DIpil Das

What’s the Story?

In Coresight Research’s India Retail Insights series, we explore the impact of consumer behavior, government regulations, macroeconomic developments, sectoral developments and retail-tech startups on the evolution of India’s retail sector.

In this report, we discuss the future of brick-and-mortar retail in India, covering pandemic-led changes in consumer confidence and behavior, actions that retailers can take to attract customers back to stores, government policies to support brick-and-mortar retailers and opportunities for international retail players.

Why It Matters

The pandemic-led nationwide lockdown between March and May 2020 saw losses across India’s retail trade total ₹13.5 trillion ($182 billion) due to temporary store closures, according to the Confederation of All India Traders. India has just passed its second wave of Covid-19 (April–June 2021), which caused further store closures and lockdowns across various states. Some states are now relaxing restrictions gradually, and stores began to reopen in July 2021. However, a third wave is on the horizon—according to a media briefing by the Ministry of Health Affairs in May 2021—which would likely impact consumer spending.

We believe that a substantial return to physical retail will occur, likely in calendar 2022, after the anticipated third wave—driven by the vaccination rollout. According to the Ministry of Health and Family Welfare on August 24, 2021, 9.8% of the population are vaccinated and 33.8% of the population have received their first dose of the vaccine. Health Minister Dr. Bharati Pravin Pawar announced that 1.35 billion vaccines would likely be made available across the country between August and December 2021, and the government is confident of meeting its vaccination target. This vaccination rollout coupled with consumers’ desire to resume more normal social and shopping activities after spending months at home over the last two years amid pandemic-led lockdowns.

We estimate that India’s total consumer spending on core retail categories will increase by 10.3% year over year in fiscal 2022 (in India, the fiscal year runs from April 1 to March 31) to $863.4 billion, following 8.9% year-over-year growth in fiscal 2021, to $782.6 billion.

The Future of Brick-and-Mortar Retail in India: In Detail

The impact of 2020’s pandemic-induced lockdowns had significant, though varying, impacts on physical retail in India—with nonessential categories hit the hardest due to store closures. Retailers in essential categories, such as groceries, had to deal with a huge spike in demand that gave rise to supply issues, and they had to manage stores with reduced staff and modify store operations to meet new health and safety standards.

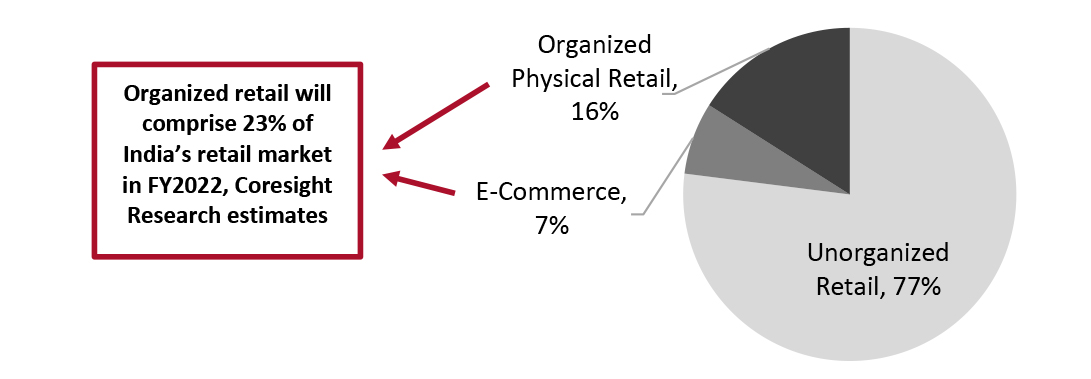

Indian retail is predominantly unorganized, comprising traditional low-cost retailing formats such as family-owned general and grocery stores, and regional corner shops with no standardization—rather than organized, which comprises privately owned large retail businesses and corporate-backed hypermarkets, supermarkets and retail chains. The online channel therefore comprised just 3.4% of the total retail market in 2020, according to the India Brand Equity Foundation (IBEF). Coresight Research estimates that online retail will increase its penetration of India’s retail market to a share of around 7% by FY2022, at which time the organized physical retail segment will comprise roughly 16% of the total retail market.

Figure 1. India Retail Market Breakdown, FY2022 [caption id="attachment_131979" align="aligncenter" width="725"]

Source: Invest India/IBEF/Coresight Research [/caption]

Consumer Confidence in In-Store Shopping

Source: Invest India/IBEF/Coresight Research [/caption]

Consumer Confidence in In-Store Shopping

Brick-and-mortar retailers should be mindful of consumers’ attitudes to visiting stores post pandemic; many may be reluctant to do so due to health and hygiene concerns, but some product categories may be more likely to attract shoppers back to the physical channel following the lockdown-led shift to e-commerce. Below, we consider how brands and retailers can adapt to changes in consumer confidence and preferences.

