Saumya Sharma

Introduction

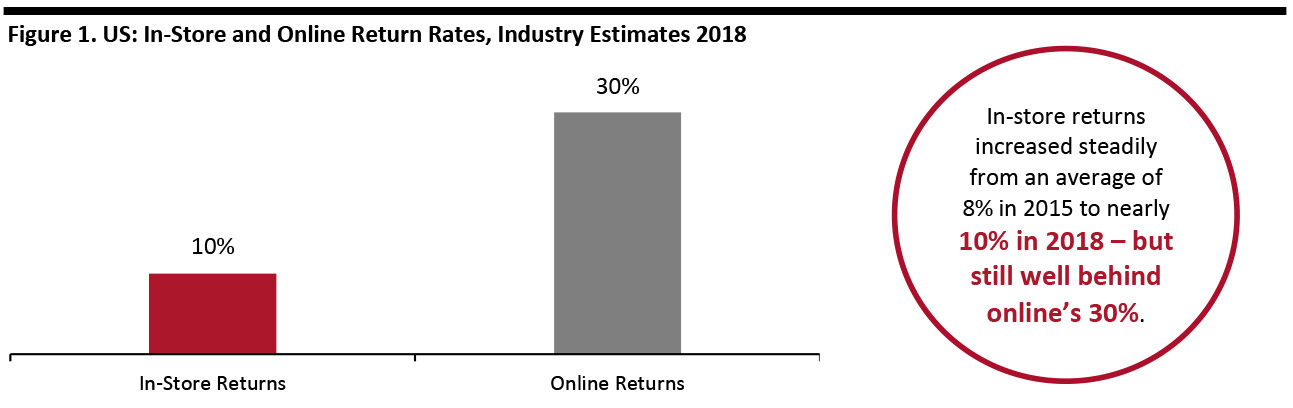

Precisely determining how a particular clothing item will fit is like a holy grail for online apparel retail, which must manage costly return programs, essentially shipping selections to customers so they can use their homes as a fitting room. The result is online return rates for apparel that average over 30% - and can run as high as 50%. Online retailers have to offer returns but are increasingly weighed down by the complexity and cost of running a reverse logistics network to manage them. [caption id="attachment_98678" align="aligncenter" width="700"] Source: NRF/eMarketer/Coresight Research[/caption]

In an October 2018 study by AlphaWise, Morgan Stanley Research’s survey arm, 81% of respondents said they had bought garments online, up from 71% in 2010. Of those respondents who do not buy clothing online, more than half cited fit-related reasons for their reluctance to do so.

