Nitheesh NH

Introduction

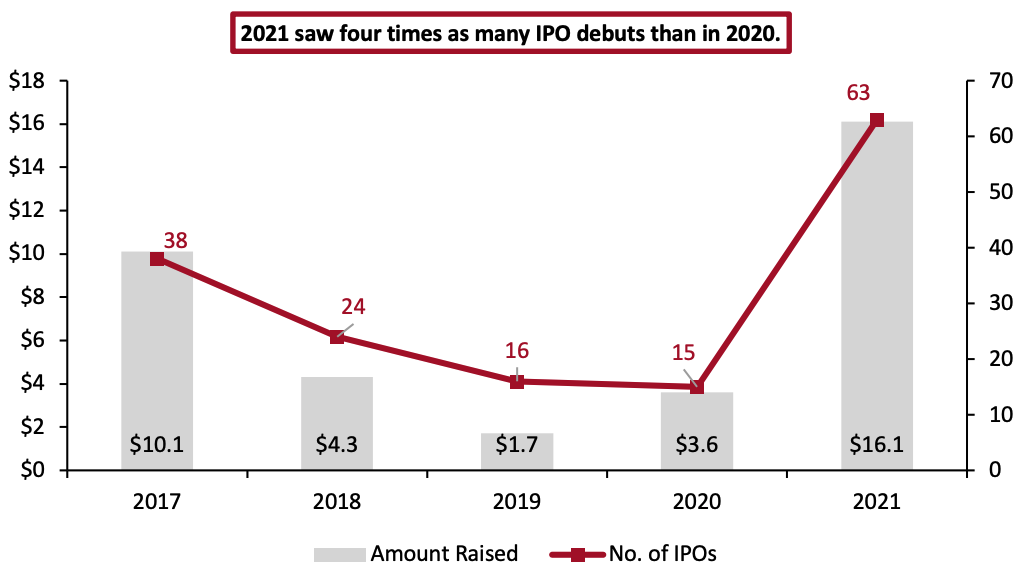

What’s the Story? Last year saw robust momentum in India’s IPO activity, primarily due to the simplification of IPO rules by SEBI, with technology brands such as Paytm, Zomato and Nykaa leading in funding. Following this momentum, we anticipate another year of growth ahead for India’s IPO activity. This report discusses upcoming retail and retail-tech IPOs for 2022, key reasons for the rise in IPO activity, the aftermarket performance of prominent retail and tech-led IPOs in 2021, and opportunities and challenges for private-sector retailers looking to enter the public market via IPO. Why It Matters Calendar 2021 set a record for the Indian primary market, with 63 companies—13 under retail and retail-tech—going public, raising a record ₹1.2 trillion ($16.1 billion), according to financial platform Chittorgarh.com. Between January 1, 2022, and March 31, 2022, six companies went public—two under retail and retail-tech—raising ₹120 billion ($1.6 billion) in funding.Figure 1. India: Amount Raised Through IPOs (Left Axis; USD Bil.) and Number of IPOs (Right Axis; Number) [caption id="attachment_145850" align="aligncenter" width="700"]

Data are for calendar years

Data are for calendar yearsConversions are at constant exchange rates as of Dec 31, 2021

The number and value of IPOs include sectors other than retail

Source: Chittorgarh.com[/caption]

Retail and Retail-Tech IPOs in 2022: Coresight Research Analysis

Following strong IPO activity in India in 2021, we have seen a slowdown in the first quarter of 2022—likely due to the ongoing Russia-Ukraine war, increased inflation and market volatility. Nevertheless, we anticipate that, as the market improves, more companies will carry out IPOs in the later quarters of 2022. In 2021, One97 Communications, parent company of digital payments platform and financial services company Paytm, raised ₹183 billion ($2.5 billion)—the largest IPO in India to date, surpassing the longstanding record of ₹152 billion ($2 billion) raised by Government of India-owned Coal India Limited in 2010. 1. Recent and Upcoming IPOs in Retail and Retail-Tech Sectors In Figure 2, we present key retail and retail-tech IPOs from the first quarter of calendar 2022. We list those lined up for the rest of the year are listed below the table.Figure 2. India: IPOs in the Retail and Retail-Tech Sector, 1Q22 [wpdatatable id=1908]

