DIpil Das

Introduction

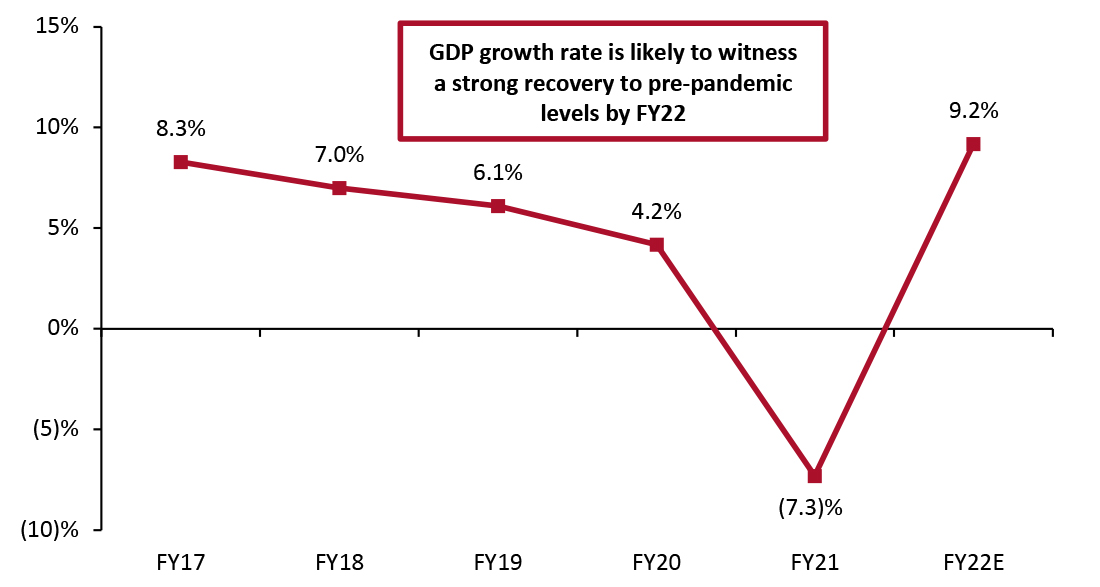

What’s the Story? India’s finance minister, Nirmala Sitharaman, presented the Union Budget—an annual financial statement about the estimated revenue and expenditure of the government for the upcoming fiscal year (in India, the fiscal year runs from April 1 to March 31)—in Parliament on February 1, 2022. The Union Budget has a widespread impact on India’s economic growth, taxes, inflation, and internal and external trade, comprising various industries and sectors. In this report, part of our India Retail Insights series, we present highlights of the Union Budget 2022—for fiscal 2023 (FY23), ending March 2023—and the implications for the country’s retail industry and associated sectors. Why It Matters The Union Budget 2022 announced various measures to boost the growth of different sectors amid rising inflation and ongoing pandemic-related uncertainty. The government also presented the Economic Survey 2022 from the Ministry of Finance—based on data and analysis from, and consultation with, other ministries—the day before the Union Budget. The Economic Survey reviews India’s economic developments in the past financial year and highlights the country’s short- and medium-term economic prospects. According to the Economic Survey 2022, India’s gross domestic product (GDP) growth rate will be 9.2% in FY22—one of the fastest growth rates among major economies. GDP had contracted by 7.3% in FY21 due to the impacts of the Covid-19 pandemic and related nationwide lockdowns (see Figure 1).Figure 1. India’s GDP Growth Rate, FY17–FY22E (%) [caption id="attachment_142193" align="aligncenter" width="700"]

Source: Ministry of Statistics and Programme Implementation [/caption]

The Economic Survey 2022 estimates that the economy will grow by 8.0%–8.5% in FY23 and that India is poised to meet future challenges. Growth will be supported by widespread vaccinations, supply-side reforms and easing regulations. With a robust financial system for economic revival, the government also expects private-sector investments to pick up in fiscal 2023.

The Economic Survey and the Union Budget together indicate a growth revival for Indian businesses in a period of recovery for India’s economy.

