DIpil Das

Introduction

Retail is changing—we are in the midst of a structural transformation from brick-and-mortar and e-commerce to unified omnichannel retail. The change is not confined to the supply side of retail; on the demand side, shopper expectations have drastically changed over the past few years. In this context, retailers face an ever-greater challenge to meet the needs of today’s always-on, hyperconnected and multichannel shoppers. Furthermore, e-commerce penetration is on the rise, with US e-commerce sales growing at almost four times the rate of total retail sales. For 2020 overall, we estimate that US e-commerce sales will grow by around 25% to reach $696.5 billion, primarily driven by consumers switching spending online due to the coronavirus. Between March 10 and March 20, for example, digital spending on essentials such as groceries increased by 230% in California, 167% in Louisiana, 158% in New York and 157% in Washington, according to Salesforce. Analyzing historical sales data is not sufficient for retailers and suppliers to succeed. In fact, it is entirely redundant in cases when retailers are deciding on carrying a new product—when no sales data is available. Retailers and suppliers need to build a pre-emptive approach to foresee consumer trends and behavior and so bring in the right innovation. The importance of this forward-looking approach is underlined by the success of American food company Chobani over the past decade, which shook the likes of General Mills with its 100-calorie Greek yogurt. Founded in 2005, Chobani disrupted the market with its preservative-free and low-fat yogurt. Today, Chobani is the most-consumed Greek yogurt brand in the US—46 million Americans consume Chobani yogurt in any one month, according to Statista’s calculations based on US Census data and the Simmons National Consumer Survey released in July 2019 by consumer survey company MRI-Simmons. Together, these market dynamics put unprecedented pressure on retail category managers and their suppliers to ensure that they make the right investments to meet shopper demand. In this report, we examine Centricity, an analytics company that leverages AI and machine learning to understand changing shopper demand. The company uses predictive analytics to unlock a pre-purchase picture of the consumer by mapping intent-to-purchase paths. By combining these insights with actual sales data, the company provides retailers and manufacturers with on-demand actionable insights. Among the points of discussion, we consider key industry trends that directly or indirectly impact retail category management. We also explore Centricity’s solution in detail, later in this report.Category Management Problems: What, When and How

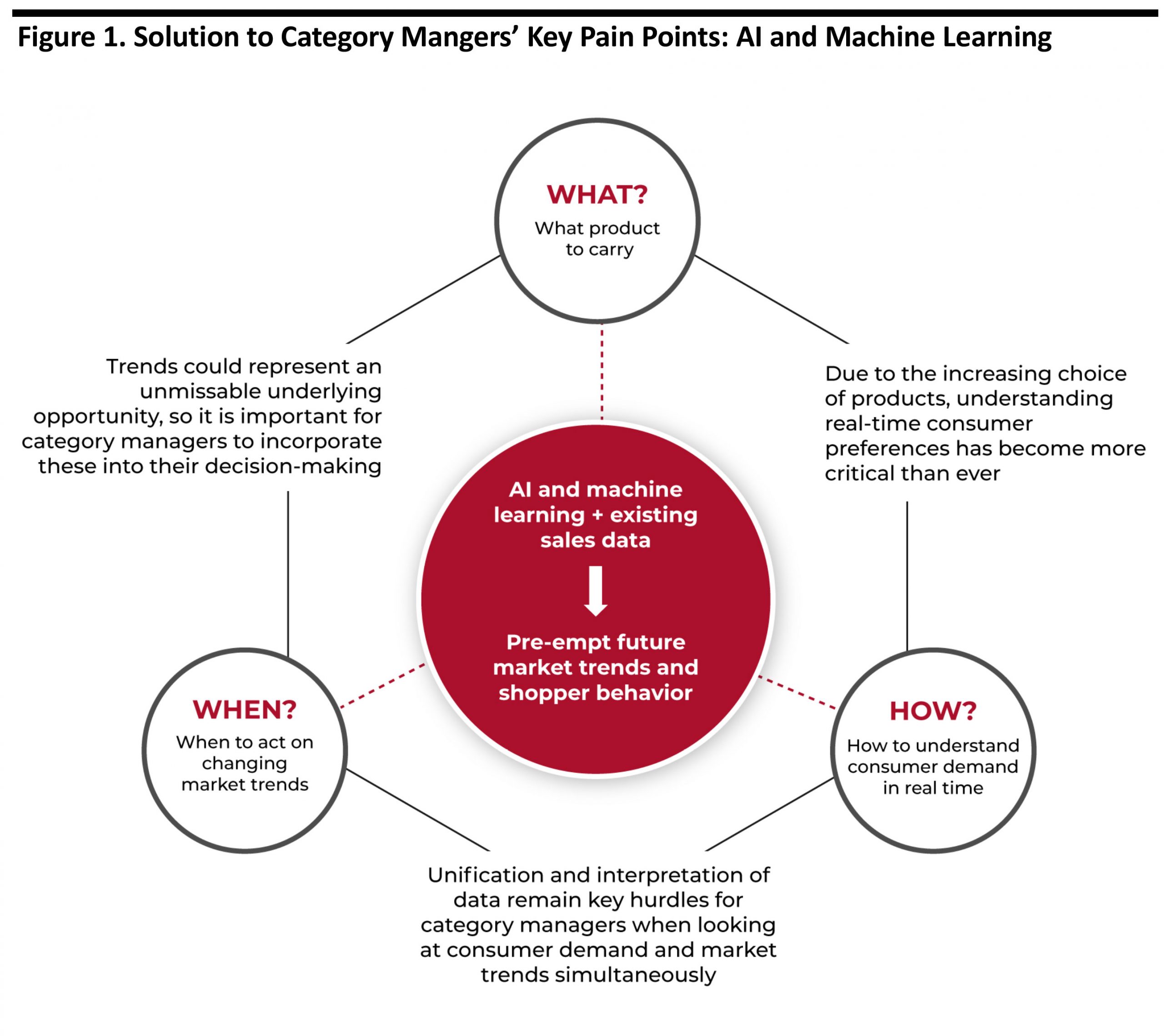

The new retail reality is fast-moving, and shopper behavior is changing at the same rate. To be successful, category managers need to leverage AI and analytics to paint a forward-looking picture of consumer demand and capture changes in real time. Figure 1 underlines the key pain points of category managers that AI and machine learning can solve. [caption id="attachment_113472" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Industry Overview