Hygiene and Safety Concerns

We believe that hygiene and safety will continue to be a top priority among consumers when visiting physical stores post pandemic. According to a survey report published in June 2020 by the Retailers Association of India (RAI) and enterprise software-as-a-service platform LitmusWorld, entitled “Unlocking Indian Consumer Sentiment Post Lockdown,” three-quarters of Indian consumers reported that they prefer the regular sanitization of stores to create a safe and hygienic shopping experience (see Figure 2). These survey findings following the lifting of the nationwide last year offer an indication of consumers’ attitudes to shopping amid the easing of current restrictions related to the second wave of Covid-19 in India.

We expect consumers to prefer retailers to maintain in-store sanitization measures post pandemic as hygiene and safety concerns will likely remain heightened for some time. Measures that retailers can consider adopting to increase consumer confidence include installing contactless sanitizer dispensers for shoppers, putting up protective screens at checkout and implementing the regular sanitization of surfaces and customer contact points.

Figure 2. Preferred Safety Measures in Retail Stores Among Indian Consumers, June 2020 (% of Respondents) [caption id="attachment_131980" align="aligncenter" width="725"]

Base: 4,239 Indian consumers in Tier 1 to Tier 3 cities

Base: 4,239 Indian consumers in Tier 1 to Tier 3 cities Source: RAI-LitmusWorld [/caption]

Contactless Shopping and Faster Checkout

The accelerated adoption of contactless shopping and payment options amid the pandemic has increased convenience and checkout speed for shoppers. According to Shopify’s “Future of Commerce 2021” report—covering an online survey of over 10,000 consumers in 11 countries in September 2020 and analyzing Shopify sales data from more than 1 million merchants around the world—82% of consumers in India reported that they are more comfortable making in-store purchases with digital or contactless payments. Physical retailers should continue to assess ways to incorporate contact-light processes in the in-store checkout experience.

To further improve convenience and add touchpoints in the shopping journey, stores can provide appropriate information related to products and inventory through digital signage and access mechanisms such as smart speakers and voice assistants, as consumers may be reluctant to use touch-based devices.

Preferences To Shop Offline, by Category

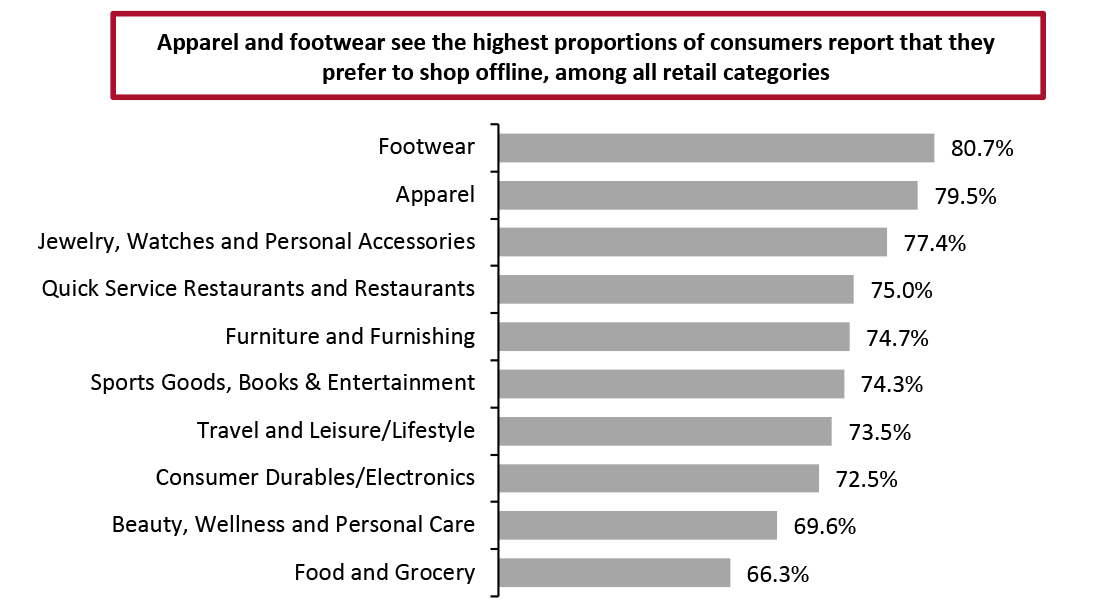

According to the RAI-LitmusWorld survey report, the brick-and-mortar channel retained its appeal in the apparel and footwear sector amid the pandemic last year: Around four in five consumers reported that they prefer to shop offline for these two categories (see Figure 3). Consumers typically want to feel and try on such products before making a purchase decision. However, consumers may not be comfortable using traditional fitting rooms after the pandemic, so retailers should look to integrate technology-backed solutions (such as virtual try-on) in the offline experience to encourage shoppers to return to physical stores.