Source: Ministry of Statistics and Programme Implementation [/caption]

The Economic Survey 2022 estimates that the economy will grow by 8.0%–8.5% in FY23 and that India is poised to meet future challenges. Growth will be supported by widespread vaccinations, supply-side reforms and easing regulations. With a robust financial system for economic revival, the government also expects private-sector investments to pick up in fiscal 2023.

The Economic Survey and the Union Budget together indicate a growth revival for Indian businesses in a period of recovery for India’s economy.

The Union Budget 2022 and Its Implications: Coresight Research Analysis

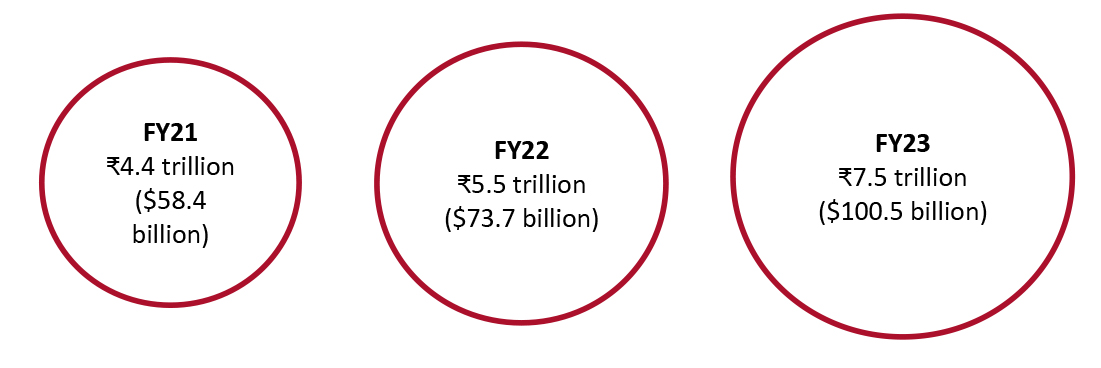

Before the announcement of the budget, there was a lot of speculation and expectations around short-term reforms building across multiple sectors, including retail. The Retailers Association of India (RAI) said that measures such as an extension of the Emergency Credit Line Guarantee Scheme to more retail categories will be a welcome move from the government. The scheme was first launched by the government in May 2020 to provide credit relief of up to 20% for micro-, small and medium-sized enterprises (MSMEs) during the pandemic. RAI also anticipated tax reforms to support a rise in consumer spending power, financial support for digitalization, better infrastructure spending and more. Below, we detail reforms from the Union Budget 2022 across 12 key areas and discuss their implications. 1. Economy Budget Reform: Focus on capex (capital expenditure) Capex outlay expanded by 35.4% to ₹7.5 trillion ($100.5 billion) for FY23 from ₹5.5 trillion ($73.7 billion) in FY22. Capex is one of the primary focus areas for the government, and the outlay has been on the rise over the last two budgets (see Figure 2).Figure 2. Capex Outlay in the Union Budget, FY21–FY23 [caption id="attachment_142194" align="aligncenter" width="700"]

Source: InvestIndia[/caption]

Implications for Retail/Associated Sectors

Source: InvestIndia[/caption]

Implications for Retail/Associated Sectors

- The government’s focus on increased capex spending will drive long-term economic growth and attract private-sector investments directly through input suppliers.

- It will have a multiplier effect in terms of job creation and growth across sectors such as retail on the supply side.

- In the medium-to-long term, the infrastructure push through increased capex allocation focusing on supply chain and logistics and domestic manufacturing will boost the consumer economy.

- The scheme already provided support to more than 13 million MSMEs across multiple sectors and will continue to do so, which is particularly important for pandemic-impacted businesses such as restaurants.

- The scheme will facilitate business and employment opportunities and contribute to economic growth.

- Inflation remains a concern due to high energy prices globally. However, it currently remans within the 2%–6% target range of the Reserve Bank of India (RBI).

- Furthermore, the government’s prediction of the economy to grow by 8.0%–8.5% in FY23 coupled with better domestic growth and reduced Covid-19 impact is likely to help RBI to bring down the inflation rates further.

- The NMP is a digital platform that brings 16 ministries together for the planning and implementation of infrastructure connectivity projects. It will provide seamless connectivity for the movement of people, goods and services from one mode of transport to another and facilitate the last-mile connectivity of infrastructure.

