Web Developers

Executive Summary

The Fung Global Retail & Technology team traveled to India to research the startup ecosystem, and to meet with startups and entrepreneurs that are making an impact in various industries. This is the first report in our Indian Startup Ecosystem series in which we provide an introduction to the ecosystem and its major players. Three key factors are fueling India’s startup ecosystem: a focus on science and technology in academic study, a largely young workforce and a spike in funding. India is also the world’s second-largest country by population and has the fourth-fastest-growing economy. We have identified the following four key types of players that are helping to develop the country’s innovation ecosystem: startups, incubators/accelerators, investors and the government. By the end of 2015, India had over 4,400 tech startups and ranked third after the US (48,000 tech startups) and the UK (over 5,000 tech startups). Many incubators are located in the country’s top science, technology, engineering, and management institutes. Local specialist firms and multinationals that have their research and development (R&D) centers in India have also established many incubators and accelerators. Indian startups have attracted the attention of domestic and foreign investors alike, and in recent times, as the government has opened up the economy, it appears that the amount of funding received from overseas investors has surpassed that of domestic investors. The government has introduced campaigns such as “Startup India” and “Make in India” to encourage entrepreneurship, investment in the country and subsequent job creation. However, challenges remain. Business would benefit from clearer and more realistic government initiatives, objectives and policies for new businesses and entrepreneurs. And improving basic infrastructure in the country would contribute to the growth of companies. Moreover, the Indian startup ecosystem would arguably benefit from greater originality in the ideas it creates, in order to compete on a global level. Instead of creating me-too firms with an Indian edge, entrepreneurs need to ideate original businesses that will give them a first-mover advantage around the globe.An Introduction To The Indian Startup Landscape

India’s startup ecosystem is robust and thriving and is vastly concentrated in the technology sector. The Fung Global Retail & Technology team traveled to India to research the startup sector and to meet and speak with the companies and entrepreneurs that are making an impact in various industries. We will publish our key findings in a series of Indian Startup Ecosystem reports. In this first report, we provide an introduction to the ecosystem and its major players.What Makes India Unique?

Three key factors are fueling India’s startup ecosystem: a focus on science and technology in academic study, a largely young workforce and a spike in funding. It is also the world’s second-largest country by population and has the fourth-fastest growing economy, according to the IMF. Here are our Need to Knows:- India had produced some 4,400 technology startups by the end of 2015, according to Indian trade body NASSCOM and management consulting firm Zinnov.

- This ranked India third, after the US (which had produced about 48,000 tech startups) and the UK (around 5,000).

- In a country where there are fiercely competitive academic exams for university courses in the science, technology, engineering, and medical fields, many startup hubs and incubators are based in some of India’s top universities, such as the Indian Institutes of Technology (IITs) and the Indian Institutes of Management (IIMs).