*Ended March 31, 2021; Conversions are at constant exchange rates as of December 31, 2021 Source: Chittorgarh.com/company reports

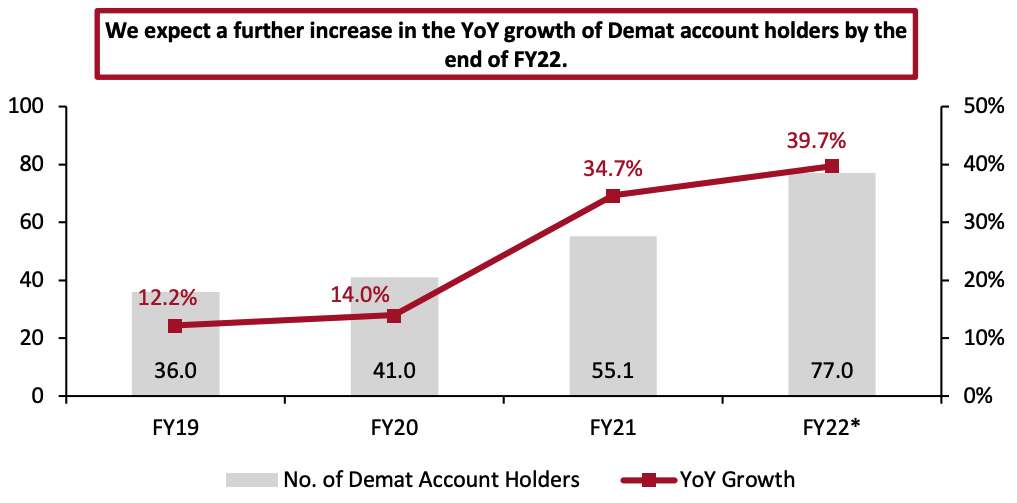

Upcoming Indian Retail and Retail-Tech IPOs in 2022 Boat Founded in 2014, Boat is a direct-to-consumer (DTC) audio electronics brand that manufactures earphones, headphones and travel accessories. In January 2022, Boat filed a draft red herring prospectus (DHRP)—an offer document submitted by companies going public—with SEBI for a ₹20 billion ($262.7 million) IPO in 2022, at a valuation of $1.5–2 billion. Delhivery Delhivery is an e-commerce logistics company founded in 2011. Since its inception, the company has fulfilled over 1 billion orders in India and now has over 80 fulfillment centers, servicing more than 17,000 zip codes. Through its 2022 IPO, the company plans to raise between ₹50 billion ($656.3 million) and ₹76 billion ($997.6 million) through primary issue and ₹26 billion ($341.3 million) via an offer for sale from existing investors, at a valuation of $6 billion. Due to unfavorable market conditions, the company postponed its planned February 2022 IPO launch. Delhivery plans to use the IPO proceeds for organic growth initiatives such as augmenting sales, inorganic growth through acquisitions and strategic initiatives. MobiKwik MobiKwik is a buy-now-pay-later (BNPL) fintech and mobile wallet company founded in 2009. It offers digital payment solutions for e-commerce shopping, utility bill payments, POS retail transactions and peer-to-peer payments through the Unified Payment Interface (UPI). It has more than 108 million registered users and over 3.5 million online and offline retail partners. It plans to raise ₹19 billion ($249.4 million) through its 2022 IPO, out of which ₹15 billion ($197 million) will be fresh issue, while the remaining ₹4 billion ($52.4 million) will be through offer for sale. MobiKwik plans to utilize 40% of its IPO funding for organic growth initiatives, such as acquiring new customers and merchants to popularize the company’s wallet. It also plans to make technology and data science investments to improve existing offerings, strengthen its platform, leverage machine learning and use lending partners to strengthen the usage of BNPL in India. PharmEasy Founded in 2014, PharmEasy is a health-tech startup offering medicine deliveries, diagnostic-test sample collection and teleconsultation services. It also offers medicines and health and personal care products through retail partners across India. It plans to raise ₹62.5 billion ($820.5 million) in fresh equity shares and has filed draft IPO papers to do so. Like Delhivery, the company is reconsidering its launch for the later part of 2022 due to market volatility. PharmEasy plans to use 31% of its IPO proceeds to repay some of its outstanding debts. The company then intends to use the remaining proceeds for organic growth initiatives—like marketing and improving supply chain and technology infrastructure—and inorganic growth initiatives, including acquisitions and other strategic proposals. VLCC Healthcare Founded in 1989, VLCC Healthcare is a beauty and wellness company offering personal care products and nutraceuticals through 110,000 retail stores, salons and spas. Currently, it has a presence in more than 150 cities across 14 countries in Africa, Asia and the Middle East. It plans to go public in 2022 to raise ₹3 billion ($39.4 million) and will use the funds to set up new and refurbish existing VLCC wellness clinics in India and the Middle East. 2. Key Factors Driving IPO Growth in India Simplification of IPO Rules by SEBI The simplification of IPO rules by SEBI was one of the primary reasons behind the record number of IPOs in India in 2021. SEBI’s earlier regulation only allowed profit-making companies to be listed on stock exchanges. However, it now allows loss-making companies to be listed (with some conditions), enabling firms with a history of loss-making—such as Paytm and Zomato—to debut on the stock market. Pandemic-Led Surge in the Number of Demat Account Holders Lockdowns and work from home prompted predominantly young consumers to become first-time stock market investors. The number of Demat accounts—a brokerage account provided by banks and financial services companies to hold financial securities in electronic form—has more than doubled since the start of the pandemic, from 36 million in March 2019 to 77 million as of November 2021, according to a December 2021 press release by India’s Ministry of Finance. In Figure 3, we show the number of Demat account holders over the last four fiscal years and year-over-year growth in the number of Demat accounts during the same period.Figure 3. India: Demat Account Holders (Left Axis; Mil.) and YoY Growth (Right Axis; %) [caption id="attachment_145853" align="aligncenter" width="700"]