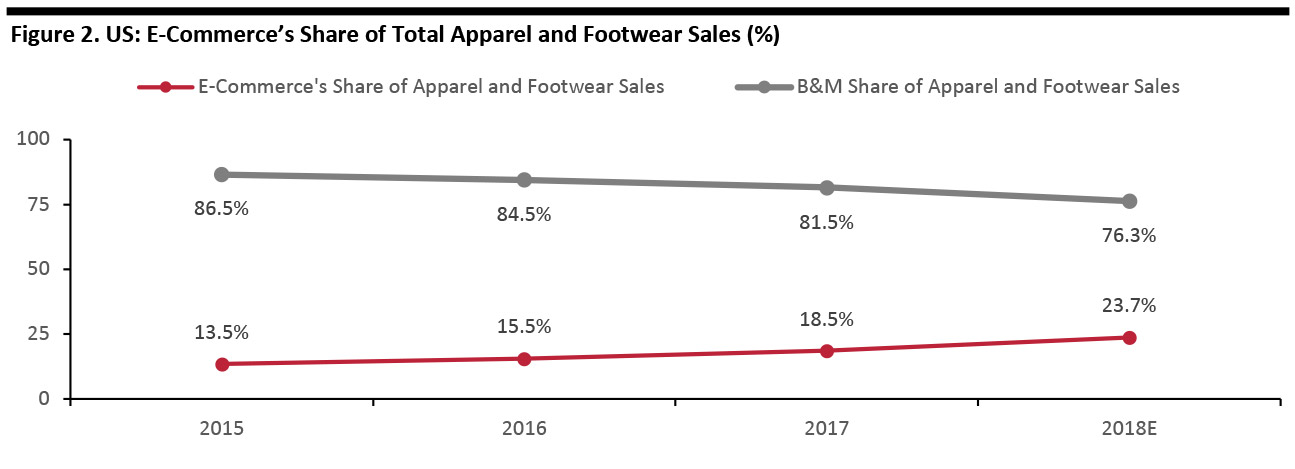

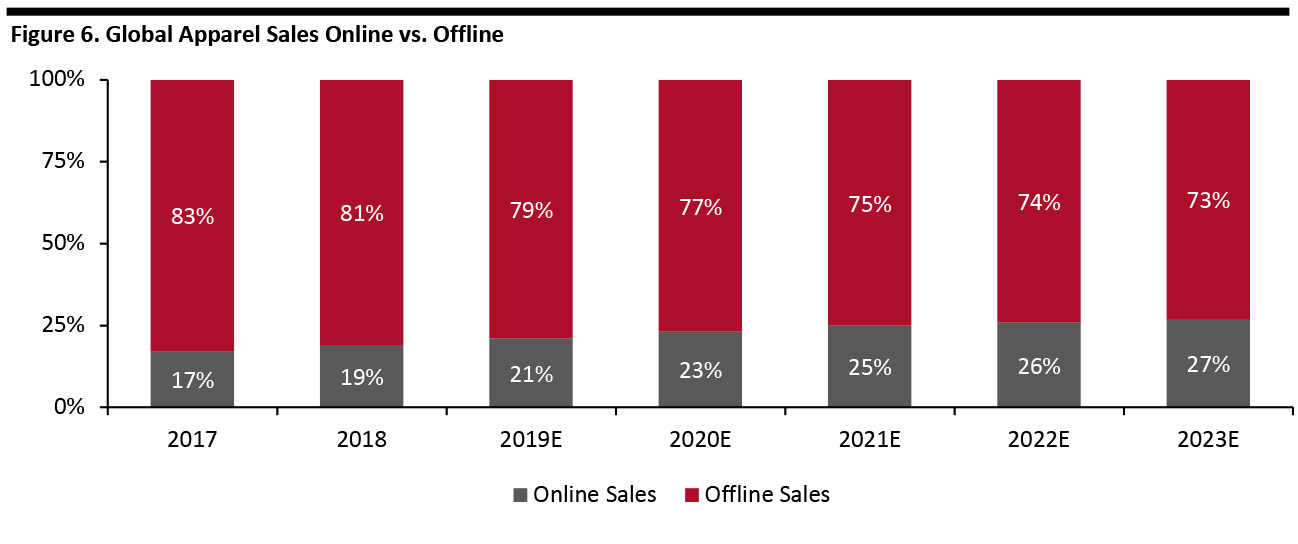

Despite the reluctance revealed in the survey, the US apparel and footwear markets are seeing a major shift from in-store to online purchases. While the overall apparel and footwear market grew 14% from 2011-2016, online apparel and footwear sales raced ahead at a 111% growth rate.

The share of apparel and footwear sold online was about 23.7% in 2018, up from 18.5% in 2017, according to Statista and Coresight Research. As more sales move online, the importance of getting fit and sizing right to reduce returns will only grow.

[caption id="attachment_98679" align="aligncenter" width="700"]

Source: NRF/eMarketer/Coresight Research[/caption]

In an October 2018 study by AlphaWise, Morgan Stanley Research’s survey arm, 81% of respondents said they had bought garments online, up from 71% in 2010. Of those respondents who do not buy clothing online, more than half cited fit-related reasons for their reluctance to do so.

Despite the reluctance revealed in the survey, the US apparel and footwear markets are seeing a major shift from in-store to online purchases. While the overall apparel and footwear market grew 14% from 2011-2016, online apparel and footwear sales raced ahead at a 111% growth rate.

The share of apparel and footwear sold online was about 23.7% in 2018, up from 18.5% in 2017, according to Statista and Coresight Research. As more sales move online, the importance of getting fit and sizing right to reduce returns will only grow.

[caption id="attachment_98679" align="aligncenter" width="700"] Source: Statista/Coresight Research[/caption]

3D body scanning technology may hold the solution to the ominous issue of returns and fit. The emerging technology helps customers get the right fit online, delivering a better customer experience and also cutting costs for retailers on reverse logistics.

This report studies the potential of 3D scanning in the retail industry and introduces 3DLOOK’s proprietary technology, which aims to use body data to disrupt traditional manufacturing methods and help brands and retailers deliver better fitting products and a more personalized shopping experience.

Source: Statista/Coresight Research[/caption]

3D body scanning technology may hold the solution to the ominous issue of returns and fit. The emerging technology helps customers get the right fit online, delivering a better customer experience and also cutting costs for retailers on reverse logistics.

This report studies the potential of 3D scanning in the retail industry and introduces 3DLOOK’s proprietary technology, which aims to use body data to disrupt traditional manufacturing methods and help brands and retailers deliver better fitting products and a more personalized shopping experience.

Industry Overview

What Is 3D Body Scanning? 3D body scanning is a noncontact, 3D measurement system that uses a line of laser lights or a camera to produce a digital copy of the surface geometry of the human body. This generates a silhouette of the shape, and an extensive list of body measurements which is stored and processed by computer programs for different applications, including pattern construction, garment draping simulation and 3D body tracking. Human body digitalization systems have been around since the early nineties, with the military one of the main users to size uniforms. A number of subsequent research projects expanded the use into commercial applications. Startups have installed full body scanning systems in various locations, such as shopping malls and boutiques. They use different methods, such as laser-scanning, projecting light patterns, combination modeling and image processing. 3D body scanning technology is still relatively new with only a few brick-and-mortar retailers implementing the service, such as:- Selfridges and Bloomingdales, which started offering 3D body scanning booths in 2011.

- UK fashion retailer New Look introduced a Bodymetrics 3D body scanning booth in its store in 2012.

- Levi’s provides a similar service in its flagship store in central London, scanning customers’ bodies to help them locate better fitting jeans.

