Introduction

Offline retail is much less developed in India than it is in Western countries. Yet, there is no shortage of tech-driven disruptors bringing more choice, greater convenience and lower prices to Indian consumers through e-commerce.

We had previously covered Indian retail and e-commerce in our report

E-Commerce Disruptors in India. We discussed the evolution of e-commerce in the country and the factors that shaped it.

In this report, we examine several notable e-commerce platforms that have contributed to the development of the segment in India.

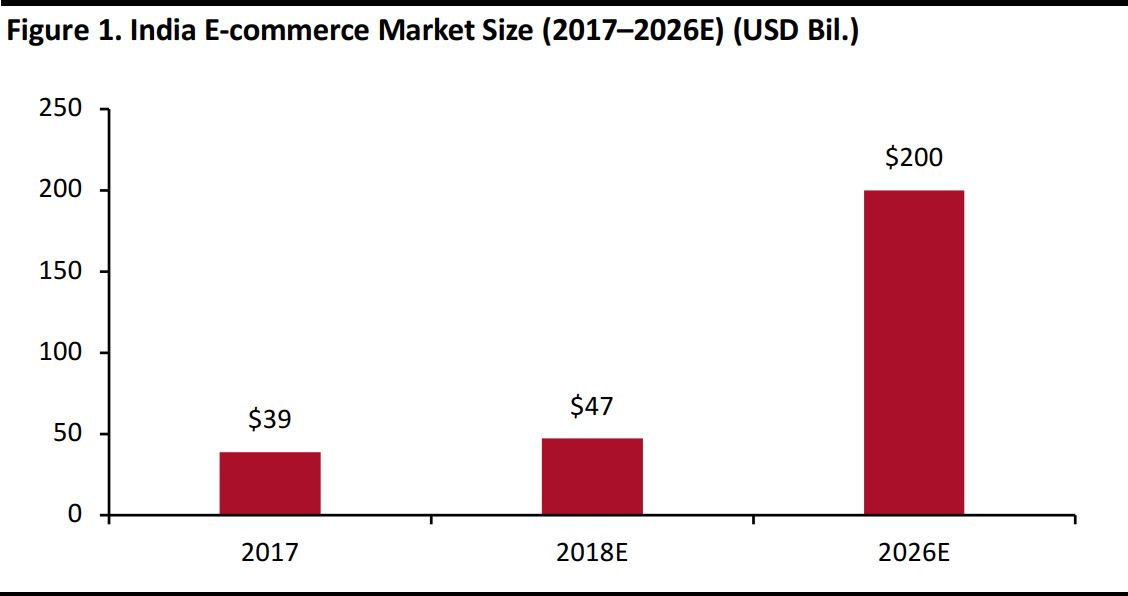

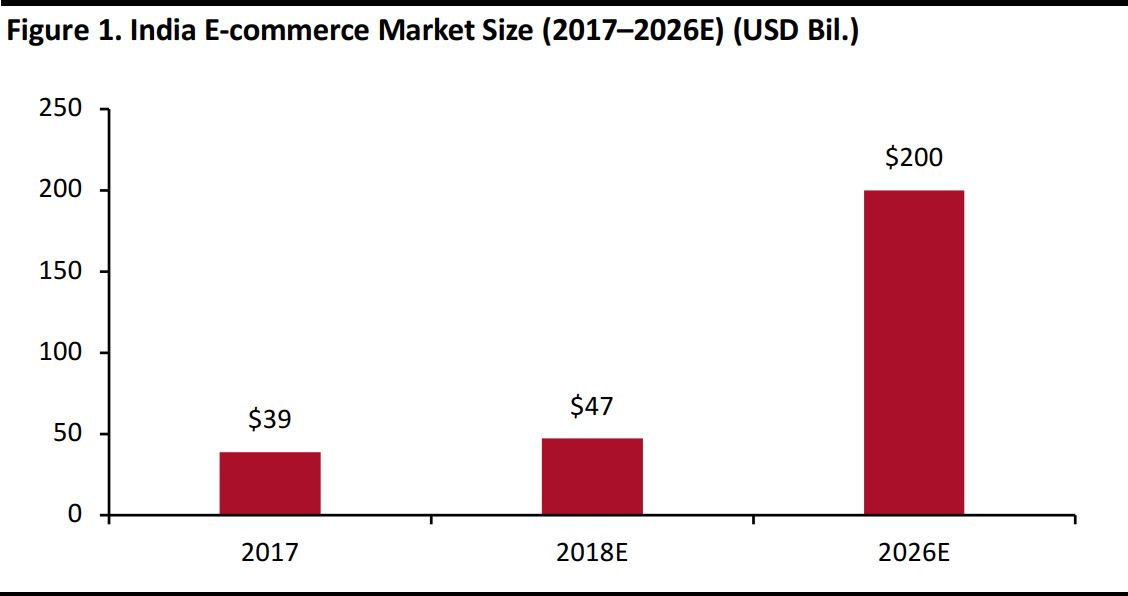

The Indian e-commerce market was worth $39 billion in 2017 and is expected to grow at a CAGR of 20% to $47 billion in 2018 and reach $200 billion by 2026, according to India Brand Equity Foundation (IBEF).

Source: IBEF

The ubiquity of the Internet and an increasing demand for a wider choice of products have contributed to the growth of e-commerce platforms in India. The marketplace model has been the business model of choice for leaders in Indian e-commerce.

The Marketplace Model Dominates E-Commerce Platforms

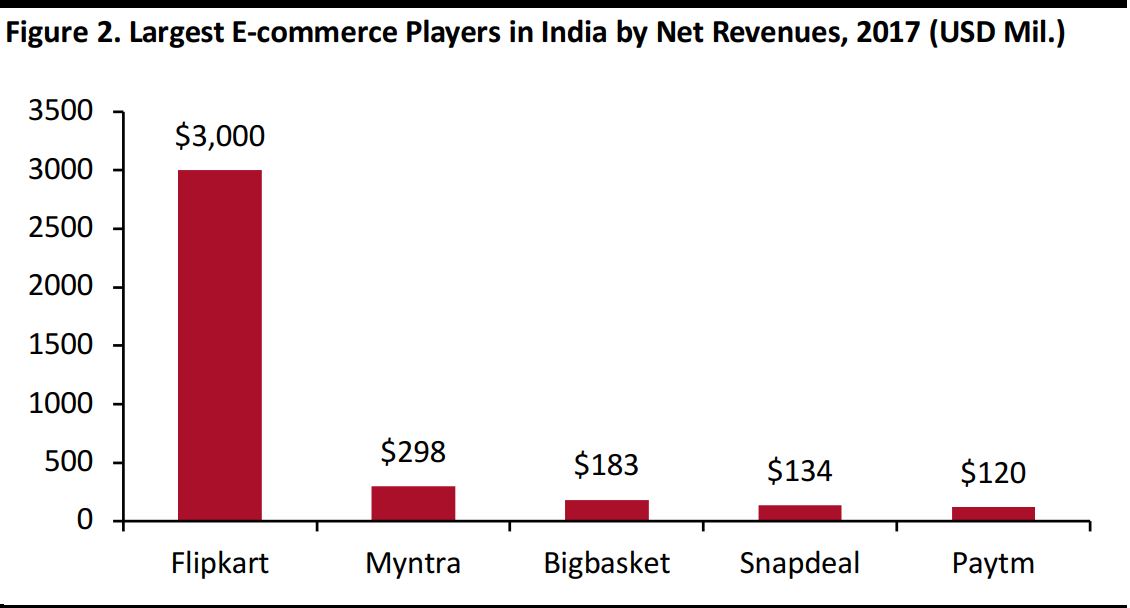

We focus our analysis on the e-commerce companies that have received the highest funding. We discuss five of India’s e-commerce “unicorns,” which are startups valued at more than a billion dollars: Flipkart, Snapdeal, Paytm, Shopclues, Quikr and Bigbasket, in detail. We also briefly discuss the major fashion pure plays and Flipkart subsidiaries Myntra and Jabong. Amazon and Flipkart led e-commerce sales in India in 2017, followed by Myntra, Bigbasket and Jabong, according to ecommerceDB, a division of statistics firm Statista.

