albert Chan

What’s the Story?

In Coresight Research’s India Retail Insights series, we explore the impact of consumer behavior, government regulations, macroeconomic developments, the competitive landscape and retail tech startups on the evolution of India’s retail sector.

In recent years, consumers have been increasingly focused on health and wellness—a shift that has been accelerated by the Covid-19 pandemic. The crisis has made consumers more health-conscious—looking toward preventative healthcare, rather than just the treatment of illnesses. It has also prompted them to buy medicines and other health-related products online. These trends are fueling the transformation of India’s organized retail pharmacy market. In this report, we explore market opportunities and growth drivers for domestic and international players.

Why It Matters

According to the Indian Journal of Community Medicine, non-communicable diseases (NCDs) comprise around 60% of deaths in India—and four diseases in particular account for nearly 80% of all NCD-related deaths: heart disease, cancer, diabetes and chronic pulmonary diseases. Additionally, India has the second highest number of adult diabetic patients in the world, totaling 77.0 million people in 2019, according to the International Diabetes Federation (IDF) Atlas. The IDF expects this to rise to 101.0 million in 2030 and to 134.2 million in 2045. The most common risk factors behind NCDs are harmful use of alcohol, a lack of physical exercise, tobacco use and an unhealthy diet (high in sugar, salt and fats).

The pandemic has boosted consumer shift toward a health and fitness-oriented lifestyle. According to a report by Research and Markets published in February 2021, covering a government survey, 45% of Indians born between 1982 and 2000 (who may be characterized as millennials, and account for about 426 million out of the total population of 1.36 billion) aspire to maintain a healthy lifestyle and are willing to spend a premium to ensure good health.

Furthermore, VLCC, an Indian beauty and wellness company, conducted a survey of more than 5,000 Indian consumers aged 22–65, published in November 2020. The study found that Indian consumers have adopted preventive healthcare habits since the start of the pandemic in 2020: 78% of respondents reported making efforts to strengthen their immunity levels, and 82% have begun taking dietary supplements to support preventive healthcare measures.

Consumers are therefore pursuing broader holistic wellness in addition to looking after their health, resulting in growing demand for a “wellness partner”—a party with a basic knowledge of illnesses, remedies, wellness and preventive medicines that can guide and support consumers in making the right decisions to lead a healthy lifestyle, rather than simply dispensing medication.

India’s organized retail pharmacy market is set to play a significant role in meeting this demand in the coming years, with product offerings across multiple categories including drugs, health foods, nutraceutical products and wellness goods.

India’s Growing Retail Pharmacy Market: In Detail

Market Size and Growth Potential

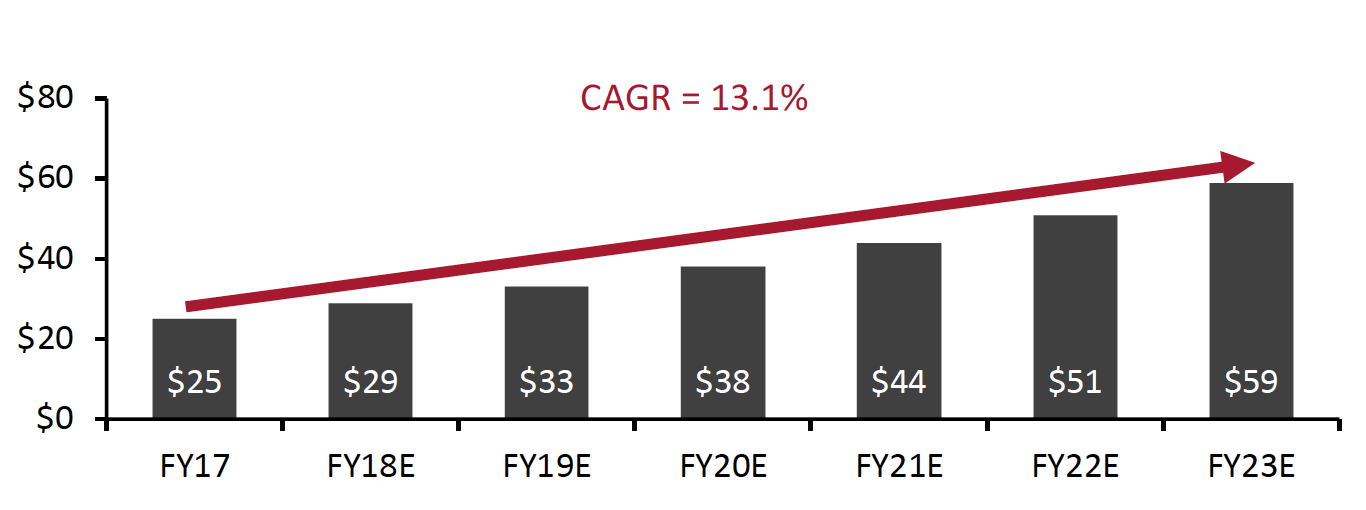

Retail pharmacies are the dominant medical distribution channel in India, with more than 800,000 pharmacies spread across the country, according to market research firm Statista. Statista estimates that the nation’s retail pharmacy market (comprising the organized and unorganized sectors) will total $44.0 billion in fiscal 2021 (ending March 31, 2022) and will reach $59.0 billion by fiscal 2023 (see Figure 1).