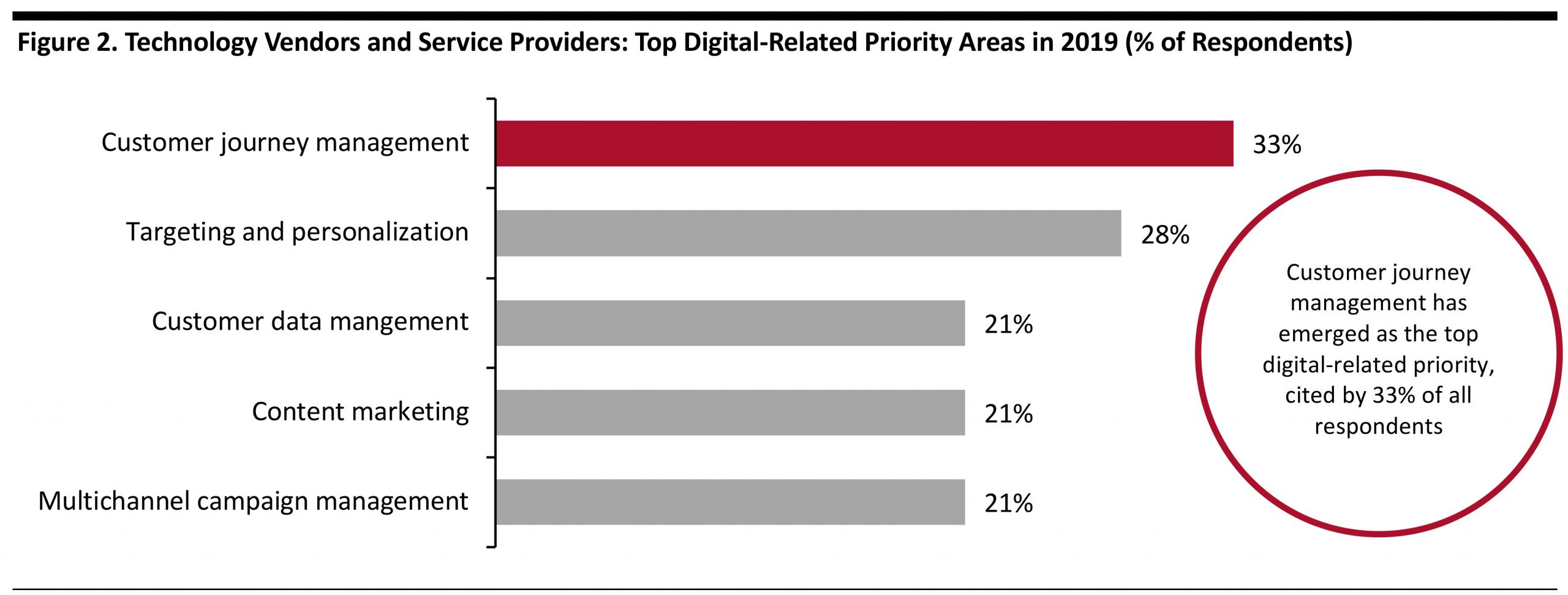

Changing Retail Landscape Underscores Importance of Data Analytics Today’s shopper uses multiple channels to search for products before making a purchase, and brand loyalty has reduced because of the abundance of choice. It has therefore become easier for market entrants to connect with the consumer, and legacy brands are being disrupted more frequently and faster than before. When interacting with brands and retailers, consumers leave a trail of engagement and behavioral data, such as purchase history and preferred shopping time. Large pockets of data from multiple channels can be leveraged to build relevant shopper profiles across different regions and types of demography. Micro-market decisions, which involve customizing product assortment down to the store level, can be critical in determining the success of category managers—but will only be possible by making data more accessible and, more importantly, by making sense of it. We are seeing increasing interest in mapping customer journeys across channels. In fact, customer journey management has emerged as the top digital-related priority, cited by 33% of technology vendors or service providers in Adobe’s 2019 Digital Trends survey. The same survey revealed that 21% of all respondents cited customer data management as their top digital priority. [caption id="attachment_113473" align="aligncenter" width="700"] Base: 12,815 global technology vendors or service providers

Base: 12,815 global technology vendors or service providers Source: Adobe [/caption] Forward-Looking Shopper-Centric Decisions Are Crucial in Retail As retailers try to sell through multiple channels while fulfilling dynamic shopper demand, operations tend to become more complex. This puts added pressure on inventory optimization, and in the event of being left with unsold inventory, retailers are forced to turn to unplanned markdowns to clear stock. In fact, some 50% of survey respondents cited inventory misjudgment as a barrier to selling products at full price, according to an October 2018 Coresight Research survey of 200 retail decision-makers in the US. Category managers have access to syndicated data and forecasts, but these have certain limitations and even drawbacks. The key limitation of syndicated data is that the estimates fail to capture granular product-level details. Furthermore, in some cases, the data may fail to recognize a self-fulfilled “bubble” for a few products. For example, a product may move quickly off the shelf due to promotional pricing rather than consumer purchase intent. Consumer data sets, if used correctly, can improve retailers’ understanding of shopper trends, but they can be overwhelming and confusing if retailers lack the data analytics tools to correctly interpret the data. Success in category management depends on the mining of a large volume and variety of consumer data to generate insights: Actionabledata, not just a large quantity of data, is the key to success. In March 2020, we surveyed grocery/drug retailers and CPG suppliers worldwide about the key skills required to succeed as a category manager and their changing role over time.

