DIpil Das

What’s the Story?

In Coresight Research’s India Retail Insights series, we explore the impact of consumer behavior, government regulations, macroeconomic developments, the competitive landscape and retail tech startups on the evolution of India’s retail sector. In this report, we examine the competitive positioning of Indian conglomerate Tata Group within retail and the implications of its impending acquisition of a 60–64% stake in online grocery retailer BigBasket. As part of the $1.2 billion deal, Alibaba, Middle Eastern investor Abraaj Group and others will exit the online retailer. Sources involved with the transaction confirmed this to various news sources, such as TechCrunch and Business Standard. The transaction is expected to close in a few weeks, with the companies awaiting approval from the Competition Commission of India.Why It Matters

India’s retail sector is poised for immense growth once the pandemic ends, or at least once vaccines are more widespread, and the e-commerce sector stands to make huge gains. With the online channel estimated to have achieved only 5% penetration of total retail sales in 2020, according to Indian retail consultancy RedSeer, there is tremendous room for growth. Grocery and essentials have been in the spotlight since the Covid-19 outbreak, and the pandemic has seen a consumer shift to online shopping. Grocery spending accounted for nearly two-thirds of total consumer spending in India’s retail market in 2020. Although the online channel comprised only 0.6% of total grocery spending, according to data from RedSeer, the grocery e-commerce sector saw 73% year-over-year growth—totaling $3.3 billion. Among India’s top 15 retail companies (by revenues), Tata Group’s retail companies—Titan Company and Trent—hold a combined share of 9.3% as of fiscal 2020 (ended March 31, 2020). This excludes revenues from Tata Group’s Infiniti Retail and Tata Cliq businesses, as they are privately held and do not provide revenue information. This means that Tata Group lags behind conglomerate Reliance Retail Ventures (a subsidiary of Reliance Industries), which commands a 54.7% share (see Figure 1). We compare Tata Group with Reliance Retail Ventures in further detail in later sections of this report. At a time when Reliance Industries is consolidating its position within Indian retail and threatening the status quo of other major players, Tata Sons (the holding company of Tata Group) is acting to consolidate its position in retail too. Starting with the BigBasket investment, the company is looking to invest in 1mg, an online pharmacy, and develop a WeChat-like “super app.”Figure 1. India: Top 15 Retail Companies by Revenue, FY20 [wpdatatable id=812]

Fiscal year ended March 31, 2020 N/A Private companies; historical data are not available. Source: S&P Capital IQ/Coresight Research

Tata Group To Boost Its Retail Presence: In Detail

BigBasket Acquisition Will Provide Multiple Benefits Tata Group’s acquisition of a major stake in BigBasket gives it a multi-pronged advantage—quick entry into online grocery retail with little investment compared to setting up a new business organically. In addition, the acquisition will provide Tata Group the opportunity to be a market leader in the grocery e-commerce segment. A major benefit of the BigBasket acquisition is that the business will complement Tata Group’s Star Bazaar offline grocery business. BigBasket could also leverage Star Bazaar’s existing storage and warehouse network, as well as physical stores, to fill any gaps in its own fulfillment and delivery network. In addition to those horizontal integration advantages, the BigBasket acquisition presents opportunities for vertical consolidation too. Tata Group’s FMCG business, Tata Consumer Products (which includes a number of globally known food and beverages brands such as Grand Coffee and Tetley), could leverage the additional retail channel, while BigBasket would gain access to a consumer products supply chain. Both businesses stand to gain from the economies of scale of trading with each other, and they are likely to have better control over costs—through decreased transport costs with strategically planned supply replenishment, locating their respective businesses in close proximity and cutting out the markups that accompany third-party services. Tata Consumer Products and BigBasket also benefit from competitive advantages of exclusively working with each other and gain greater control of supply to the market. “Super App” Could Propel Tata Group into Previously Unexplored Territory Investing in 1mg will give Tata Group immediate access to online pharmacy retail without having to establish the business from ground zero. Developing a WeChat-like “super app” will create a new dimension in India’s digital ecosystem. Based on WeChat’s functionalities, a “super app” would offer the following functionality:- Chat, similar to full-fledged messenger apps

- Payments to retailers, service-providers, utilities providers and individuals

- Ordering food, products, services and more

- Games to play with contacts

- News from various sources

- Engagement with companies and brands, similar to a social network

Figure 2. Tata Group and Reliance Industries: Key Metrics [wpdatatable id=813]