Body scans showing substantial differences between three women who all wear size 10

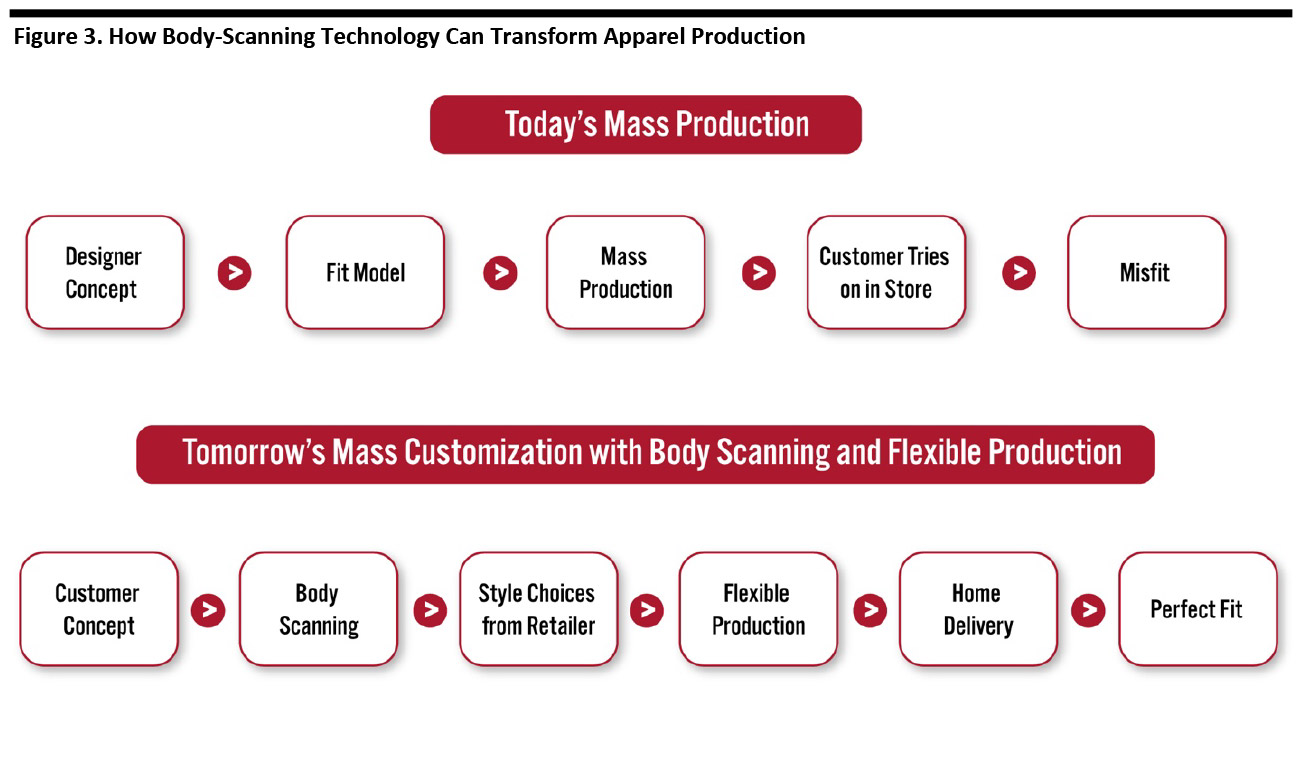

Body scans showing substantial differences between three women who all wear size 10 Source: Cornell Body Scan Research Group [/caption] Apparel Manufacturers: Struggles of Designing the Right Size Ready-to-wear apparel manufacturers often decide the dimensions of their garments based on limited information. Manufacturers generally determine sizing using fit models in one or two standard sizes. They then scale prototypes proportionally up and down to all sizes based on the originals. Apparel companies typically choose fit models of a medium size who share many of the same characteristics (such as age, gender and lifestyle) of the target customer base. But beyond transactional data and behavioral or demographic data, designers don’t actually know much about the customer base for which they are designing. Retailers currently have no way of gathering information related to customers’ exact body shape and size. The proportional scale method often results in misfit products as it does not consider variations in body shape and proportion among individuals who wear the same size, as illustrated in the graphic above. Creating clothes that fit well is especially challenging in the petite and plus-size categories, where specific parts of garments need to accommodate different body shapes rather than follow a proportional scale from standard sizes. For example, a garment in a large size might have a larger-than-proportional waist or a longer torso than mathematically scaled measurements would call for. Consumers face an additional challenge finding the right size for their body shape as the retail industry does not have a standard sizing system. Different brands have different numerical sizes and definitions of small, medium and large. And within some brands, certain products of the same size also have different fits. All of these issues present challenges even for shoppers in brick and mortar outlets – but are all the more difficult to overcome when shopping online. 3D Imaging to Transform Apparel Production The “cut” of a garment is fundamental to its desirability and is another reason retailers are looking to digital 3D. Three-dimensional shapes are digitized, and so facilitate collaboration between designers in Europe and the US and Asia-based manufacturers. The more consumers use virtual-fitting apps and smart home devices to better size online purchases, the more data retailers can gather to better understand body shape and use that data to create better fitting garments, even for online customers, hopefully driving down return rates. With increased data, retailers can adapt sizing by monitoring subtle variations in size among the core customer base and adjust garment designs accordingly. [caption id="attachment_98681" align="aligncenter" width="700"]

Source: Cornell University College of Human Ecology[/caption]

3D Data Exchange

Ultimately, trying on clothing to see whether it fits is little more than a data exchange. A consumer has a specific set of dimensions, and so does an item of clothing. Trying on clothes has so far been the only way to exchange that information.

Along comes 3D technology, making the process less cumbersome by digitizing what used to be a very physical, manual process through an exchange of fit information via a digital platform. With thousands of data points to create a three-dimensional image, mobile 3D body scanning empowers consumers to immediately determine how clothes will fit them. The retailer, in turn, can compare consumer data – which goes well beyond the traditional collar size, chest size, and sleeve length – to include hundreds of measurements that make up the detailed dimensions of a particular garment.

