Nitheesh NH

What’s the Story?

In our India Retail Insights series, we will explore the impact of consumer behavior, government regulations, macroeconomic developments, the competitive landscape and retail tech startups on the evolution of India’s retail sector.

India’s nascent e-commerce market is flourishing, thanks in no small part to the pandemic-prompted shift to online retail. In 2019, according to consulting firm Bain & Company, India’s e-commerce penetration rate was at 3.4%, compared to 16.1% in the US and 24.9% in China, based on government data. For 2020, consulting firm Redseer expects that this penetration rate was 5.0%.

India is a mobile-first nation when it comes to e-commerce. With smartphones and free messaging apps so widely adopted and accessible, we expect a substantial share of e-commerce to move through social networks.

Social commerce—buying and selling goods via social media platforms—is poised to become one of the driving forces that will lead to an explosion in e-commerce in India. In this report, we examine the size and trajectory of India’s social commerce market, as well as key players and our outlook for the future.

Why It Matters

Social commerce comprises around 5–7%, or $1.5–2.0 billion by GMV, of India’s approximately $30 billion e-commerce market, according to 2020 estimates by Bain & Company. India’s social commerce GMV is expected to expand at a CAGR of 46–48% to $16–20 billion by 2025.

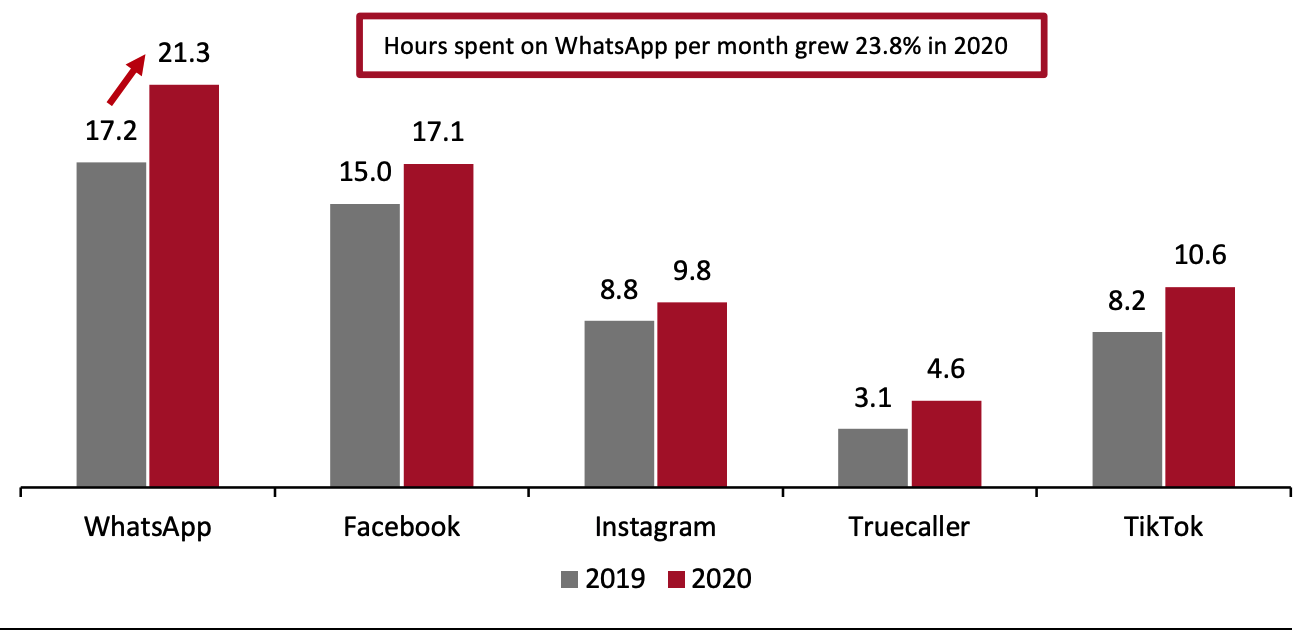

- WhatsApp is the most widely used messaging platform in India, and consumers use it to carry out transactions as well as chat. In 2020, there was a year-over-year surge of 23.8% in time spent on WhatsApp on Android devices per month in India, according to the latest data from App Annie Intelligence.

- In 2020, Indian users spent 21.3 hours per month on WhatsApp—the top social media app in India based on hours spent per month, also according to App Annie Intelligence data. In comparison, users in the US spent 17.7 hours per month and those in the UK spent 16.6 hours per month on Facebook, the top app by time spent.

It should be noted, however, that recent changes to WhatsApp’s privacy policy that imply that user-data will be shared with Facebook and group companies have likely seen it lose a significant number of users. This may be reflected in increased usage of competitors’ apps—for instance, Reuters reported that between January 5 and January 12, 2021, downloads of messaging app Signal in India jumped from a mere 15,000 to 7.1 million. Downloads of another competitor, Telegram, rose by 40%. WhatsApp downloads, meanwhile, decreased by 30%. Nevertheless, we expect a substantial number to continue to use WhatsApp. We also foresee former users returning once the privacy concerns have abated. WhatsApp and Facebook, for their part, have spent millions of rupees “to unleash an advertising blitz” in Indian newspapers to dispel fears and encourage users to return.