Figure 3. Indian Consumers Who Prefer Shopping Offline, by Product Category, June 2020 (% of Respondents) [caption id="attachment_131981" align="aligncenter" width="725"]

Base: 4,239 Indian consumers in Tier 1 to Tier 3 cities

Base: 4,239 Indian consumers in Tier 1 to Tier 3 cities Source: RAI-LitmusWorld [/caption]

BOPIS and Curbside Pickup

BOPIS (buy online and pick up in store) and curbside pickup have gained traction globally as contact-light alternative fulfillment options that offer convenience, flexibility and safety. More retailers in India have introduced such services in the past year to meet consumer demand—VR Bengaluru, a mixed-use retail center in Bangalore, India, launched contact-free curbside pickup in July 2020, for example.

According to the Shopify “Future of Commerce 2021” report, 69% of Indian consumers use BOPIS or curbside-pickup options more frequently than before the pandemic. Demand for these services is likely to remain heightened moving forward, as consumers expect an easy and frictionless shopping journey.

What Should Physical Retailers Do To Bring Customers Back to Stores?The pandemic has disrupted the way consumers interact with brands and retailers. Although physical retail in India is not under threat from online retail giants due to the market’s low e-commerce penetration rate, brick-and-mortar retailers must take action to attract consumers back to stores and capitalize on pent-up demand. Below, we present seven strategies that physical retailers can implement to maximize sales post pandemic.

1. Evaluate Store Formats and FootprintsRetailers must move away from a “one size fits all” approach, instead defining individual roles for physical stores. They should differentiate their retail offerings with flagship or experience stores, pop-ups, regular showrooms, specialty stores and other varied formats—offering flexibility and targeting specific customers.

- Future Group—which operates large-format stores including apparel chain FBB, department store Central and hypermarket chain Big Bazaar—plans to expand its smaller stores between 2020 and 2022. It aims to scale its 1,300 Easyday small-format, members-only supermarket and convenience stores to 10,000. Company CEO Kishore Biyani believes that smaller stores will contribute more volume and value than the larger store formats.

- Chinese smartphone brand Realme plans to expand its retail footprint in India, launching 300–500 exclusive Realme smart stores and a few flagship stores nationwide in 2021–22. The company is investing heavily in its smart stores to fuel technology adoption, even in rural parts of the country. It plans to open its first flagship store in Gujarat.

However, brands and retailers that re-evaluate their store footprint and formats will need to monitor their performance regularly and look to expand or close stores accordingly.

2. Enable Store Associates To Build Strong Customer RelationshipsIn-store customer service is a critical factor for physical retail: Since store associates reflect the store image, retailers must ensure that they deliver outstanding customer service and professionalism. Retailers should provide their associates with immersive and module-based training—be it for soft skills or upcoming in-store technologies to improve the customer journey. Retailers should also build a strong relationship with their associates, listening to their suggestions and implementing incentives: Satisfied associates are more likely make additional efforts to improve sales and build relationships with customers.

3. Use Technology To Revolutionize Retail SpacesThe pandemic has accelerated consumer adoption of technology, and retailers should invest in innovations to minimize physical interaction in the brick-and-mortar shopping process and enable faster checkout. One such technology is radio-frequency identification (RFID), which was gaining traction prior to the pandemic:

- Walmart-owned fashion platform Myntra launched an RFID-enabled store for its lifestyle brand, Roadster Go, in Bangalore in 2019. RFID enables fast self-checkout through auto-scanning in the basket, eliminating the need to scan products individually and remove security tags. RFID-powered digital screens around the store also enable customers to access detailed product information.

To provide a seamless physical shopping experience after the pandemic, retailers can also look at self-checkout kiosks, contactless payments through QR codes, unified payment interfaces and AR (augmented reality) experiences to offer “try before you buy” convenience.

- Indian jewelry brand Tanishq uses AR at airport kiosks in Bangalore and Delhi to let travelers try on jewelry virtually.

