Source: Company reports/Coresight Research

1H18 Results

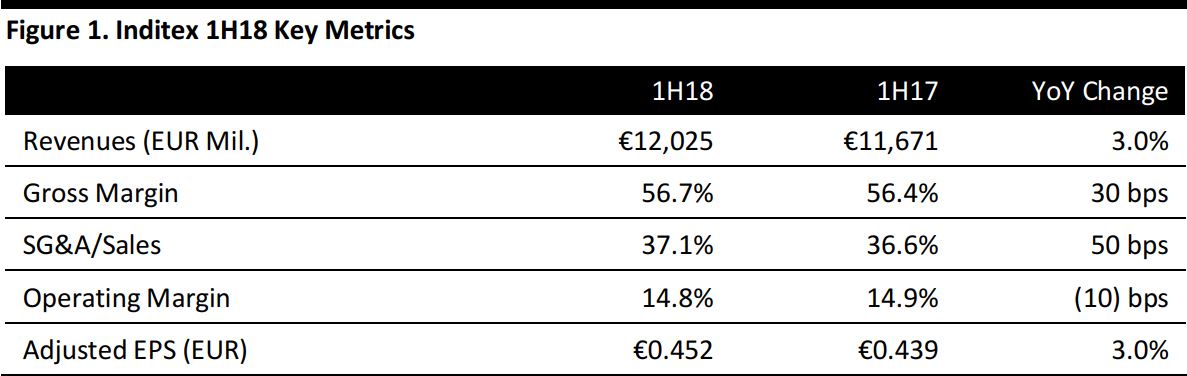

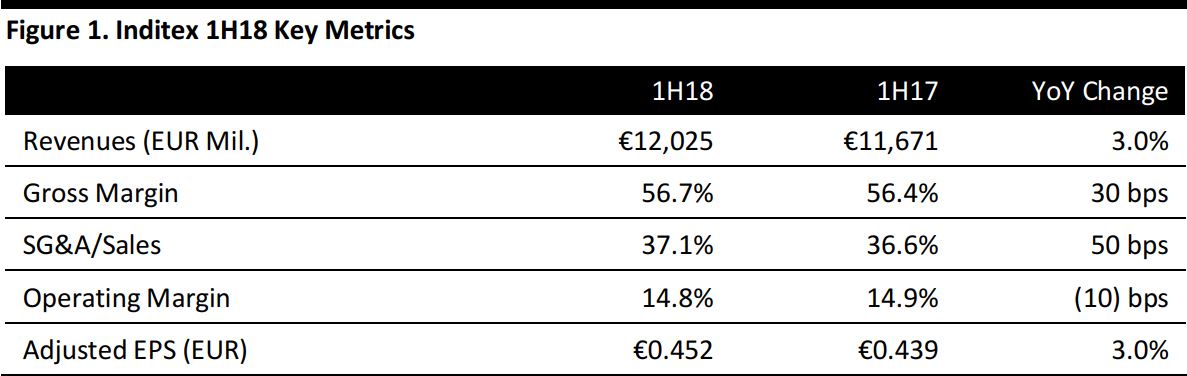

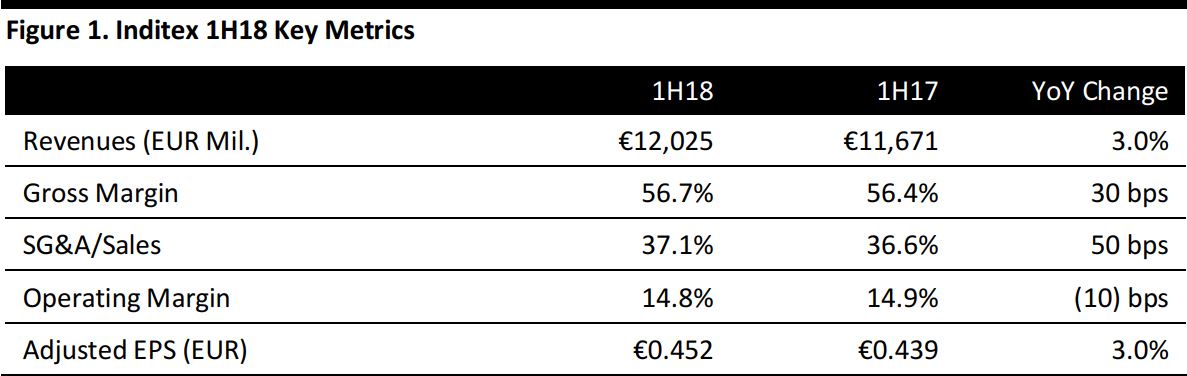

Spanish fashion retailer Inditex reported net sales growth of 3% year over year, to €12.03 billion, in the first half ended July 31, 2018. The company grew sales by 8% on a constant currency basis, missing the consensus estimate of €12.06 billion. Same-store sales grew 4% and were positive across all regions.

The company reported a gross profit of €6.8 billion, up 4% year over year (up 10% at constant currency), with a 30 basis-point expansion in the gross margin to 56.7%.

Operating expenses grew by 4.3%, which the company attributed to the addition of new retail space and which prompted the SG&A ratio to expand by 50 basis points to 37.1%.

In turn, the operating margin contracted marginally by 10 basis points, to 14.8. EPS increased by 3% year over year to €0.452.

In 1H18, Inditex opened stores in 44 markets, taking the store count to 7,422 spanning 96 markets globally.

By concept, sales under the Pull&Bear and Oysho brands grew the strongest, by 11.2% and 7.0%, respectively. Sales under Zara and Bershka—Inditex’s two largest brands—grew by 2.2% and 2.9%, respectively.

Inditex launched online stores for Zara in Australia and New Zealand and highlighted that global online sales launches are on track. By 2020, the company wants to offer its online sales across all the concepts worldwide. It also highlighted that initial winter collections have been well received by customers.

The company declared a dividend of €0.375 per share, payable on November 2, 2018, as FY17 final ordinary and bonus dividend.

Outlook

For 2H18, management estimates gross margin expansion of about 50 basis points and guided for same-store sales growth in the range of 4%–6%.

Inditex intends to spend roughly €1.5 billion in capital expenditure in the current fiscal year, mainly dedicated to the addition of new space in prime locations.

Analysts expect FY18 revenue to grow by 6.4%, operating income to rise by 4.6% and adjusted EPS to increase by 4.4%.