Figure 1. India: Hours Spent on Major Social Media Networks (Monthly)

[caption id="attachment_123588" align="aligncenter" width="720"] Android phones; Top apps ranked by overall time spent by users in India

Android phones; Top apps ranked by overall time spent by users in IndiaSource: App Annie Intelligence[/caption]

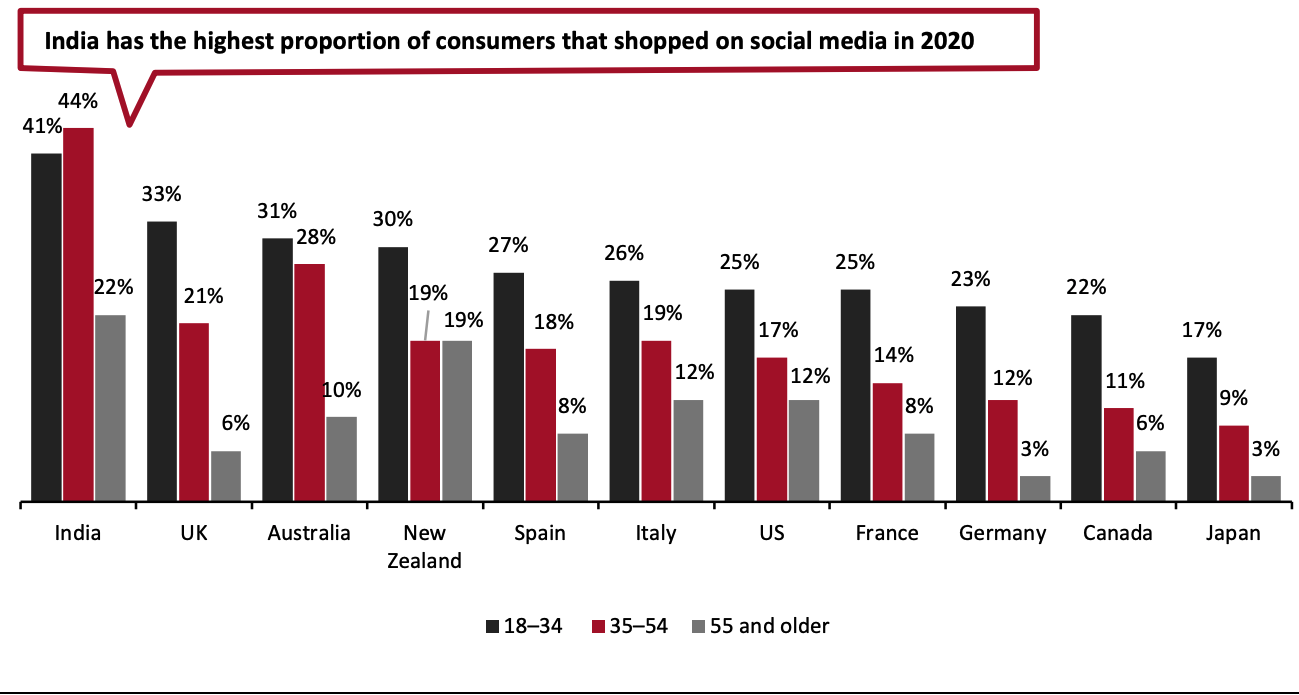

- The proportion of consumers buying via social media is higher in India than in many other countries. In 2020, over 40% of Indian consumers aged 18 to 54 and 22% of those age 55 and over purchased goods on social media—the highest results of all countries included in e-commerce tech firm Shopify’s survey. As shown in Figure 2, the proportion is much higher than in the UK, which ranked second in the survey.

Figure 2. Selected Countries: Proportion of Consumers that Have Made a Purchase on Social Media in the Last Six Months

[caption id="attachment_123589" align="aligncenter" width="720"] 10,055 consumers aged 18 and over from 11 countries surveyed September 9–28, 2020

10,055 consumers aged 18 and over from 11 countries surveyed September 9–28, 2020Source: Shopify[/caption]

Social Commerce in India: In Detail

Key Players in India’s Social Commerce Ecosystem

Indian social commerce is evolving continually in terms of the types of platforms that sellers and buyers choose to transact on. The platforms can be broadly divided into five models: social platform-based, shoppable videos, chat-based commerce, group buying and social reselling.

Figure 3. India: Key Models and Players in India’s Social Commerce Ecosystem

[caption id="attachment_123590" align="aligncenter" width="580"] Note: Some of these players may operate across more than one model. We indicate the primary model in the above graphic.

Note: Some of these players may operate across more than one model. We indicate the primary model in the above graphic.Source: Coresight Research[/caption]

