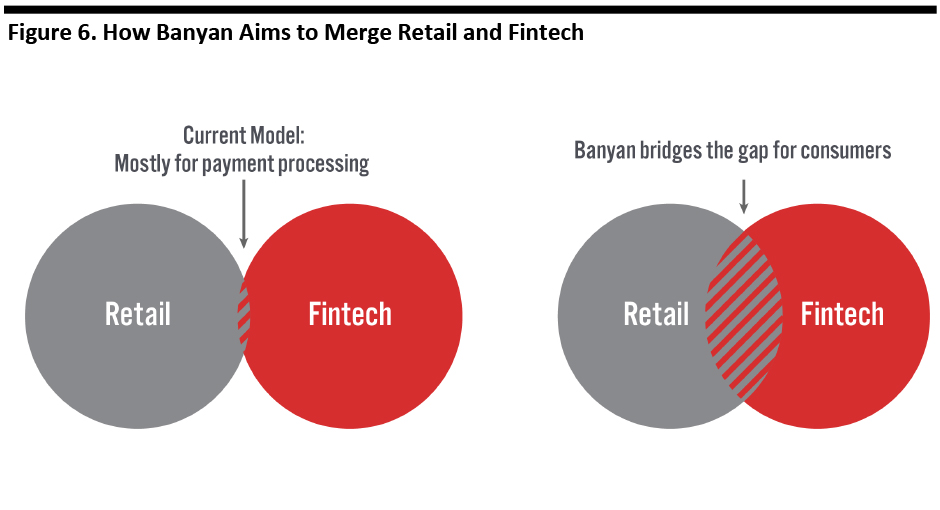

Banyan aims to bridge the gap between the enormous retail industry, which is primarily serviced by payment processors, and the innovative, fast-growing fintech industry.

[caption id="attachment_120792" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Coresight Research estimates that US retail sales will amount to nearly $4 trillion in 2020, which represents an enormous market in which innovators can help retailers to capture share more effectively. We also estimate total online retail sales of nearly $750 billion (19% of total sales) this year. This means that 81% of retail sales are not conducted online, so physical retailers have a substantial economic interest in holding and perhaps gaining market share versus e-commerce companies.

Much of this competition for market share is being waged through data, and e-commerce companies are data-centric by nature. Physical retailers possess unique sources of data from the consumers who enter their stores and only need to leverage the data that is available to them.

Platforms such as Banyan’s that can connect in-store POS data with outside-the-store financial transaction data offer a powerful tool for retailers to generate insights about their customers and develop new methods for understanding and engaging them. The $4 trillion retail industry presents retailers with substantial means to embrace solutions that help them do business better.

While there is much external data available from payment processors, market data firms and fintech companies, Banyan’s solution is, to our knowledge, one of the first to seamlessly merge POS and consumer purchases, while also providing benefits to consumers such as digital receipts.

In October 2020, Amazon launched Amazon Shopper Panel, which rewards consumers for submitting up to 10 receipts per month from other retailers, which provides intelligence on purchases at those retailers. Amazon claims that the program “will help brands offer better products and make ads more relevant on Amazon.” This move demonstrates that Amazon has recognized the value of comprehensive retail receipt data, hence prompting the launch of its own program. With many retailers reluctant to use Amazon’s services such as Amazon Web Services, which effectively aid a competitor, they could benefit from obtaining receipt data from a neutral party such as Banyan. In addition, this data could support product development among third-party marketplaces, as well as helping them improve the performance of their advertising. Moreover, whereas Banyan partners with many leading global banks and payment companies, Amazon has not announced the participation of any banks and payment platform partners in its program.

Banyan: Recent and Upcoming Announcements

Banyan is conducting a program called Net Zerø that aims to eliminate transaction fees for merchants. The company has already launched with restaurant partners and recently started a waitlist for retail partners. This program turns transaction data from POS systems into digital receipts that are shared with the consumer’s banking, budgeting and health-management apps. When the receipt is delivered to the consumer, the banks pay a fee that is shared with retailers to reduce their card-processing fees. When Banyan monetizes that data, the majority of that revenue is shared with the retailer, up to $1, which eliminates transaction fees.

Coresight Research View

Most retailers face an information blind spot from a lack of comprehensive information on customers’ purchases, both in their stores and at other retailers. Physical retailers need an edge to compete with data-centric e-commerce retailers in an increasingly competitive global retail environment: Advances in computer processing power and analytics software enable retailers to distill the wisdom from the enormous amounts of data they already possess, in combination with a wealth of external data.

Although retailers are able to know a great deal about what their customers buy in their physical and online stores, they face a vacuum regarding what consumers buy elsewhere. Retailers that leverage data analysis platforms to build complete customer profiles and offer enhanced personalization in their services should have a substantial competitive advantage over retailers not taking advantage of these platforms.

