DIpil Das

Introduction

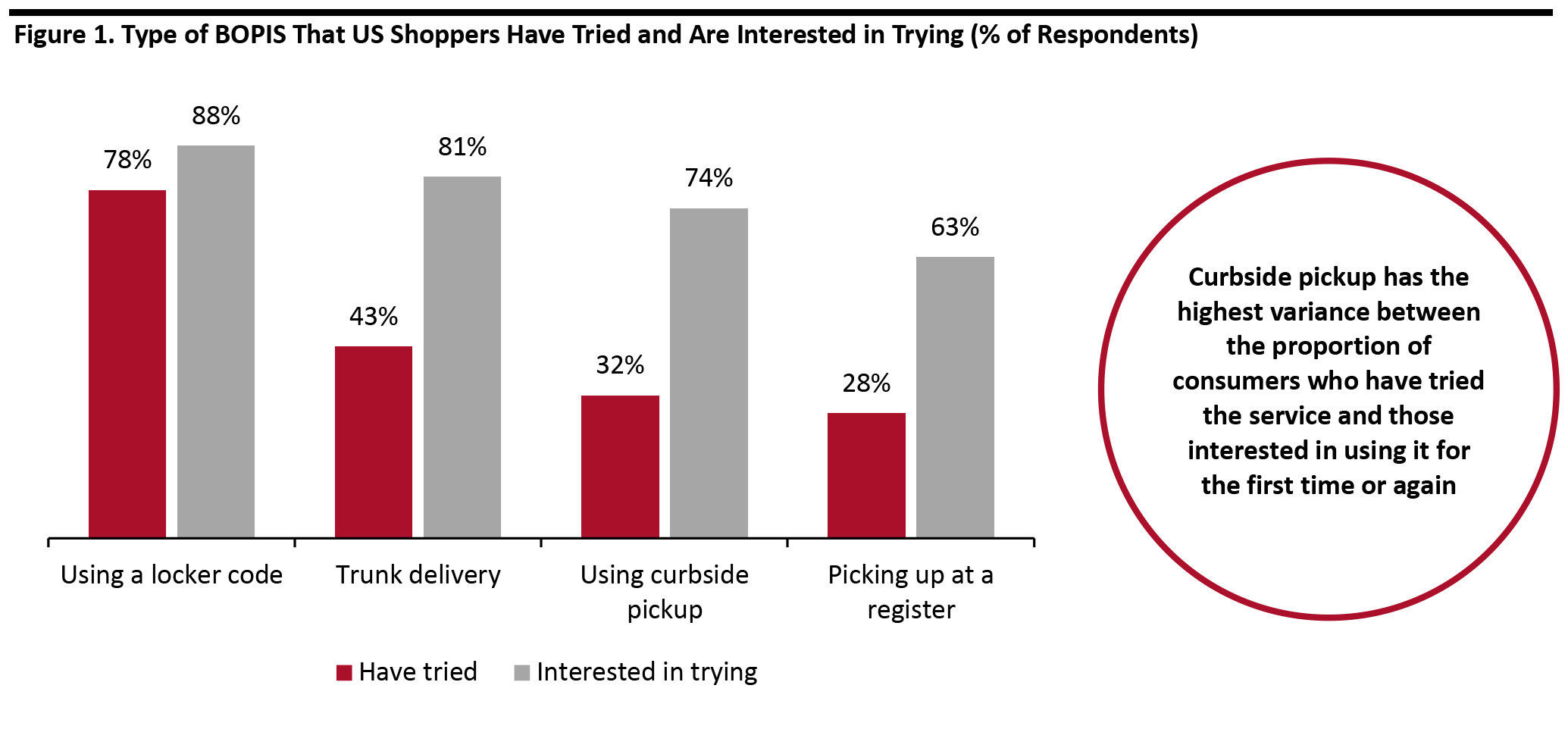

The coronavirus outbreak has significantly accelerated the growth of e-commerce. For example, daily average US e-commerce sales increased by 49% between March 12 and April 11, 2020, compared with the daily average for March 1 to March 11, according to Adobe Analytics. Moreover, BOPIS orders increased by 208% between April 1 and 20, compared with the same period a year ago. Greater shares of e-commerce and BOPIS may be permanent trends that become part of the new retail normal as we emerge from the Covid-19 pandemic. BOPIS fulfillment methods such as curbside pickup are quickly becoming the preferred fulfillment choices as shoppers become more accustomed to the convenience, speed and experience offered by these services. In this report, we examine Position Imaging’s “iPickup” platform, an e-commerce fulfillment solution that leverages computer vision to expedite the fulfillment of BOPIS orders. We also consider key industry trends in the order fulfillment space and explore the key pain points for both retailers and shoppers. BOPIS Set for Strong Growth over the Next Few Years BOPIS enables retailers to optimize the in-store experience and leverage cross-selling opportunities. Strategies such as BOPIS can be great tools to enhance the customer experience: 70% of US consumers said that BOPIS improved their shopping experience, according to an October 2019 survey by the National Retail Federation (NRF). Furthermore, the survey found that BOPIS is popular among consumers that have tried different types of this service, as well as being appealing to new customers (see Figure 1). [caption id="attachment_114661" align="aligncenter" width="700"] Base: 2,949 US adults, surveyed in October 2019 Survey question summary: Which of the following methods have you tried and which ones are you interested in trying?

