DIpil Das

Introduction

What’s the Story? 2020 brought a massive wave of temporary or permanent apparel and footwear store closures globally due to the pandemic. In 2021, stores started to reopen and we saw innovative physical store upgrades by apparel and footwear brands and retailers. For example, in September 2021, Dick’s Sporting Goods opened its first outdoor concept store, Public Lands, in Pittsburgh. The store features a 30-foot rock wall, an in-store gear repair and rental department and specialized shops dedicated to various outdoor activities. Levi’s is also planning more “NextGen” stores to bring tailor shops, digitalized shopping guides and customized recommendations into stores. We discuss what selected apparel and footwear brands and retailers are doing to innovate their physical stores and we offer relevant implications for broader brands and retailers in the sector. Why It Matters The presence of brick-and-mortar stores may boost brands’ and retailers’ web traffic, according to a study by the International Council of Shopping Centers (ICSC). The ICSC claimed that its study of consumer spending during 2016, 2017 and 2018 revealed a halo effect: When a shopper spends $100 offline, and then goes to that retailer’s online store within 15 days of the offline purchase, the customer will spend an additional $167, on average, for a total of $267, according to the study. The ICSC said that its research found that although omnichannel shoppers accounted for only 17% of the total number of consumers, they contributed 34% of total spend across all categories, compared to shoppers who only buy online or in store. We believe that apparel and footwear brands and retailers are poised to benefit from physical stores.Innovations in Apparel Stores: Coresight Research Analysis

Experiential Retail To Drive Engagement in Apparel Stores Retailers are increasingly innovating physical stores to drive customer engagement and offer more interesting, fun experiences that help retain customer loyalty and drive sales. We explore three such strategies below. Well-Designed, Theme-Focused Physical Stores Offer Warmth, Fun and Visual Enjoyment Rationale: It is important that apparel brands and retailers add interesting designs or themes into stores such as pop-up displays with innovative designs or new product layouts to drive shopper engagement. Management of brands and retailers are paying attention to store design and visual components as 71% of retail executive said the design/store planning/visual component of the retail industry is “somewhat more” or “much more” important compared to two years ago, according to the Store Design and Experience Benchmark survey conducted in February 2021 by media company Retail TouchPoints. Example: In December 2021, apparel brand Kith opened a pop-up store in Aspen, Colorado. The store was open daily throughout the holiday season, featuring an “old-school, Home Alone” vibe according to the company. The store introduced the brand’s new “Kithmas” collection and sixth installment of Kith’s partnership with Coca-Cola. [caption id="attachment_142176" align="aligncenter" width="700"] Kith’s pop-up store in Aspen, Colorado

Kith’s pop-up store in Aspen, Colorado Source: Kith [/caption] Interesting In-Store Activities or Events Rationale: In-store activities or events that are related to products will help build an elevated customer experience and gather like-minded people who are passionate about common interests, which will help retain customers for a longer time in stores and gain more possibilities to drive in-store sales. Example: In November 2021, Dick’s Sporting Goods announced the opening of its second Public Lands store and second Golf Galaxy Performance Center. The 60,000-square-foot store will feature a 30-foot rock wall, an in-store gear repair and rental department and specialized shops dedicated to various outdoor activities. The Golf Galaxy Performance Center will offer golfers access to industry leading TrackMan and BioMech golf technologies, hitting bays, custom fittings, golf lessons from a Class A Certified PGA Professional, and apparel and footwear from top brands. The company opened its first Public Lands concept store in Pittsburgh, Pennsylvania, in September 2021. [caption id="attachment_142175" align="aligncenter" width="700"]

Dick’s Sporting Goods’ second Public Lands store in Columbus, Ohio

Dick’s Sporting Goods’ second Public Lands store in Columbus, Ohio Source: Dick’s Sporting Goods [/caption] Apparel Customization Shops Rationale: Although custom apparel is not going to become mainstream in the near future, it is an important part of the market; it serves a niche consumer group looking to showcase their individuality with unique purchases, as well as consumers looking for solutions to personal style or size requirements. Examples:

