DIpil Das

Introduction

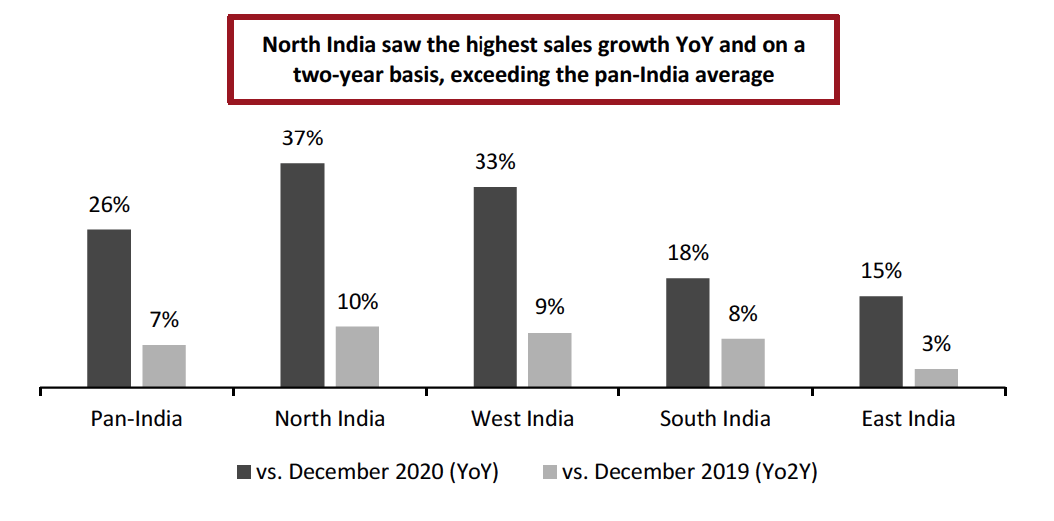

What’s the Story? In this report, part of our India Retail Insights series, we identify prominent trends and developments in retail in 2021 and discuss our expectations for 2022, covering the growth of India’s startup ecosystem and funding, retail and technology-led IPOs (initial public offerings), the proliferation of the quick-commerce market and the surge in e-commerce. Why It Matters Last year was crucial for India’s retail sector in the path to recovery from the impacts of the Covid-19 pandemic in 2020. Although the second wave of the pandemic hit the country in April 2021, the retail sector witnessed a strong resurgence in retail sales through the year. The latest data from the Retailers Association of India’s (RAI’s) Business Survey, published in December 2021, show that sales in December 2021 grew by 26% year over year and 7% compared to the pre-pandemic levels of December 2019 (see Figure 1).Figure 1. India: Retail Sales Growth by Region, December 2021 (%) [caption id="attachment_140691" align="aligncenter" width="700"]

Source: RAI [/caption]

India’s total consumer spending on core retail categories reached $749.7 billion in fiscal 2021 (in India, the fiscal year runs from April 1 to March 31), representing 9.2% year-over-year growth. Coresight Research estimates that spending will increase by 9.0% year over year in fiscal 2022, to $817.3 billion, and witness steady growth thereafter to touch $1 trillion by fiscal 2024, based on data from the Ministry of Statistics and Programme Implementation (all conversions to dollar figures are at constant 2021 exchange rates).

With new Covid-19 variants hitting the country, India’s retail sector will continue to be impacted by changes in consumer behavior and government-imposed restrictions in 2022. It is imperative for brands and retailers to review the past year’s successful trends and learn from them to weather any future periods of turbulence and identify future growth opportunities.

Source: RAI [/caption]

India’s total consumer spending on core retail categories reached $749.7 billion in fiscal 2021 (in India, the fiscal year runs from April 1 to March 31), representing 9.2% year-over-year growth. Coresight Research estimates that spending will increase by 9.0% year over year in fiscal 2022, to $817.3 billion, and witness steady growth thereafter to touch $1 trillion by fiscal 2024, based on data from the Ministry of Statistics and Programme Implementation (all conversions to dollar figures are at constant 2021 exchange rates).

With new Covid-19 variants hitting the country, India’s retail sector will continue to be impacted by changes in consumer behavior and government-imposed restrictions in 2022. It is imperative for brands and retailers to review the past year’s successful trends and learn from them to weather any future periods of turbulence and identify future growth opportunities.