- Allocation of the first outlay of ₹200 billion ($2.7 billion) for expanding the national highway network by 25,000 kilometers in FY23 under the NMP was announced during the budget.

- As part of the initiative, a Unified Logistics Interface Platform (ULIP) will be set up, comprising seven elements—roads, railways, airports, seaports, mass transport, waterways and logistics infrastructure—to boost the economy in future.

- The multimodal transport shift to ULIP platform will help with the efficient movement of goods—reducing logistics costs and time requirements, improving last-mile deliveries and facilitating better inventory management in retail.

- The platform will strengthen operational efficiency by facilitating real-time information sharing among various stakeholders.

- The NMP comprises setting up multimodal logistics parks to offer end-to-end logistics solutions (including warehousing and distribution), as well as 100 cargo terminals, over the next three years.

- The NMP will accelerate the progress of the highly fragmented logistics industry in India and bring it on par with global supply chain networks.

- The plan will boost confidence in entrepreneurs, developers and institutional investors to further their investment in logistics startups and companies, supporting operational expansion to other geographies, fleet expansion/diversification and technology investments for growth.

- The move will empower citizens to skill, reskill and upskill through online training programs and API-based skill credentials.

- RAI CEO Kumar Rajagopalan said that as the retail sector is labor-intensive with high employee churn rates, there is always demand for skilled talent, so the sector will benefit from this initiative.

- PLI schemes in 14 sectors, including textiles, pharmaceuticals and electronics, were allocated investment intentions worth ₹30 trillion ($401.3 billion) in the budget and have the potential to create 0.6 million new jobs. The FY22 budget previously allocated ₹2 trillion ($26.5 billion) for PLI schemes to create manufacturing hubs across 13 sectors.

- Two prominent PLI schemes announced in the latest budget are building a strong 5G ecosystem and building high-efficiency solar-power modules.

- PLI schemes attract and incentivize foreign investors to set up their manufacturing units in India across sectors encompassing retail and consumer goods.

- These schemes encourage local manufacturers to expand their manufacturing units, generate more employment and boost the economy.

- The PLI schemes aim to support India in making advances in critical technologies by becoming a design-oriented and tech-driven manufacturing hub, increasing its global competitiveness.

- The PLI scheme linked to 5G rollout will improve the Internet infrastructure in India and augment e-commerce growth.

- The initiative will revitalize the pandemic-hit MSME sector and augment the competitiveness and productivity of MSMEs in various retail categories.

- The improved use of drones across various sectors and applications will lead to a proliferation of startups providing drone-as-a-service.

- The startups can partner with e-commerce companies to facilitate drone deliveries in urban areas.

- The extension of tax benefits by one more year will provide an impetus to entrepreneurial ventures and fuel India’s startup ecosystem.

- Five existing academic institutions for urban planning will be designated “Centres for Excellence” with an endowment fund of ₹2.5 billion ($33.5 million).

- The capacity building and urban planning will lead to better urban infrastructure and a rise in urban households, providing opportunities for furniture and home-improvement retailers.

- The budget sets a target for the completion of 800,000 households for the middle class and economically weaker sections in urban areas in fiscal 2023.

- The initiative will offer opportunities for real estate developers to partner with the government for the housing projects.

- It will offer moderate growth prospects for furniture retailers due to the improved standard of living of the beneficiaries.

- 100% of 150,000 post offices will come on the core banking system (services rendered by a group of networked bank branches) enabling financial inclusion and access to accounts through net/mobile banking, ATMs and provide online transfer of funds between post office accounts and bank accounts.

- Scheduled commercial banks will set up 75 digital banks in 75 districts to encourage digital payments.

- Digital payments encouragement was a key reform in the FY22 budget as well, with ₹15 billion ($199.1 million) allocated for a scheme to incentivize innovations in digital payment systems.

- India’s postal infrastructure could be a solid financial distribution platform to augment the digitalization of banking in India.

- It will help banks to accelerate digital payment adoption among consumers in Tier 3+ cities and undeserved rural markets, supporting financial inclusion.

- Digital adoption will support the growth of e-commerce in these markets.

