Nitheesh NH

Introduction

What’s the Story? The Covid-19 pandemic-led global supply chain disruptions have impacted businesses and consumers alike, as has the ongoing Russia-Ukraine war. In this report, part of our India Retail Insights series, we examine the supply chain woes impacting retail businesses, consumers and the Indian economy, and discuss how retailers can address disruption. Why It Matters Supply chains are the backbone of a retailers’ business, and the Covid-19 pandemic has caused global disruption to operations. In India, the supply chain woes are affecting businesses across most sectors, as the country depends on other nations, especially China, for some of its imports on manufacturing inputs: 14% of all the Indian imports were from China in the fiscal year ending March 2020—increasing to 19% as of October 2020—according to the United Nations Conference on Trade and Development-Eora Global Value Chain. Furthermore, 63% of Indian retailers (public and private companies and multinational corporations) reported that their supply chains had been affected by the pandemic, according to a March 2020 survey by India-based non-governmental trade association The Federation of Indian Chambers of Commerce and Industry. Although there was some recovery in the last calendar quarter of 2021, it was offset by the spread of the Omicron variant and associated lockdowns, including China’s stringent zero-Covid lockdowns. A December 2021 survey by The Confederation of Indian Industries, a non-governmental industry organization, found that 70% of CEOs at India-based companies cited supply chain disruption as an adverse outcome of the Omicron variant—and 55% predicted that the services sector would take a hit. The Russia-Ukraine war has also shattered global markets as these countries account for a sizeable global supply of commodities such as natural gas, wheat and oil. The restrictions imposed on Russia’s sanctions by the West affect global trade. For India, the impact on commodities, especially energy, will lead to a surge in crude oil prices, increased costs of producing goods, a rise in inflation and reduced GDP growth—from the predicted 9.2% for fiscal 2022 in the Government of India’s Economic Survey 2022—dampening India’s growth and weakening the rupee against the dollar.- Read more about the global impacts of the Russia-Ukraine war on supply chains in our Supply Chain Briefing report.

Impacts of Supply Chain Disruption on India Retail: Coresight Research Analysis

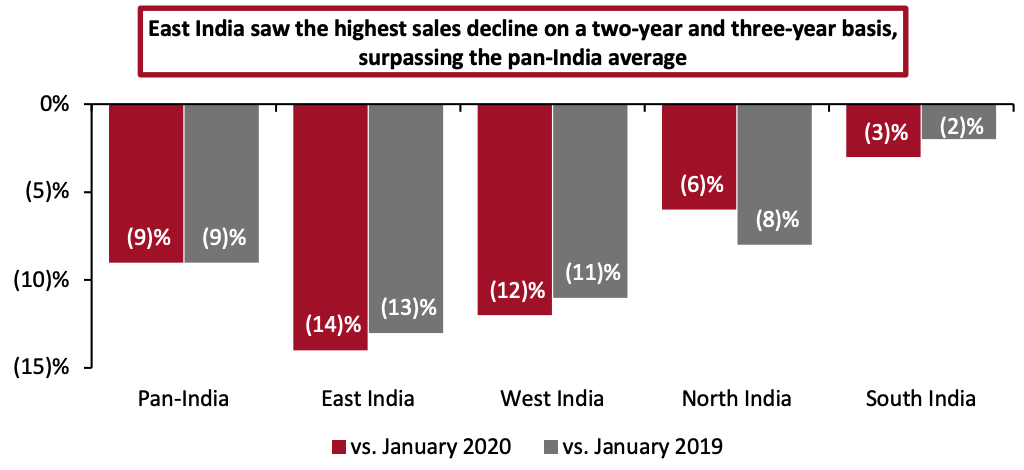

Retail Sales Overall The arrival of the Covid-19 pandemic in 2020 and the associated lockdowns led to a dip in consumer demand across most non-discretionary retail categories. Demand then skyrocketed as lockdowns lifted. However, idle supply chains—with port closures, container and labor shortages, and logistics restrictions in the movement of goods—due to pandemic-led lockdowns and restrictions in most countries, struggled to keep up with demand. Furthermore, Omicron adversely impacted the retail sales in India in January 2022 across sectors, ranging from apparel to CPG (consumer packaged goods) to furniture. The latest data from the Retailers Association of India’s (RAI’s) Business Survey, published in January 2022, show that sales in January 2022 declined by 9% compared to the pre-pandemic levels of both January 2020 and January 2019 (see Figure 1).Figure 1. India: Retail Sales Growth by Region, January 2022 (%) [caption id="attachment_144921" align="aligncenter" width="700"]

