Nitheesh NH

Introduction

What’s the Story? Resale constitutes buying and selling previously owned products, which are often in good condition after minimal usage. Due to the increased adoption of the sharing economy, resale platforms are gaining prominence among Indian consumers. Additionally, the growing number of millennials and Gen Zers who want to own traditionally expensive branded products—including luxury items—and wish to do so in a sustainable, less expensive way are also contributing to the growth of the resale market in India. In this report, part of our India Retail Insights series, we look at the resale market in India, its key players, and opportunities and challenges for retailers entering the market. Why It Matters Reselling is more popular and robust in Europe and the US, given the presence of well-established players such as Farfetch, The RealReal, ThredUp and Vestiaire Collective. In the West, there are a variety of resale models, including retail and consignment retail, but in India, resale platforms largely follow the peer-to-peer model, which we discuss later in this report. The resale market in India has grown rapidly in recent years due to an eager consumer base and many social media platforms, namely Facebook and Instagram, adding reselling features—social commerce and reselling have emerged as a winning combination. Research and consulting firm RedSeer estimates that the Indian resale market totaled $600 million in 2020 and projects social commerce to become a $7 billion market by 2025.Resale in India: Coresight Research Analysis

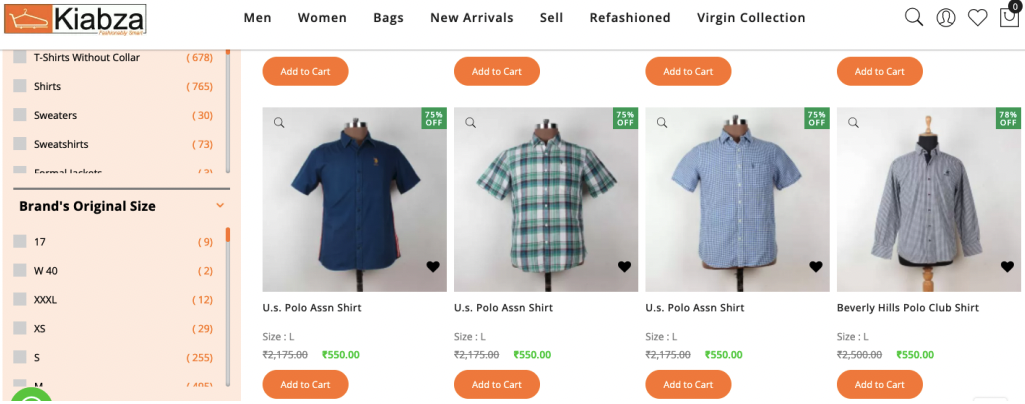

1. Prominent Reselling Models Below, we discuss three prominent reselling models and Indian companies that follow specific models. Retail resale—This model comprises retailers buying used items and reselling them via a brand-specific authentication process. This model is much more predominant in the US and Europe than in India. Consignment resale—In this model, the owner places items on consignment and gets paid up only when the item sells, minus the retailers’ commission.- Mumbai-based company Kiabza, founded in 2016, is an apparel resale platform that allows sellers to consign their previously owned branded clothing. Sellers provide the branded clothing, and Kiabza takes care of the rest of the process, including product curation, delivery and payment. Kiabza features products from over 3,000 domestic and international brands, including Armani, Burberry, Mango, Versace and Zara.

Kiabza platform offering men’s branded resale products

Kiabza platform offering men’s branded resale productsSource: Company website[/caption]

- Jodi Life is an Indian fashion label that designs clothing and accessories using artisanal hand-block printing. It also has an initiative called “Relove,” enabling customers to resell their used Jodi Life products. Customers share which items they would like to resell; if purchased, Jodi Life provides the shipping label and packaging, and even picks the item up for shipping.