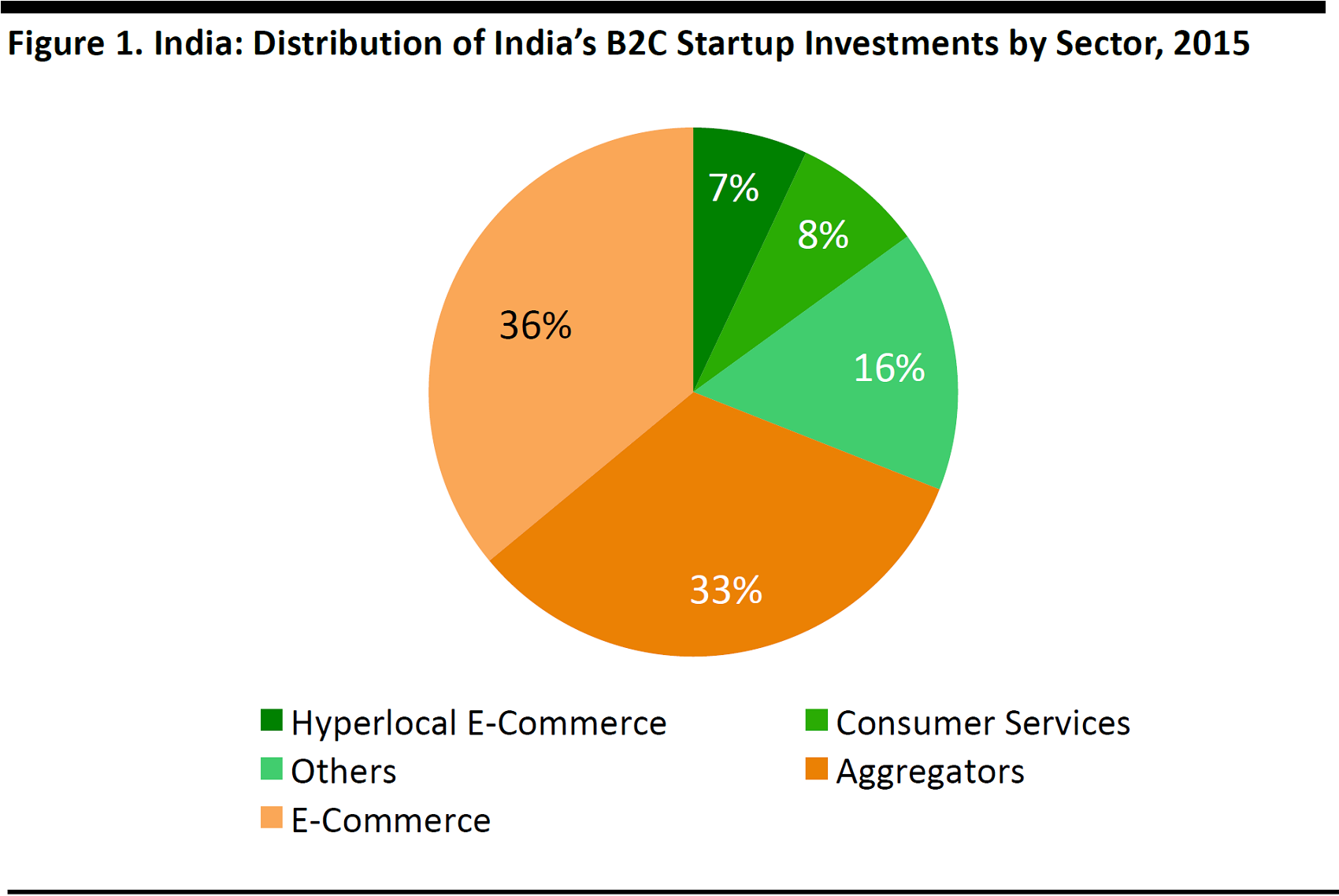

- Nearly 76% of India’s B2C tech startups were concentrated in the e-commerce and online aggregators sector in 2015, according to NASSCOM and Zinnov.