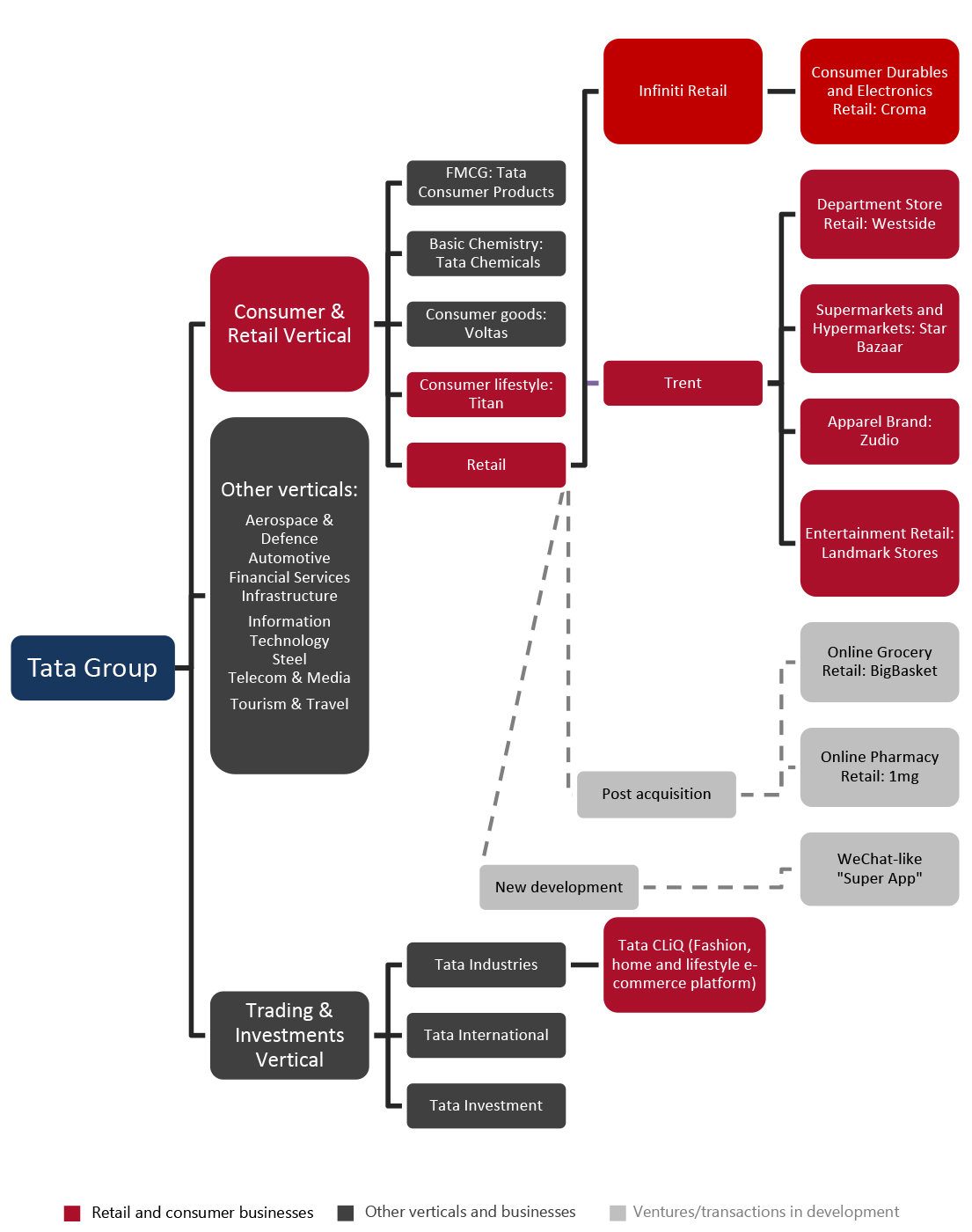

Fiscal year ended March 31, 2020 *Combined market capitalization of listed companies Source: Company reports/S&P Capital IQ/Coresight Research Mapping Tata Group’s Businesses Tata Group operates its retail businesses under various banners:

- Its consumer and lifestyle business, Titan Company, manufactures and sells watches, eyewear and jewelry under the banners of Titan and Tanishq.

- Within Tata Group’s retail sub-vertical Infiniti Retail, it operates consumer electronics stores and an online store under the Croma banner.

- Under the Trent sub-vertical, Tata Group operates stores under the banners of Landmark, Westside and Zudio. Trent also has joint ventures (JVs) with international retailers—it operates hypermarkets and supermarkets under the banner of Star Bazaar as a JV with British supermarket chain Tesco, and it has JVs with Inditex to operate stores in India of two of the Spanish fashion company’s brands—Massimo Dutti and Zara. In 2019, Trent acquired a 51% stake in wholesale business Booker India, a subsidiary of UK wholesaler Booker Group.

- Tata Group also operates a fashion, home and lifestyle e-commerce site Tata CLiQ within its Tata Industries sub-vertical which promotes and incubates new ventures of the business.

Figure 3. Tata Group: Verticals of Operation, Retail Businesses and Potential Acquisitions [caption id="attachment_124842" align="aligncenter" width="725"]

Source: Tata Group/Coresight Research[/caption]

Source: Tata Group/Coresight Research[/caption]

What We Think

Tata Group has long taken a low-key approach to the retail sector compared to Reliance Industries. However, we think that Tata Group poses formidable competition to Reliance, not least because of its vast pool of funds and deep expertise in several sectors. Implications for Brands/Retailers- Acquiring BigBasket will increase competition for online grocery retailers. As many are startups, they do not have the access to the funds or wide network and tech expertise that Tata Group has (Tata has a software business).

- If BigBasket aggressively expands outside of the bigger cities where it currently operates, it will create increased competition for local, independent retailers.

- Vertical consolidation across the supply chain could price out potential suppliers and increase Tata Group’s control over the grocery retail sector.

- Tata Group may need additional warehousing and fulfillment space if it plans to expand BigBasket to new cities across India.

- Inventory, supply chain and last-mile delivery technology solutions could be in demand if Tata Group plans to build out the new business quickly.

- Tata Group could consider using existing technology or acquire providers as it may be more economical than building such technologies in-house; thiscould complement the company’s existing technology business.