Trends from 2021, Learnings for 2022: Coresight Research Analysis

India’s Startup Ecosystem: Strong Growth and Investor Interest Last year was a remarkable one for the Indian startup ecosystem. India ranked 20th among the top 100 countries in the Global Startup Ecosystem Index 2021 by StartupBlink, a global startup ecosystem map and research center—up from 23rd position in 2020. The total number of startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT)—which acts as the nodal department for the Indian government’s Startup India initiative (launched in January 2016 to help build a robust ecosystem for the growth of startups through innovation and design)—touched the 50,000 milestone on June 3, 2021. The latest 10,000 startups were recognized in a record timeline of just 180 days between January and June 2021. According to Invest India, the national investment promotion and facilitation agency, the government had recognized 59,000 startups as of early December 2021. According to Invest India, the Indian startup ecosystem has 81 unicorns—startups that have a valuation of $1 billion or more—as of December 2021, with 44 of them born last year. Notable unicorns created in 2021 include CRED, Licious, Meesho, PharmEasy and Urban Company. India’s startup ecosystem saw considerable interest from investors in 2021, driven by technology innovations and new business models amid consumers’ increased digital adoption. Startups raised total funding of $34.5 billion in 2021 across 1,073 deals, according to PwC and Venture Intelligence—up from $11.0 billion in 2020. For the first time, privately held Indian startups recently raised more than $10 billion in a given quarter—totaling $11.2 billion in the July–September 2021 quarter. The Government of India also introduced two key schemes last year for the development of the country’s startup ecosystem:- In August 2021, the Startup Accelerators of MeitY for Product Innovation, Development and Growth (SAMRIDH) program was introduced to create a conducive platform for Indian software product startups to enhance their product offerings and secure investments for improving their businesses. The program, implemented by the Ministry of Electronics and Information Technology (MeitY) Startup Hub (MSH), will focus on accelerating 300 startups by offering “customer connect, investor connect and international immersion” in the next three years. The scheme also facilitates an investment of up to ₹4 million ($0.05 million) to startups based on their current valuation and growth stage through selected accelerators.

- In January 2021, The Startup India Seed Fund Scheme (SISFS) was announced by DPIIT to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization. DPIIT has an outlay of ₹9.5 billion ($127.8 million) to support approximately 3,600 entrepreneurs through 300 incubators in the next four years.

- Digital adoption is growing among consumers, and brands and retailers are also integrating immersive technologies to offer a seamless shopping experience. We believe that this trend will lead to a growth in tech startups and opportunities to offer new-age technologies, attracting investor interest.

- With growing investor interest and as the ecosystem matures, we expect that India will soon witness a rise in the number of “decacorns” (startups with a valuation of over $10 billion).

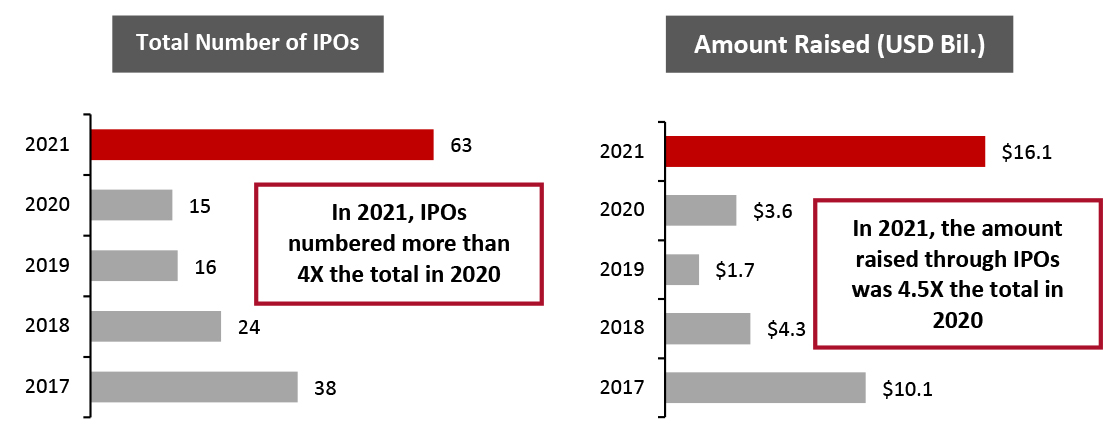

Figure 2. India IPOs [caption id="attachment_140403" align="aligncenter" width="700"]

Data are for calendar years

Data are for calendar years Conversions are at constant exchange rates as of December 31, 2021

Source: Chittorgarh.com [/caption] Overall, IPOs last year saw strong participation from retail and technology companies. One 97 Communications, the parent company of digital payments platform and financial services company Paytm, raised ₹183 billion ($2.5 billion)—the largest IPO in India to date, surpassing the longstanding record of ₹152 billion ($2 billion) raised by Government of India-owned Coal India Limited in 2010. In Figure 3, we present some of the recent retail and tech-led company IPOs that created a buzz in the primary market in 2021.

