albert Chan

What’s the Story?

In Coresight Research’s India Retail Insights series, we explore the impact of consumer behavior, government regulations, macroeconomic developments, sectoral developments, the competitive landscape and retail tech startups on the evolution of India’s retail sector.

India’s beauty and personal care (BPC) market is undergoing a drastic transformation in the ongoing wave of digitalization, which has been rapidly accelerated by the Covid-19 pandemic. According to market research firm Statista, Internet penetration in India was around 50% in 2020, up from 27% in 2015. Increased digital adoption has driven huge potential for online product sales in beauty, as well as a rise in consumer engagement in online beauty content: Today’s beauty consumers are seeking out online sources for advice, ideas and inspiration in addition to buying products through e-commerce.

We analyze the surge of digitally native vertical brands (DNVBs) in the Indian beauty segment—brands that began online, sell through their own websites or brick-and-mortar locations and control their entire customer experience from factory to consumer. Such brands include MyGlamm, Nykaa, Purplle, Mamaearth, Plum and Sugar—the first three of which we examine in this report.

Why It Matters

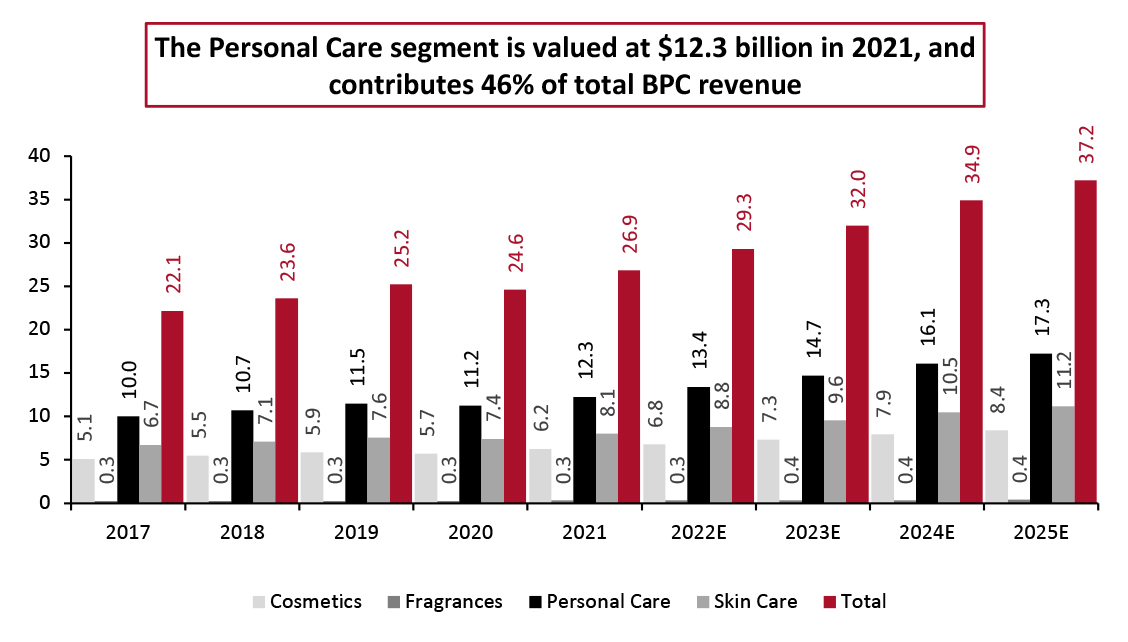

India became the fourth-largest global market for BPC in 2018, behind the US, China and Japan. The BPC market has become one of the fastest-growing consumer markets in the country, according to Statista. Statista estimates that the market will achieve total revenues of $26.9 billion in 2021 and $37.2 billion by 2025, representing a CAGR of 8.5%.

Figure 1. India: Total Revenue and Revenue by Segment in the BPC Market (USD Bil.)

