DIpil Das

Introduction

What’s the Story? A super app is a single mobile or web application that offers a portfolio of services and products. The concept first emerged in Asia, where companies such as WeChat, GoJek and Grab leveraged traffic on social media and communication platforms to offer additional services. China’s WeChat, for example, started as a messaging app before expanding into payments, taxi booking, shopping and food ordering, thus becoming a super app. Like WeChat, most super apps have one high-frequency core offering, which leads customers to other products and services in the app with little friction. The latest super app on the market in India is Tata Neu, which was launched by Indian multinational conglomerate Tata Group’s digital business, Tata Digital, on April 7, 2022. In this report, part of our India Retail Insights series, we examine the Tata Neu super app, covering its core offerings, features, benefits and plans for growth. We also discuss India’s super-app ecosystem as a whole, including its major players. Why It Matters Increased smartphone ownership among Indian consumers, along with growing reliance on digital payment solutions, will lead to greater adoption of mobile commerce through mediums such as super apps.- India has the second-largest population in the world, at 1.4 billion, and 75% of the total population is aged above 14 years, according to the United Nations Population Fund’s (UNFPA’s) 2021 data.

- The total number of Internet subscribers in the country is 834.3 million as of September 2021, according to the latest data from the Telecom Regulatory Authority of India (TRAI).

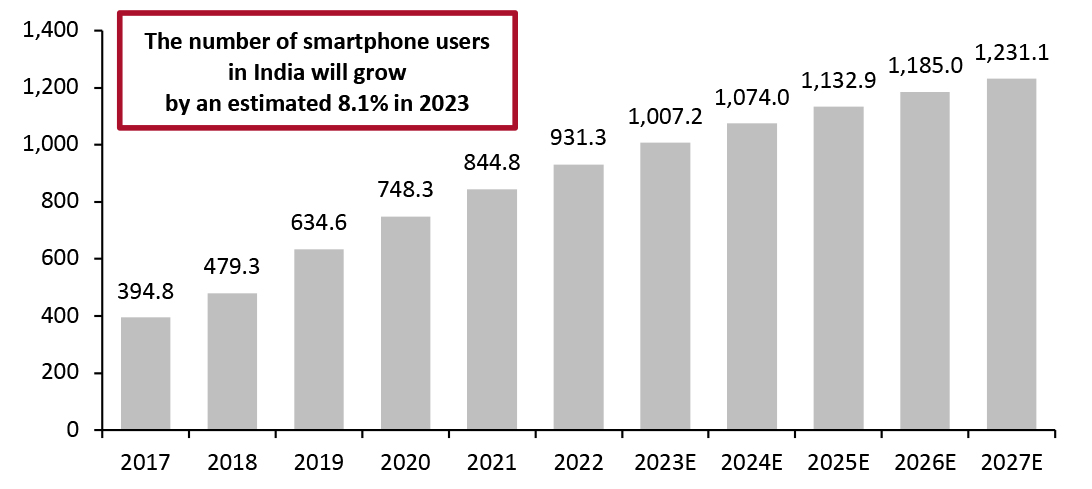

- India’s smartphone user base is set to reach 1 billion in 2023, according to Statista data—more than double the 2018 total—representing high-single-digit year-over-year growth (see Figure 1 below).

- India accounted for around 14% of global app installs in 2020, representing 28% year-over-year growth—four times higher than the worldwide average of 7% growth for the same period—according to a January 2021 report by InMobi, a mobile advertising technology company.

Figure 1. Number of Smartphone Users in India (Mil.) [caption id="attachment_147641" align="aligncenter" width="699"]

Source: Statista[/caption]

Super apps also provide heightened convenience by combining multiple services into a single app, allowing smartphone users to eliminate other apps, declutter their devices and save storage space. With the country’s young, smartphone-using population and growing acceptance of apps, there is opportunity for both Indian and international companies to enter India’s evolving super-app ecosystem.

Source: Statista[/caption]

Super apps also provide heightened convenience by combining multiple services into a single app, allowing smartphone users to eliminate other apps, declutter their devices and save storage space. With the country’s young, smartphone-using population and growing acceptance of apps, there is opportunity for both Indian and international companies to enter India’s evolving super-app ecosystem.