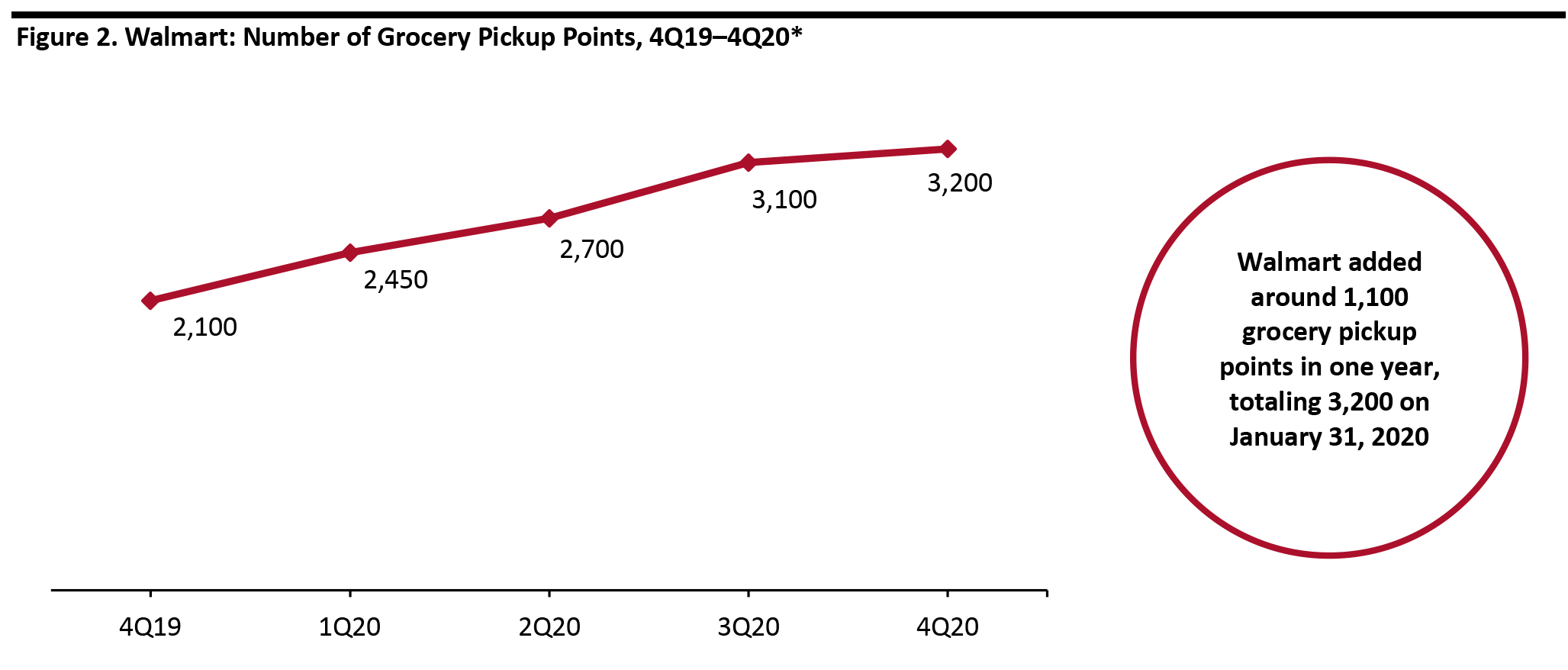

Base: 2,949 US adults, surveyed in October 2019 Survey question summary: Which of the following methods have you tried and which ones are you interested in trying? Source: NRF [/caption] Curbside pickup and trunk delivery show the highest variance between the proportion of respondents who had tried the services and those interested in doing so for the first time or again. Although just 43% of respondents had tried trunk delivery—where store associates place the order in the trunk of the customer’s car—more than two-thirds were interested in trying this method (or would use again). Curbside pickup followed a similar pattern, with 74% of consumers interested in this type of BOPIS but only 32% having used it before. Responding to the rising popularity of BOPIS services, retailers have continued to strengthen their offering to provide a seamless experience to shoppers. For example, Walmart expanded its grocery-pickup service to nearly 3,200 locations as of January 31, 2020, from around 2,100 locations on January 31, 2019. [caption id="attachment_114662" align="aligncenter" width="700"]

*As of the end of each fiscal quarter. Walmart’s fiscal year 2020 ended January 31, 2020.