Source: RAI[/caption]

Impacts by Retail Sector

Apparel

Supply chain disruptions affect the apparel industry by increasing the cost of raw materials. The logistics crisis is restricting the free movement of material, creating shortages and adding to the complexity in apparel supply chains. Furthermore, the recent reverse migration of workers from production locations (fearing Omicron-led restrictions) has caused a shortage in stitching, ironing and pressing garments, according to various apparel associations in India.

Demand for apparel from the domestic and overseas markets also declined due to the rising Omicron cases. Following restrictions imposed by states to curb the spread of the virus, domestic apparel sales in India in the first week of January 2022 saw a 30% decline compared to the same period in the previous month, according to The Confederation of All India Traders (CAIT), a trading community encompassing notable trade bodies of different states in India. CAIT expects a year-over-year decline in sales during the wedding season (January–April 2022) from ₹4 trillion ($52 billion) to about ₹1.3 trillion ($17 billion) owing to the Omicron impact.

Consumer Electronics and Home Appliances

A shortage of electronic components and an increase in the price of crude oil due to supply chain woes are forcing consumer electronics and home appliances companies to take a hit in their manufacturing and operating costs, in addition to delays in order fulfillment.

Source: RAI[/caption]

Impacts by Retail Sector

Apparel

Supply chain disruptions affect the apparel industry by increasing the cost of raw materials. The logistics crisis is restricting the free movement of material, creating shortages and adding to the complexity in apparel supply chains. Furthermore, the recent reverse migration of workers from production locations (fearing Omicron-led restrictions) has caused a shortage in stitching, ironing and pressing garments, according to various apparel associations in India.

Demand for apparel from the domestic and overseas markets also declined due to the rising Omicron cases. Following restrictions imposed by states to curb the spread of the virus, domestic apparel sales in India in the first week of January 2022 saw a 30% decline compared to the same period in the previous month, according to The Confederation of All India Traders (CAIT), a trading community encompassing notable trade bodies of different states in India. CAIT expects a year-over-year decline in sales during the wedding season (January–April 2022) from ₹4 trillion ($52 billion) to about ₹1.3 trillion ($17 billion) owing to the Omicron impact.

Consumer Electronics and Home Appliances

A shortage of electronic components and an increase in the price of crude oil due to supply chain woes are forcing consumer electronics and home appliances companies to take a hit in their manufacturing and operating costs, in addition to delays in order fulfillment.

- BSH Home Appliances’ MD and CEO, Neeraj Bahl, said that the company absorbed the spike in costs arising from supply chain disruptions in 2021 without passing it on to consumers. However, the intensifying disruption forced the company to increase the price of refrigerators in India in February 2022 and the company plans to increase the price of washing machines in April 2022.

- India-based dairy products retailer Amul increased milk prices in India in March 2022.

- Swedish furniture retailer IKEA mitigated the disruptions by leasing more ships, buying containers and re-routing goods between warehouses. However, the company expects the disruptions to continue through 2022, forcing the retailer to increase its prices. IKEA has implemented a 9% average hike in the prices of its products across markets, including India, according to its holding company, Ingka Group.

- According to Kamal Nandi, Business Head of Godrej Appliances, the 7%–8% difference between input and selling cost further widened to 10%–12% in early March 2022, due to the Covid-19 pandemic, as reported by The Economic Times. The prices of electronics products are therefore likely to increase from April 2022.

- Saugata Gupta, MD and CEO of India-based consumer goods company Marico, said that organizations need to absorb some input costs through optimization, as reported by Financial Express. However, the continuous increase in input costs will likely force them to pass on costs to consumers.