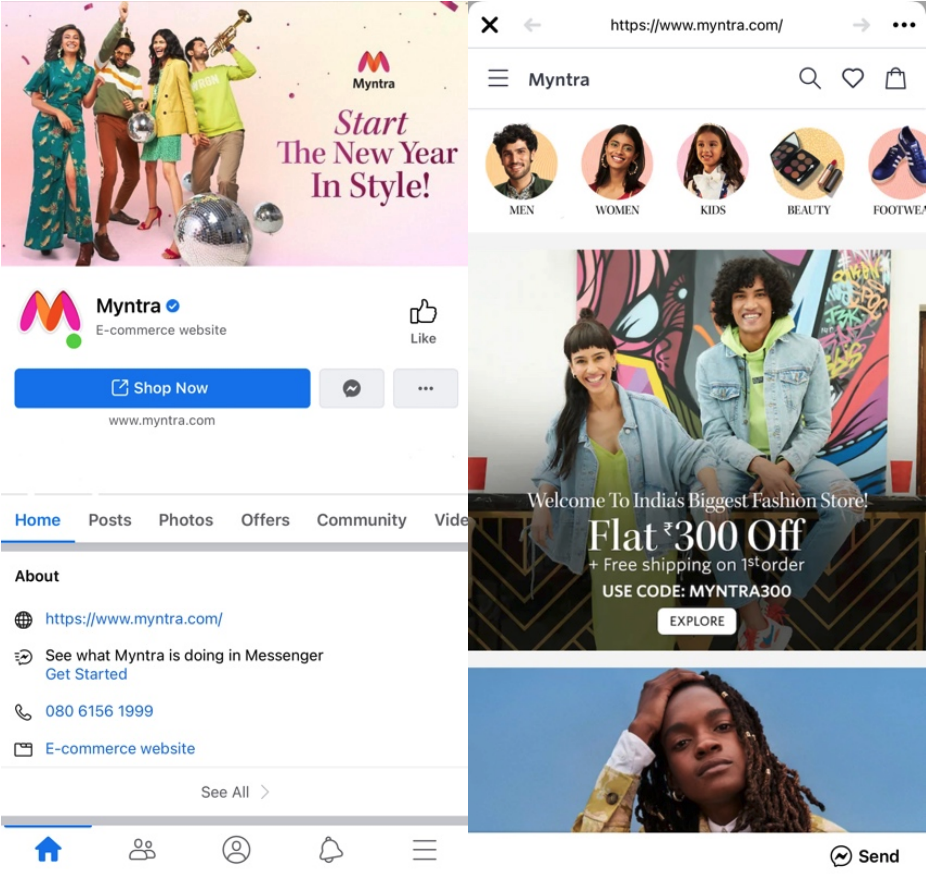

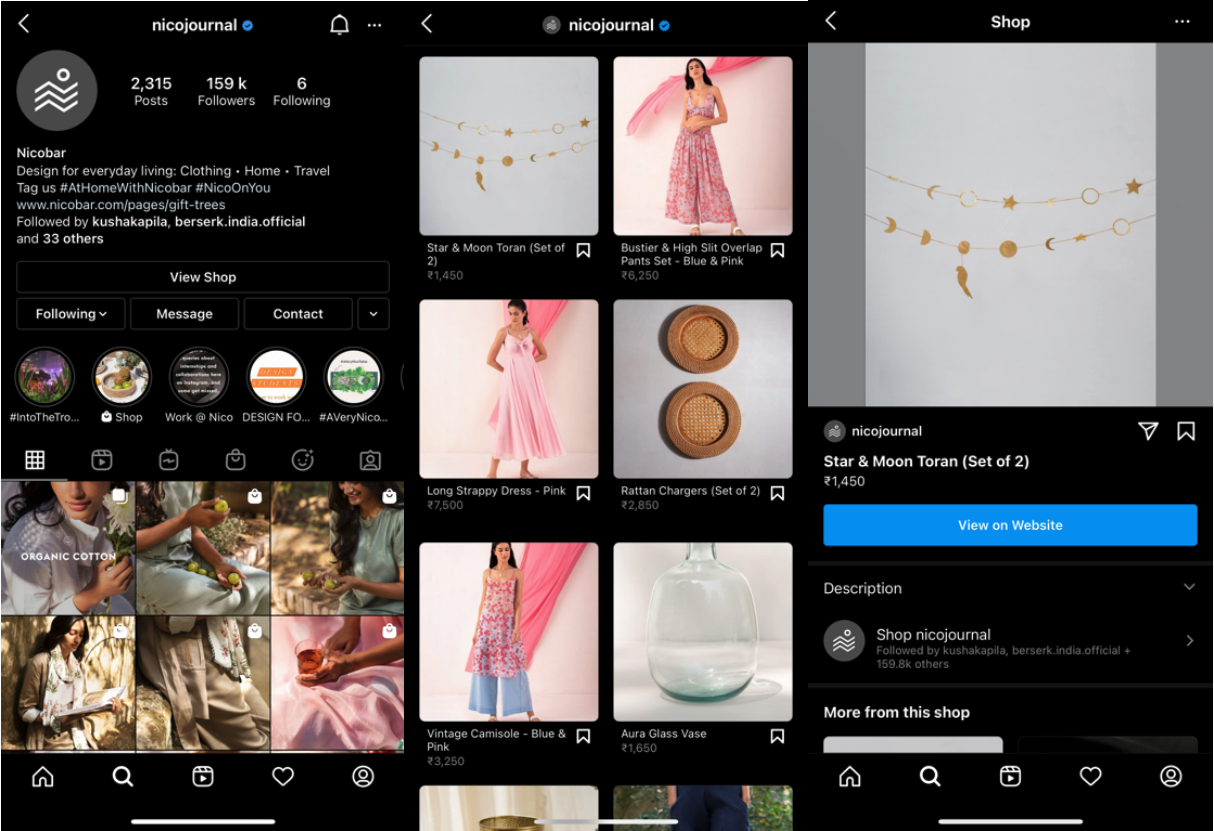

- Social platform-based: This model involves buying via existing social media platforms. Shoppers use social media to search and discover brands, products and retailers. Some retailers, such as e-commerce fashion platform Myntra, redirect shoppers to their website from their social media accounts and open it through an in-app browser. Others, such as Nicobar, allow users to view product pages using the social media app and then redirect users to the website through an in-app browser to check out and pay for items.

Indian fashion e-commerce platform Myntra’s Facebook account features a “Shop Now” button, which opens the retailer’s website via an in-app browser.

Indian fashion e-commerce platform Myntra’s Facebook account features a “Shop Now” button, which opens the retailer’s website via an in-app browser.Source: Facebook/Myntra[/caption] [caption id="attachment_123592" align="aligncenter" width="720"]

Lifestyle brand Nicobar’s Instagram account features a “View Shop” button, which enables users to view product pages on the app and opens the retailer’s website via an in-app browser.

Lifestyle brand Nicobar’s Instagram account features a “View Shop” button, which enables users to view product pages on the app and opens the retailer’s website via an in-app browser.Source: Instagram/Nicobar[/caption]