Figure 1. Peer-to-Peer Resale Platforms in India [wpdatatable id=2101]

Source: Company websites

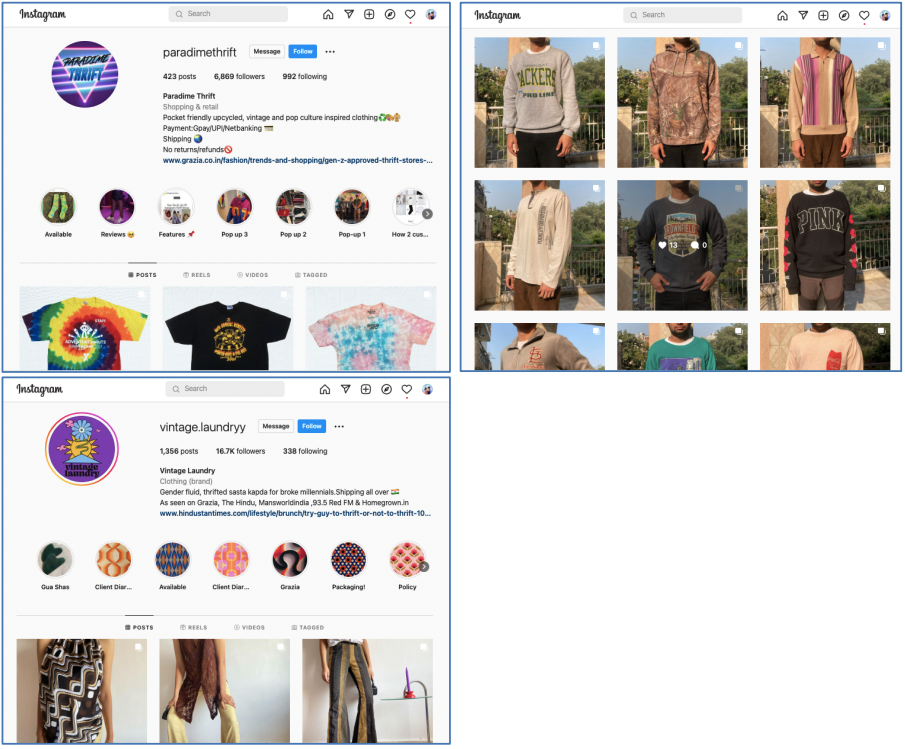

2. The Rise of Online Thrift Stores Online thrift stores are Internet platforms that leverage social media channels, especially Instagram, to sell previously owned and upcycled clothing and accessories. While online thrift stores generally sell mint or gently used items, the fact that they are pre-owned allows the platforms to price products at much lower prices than their off-the-rack counterparts. Consumers who use online thrift stores tend to desire vintage items, cheaper items or a more sustainable way to buy clothing and accessories. Popular online thrift stores in India include All Things Pre-Loved, Bombay Closet Cleanse, Paradime Thrift, Snazzy Thrift and Vintage Laundry, among others. Online thrift stores largely focus on and highlight a theme—such as sustainability, affordable luxury, vintage, gender-fluid or fast fashion—and offer unique products to customers. Some online thrift stores such as Bombay Closet Cleanse have their own websites, using the traditional retail model to connect with buyers. Others (Gon Vintage, Luu Liu, Paradime Thrift, etc.) leverage Instagram to resell products and take care of shipping across India, either for free or for a nominal fee. Some thrift stores also follow the consignment model of reselling. Certain thrift stores (for example, Carol’s Shop and Tea Room) source products even from international markets and ship Indian products to global customers. [caption id="attachment_150846" align="aligncenter" width="700"] Paradime Thrift Instagram page (top left) and its men’s collection of upcycled clothes (top right); pre-loved clothes from Vintage Laundry (bottom)