Source: NASSCOM/Zinnov

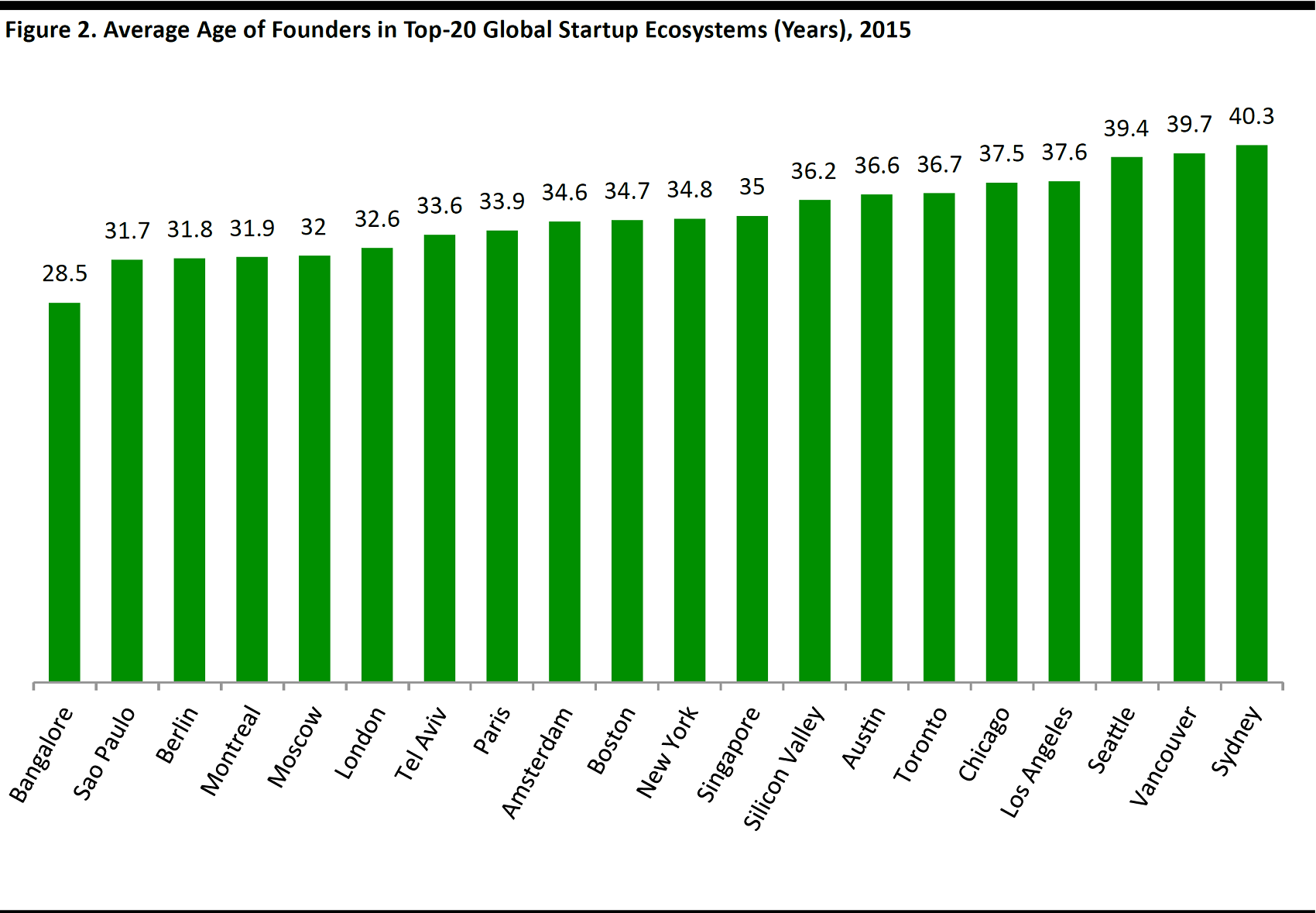

India’s youthful population supports this ecosystem. Some 65% of Indians are aged 35 or under and Bangalore has the youngest entrepreneurs among major cities worldwide, with an average age of 28.5 years compared to Silicon Valley’s 36.2 years. Bangalore is India’s top city for startups and ranked 15 in the Global Startup Ecosystem Index.