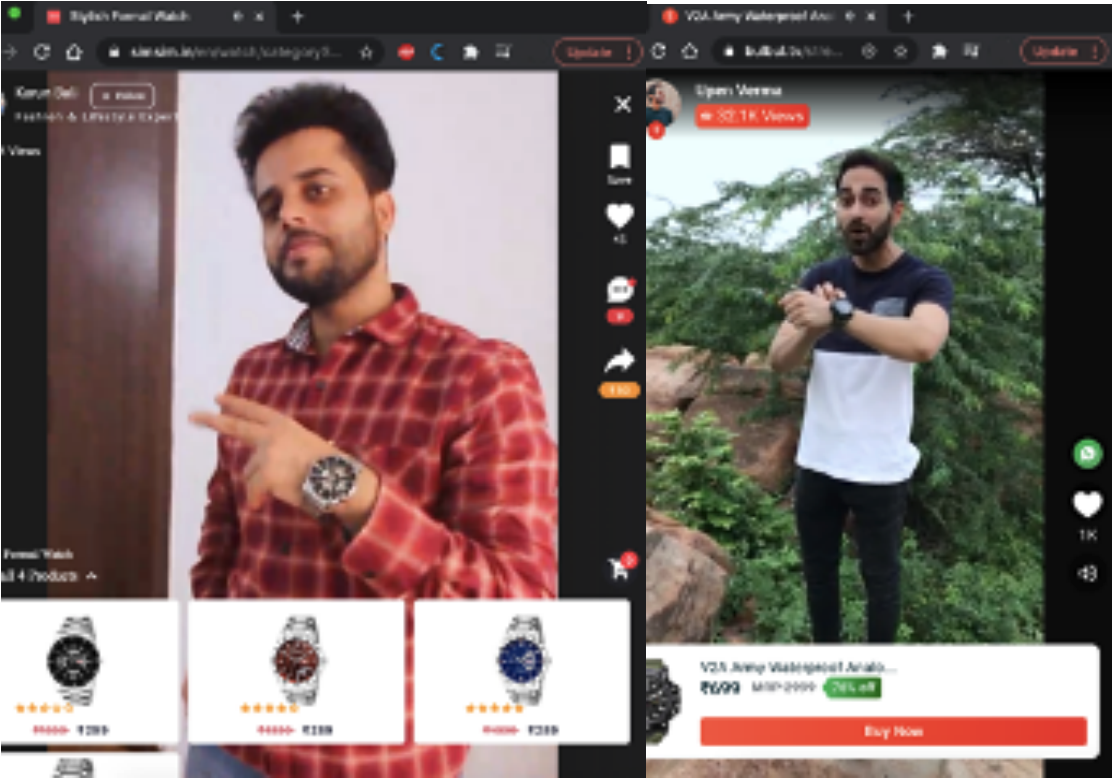

- Shoppable videos: This model involves shopping via videos that showcase a brand or product. Bulbul and Simsim apps that employ this model in India can be accessed through a browser or by downloading from the Google Play store. Shoppers can watch videos featuring products across a broad range of categories—such as accessories, clothing, electronics and home decor—and click on the “Buy Now” button to purchase items. App users can accumulate followers based on their expertise and frequency of video posts. The apps are available in English as well as several Indian languages, including Hindi, Marathi and Tamil.

Simsim (left) and Bulbul (right) app users display watches for sale.

Simsim (left) and Bulbul (right) app users display watches for sale.Source: Simsim/Bulbul[/caption]