Figure 1. India’s Retail Pharmacy Market Size (USD Bil.)

[caption id="attachment_128401" align="aligncenter" width="700"] The Indian fiscal year runs from April 1 to March 31 of the following year

The Indian fiscal year runs from April 1 to March 31 of the following yearSource: Statista/Coresight Research[/caption]

In addition, in March 2021 the India Brand Equity Foundation (IBEF), a trust established by India’s Department of Commerce, estimated that spending on medicine in India will grow by 912% over the next five years. This will make it among the top 10 countries with the highest spending on medicine.

Unorganized local players currently dominate the retail pharmacy sector with an approximately 93% market share as of 2018, according to a Research and Markets report dated February 2021—meaning that the organized sector (comprising licensed and registered players) takes the remaining 7% share. The report states that this is likely to increase steadily in the forecasted period of 2019–2024 (current data from 2021 is unavailable).

We believe that there are four key factors that are causing the rise in organized pharmacy’s market share, which will also boost further growth in the coming years. We discuss each factor below.

- Increased consumer awareness of health and wellness: Consumers are increasingly focusing on preventive healthcare to boost their immunity. For example, consumers are looking to immunity-boosting drinks and vitamin supplements as preventive measures against obesity, diabetes, heart diseases, hypertension and premature mortality. The government also focuses on preventive healthcare with initiatives such as “Health for All,” aligning with the World Health Organization’s goal for securing the health and wellbeing of people around the world. Organized retail pharmacies can further tap this demand by offering a wide variety of products related to preventive healthcare and wellbeing.

- The changing role of the pharmacist: Pharmacists are becoming trusted healthcare consultants for consumers, through personal interaction and services. According to the government’s latest Pharmacy Practice Regulations (2015), pharmacists are empowered to provide patient counseling in addition to dispensing medicines. The VLCC survey showed that 82% of people would prefer to seek professional guidance for wellness needs than self-experiment. By helping consumers meet their wellness-related requirements, pharmacies can strengthen their connection with consumers and build brand trust.

- Offline presence and diversified portfolio: Pharmacies are known for offering a wide variety of products, not only medicines or health and wellness solutions, but essentials such as toiletries, vitamin supplements and other FMCG products. Further diversification and expansion of product offerings present opportunities for growth. Additionally, in physical retail, we believe the aesthetic of pharmacy store designs are becoming more innovative as companies increasingly look to appeal to health-conscious consumers.

- Online and omnichannel presence: A small number of organized retail pharmacies, such as the chains Apollo and Medplus, currently have a significant online presence, boosting sales and growth. The pandemic has further accelerated e-commerce in all retail sectors, and retail pharmacy is no different. According to a survey by management consulting agency RedSeer, over 70% of users reported that they are willing to use online pharmacies after Covid-19 due to their recent positive experiences, with stronger adoption among low-income households. This also, however, poses significant challenges for physical pharmacies: exclusively online pharmacies and health-technology companies are on the rise. One example is Practo, a health-technology company that connects consumers to India’s fragmented medical community. Through its app consumers can book diagnostic tests, buy medicines and health and wellness products, consult online with doctors and arrange appointments.

Organized Retail Pharmacy in India: Domestic Players

Growth Drivers

The generic medicines segment dominates India’s retail pharmacy sector, due to low prices. Over-the-counter (OTC) medicines rank second, followed by patented products, according to Research and Markets. The company predicts that the OTC segment will grow its share, driven by several factors. The Government has proposed an initiative to include various medicines under the OTC category which are currently sold as prescription only, and provided a clear definition of criteria for those medicines to switch from prescription drugs to OTC. Research and Markets also predicts that increasing consumer awareness of wellness and preferences for self-medication is likely to have an impact.

Consumers’ ability to spend on health and wellness products is being driven by a rise in per-capita income and increased penetration of health insurance coverage. According to India Ratings and Research, lifestyle-based and chronic conditions (such as hypertension, diabetes and other cardio-vascular diseases) will continue to drive growth, as they require continuous medication. Additionally, consumers looking to prevent these ailments may turn to health and wellness products. Both provide opportunities for organized retail pharmacies.

Opportunities

- Pharmacies have the potential to become health centers: Consumers may be willing to spend on specialized services including blood pressure and sugar-level monitoring, on training for usage of these monitoring devices, and vaccinations. Pharmacies therefore have the opportunity to increase their breadth of services, effectively becoming health centers that offer advice and professional services in addition to selling high-quality products.