Data are for fiscal years; In India, fiscal year runs from April 1 to March 31

Data are for fiscal years; In India, fiscal year runs from April 1 to March 31*FY22 data is as of November 2021

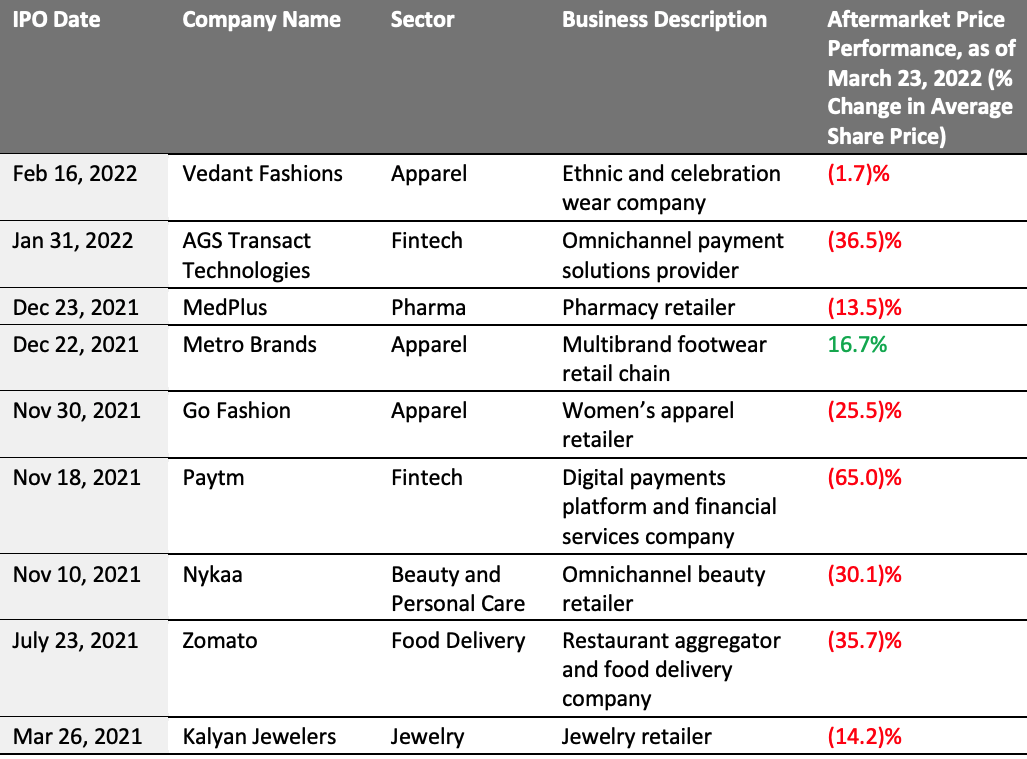

Source: Ministry of Finance[/caption] Increased Investment Interest from Individual Investors The average number of individual investors that subscribe to IPO applications has increased by more than three times since the start of the pandemic. Between September 2021 and December 2021, the 20 IPOs that debuted on the stock market attracted an average of 1.3 million applications—compared to 500,000 during pre-pandemic times—including investments of up to ₹200,000 ($2,628.60) from small individual investors, according to primary market tracking company Prime Database. The improved performance of company shares post-listing is the primary factor attracting individual investors. Meanwhile, the increased liquidity offered by individual investors and spikes in secondary market valuations prompt companies to go to the primary market with their IPOs. Startups Leverage the IPO Route to Attract Funding for Growth IPOs are often one of the most sought-after exit routes for startups, as they provide the required funding for growth. 50% of 2021 IPOs provided an exit to private equity (PE), venture capital (VC) firms and early investors. In 2021, out of the 63 Indian IPOs, 11 were startups that, combined, raised over $7.4 billion. Nine of these 11 companies went for a fresh issue of shares, ensuring the proceeds of the issue went back to the company. These proceeds will improve production and expansion, generate more employment opportunities and trigger economic activity. Companies that went for a fresh issuance include prominent retail and retail-tech startups such as Nykaa (omnichannel beauty retailer), Paytm (digital payments platform and financial services company) and Zomato (restaurant aggregator and food delivery company). 3. Aftermarket Performance of 1Q22 and 2021 Retail and Retail-Tech IPOs Aftermarket performance—the price variation of the company’s newly issued stock during a period after its IPO—is a valuable metric in understanding the success of an IPO. All but one of the completed retail and retail-tech IPOs in calendar 2021 and so far in 2022 have witnessed negative aftermarket performance, with an average decline of 27.7% as of March 23, 2022. However, this is mainly due to market volatility resulting from supply chain issues, the surge in Omicron cases and the ongoing Russia-Ukraine war. In Figure 4, we list completed retail and retail-tech IPO transactions in India from January 1, 2021, to March 23, 2022, and the companies’ aftermarket performance as of March 23, 2022. Figure 4 excludes IPOs in the software retail, automotive retail, travel-tech and restaurant sectors.

Figure 4. India: Aftermarket Performance of Retail and Retail-Tech IPOs 2021–22* [caption id="attachment_145855" align="aligncenter" width="700"]

*Data are for calendar years; for 2022, IPOs include those companies that went public between January 1, 2021, and March 31, 2022.

*Data are for calendar years; for 2022, IPOs include those companies that went public between January 1, 2021, and March 31, 2022.Figure 4 excludes IPOs in the software retail, automotive retail, travel-tech, and restaurant sectors.