Source: Coresight Research[/caption]

Retailers Face a Data Deficit

Retailers take a variety of approaches to collecting customer data: Some do not collect customer data at all; some have partial collection methods; and some collect data through a loyalty program and use permission-based marketing. These practices often make it difficult to link a purchase to an individual shopper. Retailers seeking to leverage in-store customer data face the following challenges:

Source: Coresight Research[/caption]

Retailers Face a Data Deficit

Retailers take a variety of approaches to collecting customer data: Some do not collect customer data at all; some have partial collection methods; and some collect data through a loyalty program and use permission-based marketing. These practices often make it difficult to link a purchase to an individual shopper. Retailers seeking to leverage in-store customer data face the following challenges:

Source: Coresight Research[/caption]

Data Capture

Retailers can improve offline data collection during checkout, during payment and during the lifetime of the customer relationship.

Many legacy POS systems do not collect much customer information during checkout; they possibly collect the last four digits of the customer’s credit card or hash the entire credit card number to create an identification code. Retailers can improve the quality and depth of first-party data collection using current-day POS systems that collect additional data such as customer names, e‑mail addresses, phone numbers or other loyalty-program information to link the customer to their purchase history.

The payment process offers additional data and data-gathering opportunities for retailers. Several large retailers such as Amazon, Target and Walmart have introduced their own payment platforms, including cobranded credit cards and payment apps, which collect data and connect to loyalty programs.

After purchases, loyalty programs enable data collection and use, keep the consumer connected to the retailer and also offer opportunities for personalized marketing and continuous communication with the consumer, including information on discounts and promotions, both online and offline.

Data Infrastructure

Retailers must have technology infrastructure to benefit from existing and new sources of data: As well as the ability to collect data from a variety of sources, retailers need cloud-based or local storage to retain it and trained data scientist staff to turn data into insights that they can act upon.

Much of the data that is beneficial to retailers is located outside of retailers’ doors, in third-party databases of consumer, financial and weather data, as well as other types of data, such as social media posts. Retailers are unlikely to have the necessary expertise in-house to handle these diverse sources of data and will likely have to work with third-party analytics providers. The value of consumer data increases when it is linked to multiple sources, such as demographic data, location-based mobile data, and social media or other digital data.

Data Culture

Retailers also need to create a data-focused culture throughout the organization, not just in the marketing department, but also in finance, IT and operations. Employees need to understand the crucial importance of data so as to exercise discipline in collecting it and constantly remaining vigilant for new opportunities to leverage data.

The Power of 360-Degree Data: Transforming the Future of Retail

Retailers can overcome their data deficits and hone their data strategy by taking a holistic, 360-degree approach to data. Embracing 360-degree data can benefit retailers by improving engagement opportunities and customer relationships, as well as enhancing core sales activities, as illustrated in Figure 3 and discussed thereafter.

[caption id="attachment_120789" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Data Capture

Retailers can improve offline data collection during checkout, during payment and during the lifetime of the customer relationship.

Many legacy POS systems do not collect much customer information during checkout; they possibly collect the last four digits of the customer’s credit card or hash the entire credit card number to create an identification code. Retailers can improve the quality and depth of first-party data collection using current-day POS systems that collect additional data such as customer names, e‑mail addresses, phone numbers or other loyalty-program information to link the customer to their purchase history.

The payment process offers additional data and data-gathering opportunities for retailers. Several large retailers such as Amazon, Target and Walmart have introduced their own payment platforms, including cobranded credit cards and payment apps, which collect data and connect to loyalty programs.

After purchases, loyalty programs enable data collection and use, keep the consumer connected to the retailer and also offer opportunities for personalized marketing and continuous communication with the consumer, including information on discounts and promotions, both online and offline.

Data Infrastructure

Retailers must have technology infrastructure to benefit from existing and new sources of data: As well as the ability to collect data from a variety of sources, retailers need cloud-based or local storage to retain it and trained data scientist staff to turn data into insights that they can act upon.

Much of the data that is beneficial to retailers is located outside of retailers’ doors, in third-party databases of consumer, financial and weather data, as well as other types of data, such as social media posts. Retailers are unlikely to have the necessary expertise in-house to handle these diverse sources of data and will likely have to work with third-party analytics providers. The value of consumer data increases when it is linked to multiple sources, such as demographic data, location-based mobile data, and social media or other digital data.

Data Culture

Retailers also need to create a data-focused culture throughout the organization, not just in the marketing department, but also in finance, IT and operations. Employees need to understand the crucial importance of data so as to exercise discipline in collecting it and constantly remaining vigilant for new opportunities to leverage data.

The Power of 360-Degree Data: Transforming the Future of Retail

Retailers can overcome their data deficits and hone their data strategy by taking a holistic, 360-degree approach to data. Embracing 360-degree data can benefit retailers by improving engagement opportunities and customer relationships, as well as enhancing core sales activities, as illustrated in Figure 3 and discussed thereafter.