- Subscription services for refills: Customers frequently buying medicines (for example, for chronic illnesses) and other health and wellness products (such as herbal products and medicines, probiotics, protein and amino acid supplements, vitamin and mineral supplements, and even traditional medicines) may be willing to enter into long-term relationships with pharmacies. Pharmacies could introduce subscription services, offering deals for medication refills.

- Availability of specialty medicines: New medications and specialty medicines are regularly brought to the market. Organized retailers should ensure availability by stocking a more comprehensive range of stock-keeping units (SKUs) to meet increasing consumer demand.

- Sale of health and beauty products: Customers visiting organized retail pharmacies for buying non-prescription items may focus on quality rather than price. Once customer loyalty is established, pharmacies should offer high-quality products and focus on cross-selling opportunities.

- Digital solutions: Pharmacies have the opportunity to offer their customers digital solutions, such as online consultations with doctors, online access to e-prescriptions, and meaningful online content for their wellness needs. They could also offer pharmacy staff online access to information on generic products or check for stock availability of rare medicines. Additionally, players in the organized market should enhance their ability to deliver online orders—including to remote areas and with tracking options. Increased online services will help to provide a seamless, integrated experience for customers, therefore increasing loyalty and generating more revenue.

Organized Retail Pharmacy and FDI

For international companies, restrictions on foreign direct investment (FDI) may hamper opportunities in pharmacy retail, as shown in Figure 3. The retail pharmacy business comes under multi-brand retail, where FDI is allowed only up to 51% investment.

For context, we also show below how FDI regulations impact the pharmaceuticals manufacturing industry.

Figure 2. Condition for FDI in the Retail and Pharmaceuticals Manufacturing Sectors in India

| Sector | Entry into India | |

| No Government Approval Required—Percentage of investment by a non-resident Indian without the prior approval of the Reserve Bank of India or the Central Government. | Government Approval Required—Percentage of investment by a non-resident Indian where prior Government approval is necessary, and foreign investment needs to be in accordance with Governmental conditions stipulated. | |

| Retail | ||

| Retail and E-commerce—E-Commerce Activities | 100% | N/A |

| Retail and E-commerce— Multi-Brand Retail Trading | N/A | 51% |

| Retail and E-commerce—Single Brand Product Retail Trading | 100% | |

| Pharmaceuticals Manufacturing | ||

| Pharmaceuticals—Brownfield Projects (Existing pharmaceutical projects in India, for example, investments in an existing manufacturing plant) | Up to 74% | Above 74% |

| Pharmaceuticals—Greenfield Projects (New pharmaceutical projects in India, for example, constructing production and operational facilities of a new manufacturing plant from the ground up) | 100% | N/A |

However, there are alternatives for non-domestic companies entering the wider Indian pharmaceutical industry, detailed below:

- As stated above, 100% FDI is allowed in the pharmaceutical sector for Greenfield projects. Up to 74% FDI has been permitted under Brownfield projects without any approvals—above 74% requires Government approval.

- FDI up to 100% is allowed for manufacturing medical devices without any approval, irrespective of Greenfield and Brownfield projects.

- Consumers consider retail pharmacies a quick alternative for buying essentials, which provides opportunities for international single-brand owners to look at investment opportunities and push their higher-end premium brands through retail pharmacies and drive sales.

What We Think

With the consumer shift toward healthy lifestyles and an increased willingness to spend on health and wellness products, we expect positive growth for the organized retail pharmacy sector. During the pandemic, consumers have realized that healthcare is of utmost importance, and organized retail pharmacies can address their medical, health, and wellness needs for holistic well-being.

Implications for Brands/Retailers

- The growing demand for organized retail pharmacies may attract more domestic players into the market and offer scope for expansion to newer markets for existing players.

- E-pharmacies are offering organized retail pharmacies stiff competition. Hence, organized retail pharmacies should focus on digital initiatives such as connecting doctors to pharmacies online, and leveraging hyperlocal opportunities to attract and retain consumers. They should also offer digital solutions such as IT support for pharmacy staff with easy access to information on generic products, side effects, offering consumers a seamless experience.

- With pharmacists becoming consumers’ trusted retail partners, organized pharmacy retailers have scope for store expansion to more localities within their cities, in order to build trust in the pharmacy retail brand.

- Consumers are increasingly looking at organized pharmacy retail outlets as quick alternatives for convenience stores. Hence, international FCMG brands should look at opportunities for a tie-up with pharmacies, offering a wide range of essentials at discounted rates to cater consumer needs.

Implications for Technology Vendors

- Organized pharmacy retailers are likely to adopt AI analytics in future to provide consumers with customized medical services, offering growth avenues and opportunities for AI technology providers.