Exploring India’s Latest Super App and the Wider Super-App Ecosystem: Coresight Research Analysis

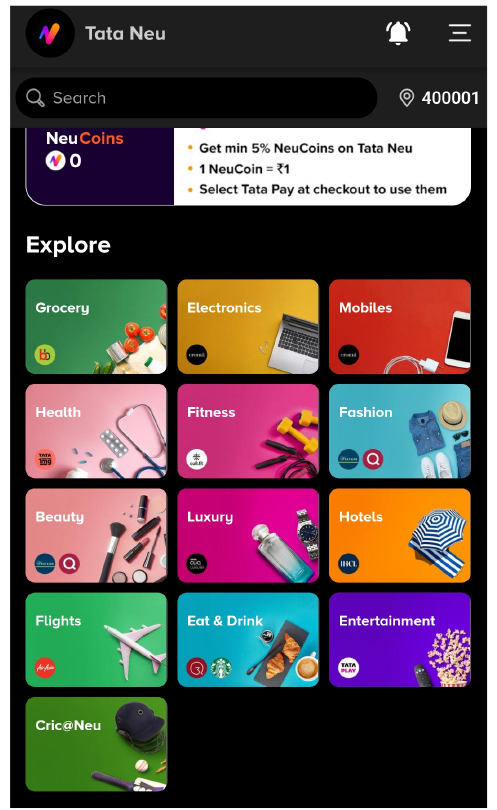

Tata Neu: India’s Latest Super App Core Offerings Tata Group claims that its super app, Tata Neu, seamlessly integrates the group’s most trusted brands, services and products on a single platform for a consumer-focused, future-oriented experience. [caption id="attachment_147642" align="aligncenter" width="393"] Source: Tata Neu[/caption]