Source: Compass

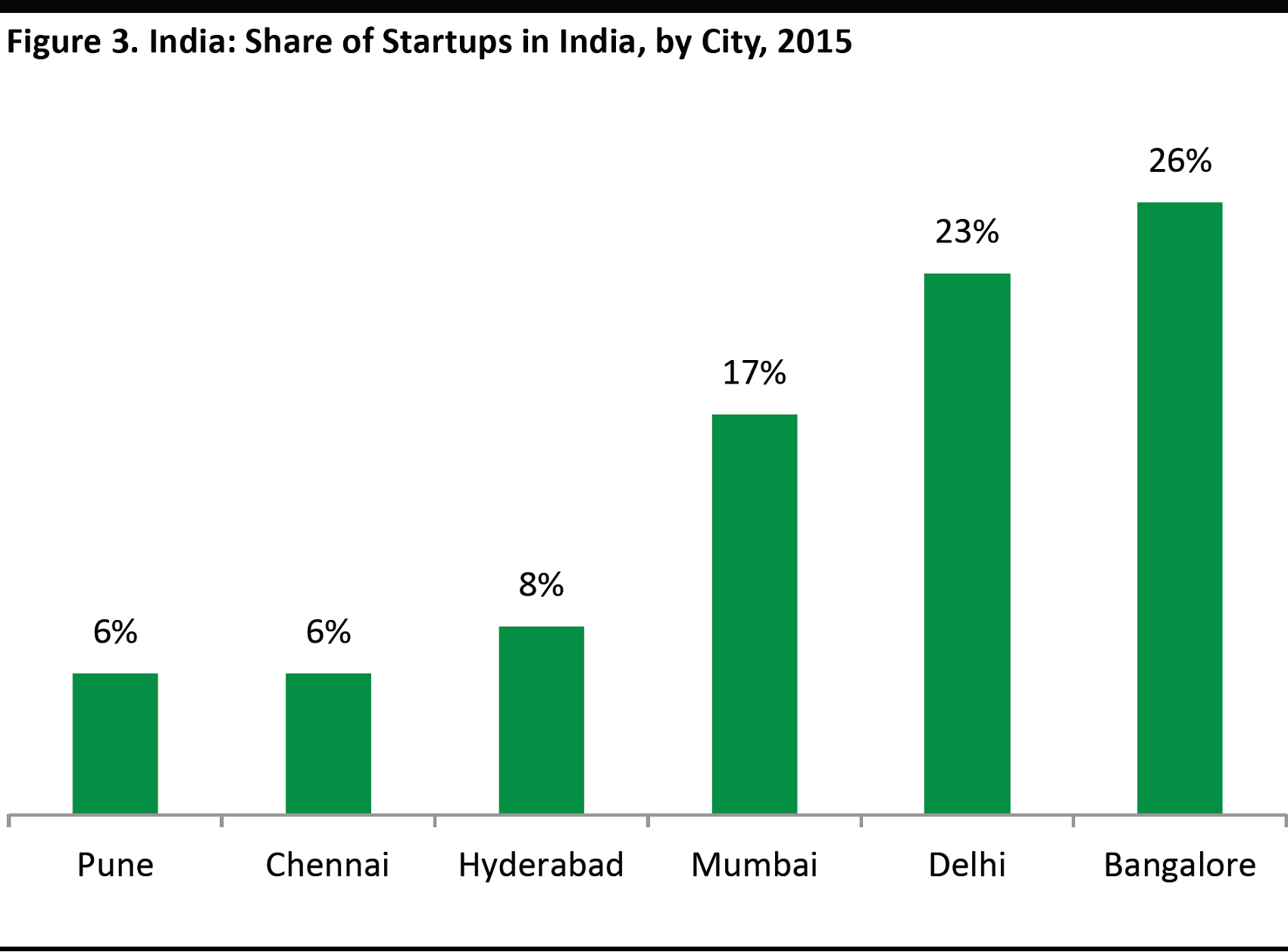

Bangalore is home to 26% of India’s startups, according to 2015 data from NASSCOM and Zinnov. Dubbed as India’s ‘Silicon Valley,’ the city is smaller in size than the bustling metropolises of Mumbai and Delhi, has a cosmopolitan English-speaking crowd, numerous co-working spaces and fairly good technological infrastructure. It is home to many of India’s indigenous IT firms, and has long been known as an outsourcing destination for tech companies in the US and Europe, so hiring technologically-skilled people in the city is relatively easy. Apart from containing the majority of Indian startups, Bangalore has seen many incubators, accelerators and venture capitalists set up shop.

