DIpil Das

What’s the Story?

Group buying is gaining prominence in India, particularly outside Tier 1 cities. Group buying allows consumers to buy together and benefit from discounts through their aggregated purchase quantities; it has proliferated due to rural and small-town consumers’ pandemic-driven shift to online shopping, including social e-commerce. We estimate the size of the group-buying market in India to be $23.9 million as of 2021. In this report, part of our India Retail Insights series, we assess the size of India’s group-buying market, and offer an overview of group buying in India, a comparison with the Chinese group-buying market, profiles of key players, and analysis of the market’s opportunities and challenges.Why It Matters

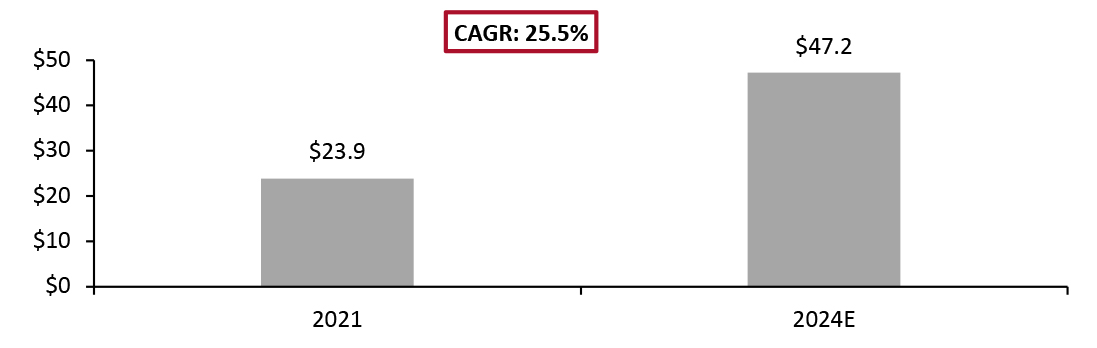

With increased smartphone adoption among Tier 2, Tier 3 and small town Indian consumers coupled with the availability of cheaper data plans, online shopping has become popular among them. For this demographic, lower prices are a powerful draw, and trust is a key element: word-of-mouth recommendations are significant factors in their purchasing decisions. We estimate that the group-buying market will reach $47.2 million by 2024, from $23.9 million in 2021, growing at a CAGR of 25.5%. In terms of market share, we believe that the group-buying market will account for less than 1% of India’s estimated $797.2 billion overall grocery market and estimated $59.4 billion online grocery market in 2024 (grocery being a key category in community group buying).Figure 1. India: Group-Buying Market Size (USD Mil.) [caption id="attachment_138308" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Group Buying in India: Coresight Research Analysis

There are two group-buying models:- Traditional: Consumers anywhere can search for products and join a group to purchase. Consumers initiate the process by teaming up, leveraging their network of family and friends to access group discounts; retailers can offer lower prices due to the increase in sales.

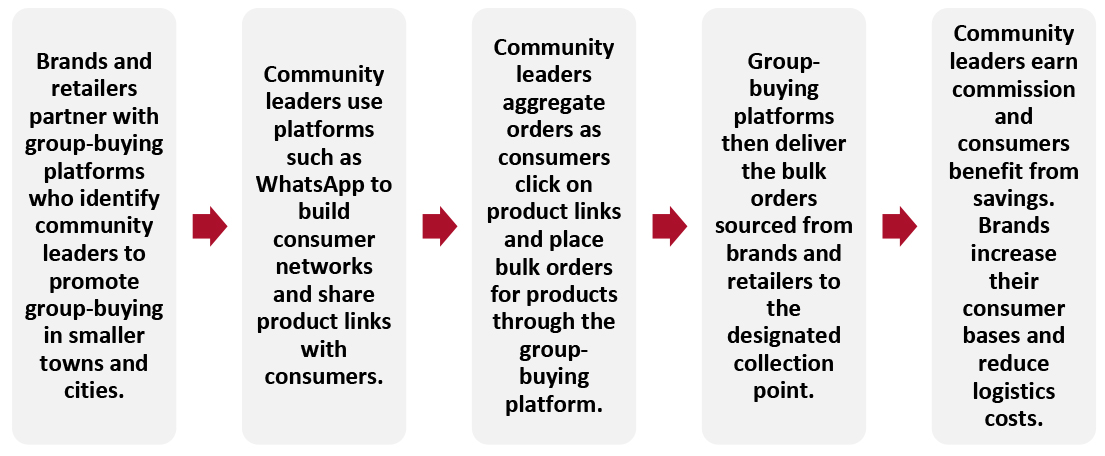

- Community group buying: Group purchases are made by consumers living in the same area, permitting bulk deliveries, and initiated and organized by a local community leader. Community group buying tends to focus on essential items, such as groceries, whereas standard group buying covers all categories.

Figure 2. India: Community Group-Buying Model [caption id="attachment_138324" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Community Group Buying–Retailer and Consumer Perspectives

We look at the community group-buying model, the predominant model in India, from both retailer and consumer perspectives.

Retailer Perspectives

Source: Coresight Research[/caption]

1. Community Group Buying–Retailer and Consumer Perspectives

We look at the community group-buying model, the predominant model in India, from both retailer and consumer perspectives.

Retailer Perspectives

- Reduced distribution and storage costs—The community group-buying model omits traditional distribution channels, including wholesalers and distributors, and their associated costs. It also focuses on regional or local sourcing of products closer to community centers, thus minimizing storage and distribution costs for retailers.

- Reduced inventory costs—The model also carries a lower inventory risk than conventional retail as demand is identified beforehand, enabling group-buying platforms to source accurate quantities of products. This minimizes inventory turnover risk and the resultant costs for those brands and retailers that group-buying platforms source from.