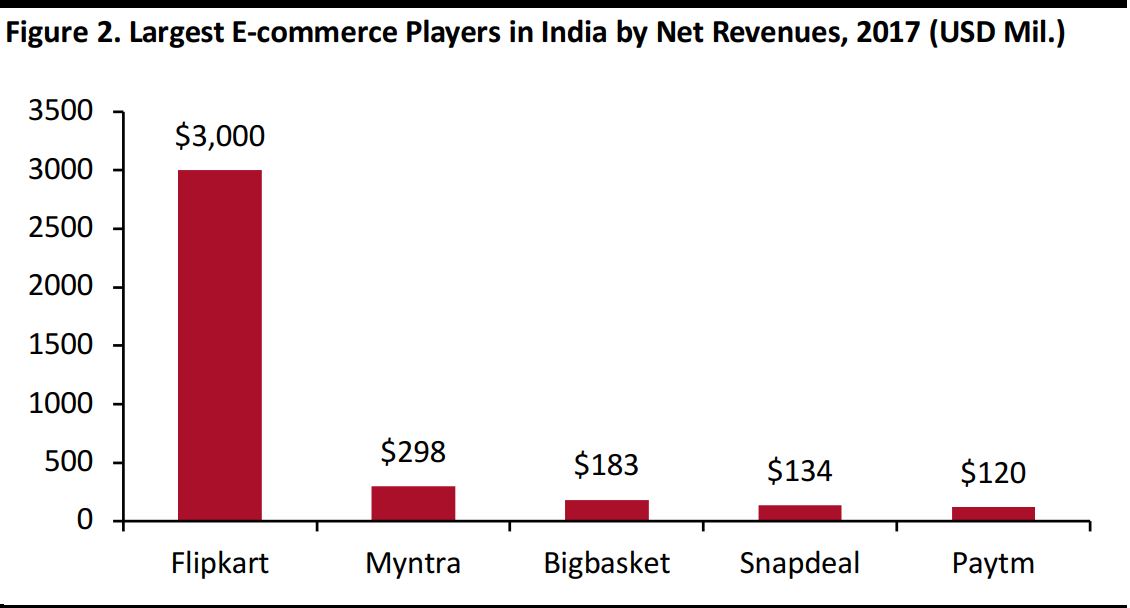

Based on net revenue figures published in regulatory filings, Flipkart and Myntra led e-commerce sales, followed by Bigbasket, Snapdeal and Paytm, in fiscal year 2017.

Note: The Indian financial year runs from April 1 to March 31. We have used a fixed FY17 exchange rate of INR 67.06 per USD throughout the report.

Source: Company reports/Livemint.com/Business Standard/The Economic Times

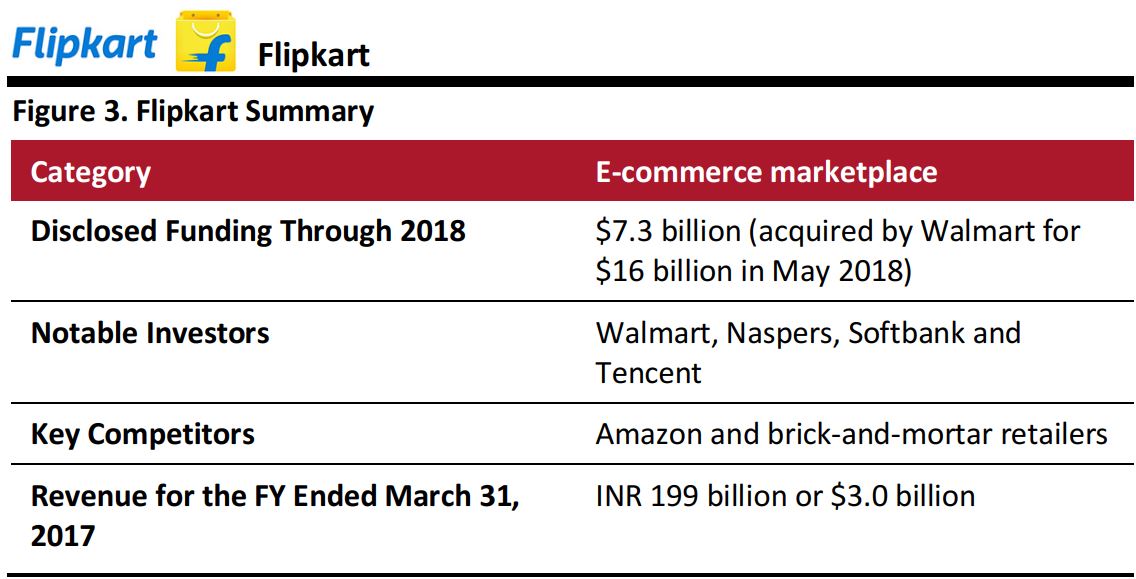

Source: Crunchbase.com/Business Standard/The Economic Times

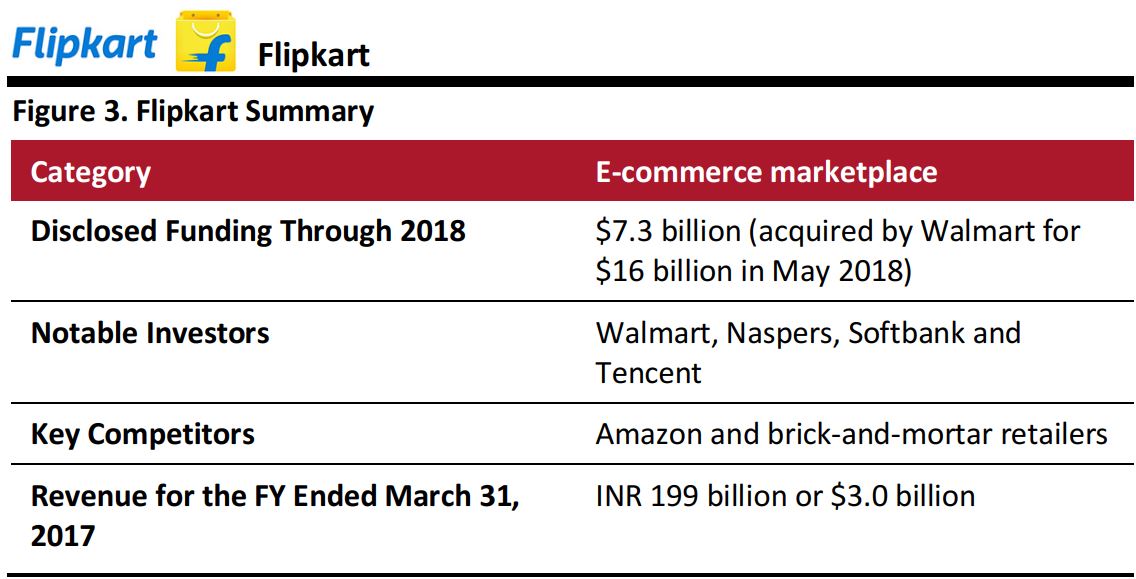

Flipkart began as an e-commerce company in Bengaluru, India in 2007, focusing solely on the sale of books. Within a decade, the company established itself as the homegrown leader, selling an assortment of products ranging from consumer electronics to apparel and footwear. Flipkart successfully raised $4.1 billion from Softbank and Naspers in 2017, taking its valuation up to $11.6 billion. This yielded some respite to the company as its valuation was down to $5.6 billion on November 29, 2016 from a peak valuation of $15.2 billion in 2015.

On May 9, 2018, Walmart paid $16 billion to acquire a 77% stake in Flipkart. The deal includes a fresh infusion of equity worth $2 billion to bolster Flipkart’s position against Amazon, its biggest competitor. Flipkart is valued at $21 billion after the acquisition.

What Made Flipkart Successful?

Flipkart has successfully hosted four Big Billion Days (BBDs)—its flagship annual sale when products are sold at deep discounts—as of June 2018. Flipkart’s acquisition of specialist retailers such as Myntra and Jabong.com has bolstered its position further to compete with Amazon in India. Flipkart also acquired the payments app PhonePe in April 2016.

Additionally, to promote operational and cost efficiencies, Flipkart does not own the inventory sold via its platform. Flipkart’s gross merchandise value (GMV) as of fiscal year 2018 was $7.5 billion. According to a forward

-looking statement issued by Walmart in May 2018

, Flipkart held the highest GMV share in fashion, mobile phones and large electronic appliances among all the marketplaces in India.

Challenges Flipkart Faced

Flipkart has weathered a rather turbulent financial journey. Losses mounted until fiscal year 2015, when Flipkart posted a net loss of INR 8.7 billion ($128.7 million) and in the following year, the company posted a net loss of INR 5.4 billion ($79.8 million).

Another major challenge the company has faced to date is when it received severe criticism from its customers for its first BBD on October 6, 2014. The company targeted to reach a total of 1 billion transactions in a single day, which it achieved; but issues with the website and lack of adequate inventory resulted in many dissatisfied customers.

Flipkart was in deep water again in 2016 when its competitors filed a case against it claiming that the company had breached competition laws by selling at prices lower than cost.

Recent Developments

Since 2016, Flipkart has created eight private labels for 53 product-categories. Adarsh Menon, head of private labels and electronics at Flipkart said, “By the end of 2018, the company expects to add around 165 categories,” adding that “private labels provide 40% margins on average.”