Source: Cornell University College of Human Ecology[/caption]

3D Data Exchange

Ultimately, trying on clothing to see whether it fits is little more than a data exchange. A consumer has a specific set of dimensions, and so does an item of clothing. Trying on clothes has so far been the only way to exchange that information.

Along comes 3D technology, making the process less cumbersome by digitizing what used to be a very physical, manual process through an exchange of fit information via a digital platform. With thousands of data points to create a three-dimensional image, mobile 3D body scanning empowers consumers to immediately determine how clothes will fit them. The retailer, in turn, can compare consumer data – which goes well beyond the traditional collar size, chest size, and sleeve length – to include hundreds of measurements that make up the detailed dimensions of a particular garment.

Key Retail Benefits of 3D Imaging

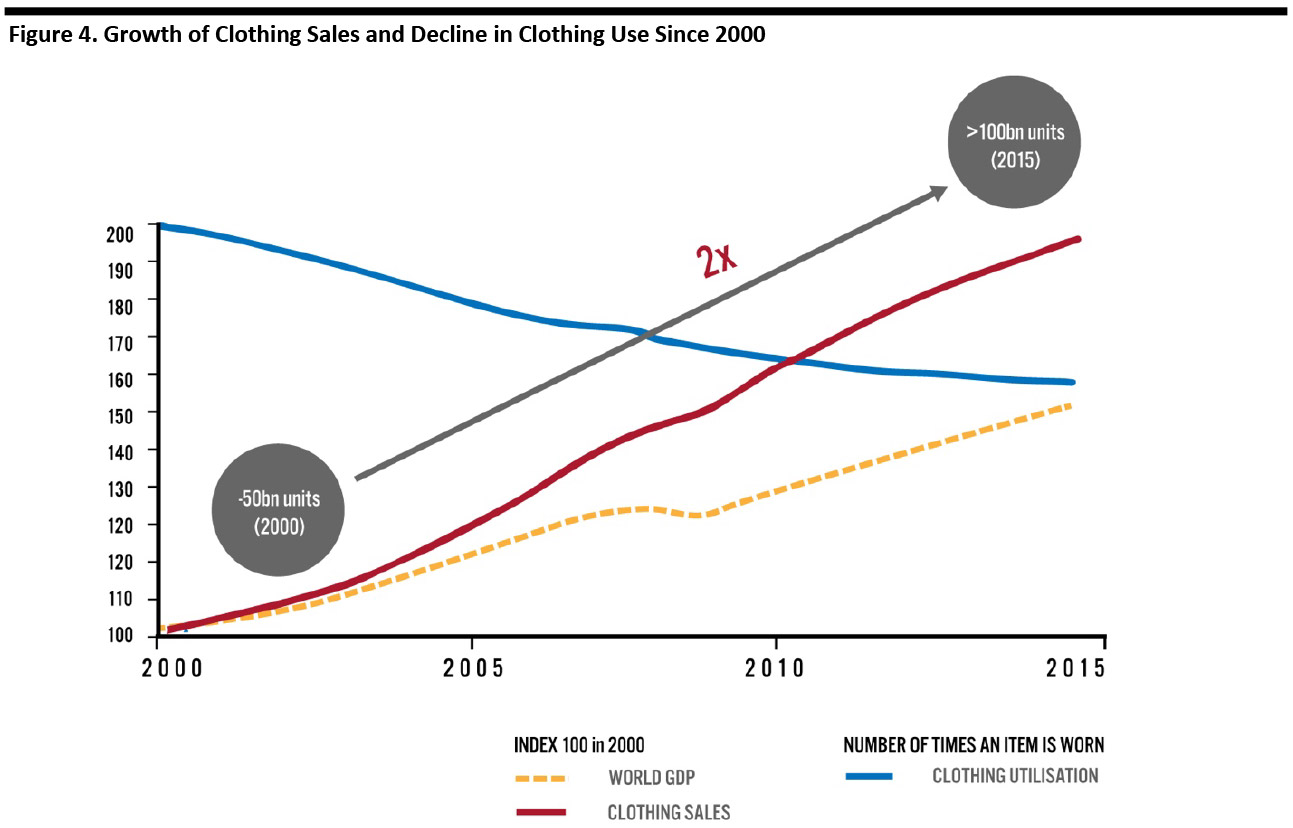

Improved Inventory As retailers collect more customer sizing data, 3D technology could enable brands to define their true size DNA, setting a new industry standard in product development. For chains that sell across different regions, it could enable further segmentation and product localization based on regional patterns. Custom-Made Apparel Besides being a potentially valuable tool for driving down return rates and improving inventory allocation, mobile 3D scanning is also perfectly suited for on-demand production. Fashion’s center of gravity has gradually moved from the Paris runway and the pages of Elle to the Instagram feeds of key influencers, boosting consumers’ burgeoning desire to create their own style. Though few traditional retailers have integrated on-demand production into their offerings, various direct-to-consumer (DTC) stores have popped up offering online, custom-made clothing. 3D body scanning technology could greatly facilitate the ability to collect measurements – and to significantly lower the threshold for smaller industries to offer on-demand apparel as well. Test-and-Repeat Inventory is not likely to become a thing of the past altogether, as brands generally offer a core collection that is available all year, with seasonal collections developed to refresh the offering. But so-called capsule collections that seek to capture the trend of the moment are often hit or miss, resulting in waste and brand dilution, as markdowns may cheapen the perception of a retailer. By designing and manufacturing collections on a smaller scale, brands can test products before rollout at far lower cost than a traditional limited run. And, if there’s a spike in sales on a particular style, the brand can more quickly increase supply to replenish inventory. By reducing the risk of overproducing and underselling, even small businesses could create and test new products with lower up-front financial commitment. 3D technology could add an additional dimension to this cycle as brands design using the average size and demographic data of a particular location. Increased Sustainability Large retailers could also benefit from on-demand and test-and-repeat models, as traditional manufacturing generally involves enormous inaccuracy and waste. The traditional manufacturing supply chain was created to accommodate the needs of large businesses. Overseas production facilities have high minimum order quantities (MOQ) often with long lead times of up to 10 months. The high MOQs recurrently lead to over-production, excess stock and markdowns that can negatively impact margin. At the same time, fabric manufacturers across China are left with hundreds of millions of yards of material that may never be used. Waste in the garment industry has soared following the fast-fashion industry’s powerful take-off over the past 20 years. The apparel industry is now said to be the second-largest polluter in the world, beset by energy-intensive processes, high water consumption, use of non-renewable resources and general excess. Several big brands were exposed in recent years destroying what they call “deadstock.”