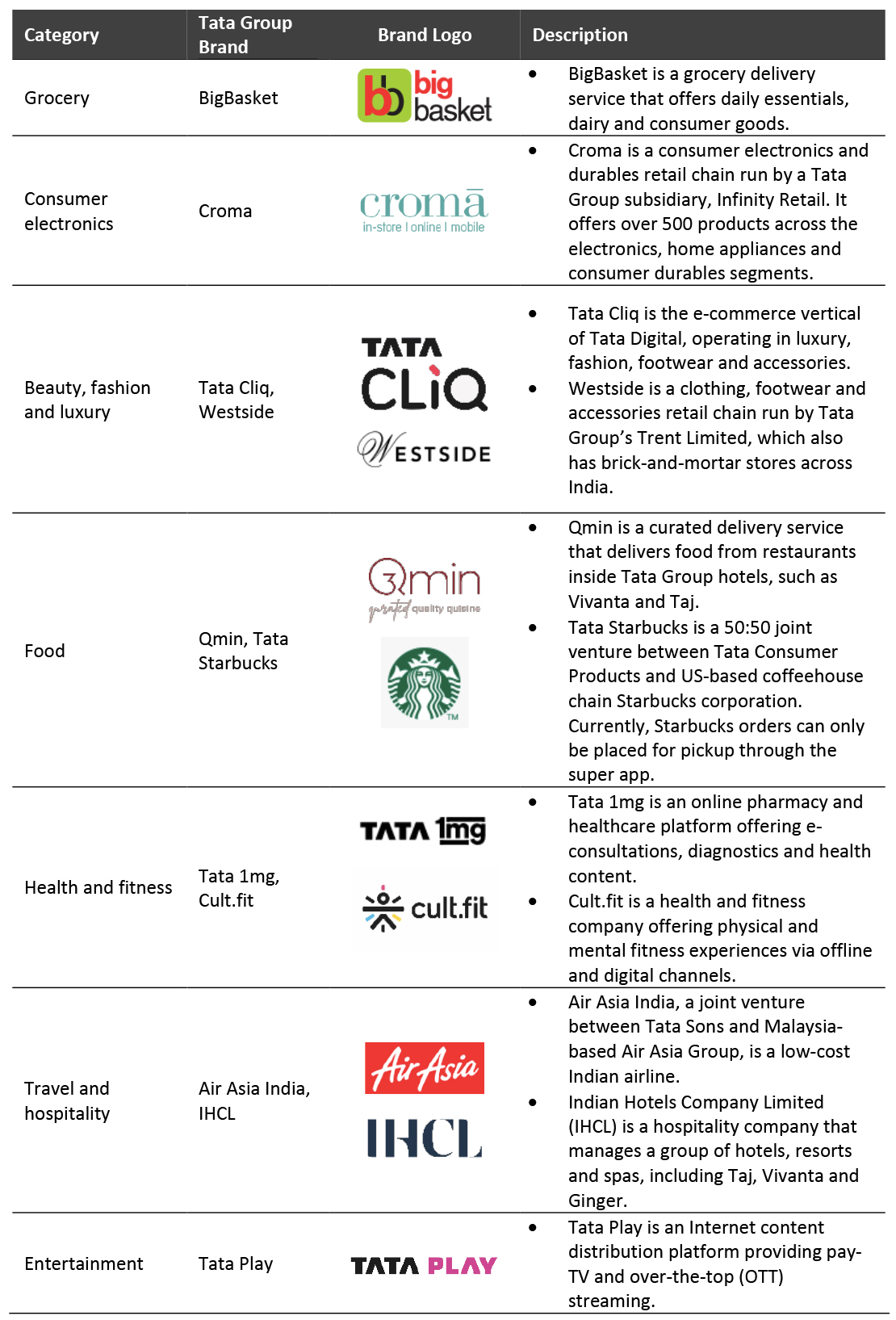

The super app features a variety of Tata Group brands across many product categories, including grocery, consumer electronics, fashion, pharma, financial services, and travel and hospitality. Tata Neu app users can order groceries from BigBasket, medicines from Tata 1mg, electronics from Croma and apparel from Westside, all within the same app. However, app users must complete separate checkouts for each brand.

Natarajan Chandrasekaran, Chairman of Tata Sons, the private entity that owns Tata Group, said in a LinkedIn post:

Source: Tata Neu[/caption]

The super app features a variety of Tata Group brands across many product categories, including grocery, consumer electronics, fashion, pharma, financial services, and travel and hospitality. Tata Neu app users can order groceries from BigBasket, medicines from Tata 1mg, electronics from Croma and apparel from Westside, all within the same app. However, app users must complete separate checkouts for each brand.

Natarajan Chandrasekaran, Chairman of Tata Sons, the private entity that owns Tata Group, said in a LinkedIn post:

Tata Neu is an exciting platform that gathers all our brands into one powerful app. Combining our traditional consumer-first approach with the modern ethos of technology, it is an all-new way to discover the wonderful world of Tata. Our aim is to make the lives of Indian consumers simpler and easier.