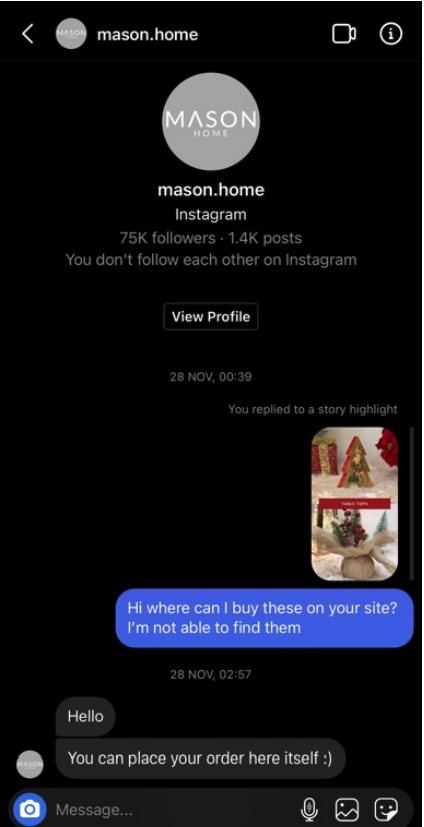

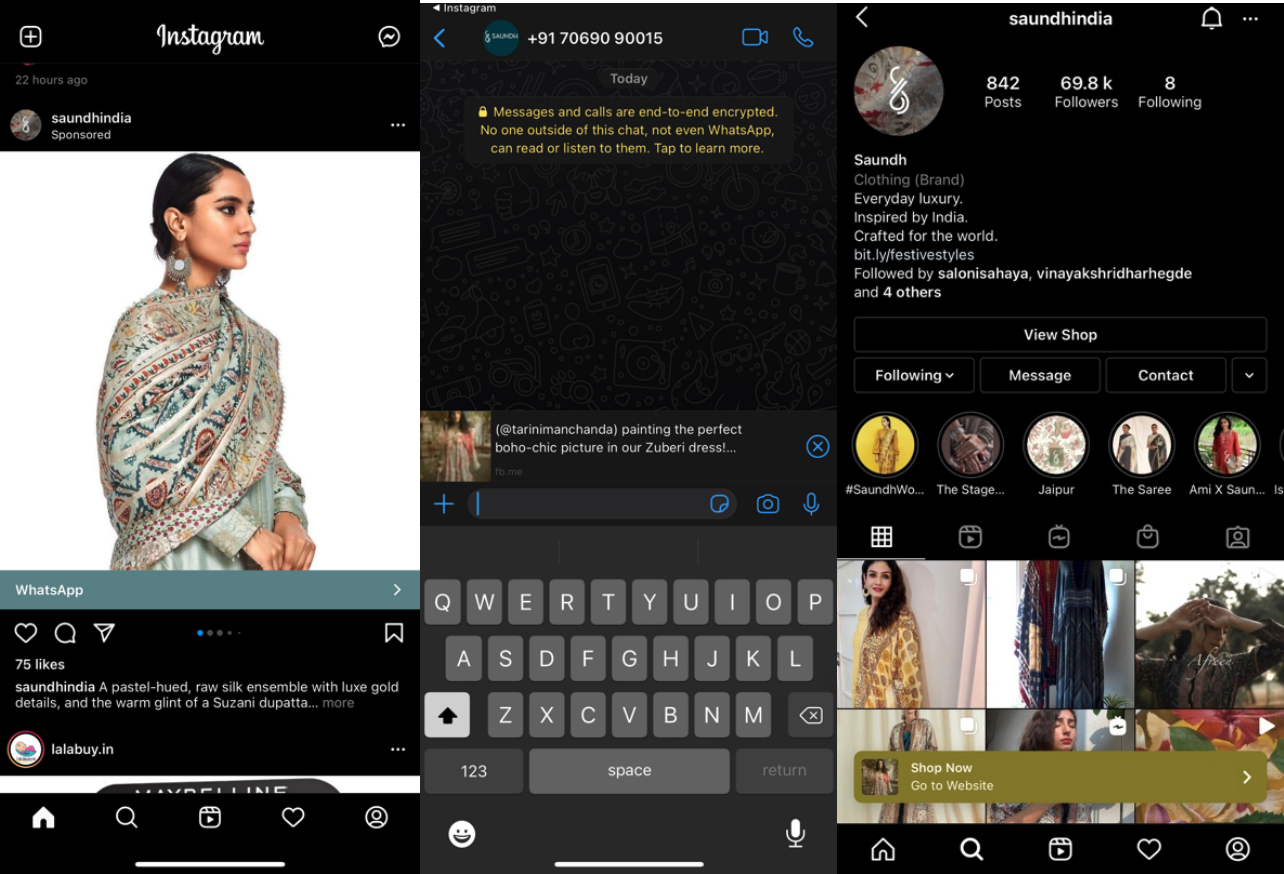

- Chat-based commerce: This model involves sellers interacting with users via a chat function, with orders placed through the chat. Payment can be taken through the app or another method agreed upon by the seller and buyer. For instance, Mason Home, a Mumbai-based home decor retailer, accepts orders via Instagram. Indian clothing brand Saundh, on the other hand, encourages Instagram users to send messages on WhatsApp to purchase or inquire about a product, although consumers can also view its shop and visit its website directly through its Instagram account.

Mason Home Instagram offers a chat function for product inquiries.

Mason Home Instagram offers a chat function for product inquiries.Source: Mason Home/Instagram[/caption] [caption id="attachment_123595" align="aligncenter" width="720"]

Saundh’s sponsored posts encourage users to message the retailer on WhatsApp (left and middle). Saundh’s Instagram page features a “Shop Now” button at the bottom of the page that redirects visitors to its website (right).

Saundh’s sponsored posts encourage users to message the retailer on WhatsApp (left and middle). Saundh’s Instagram page features a “Shop Now” button at the bottom of the page that redirects visitors to its website (right).Source: Saundh/Instagram[/caption]

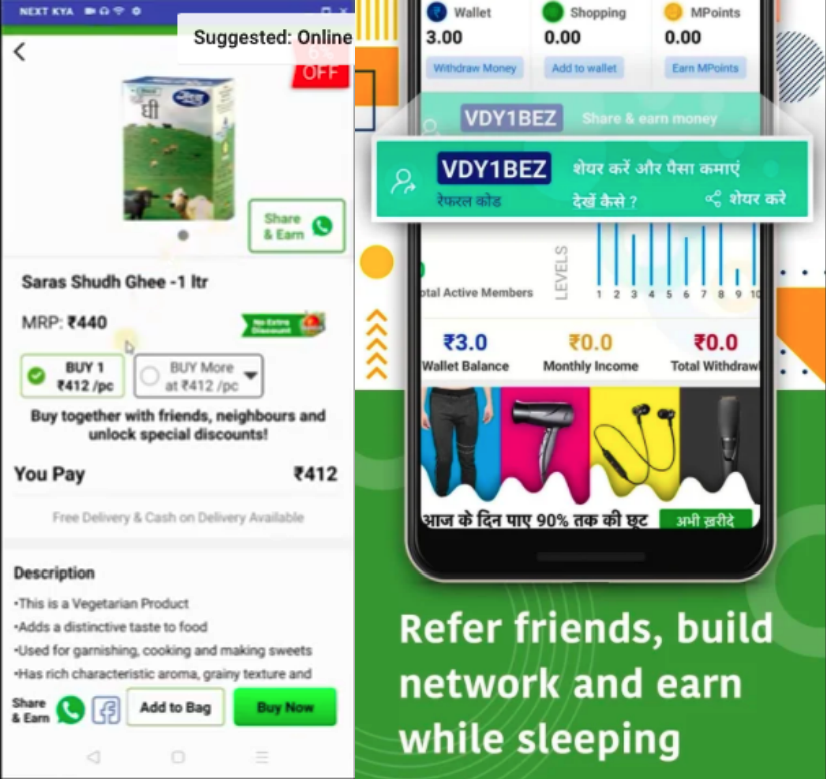

- Group buying: This model was pioneered by platforms in China, such as Pinduoduo. In India, DealShare and Mall91 are popular group-buying apps. DealShare is a multi-category consumer products platform that targets consumers located in smaller cities and rural regions. It sources products from local merchants and provides deep discounts and rewards to shoppers who form buying groups, usually with friends and family. The app allows these users to share unique links for products or deals via WhatsApp so the group can benefit from a discounted price. Mall91 works in a similar manner, with the exception that users earn a commission when people in their network buy products through the links that they share.

The product information page from DealShare features a “Buy Now” button and “Share & Earn” button via WhatsApp (left). Mall91’s page on the Google Play store indicates that users can share product links to earn a commission (right).