- Burberry incinerated nearly $40 million worth of merchandise rather than mark it down to preserve product scarcity and brand exclusivity.

- H&M was accused by a Danish TV program of burning 13 tons of new, unsold clothing annually. At the beginning of the year, the Swedish retail giant reported sitting on a huge pile of $4.3 billion worth of unsold garments. The company produces so many clothes that a power plant in a Swedish town northwest of Stockholm is now burning part of its products to generate energy. (But all the energy used to create the clothes in the first place is still wasted).

- The number of garments purchased per person shot up 40% between 1996 and 2012 alone.

- In the last 15 years, the industry has doubled production, but the average amount of time clothing is worn before being discarded plummeted 40%.

- Of clothing that is thrown away, 73% is burned or dropped in a landfill, according to the World Economic Forum.

Source: World Bank[/caption]

Returns also make up a big part of clothing that is discarded. Few returns make it back into store inventory and onto shelves; the majority ends up in landfills, racking up a giant carbon footprint as they wind their way through a network of intermediaries and resellers. The free shipping/free returns standard seems to have been a big win for consumers, allowing shoppers to buy several sizes of an item to determine the right size. But it comes at a high price as online sales, and with it, returns, continue to rise.

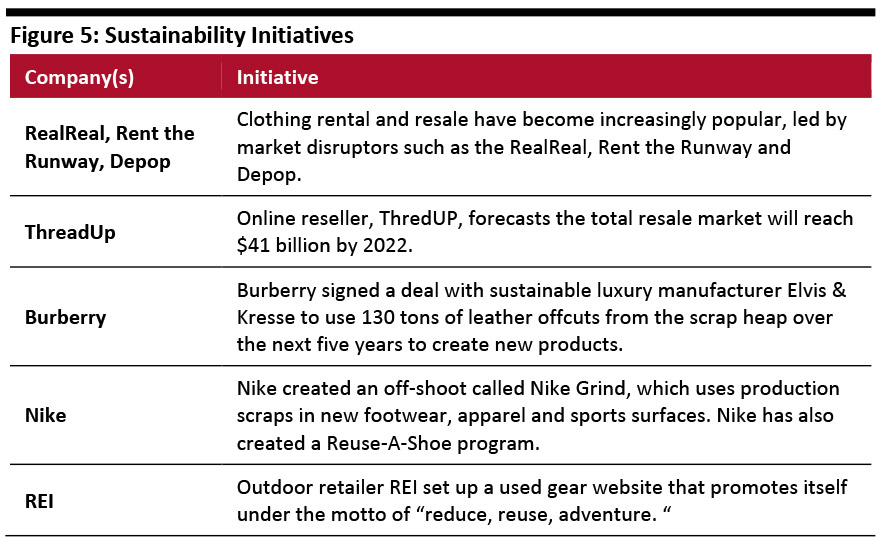

To cut waste, some companies have introduced initiatives focused on recycling and reuse:

[caption id="attachment_98683" align="aligncenter" width="700"]

Source: World Bank[/caption]

Returns also make up a big part of clothing that is discarded. Few returns make it back into store inventory and onto shelves; the majority ends up in landfills, racking up a giant carbon footprint as they wind their way through a network of intermediaries and resellers. The free shipping/free returns standard seems to have been a big win for consumers, allowing shoppers to buy several sizes of an item to determine the right size. But it comes at a high price as online sales, and with it, returns, continue to rise.

To cut waste, some companies have introduced initiatives focused on recycling and reuse:

[caption id="attachment_98683" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Even more important than recycling already produced garments, however, is producing less and smarter in the first place, and 3D scanning could play a crucial part.

End-Consumer Benefits

3D imaging offers a number of benefits for retailers and consumers.

Consumers get access to more accurate sizing information and hence better fitting clothes; retailers benefit from deeper insight into customer sizing and body shape to create clothes more likely to fit from the start; improved sizing could drive down dizzyingly high return rates; and, collectively, the improved accuracy and efficiency could help reduce retail’s environmental footprint.