[caption id="attachment_131361" align="aligncenter" width="726"] Forecast adjusted for expected impact of Covid-19

Forecast adjusted for expected impact of Covid-19Source: Statista/Coresight Research[/caption]

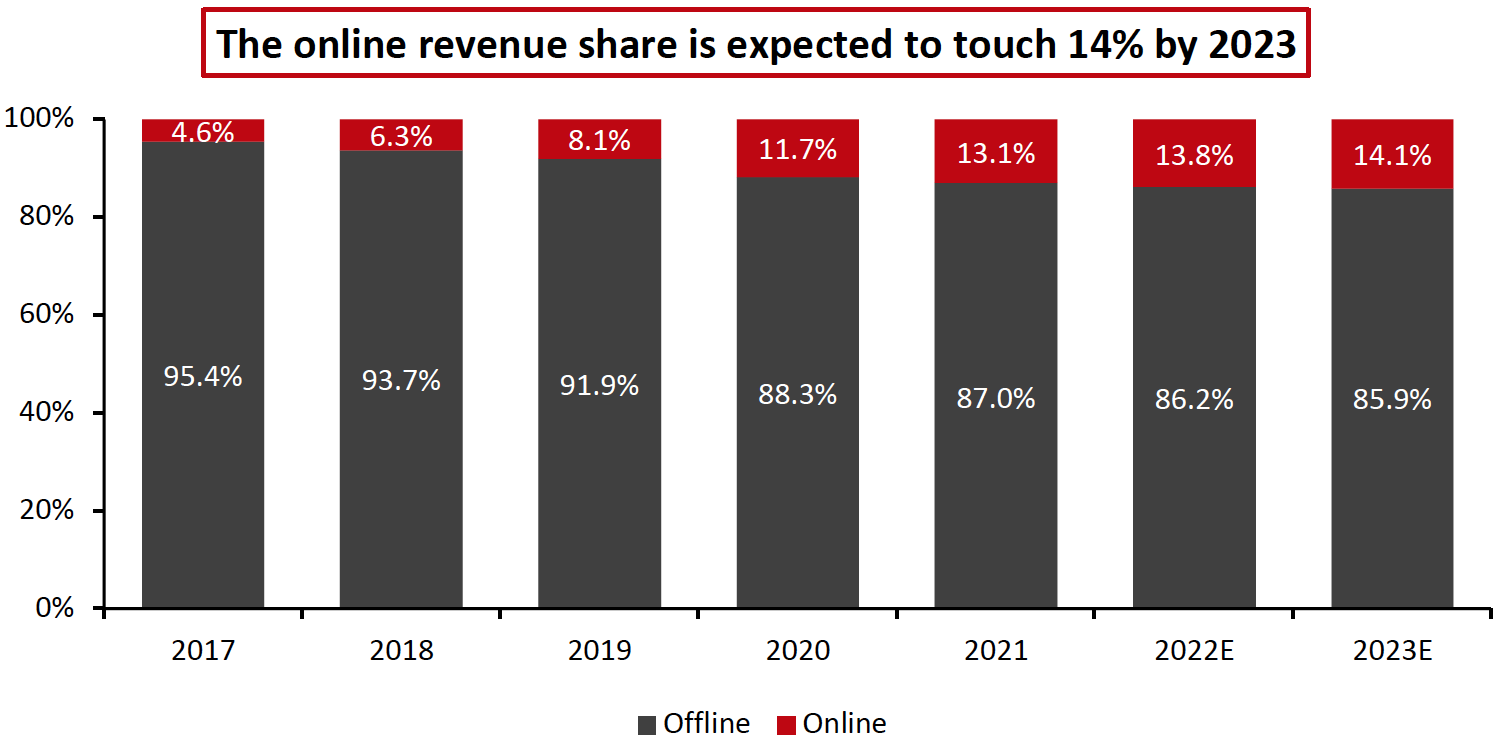

Additionally, Statista estimates that e-commerce penetration in the market is set to increase slightly this year to 13.1%, reaching 14.1% by 2023 (see Figure 2).

Figure 2. India: Revenue by Sales Channel in the BPC Segment (% of Total Segment Revenue)

[caption id="attachment_131081" align="aligncenter" width="700"] Forecast adjusted for expected impact of Covid-19

Forecast adjusted for expected impact of Covid-19Source: Statista/Coresight Research[/caption]

We see three reasons behind the ongoing online growth in India’s BPC segment:

- Young Indian consumers are engaging with beauty content through social media and other digital channels—A survey of 3,000 Indian millennials conducted by marketing solutions provider Schbang in January 2021 revealed that 81% of respondents prefer to watch beauty tutorials from an influencer rather than a brand, presenting opportunities for beauty brands to integrate influencers into their marketing strategies.