*As of the end of each fiscal quarter. Walmart’s fiscal year 2020 ended January 31, 2020. Source: Company reports [/caption]

Industry Overview

Order Fulfillment Continues To Draw Retailers’ Attention Over the past few years, retailers have continued to improve their fulfillment options in order to enhance the overall omnichannel customer experience. They are considering various types of BOPIS, such as “buy online, pick up at curbside” (BOPAC) and “buy online, pick up in mall” (BOPIM). However, these options may expose multiple friction points, such as difficulties in finding an order, slow pickup times and high rates of returns, when fulfilling online orders in stores. In addition, shoppers are now wary of human interactions when collecting their BOPIS orders due to the ongoing pandemic. The coronavirus outbreak and associated importance of contactless services across all consumer touchpoints has served to accelerate retailers’ adoption of innovative fulfillment options.Figure 3. Selected Retailers: Key Statistics and Insights on Order Fulfillment [wpdatatable id=392 table_view=regular]

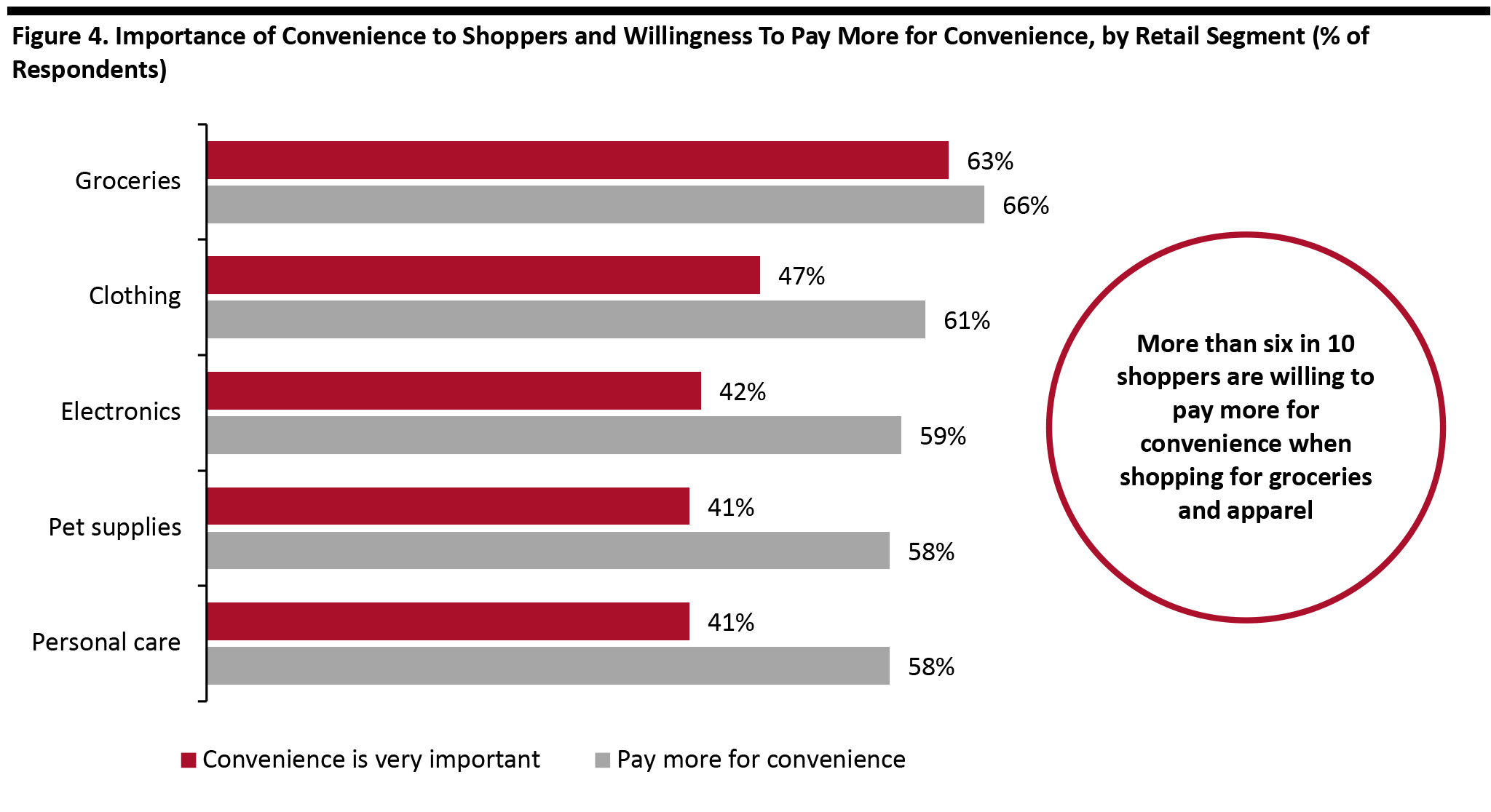

Source: Company reports/Coresight Research Shoppers Seek Convenience above Everything Consumers expect a seamless experience through every step of their shopping journey, from product search to checkout: Convenience is one of the top priorities for shoppers. In fact, over eight in 10 US shoppers said that convenience while shopping is more important than it was five years ago, according to an October 2019 survey by the NRF. Interestingly, shopper expectations around convenience vary across retail segments. According to the same study, the majority of respondents (63%) said that convenience is very important while shopping for groceries, compared to less than half (41%) that believe it is very important when shopping for personal care items, for example. Furthermore, shoppers are most willing to pay a premium for convenience in the grocery sector, with 66% of all respondents reporting that they would pay more for convenience when buying groceries. [caption id="attachment_114664" align="aligncenter" width="700"]