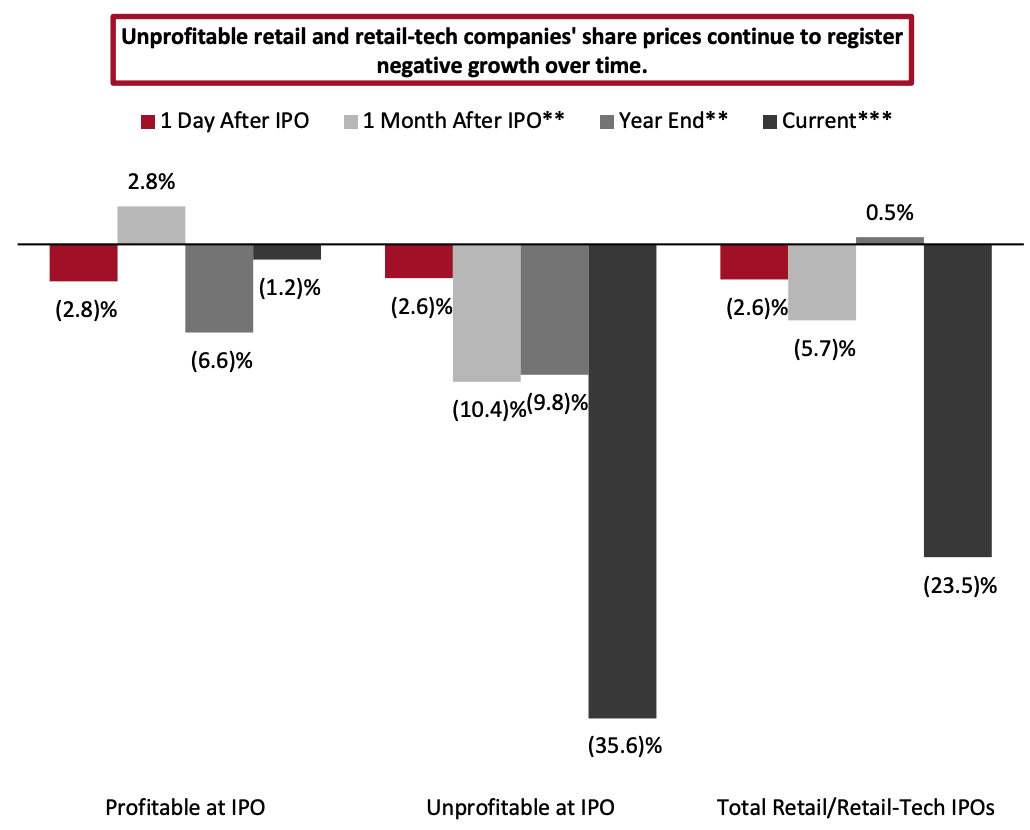

Source: Bombay Stock Exchange/Google/Coresight Research[/caption] In Figure 5, we present the post-IPO share performance of profitable versus unprofitable retail and retail-tech companies that went public between January 1, 2021, and March 31, 2022.

Figure 5. India: Average Share Price Performance of Profitable and Unprofitable Companies After IPO* (% Change in Average Share Price) [caption id="attachment_145856" align="aligncenter" width="700"]

*Profitability and unprofitability considered as of fiscal year ended March 31, 2021

*Profitability and unprofitability considered as of fiscal year ended March 31, 2021**One month after IPO and year end time periods depend on the listing date for shares under consideration

***Current share price performance considered as of March 31, 2022

Figure includes retail and retail-tech companies that went public between January 1, 2021, and March 31, 2022, excluding IPOs in the software retail, automotive retail, travel-tech and restaurant sectors

Source: Bombay Stock Exchange/company reports/Coresight Research[/caption] Prominent IPO debuts, such as Paytm and Zomato, are registering poor aftermarket performance. We analyze these two companies in more detail below. Paytm Digital payments platform and financial services company Paytm debuted on the stock market on November 18, 2021, at 27% lower than its issue price of ₹2,150 ($28.20). Since then, its stock has continued to decline and sits at an all-time low of 65% below its issue price, as of March 23, 2022. On March 11, 2022, due to “material supervisory concerns,” the Reserve Bank of India (RBI) barred Paytm Payments Bank from onboarding new customers. Additionally, RBI directed Paytm to appoint a company to audit its IT system over these supervisory concerns. RBI suspects a data breach of Paytm Payments Bank, resulting in the data ending up in Chinese servers, a violation of India’s rules. Earlier, in July 2021, RBI issued a show-cause notice to Paytm