Flipkart expanded the product range under MarQ, its electronics and appliances private label, earlier in 2018 to include air conditioners, smart televisions, washing machines and personal healthcare for both men and women. It plans grow this label further during the year.

In August 2018, Flipkart invested $66 million in PhonePe, taking the total investment in its payments arm to $184.1 million. Flipkart has proposed to invest nearly $500 million in PhonePe.

Flipkart also announced the expansion of its recently-launched grocery e-commerce arm, Supermart, to five new cities by the end of 2018; it is currently available only in Bengaluru. The online grocery market in India is a lot more developed than it was a few years ago and Flipkart seems slightly late to the race, which is already led by Alibaba-backed Bigbasket.

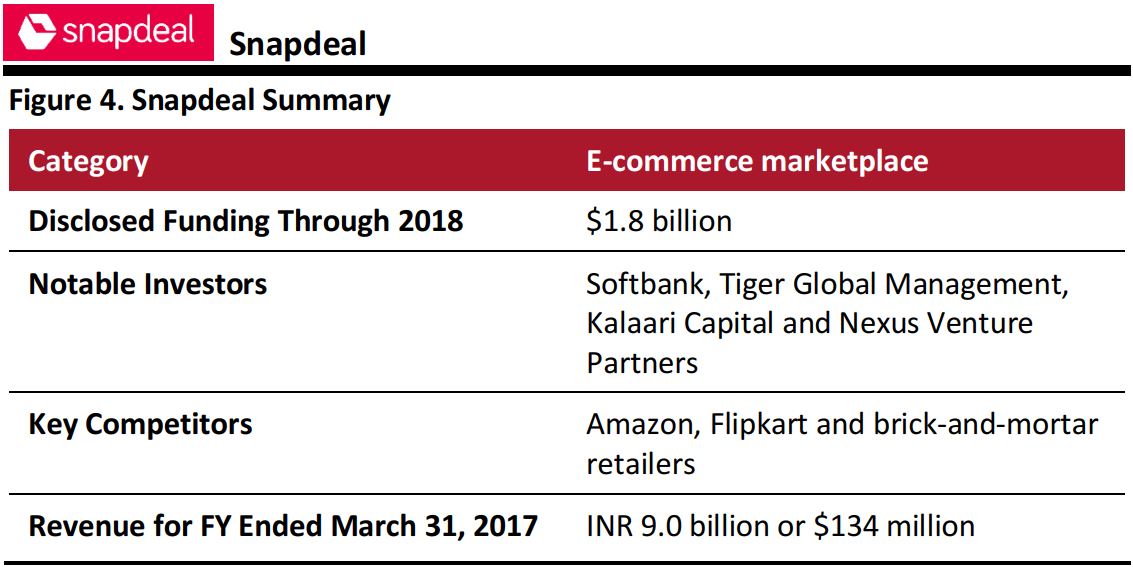

Source: Crunchbase.com/Livemint.com

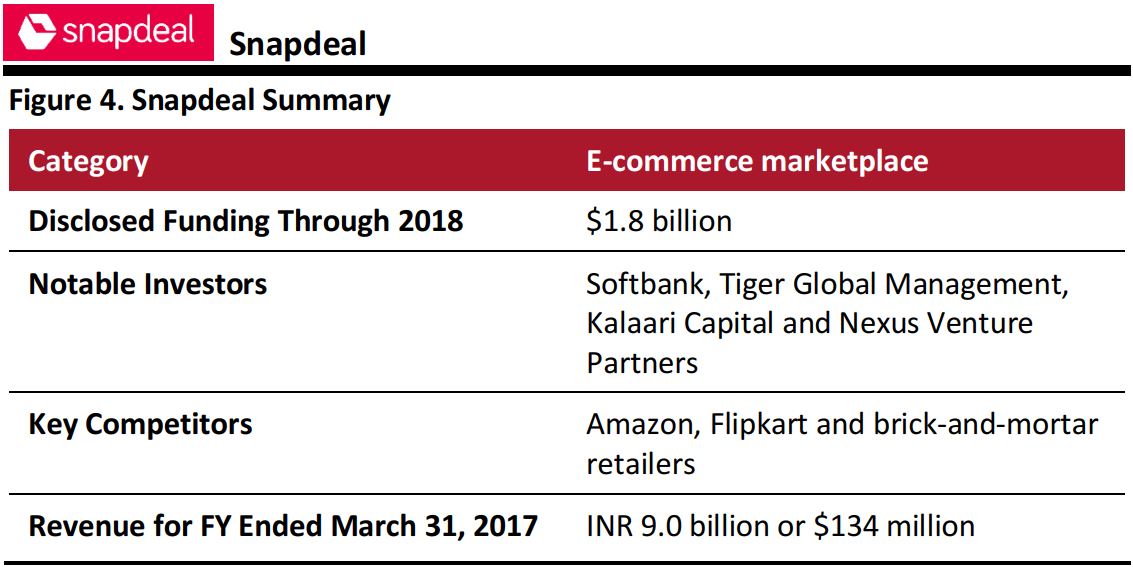

Delhi-based Snapdeal began as a daily deals platform in 2010 and expanded to become an online marketplace within a year of its establishment. It has received substantial funding from many investors including Alibaba and Softbank (which is also a major investor in rival firm Flipkart).

What Made Snapdeal Successful?

Snapdeal runs festive discounts and flash sales like Amazon and Flipkart do but the company’s early success lies in its business model. Inspired by the success of online marketplace Alibaba, Snapdeal plunged into transforming its business model and converted itself into an online marketplace that offers attractive deals and deep discounts.

Challenges Snapdeal Faced

Snapdeal has not made any potential acquisitions to bolster its position in the marketplace and the ones it has made have not paid off well. Fashion platform Exclusively.com and Shopo, a consumer to consumer marketplace, both ceased operations within a year of their acquisition by Snapdeal.

The company performed below par in the latest reported fiscal year, reporting a 40% drop in its revenue in fiscal 2017 as per regulatory documents submitted with the Registrar of Companies (RoC).

Snapdeal has considerably shrunk its operations and both its cofounders announced a 100% cut in their salaries in March 2017 in order to meet the firm’s financial obligations. The company has not been able to revive its sales despite an INR 2 billion ($30.7 million) re-branding campaign it undertook in 2016.

Recent Developments

In February 2017, the All India Online Vendor Association (AIOVA), a body of more than 2,000 online vendors cautioned its members to stop selling on Snapdeal, stating that the company carries a credit risk as large as $60 million.

In April 2018, Snapdeal’s CEO, Kunal Bahl addressed all employees in an e-mail stating that the company’s investors are driving the way forward and there is little he can do. Earlier this year, Softbank initiated talks with Tiger Global Management to convince Tiger to sell a 10% share in Snapdeal of its total 30%, which would make Softbank the largest shareholder in Snapdeal. Softbank, being keen on the merger of Snapdeal and Flipkart, raised its investment in both firms as they shaped the Indian e-commerce marketplace model. The deal, however, was opposed by two other major investors in Snapdeal, Kalaari and Nexus, who hold a combined 18% share in the company.

Snapdeal has managed to overcome its difficulties to an extent. The firm turned profitable in June 2018, according to

The Economic Times, a financial newspaper. Its order volumes increased to 45,000-50,000 in May 2018 up from 20,000-25,000 in 2017.