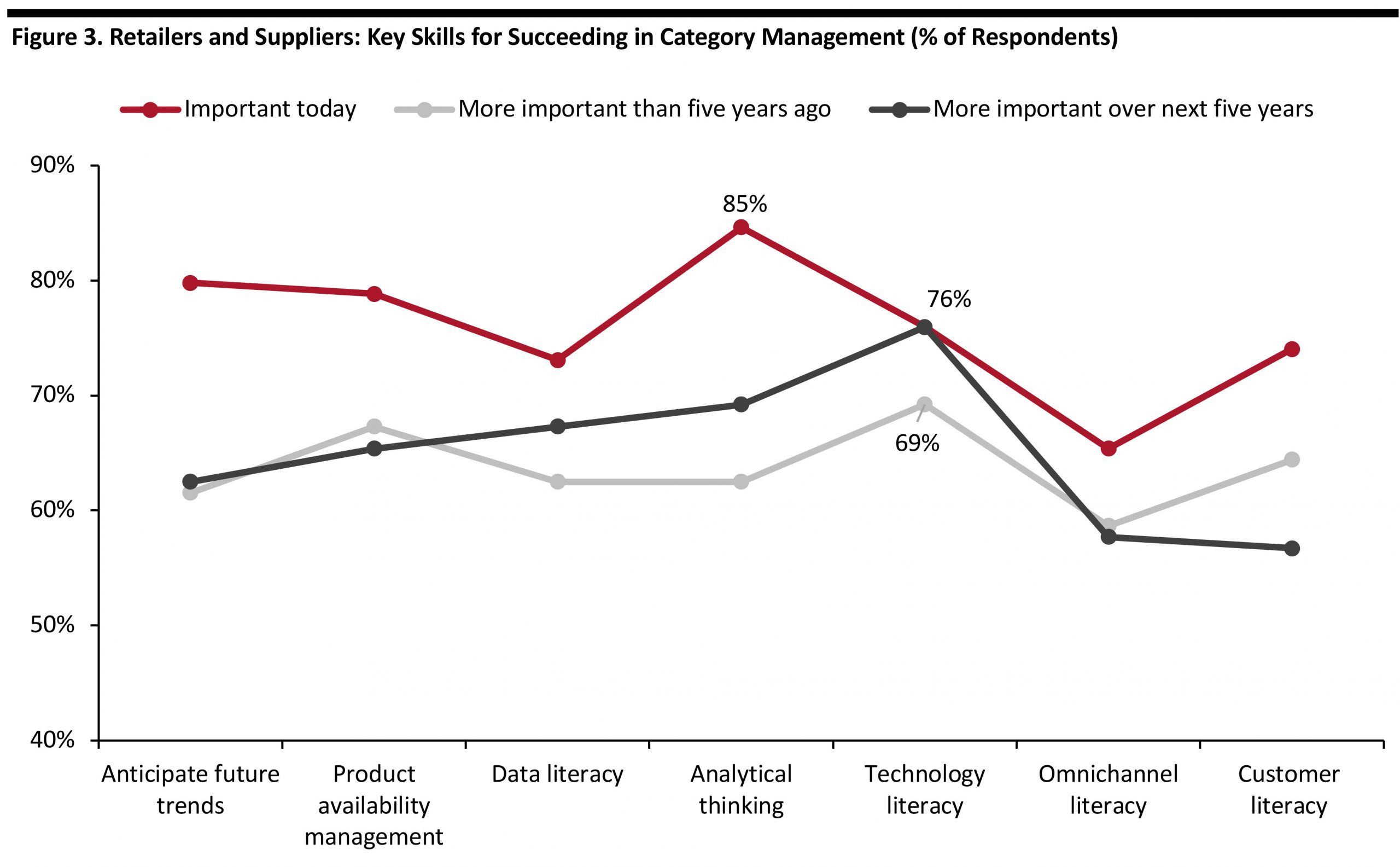

- Fully 85% of respondents cited analytical thinking as an important skill that is necessary today.

- The majority of respondents (69%) believe that technology literacy has a more important role to play in succeeding as a category manager today than five years ago.

- Over the next five years, the majority of respondents (76%) believe that technology literacy will play a key role in determining the success of category managers.

Base: 104 grocery/drug retailers and CPG suppliers Survey question summary: What key skills/abilities are important for succeding in the role of retail category manager?

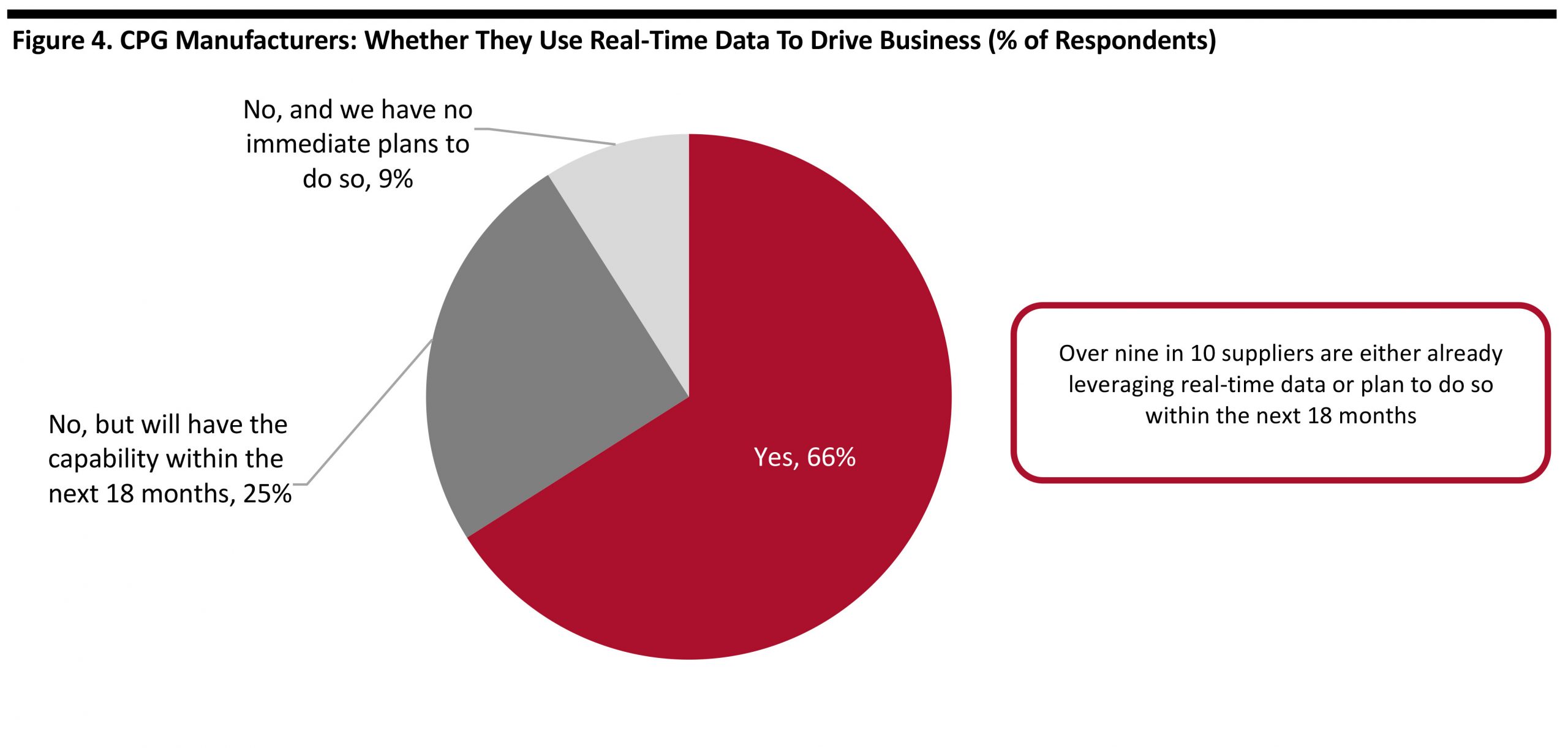

Base: 104 grocery/drug retailers and CPG suppliers Survey question summary: What key skills/abilities are important for succeding in the role of retail category manager? Source: Coresight Research [/caption] CPG Manufacturers: Harnessing Real-Time Data Remains a Key Challenge The disruptions caused by market forces such as multiple sales channels, always-on shoppers and agile competitors are not confined to retailers alone. There is an increasing need for manufacturers to leverage advanced technologies such as machine learning and AI to gain visibility into consumer interest at scale and down to the micro-market level. In order to succeed and stand out from the competition, manufacturers are tasked with building end-to-end agility across the entire supply chain. Manufacturers need to harness the power of real-time data to not only be responsive to market signals but also build a pre-emptive approach to manufacturing—and the ongoing coronavirus pandemic has underlined the importance of this. For example, consumer interest in yeast increased by over 6,000% over a period of two weeks before US states implemented lockdowns due to coronavirus, according to Centricity—this was weeks before the product went out of stock at multiple stores. CPG manufacturers have embraced real-time data to a very large extent. Some 66% of CPG manufacturers use real-time data to drive their business, and 25% expect to leverage real-time data by mid-2021, according to a December 2019 survey by American trade publication IndustryWeek in partnership with Oracle. [caption id="attachment_113475" align="aligncenter" width="700"]

