Nitheesh NH

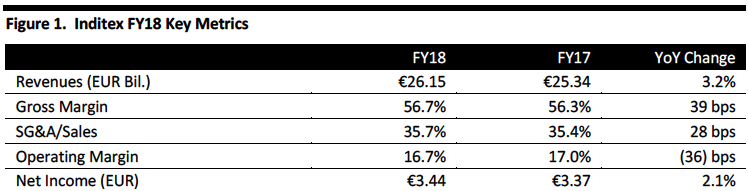

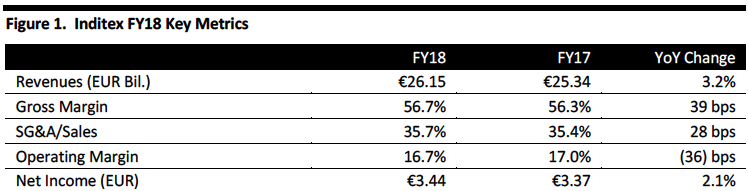

[caption id="attachment_80281" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

FY18 Results

Industria de Diseño Textil, S.A. (Inditex) reported FY18 revenues of €26.15 billion, lower than the consensus estimate of €26.41 billion and up 3.2% from the year ago period. The company reported net income of €3.44, up 2.1% from the year-ago period.

Management reported comparable store sales increased 4.0% in FY18 with positive comps across all regions and brands as well as online and in-store.

Online sales grew 27% to €3.2 billion. Management stated that online sales accounted for 12% of sales. In 2018, Zara launched online in 106 new markets, including Australia and New Zealand. Zara says its products are now available online in 202 markets. Zara plans to launch online sales in Brazil in March, 2019. In May 2019, Zara expects to launch online sales in Dubai, Egypt, Indonesia, Israel, Lebanon, Morocco, Saudi Arabia, Serbia and the UAE.

The company commented that its “central inventory” business model allows Inditex to serve customers globally through its stores and direct online sales. The company says it optimized 90% of its retail space between 2012 and 2018, and now offers online sales with same-day delivery in key capital cities, and next-day delivery as the global standard.

The company has 7,490 total stores in 96 markets, of which 3,364 have been opened in the last seven years, 2,374 have been refurbished and 1,019 enlarged. The company opened new stores in 56 different markets in 2018. The new stores are larger and offer more customer service. The average size of the new stores opened in 2018 is 39% larger than those opened in 2012. Zara stores are on average 50% larger than they were in 2012.

Management reported its strategy is to develop a fully integrated, fully digital, and fully sustainable store and online model supported by the latest technology by 2020. The company maintained capital expenditure at €1.62 billion to support its strategy, which went toward technology upgrades in stores, logistics platforms and to upgrading sales space in line with the strategy of fully integrating online and offline. The company focused on larger stores in premium locations.

Management stated that Zara Home operations will integrate into Zara to better leverage operational and brand management of online and offline platforms.

Outlook

Management projects comparable sales growth of 4-6% in FY19.

Source: Company reports/Coresight Research[/caption]

FY18 Results

Industria de Diseño Textil, S.A. (Inditex) reported FY18 revenues of €26.15 billion, lower than the consensus estimate of €26.41 billion and up 3.2% from the year ago period. The company reported net income of €3.44, up 2.1% from the year-ago period.

Management reported comparable store sales increased 4.0% in FY18 with positive comps across all regions and brands as well as online and in-store.

Online sales grew 27% to €3.2 billion. Management stated that online sales accounted for 12% of sales. In 2018, Zara launched online in 106 new markets, including Australia and New Zealand. Zara says its products are now available online in 202 markets. Zara plans to launch online sales in Brazil in March, 2019. In May 2019, Zara expects to launch online sales in Dubai, Egypt, Indonesia, Israel, Lebanon, Morocco, Saudi Arabia, Serbia and the UAE.

The company commented that its “central inventory” business model allows Inditex to serve customers globally through its stores and direct online sales. The company says it optimized 90% of its retail space between 2012 and 2018, and now offers online sales with same-day delivery in key capital cities, and next-day delivery as the global standard.

The company has 7,490 total stores in 96 markets, of which 3,364 have been opened in the last seven years, 2,374 have been refurbished and 1,019 enlarged. The company opened new stores in 56 different markets in 2018. The new stores are larger and offer more customer service. The average size of the new stores opened in 2018 is 39% larger than those opened in 2012. Zara stores are on average 50% larger than they were in 2012.