Source: Crunchbase.com/Livemint.com

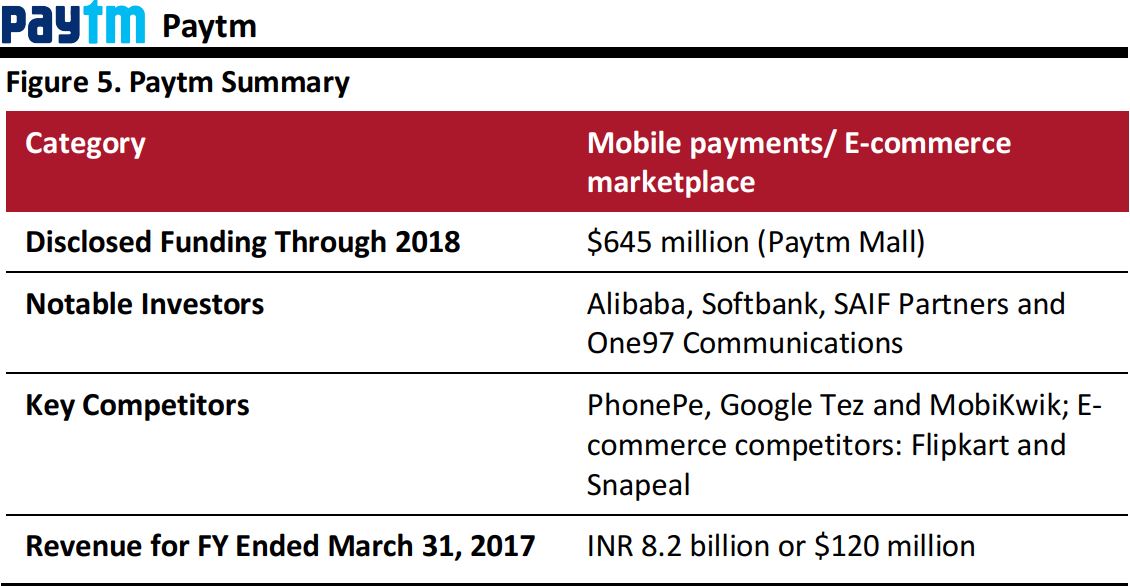

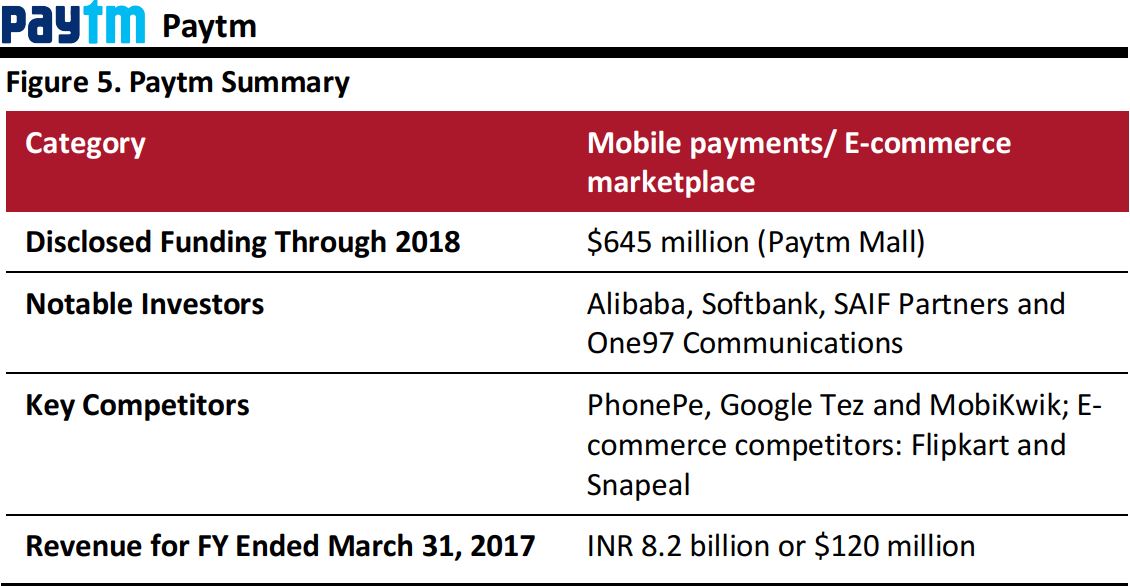

Paytm began as an e-commerce payment system platform and was one of the first to make a foray in this segment, in India. It was founded in 2010 and initially offered services such as mobile currency recharges and utility bill payments. It branched out into e-commerce in 2014, by adding a shopping feature called “Mall” to its payment app. Paytm has attracted the attention of many notable investors including Alibaba, Softbank and the Tata group.

What Made Paytm Successful?

Paytm’s success largely lies in its strategic and far-sighted expansionary decisions. Paytm acquired Plustxt, a Bangalore-based instant-messaging app, in 2013 for $2 million.

In 2014, Paytm launched a new shopping function called “Bargain.” The function allows consumers to bargain or negotiate prices and deals using text messages powered by Plustxt. Shoppers can choose from over 100,000 products sold by more than 250 merchants, including major players such as Zovi, Myntra and Yepme.

In 2015, One97 Communications, the parent company of Paytm announced a strategic alliance with Alibaba-backed Ant Financial Services, conceding a 25% share to the latter. The partnership rendered Paytm with the experience of Alipay wallet, China’s largest mobile payment service provider which hosted over 190 million users, as of 2015.

Challenges Paytm Faced

In July 2017, Paytm Mall delisted 85,000 sellers while keeping only 30,000 sellers onboard. The problem of counterfeit products and dubious sellers is one of the major challenges faced by e-commerce companies. Flipkart and Amazon have taken precautionary measures to address this problem, but Paytm’s delisting of numerous sellers in one fell swoop is unprecedented in Indian e-commerce.

Paytm has made a concerted effort to mitigate potential risks to customers and to Alibaba’s image as a platform for counterfeit sellers by regularly screening sellers for authenticity, and as a result, the news reports about it have been largely positive. Paytm Chief Operating Officer Amit Sinha said, “There are no faceless names anymore. We have had sellers working out of a warehouse and then one fine day, when we want to take action, the sellers have vanished.”

Recent Developments

In an interview with financial newspaper

The Economic Times, Vijay Sharma, founder of Paytm stated, “In 2018, we will be growing vertically rather than horizontally and would definitely go deeper into everything instead of starting something new.” The company’s focus this year will primarily be on the expansion of its payments and financial services business, Sharma said.

Paytm Mall has announced a flurry of benefits to shoppers, including no-cost equated monthly installments or EMIs—a term used to describe monthly payments toward a loan or items purchased on credit, device insurance, extended warranty (for a small additional fee) and an easy exchange both online and offline through partner stores. The announcement follows the recent influx of $450 million in funding by Alibaba and Softbank.

In February 2018, Paytm Mall announced its partnership with RedTape, a domestic fashion brand. All products in RedTape physical stores will be equipped with Paytm Mall QR codes, and this will enable the customer to purchase the product in-store by simply scanning the barcode. By the end of 2018, the company aims to cover 150 stores under the scheme from 50 in March 2018.

Paytm Mall registered gross sales amounting to $3.5 billion in June 2018 and is aiming to achieve $10 billion in gross sales by March 2019. The company expects its unit orders to jump to around 1–1.5 million orders per day from the current level of 625,000. It hopes to achieve this through its offline to online operating model, which could put some 15 million offline shops in India online. Paytm Mall is expecting to increase its reach to 25 cities from 10 currently, by November this year. Paytm Mall works with offline stores including Samsung and Hitachi among others