Source: NASSCOM/Zinnov

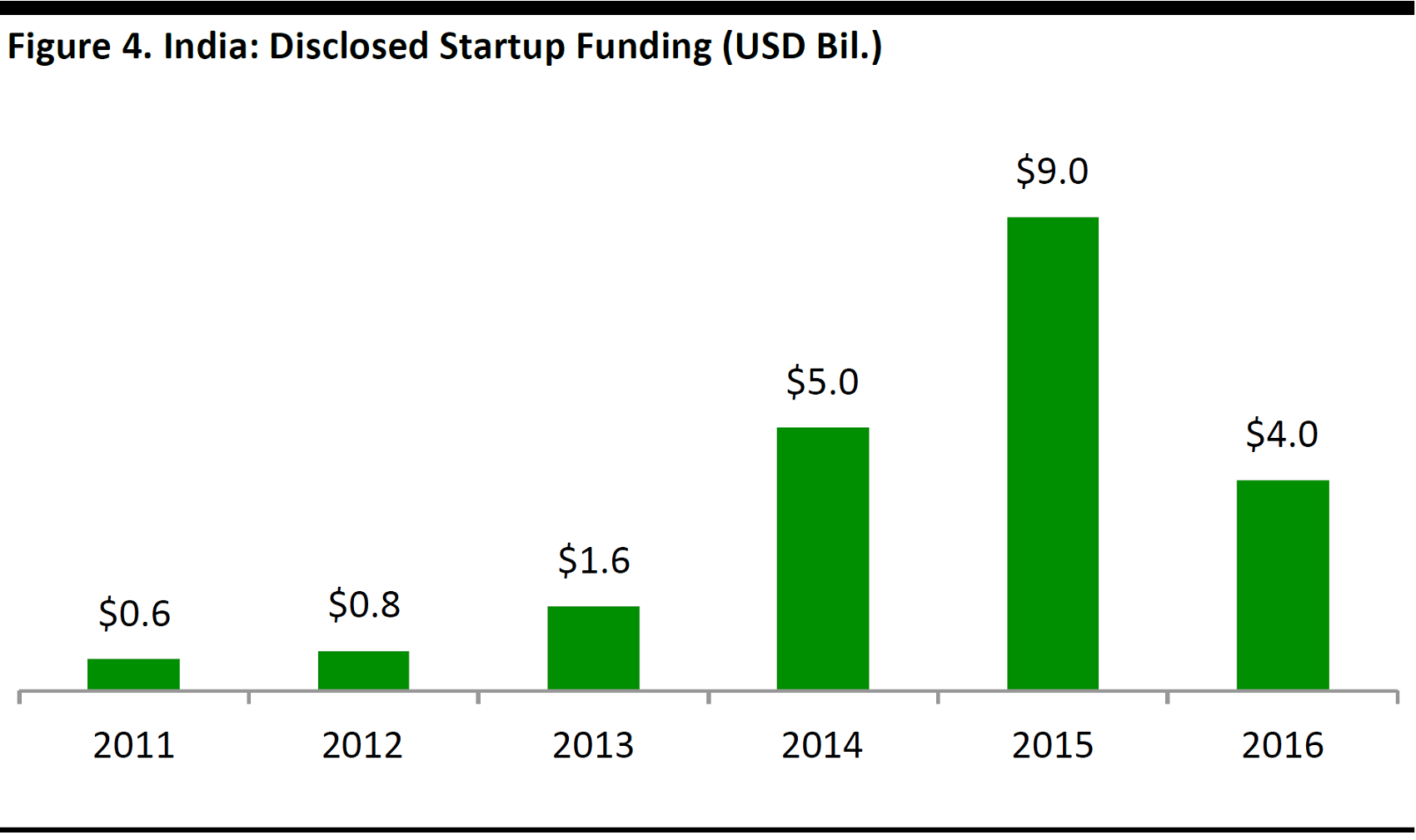

However, the startup story in India is not a recent one. According to Microsoft Accelerator, the Indian entrepreneurial evolution occurred in the 1970s when the first graduates of computer science from national universities went on to found some of India’s biggest names in IT, such as Tata Consultancy Services (TCS), HCL and Patni. After the government introduced liberal reforms to the tech industry, around the mid-1980s, Texas Instruments was one of the first international technology companies to establish an Indian facility for software exports in Bangalore. This was the forerunner to many more international firms following suit and setting up an Indian IT facility to support their global business. Since the 1980s, Indian commerce has seen much evolution in terms of the kinds of companies being established in the country and the number of multinational players showing interest in the country; some estimates suggest that the number of multinationals in India quadrupled between 1991 and 2012. It has also gained from reforms introduced by the government to open up the economy. However, in the last decade or so, India has generated increased interest from foreign investors. This has been particularly notable in the past two to three years, as the government launched campaigns such as ‘Startup India’ and ‘Make in India’ to encourage investment and support businesses and entrepreneurs in the country. In 2015, India saw its highest-ever level of startup funding, with some $9.0 billion invested in the country’s firms, up from some $5.0 billion in 2014, but 2016 saw funding fall to about $4.0 billion, according to startup-tracker YourStory.

Source: YourStory

R&D in India

The Indian government plans to plough cash into R&D. Until 2015, the government had allocated less than 1% of GDP toward R&D. The Ministry of Science & Technology has proposed that this be increased to at least 2% in the coming years. It remains to be seen if the government will move forward on this. In the private sector, however, India has seen a sizeable amount invested in R&D, as several international corporations moved to set up their R&D base in the country. Most recently, American firms Mondelez, the Boston Scientific Corporation, Ford Motor Co., Informatica, German firm Bosch and Chinese tech company Huawei are a few of the many international names that have chosen India to further their R&D competence. The Indian government has also signed a Memorandum of Understanding (MoU) with the UK government, to take research in the fields of solar energy and nanomaterials, further. As India has grown to be an innovation hub, this has led to the rise of an active ecosystem, with many firms setting up their base in India or home-grown firms being founded to fulfill the various roles necessary for other companies to thrive.The Key Players in the Indian Startup Ecosystem

We have identified the following four key types of players in the startup ecosystem:i. Startups ii. Incubators and accelerators iii. Investors iv. The government

In this section, we discuss some of the important firms that have made a mark on the Indian startup ecosystem.i. Startups