for submitting false information regarding the transfer of Bharat Bill Payment, an integrated bill payment system, from One97Communications to Paytm Payments Bank. Paytm said that it is currently working with RBI to address these concerns. RBI’s moves have delivered a major blow to Paytm’s expansion plans of converting itself into a small bank. The company had previously planned to apply for a license to do so in August 2022. Zomato Restaurant aggregator and food delivery company Zomato debuted on the stock market on July 23, 2021, at 65.8% above its issue price of ₹76 ($1.00), reaching an all-time high of 110% above its issue price on November 15, 2021. However, it has declined since then, and currently sits at 5.8% above the issue price. Recent macro-economic developments, such as the surge in retail inflation, supply chain disruptions and the ongoing Russia-Ukraine war, are some of the reasons for the decline in Zomato’s stock price. But macro-economic developments are not the only issues Zomato faces. The company’s earnings in the third quarter of fiscal 2021 (ended December 2021) also led to a fall in its share price. The company reported only 1.7% sequential growth in the gross order value (GOV) in its third quarter, compared to 37% and 19% growth in the GOV in the quarters ended June and September 2021, respectively. With the Covid-19 curve flattening and people going out more often, Zomato expects a neutral outlook for the short-term. 4. Benefits and Challenges of IPOs for Brands and Retailers Often, going public is one of the most effective ways to raise capital for brands and retailers looking to grow. After the IPO boom in 2021, many private companies are assessing their readiness to go public. However, the listing process is complex, and brands and retailers need to look at their short-term timelines, long-term growth plans and resources before entering the market. In Figure 6, we examine some of the benefits and challenges of going public for private brands and retailers.