Source: Crunchbase.com/Livemint.com

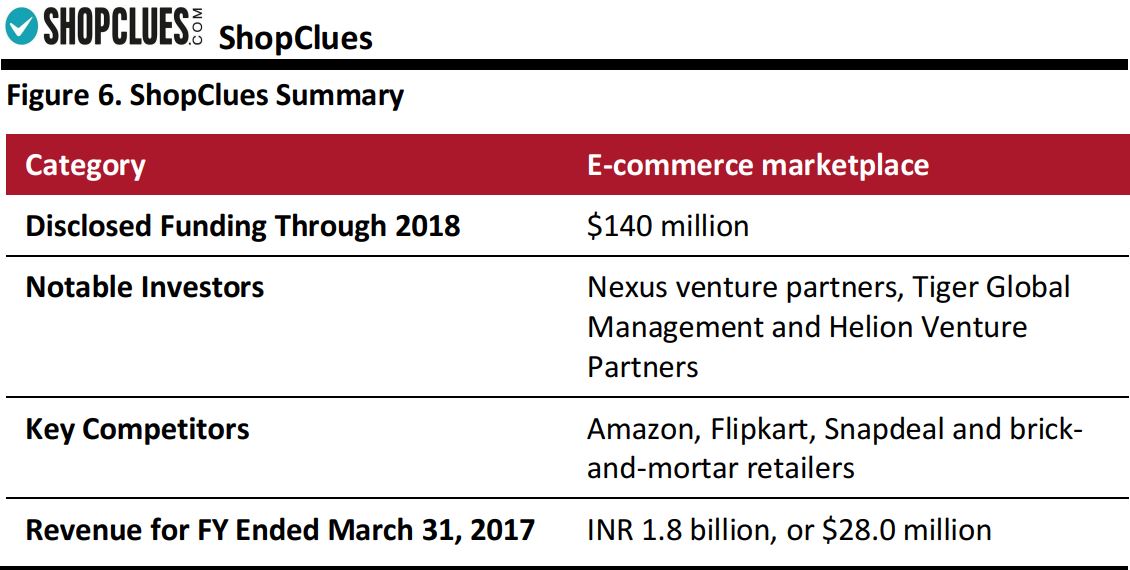

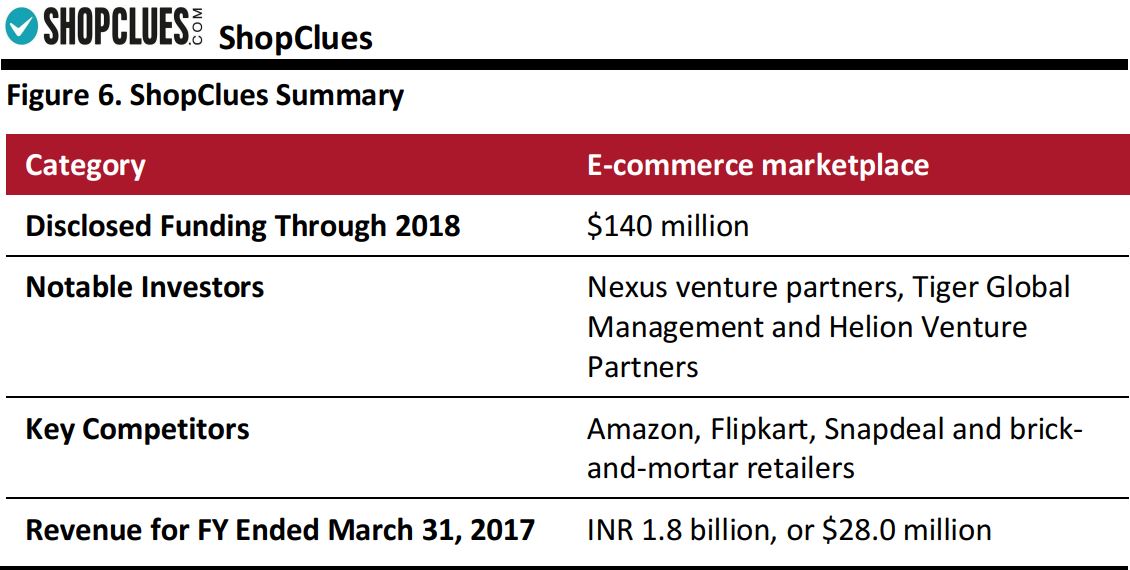

Online marketplace ShopClues was launched in 2011 and has since focused on tier-II and tier-III cities. ShopClues focuses on the lifestyle segment and sells home and kitchen, fashion and electronic products on its platform. The e-commerce company attained unicorn status in January 2016 with a valuation of $1.1 billion. Its notable investors include Nexus Venture Partners and Tiger Global Management.

What Made ShopClues Successful?

Financial stability makes ShopClues stand out from the rest of the retailers in its cohort. Its objective to cater to “Bharat,” the unorganized Indian market including both merchants and shoppers, is another feature that sets it apart.

As reported by

The Economic Times, some 80% of the company’s revenue comes from tier-III cities and beyond, including remote towns such as Haflong, Pilai and Chatarpur. The company has so far succeeded in catering to a unique consumer base, out of reach of its competitors Flipkart and Amazon.

In an interview at TechSparks, a summit for entrepreneurs, Shopclues cofounder Radhika Aggarwal stated, “We have our blinders on and we have focused on that. Today we have about 15% market share in lifestyle—we are the fourth-largest player in the country. We have been able to do all this with a total raise of less than $200 million.”

Challenges ShopClues Faced

ShopClues faced immense resistance from investors in its early years of inception. According to

Livemint, a financial newspaper, an early prospective investor pulled out of a $5 million deal with the firm.

During 2011–2014, the company went through many funding rounds to raise $100 million; eventually, its valuation went up to $500 million in 2014. Scarce funds made it difficult for the company to grow its offering of regional and local brands.

Recent Developments

In late 2017, ShopClues launched its first exclusive electronic label “Digimate.” The development followed ShopClues’ previously launched private-label brands Homeberry, MEIA and Baton. The Digimate product range has a price ceiling of INR 699 that aligns it with the company’s strategy of catering to customers seeking affordable purchases.

The company announced that it has postponed its plans for an Initial Public Offering in 2019 in the context of slowing business which was a result of high denomination notes being demonetized in November 2016 and the introduction of a new Goods and Services Tax (GST) regime in June 2017.

The company plans to expand its footprint in tier-IV cities and serve a higher number of consumers and merchants in those areas.

Source: Crunchbase.com/VCCircle.com

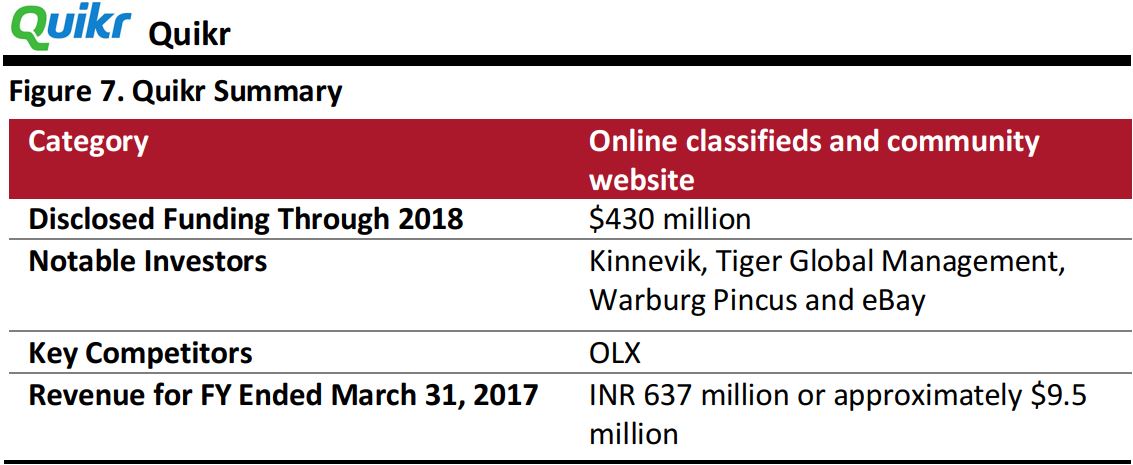

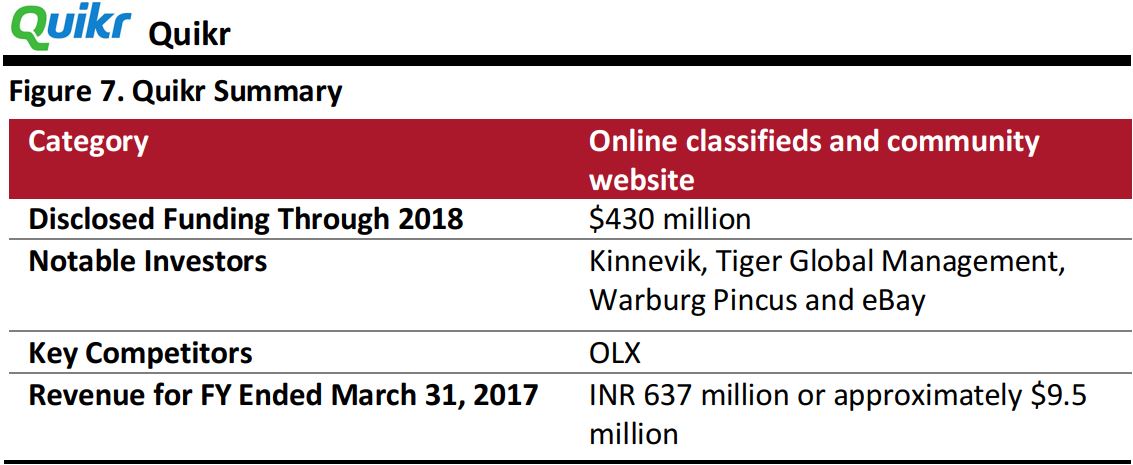

Quikr was one of the first websites in India to function as an online classifieds platform connecting local buyers and sellers across various categories. It was established in 2008 and has attracted funding from Kinnevik and Tiger Global, which are its largest investors, as well as from Warburg Pincus and eBay.

What Made Quikr Successful?

Quikr has made several strategic acquisitions to strengthen its position, the main ones being Stepni, which connects vehicle owners with service providers; Grabhouse, a home rental firm; and ZapLuk and Salosa, which are beauty and wellness services providers.

Challenges Quikr Faced

In an interview with BestMediaInfo

, a marketing and media news portal, Quikr Chief Marketing Officer, Vineet Sehgal, said that the competition and challenges faced are exclusively from the offline market, particularly the intense competition from local newspapers that form the majority of the classifieds market in India.

Recent Developments

In December 2016, Quikr agreed on an equity deal worth INR 3.6 billion ($56 million) to acquire brokerage business HDFC Realty and online real estate classifieds business HDFC Developers. The company expects the deal to fortify its real estate classifieds offering.

Quikr registered growth of 55% in its turnover in the fiscal year ended March 2017, as per filings with the Ministry of Corporate Affairs (MCA). The company stated that the increase reflects the success of its strategy to operate across several verticals.

To strengthen its broad list of acquisitions, Quikr acquired Babajob, a blue-collar job classifieds site in May 2017. The acquisition places QuikrJobs in a leadership position in the blue-collar jobs market.