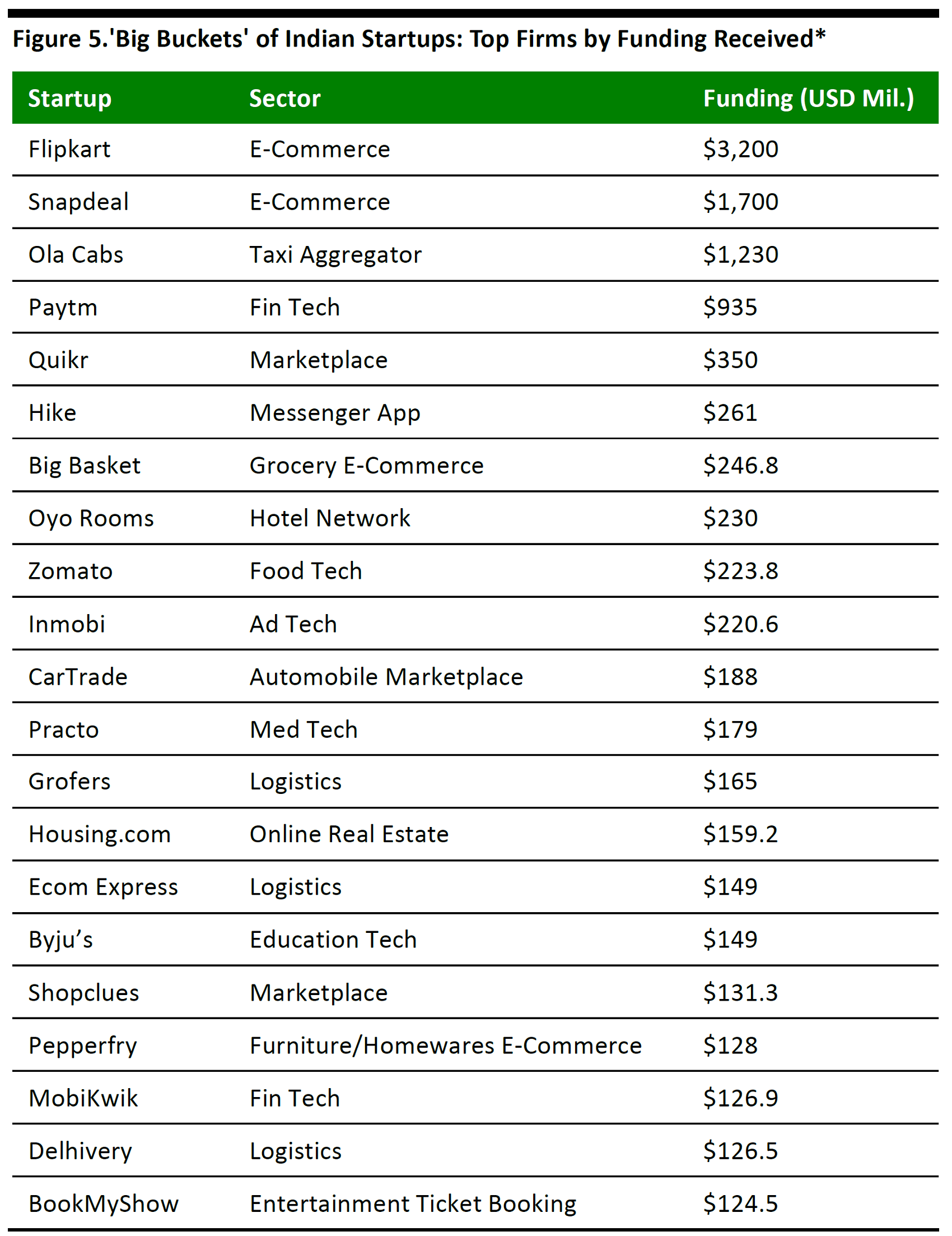

As we noted earlier, many of India’s startups are centered primarily around technology. So far, India has seen around nine of its startups, across sectors, join the unicorn club (i.e., having a total valuation of $1 billion or more). These are ranked below by the amount of funding they have received.

*As of January 20, 2017. Source: Tracxn/Techinasia.com/Crunchbase.com

ii. Incubators and Accelerators

Many of the important incubators have risen from India’s top national engineering and science colleges and universities. The government lists some 118 incubators from universities, public-sector industry associations and self-help groups on the website for its “Startup India” campaign, but there are many that have been established by industry veterans and by the multinationals that have located their R&D centers in India. Below, we profile some of the main incubators and accelerators that we have identified in the retail and tech space:- Kyron Global: Bangalore-based accelerator Kyron was established in 2012 and focuses on the fintech, ed-tech, media, and retail sectors. It takes a keen interest in startups using emerging technologies such as 3D printing, Internet of Things (IoT), virtual reality (VR) and robotics. Some of the better-known startups from this accelerator include bitcoin company Unocoin and price-comparison platform Scandid.