Figure 6. Key Benefits and Challenges of IPOs

| Benefits | Access to capital: IPOs often help companies acquire capital to meet their liquidity needs and launch business expansion plans, including market growth, new projects and product releases. In addition to the capital raised via the IPO launch, companies can raise additional capital through follow-up public offerings. |

| Enhance the company’s image: Going public enables brands and retailers to create more awareness about their company, provide exposure in global markets and build brand confidence in investors, suppliers, employees and consumers. | |

| Strong exit opportunity: For promoters and founders with investments tied up in the company, an IPO offers a strong exit opportunity where they can liquefy the capital they have invested in the company. IPOs often help those stakeholders who did not get any significant financial return on their contributions for years, compensating them. | |

| Cost-effective way to raise capital: IPOs are a more cost-effective way to raise capital than debt financing, as private companies must pay higher interest rates on their bank loans. Furthermore, once listed, a company can raise more capital through subsequent offerings on the stock market, which is usually cheaper and easier than debt financing. | |

| Stock as a means of payment: Brands and retailers can use publicly traded shares as currency for acquiring other businesses, replacing cash. Publicly traded stock can serve as a form of payment to provide employees with stock or stock options, enabling retailers to attract and retain the right talent and win over the competition. | |

| Challenges | Significant upfront costs: Brands and retailers going public need to pay for underwriters’ commissions, typically 1%–2% of the gross proceeds of an IPO. Furthermore, they also need to incur other underwriting expenses, such as marketing, accounting, legal and printing costs. |

| Greater public disclosure and increased exposure to risk: A public retail company must publicly disclose more information than a private one, such as financial results, share price, executive compensation, director and management performance, corporate governance practices and insider trading information. The greater disclosure increases the risk of scrutiny against the company and lawsuits against management. | |

| Subject to market pressures: Investor pressures and analyst opinions may often prompt public retailers to look at short-term gains and profit-driven goals. This would affect the company’s focus on targeting long-term goals and drive up stock prices, impacting the company’s short-term earnings. |

Source: Coresight Research

What We Think

With a record number of successful IPOs in India in 2021, we believe that IPOs in 2022 will exceed 2021 in both total number and overall value. Many companies are already lined up for their stock market debut this year, including well-known companies like PharmEasy and Delhivery. We believe that IPOs will gain momentum in the later quarters of 2022, once market volatility ends. We also believe that the proliferation of startups in India—around 14,000 recognized startups opened in the first nine months of fiscal 2022 (ended March 31, 2022) alone—will also lead to a surge in IPOs as startups increasingly leverage the IPO route for expansion and exit opportunities. Finally, we expect to see more retail and associated sectors companies—fintech, food-tech, pharma retail, logistics, software-as-a-service—go public, especially those that have recovered from pandemic-related effects and want to expand. Implications for Brands/Retailers- Established private-sector players and emerging retail companies alike should consider the long-term consequences of an IPO and ensure that going public aligns with their long-term goals.

- Most retail companies going public gain access to large amounts of funding and plan to utilize part of their IPO proceeds for organic expansion and growth, posing a threat to those retail companies that do not opt for the IPO route.

- With the surge in the number of individual investors, companies planning to go public should clearly list their growth plans, using the IPO proceeds to attract further investments during follow-up rounds.