Base: 2,949 US adults, surveyed in October 2019

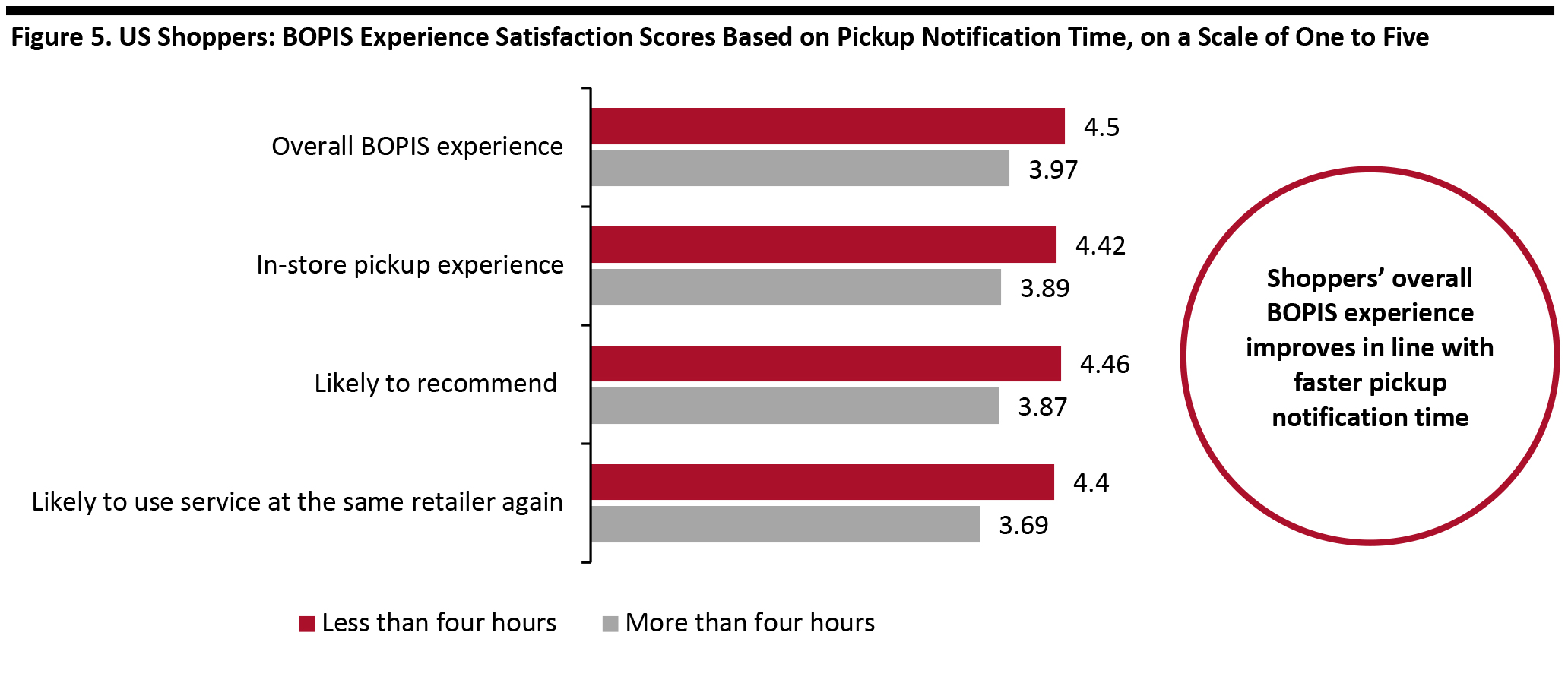

Base: 2,949 US adults, surveyed in October 2019 Source: NRF [/caption] With consumers agreeing that shopping today is more convenient than ever before, they are looking for ways to simplify their in-store journey, in order to save both time and effort. This is particularly true for the checkout process, with 56% of all respondents reporting that they expect additional convenience in simplifying checkout, according to the NRF survey. Due to the coronavirus outbreak, shoppers expect to receive their products quickly and with little to no human interaction. Faster Order Fulfillment Translates to Higher Customer Satisfaction One of the key reasons that customers would choose to collect their online orders from a store is to receive their product in a shorter timeframe than provided by home delivery services—plus, they would not have to pay a shipping fee. Retailers should look to satisfy consumer demand for a seamless and convenient shopping experience in the BOPIS ordering and fulfillment process. For example, it is vital that they inform the shopper of the availability of their items as soon as possible: The length of time it takes for a customer to receive a pickup-availability notification has a significant impact on shoppers’ overall BOPIS experience. In fact, shoppers who were notified about their product in less than four hours were 19% more likely to use the service again and 15% more likely to recommend it to others, compared to shoppers who received notifications after four hours, according to a December 2018 BOPIS experience study by mystery shopping service provider Secret Shopper and research firm IHL Group. The study suggests higher satisfaction scores for BOPIS orders where pickup notification time was less than four hours. [caption id="attachment_114665" align="aligncenter" width="700"]

Base: 300 mystery shoppers who tried BOPIS at 10 US retailers

Base: 300 mystery shoppers who tried BOPIS at 10 US retailers Source: Secret Shopper/IHL Group [/caption] Although retailers have been quick to adopt innovative fulfillment solutions, there is still a lot of room for improvement. Retailers should look beyond pickup notification time to increase the speed of order fulfillment, such as by expediting the order pickup for shoppers once they enter the store. The survey found that the total time it takes shoppers to pick up their orders after entering a store varies across retailers—under five minutes on average for retailers such as Best Buy and Home Depot, but over six minutes at Kohl’s. However, some retailers that are not as fast in fulfilling customer orders are highly efficient in other tasks; associates at Kohl’s take just over two minutes on average to find an order—faster than associates at retailers such as Staples and Walmart (see Figure 6).

Figure 6. US Retailers: BOPIS Order-Retrieval Times, in Minutes [wpdatatable id=393 table_view=regular]