Source: Crunchbase.com/The Economic Times

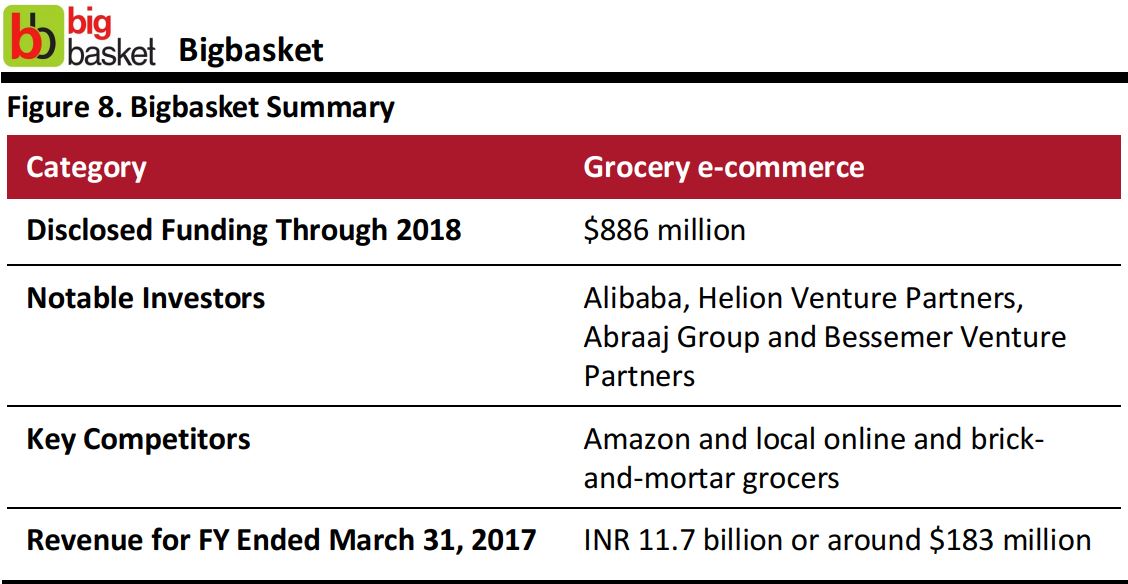

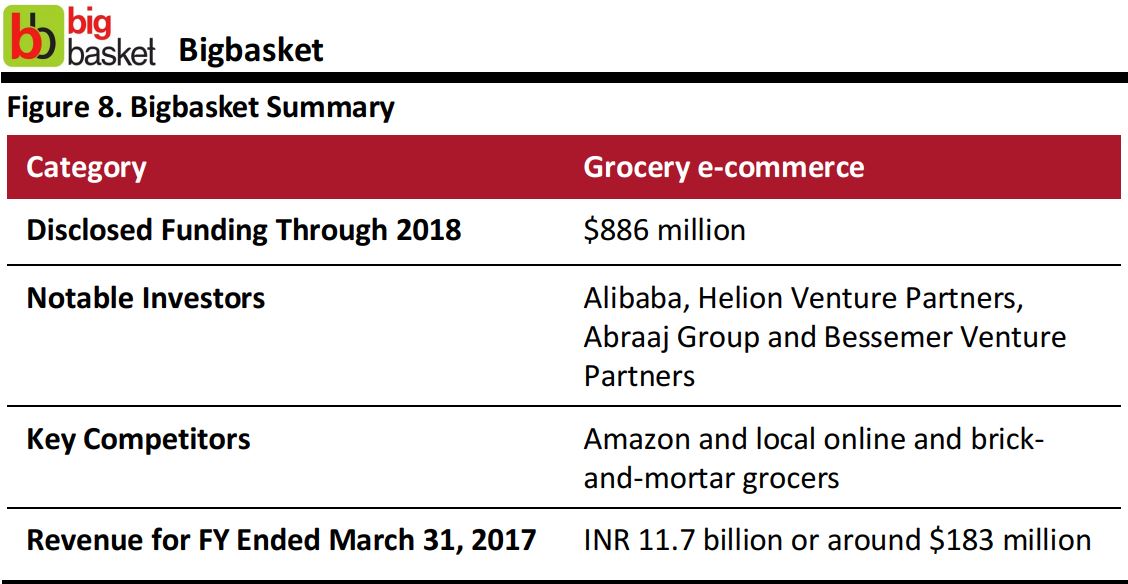

Internet grocery retailer Bigbasket launched in 2011 as one of the first online grocery stores in India. It is now the largest online grocery retailer in the country and offers some 18,000 products and more than 1,000 brands across 25 Indian cities, including smaller cities like Surat, Mysore and Coimbatore.

What Made Bigbasket Successful?

Bigbasket’s operating model sets it apart from Flipkart and Snapdeal. It is not a marketplace, which means that it owns its inventory, as well as its warehouses and delivery fleet.

To get around the foreign investment restrictions in direct online retail and the inventory-led e-commerce model, the owner of the Bigbasket brand, Supermarket Grocery Supplies, sources the products and sells them to Innovative Retail Concepts, the company that is responsible for the website, logistics and delivery. So, in effect, the business-to-business firm Supermarket Grocery Supplies, rather than the business-to-consumer company Innovative Retail Concepts, receives investment from foreign firms.

According to

The Economic Times, Bigbasket reported revenues of INR 5.6 billion ($82.8 million), in fiscal year 2016, almost triple its revenues from the year before. Bigbasket continued the positive trend by reporting revenues of INR 11.7 billion ($174 million) in fiscal year 2017.

Challenges Bigbasket Faced

In an interview with Yourstory in December 2016, CEO and Cofounder Hari Menon said that one of the challenges that the company faces is the over-reliance on blue-collar workers which make up 75% of the workforce. “The business goes down even if 30 people do not show up.” he added.

Recent Developments

Bigbasket raised $300 million from Chinese e-commerce marketplace Alibaba in February this year. This positions Bigbasket in a better position than its competitors, as Alibaba is now the single-largest shareholder in Bigbasket.

With reinforced investments, Bigbasket aims at growing vertically and not horizontally. Menon stated, “We want to pump in money into three things—marketing, infrastructure and scaling up.”

The growth plans underline the company’s objective of INR 2 billion ($29 million) a month in revenue by September 2018 and INR 5 billion ($73 million) by March 2019. “It is so internalized in the company that everyone in the company knows this number and his share of that number,” said Menon.

In order to materialize the revenue targets, Bigbasket aims at installing vending machines in various apartment blocks, with the program already in place at a few sites in Bengaluru.

The company plans to run a subscription-based model for groceries, beginning with subscriptions for milk. It also aims at expanding the private label brands, focusing largely on health foods.