Source: Company reports/Coresight Research[/caption]

Even more important than recycling already produced garments, however, is producing less and smarter in the first place, and 3D scanning could play a crucial part.

End-Consumer Benefits

3D imaging offers a number of benefits for retailers and consumers.

Consumers get access to more accurate sizing information and hence better fitting clothes; retailers benefit from deeper insight into customer sizing and body shape to create clothes more likely to fit from the start; improved sizing could drive down dizzyingly high return rates; and, collectively, the improved accuracy and efficiency could help reduce retail’s environmental footprint.

Startup Investment on the Rise

Large corporations and financial investors have been building their stakes in body data and personalization platforms in recent years. Online retail giant Amazon acquired Body Labs in 2017. In January 2018, personalization platform True Fit received $55 million in Series C funding, bringing its total investment to over $100 million. In June 2018, Khosla Ventures invested in Body Scan, whose technology is currently tied to a single brand, MTailor. And, Gerber technology bought Avametric, a virtual fit specialist that does not offer mobile scanning. So, what’s driving the investment? The retail sector has been under structural pressure for years as channels shift and consumer preferences change – mainly for the increased convenience of online shopping. Despite a steady migration of retail categories online, apparel remains strongly entrenched in the brick and mortar age, largely from the consumer side due to the desire to try on clothes. Retailers that have ventured into online apparel have experienced sky-high return rates. 3D scanning could be a game-changer. With greater sizing confidence, consumers may be more willing to buy online – and perhaps less likely to buy in size clusters to make sure at least one fits. [caption id="attachment_98684" align="aligncenter" width="700"] Source: Statista [/caption]

If 3D scanning can eliminate or reduce “intentional returns,” online retailers could lower prices, which could shift more of the apparel market online.

Source: Statista [/caption]

If 3D scanning can eliminate or reduce “intentional returns,” online retailers could lower prices, which could shift more of the apparel market online.

Technologies in the Market

Several apps are available that offer body scanning, some of which require the purchase of associated items.- Start Today, a public company that operates the largest Japanese online fashion website, Zozotown, announced in 2018 it had received more than one million orders directly from consumers for its body measurement suit. The suit, called Zozosuit, has hundreds of sensors that allow wearers to create a 3D image using a smartphone camera. Despite the initial boom and distributing over three million suits across 72 countries (free), the company in January noted it didn’t reach the scale it had hoped for: Of the millions who ordered the suit, a disappointingly low number actually ordered clothes, while others did not even bother uploading their measurements to the app.

- Other companies require users to add a special device to their mobile phone called a structure sensor, which uses an infrared laser projector to create a 3D image. This and other devices like it cost the customer several hundred US dollars, which has limited its appeal.

- Most 3D companies do not require buying a proprietary outfit or other piece of hardware. Rather, they merge several photographs taken on a smartphone using a prescribed set of poses. Some require more than three photos, or the user needs to undress to their underwear, use a specific color background, place a ball between their feet or other specific requirements.