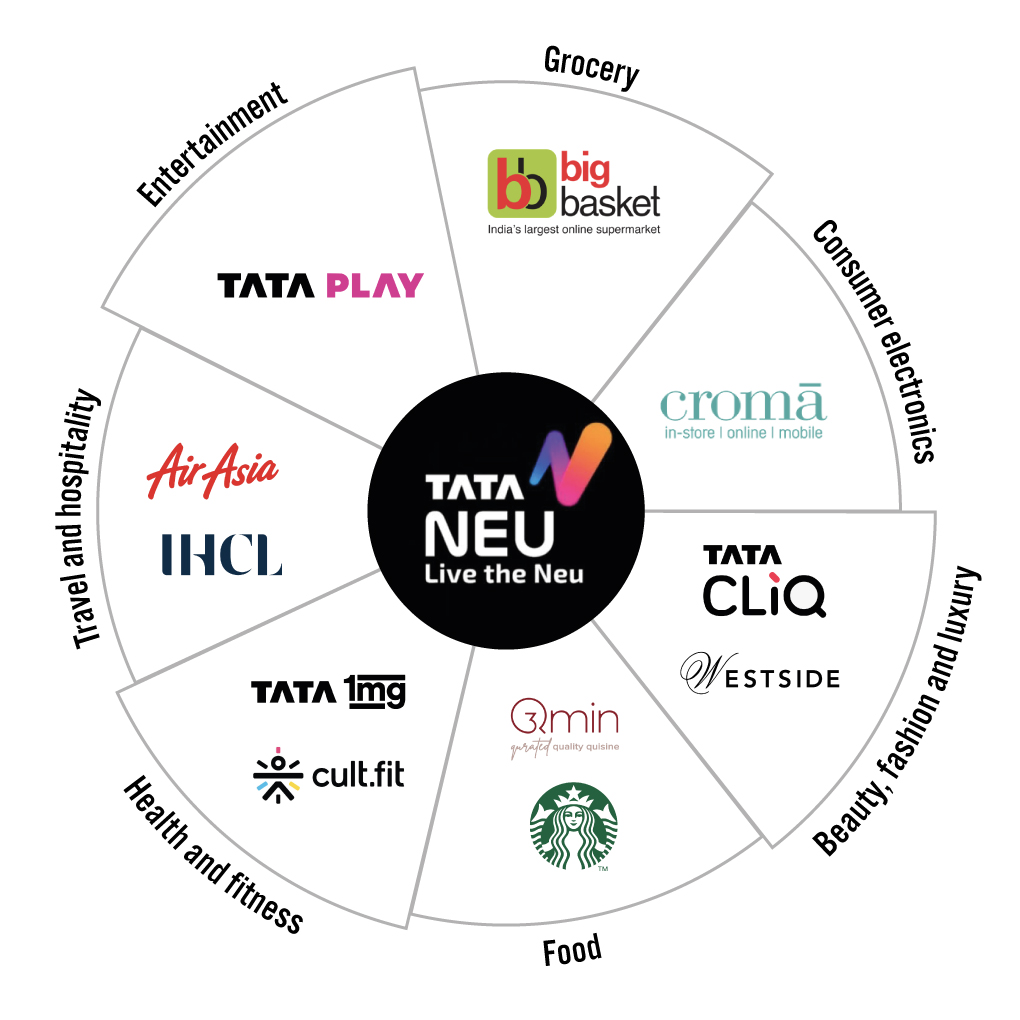

In Figure 2, we summarize the key categories and brands offered in the Tata Neu super app.Figure 2. Key Categories and Brands Offered in Tata Neu

[caption id="attachment_147653" align="aligncenter" width="700"]

[caption id="attachment_147653" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

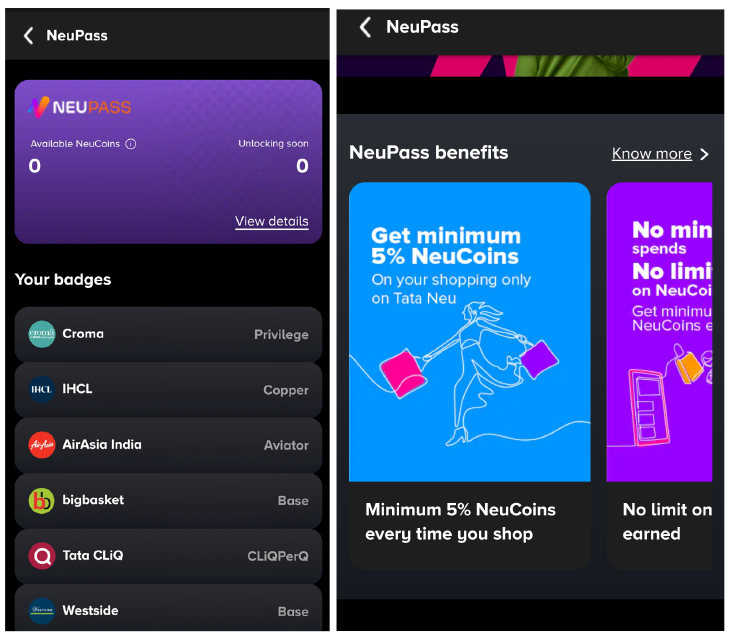

Loyalty-Building Features

The Tata Neu super app provides exclusive offers, an integrated loyalty program and diverse payment options for ease of use. Below, we discuss some of Tata Neu’s key and loyalty-building features and resulting consumer benefits.- NeuCoins

- NeuPass

NeuPass membership program page (left) and NeuPass benefits page (right)

NeuPass membership program page (left) and NeuPass benefits page (right) Source: Tata Neu [/caption]