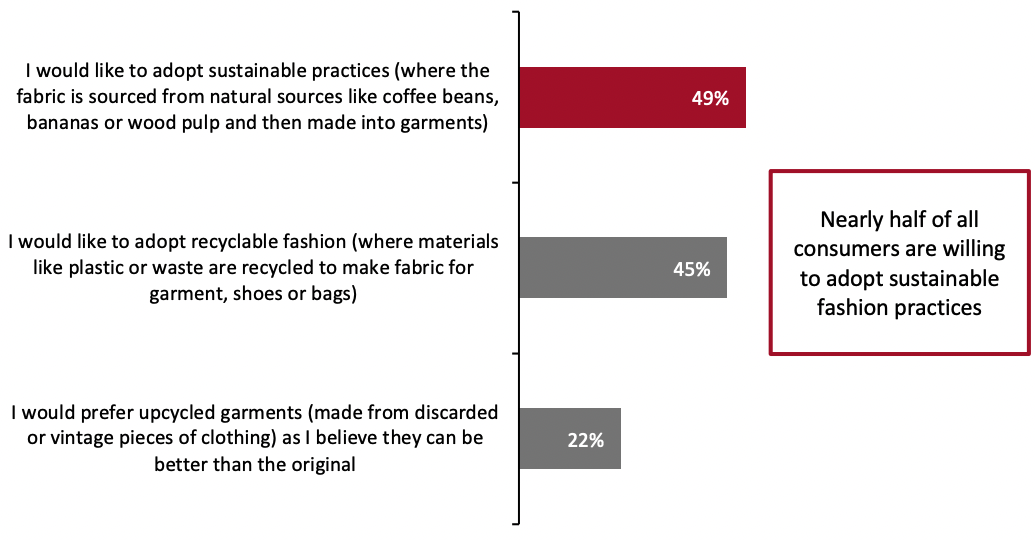

Paradime Thrift Instagram page (top left) and its men’s collection of upcycled clothes (top right); pre-loved clothes from Vintage Laundry (bottom)Source: Company Instagram accounts[/caption] 3. Opportunities for Retailers in Resale Demand for secondhand items is on the rise in India due to a predominantly young Indian population—as well as an overall digitally savvy audience—and growing sustainability concerns among consumers. Young Consumers Are Open to Buying Secondhand Products, Especially Luxury Of India’s total population, 67.4% is in the 15–64 age group (working age group), according to the United Nations Population Fund’s 2021 data. The country’s young population drives a culture of innovation and diversity, contributing to shifts in behavioral dynamics, such as investing in experiences over products. However, young Indian consumers also crave branded products, especially luxury items. The resale market creates an attractive proposition for young Indian consumers to buy luxury items at much lower prices. Via reselling platforms, these price-sensitive shoppers gain access to a variety of brands at affordable prices. This creates an excellent opportunity for luxury brands and retailers to grow their customer base and establish themselves in an untapped market. As such, India, with its large working-age population, holds tremendous growth potential for resale platforms and luxury brands. Digitally Savvy Audience Consumers now spend considerable amounts of time on their digital screens. India has 834.3 million Internet subscribers as of September 2021, the equivalent of just under 60% of its population, according to data from the Telecom Regulatory Authority of India. The country’s smartphone user base is set to reach 1 billion in 2023, according to data from Statista—more than double the 2018 total—representing high-single-digit year-over-year growth. As some Indian consumers remain hesitant about the credibility and authenticity of products on the resale market, businesses need to use transparent and informative content that resonates with millennials and Gen Zers to gain their trust, as well as to broaden their audience. Resale companies should also educate consumers on the economic and environmental benefits of investing in secondhand purchases. Given the rising number of brand-conscious, digitally savvy consumers, the online resale market in India will witness significant growth in the coming years. Anuradha Balasubramanian, General Manager of social shopping marketplace Poshmark India, estimates the reseller market to reach $20 billion by 2026. Growing Sustainability Concerns Among Consumers Consumers are increasingly aware of the environmental impacts of the apparel industry. As a result, the desire for sustainable clothing is growing. Figure 2 presents findings from a survey of consumers across five Indian cities, published in the India Sustainability Report 2020 by online fashion magazine The Voice of Fashion in collaboration with the Indian Ministry of Textiles. The survey found that many Indian consumers are increasingly looking for ways to be more environmentally conscious, including by purchasing upcycled and previously owned merchandise.

Figure 2. Indian Consumers’ Agreement with Statements on Sustainable Fashion (% of Respondents) [caption id="attachment_150847" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 937 respondents, aged 18–60, from five Indian cities

Source: India Sustainability Report 2020—The Voice of Fashion/Ministry of Textiles, Government of India[/caption] 4. Headwinds While the factors above are driving growth, there are also challenges facing the resale market in India:

- Safety concerns among consumers—Because of the Covid-19 pandemic, masks and social distancing have become ingrained habits, and ongoing health concerns may mean that some consumers remain hesitant to use previously owned used clothing or accessories.