- GSF India Accelerator: This 13-week accelerator program is in its fifth year and has produced several successful startups such as DailyRounds, a clinical case-based mobile app for doctors, and Townista, an app to discover and book local social events in a city. Several of the angel investors and mentors are the founders of established startups and well-known companies in India.

- Freemont Partners: Mumbai-based Freemont Partners provides seed funding and mentorship to tech-based startups in the mobile, health-tech and e-commerce sectors. It has partnered with the incubation cells of four of India’s top business and engineering schools and provides seed funding of up to Rs5 million ($73,400).

- Microsoft Accelerator: This accelerator was set up by the tech giant Microsoft in 2012 to identify and support early-stage tech entrepreneurs. It runs two programs of four months each to mentor startups in the cloud, internet and mobile technologies that use Microsoft.

- Target Accelerator: This was set up by US retailer Target in 2014, for startups that concentrate on disrupting retail. The key areas that the 16-week program looks at are: marketing, omnichannel, mobile, big data analytics, merchandising and supply-chain technologies.

- Catalyzer: This accelerator runs programs for startups concentrating on mobile, internet and telecom in the tech space, and on education, environment, healthcare, nutrition and design in the nontech space. It even ran a workshop in 2015, in collaboration with US-based MIT to mentor and train an exclusive set of attendees.

- AnthahPrerana: This is an accelerator organized by the Bangalore chapter of global community The Indus Entrepreneurs to mentor 10 selected startups every year. It runs a two-day bootcamp at Bangalore’s premier business school IIMB and then a 90-day “Turbo Accelerator” program. Key areas of focus include health-tech, food-tech, smart-farming solutions, and robotics.