The product information page from DealShare features a “Buy Now” button and “Share & Earn” button via WhatsApp (left). Mall91’s page on the Google Play store indicates that users can share product links to earn a commission (right).Source: DealShare/Mall91[/caption]

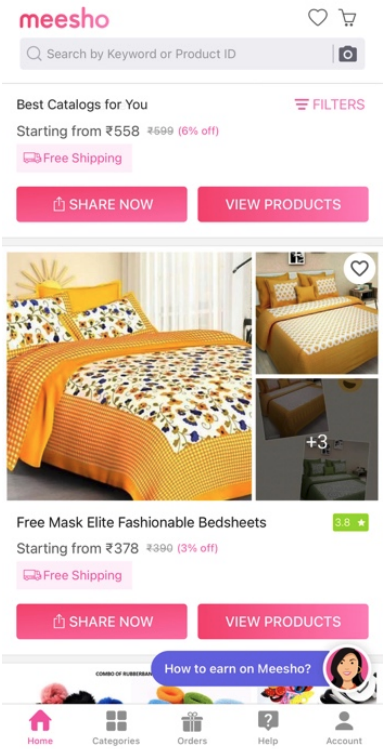

- Social reselling: Apps such as Meesho and GlowRoad allow users to become “resellers” and earn commissions on products sold. Meesho users share links to products listed on the platform on their social media accounts, including Facebook and WhatsApp. When customers use these links, resellers place the order on the Meesho app, adding their commission to the customer’s total price once the purchase is complete. GlowRoad works in a similar manner. Both platforms offer a range of products, such as accessories, beauty, clothing, footwear and home decor. In addition, they both handle delivery and returns and help to consolidate sales and payments made to sellers.

The Meesho product page allows users to view products in a catalog or share a link to a catalog on their social networks.

The Meesho product page allows users to view products in a catalog or share a link to a catalog on their social networks.Source: Meesho[/caption] [caption id="attachment_123598" align="aligncenter" width="720"]

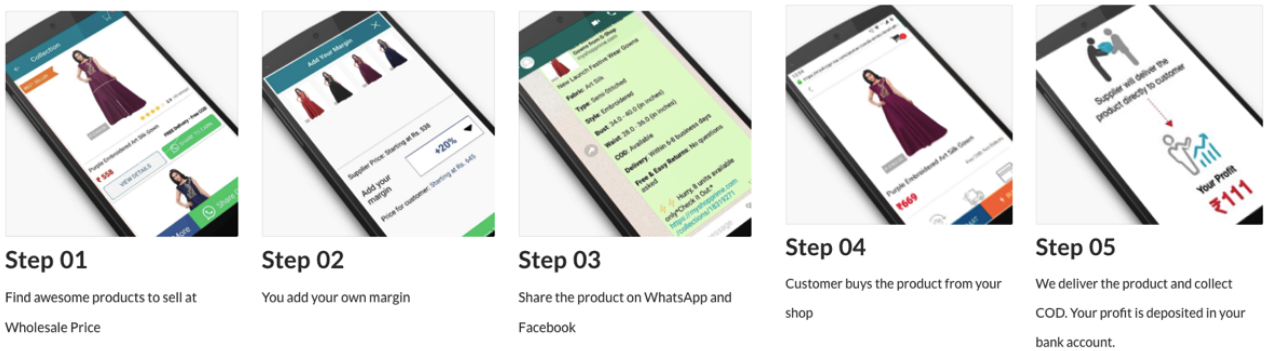

This step-by-step breakdown outlines how users can earn money on GlowRoad.

This step-by-step breakdown outlines how users can earn money on GlowRoad.Source: GlowRoad[/caption]

Funding Social Commerce in India

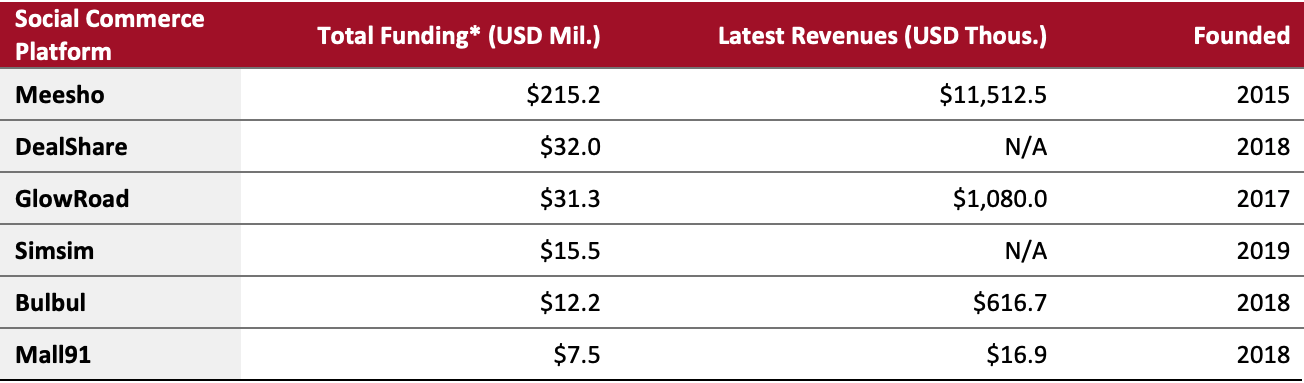

Social commerce funding is heating up in India, and the platforms we covered in the previous section (with the exception of Facebook, Instagram and WhatsApp) have received $314 million in funding in total.

Meesho has received the lion’s share of funding in its cohort so far and is reportedly in the running to receive an additional $150 million from existing investors, including Facebook and Naspers, which could push it into the unicorn category with a valuation of $1.3–1.5 billion.

Figure 4. Key Metrics: Major Social Commerce Platforms in India

[caption id="attachment_123599" align="aligncenter" width="720"] *As of February 12, 2021.

*As of February 12, 2021.Source: Crunchbase/Tracxn/The Economic Times/VCCircle.com[/caption]

What Makes India Unique?

India has myriad cultural and socio-economic factors that define its uniqueness as a consumer market. We think these tie in with the country’s growth potential for social commerce.

