DIpil Das

[caption id="attachment_96476" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

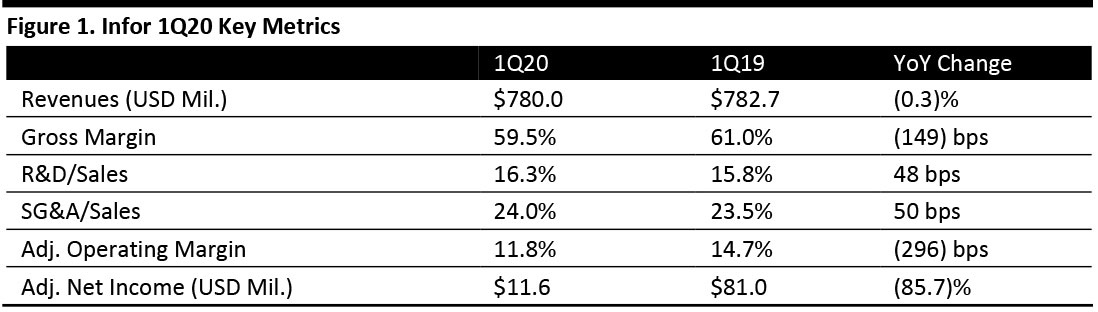

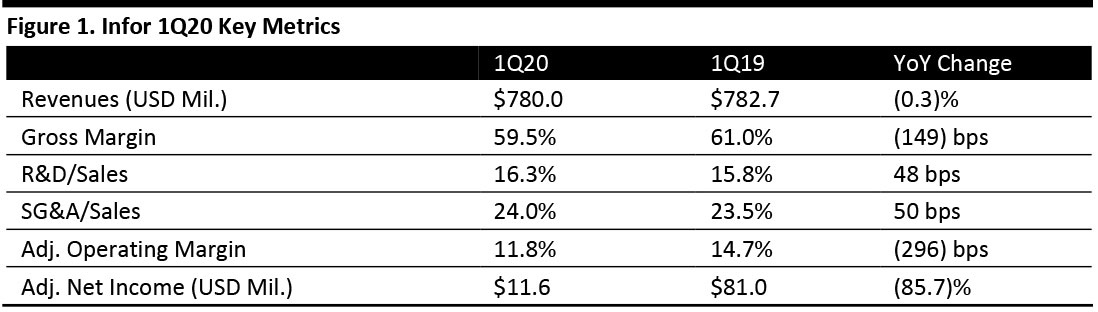

1Q20 Results

Infor reported fiscal 1Q20 revenues of $780.0 million, down 0.3% year over year and up 1.3% on a constant currency basis. Management attributed the growth to higher SaaS subscription and consulting services revenues. One European SaaS customer put its project on hold, which hurt revenues by $7 million and margins by 2%.

Adjusted net income was $11.6 million, down 85.7% year over year.

Adjusted EBITDA was $183.1 million, representing a 23.4% margin and down 9.4% year over year.

The company ended the quarter with $253.3 million in cash and equivalents, down from $356.4 million at the end of the prior quarter, which was affected by the timing of the maintenance renewal cycle.

Leadership Transition

On August 21, Infor announced the following management changes:

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Infor reported fiscal 1Q20 revenues of $780.0 million, down 0.3% year over year and up 1.3% on a constant currency basis. Management attributed the growth to higher SaaS subscription and consulting services revenues. One European SaaS customer put its project on hold, which hurt revenues by $7 million and margins by 2%.

Adjusted net income was $11.6 million, down 85.7% year over year.

Adjusted EBITDA was $183.1 million, representing a 23.4% margin and down 9.4% year over year.

The company ended the quarter with $253.3 million in cash and equivalents, down from $356.4 million at the end of the prior quarter, which was affected by the timing of the maintenance renewal cycle.

Leadership Transition

On August 21, Infor announced the following management changes:

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Infor reported fiscal 1Q20 revenues of $780.0 million, down 0.3% year over year and up 1.3% on a constant currency basis. Management attributed the growth to higher SaaS subscription and consulting services revenues. One European SaaS customer put its project on hold, which hurt revenues by $7 million and margins by 2%.

Adjusted net income was $11.6 million, down 85.7% year over year.

Adjusted EBITDA was $183.1 million, representing a 23.4% margin and down 9.4% year over year.

The company ended the quarter with $253.3 million in cash and equivalents, down from $356.4 million at the end of the prior quarter, which was affected by the timing of the maintenance renewal cycle.

Leadership Transition

On August 21, Infor announced the following management changes:

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Infor reported fiscal 1Q20 revenues of $780.0 million, down 0.3% year over year and up 1.3% on a constant currency basis. Management attributed the growth to higher SaaS subscription and consulting services revenues. One European SaaS customer put its project on hold, which hurt revenues by $7 million and margins by 2%.

Adjusted net income was $11.6 million, down 85.7% year over year.

Adjusted EBITDA was $183.1 million, representing a 23.4% margin and down 9.4% year over year.

The company ended the quarter with $253.3 million in cash and equivalents, down from $356.4 million at the end of the prior quarter, which was affected by the timing of the maintenance renewal cycle.

Leadership Transition

On August 21, Infor announced the following management changes:

- CFO Kevin Samuelson was named CEO, and Charles Philips, who had served as CEO since 2010, will become chairman of the board.

- Soma Somasundaram will remain CTO and also will take on the newly created position as president of products.

- Jay Hopkins moved from chief accounting officer to CFO.

- Cormac Watters was promoted to general manager, head of international markets.

- Rod Johnson was promoted to general manager, head of Americas.

- Software subscription and license fee revenues were $226.7 million, up 2.1% year over year and up 3.1% in constant currency.

- Product update and support fee revenues were $340.6 million, down 3.0% year over year and down 1.3% in constant currency. The company commented that retention rates continue to perform well, partially offsetting decreases from UpgradeX conversions and lower perpetual license bookings levels during the past year.

- Consulting service and other fee revenues were $172.9 million, up 0.9% year over year and up 3.6% in constant currency. Management commented that consulting services grew in all geographies.