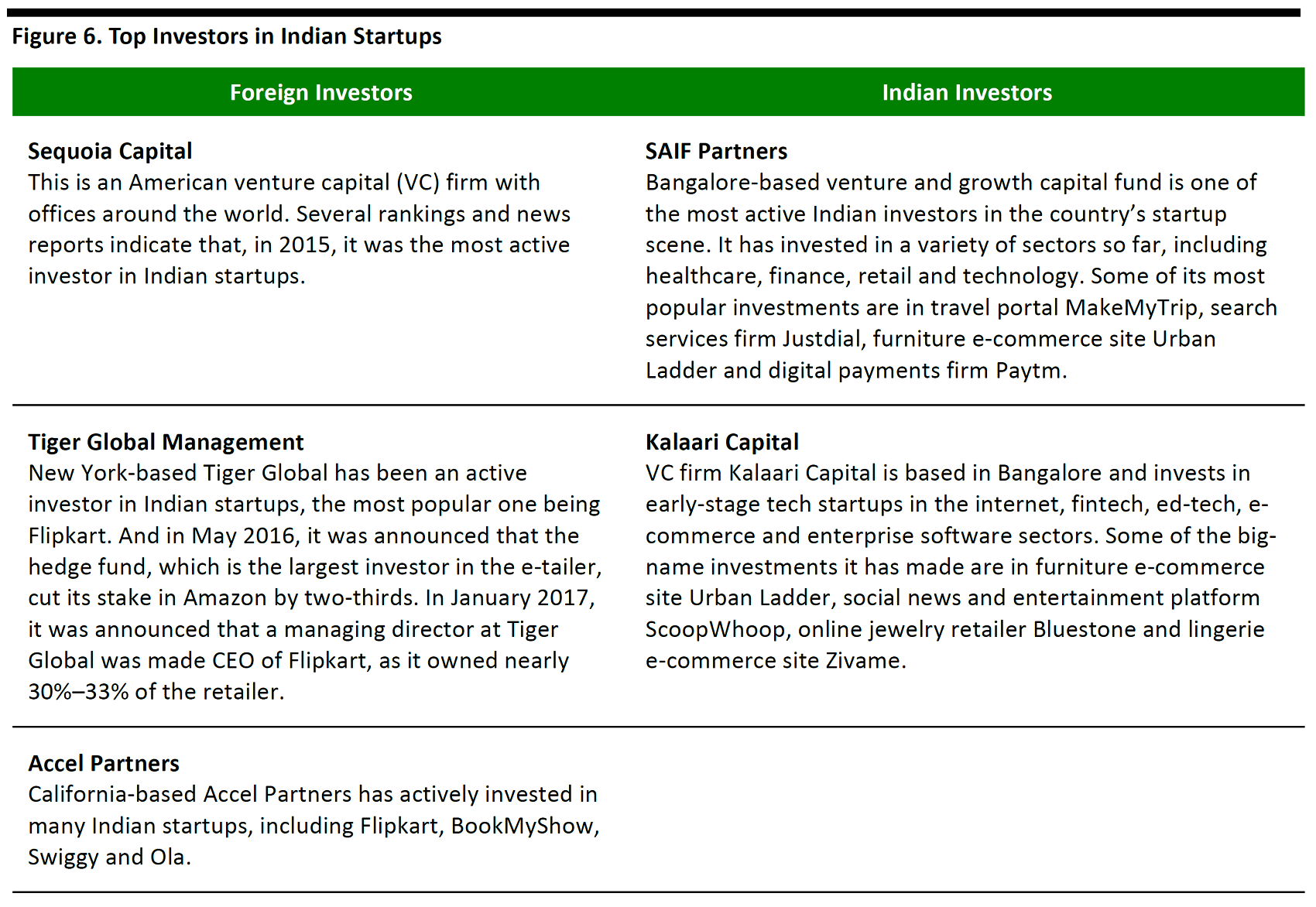

iii. Investors

Indian startups have attracted the attention of domestic and foreign investors alike, and in recent times, as the government opened up the economy, it appears that the amount of funding received from overseas investors has surpassed that of domestic investors. We outline some of the most active investors below. Many of these have invested heavily in retail, e-commerce, and technology.

Source: Yourstory/Tracxn/Sequoia Capital/SAIF Partners/Kalaari Capital/Tiger Global Management/Accel Partners/IDG Ventures

This is not an exhaustive list of venture capital firms in India but is indicative of the companies providing venture funding to startups. Apart from these firms, individual investors, private equity firms, crowdfunding platforms, banks and asset management firms take an active interest in the Indian startup space.iv. The Government

In August 2015, the Indian government announced a campaign called Startup India to encourage entrepreneurship, the establishment of new businesses and the subsequent creation of jobs. As part of the campaign, new policies were created to foster the easy setup of business in India and avoid the typical bureaucratic barriers that firms used to face. To facilitate entrepreneurship in India, the government has implemented many benefits as part of the Startup India initiative, such as:- Reducing the patent registration fee by 80%.

- Launching a mobile app and website, bringing together important information about the country’s startup ecosystem.

- Offering tax rebates for three years.

- Introducing a modified bankruptcy code.

- Launching a fund of funds worth Rs100 billion to provide seed capital to startups.

Source: india.gov.in

The campaign has allowed for many such provisions but in a complex, fragmented economy like India’s, optimistic initiatives such as this face a high risk of running aground. For example, the initial participation was lower than anticipated, so the policy was revamped and relaunched in 2016. Currently, the government is mulling over the overhaul of the fund of funds and allowing the involved investors to allocate half of the amount to mature-stage startups and the other half to early-stage startups. In the World Bank’s 2016 ranking of 189 countries for ease of doing business, India comes in at a disappointing 131. Inefficient implementation of highly idealistic incentives such as this, including the frequent altering of policies, do not help to ease conduct of business. Such implementation can make the government’s role less assuring and fail to provide the intended boost to startups.Outlook: What Is Still Needed

The pace of economic growth, the size of its youthful population and flourishing talent pool mean India is primed to be a global leader in innovation. However, there are several aspects that are restraining its ability to grow, of which many are related to the country’s governance.- Business would benefit from clearer and more realistic government initiatives, objectives and policies for new businesses and entrepreneurs: While the “Startup India” campaign looks great on paper, and is likely to curb the “Inspector Raj” culture or the rule of bureaucracy, there are areas that can be simplified or improved on. For example, a tax holiday for three years may not be very useful to most startups, as most businesses need between two to three years just to break even.

- Improving basic infrastructure in the country will contribute to growth in commerce and the economy: High Internet penetration numbers and such are merely due to the size of the population and are driven by private-sector investments. In 2015, the World Economic Forum identified the following factors as holding up India’s infrastructure development: corruption, political and regulatory risk, access to financing and macroeconomic instability.

- The Indian startup ecosystem would arguably benefit from greater originality in the ideas it creates, in order to compete on a global level: It is commendable that numerous home-grown startups, such as Flipkart and Ola, are giving their global rivals a run for their money within India. But instead of creating me-too firms with an Indian edge, entrepreneurs need to ideate original businesses that will give them a first-mover advantage around the globe.