3DLOOK Company Overview

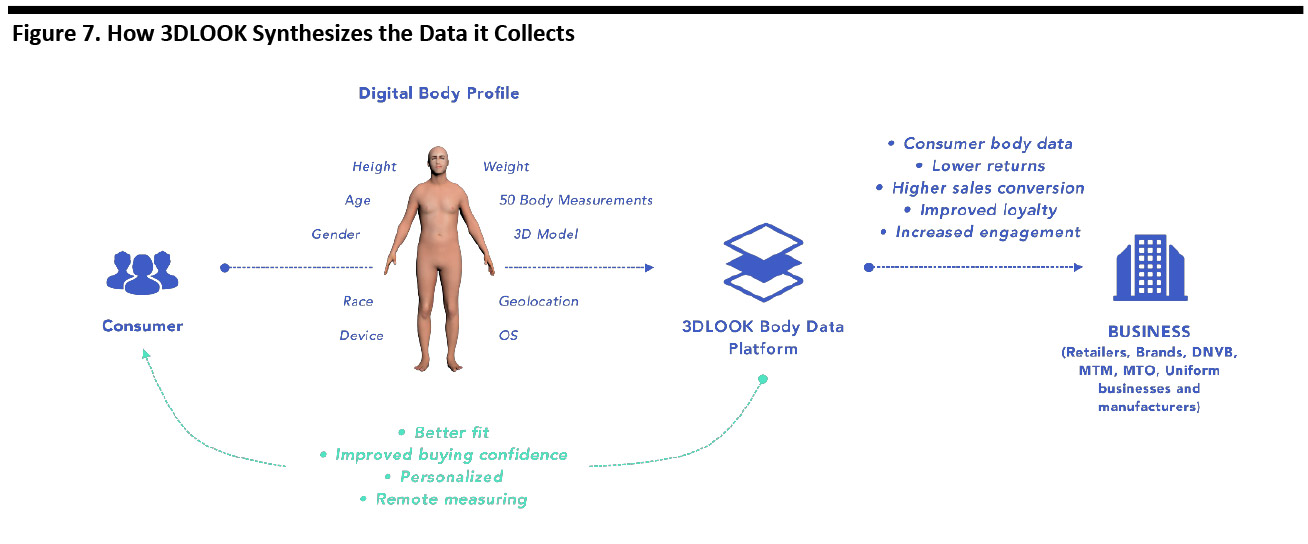

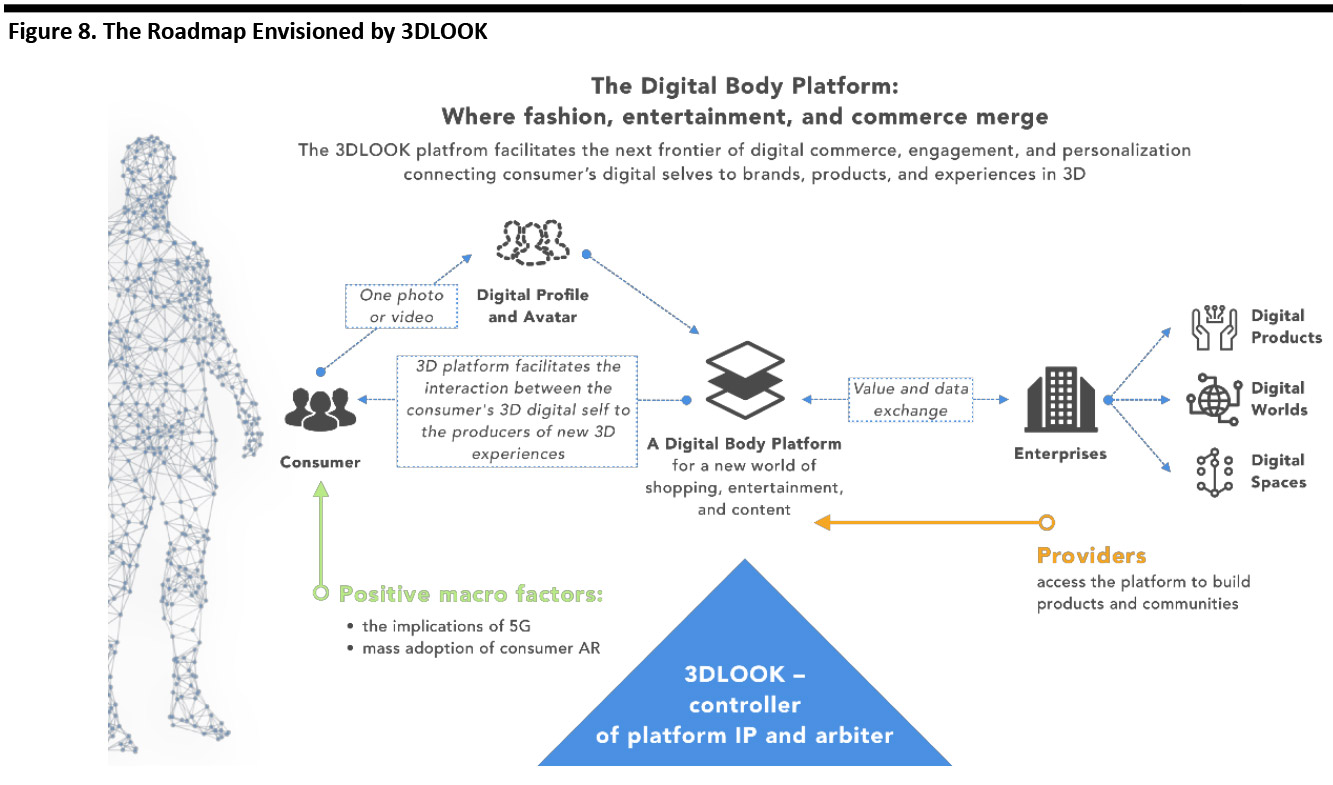

Company Introduction 3DLOOK provides a 3D digital body platform. In the current age of individualization and customization, the so called #mybody era of hyper-segmentation in which the market is increasingly focused on the individual, one size doesn’t fit all. 3DLOOK’s technology empowers retailers with the knowledge of what their customers actually look like and uses this data to curate a more personalized shopping experience for each customer. The current Zeitgeist encourages people to celebrate who they are, and feeds into consumers’ expectations of personalized retail experiences and offerings, forcing stores selling apparel to devise a proper response. And with the made-to-measure (MTM) and made-to-order (MTO) community set to expand massively as we move into the next decade, personalization is imperative. 3DLOOK can give companies consumer data specific to their target audience. By creating personalized emails and communications based on unique consumer data, 3DLOOK can enable retailers to reach consumers with more accurate, more personalized recommendations. So, how does it work? [caption id="attachment_98685" align="aligncenter" width="700"] Source: 3DLOOK[/caption]

3DLOOK uses computer vision, machine learning, and statistical modeling to process and measure the human body, using only two photos from any mobile device. The computer vision algorithms analyze the photos to reconstruct the user’s body – and the user does not have to disrobe. The algorithms are trained to detect a dressed human body on photos taken by any smartphone against any background.

3DLOOK has trained custom neural architectures to process photos and extract all relevant data about the body, developed using photos of fully measured subjects using statistical body shape priors built on a large database of 3D scans augmented with high-quality synthetic data. The company uses the statistical modeling and 3D geometry algorithms to build a 3D model of the human body. This allows 3DLOOK to more accurately obtain human body measurements. The company has more than 50 body measurements available today after collecting data from thousands of unique body scans.