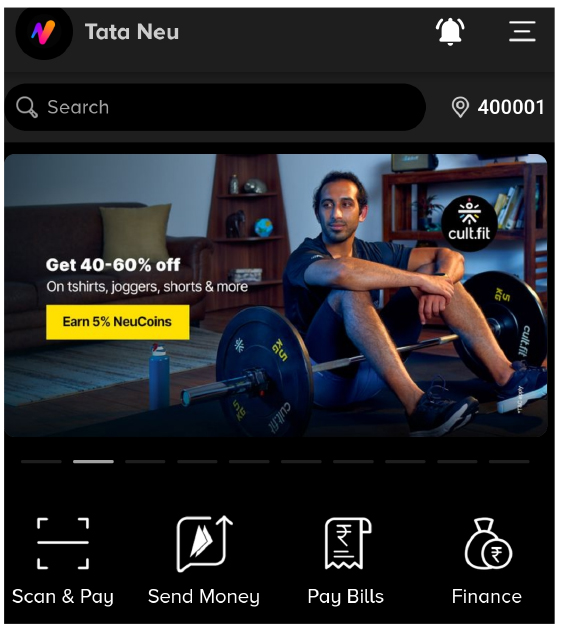

- Tata Pay

Tata Pay enables peer-to-peer and utility bill payments

Tata Pay enables peer-to-peer and utility bill payments Source: Tata Neu [/caption]

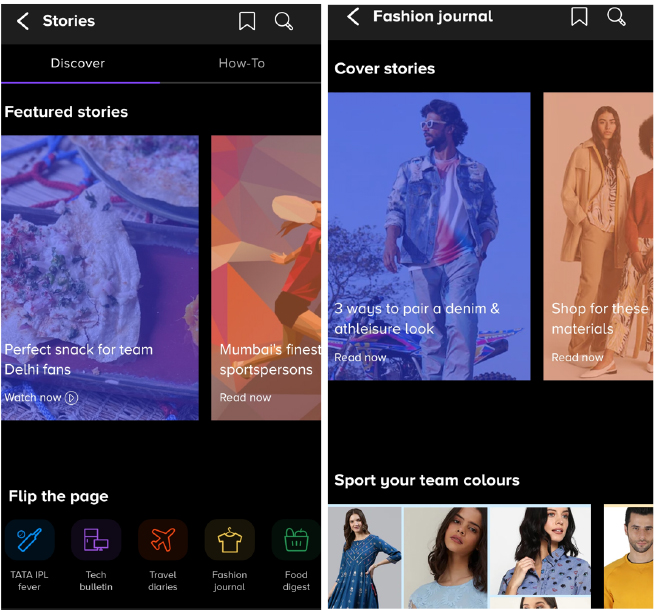

- Stories

Stories offers digital content

Stories offers digital content Source: Tata Neu [/caption] Plans for Growth and Upcoming Features While NeuCoins, NeuPass, Tata Pay and Stories are currently live in Tata Neu, Tata Digital is planning to add many features to the super app in the coming months and years, including the following:

- Funding—Tata Sons is reportedly planning to make an interim investment of $500 million in Tata Digital for Tata Neu’s continued growth, per leading Indian media platform Inc42. Tata Group is also holding talks with global investors such as Canada Pension Plan Investment Board, Singapore’s Temasek Holdings, SoftBank Group and Abu Dhabi Investment Authority to fund the super app’s growth plans.

- Third-party brands—According to Tata Digital’s CEO, Pratik Pal, the company currently has a roadmap for adding new categories and brands to Tata Neu, including both third-party companies and more in-house brands, such as luxury brand Titan and jewelry brand Tanishq.

- Increased benefits to small sellers—Pal stated that the small sellers and retailers supplying its existing brands, such as BigBasket and Croma, will benefit from Tata Neu’s increased footprint, growth and sales.

- Customer-driven evolution—As Tata Neu expands its offerings beyond Tata Group brands, its evolution will be customer-demand-driven, not contract-driven, according to Chandrasekaran.

- BNPL (buy now, pay later)—Chandrasekaran said that Tata Neu plans to introduce a BNPL feature to cater to millennials.

- Enhanced NeuPass benefits—NeuPass will feature enhanced benefits for members, such as sneak peeks at tech innovation and an artificial intelligence (AI)-driven personal assistant.