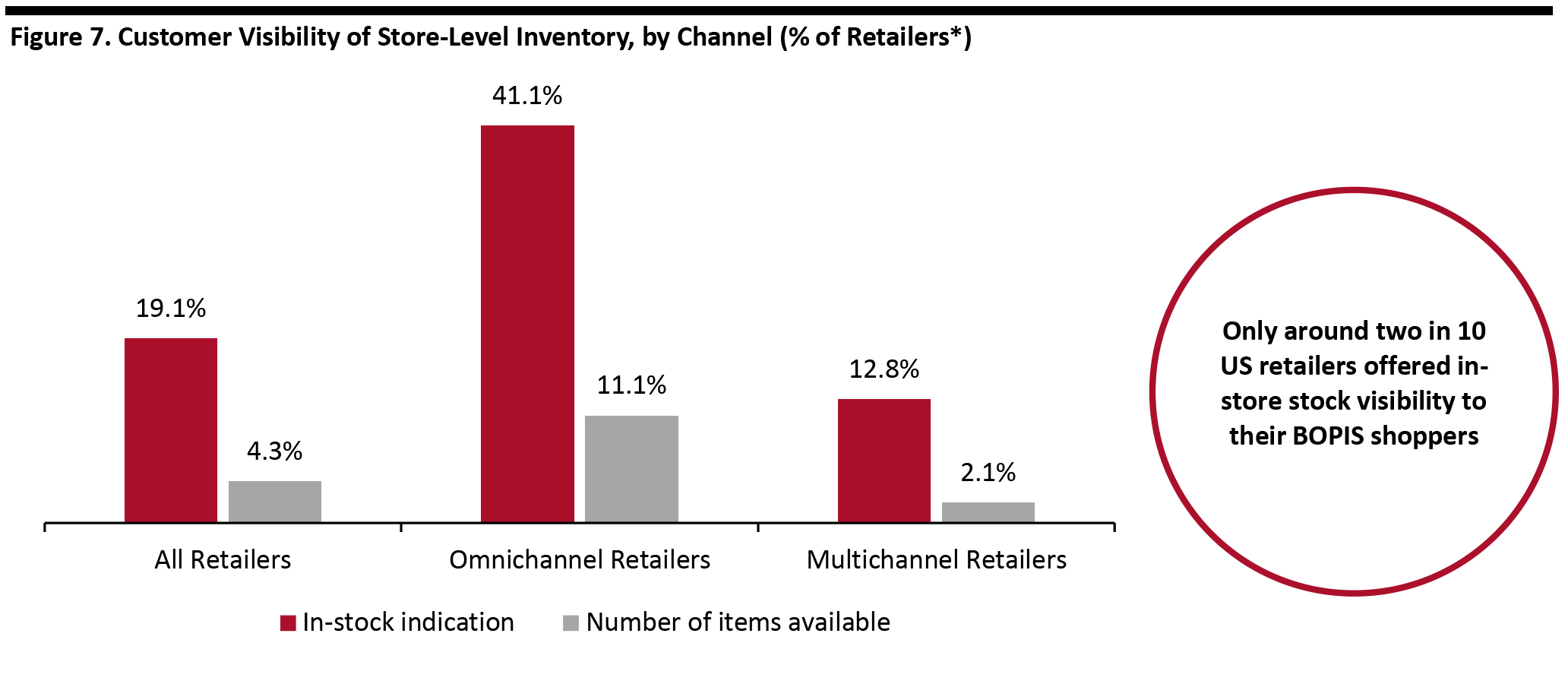

Base: 300 mystery shoppers in the US Source: Secret Shopper/IHL Group Inventory Management Is Critical for Omnichannel Fulfillment In order to fulfill online orders from their stores—or ensure efficient shipping from a distribution center—it is more important than ever for retailers to have real-time visibility of their inventory. When fulfilling online orders from a physical location, retailers must ensure that the products available for BOPIS on their website are, in fact, available in store. Managing stock levels across multiple stores can often be challenging for retailers and can lead to poor customer experience. It is therefore necessary for retailers to have accurate real-time information about their stock levels. Furthermore, consumers have limited visibility of stock availability when placing their BOPIS orders: Only 19.1% of US retailers provide shoppers with store-level in-stock information, and just over 4% provide information about the availability of a number of items of a specific product, according to a November 2018 study by supply-chain software company Tecsys. [caption id="attachment_114667" align="aligncenter" width="700"]

*Tecsys’ research is based on a total of 753 US retail chains with 10 or more stores and a web presence

*Tecsys’ research is based on a total of 753 US retail chains with 10 or more stores and a web presence Source: Tecsys [/caption]

Position Imaging: Company Overview and Solution

Position Imaging is a logistics and asset-tracking company. In this section, we discuss its “iPickup” platform, an order-fulfillment solution that leverages computer vision and laser- and audio-guidance technologies to help customers and/or staff locate the exact items for retrieval, thus allowing retailers to simplify and expedite the fulfillment of BOPIS and curbside-pickup orders for both staff and customers. What Does the iPickup Setup Include? The Single-Zone iPickup Center includes the following components:- Shelf unit provided by Position Imaging’s retail shelving partner Lozier