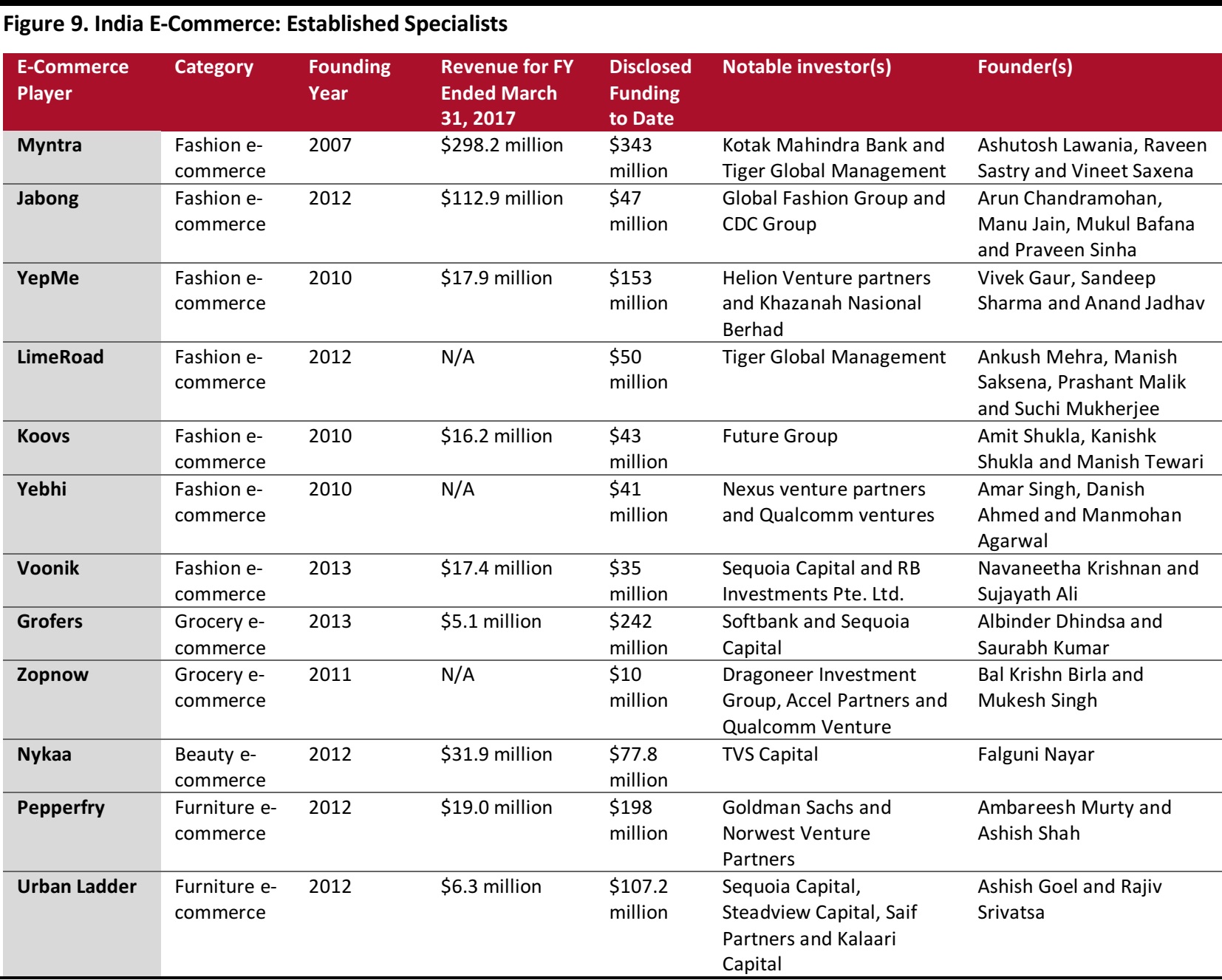

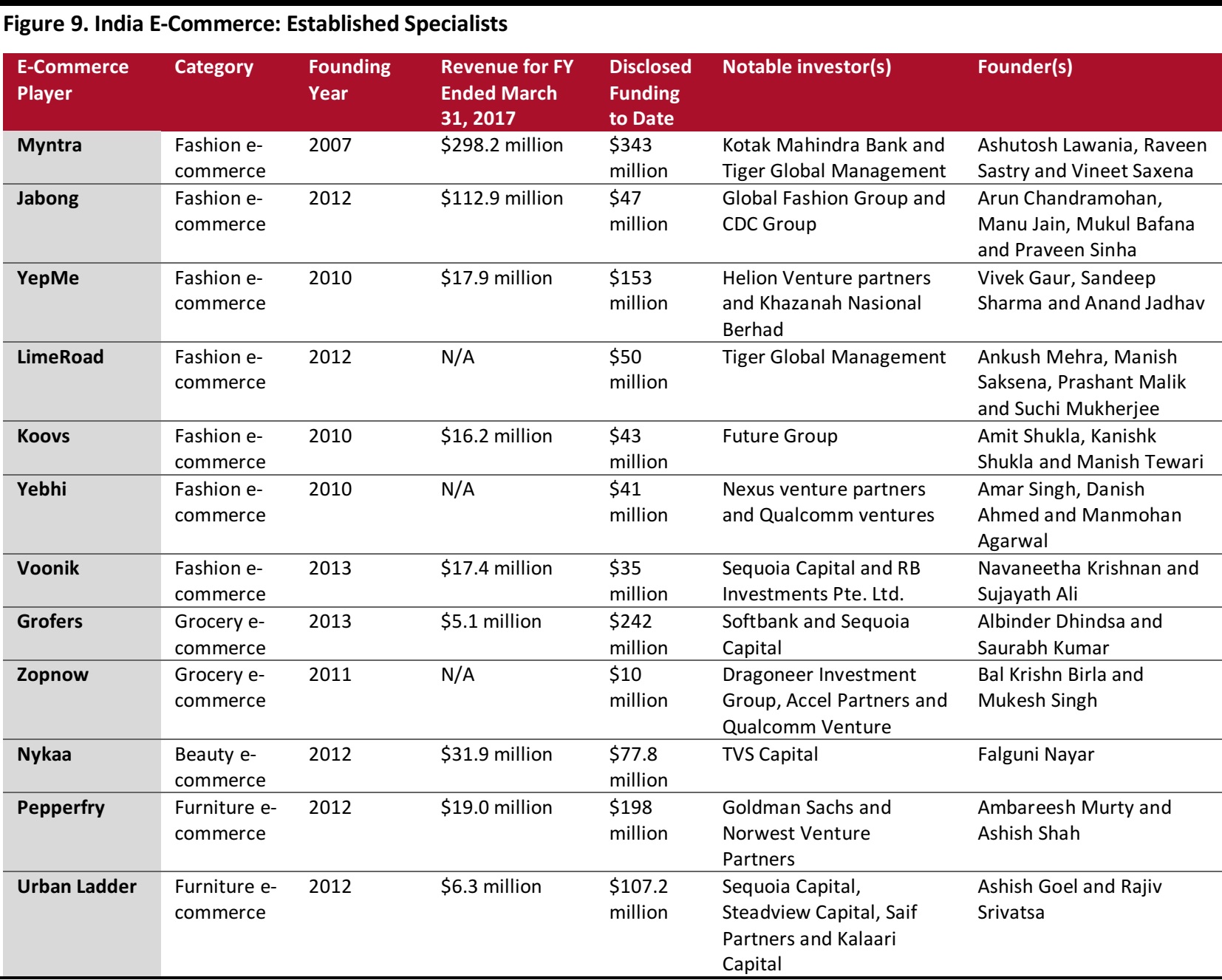

Fashion Pure Plays Dominate Among Specialists

The e-commerce market in India is highly competitive and houses many medium- and small-sized players apart from the larger marketplace sites discussed above. Among the specialist online retailers, fashion e-commerce sites dominate the market. The fashion e-commerce market in India, valued in the range of $7–$9 billion in 2017, is expected to grow to $30 billion by 2020, according to a report by Boston Consulting Group (BCG) and Facebook. The joint study expects fashion to be the first preferred category that Indian consumers buy online by 2020.

Flipkart acquired Myntra in 2014 in order to gain a strong foothold in fashion e-commerce. In 2016, Flipkart acquired Jabong through its Myntra unit to grow its userbase and market share.

By offering fast fashion at affordable prices and being able to reach a wider audience than physical retailers, both Myntra and Jabong have achieved market dominance in online fashion, and other players have had little luck in displacing them.

Other major e-commerce categories include grocery, furniture and makeup. We outline some of the established Indian e-commerce players and key information, in the table below.

Note: The table provides details of major e-commerce players that are not profiled in detail earlier in the report and were founded in 2013 or before.