Management reported its strategy is to develop a fully integrated, fully digital, and fully sustainable store and online model supported by the latest technology by 2020. The company maintained capital expenditure at €1.62 billion to support its strategy, which went toward technology upgrades in stores, logistics platforms and to upgrading sales space in line with the strategy of fully integrating online and offline. The company focused on larger stores in premium locations.

Management stated that Zara Home operations will integrate into Zara to better leverage operational and brand management of online and offline platforms.

Outlook

Management projects comparable sales growth of 4-6% in FY19.

Source: Company reports/Coresight Research[/caption]

FY18 Results

Industria de Diseño Textil, S.A. (Inditex) reported FY18 revenues of €26.15 billion, lower than the consensus estimate of €26.41 billion and up 3.2% from the year ago period. The company reported net income of €3.44, up 2.1% from the year-ago period.

Management reported comparable store sales increased 4.0% in FY18 with positive comps across all regions and brands as well as online and in-store.

Online sales grew 27% to €3.2 billion. Management stated that online sales accounted for 12% of sales. In 2018, Zara launched online in 106 new markets, including Australia and New Zealand. Zara says its products are now available online in 202 markets. Zara plans to launch online sales in Brazil in March, 2019. In May 2019, Zara expects to launch online sales in Dubai, Egypt, Indonesia, Israel, Lebanon, Morocco, Saudi Arabia, Serbia and the UAE.

The company commented that its “central inventory” business model allows Inditex to serve customers globally through its stores and direct online sales. The company says it optimized 90% of its retail space between 2012 and 2018, and now offers online sales with same-day delivery in key capital cities, and next-day delivery as the global standard.

The company has 7,490 total stores in 96 markets, of which 3,364 have been opened in the last seven years, 2,374 have been refurbished and 1,019 enlarged. The company opened new stores in 56 different markets in 2018. The new stores are larger and offer more customer service. The average size of the new stores opened in 2018 is 39% larger than those opened in 2012. Zara stores are on average 50% larger than they were in 2012.

Management reported its strategy is to develop a fully integrated, fully digital, and fully sustainable store and online model supported by the latest technology by 2020. The company maintained capital expenditure at €1.62 billion to support its strategy, which went toward technology upgrades in stores, logistics platforms and to upgrading sales space in line with the strategy of fully integrating online and offline. The company focused on larger stores in premium locations.

Management stated that Zara Home operations will integrate into Zara to better leverage operational and brand management of online and offline platforms.

Outlook

Management projects comparable sales growth of 4-6% in FY19.

Source: Company reports/Coresight Research[/caption]

FY18 Results

Industria de Diseño Textil, S.A. (Inditex) reported FY18 revenues of €26.15 billion, lower than the consensus estimate of €26.41 billion and up 3.2% from the year ago period. The company reported net income of €3.44, up 2.1% from the year-ago period.

Management reported comparable store sales increased 4.0% in FY18 with positive comps across all regions and brands as well as online and in-store.

Online sales grew 27% to €3.2 billion. Management stated that online sales accounted for 12% of sales. In 2018, Zara launched online in 106 new markets, including Australia and New Zealand. Zara says its products are now available online in 202 markets. Zara plans to launch online sales in Brazil in March, 2019. In May 2019, Zara expects to launch online sales in Dubai, Egypt, Indonesia, Israel, Lebanon, Morocco, Saudi Arabia, Serbia and the UAE.

The company commented that its “central inventory” business model allows Inditex to serve customers globally through its stores and direct online sales. The company says it optimized 90% of its retail space between 2012 and 2018, and now offers online sales with same-day delivery in key capital cities, and next-day delivery as the global standard.

The company has 7,490 total stores in 96 markets, of which 3,364 have been opened in the last seven years, 2,374 have been refurbished and 1,019 enlarged. The company opened new stores in 56 different markets in 2018. The new stores are larger and offer more customer service. The average size of the new stores opened in 2018 is 39% larger than those opened in 2012. Zara stores are on average 50% larger than they were in 2012.

Management reported its strategy is to develop a fully integrated, fully digital, and fully sustainable store and online model supported by the latest technology by 2020. The company maintained capital expenditure at €1.62 billion to support its strategy, which went toward technology upgrades in stores, logistics platforms and to upgrading sales space in line with the strategy of fully integrating online and offline. The company focused on larger stores in premium locations.

Management stated that Zara Home operations will integrate into Zara to better leverage operational and brand management of online and offline platforms.

Outlook

Management projects comparable sales growth of 4-6% in FY19.