- Boom-mounted Amoeba Computer Vision, Position Imaging’s in-house patented computer-vision technology module with camera, status light indicator and laser light-guidance technologies.

- Floor-mounted check-in kiosk with scanner

- Operating hardware

- Floor decal, which denotes “iPickup Zone”

A Single-Zone iPickup Center setup

A Single-Zone iPickup Center setup Source: Company website [/caption] Below, we outline why Position Imaging’s iPickup solution is an industry disruptor:

- The iPickup fulfillment solution is scalable and flexible—the boom-mounted computer-vision module can be installed on shelves at the store front, inside storage rooms or on the sales floor.

- iPickup accelerates the process by allowing associates to randomly place customer orders for pickup on the shelf, eliminating the need to pack or sequence the items or find best to fit locker compartments for each item.

- iPickup can function both as a contactless self-serve or an associate-driven solution enabling more efficient curbside delivery. It also offers a more efficient use of space than package lockers as more items can be staged in a smaller area.

- One of the key advantages of iPickup is its speed—the average time taken to place an item for pickup on the shelf is around 15 seconds, with the average customer pickup time being less than 15 seconds from checking in at the kiosk to picking up the item, according to Position Imaging.

- In case of unauthorized access, an audio warning sounds from the kiosk and the Amoeba module flashes red. An alert can also be sent to all mobile point-of-sale devices and other communication systems that are in use inside the store.