Source: Company websites/Crunchbase.com/Coresight Research

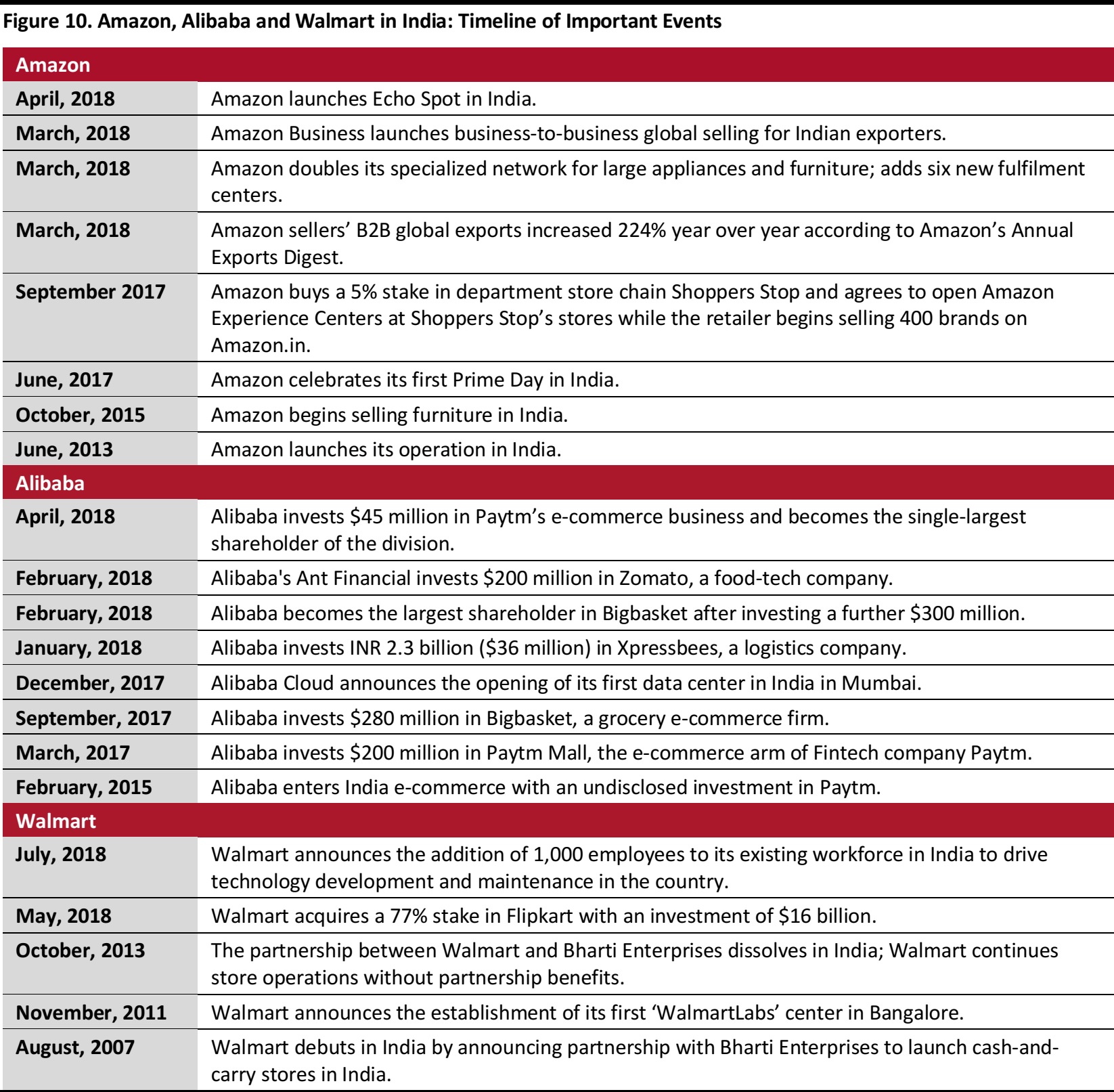

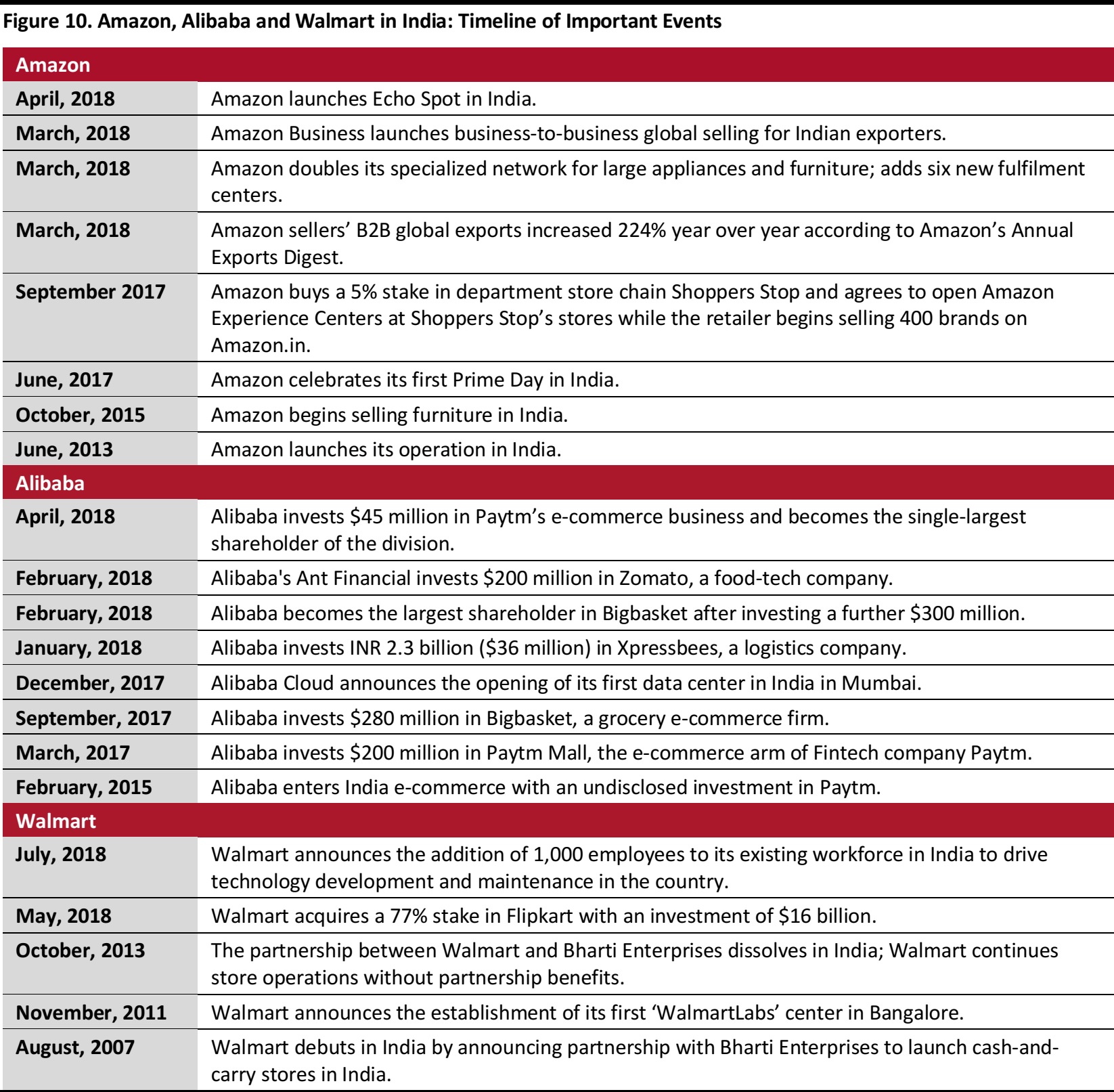

The Indian E-Commerce Market: How Amazon, Alibaba and Walmart Influence It

The Indian e-commerce market has witnessed changing rules in the context of Foreign Direct Investment (FDI). The FDI rules were first relaxed in 2012 when foreign entities were allowed up to 51% of ownership in Indian entities. The rules were further relaxed in April 2016 when the government announced 100% FDI in e-commerce.

During the early years, a lack of competition resulted in the growth of players such as Flipkart, Snapdeal, Quikr and Bigbasket. But more recently, the market has witnessed increased competition and increased investments from global players such as Amazon, Alibaba and most recently Walmart, which acquired a 77% stake in Flipkart.

With each of these international firms pledging increasingly larger amounts of investment in India, it appears that the e-commerce battle in the country will be limited to them and not to the homegrown companies.

Source: Company websites/Crunchbase.com/Coresight Research

Amazon has dominated the e-commerce technology space with the introduction of new features, products and services into the Indian market. Given Amazon’s global scale of operations, expertise and strong capital base, it did not have to strive for very long before overtaking domestic rivals to become one of the leading players in Indian e-commerce.

Alibaba has strengthened its foothold in Indian e-commerce in 2018 with investments of $300 million in Bigbasket and $200 million in Zomato, a food-tech and delivery company in February. Alibaba extended its investments in the country this year, by pouring in funds of INR 2.3 billion ($35.6 million) into logistics company Xpressbees in January and $45 million into Paytm’s e-commerce business in April. The latest investment follows Alibaba’s $200 million investment in Paytm Mall in 2017 and makes it the majority stakeholder in Paytm.

Not to be left behind, Walmart acquired a 77% stake in Flipkart in a deal valued at $16 billion earlier this year, conspicuously marking its entry into India’s e-commerce segment.

Going by the latest developments in FDI in e-commerce in India, a draft e-commerce policy unveiled on July 30 might negatively impact the foreign stakeholders in Indian e-commerce if implemented. The draft policy proposes a ban on: bulk buying, group companies of online marketplaces influencing prices and short-lived deep discounts. If the policy is finalized with these proposals, e-commerce companies may find it more challenging to compete and maintain market share.

What We Think

The India e-commerce market has become more competitive than ever with larger players such as Flipkart attracting significant investments and smaller players focusing on niche segments.

The e-commerce market in India was dominated by homegrown marketplace platforms Flipkart and Snapdeal until Amazon entered the fray and Alibaba began investing more aggressively into other Indian firms. Walmart is the latest entrant, albeit through Flipkart, that will provide tougher competition to smaller domestic players.

If the investments from Alibaba and Walmart in the Indian e-commerce space continue at a steady pace along with the expanding market share of Amazon, then we expect very little room for domestic players that are not largely funded by foreign entities.

Proposed changes to the current FDI e-commerce policy are expected to limit the ability of companies like Flipkart and Amazon which use their scale of operations to reduce prices and run deep discounts for sustained periods of time.

The policy framework is expected to unfold over the next few months and it will be interesting to see if the government moves ahead with “India-first” measures that focus on smaller domestic players. If it does, this might prove to be the biggest reform after the 100% FDI approval in e-commerce marketplaces in April 2016.