Consumers now spend a large portion of their time online: According to a survey by market research firm Ipsos, Indian Gen Zers spend an average of eight hours per day online. Since India has a predominantly young population, it is crucial for physical retailers to cultivate an online presence. Retailers should leverage social media to promote products and engage consumers. Offering exclusive sales, promotions or deals is a key way to attract consumers to stores, and brands and retailers should build a customer database to enable them to send personalized promotional emails based on past shopping habits.

- Indian department store chain Shoppers Stop (which operates 80 stores across 40 cities) and Indian fashion brand Max Fashion (which operates 160 stores across 40 cities) strongly leverage their online presence to drive business. They use social media channels including Instagram to inform consumers about deals, events, offers, products, promotions and services. They also send promotional e-mails to members and existing and potential customers.

Social media communication on Father’s Day collections by Shoppers Stop and Max Fashion

Social media communication on Father’s Day collections by Shoppers Stop and Max Fashion Source: Instagram [/caption]

In unorganized retail, even kirana (neighborhood) stores have started to build a digital presence—using the Whatsapp Business app to accept orders, list inventory and receive payments, and moving online with the help of retail technology startups.

5. Partner with Online Retailers for Festive SalesRetailers can partner with major e-commerce players, including Amazon and Flipkart, for the upcoming festive season during October–November 2021 (covering Dussehra and Diwali).

- Amazon partnered with more than 650,000 micro, small and medium enterprises, local sellers and kiranas to offer over 40 million products during its “Great Indian Festival” in October 2020.

- Walmart-owned Flipkart partnered with more than 100 brands and 2,000 fashion stores during its festive sale “Big Billion Days” in October 2020. Flipkart gained access to store inventories in over 300 cities, while offline retailers generated sales during the much-awaited recovery after 2020’s nationwide lockdown.

With the second phase of lockdown currently affecting most Indian states, retailers are again banking on the upcoming festive season to enable recovery.

6. Accelerate Omnichannel InitiativesThe pandemic has influenced consumer purchasing behavior and accelerated retailers omnichannel adoption exponentially. Omnichannel strategies will not only help retailers to converse with their customers but will also enable better customer experience. A number of retailers have developed dedicated experience studios to improve customer journeys.

- Furniture retailer Pepperfry operates a network of offline centers, “Studio Pepperfry,” for an immersive in-person experience. In-store design consultants help customers find furniture that’s right for them. Customers can then purchase products in the studio or return home to buy online. Pepperfry reports that 10–15% of its sales come from its studios and that it is planning to expand them into other cities in India.

- Indian lingerie retailer Zivame is expanding its network of studios across the country that offer fitting lounges. Its studios aim to help women explore new collections and make choices that are right for them, offering personalized one-to-one sessions with fitting consultants and advisors. The lounge allows customers to buy items online from the studio itself and complements the online store by providing customers with a physical experience and personal interaction.

Retailers can enhance their omnichannel experience through other initiatives, including providing up-to-date information on products, features and trends through technology-enhanced physical stores; facilitating online ordering from stores; and offering omnichannel reward programs through reward apps, among others.

7. Look to Malls and Smaller Cities for Offline ExpansionIn India, going to movies and dining out are popular weekend activities. In Metro and Tier 1 cities, these activities largely take place in malls and shopping centers, accounting for a large portion of foot traffic: Movies alone typically attract about 10%–15% of total mall traffic, according to the Delhi Mall Owners Association. Despite the second wave of the pandemic, customers have already started returning to malls—with traffic now equating to around 40%–50% of pre-pandemic 2019 footfall—and the reopening of restaurants and movie theaters will likely add up to another 20%, as reported by The Economic Times on June 27, 2021. With malls offering a safe shopping experience through social distancing and queue management, coupled with the impact of the vaccination rollout, physical retailers should capitalize on increasing consumer confidence and target mall stores for offline expansion through 2021 and beyond.

A thriving middle class and the recent reverse migration of urban middle class from Metro cities to smaller towns during the pandemic will boost sales, as many consumers are diverting their rental income toward shopping. Moreover, rentals, staff salaries and operational costs are 30%–40% lower in Tier 2 and Tier 3 cities than in Metros and Tier 1 cities, according to estimates by market research firm International Brand Equity. To recover from pandemic-induced losses, physical retailers could therefore focus on Tier 2 and Tier 3 cities to capitalize on demand in a more favorable cost environment.

What Is the Government Doing To Support Physical Retailers?The Government of India’s “Digital India” campaign aims to digitally empower India by developing secure and stable digital infrastructure across the country—especially connecting rural markets with high-speed Internet networks—to boost the growth of the retail sector.