- Mobile-first economy: Similar to China, India has skipped several stages in the development of e-commerce largely observed in other countries. In many markets, the natural evolution of e-commerce has been for consumers to access retailers’ websites through laptops and desktops until smartphones became increasingly sophisticated, data got cheaper, and retailers’ sites were optimized for mobile phones or apps. This led consumers to shift their shopping journeys to mobile phones.

However, with a significant proportion of the population in India unable to afford computers, the country missed out on the early stages of desktop e-commerce, and instead joined when smartphones and data became cheaper and ubiquitous, causing mobile e-commerce to develop faster than desktop e-commerce.

- Lack of large stores and malls: Outside of the major cities, India lacks the large stores and malls that are prevalent across Western markets and some Asian markets—including China and Malaysia—and countries in the Middle East, among others. From a cultural standpoint, part of the appeal of social commerce compared to less-personal e-commerce is that India has not yet adapted to more impersonal shopping experiences. Stores in India also tend to be more cramped in terms of layout than those in the West. Aisles are narrower and often loaded with too much merchandise, while stores are overstaffed, thus inhibiting shoppers from discovering products freely.

- Multiplicity of dialects and languages: Whereas markets such as China have a predominantly unified culture and language across the country—over 80% of the Chinese population speaks Mandarin, according to October 2020 data cited by Chinese news site People’s Daily Online—India is linguistically diverse. The most widely spoken language in India is Hindi—however, only around 50% of the Indian population speaks the language, according to the latest government data. Nearly every state has a unique culture, cuisine and language. With social commerce, sellers and buyers can connect virtually at a local level through a common language.

Why Are Indians Shopping on Social Networks Today?

India’s retail sector is dotted with a plethora of mom-and-pop stores and other neighborhood stores, accounting for some 90% of the total market as of 2018. The India Brand Equity Foundation expects to see this share at 75% by the end of 2021. We think a number of factors are prompting this shift to a more organized and formal retail environment, including steady urbanization, India’s large youth population entering the workforce and rising incomes.

Considering how embedded local stores are in the Indian mindset and consumer behavior, the ability of social networks to foster connections between consumers and sellers can support the transition toward social commerce. The advantages it offers Indian consumers include the following:

- Ability to transact in a local language: Most e-commerce stores do business in a single language, which is typically English in India, despite the diverse range of languages spoken across the country. Many, however, feel more at ease conversing in their native language. Amazon and Flipkart have made their platforms available in several other languages, but social commerce allows sellers and buyers to interact in any language that is familiar to them.

- Convenience: Social commerce affords a convenience that online stores do not always allow. Being able to text a local store with an order, pay for it through a payment app or in-app payment facility (or cash on delivery) and have it delivered avoids some of the friction involved in purchasing through individual online stores. Most online stores typically need require shoppers to sign in or register accounts, add payment details, authenticate transactions, and so on.

- Familiarity with sellers: Social media platforms allow a quick one-to-one conversation with sellers—something that shoppers buying in person from familiar sellers enjoy and e-commerce platforms do not always allow.

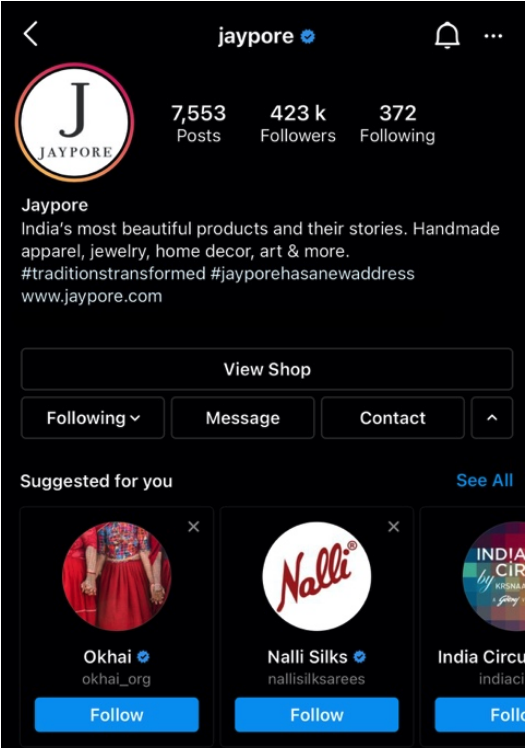

- Product discovery: Users can discover products in line with their interests or browse vendors similar to those they have already researched. For example, on Instagram, users can tap on an arrow below an account’s description to look at similar accounts suggested by the app to discover additional retailers and products.

Indian fashion and lifestyle retailer Jaypore’s Instagram account displays similar suggested accounts to users for brands Okhai, Nalli Silks and India Circus.

Indian fashion and lifestyle retailer Jaypore’s Instagram account displays similar suggested accounts to users for brands Okhai, Nalli Silks and India Circus.Source: Instagram[/caption]

- Product information: Consumers can learn about a product from a known seller or sellers recommended by friends. This improved consumer confidence helps to alleviate fear of counterfeit goods—something that may not be easy to establish in e-commerce marketplaces where transactions are usually carried out with unknown sellers.

- Reduced costs: Flipkart and Amazon have been working to make setting up storefronts more affordable for small and medium-sized businesses in India. They also hope to encourage female entrepreneurs to participate, whether they are stay-at-home mothers or independent businesswomen. However, not all sellers are able to afford a storefront. Social platforms allow users to set up a store with virtually no investment—they simply need to download a social media application and display their products through it. For example, small bookshop owner Abhishek Sayam told news site Quartz that he downloaded WhatsApp Business for free and began selling through it when his store, Books by Kilo, had to close for several weeks during the early stages of the pandemic when only “essential” businesses were allowed to operate. As he pivoted to selling via WhatsApp, Sayam saw sales rise by 40% between March and August 2020—despite India being in lockdown,.

Tailwinds and Headwinds

Social commerce in India appears to have more tailwinds than headwinds currently, indicating significant room for growth.