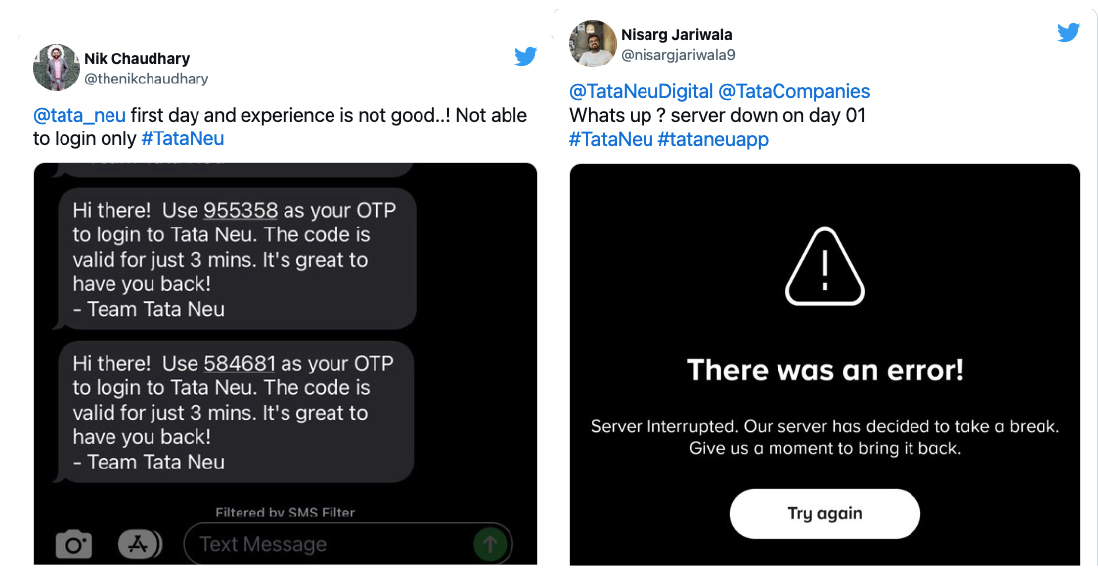

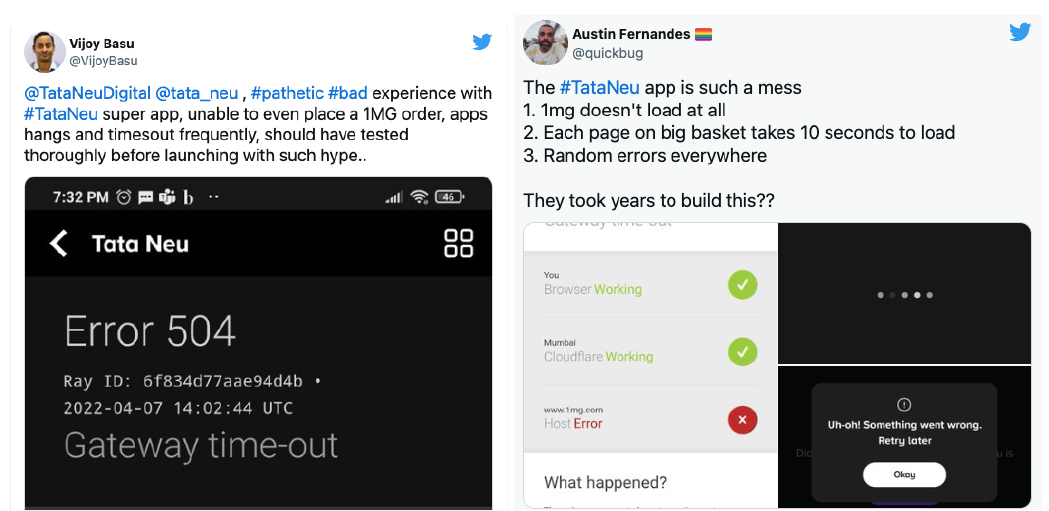

Source: Twitter.com[/caption]

Meanwhile, others faced issues inside the app after signing up, including timeouts, server and other errors, disconnects, long load times and products failing to be added to their basket.

[caption id="attachment_147647" align="aligncenter" width="700"]

Source: Twitter.com[/caption]

Meanwhile, others faced issues inside the app after signing up, including timeouts, server and other errors, disconnects, long load times and products failing to be added to their basket.

[caption id="attachment_147647" align="aligncenter" width="700"] Source: Twitter.com[/caption]

In response to these issues, Tata Neu replied to customer tweets, apologizing for the inconvenience and reaching out directly to customers via text and e-mail.

However, despite delays in launch dates and a few technical day-one glitches, Tata Neu is currently quite popular among Indian consumers. In a press conference on April 14, 2022, Pal said that the super app has registered 2.2 million downloads and witnessed a “significant” number of transactions in its first week. As of May 11, 2022, the app has more than 5 million downloads via the Google Play store.

India’s Super-App Ecosystem

Tata Group isn’t the only pioneer in the Indian super app space. Before Tata Neu’s launch, Indian companies Reliance Industries and Paytm each launched super apps.