- In November 2021, Levi’s opened the first NextGen store in Chile (also its first store in Latin America), bringing the total number of NextGen stores to 127 globally. This new location features an elevated in-store experience including an illuminated entrance, fit and style guidance, improved fitting rooms and a tailor shop. Levi’s disclosed in its press release that the store has already received rave reviews from consumers and has increased its conversion rate and exceeded its sales goal. Additionally, the tailor shop is off to a strong start; patches are selling four times more than the team expected.

Levi’s NextGen store in Chile

Levi’s NextGen store in Chile Source: Levi’s [/caption]

- In November 2021, Uniqlo opened its flagship store in Beijing, China, which features a customization workshop where customers can design their own T-shirts using thousands of specially designed content types, including Chinese-style Universal Studios and Disney motifs and Chinese-calligraphy-themed patterns.

Uniqlo’s flagship store in Beijing, China

Uniqlo’s flagship store in Beijing, China Source: Uniqlo [/caption] Build Seamless Shopping Processes The Covid-19 pandemic has significantly impacted the ways in which consumers engage in retail. Brick-and-mortar retail is responding with new solutions. Retailers are increasingly adopting technologies that support seamless and integrated in-store processes to drive sales. The following three solutions are being adopted to help customers remove friction from the shopping process. Self-Guided Scanning or Scanning by a Store Associate To Access Further Item Details Rationale: It is important that apparel brands and retailers offer customers clear information on product inventory levels and details, especially during the pandemic when supply chain restrictions largely influence product’s inventory levels and shipping speed. Negative experiences, such as out-of-stocks, limited product availability or extended shipping times, influence purchasing decisions as well. Examples:

- Amazon will open its first Amazon Style store in Los Angeles in late 2022. Shoppers will need to rely heavily on their smartphones in order to browse the apparel items because there will be only just one size and color of a particular product in store (the remaining inventory will be kept in the back of the store). Consumers will need to scan a QR code to view additional sizes, colors, product ratings and other information, such as personalized recommendations for similar items. After scanning the code, shoppers can also choose to add the item to a fitting room or send it to a pickup counter. In the fitting rooms, Amazon will add touch screen displays, which shoppers can use to rate items or request different styles or sizes to be delivered to their fitting rooms.

Amazon’s first Amazon Style store will feature touch screens in fitting rooms

Amazon’s first Amazon Style store will feature touch screens in fitting rooms Source: Amazon [/caption]

- In December 2021, Wrangler, a denim brand owned by Kontoor, opened its first standalone store in Nanjing, China. The store features neon light displays and stations with detailed information on key products, offering customers an engaging retail experience. The store will also be fully localized and showcase Wrangler’s latest collaboration with Chinese apparel brand Sankuanz.

Wrangler’s first standalone store in Nanjing, China

Wrangler’s first standalone store in Nanjing, China Source: Wrangler [/caption]

