DIpil Das

What’s the Story?

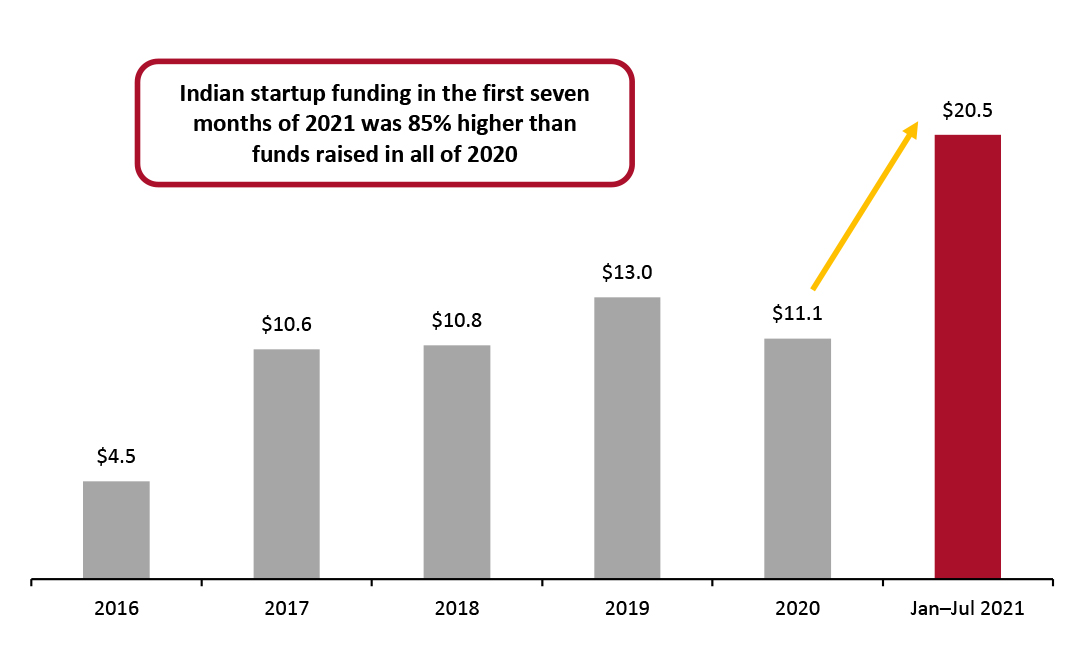

This year, Indian startups have enjoyed their highest levels of funding to date. As of the end of July 2021, based on Venture Intelligence data for the first half and disclosures during the month by startups, we have tracked funding amounting to $20.5 billion—already exceeding total funds that startups raised in 2020 by $9.4 billion. In July alone, disclosed Indian startup funding was nearly $8.4 billion. July also saw notable Indian startups debut on the stock market and some fundraising this year is reportedly part of startups’ pre-IPO (initial public offering) rounds.Why It Matters

In 2021, India joined the top 20 startup ecosystems in the world, based on data from startup research firm StartupBlink. The country is ranked fifth in Asia Pacific and is home to 43 cities in the global top 1,000 cities for startups. The country’s size, availability of talent, high economic growth rate and startup-friendly government policies make it a hotbed for foreign investment. According to Inc42, a news site focused on Indian startups, there are 5,694 total active investors in India’s 38,000 startups, of which about 27% are based in the US.Indian Startup Ecosystem Funding, 2021: Coresight Research Analysis

2021 YTD Funding Surpasses Total Funds Raised Annually over the Last Five Years The Indian startup ecosystem attracted growing levels of funding until 2019, after which momentum slowed as the coronavirus outbreak spread globally and funding levels declined. In 2021, however, Indian startups saw renewed interest as e-commerce, food delivery and home-learning were in high demand during the crisis, which prompted startups to improve and expand their offerings. Indian startups raised $12.1 billion in the first half of 2021, already surpassing total funds raised in 2020. Momentum gathered in July, as many states in India began to lift pandemic restrictions and the economy slowly began to restart—leading startups to raise nearly $8.4 billion. As of the end of July, based on disclosed funding, Indian startups have raised $20.5 billion—but the actual number may be much higher as not all startups disclosed funds received.Figure 1. India Startup Funding, 2016–July 2021 [caption id="attachment_132166" align="aligncenter" width="725"]

Source: Entrackr/Money Control/TechCrunch/ Venture Intelligence/YourStory/Coresight Research [/caption]

Fundraising Sees Record Number of Startups Join the Unicorn Club

In 2021, fundraising has pushed at least 23 startups into India’s unicorn club (startups valued at $1 billion and over), according to startup news platform YourStory. Startup media platform StartupTalky states that there are currently 59 unicorns in India.