Base: 167 global CPG manufacturers

Base: 167 global CPG manufacturers Survey question summary: Is your company leveraging real-time data in decision-making?

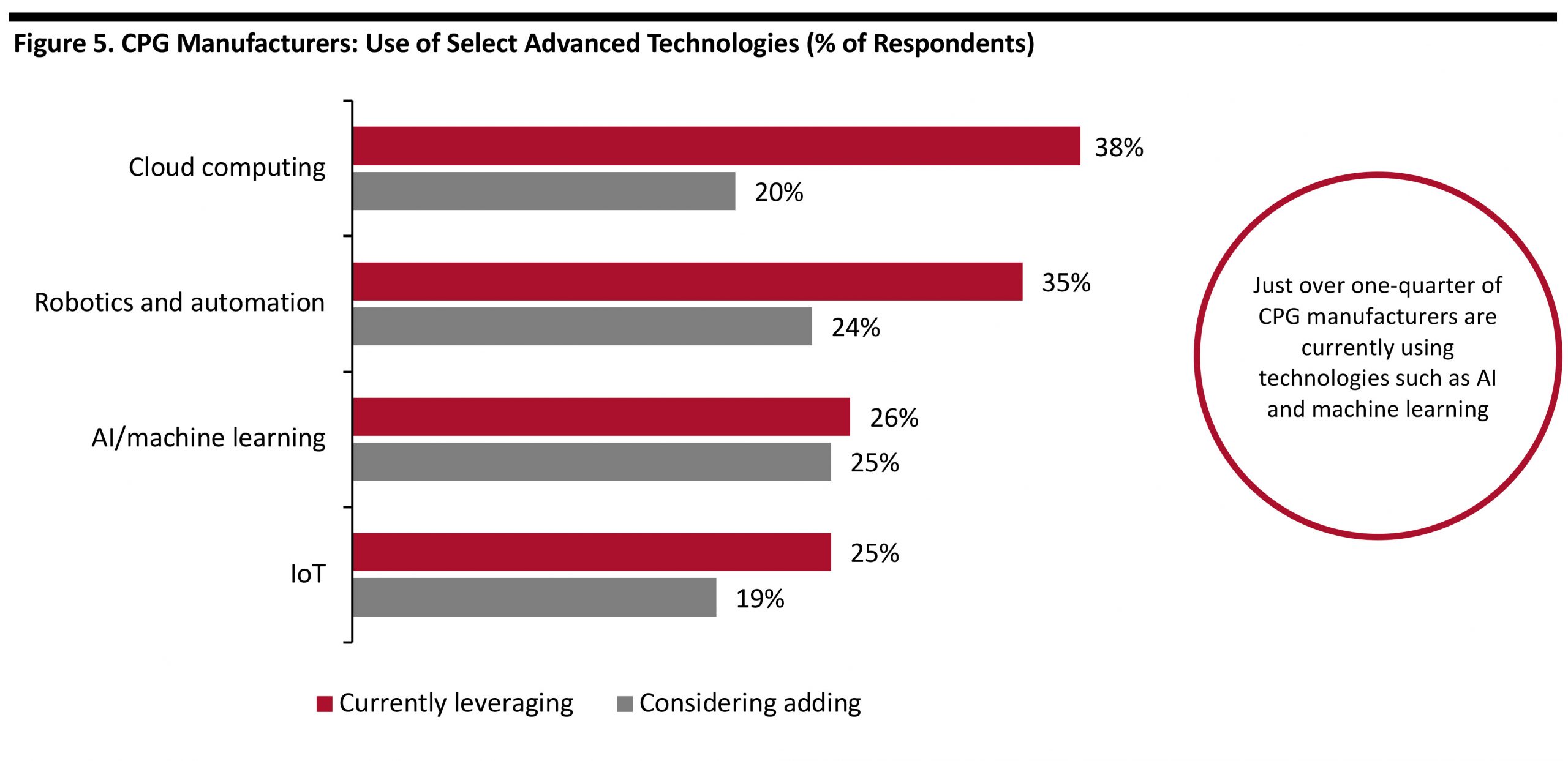

Source: IndustryWeek/Oracle [/caption] Although the overwhelming majority of CPG manufacturers leverages real-time data to drive their business, it needs to be combined with technologies such as AI and machine learning to harness its true power. The same survey revealed that the overall adoption of advanced technologies such as AI and machine learning is currently relatively low: Only 26% of respondents cited using such technologies. [caption id="attachment_113476" align="aligncenter" width="700"]

Base: 167 global CPG manufacturers

Base: 167 global CPG manufacturers Survey question summary: Which smart manufacturing technologies is your company currently leveraging or considering adding within the next three years?