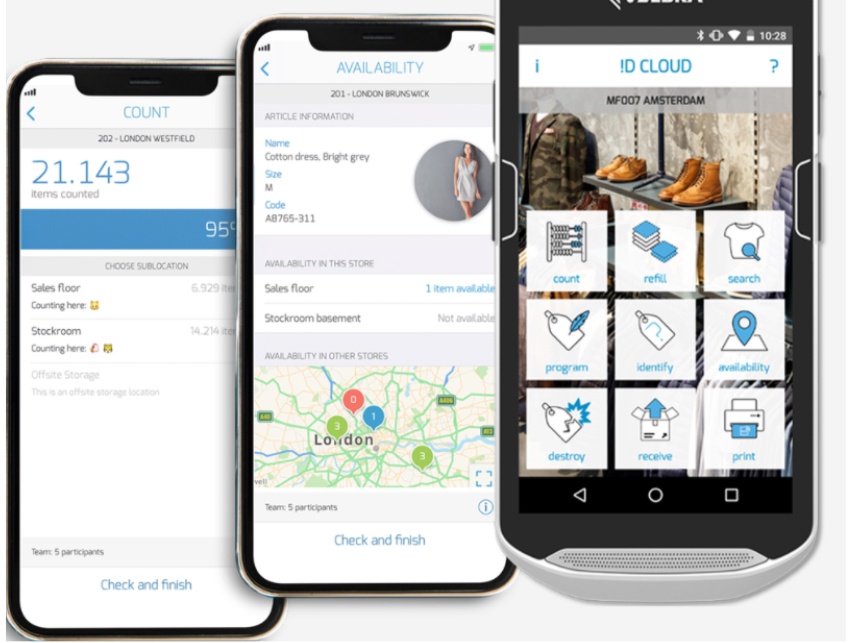

- In November 2021, Under Armour deployed the Nedap iD Cloud RFID-based inventory visibility platform throughout 400 of its owned and operated stores globally, aiming to achieve accurate stock visibility in retail stores.

The Nedap iD Cloud RFID technology launched by Nedap, a Dutch multinational technology company

The Nedap iD Cloud RFID technology launched by Nedap, a Dutch multinational technology company Source: Nedap [/caption]

- In August 2021, NIKE opened its second Rise retail concept store in Seoul, Korea. NIKE opened its first Rise store in Guangzhou, China in July 2020. The new store in Seoul introduces Sport Pulse, a digital platform across all levels of the store and allows consumers to see local NIKE product trends and sports updates. Another new experience is Inside Track, an interactive RFID-enabled digital footwear table where shoppers can compare details including product benefits, footwear technology and online reviews for any two shoes in the store when placing them on the table.

NIKE’s Rise retail concept store in Seoul, Korea

NIKE’s Rise retail concept store in Seoul, Korea Source: NIKE [/caption]

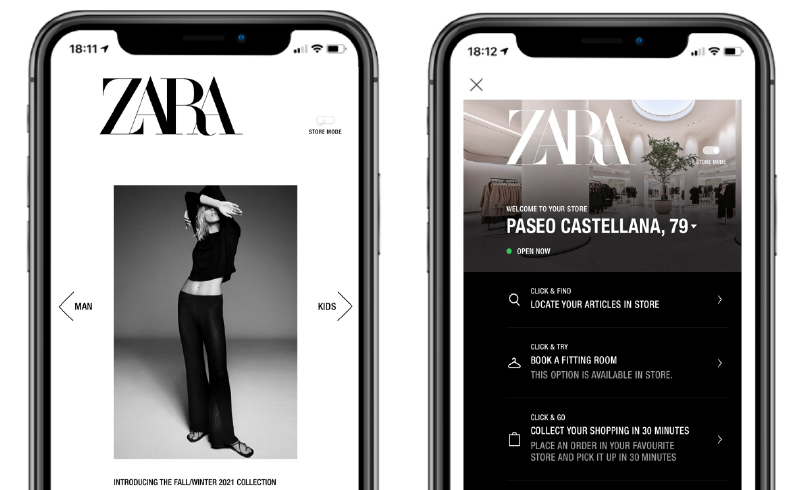

- In July 2021, Zara launched its Store Mode technology across all UK stores, connecting its physical locations with its website and app. Originally tested in nine London locations, this technology can allow customers to check into any UK store online and view the products or sizes available in specific stores. Then, customers can buy and pick up in-store on the same day.