This year, notable entrants into the unicorn club include financial technology firm Cred (which raised $215 million in April), social networking app Gupshup (which raised $100 million in April and a further $240 million in July), and software-as-a-service startup BrowerStack (which raised $200 million in June).

In the first half of the year, other startups with major funding rounds included the following:

Source: Entrackr/Money Control/TechCrunch/ Venture Intelligence/YourStory/Coresight Research [/caption]

Fundraising Sees Record Number of Startups Join the Unicorn Club

In 2021, fundraising has pushed at least 23 startups into India’s unicorn club (startups valued at $1 billion and over), according to startup news platform YourStory. Startup media platform StartupTalky states that there are currently 59 unicorns in India.

This year, notable entrants into the unicorn club include financial technology firm Cred (which raised $215 million in April), social networking app Gupshup (which raised $100 million in April and a further $240 million in July), and software-as-a-service startup BrowerStack (which raised $200 million in June).

In the first half of the year, other startups with major funding rounds included the following:

- Educational technology leader Byju’s, which raised $1.5 billion in three tranches, between December 2020 and April 2021

- Fantasy sport gaming startup Dream11, which raised $400 million in March 2021

- Food technology firms Zomato, which raised $250 million in February 2021, and Swiggy, which raised $800 million in April 2021

- Regional-language social media app ShareChat, which raised $502 million in April 2021

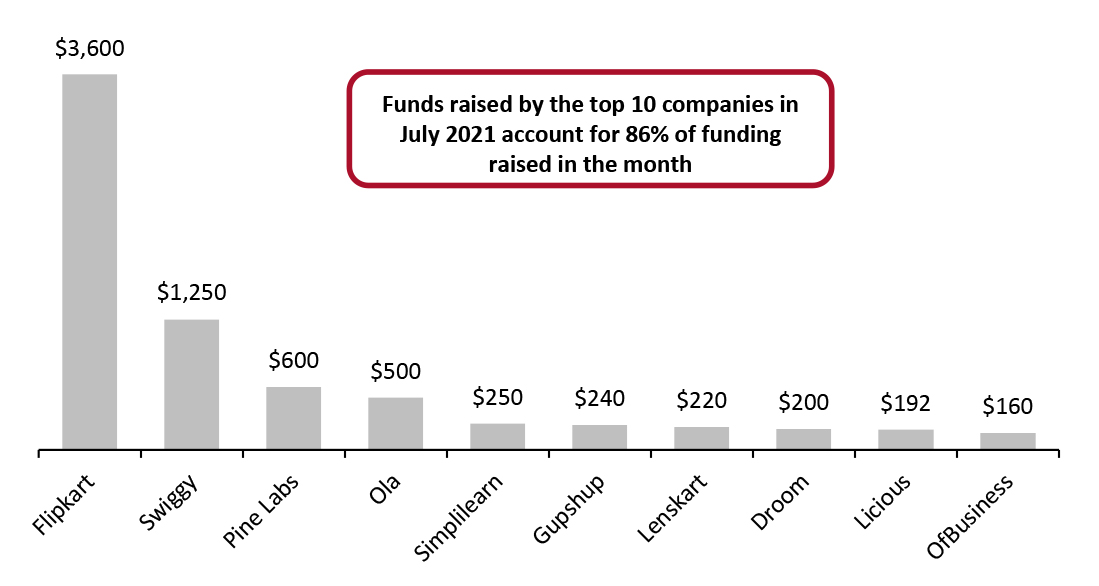

- In July 2021, Flipkart raised $3.6 billion in a funding round led by Singaporean sovereign wealth fund GIC, Canada’s Pension Plan Investment Board, SoftBank Vision Fund 2 and Walmart—one of the largest fundraising rounds by an Indian startup.

- Following its $800 million funding round in April, Swiggy also raised $1.25 billion in July, led by investment firm Prosus and SoftBank Vision Fund 2. The company aims to bolster its reserves to compete with rival Zomato, which made a blockbuster debut on the Indian stock exchange in the same month.