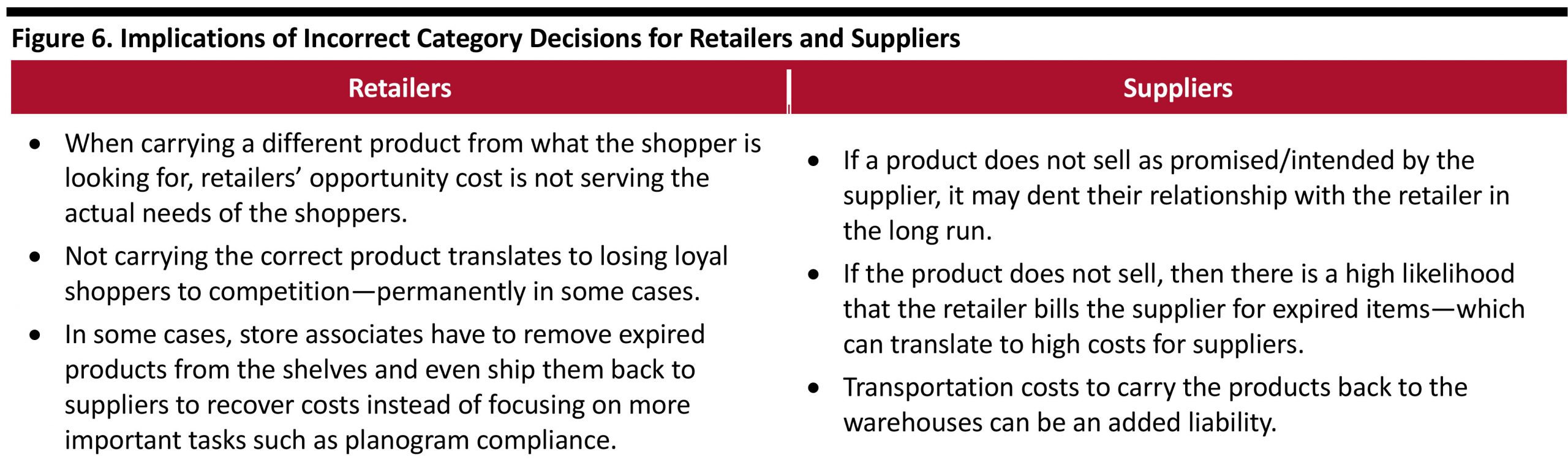

Source: IndustryWeek/Oracle [/caption] Incorrect Category Management Decisions Have Deep Implications Decision-making has continued to become increasingly challenging for retailers. Both retailers and their suppliers understand the importance of joint business planning and increased collaboration, yet there are many obstacles, including misaligned goals. Furthermore, lack of trust and transparency remains a key challenge between retailers and suppliers, which often translates into limited data sharing and misaligned key performance indicators. The outcome is that retail category managers often rely on their instincts when considering new products with near-zero differentiation for their stores. In such an environment of isolated planning, category managers may not be able to forecast market trends accurately, which may prevent them from reaching the ultimate goal of shopper centricity. More importantly, “bad innovation” or an incorrect decision has a ripple effect on the overall business of both retailers and their suppliers. [caption id="attachment_113477" align="aligncenter" width="700"]

Source: Centricity/Coresight Research[/caption]

Effective Category Management Increases Profitability

Retailers are under increasing pressure to bring in the right innovation at the right store and at the right time. This means that they must correctly align their assortments with shopper demand.

Retail category managers’ decisions have a ripple effect on their organizations. For example, if a category manager decides to carry a new product, there is an immediate impact on supply chain processes such as inventory management and warehousing. Most decisions by category managers impact the store associates for manual tasks such as planogram generation and assortment planning. In addition, discontinuation of old products involves marking down the old products—at a loss in some cases.

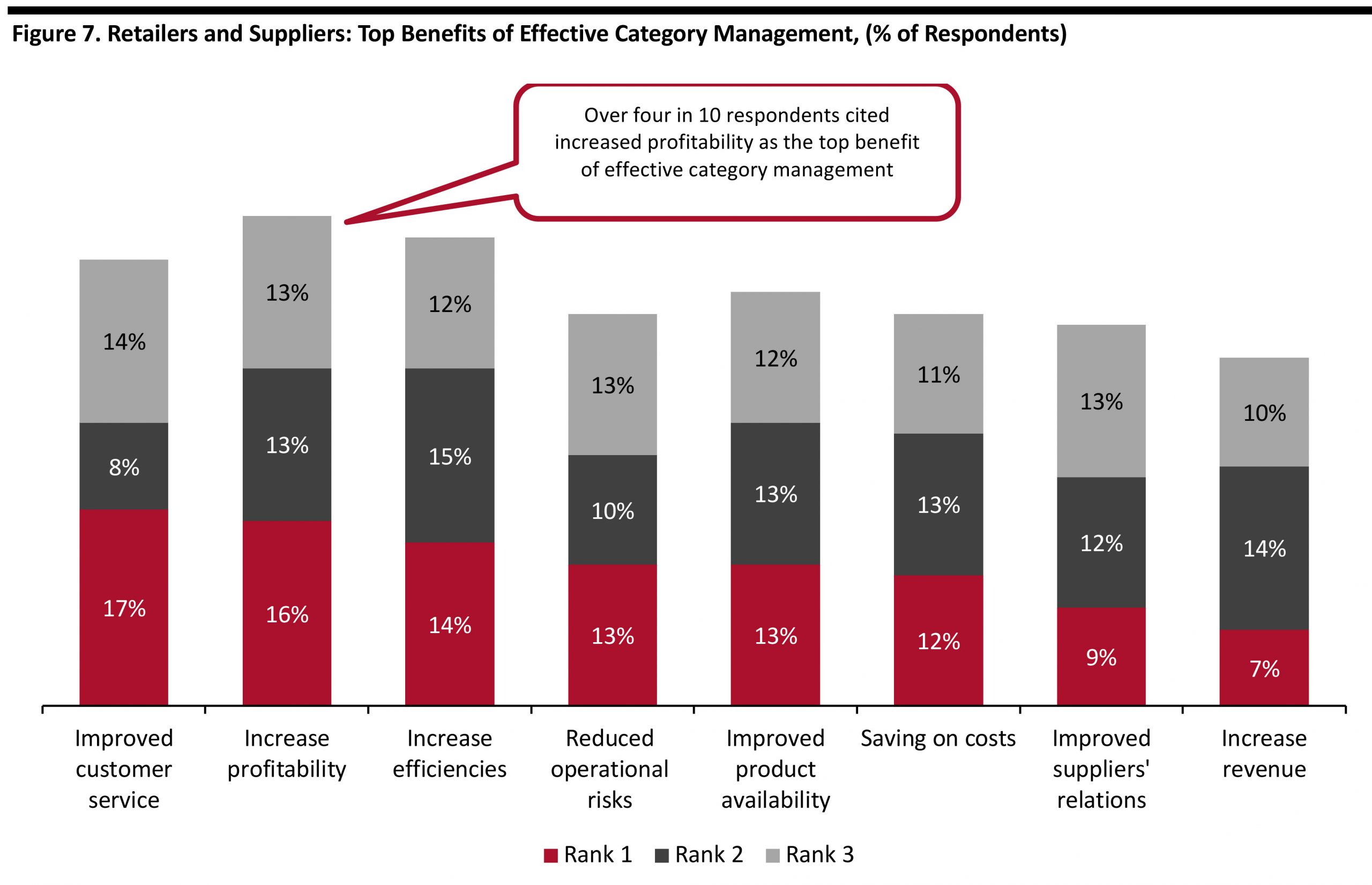

Category managers therefore substantially impact store operations and, in turn, overall profitability. In fact, increased profitability (42%), higher efficiencies in operations (41%) and better customer service (39%) surfaced as the top benefits of effective retail category management, according to our March 2020 survey.