Figure 3. India: Retail and Technology-Led Company IPOs, 2021 [wpdatatable id=1659 table_view=regular]

*Ended March 31, 2021; Conversions are at constant exchange rates as of December 31, 2021 Source: Chittorgarh.com/company reports One of the reasons that led to the record number of IPOs in 2021 was the simplification of rules by the Securities and Exchange Board of India (SEBI). According to SEBI, its earlier regulation allowed only profit-making companies to be listed at stock exchanges, but it now allows even loss-making companies to be listed with some conditions, enabling firms with a history of loss-making—such as Paytm and Zomato—to debut on the stock market. Implications for 2022

- We believe that IPOs in 2022 will outnumber those in 2021, with around 25 companies (across sectors) already lined up for their stock market debut in the first half of the year.

- We expect that in value terms, the IPOs in 2022 will exceed last year’s total, with some large and well-known companies lined up to be listed this year.

Figure 4. India: Selected Players That Entered/Announced Plans To Enter the Quick-Commerce Market, 2021 [wpdatatable id=1660 table_view=regular]

Source: Company reports Online food delivery platform Swiggy also announced plans to invest $700 million in its quick-commerce business, Instamart, which launched in August 2020. Instamart delivers groceries and daily essentials in 15–30 minutes in 18 Indian cities and plans to leverage its dark-store networks to bring down the delivery time to less than 15 minutes from January 2022. Implications for 2022

- With competition intensifying in the quick-commerce market, companies are likely to look for ways to differentiate themselves, including by shortening delivery times—meaning they will need to ramp up their back-end operations.

- While India’s quick-commerce market is likely to touch $0.75 billion in 2022, we expect a 20%–25% decline in year-over-year growth.

- Learn more about e-commerce in India in our Market Outlook.

- Amid the spread of the new Covid-19 Omicron variant, we anticipate strong e-commerce sales in the first quarter of 2022.

- We expect e-commerce penetration (online retail sales as a proportion of total retail sales) in 2022 to increase by 2.0 percentage points from 2021, to 10.1%.

- Coresight Research has identified festivalization as a key trend to watch in retail in 2022, with more sellers and consumers likely to participate in shopping events to reap benefits such as increased brand awareness and low prices, respectively.

What We Think

We believe that 2021 provided the Indian startup ecosystem with the best market conditions to flourish, with digital products and services adoption reaching an all-time high among consumers then. We anticipate this trend to continue, leading to the emergence and growth of startups in sectors that impact retail—such as fintech (digital payments), SaaS (software-as-a-service) solutions and platforms, and supply chain and logistics (back-end operations). With the simplification of rules by SEBI coupled with a strong history of 63 successful IPOs in 2021, we expect the IPO trend to continue in 2022 with companies such as Flipkart, Delhivery, Ola, Pharmeasy and Byju’s having already lined up transactions. The consumer trend of panic-buying—stocking groceries and essentials fearing scarcity—will prevail to some extent when new Covid-19 variants hit India. However, we believe that the proliferation of quick commerce will likely mitigate this trend. We expect that festive-season sales will scale up in 2022, both in volume and value terms, following the previous year’s success. Implications for Brands/Retailers- Brands and retailers should look at partnerships with new-age tech startups that augment their current technology offerings to achieve scale and continued fast-paced growth.

- Companies planning for long-term expansion requiring huge investments can look at IPOs as a lucrative option to raise funds.

- Brands and retailers entering the quick-commerce market can look at Tier 2 cities and beyond for expansion as the consumers in these cities are already inclined toward online channels.

- Offering attractive deals and discounts to consumers during the festive season will help brands and retailers to maximize order volumes and win a larger customer base for the rest of the year.

- Retailers can offer curated product offerings and discounts focusing Tier 2 and Tier 3 consumers in the festive season to maximize sales and conversions.

- Real estate firms can offer storage and warehouse spaces in high-demand neighborhoods and locations near to delivery centers for retail firms (particularly quick-commerce companies) looking to expand their dark stores.

- Technology startups that offer software solutions can help small and medium-sized offline businesses achieve a digital switch and fast growth.

- Companies specializing in warehousing and logistics solutions can partner with quick commerce and e-commerce companies providing automation opportunities to help them expand their operations.