Zara’s Store Mode technology-based mobile app

Zara’s Store Mode technology-based mobile app Source: Zara [/caption] Smart Dressing Rooms and Virtual Try-On Rationale: Although smart dressing rooms or virtual try-on may not immediately provide purchase conversion lifts for apparel categories, they are important differentiators that offer customers convenience and help retain customer loyalty. Example: In April 2021, Adidas opened its first Mideast flagship in Dubai. The fitting rooms are outfitted with interactive mirrors that use RFID technology to recognize products and provide information. Shoppers can request different sizes and colors without leaving the space. Customers can also use the Adidas app to scan products, check sizes and have the products delivered to home while browsing them in stores. [caption id="attachment_142167" align="aligncenter" width="700"]

Adidas’ flagship store in Dubai

Adidas’ flagship store in Dubai Source: Adidas [/caption] New POS Systems To Reduce Customer Checkout Time Rationale: It is important that apparel brands and retailers implement more efficient service tools at physical stores to create a more streamlined and fast shopping experience for customers. 71% of customers favor speed of service and checkout ease when deciding whether to continue shopping with a retailer, according to Oracle’s survey of more than 5,000 global consumers in 2020. Example: In October 2021, Carter’s reported on its 3Q21 earnings call that it is on track with a project to replace POS systems across its more than 1,000 company-owned stores with a new system that is expected to reduce checkout time by 50% and increase integration of in-store and e-commerce. experiences for consumers such as marketing personalization. [caption id="attachment_142166" align="aligncenter" width="700"]

Carter’s current store checkout point in Mall of America, Bloomington, Minnesota

Carter’s current store checkout point in Mall of America, Bloomington, Minnesota Source: Carter’s [/caption] Apparel and Footwear Physical Stores in 2022 and Beyond 2022 will be another transformative year for physical retail as more consumers will be able to shop in stores. We are also seeing brands and retailers preparing to upgrade in-store infrastructures and experiences to get ready for a full recovery of physical retail. We expect the future of apparel physical stores to be more personalized, convenient and interesting. Specifically, we envision the future of apparel physical stores will do the following.

- Personalize offerings or styling recommendations: A select group of retailers are already leveraging mobile devices to offer customers personalized digital coupons when they enter the store. In the next few years, we will see more sales associates or digital tablets that help customers create tailored recommendations on products. Using information that reveals the preferences of consumers, apparel brands and retailers can better highlight merchandise that fits more precisely with individual tastes and budgets. In addition, apparel brands and retailers will continue to offer customization services to customers to drive engagement.

- Offer more convenient services for customers to try-on clothes and check product availability: Apparel brands and retailers will offer innovative solutions such as smart mirrors or virtual try-on to improve the efficiency of apparel try-on. They will likely use more digitally connected systems or devices in stores to allow customers to search for the product information they want, mostly sizes and product availability, to save labor costs and improve operational efficiency.

- Offer more interesting in-store activities to drive customer engagement and product discovery: We expect to see more apparel brands and retailers launch in-store activities, similar to Luluelmon’s yoga classes, Dick’s Sporting Goods’ climbing activities or other stores offering workshops that gather like-minded consumers.

What We Think

Implications for Apparel and Footwear Brands and Retailers- We believe apparel and footwear brands and retailers are poised to benefit from physical stores. The future of apparel physical stores will be more personalized, convenient and interesting. Therefore, it is important that apparel brands and retailers make changes to physical stores and attract customers to make purchases.

- Brands and retailers can adopt the following physical store innovation strategies to drive customer engagement: well-designed or theme-focused physical stores that offer customers warmth, fun and visual enjoyment, interesting in-store activities or events that drive excitement and apparel customization shops.

- Brands and retailers can adopt the following three solutions to help remove friction from the shopping process: self-guided scanning or scanning by a store associate to access further item details, smart dressing rooms and virtual try-on, and new POS systems that can reduce customer checkout time.

- 2022 will be an important turning point for commercial real estate owners as they will likely have more opportunities to rent space to brands and retailers and recover sales that were lost during the pandemic years of 2020 and 2021. We encourage commercial real estate owners to work with brands and retailers and come up with innovative solutions to utilize space efficiently and attract customers back to stores.