Tailwinds

- Few players and low barriers to entry: There are only a handful of significant players in the sector, currently, denoting low competition for new entrants. The segment also has low barriers to entry in terms of regulation. Although the rules for e-commerce were made stricter in 2020—including prohibitions against manipulating prices and writing false reviews—the sector is not highly regulated at present.

- Large population of youth and stay-at-home women: Fully 35% of India’s population is between the ages of 15 to 34. As young people enter employment and face low income levels, they may look to supplement their income via social commerce. A number of apps, such as GlowRoad and Meesho, are also looking to wives and stay-at-home mothers seeking to earn supplemental income by selling via social commerce during their spare time.

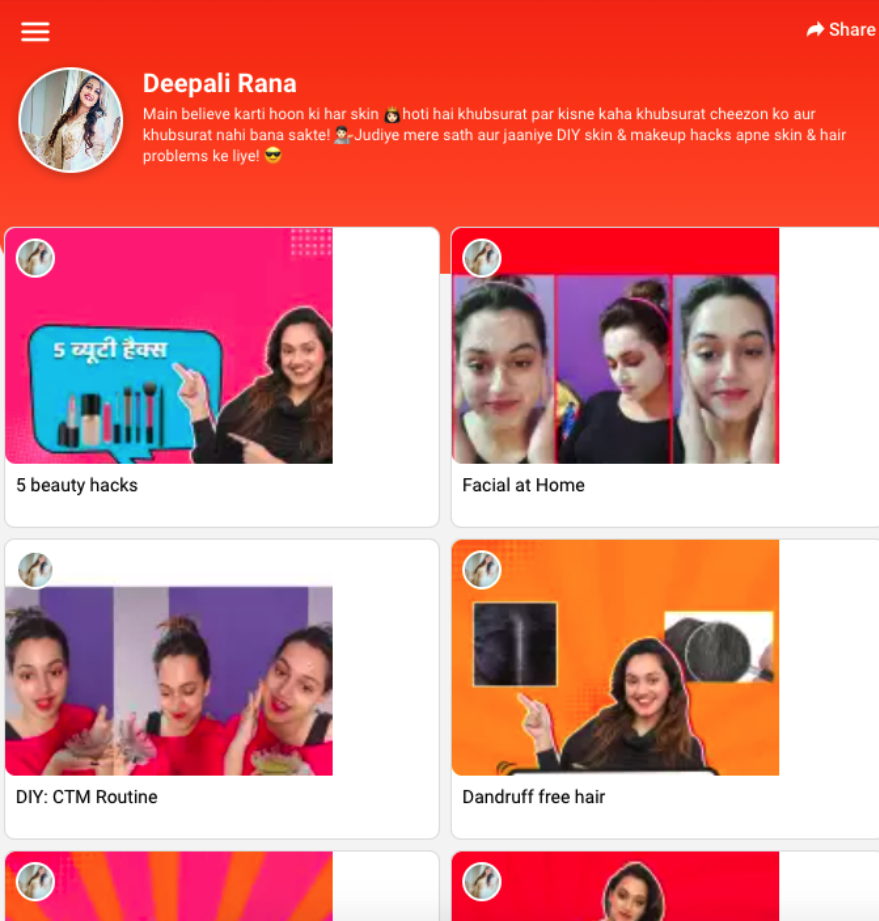

- Ease of Localization: Being able to transact in local languages can attract a wider range of consumers. Social commerce platforms do not need to overhaul their apps to accomplish this. Media, such as videos, can be produced in different languages, and customers and sellers can chat in their language of choice. The example from Bulbul below shows influencer Deepali Rana’s page in English while her introduction is in Hindi (albeit written in the English alphabet). Rana also speaks in Hindi in her videos. E-commerce platforms, on the other hand, would need to revamp thousands of product pages and functions on their websites to achieve the same linguistic flexibility.

On influencer Deepali Rana’s page on Bulbul, biographical information at the top is written in Hindi with English lettering. Her videos are also in Hindi.

On influencer Deepali Rana’s page on Bulbul, biographical information at the top is written in Hindi with English lettering. Her videos are also in Hindi.Source: Bulbul[/caption]

Headwinds

- Large players could dominate: Large social media platforms could dominate the landscape, given their scale and greater access to funds and expertise.

- Dependence on a single platform: WhatsApp is the dominant messaging app in India. Social commerce apps that are dependent on it to further transactions via connected networks could have been affected by the decline in downloads that occurred earlier this year when users flocked to other apps due to privacy concerns. If social commerce apps continue to be dependent on external apps, they could likewise be affected by such shocks.

- Changes in the regulatory environment: India has a history of revising its regulations for international retailers operating in India. Although it has been liberalizing its economy, the Indian government is also laying down more targeted social commerce rules as markets and market segments continue to grow. While the sector is not highly regulated currently, quick growth, new entrants or dominant players could all lead to additional regulation.

What We Think

Social commerce is evolving to become the online stand-in for in-person retail at local and neighborhood stores. The convenience and familiarity that social commerce allows—and the flexibility of conversing with people in their local languages—will help it draw a greater number of consumers than traditional e-commerce in India.

Implications for Brands/Retailers

- Name-brands and known retailers should consider social commerce to reach audiences that do not regularly visit their sites due to language barriers or a lack of transparency.

- Existing social media and commerce platforms provide a means to reach new consumers. Having resellers that resonate with local audiences by creating conversational content in various languages may help to alleviate doubts about product quality and authenticity, and brands. Retailers, as a consequence, can expect to reach a greater number of consumers.

- New brands and retailers looking to enter India should be conscious of India’s socio-cultural diversity, which renders it uniquely poised to benefit from social commerce.

Implications for Technology Vendors

- Technology vendors should explore ways to consolidate multiple social media apps on social commerce apps. In the case of social reselling, for example, users need to share links on social networks and then place orders on the app when buyers confirm them. Having an automated method for order placement will reduce friction and delays in shopper journeys.