- Consumers are seeking clean and functional skincare products, and trust and transparency have become of paramount importance—a consumer mindset augmented by the pandemic. There is opportunity for beauty DNVBs to capitalize on these trends—for example, beauty startup Plum offers a chemical-free product range along with recycled product packaging.

- Alongside rising Internet penetration in India, a variety of investors and company founders are increasingly emphasizing the importance of online sales. Many leading beauty brands are venturing online to reach customers amid the pandemic, even outside Indian metropolitan centers.

Indian DNVB beauty companies are looking to capitalize on the online shopping surge, adopting plans for large-scale expansion and aiming to capture the market through huge investments.

Beauty DNVBs Set for Next-Level Growth Through Increased Funding: In Detail

India’s thriving ecosystem of content creation, influencer marketing and omnichannel commerce tools have considerably changed business models in the beauty sector. Although funding activity in India’s startup space declined in the second and third quarters of 2020 due to the pandemic, it has begun to turn around. According to an Avendus report in October 2020, the online Indian beauty segment is expected to see a slew of acquisitions over the next three to four years as smaller DNVBs reach scale.

Indian FMCG giants have begun testing the waters by snapping up stakes in startups. Marico, India’s leading consumer goods company, acquired men’s grooming startup Beardo in 2020. Additionally, Indian FMCG giants such as ITC and Emami have backed Fireside Ventures, an early-stage fund focusing on consumer brands, which has beauty company Mamaearth in its portfolio.

Three key players in the online beauty segment are gearing up for the next level of growth and attracting huge investments to their online beauty platforms: MyGlamm, Nykaa and Purplle. We discuss the business models and funding details of each company below.

MyGlamm Valued at $100 Million Within Three Years of Its Inception

Company Summary

MyGlamm is a DNVB that manufactures and distributes beauty products for women. Founded in 2017 by Darpan Sanghvi, the company uses online content and social media to facilitate product discovery and enable its customers access to its rich, personalized content and beauty tutorials.

MyGlamm began its operations online but now operates a hybrid online-offline model, although nearly 60% of its sales are still online. The company’s products are available through its app and website, as well as 4,000 physical counters inside retail outlets and in prominent malls across 50 cities in India. MyGlamm currently has more than 600 SKUs (stock-keeping units) covering makeup, personal care and skincare.

The company has a heavy focus on celebrity collaborations. In January 2019, it launched an exclusive cosmetic line called “Manish Malhotra Haute Couture Makeup” with India’s leading couturier Manish Malhotra. MyGlamm has also introduced cosmetic lines with actor Sidharth Malhotra as well as masterclasses and beauty tutorials with makeup artist Daniel Bauer.

[caption id="attachment_131084" align="aligncenter" width="550"] Manish Malhotra Eye Advanced Makeup Kit

Manish Malhotra Eye Advanced Makeup KitSource: Company website[/caption]

In August 2020, MyGlamm acquired PopXo, India’s largest online content, community and commerce platform that focuses on millennial women. The acquisition will leverage PopXo’s content to understand and engage the users of MyGlamm, with the aim of co-creating products to meet consumer demand.

Funding Received

- In March 2021, MyGlamm raised $23.7 million in a funding round led by Amazon, investment firm Ascent Capital and Indian FMCG company Wipro Consumer. The investment valued MyGlamm at over $100 million, less than three years after it was founded. It marks the first time that e-commerce giant Amazon has invested in an Indian consumer brand. According to MyGlamm’s CEO, the company plans to use the funding for data science research, offline expansion and growing its product range.

- In June 2020, MyGlamm raised $14.47 million in a funding round led by American venture capital company Bessemer Venture Partners and Indian investment firm Mankekar Family Office. Existing investor beauty brand L’Occitane also participated. The company was valued at $72.35 million following the funding round. Additionally, early investor Tano Capital sold most of its stake for $4.06 million, making a 3X return on its investment.