[caption id="attachment_113478" align="aligncenter" width="700"]

Source: Centricity/Coresight Research[/caption]

Effective Category Management Increases Profitability

Retailers are under increasing pressure to bring in the right innovation at the right store and at the right time. This means that they must correctly align their assortments with shopper demand.

Retail category managers’ decisions have a ripple effect on their organizations. For example, if a category manager decides to carry a new product, there is an immediate impact on supply chain processes such as inventory management and warehousing. Most decisions by category managers impact the store associates for manual tasks such as planogram generation and assortment planning. In addition, discontinuation of old products involves marking down the old products—at a loss in some cases.

Category managers therefore substantially impact store operations and, in turn, overall profitability. In fact, increased profitability (42%), higher efficiencies in operations (41%) and better customer service (39%) surfaced as the top benefits of effective retail category management, according to our March 2020 survey.

[caption id="attachment_113478" align="aligncenter" width="700"] Base: 104 grocery/drug retailers and CPG suppliers

Base: 104 grocery/drug retailers and CPG suppliers Survey question summary: Respondents were asked to rank in order of importance the benefits of effective retail category management, with “rank 1” as most important.

Source: Coresight Research [/caption]

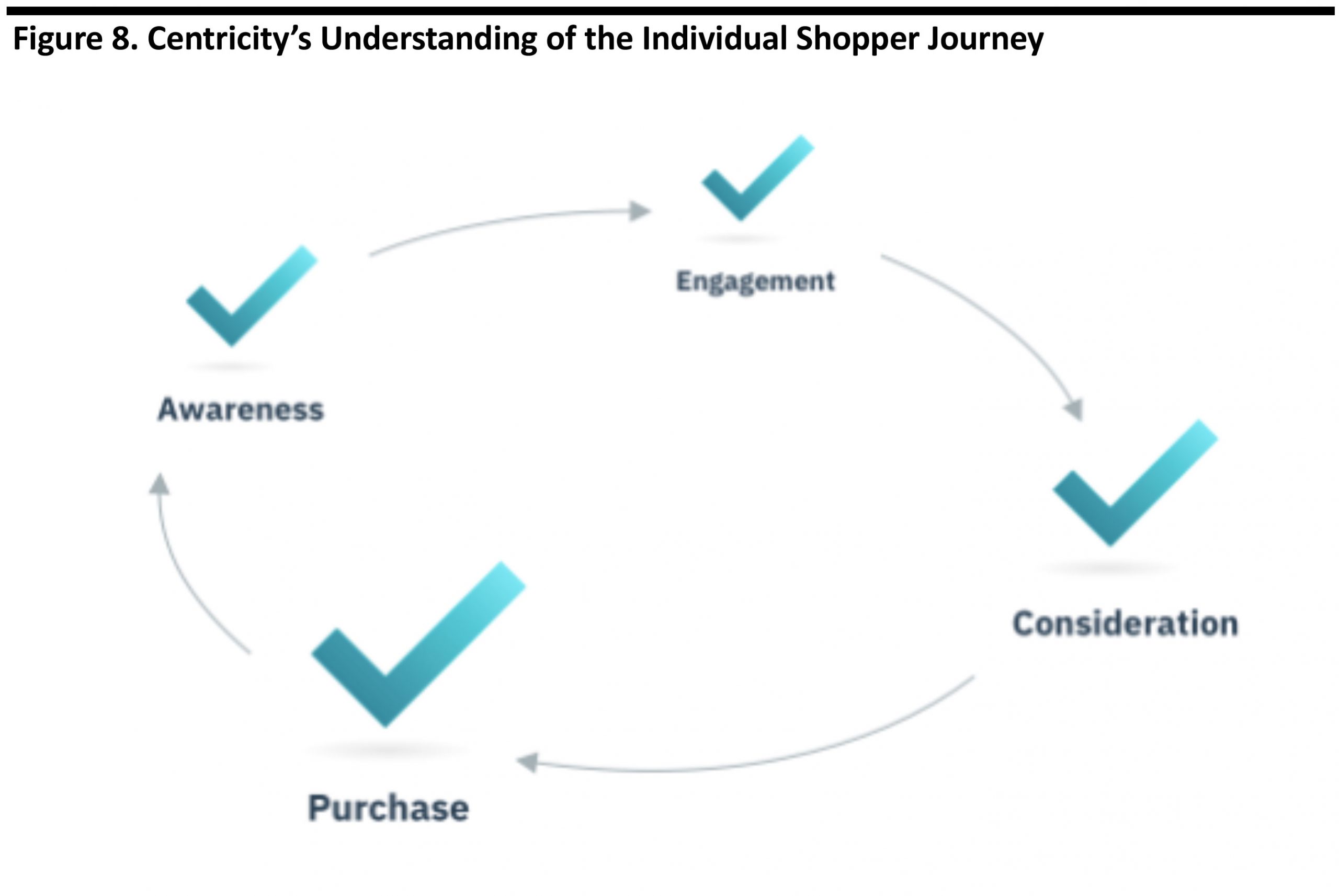

Centricity: Company Overview and Solution

Centricity’s cloud-based customer analytics platform leverages AI and machine learning algorithms to generate actionable customer insights—identifying whether consumers are interested in buying a product or not, across geographies and demography, which the company refers to as “consumer intent.” Centricity aims to provide real-time, forward-looking and actionable insights into consumer behavior to help retail category managers and manufacturers improve their decision-making mechanism. How Can Centricity’s Platform Help CPG Manufacturers? CPG manufacturers are under increasing pressure to move beyond traditional analysis of shopper behavior, and although they may be emphasizing the importance of results-driven collaboration with their retailers, there are multiple challenges that still remain. The biggest challenge that plagues the industry is the lack of trust and collaboration between manufacturers and retailers, which keeps the data-driven collaboration capped at all times. In order to innovate for meeting the needs of tomorrow’s shopper, manufacturers need a holistic view of the shopper. For creating an impact, CPG manufacturers need to look beyond how consumers behave at individual stores—they need to leverage cross-retailer, real-time shopper data to understand what shopper preferences. However, there are persistent hinderances, such as lack of skilled workforce, that limit the ability of manufacturers to find insights from large amounts of unstructured data. Centricity’s platform can benefit manufacturers by allowing them to understand the changing shopper preferences in real-time, by leveraging multiple data sources. This information will allow manufacturers to invest their resources in what will actually sell, not what they believe will sell. This has a direct impact on manufacturers’ R&D decisions and allowing them to uncover exclusive market trends and invest in the right product to reduce overall supply chain costs. How Can Centricity’s Platform Help Retailers? Centricity’s platform can help retail category mangers simplify their decision-making process and help align supply with consumer demand. Retailers are often under a fix when deciding on what brand to carry, types of promotions and the overall product assortment. This is primarily down to limited information on what Centricity refers to as “intent data,” data points that build a forward-looking picture of consumer demand and preferences. [caption id="attachment_113479" align="aligncenter" width="700"] Source: Centricity/Coresight Research[/caption]

Centricity’s platform enables retail category managers to foresee disruptions before they occur and be at the forefront of innovation by carrying the right quantity of the right products at the right stores. Retailers can benefit from micro-market-level insights, which can help merchandising teams to localize their product assortment. Another key benefit for retailers is that the time saved can be channeled towards other relevant tasks such as planogram compliance.