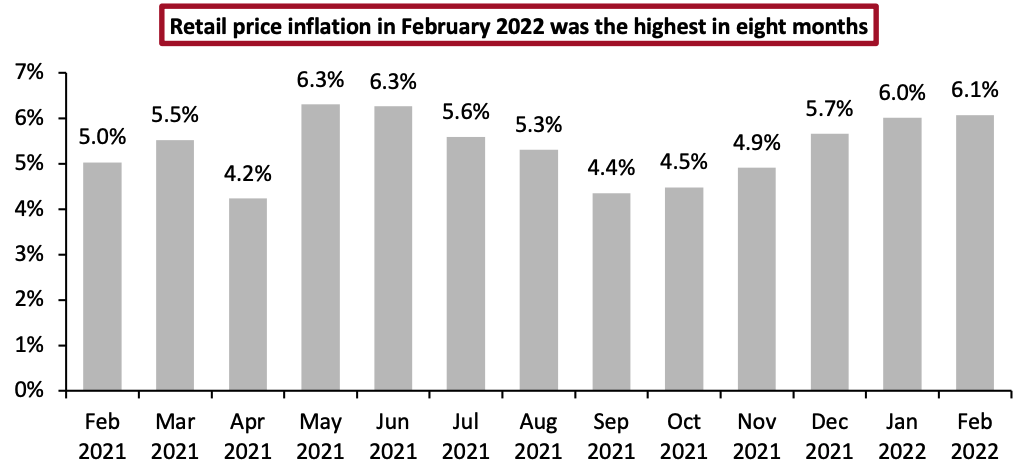

Figure 3. India: Retail Price Inflation [caption id="attachment_144920" align="aligncenter" width="700"]

Source: MOSPI/Trading Economics[/caption]

Inflation as measured by the Wholesale Price Index remained in double digits for the 11th month in a row. It stood at 13.1% in February 2022, up from 12.9% in January 2022, according to data released by the Ministry of Commerce and Industry.

Rising inflation will have an impact on consumers, with prices increasing across commodities and consumer goods.

Aside from inflation, the Russia-Ukraine war is likely to have adverse effects on the country’s economic growth. According to recent government data, economic growth for fiscal 2022 is likely to come down to 8.9% from the predicted 9.2% in the Economic Survey 2022.

What Can Retailers Do To Address Supply Chain Disruption?

Dependency on China

India should reduce its economic dependence on China for critical supply chains. China is known for its strict zero-Covid lockdowns and restrictions; minimizing its reliance on China will help India mitigate risks against future supply disruption that could arise from black swan events.

The Quad

Quadrilateral Security Dialogue, popularly known as the Quad, is a strategic alliance among four nations—India, Australia, Japan and the US. One of the objectives of the Quad is to counter the Chinese dominance in the Indo-Pacific region and work for a free, open and inclusive space. India can leverage the opportunity through these major power nations to attract large businesses to look at the country as an investment destination. However, this depends on profit prospects and associated risks. India needs to streamline its industrial policies, investment promotion and ease of doing business to bring those parts of the global supply chain to the country.

Government Initiatives To Promote Domestic Manufacturing

In its Union Budget on February 1, 2022, the Government of India announced two key industrial reforms: a cut on import duties and production-linked incentive schemes (PLIs) in 14 sectors—including textiles, pharmaceuticals and electronics—to promote domestic manufacturing. This will attract and incentivize foreign investors to set up their manufacturing units in India and encourage local manufacturers to expand their manufacturing units, increasing India’s global competitiveness while reducing dependence on global supply chains.

The PM Gati Shakti – National Master Plan for the planning and implementation of infrastructure connectivity projects will provide seamless connectivity for the movement of people, goods and services from one mode of transport to another and facilitate the last-mile connectivity of infrastructure. The multimodal transport shift to the Unified Logistics Interface Platform (comprising seven elements—roads, railways, airports, seaports, mass transport, waterways and logistics infrastructure) will help with the efficient movement of goods. It will also accelerate the progress of the highly fragmented logistics industry in India and bring it on par with global supply chain networks.

The special economic zones (SEZs) have a history of delivering modest results in manufacturing. The government should also look at revamping the policies for SEZs to create a parallel ecosystem and transform India as a manufacturing hub and become a part of global supply chains.

Source: MOSPI/Trading Economics[/caption]

Inflation as measured by the Wholesale Price Index remained in double digits for the 11th month in a row. It stood at 13.1% in February 2022, up from 12.9% in January 2022, according to data released by the Ministry of Commerce and Industry.

Rising inflation will have an impact on consumers, with prices increasing across commodities and consumer goods.