- Fluctuating demand and supply—Inflation and current economic uncertainty will likely remain through 2022, affecting demand for resale products, especially luxury goods.

- Fraud and counterfeiting—Reports of fraud and counterfeit goods dampen consumer interest in secondhand goods and resale platforms. Resale companies should take appropriate measures to prevent counterfeiting, such as authenticating items and verifying buyers and sellers.

- Shopper disappointment due to out-of-stocks—Reselling platforms do not have control over inventory volumes of specific, in-demand goods, such as new, limited-edition or vintage items. Resale platforms must quickly match customers with available products through personalized product recommendations via past purchase analysis.

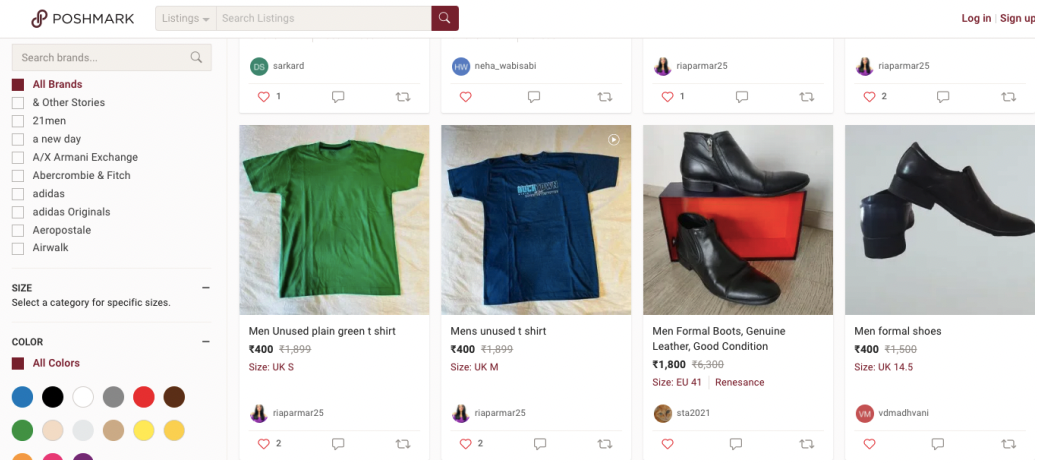

- US-based social shopping marketplace Poshmark launched in India in September 2021. Poshmark focuses on secondhand clothing and provides end-to-end seller services, including listing, merchandising, pricing and shipping. Meanwhile, it engages buyers with a highly engaging shopping experience and a mix of mass-market, premium and high-end brands.

Poshmark India offers secondhand clothing and footwear for men

Poshmark India offers secondhand clothing and footwear for menSource: Company website[/caption]

- UK-based Saritoria, which specializes in pre-owned South Asian luxury fashion, is reportedly set to launch in India. “We looked at figures and realized there was a huge opportunity,” Founder Shehlina Soomro explained to Vogue Business in September 2021.

- The value e-commerce market in India will reach $20 billion by 2026 and $40 billion by 2030, according to an August 2021 report by consulting company Kearney. The report also states that around 70% of lifestyle retail demand comes from the value lifestyle segment.

- Value-conscious consumers evaluate products based on discounts, quality and value, meaning they are less loyal to brands and more likely to use online marketplaces and resell platforms.

What We Think

The resale market is still at a nascent stage in India and the proliferation of e-commerce and social commerce is likely to drive its online growth. We believe that offline thrift stores will also gain momentum in India with increased consumer inclination to shop for secondhand clothing driven by their values to embrace circular fashion. India’s favorable demographic and growing digital ecosystem will attract international players to look at the country for their expansion, especially the lower-tier markets where social commerce adoption is on the rise. Implications for Brands/Retailers- Apparel brands and retailers can look at the retail resale models of prominent players in the West for guidelines.

- Brands leveraging social media channels for resale must ensure proper authentication and communicate about the same to their audience to win trust and loyalty.

- Online thrift stores can leverage the experiential route and launch flagship stores to enable consumers to experience their brand and products.

- Technology vendors that provide authentication services can partner with resale platforms to combat counterfeiting and improve consumer trust.

- AI/ML (artificial intelligence/machine learning) technology vendors can offer pricing recommendations for luxury resale platforms.