With AI-based technologies, much rides on the data set: The functionality of the data depends on how you “train” your neural-networks. 3DLOOK created its own 3D laboratory, gathering human body data based on 3D body scans in a variety of poses, full-body photos and manual measurements. 3DLOOK has several proprietary datasets for different elements of its pipeline and has trained its neural networks to recognize dressed people on any background under any lighting condition.

The 3D Platform

Retailers can implement 3DLOOK’s technology on the website or mobile app with a few lines of code, enabling companies to easily offer customers the ability to upload two photos from a smartphone to get personalized size recommendations or measurements (depending on the retailer's business model).

The retailer can then monitor and analyze key customer data metrics to glean valuable consumer insights, either by accessing the information via a personal account on the 3DLOOK platform or by exporting the data to the company’s own reporting system or dashboard.

The platform (which includes a dynamic dashboard scheduled for commercial release in January) enables customers to access all data points the mobile body scanning technology computes: gender, height, weight, over 50 separate measurements, and even body shape segmentation. This delivers access to customer data which can be used collaboratively and cross-functionally across teams within a company.

The goal of the platform is to enable brands and retailers to use body data to augment customer profiles to deliver deeper levels of personalization and retarget customers with products that will better fit their body shapes.

The platform also tracks conversion metrics and returns, as well as segmenting body data to bring greater efficiency to the product development and planning process, and to inform inventory distribution and control.

[caption id="attachment_98686" align="aligncenter" width="700"]

Source: 3DLOOK[/caption]

3DLOOK uses computer vision, machine learning, and statistical modeling to process and measure the human body, using only two photos from any mobile device. The computer vision algorithms analyze the photos to reconstruct the user’s body – and the user does not have to disrobe. The algorithms are trained to detect a dressed human body on photos taken by any smartphone against any background.

3DLOOK has trained custom neural architectures to process photos and extract all relevant data about the body, developed using photos of fully measured subjects using statistical body shape priors built on a large database of 3D scans augmented with high-quality synthetic data. The company uses the statistical modeling and 3D geometry algorithms to build a 3D model of the human body. This allows 3DLOOK to more accurately obtain human body measurements. The company has more than 50 body measurements available today after collecting data from thousands of unique body scans.

With AI-based technologies, much rides on the data set: The functionality of the data depends on how you “train” your neural-networks. 3DLOOK created its own 3D laboratory, gathering human body data based on 3D body scans in a variety of poses, full-body photos and manual measurements. 3DLOOK has several proprietary datasets for different elements of its pipeline and has trained its neural networks to recognize dressed people on any background under any lighting condition.

The 3D Platform

Retailers can implement 3DLOOK’s technology on the website or mobile app with a few lines of code, enabling companies to easily offer customers the ability to upload two photos from a smartphone to get personalized size recommendations or measurements (depending on the retailer's business model).

The retailer can then monitor and analyze key customer data metrics to glean valuable consumer insights, either by accessing the information via a personal account on the 3DLOOK platform or by exporting the data to the company’s own reporting system or dashboard.

The platform (which includes a dynamic dashboard scheduled for commercial release in January) enables customers to access all data points the mobile body scanning technology computes: gender, height, weight, over 50 separate measurements, and even body shape segmentation. This delivers access to customer data which can be used collaboratively and cross-functionally across teams within a company.

The goal of the platform is to enable brands and retailers to use body data to augment customer profiles to deliver deeper levels of personalization and retarget customers with products that will better fit their body shapes.

The platform also tracks conversion metrics and returns, as well as segmenting body data to bring greater efficiency to the product development and planning process, and to inform inventory distribution and control.

[caption id="attachment_98686" align="aligncenter" width="700"] Source: 3DLOOK[/caption]

Source: 3DLOOK[/caption]

3DLOOK’s Competitive Advantages and Case Studies

Competitive Advantages 3DLOOK is supported by a strong R&D team of more than 25 people located in two offices in Ukraine, including three PhDs, who previously worked at industry giants, including Intel Labs, Samsung, Materialise and others. Case Studies 3DLOOK currently has a customer base of small and medium-sized (SMB) businesses, as well as pilot programs in large enterprises, retail firms and law enforcement. Military uniforms were one of the earliest adopters of 3D scanning, but 3DLOOK has expanded its application to include uniforms for airlines and hospitality staff as well, some of which are serviced by a manufacturing company in Ireland which supplies uniforms throughout the European Union. US Patriot, a leading retailer of military and tactical goods, will integrate 3DLOOK’s size recommendation widget this month. The company has also launched proof of concepts and pilots at large chains, asking customers to use the sizing tool so the company can collect feedback in real-time. New York City-based women’s online and wholesaler 1822 Denim implemented 3DLOOK's mobile web widget last summer. Purchase rates for customers using the widget were nearly two and a half times as high at 4.92% compared to the average of just 2% for those who did not use the app. The brand signed a long-term commercial contract with 3DLOOK with plans to be the first beta tester of the 3DLOOK dynamic dashboard launching in January.Business Model and Go-to-Market Strategy

The current business model is a software-as-a-service (SaaS), monthly subscription for small and medium-sized businesses, with web-based widgets and a business dashboard that offers three plans based on usage.Key Management

3DLOOK’s executive leadership is based in San Francisco, New York City, Odessa and Kiev (both in Ukraine). The team inlcudes four cofounders:- CEO Vadim Rogovskiy

- CTO Ivan Makeev

- CPO Alex Arapov

- Chief Strategy Officer Whitney Cathcart