Aside from inflation, the Russia-Ukraine war is likely to have adverse effects on the country’s economic growth. According to recent government data, economic growth for fiscal 2022 is likely to come down to 8.9% from the predicted 9.2% in the Economic Survey 2022.

What Can Retailers Do To Address Supply Chain Disruption?

Dependency on China

India should reduce its economic dependence on China for critical supply chains. China is known for its strict zero-Covid lockdowns and restrictions; minimizing its reliance on China will help India mitigate risks against future supply disruption that could arise from black swan events.

The Quad

Quadrilateral Security Dialogue, popularly known as the Quad, is a strategic alliance among four nations—India, Australia, Japan and the US. One of the objectives of the Quad is to counter the Chinese dominance in the Indo-Pacific region and work for a free, open and inclusive space. India can leverage the opportunity through these major power nations to attract large businesses to look at the country as an investment destination. However, this depends on profit prospects and associated risks. India needs to streamline its industrial policies, investment promotion and ease of doing business to bring those parts of the global supply chain to the country.

Government Initiatives To Promote Domestic Manufacturing

In its Union Budget on February 1, 2022, the Government of India announced two key industrial reforms: a cut on import duties and production-linked incentive schemes (PLIs) in 14 sectors—including textiles, pharmaceuticals and electronics—to promote domestic manufacturing. This will attract and incentivize foreign investors to set up their manufacturing units in India and encourage local manufacturers to expand their manufacturing units, increasing India’s global competitiveness while reducing dependence on global supply chains.

The PM Gati Shakti – National Master Plan for the planning and implementation of infrastructure connectivity projects will provide seamless connectivity for the movement of people, goods and services from one mode of transport to another and facilitate the last-mile connectivity of infrastructure. The multimodal transport shift to the Unified Logistics Interface Platform (comprising seven elements—roads, railways, airports, seaports, mass transport, waterways and logistics infrastructure) will help with the efficient movement of goods. It will also accelerate the progress of the highly fragmented logistics industry in India and bring it on par with global supply chain networks.

The special economic zones (SEZs) have a history of delivering modest results in manufacturing. The government should also look at revamping the policies for SEZs to create a parallel ecosystem and transform India as a manufacturing hub and become a part of global supply chains.

- Read the previous India Retail Insights report for more about the implications of India’s Union Budget 2022 for retail and associated sectors.

- Strengthen tech investments: Businesses should look beyond investing in intelligent automation of their warehouses and stores to digital enablers such as cognitive planning and AI (artificial intelligence)-driven predictive analytics to augment their supply chain planning capabilities.

- Diversify trading partnerships: Retailers largely rely on one major trading partner–supplier, customer and supply chain partner. They should widen their prospects and look at a broader list of suppliers, customers/markets and logistics providers to diversify and strengthen their supply chains and mitigate risks arising from sole reliance on trading partners.

- Plan for the evolving customer: Customer expectations on deliveries and returns management are constantly evolving. Retailers should consider customers’ future buying behaviors and expectations to plan their fulfillment and return strategies and design alternative supply chain flows to optimize the last mile and returns.

- Shift focus to micro-supply chains: Retailers and businesses should look at micro-supply chains local to the market to help save on logistics and gain flexibility during uncertain times.

What We Think

Pandemic-related restrictions globally have caused supply chain disruption—and there remains risk of future challenges for India’s supply chains related to Covid-19 or other black swan events. We believe that retailers should leverage advanced technologies for long-term prediction, planning and visibility throughout the extended supply chain to anticipate and curb disruption quickly. Retailers, businesses and the government should work together to boost domestic manufacturing capabilities, attract foreign investments and improve reliance on micro-supply chains to build resilience. Implications for Brands/Retailers- Brands and retailers should look at various sourcing strategies to keep a check on their input costs. They should cap rising product prices either by absorbing costs (if they don’t find alternative sourcing) or by offering cheaper alternatives (if they find alternative sourcing).

- Real estate firms with large spaces near ports will continue to see increased demand as they offer storage and warehousing opportunities amid shipping backlogs.

- Technology providers should develop applications that help increase visibility and promote coordination between supply chain stakeholders.

- Companies specializing in AI and predictive analytics can partner with businesses and retailers to help them with long-term planning to anticipate and avoid future disruption.