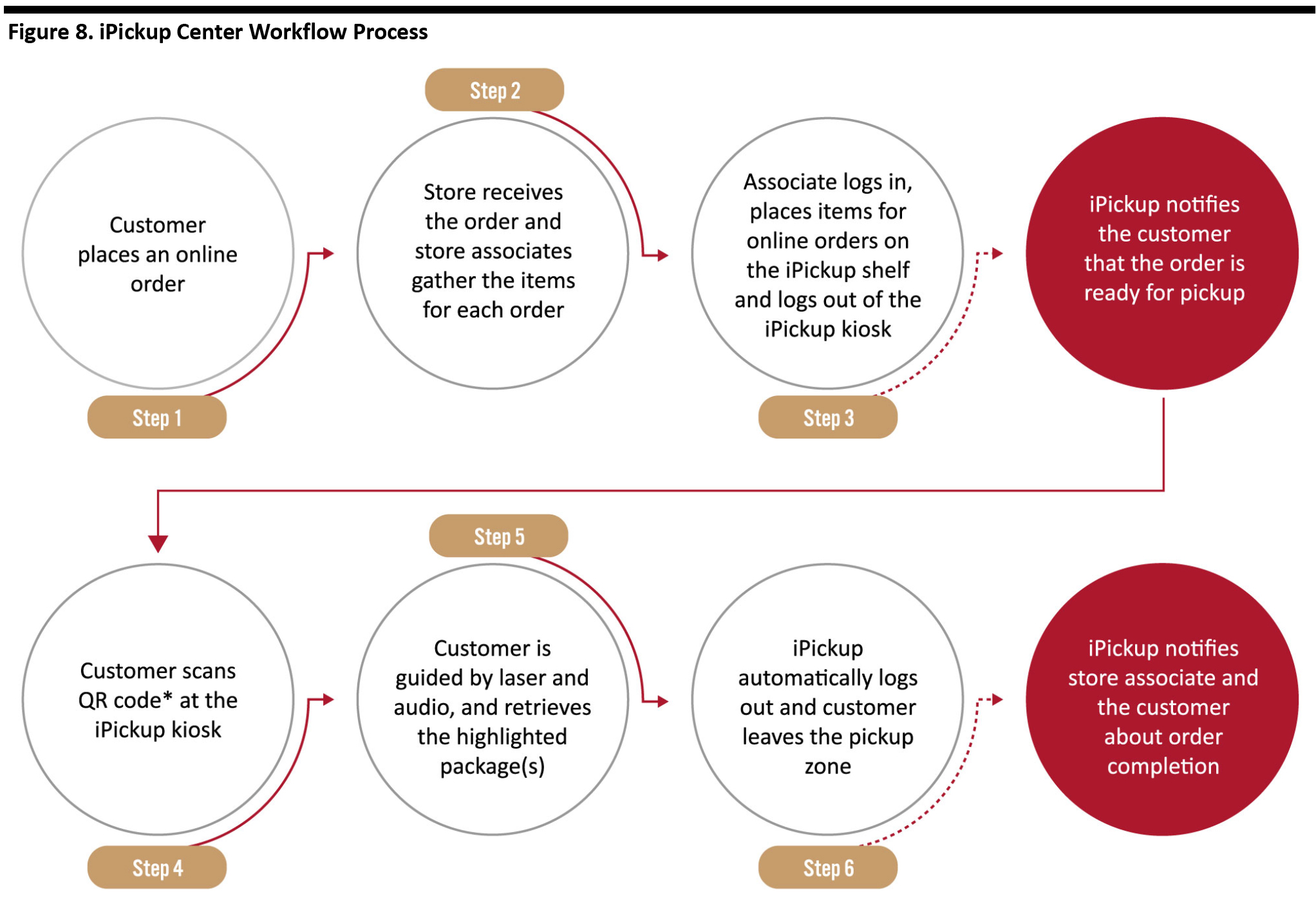

*Customers can alternatively use the original order barcode or their phone number

*Customers can alternatively use the original order barcode or their phone number Source: Company reports/Coresight Research [/caption] What Are the Different Installation Options? Retailers can choose from the iPickup product line based on their specific requirements. The portfolio of solutions comprises the following:

- Single-Zone iPickup Center: With the Single-Zone iPickup Center, retailers have the option to install a single shelf unit with a boom-mounted computer-vision module at any location of their choice and the solution can be consumer facing and/or staff driven.

- Multi-Zone iPickup Center: As daily package volume increases, retailers can choose to add more than one shelf unit along with additional boom-mounted computer-vision modules. This allows retailers to shelve and hold more orders at any given time. iPickup can easily adapt to growing order volumes and seasonal sales increases.

- Multi-Zone iPickup Room: Retailers can choose to have a separate enclosed space dedicated to online order fulfillment and/or curbside delivery. There are multiple shelves and computer-vision modules inside the Multi-Zone Room. Shoppers and/or staff can gain entry to the room by scanning their order QR code and are guided to easily find and pickup items.

iPickup Case Study

In this section, we discuss how iPickup has simplified BOPIS fulfillment for one of the largest American home-improvement retailers. The retailer has deployed a pilot of iPickup Centers across five US locations—one in Nashville and two each outside of Boston and New York—since mid-September last year. The iPickup Centers are placed just inside the main entrance of each store, and there have been over 2,500 BOPIS deliveries through the system. From using the iPickup Center, the retailer realized the following key benefits:- The average time taken by store associates to place an order on the shelf was 16.6 seconds, and it took customers just 15.3 seconds on average to pick up their orders after scanning their QR code at the iPickup Center in the store.

- Over three in 10 shoppers who used the iPickup service made additional in-store purchases when they visited to pick up their online order.

- Around nine in 10 shoppers indicated that they would like to use the iPickup Center again.

- There have been no instances of theft at any of the five locations, even during the peak holiday season.

