Source: Company reports/Fung Global Retail & Technology

FY16 Results

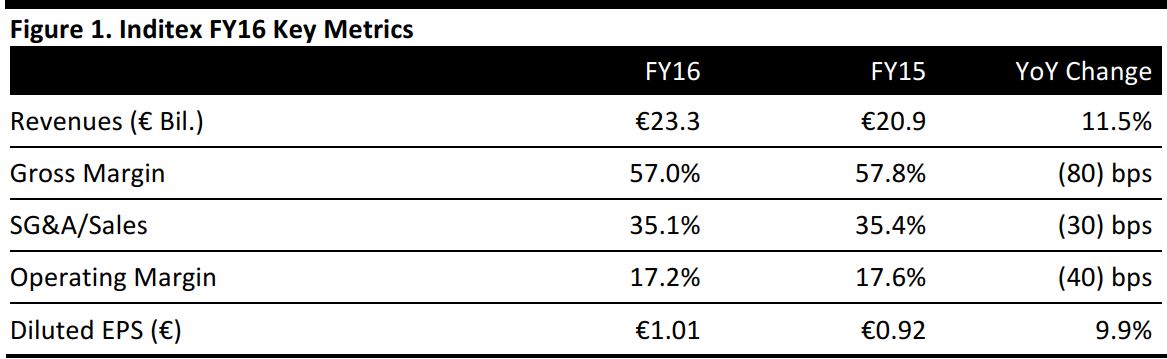

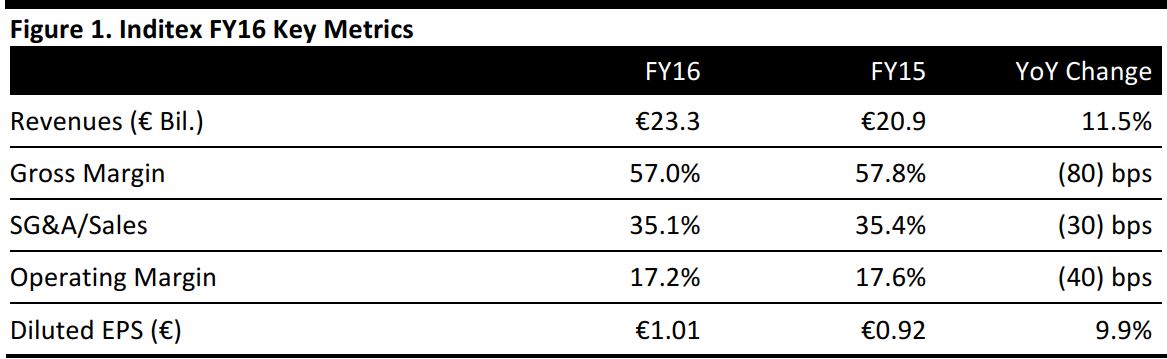

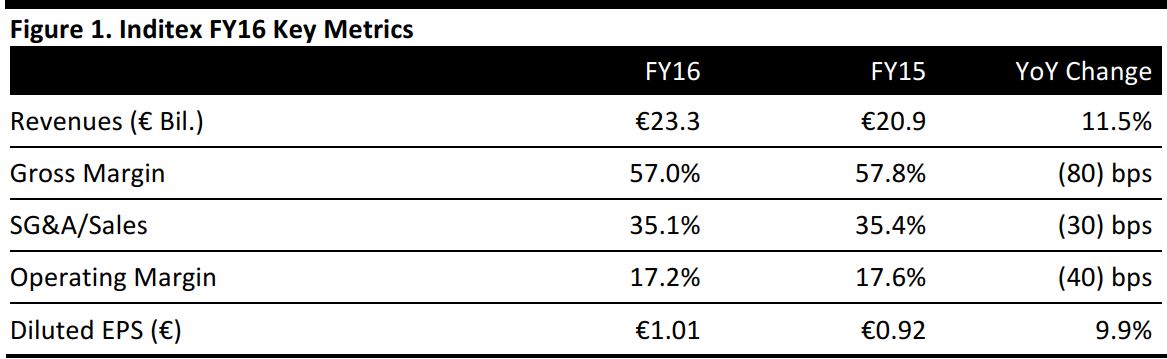

Inditex, an international textile company based in Spain, reported a revenue increase of 11.5% year over year to €23.3 billion for FY16, in line with consensus estimates. EPS was €1.01, an increase of 9.9% versus FY15.

FY16 gross profit margin contracted by 80 bps year over year to 57.0%. Operating expenses were tightly controlled and the SG&A margin declined by 30 bps to 35.1%.

Inditex reported EBIT growth of 9.4% year over year to €4.1 billion and FY16 EBIT margin contracted by 40 bps year over year to 17.2%.

The results were underpinned by very strong comps and by store and online expansion. Comparable store sales increased 10% year over year in FY16 and new space growth increased 8%. Inditex opened a net 279 stores in 56 different markets, reaching a total of 7,292 stores in 93 markets. The majority of new store openings included Zara and Zara Home stores. Online sales for Zara were launched in Singapore and Malaysia in March 2017.

Sales by Concept

Zara and Zara Home were the company’s strongest performing banners. Zara sales increased 13% year over year in FY16 and Zara Home sales increased 16% year over year. Massimo Dutti sales increased by 9% year over year.

Outlook

Inditex’s store and online sales at constant currencies for the trading period of February 1 to March 12, 2017 have increased by 13% year over year.

The company expects to continue its store expansion program in FY17 at a similar rate to FY16, with 450-500 gross store openings.

Online sales for Zara in Thailand and Vietnam will be launched at the end of March and April 2017, respectively. Zara expects to launch online sales in India in 2017.

The group expects to incur capex of €1.5 billion in FY17.

Analysts estimate that Inditex will generate €26.0 billion in net sales in FY17, along with €4.7 billion in EBIT and EPS of €1.17. Consensus estimates imply FY17 year-over-year revenue growth of 11.5%, EBIT margin of 18.0% and EPS growth of 15.8%.