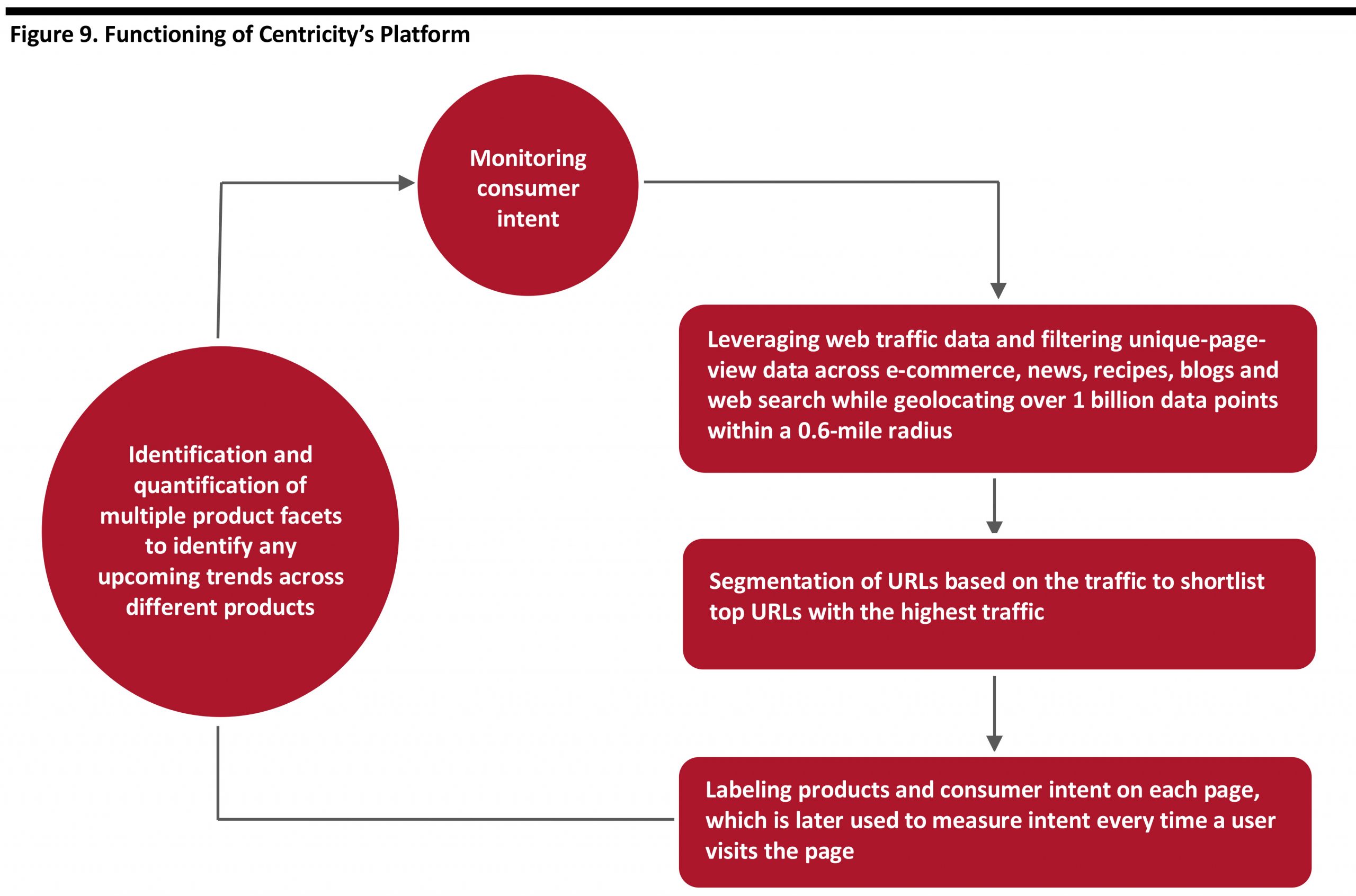

How Does Centricity’s Platform Function?

What differentiates Centricity from competitors is its ability to provide insights on pre-purchase consumer intent. The company’s focus is to help brick-and-mortar retailers to optimize the assortment of their products down to the stock-keeping unit level. In fact, it is necessary to create an assortment that matches demand, because digital native retailers such as Amazon are already doing it in real time. On the other hand, it’s focus for manufacturers is to help them maintain their relevance in their market by having the right tools at their disposal.

Centricity tracks web page views by consumers across e-commerce, news, recipes, blogs and web search to find out what people are searching for. In one day, the company claims to record over 1 billion-page views—which translates to location, time and URL data. In the next step, the company leverages both human intelligence and machine learning to identify the URLs that receive the highest traffic and label them with products and consumers’ intent to purchase. Centricity is thus able to understand real-time consumer purchase intent for a wide range of products.

In addition, the company applies correlation analysis against sales data to identify the correlation between sales data and consumer intent. Figure 6 explains the functioning of Centricity’s platform.

[caption id="attachment_113480" align="aligncenter" width="700"]

Source: Centricity/Coresight Research[/caption]

Centricity’s platform enables retail category managers to foresee disruptions before they occur and be at the forefront of innovation by carrying the right quantity of the right products at the right stores. Retailers can benefit from micro-market-level insights, which can help merchandising teams to localize their product assortment. Another key benefit for retailers is that the time saved can be channeled towards other relevant tasks such as planogram compliance.

How Does Centricity’s Platform Function?

What differentiates Centricity from competitors is its ability to provide insights on pre-purchase consumer intent. The company’s focus is to help brick-and-mortar retailers to optimize the assortment of their products down to the stock-keeping unit level. In fact, it is necessary to create an assortment that matches demand, because digital native retailers such as Amazon are already doing it in real time. On the other hand, it’s focus for manufacturers is to help them maintain their relevance in their market by having the right tools at their disposal.

Centricity tracks web page views by consumers across e-commerce, news, recipes, blogs and web search to find out what people are searching for. In one day, the company claims to record over 1 billion-page views—which translates to location, time and URL data. In the next step, the company leverages both human intelligence and machine learning to identify the URLs that receive the highest traffic and label them with products and consumers’ intent to purchase. Centricity is thus able to understand real-time consumer purchase intent for a wide range of products.