To help retailers recover from the pandemic, the government could bring in two long-term reforms: rationalization of the licensing process through digitization to reduce the time it takes new entrants in the retail sector to obtain licenses; and incentives in the form of additional depreciation for boosting retail infrastructure, especially in Tier 2 and Tier 3 cities.

Several governmental measures to create a conducive environment for retail-industry growth, such as favorable FDI terms (discussed later), have been successful. Following the pandemic’s impact on the industry, a policy-based approach through which the government and industry work together will help the retail industry to thrive.

The government is in the final stages of drafting its new National Retail Trade policy, which focuses on creating a conducive environment for retail trade by simplifying rules and regulations hindering growth. According to the Department for Promotion of Industry and Internal Trade, the policy will address five issues: the ease of doing business, rationalization of the retail trade license process, digitalization of retail, reforms, and an open network for digital commerce. The new policy aims to benefit 65 million small retailers.

The government released a draft of the e-commerce policy in June 2021, which was open for public consultation until August 5, 2021. It is likely to extend restrictions on large e-commerce marketplaces to their associates and related parties, curb alleged circumvention of foreign direct investment rules and stop anti-competitive activities to protect the interests of consumers and small retailers. In Figure 5, we highlight the key takeaways of the draft e-commerce policy and examine the implications for physical retailers.

Figure 5. Key Highlights of India’s Draft E-Commerce Policy and Implications for Physical Retailers [wpdatatable id=1219 table_view=regular]

Source: MoneyControl/Coresight Research

International Investment Opportunity

According to national investment agency Invest India, India is a favorable destination for foreign retail investments, not least because it has a predominantly young population of millennials and Gen Z, who exhibit higher levels of discretionary spending, and a growing middle class of 600 million people with increasing household income. A shift in buying patterns among these consumers to more discretionary spending after the pandemic creates a favorable situation for more international brands to target India for growth. In addition, the rise of digital payment options means it is easier for consumers to indulge in discretionary spending.

No foreign direct investment (FDI) is permitted in e-commerce multibrand retail. In physical retail, however, the government has liberalized its FDI policy:

- 100% FDI without government approval allowed in single-brand retail (including online presence), cash-and-carry wholesale trading, duty-free shops and food retail.

- 51% FDI with government approval is allowed in multibrand retail.

Below, we summarize recent notable investments into the India retail market by major international retailers.

- In May 2021, British performance electric bicycle and activewear maker GoZero Mobility announced plans to invest £17 million ($23.5 million) in India and Britain to expand its manufacturing operations, retail presence and enhance research and development in the next five years.

- China-based electronics company Xiaomi announced in March 2021 that it will invest ₹1 billion crores ($13.5 million) in expanding its offline retail presence in Tier 2 and 3 cities, towns and rural India between 2022 and 2023. It plans to double its store count from its current 3,000 to more than 6,000.

- In February 2021, IKEA announced that it will invest ₹55 billion ($741 million) in developing hotels, offices, retail areas and shopping malls by 2025. IKEA has rented 100,000 square feet in Bengaluru to set up its first store in the city, in the VR Bengaluru shopping mall; it will be operational by 2022.

- British technology company Dyson has expanded its presence in Mumbai, opening its seventh India demo space at Infiniti mall in February 2021.

What We Think

After the pandemic, there is likely to be a strong consumer return to brick-and-mortar retail, although hygiene and safety will be top of mind and consumers will expect a seamless shopping experience through technology-backed solutions and omnichannel initiatives. We expect that the aftermath of the pandemic will likely accelerate the consolidation or better organization of retail in India—larger retailers will be better positioned to make investments in technology, infrastructure and related areas that can attract shoppers.

Implications for Brands/Retailers

- Physical retailers could explore different store formats and footprints to differentiate themselves—for example, experience studios or exclusive outlets. They should closely monitor and evaluate store performances to ensure portfolio optimization.

- Physical retailers should leverage social media to increase their online presence and attract India’s predominantly young population.

- Brands and retailers should introduce initiatives to show appreciation for store associates by rewarding best performances and incentivizing them to put in additional effort to build strong customer relationships.

Implications for Technology Vendors

- Startups specializing in AR solutions can enter into strategic partnerships with retail chains to help them build robust AR infrastructure across stores.

Implications for Real Estate Firms

- Physical retailers may look to roll out flagship/experience stores to improve brand communication with consumers, as well as further expanding their offline footprint through exclusive showrooms and franchisees as part of growth strategies. This provides opportunities for real estate players to develop and offer such spaces, especially in Tier 2 and Tier 3 cities and in smaller towns.