Source: Twitter.com[/caption]

In response to these issues, Tata Neu replied to customer tweets, apologizing for the inconvenience and reaching out directly to customers via text and e-mail.

However, despite delays in launch dates and a few technical day-one glitches, Tata Neu is currently quite popular among Indian consumers. In a press conference on April 14, 2022, Pal said that the super app has registered 2.2 million downloads and witnessed a “significant” number of transactions in its first week. As of May 11, 2022, the app has more than 5 million downloads via the Google Play store.

India’s Super-App Ecosystem

Tata Group isn’t the only pioneer in the Indian super app space. Before Tata Neu’s launch, Indian companies Reliance Industries and Paytm each launched super apps.

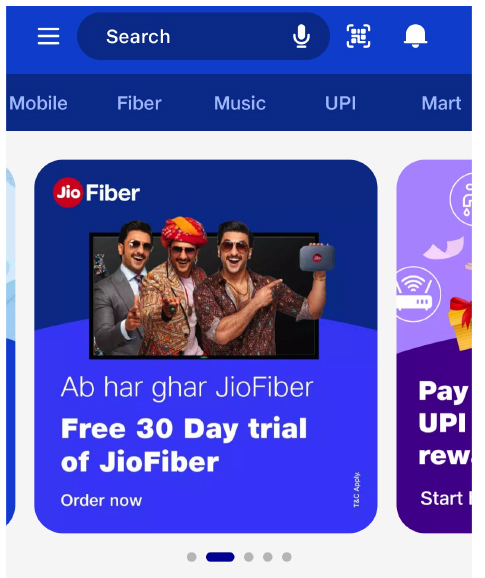

- Reliance Industries, a retail conglomerate, launched its super app, MyJio, under its Jio umbrella. MyJio offers entertainment streaming—music (JioSaavn), online games and movies (JioCinema)—mobile phone payments and online grocery ordering from JioMart. Like Tata Group, Reliance currently only offers its owned services.

Reliance’s MyJio app offers entertainment content streaming, payments, mobile recharge and grocery delivery

Reliance’s MyJio app offers entertainment content streaming, payments, mobile recharge and grocery delivery Source: MyJio [/caption]

- While Paytm started as a digital payments platform and financial services company, it recently brought together other services, including ticket bookings, games, online shopping, banking and consumer finance, into its titular app.

Figure 3. Service Overview of Global Players’ Super-App Offerings in India [wpdatatable id=1976 table_view=regular]

Source: Company reports/YourStory/Coresight Research India’s super-app ecosystem is still in its nascent stages. Early super apps used their core offerings—such as communication platforms or ride-hailing services—to attract customers before adding on services such as food and grocery delivery, and movie ticket bookings. Unlike early super apps, Tata Neu focused on total customer convenience from the very beginning, integrating all its e-commerce offerings into a single platform from day one. We see India as the next target market for super apps, given its sizeable mobile-first population, as most Indian Internet users access the Internet through mobile phones, per a 2019 report by the Internet and Mobile Association of India and market research firm NielsenIQ (latest available data). Meanwhile, according to a June 2021 report in The Indian Express newspaper, many consumers in India are experiencing the Internet for the first time thanks to mobile phones. Both the increase in mobile phones and India’s mobile-first population could lead to a proliferation of super apps in the country in the future.

What We Think

We expect retail conglomerates and companies with multiple consumer-facing businesses, including international players, to look at super apps as one way to integrate all their offerings under one digital roof, which will also provide revenue-generating opportunities. However, we believe that new super apps in India will focus on complete consumer convenience rather than occasional augments to core service offerings, as early super apps did. These apps will also provide companies with large volumes of data, allowing them to learn more about consumers’ buying behaviors and preferences. We expect India’s super-app ecosystem to gain traction as competition intensifies in the space. With growing Internet and smartphone penetration, we strongly feel that India’s lower-tier markets will offer a robust consumer base for companies’ super apps. Implications for Brands/Retailers- Online brands should look at partnerships with companies building super apps to increase their footprint and reach new consumers.

- Brands and retailers can leverage the consumer data from super apps to offer their consumers personalized products, services, deals and offers.

- Companies building super apps should also integrate technologies such as 3D product models, AI and virtual reality for a seamless shopping experience.

- Technology and software-as-a-service companies benefit through long-term association and partnerships with brands building super apps.