Figure 2. Top 10 Fundraising Rounds in July 2021 (USD Mil.) [caption id="attachment_132167" align="aligncenter" width="726"]

Source: TechCrunch/Entrackr [/caption]

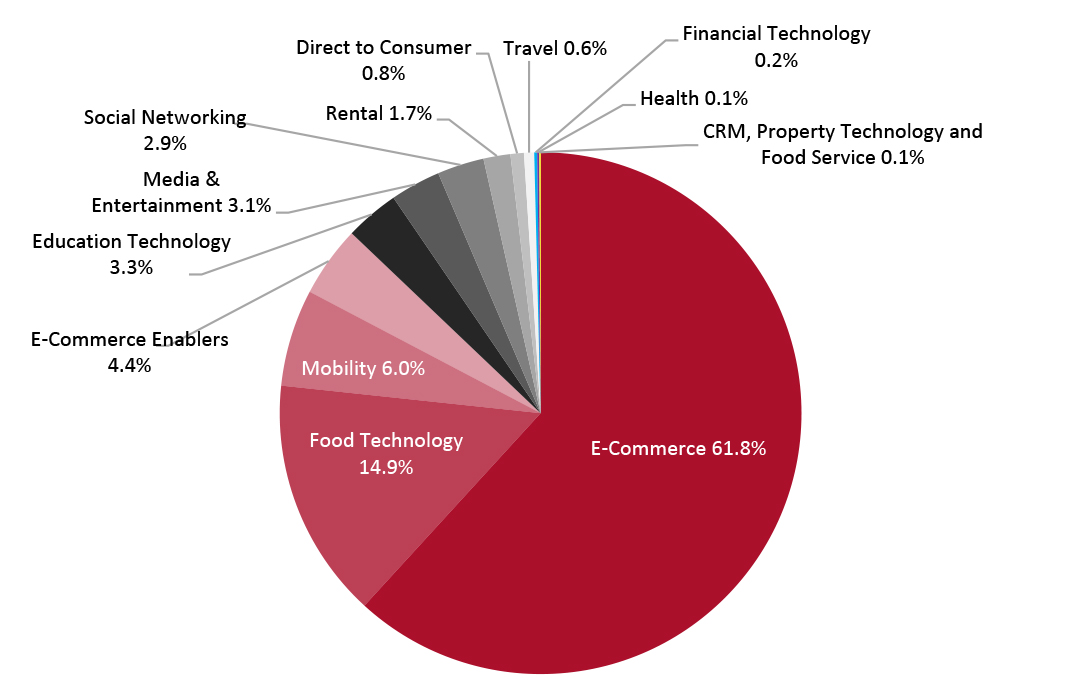

E-Commerce, Food Technology and Mobility Are Top Sectors for Fundraising in July

In July, Flipkart dominated the e-commerce sector in terms of fundraising, but a further six of the top 10 companies shown in Figure 2 are also e-commerce startups. Notably, merchant commerce firm Pine Labs raised $600 million, omnichannel eyewear retailer Lenskart (which started as online-only) raised $220 million and automobile marketplace Droom raised $200 million.

E-commerce enablers (startups that provide e-commerce firms with ancillary services such as supply chain services and logistics) also performed well in July.

Source: TechCrunch/Entrackr [/caption]

E-Commerce, Food Technology and Mobility Are Top Sectors for Fundraising in July

In July, Flipkart dominated the e-commerce sector in terms of fundraising, but a further six of the top 10 companies shown in Figure 2 are also e-commerce startups. Notably, merchant commerce firm Pine Labs raised $600 million, omnichannel eyewear retailer Lenskart (which started as online-only) raised $220 million and automobile marketplace Droom raised $200 million.

E-commerce enablers (startups that provide e-commerce firms with ancillary services such as supply chain services and logistics) also performed well in July.

- Global Bees, a startup which acquires and partners with brands that have a revenue rate of $1–20 million, raised $150 million. It aims to use the funds to create a house of brands similar to US firm Thrasio, which acquires and builds third-party brands that sell on Amazon.

- Goat Brand Labs raised $36 million. The startup provides similar services to Global Bees and was founded by the former head of Flipkart Fashion. Funders included Flipkart Ventures, the e-commerce firm’s investment arm, reflecting Flipkart’s determination to expand across a variety of e-commerce segments.

Figure 3. Funds Raised in July 2021 by Startup Sector [caption id="attachment_132168" align="aligncenter" width="725"]

Source: TechCrunch/Entrackr/Money Control/YourStory/Coresight Research[/caption]

Source: TechCrunch/Entrackr/Money Control/YourStory/Coresight Research[/caption]

What We Think

After a stellar performance in the first seven months, we believe the Indian startup ecosystem is poised for further growth and investments during the rest of the year. We believe that the country will become one of the most sought-after locations for foreign investment firms. India’s low e-commerce penetration means it is well positioned to accommodate both new innovators in the sector and firms that provide ancillary services. The country’s predominantly young population and its size present a potentially huge consumer audience for education technology, food technology and other consumer-driven sectors. Implications for Brands/Retailers- As startups look to grow, brands and retailers should look to onboard the latest retail technology to compete on a global scale.

- With increasing funding for e-commerce firms, traditional brands and retailers should look to step up competitiveness by acquiring or partnering with retail technology firms.