[caption id="attachment_120789" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Enhance Core Sales Activities

Retailers taking a 360-degree view of data can enhance core sales activities in the following areas:

Source: Coresight Research[/caption]

Enhance Core Sales Activities

Retailers taking a 360-degree view of data can enhance core sales activities in the following areas:

Source: Coresight Research[/caption]

The resulting data can be analyzed and interpreted by a retailer’s internal data-analytics team or an external analytics company.

Banyan links the data it accesses via a token (i.e., a large, anonymous code) that it creates and owns, which does not include the consumer’s personal information, thereby protecting consumer privacy. Figure 5 illustrates how Banyan transforms consumer receipt data with data from financial institutions into an anonymized token, which can be used to develop a 360-degree of the consumer with insights and analytics.

[caption id="attachment_120791" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

The resulting data can be analyzed and interpreted by a retailer’s internal data-analytics team or an external analytics company.

Banyan links the data it accesses via a token (i.e., a large, anonymous code) that it creates and owns, which does not include the consumer’s personal information, thereby protecting consumer privacy. Figure 5 illustrates how Banyan transforms consumer receipt data with data from financial institutions into an anonymized token, which can be used to develop a 360-degree of the consumer with insights and analytics.

[caption id="attachment_120791" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Creating a 360-degree view of the customer’s purchases presents the following benefits to retailers:

Source: Coresight Research[/caption]

Creating a 360-degree view of the customer’s purchases presents the following benefits to retailers:

Source: Company reports[/caption]

Coresight Research estimates that US retail sales will amount to nearly $4 trillion in 2020, which represents an enormous market in which innovators can help retailers to capture share more effectively. We also estimate total online retail sales of nearly $750 billion (19% of total sales) this year. This means that 81% of retail sales are not conducted online, so physical retailers have a substantial economic interest in holding and perhaps gaining market share versus e-commerce companies.

Much of this competition for market share is being waged through data, and e-commerce companies are data-centric by nature. Physical retailers possess unique sources of data from the consumers who enter their stores and only need to leverage the data that is available to them.

Platforms such as Banyan’s that can connect in-store POS data with outside-the-store financial transaction data offer a powerful tool for retailers to generate insights about their customers and develop new methods for understanding and engaging them. The $4 trillion retail industry presents retailers with substantial means to embrace solutions that help them do business better.

While there is much external data available from payment processors, market data firms and fintech companies, Banyan’s solution is, to our knowledge, one of the first to seamlessly merge POS and consumer purchases, while also providing benefits to consumers such as digital receipts.

In October 2020, Amazon launched Amazon Shopper Panel, which rewards consumers for submitting up to 10 receipts per month from other retailers, which provides intelligence on purchases at those retailers. Amazon claims that the program “will help brands offer better products and make ads more relevant on Amazon.” This move demonstrates that Amazon has recognized the value of comprehensive retail receipt data, hence prompting the launch of its own program. With many retailers reluctant to use Amazon’s services such as Amazon Web Services, which effectively aid a competitor, they could benefit from obtaining receipt data from a neutral party such as Banyan. In addition, this data could support product development among third-party marketplaces, as well as helping them improve the performance of their advertising. Moreover, whereas Banyan partners with many leading global banks and payment companies, Amazon has not announced the participation of any banks and payment platform partners in its program.

Source: Company reports[/caption]

Coresight Research estimates that US retail sales will amount to nearly $4 trillion in 2020, which represents an enormous market in which innovators can help retailers to capture share more effectively. We also estimate total online retail sales of nearly $750 billion (19% of total sales) this year. This means that 81% of retail sales are not conducted online, so physical retailers have a substantial economic interest in holding and perhaps gaining market share versus e-commerce companies.

Much of this competition for market share is being waged through data, and e-commerce companies are data-centric by nature. Physical retailers possess unique sources of data from the consumers who enter their stores and only need to leverage the data that is available to them.

Platforms such as Banyan’s that can connect in-store POS data with outside-the-store financial transaction data offer a powerful tool for retailers to generate insights about their customers and develop new methods for understanding and engaging them. The $4 trillion retail industry presents retailers with substantial means to embrace solutions that help them do business better.

While there is much external data available from payment processors, market data firms and fintech companies, Banyan’s solution is, to our knowledge, one of the first to seamlessly merge POS and consumer purchases, while also providing benefits to consumers such as digital receipts.

In October 2020, Amazon launched Amazon Shopper Panel, which rewards consumers for submitting up to 10 receipts per month from other retailers, which provides intelligence on purchases at those retailers. Amazon claims that the program “will help brands offer better products and make ads more relevant on Amazon.” This move demonstrates that Amazon has recognized the value of comprehensive retail receipt data, hence prompting the launch of its own program. With many retailers reluctant to use Amazon’s services such as Amazon Web Services, which effectively aid a competitor, they could benefit from obtaining receipt data from a neutral party such as Banyan. In addition, this data could support product development among third-party marketplaces, as well as helping them improve the performance of their advertising. Moreover, whereas Banyan partners with many leading global banks and payment companies, Amazon has not announced the participation of any banks and payment platform partners in its program.