In addition, the company applies correlation analysis against sales data to identify the correlation between sales data and consumer intent. Figure 6 explains the functioning of Centricity’s platform.

[caption id="attachment_113480" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

In order to label products and consumer intent, Centricity leverages a human-in-the-loop, natural-language processing system that operates in the following three distinct phases:

Source: Company reports/Coresight Research[/caption]

In order to label products and consumer intent, Centricity leverages a human-in-the-loop, natural-language processing system that operates in the following three distinct phases:

- Entity Extraction: In this phase, Centricity identifies relevant products on the page. For example, chocolate is an entity in the sentence: “Eating chocolates increases the risk of diabetes.”

- Sentiment Analysis: For each instance of an entity being identified in the first phase, Centricity determines the sentiment on a scale of -5 to +5, which corresponds to consumer intent to purchase a product or not.

- Classification: With all the entities, in parallel to the sentiment analysis, Centricity performs standard classification and assigns each instance to an entity in its hierarchy. Once the classification is done, Centricity’s platform assigns an intent score to each entity by averaging the sum of scores of all instances. For example, if there are three references to “chocolate,” a +1, a -1 and a +3, the algorithm would generate a score of “+1” for every view of that page.

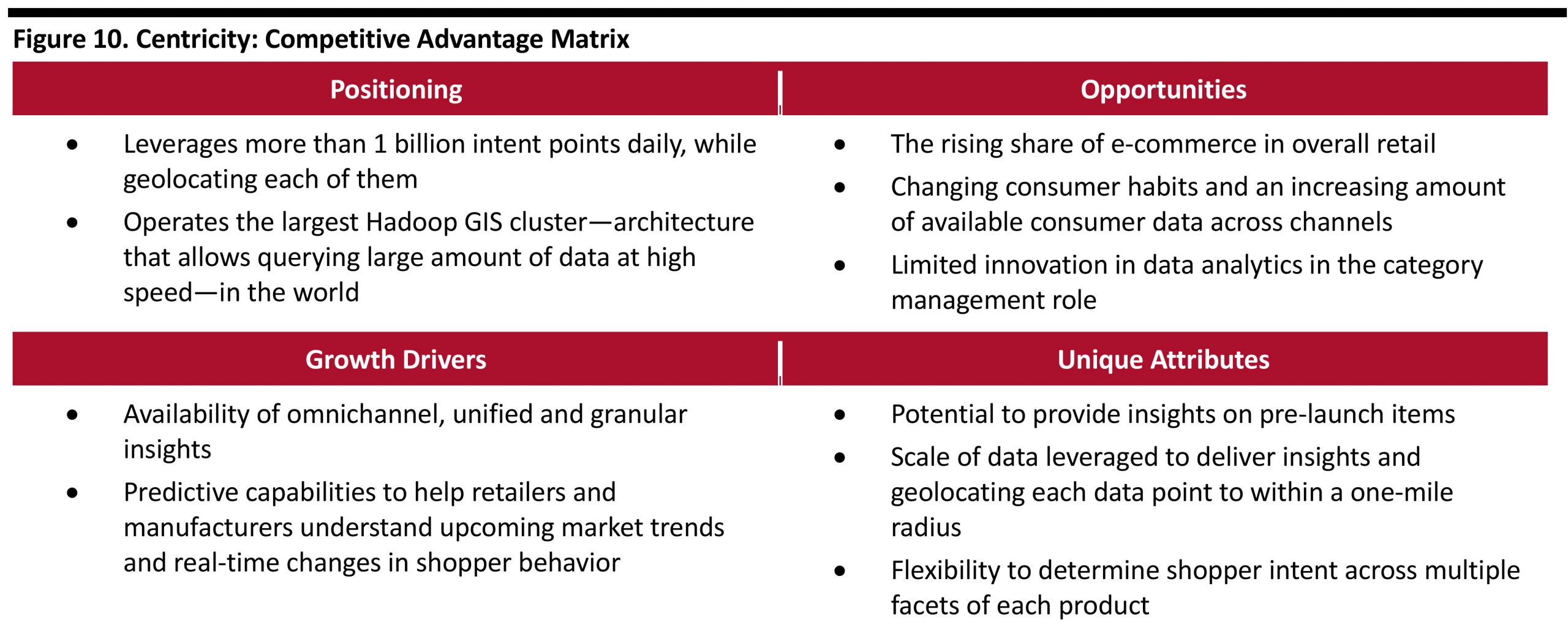

Centricity: Competitive Advantage Matrix

In this section, we analyze Centricity’s market positioning, current opportunities in the market and growth drivers, and the company’s unique attributes. First, we identify some of Centricity’s key competitive advantages below:- Accuracy: Centricity leverages big data architecture to track over 1 billion intent events each day, while geolocating each one of them to within a one-mile radius—half-mile in a few cases—making the data highly accurate when identifying consumer intent across regions.

- Pre-purchase shopper behavior: Centricity helps retailers and manufacturers understand pre-purchase consumer behavior, which allows them to optimize their supply chain operations.

- Data Unification: Centricity’s platform leverages data from multiple sources to create a picture of future shopper demand based on their interest across different platforms.

- Flexibility: Centricity’s platform can be configured for individual businesses.

- Real-time insights: Centricity helps its clients by capturing consumer purchase intent in real time, enabling them to plan for relevant substitutes before the demand of a certain product plateaus.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Centricity: Business Model

Centricity is a software as a service (SaaS) company, and it follows a licensing model for its software on a yearly basis.Centricity: Recent and Upcoming Announcements

Centricity has recently launched the facet analysis feature that identifies certain facets of products, such as “organic,” “plant-based” and “healthy.” Using these facet categories and subcategories, Centricity offers predictive facet demand across product categories. In the first quarter of 2021, Centricity plans to launch a sales forecasting feature. The company also plans to incorporate social media analysis to provide its clients with supplemental demand trends.Coresight Research View

Retail will continue its transformational shift—the process is only likely to be expedited due to the recent pandemic. Shopper behavior, demand and needs will be more dynamic and less predictable than before, especially in the near future. This means that category managers will be under increasing pressure to maintain consumer profiles to bring in the right innovation, so that products and offers can be effectively marketed to shoppers. In our opinion, the following two trends will be critical in retail category management, in the near future and in the long run.- Technological disruption: We expect technologies such as big data to play a central role in category management in the coming few years. This will primarily be fueled by an increasing need for shopper centricity to optimize the flow of products across the supply chain.

- Automation: We expect automation will play a key role on overseeing repetitive tasks such as planogram compliance. However, we expect that the demand for automation will primarily come from an increasing use of technology for predictive analytics. Automation will allow category managers to quickly respond to real-time changes in consumer behavior or in the supply chain.