- Reduced customer acquisition costs—Community leaders use their contacts and social media to build customer networks, enabling brands and retailers to save on customer acquisition and marketing costs.

- Cheaper bulk purchases—Since products are purchased in bulk from suppliers, retailers’ purchase costs are lower, which can be passed on to consumers.

- For consumers, the group-buying model offers several advantages. Foremost among them are the reduced prices available and prompt delivery. Community group buying offers an easy way for consumers unused to shopping online (for example, older consumers in rural areas) to make purchases, and the community leader serves as a readily accessible point of contact for queries and concerns.

Figure 3. India: Prominent Group-Buying Brands and Startups [wpdatatable id=1560 table_view=regular]

Source: Company reports/Coresight Research Online food delivery platform Swiggy has announced plans to launch a social commerce vertical, Swiggy Bazaar, focusing on community group buying. The company plans to offer groceries before expanding into other categories. Social commerce platform Meesho’s grocery arm, Farmiso, also focuses on a community group model, with a community leader, such as a grocery shop owner, aggregating orders and undertaking last-mile fulfillment, reducing the company’s costs. 4. Recent Funding Raised by Prominent Group-Buying Platforms Figure 4 shows the wide disparity in recent funding raised by selected prominent group-buying platforms and companies entering the group-buying market. Major funding initiatives include Swiggy’s $1.3 billion Series J round, followed by DealShare’s $144 million Series D round and CityMall’s $22.5 million Series B round. Gobillion, having raised only $125,000 in its seed round, faces much better-funded competition.

Figure 4. India: Recent Funding Raised by Select Group-Buying Platforms/Companies Entering the Group-Buying Market [wpdatatable id=1561 table_view=regular]

Source: Crunchbase/Company reports/Newspaper reports/Coresight Research 5. Opportunities and Challenges in the Group-Buying Market Group buying presents the following opportunities for brands and retailers.

- New areas and demographics—Community group buying enables brands and retailers to expand their reach to lower-tier cities and rural areas; some smaller towns in India are not served by traditional e-commerce delivery, only by community groups’ bulk deliveries. Community group buying also allows brands and retailers to reach consumers who do not otherwise use e-commerce, such as older and less tech-savvy demographics, who are more comfortable making purchases through a community leader.

- Access to data—Since the Indian retail market is predominantly informal or unorganized, bringing new consumers into e-commerce via community group buying has a further advantage for brands and retailers: access to consumer data. Data-driven insights into shopper behavior are a game-changing advantage for retailers accustomed to selling through the informal retail market, allowing them to target recommendations and deals more effectively, as well as manage their inventory more efficiently. Brands and retailers can clear ageing inventory for certain product groups through group-buying discounts, and shopper data can help them identify products that will interest consumers.

- Expansion for larger value players—Community group buying at present largely involves regional players offering their products at discounted prices. Value brands and retailers with a nationwide presence can look at partnerships with group-buying platforms that offer them new markets; offering their value products at further discounted prices will enable them to capture these lower-tier markets.

- Tier 2 and 3 consumers’ shift to e-commerce—Use of e-commerce platforms among Tier 2 and 3 consumers has grown in recent years, especially during shopping festivals hosted by e-commerce players. This year’s Big Billion Days sale by Walmart-owned Flipkart, for example, saw around 45% of customer demand coming from Tier 3 cities and rural areas, according to Flipkart. In its October 2020 report, cloud-based e-commerce solutions provider Unicommerce stated that Tier 2 and 3 cities account for about 66% of India’s online consumer demand, and the share will rise further in the coming years. The growth in e-commerce adoption among lower-tier consumers will likely affect the share of group-buying platforms in future—particularly community group-buying platforms, which function as an alternative form of e-commerce for many consumers.

- Reliance on community leaders—Since community group buying depends on community leaders driving sales, suppliers’ relationships with community leaders are critical. The challenge for retailers lies in ensuring that they offer the necessary support to community leaders, including efficient supply chains for smooth and consistent delivery, high-quality products and effective tech support to allow community leaders to compete with e-commerce players.

What We Think

We believe that the traditional group-buying model will gain prominence in India in the coming years, as consumers engage further with e-commerce and build like-minded networks of friends and family. We also think that brands and retailers in the grocery sector can look to group-buying models as a way to diversify their business, as it offers advantages in reach and consumer base at low cost. We think diversification into mass purchase categories such as beauty and personal care is yet another way for brands and retailers to scale up. We think that brands and retailers should empower community leaders with technologies and help with digital adoption to manage orders, track deliveries and receive feedback. We also believe that the community group-buying model is likely to face tough competition from e-commerce companies; growing consumer adoption of smartphones even in rural India promises e-commerce players better penetration in lower-tier and rural markets. Implications for Brands/Retailers- Since group buying relies on recommendations from consumers or community leaders to drive sales, brands and retailers can look at leveraging existing micro-influencers—well-known consumers or popular local social media figures—to promote their products.

- Brands and retailers should leverage data to understand buying patterns and consumer behavior to provide community-based offers, deals and discounts.

- Value brands and retailers looking to tap into rural markets can partner with group-buying platforms to reach new consumers.

- Brands and retailers planning to diversify into other categories should also strengthen their supply chain to guarantee timely deliveries—even when shipping in bulk or to remote areas.

- Real estate companies can partner with group-buying platforms to build, develop and organize storage spaces and warehouses in and around community centers to help platforms ramp up their capabilities.

- Technology startups can partner with group-buying platforms to offer solutions to brands, retailers and community leaders to scale up their operations.