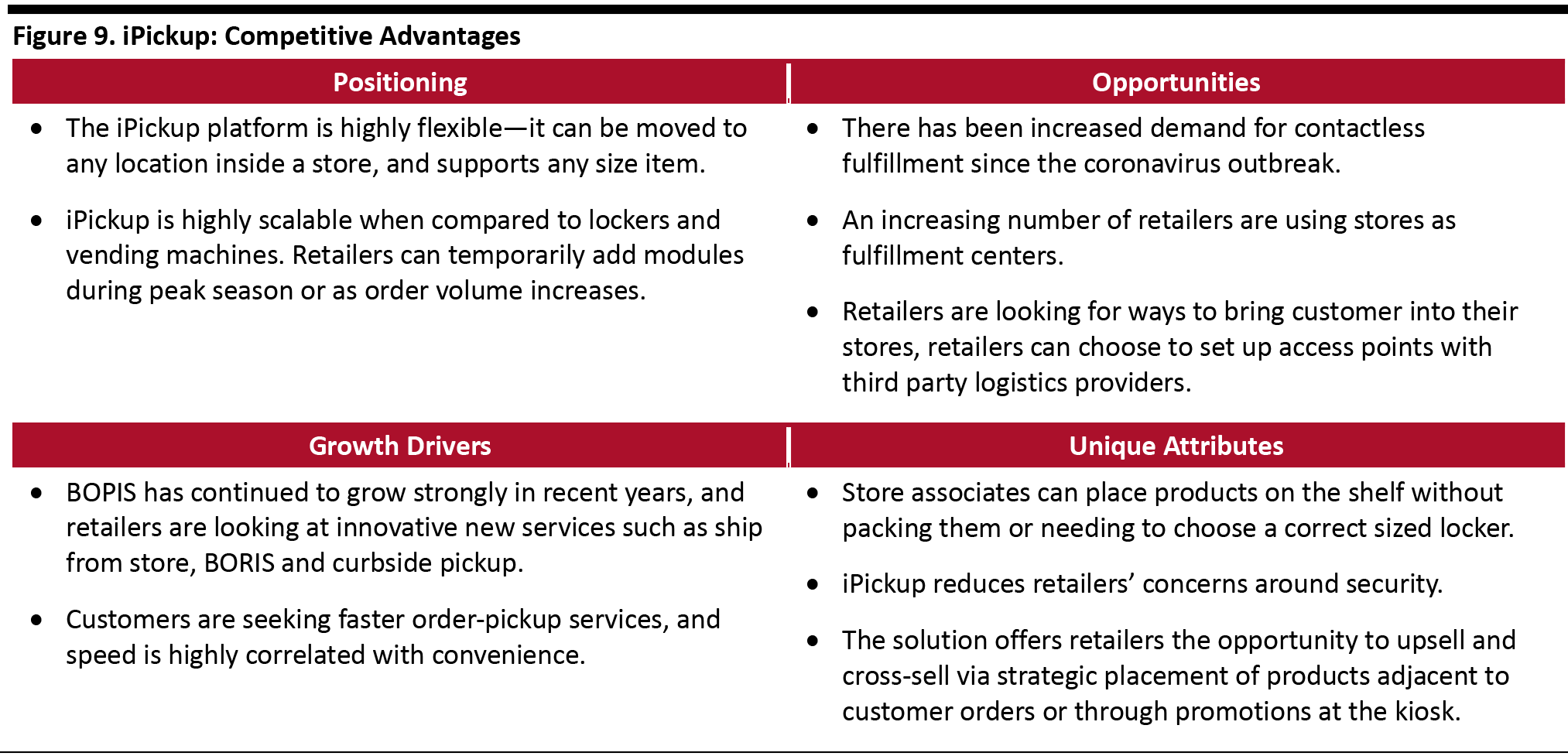

iPickup: Market Positioning

In this section, we analyze iPickup’s market positioning, current opportunities in the market and growth drivers. First, we identify some of iPickup’s key competitive advantages:- Flexibility: The shelves can carry heavy and large products that may not fit into a locker-based fulfillment solution. iPickup’s automation capabilities make in-store/curbside pickup easy to use for both retailers and shoppers.

- Contactless: iPickup offers contactless pickup that does not require the intervention of store associates or touching locker compartments. Customers can scan iPickup’s QR code to access and easily retrieve their orders without even touching the kiosk.

- Fulfillment speed: iPickup substantially reduces the time taken by associates to place customer orders on the shelf, as they do not need to place the items in bags, barcode, alphabetize, or sequence orders. Customers can easily identify their products when they check in at the kiosk—they are guided by audio commands and lasers to the item—helping to expedite the pickup process.

- Real-time order status and analytics: Retailers can track orders in real time—including information about the number of orders picked up, the number of orders that are ready to be picked up and the time that has lapsed since orders were shelved.

- Highly secure: iPickup is highly secure, with multiple features that prevent theft. Its computer-vision technology constantly monitors the area in front of the shelf and the Amoeba module flashes red and generates audio alarm prompts to flag any unauthorized access, until a store associate signs in. Once the iPickup platform is integrated with the store’s network, an alert can be sent directly to the store’s mobile POS and/or communication system.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

iPickup: Pricing Model

Position Imaging prices its iPickup solution based on the scale of deployment and offers retailers the following two cost models:- The OPEX model involves a monthly fee for an all-inclusive solution as a service.

- The CAPEX model involves an upfront fee for the system’s hardware and a smaller monthly fee than the OPEX model.