Nykaa Set To Become the Next Multibillion-Dollar Indian Company in the BPC Segment

Company Summary

Nykaa was founded in 2012 by Falguni Nayar. The beauty, fashion and wellness products brand began as an exclusively online beauty retailer but adopted an online-offline approach in 2015. The company has 76 stores as of February 2021 across three formats: Nykaa Luxe for premium brands, On-Trend for premium to masstige brands, and kiosks exclusively selling its private labels. Nykaa retails over 1,200 brands and 200,000 products across its platforms.

[caption id="attachment_131085" align="aligncenter" width="550"] Nykaa Luxe offers makeup, skincare, fragrance and hair, bath and body products from premium brands

Nykaa Luxe offers makeup, skincare, fragrance and hair, bath and body products from premium brandsSource: Company website[/caption]

Funding Received

- In November 2020, Nykaa raised an undisclosed sum from Boston-based asset management firm Fidelity Management & Research Company, at a valuation of $1.2 billion. The investment is likely to fund its offline expansion and operational costs, as Nykaa plans to operate 180 stores in the largest 60–80 cities across India in the next five years, according to CEO Anchit Nayar. The company plans to strengthen its presence in Tier 2 and Tier 3 markets, setting up stores with an average range of 800–1,000 square feet.

- Nykaa entered the unicorn club (startups which are valued at $1 billion or more) last year, after raising $22.7 million from London-based India-focused hedge fund Steadview Capital between April and May 2020, at a valuation of $1.2 billion. The investment by Steadview Capital came in two phases, an initial $13.6 million in April 2020, followed by $9.1 million in May 2020.

- In April 2019, Nykaa raised $13.5 million from American private equity firm TPG Growth. TPG was the first foreign investor in the company and its investment gave Nykaa a spectacular jump in its post-money valuation. In September 2018, Nykaa was valued at $330 million—which increased to $724 million after the investment.

- Nykaa is also looking toward an initial public offering (IPO) later this year or in early 2022, seeking a valuation of around $3.5 billion. The company plans to raise $500–750 million from its listing.

Purplle’s Funding Enabled Early Investor IvyCap To Clock 22X Gains

Company Summary

Purplle is a DNVB beauty company that sells cosmetics, fragrances, haircare and skincare products. It was founded in 2011 by Manish Taneja and Rahul Dash. The company provides its users with a highly personalized digital shopping experience, recommending products based on personal preferences, search keywords and purchase behavior. It also offers dedicated articles, guides and tips on common beauty concerns.

According to the company, it sells over 1,000 brands, in addition to its own brand, and nearly 50,000 products on its website and app.

[caption id="attachment_131086" align="aligncenter" width="550"] Purplle’s Beauty Assistant helps shoppers find products from across brands and categories according to their individual preferences

Purplle’s Beauty Assistant helps shoppers find products from across brands and categories according to their individual preferencesSource: Company website[/caption]

Funding Received

- In March 2020, Purplle raised ₹3.26 billion ($45 million) from Sequoia Capital India and existing investors Verlinvest, Blume Ventures and JSW Ventures. The investment will help Purplle become a multibillion-dollar, digital-first BPC enterprise, according to Co-Founder Manish Taneja. The round of investment saw the company’s value rise to ₹22 billion ($297.8 million).

- With this investment, IvyCap Ventures, an early investor in Purplle, partially exited with 22X gains at a value of ₹3.3 billion ($45 million). In 2015, the investor bought a 30% stake in Purplle for ₹150 million ($2.03 million) when the company was valued at ₹500 million ($6.78 million), making it one of the largest returns ever for a rupee fund.

According to Sakshi Chopra, the Principal of Sequoia Capital, Purplle is expected to emerge as a dominant beauty destination as it is focused on democratizing beauty across India through affordable and accessible products.

What We Think

Although there was a slowdown in the growth of “nonessential” category businesses such as BPC early in the pandemic, increased digital adoption among Indian consumers has regained investors’ interest—a key example being MyGlamm’s March 2021 funding round, led by both domestic and international investors.

DNVBs are increasingly becoming the preferred segment for investors as they scale faster due to their agile nature, efficient operational policies and innovative marketing strategies. DNVBs are carving out their niche and leveraging technologies to sell their products and increase their brand presence. Investors are largely looking at high-growth DNVBs that are financially sound and enjoy an extremely loyal customer base. Higher product margins in the BPC segment also make these startups an attractive choice for investors and a better proposition in terms of returns or exit options.