- The digital rupee issued by RBI will make online payments more secure as it will be legal tender, compared to the decentralized private virtual currency.

- Prime Minister Narendra Modi said that the digital rupee proposed in the budget could be exchanged for cash and will open new opportunities in the fintech sector.

- It will play a key role in building trust in digital payments among lower-tier consumers, accelerating digital transformation and benefiting e-commerce.

- Leveraging blockchain, the digital currency will boost metaverse opportunities in retail.

- The regulatory and tax clarity on digital assets will facilitate the flow of risk capital into companies dealing with digital assets, with implications for tax buoyancy and employment opportunities in the sector.

- According to the Blockchain and Crypto Assets Council (BACC), 1% TDS on the transfer of virtual assets will likely dent crypto trading volumes.

- Traders that frequently trade and pay a small sum on every trade will find the process cumbersome and time-consuming due to the substantial volume of TDS payouts.

- Any relief on income tax slabs and deductions for the salaried class would have propelled consumers’ disposable income for discretionary spending. However, a lack of additional tax regime will enable the retail and consumer goods sector to maintain the status quo.

- Duty on cut and polished diamonds and gemstones has been reduced from 7.5% to 5%. A similar concession was announced in the previous budget, reducing duty on gold and silver from 12.5% to 7.5%.

- There will be zero import duty on sawn diamond (rough diamond that has undergone sawing and before polishing).

- There will be duty concessions for certain consumer electronic devices, such as wearables and specific mobile phone components.

- The move will boost domestic manufacturing—supporting the government’s “Make in India” initiative—in sectors such as jewelry and consumer electronics, as well as increase exports.

- The import duty concessions will likely reduce the prices of diamond and gemstone-studded jewelry, boosting diamond and gemstone jewelry sales.

- It will enable the faster rollout of consumer electronics products, which are predominantly high-growth and less complex items.

- The concessions will attract international companies to set up manufacturing units in India, as the government already allows 100% foreign direct investment (FDI) in the electronics sector.

- Sudhir Sathiyamoorthy, CEO of Bengaluru-based technology company Resonate, welcomed the move, stating that it will attract high order volumes and accelerate the electronic manufacturing ecosystem.

- Chinese smartphone manufacturer Xiaomi stated that it is actively working to strengthen its domestic manufacturing, and the duty concession on electronic components will further strengthen this initiative.

- With a simplified process in doing business and a reduced timeline for voluntary exits, India will gain an edge in attracting private and foreign investors and companies.

- Sustainability will be major priority for the government, with a long-term objective of net-zero carbon by 2070.

- The budget allocates an additional ₹195 billion ($2.6 billion) in a PLI scheme for manufacturing high-efficiency solar modules.

- The implementation of a PLI scheme for solar panels will take India to a renewable energy-driven economy and offer opportunities for startups and private investments in the sector.

- The policy will encourage the private sector to create sustainable and innovative business models for “Battery or Energy as a Service.”

- It will improve the EV ecosystem, bring down the cost of EVs and promoting a faster pace of EV adoption.

- E-commerce companies are likely to use more EVs in their last-mile delivery fleets, saving logistics costs while reducing their carbon footprint.

- The policy will mitigate the bottleneck of having charging stations; previously, limited ports in crowded urban areas caused a higher wait time for charging.

- The program will widen the reach of mental healthcare services across India, as organizations implement measures to help employees and families manage pandemic-led stress and mental health issues.

- The digital switch will enable health-tech retailers to enter the mental healthcare space and partner with corporates for employee welfare programs, intensifying the competitive landscape.

- Mental health experts and officials from companies such as Accenture, Dabur, Flipkart and Paytm welcomed the move and said that they expect to see more time and money being pumped into this initiative in the coming months.

- The scheme will position India as a global manufacturing hub, providing opportunities for multinational telecom companies to deepen their manufacturing capabilities in the country.

- Swedish telecom device manufacturer Ericsson’s India’s Managing Director, Nitin Bansal, said that design-led initiatives under the PLI scheme will also strengthen the “Make in India” initiative.

- Finnish telecom and consumer electronics company Nokia said that it is exploring opportunities to manufacture more products in India in a cost-effective manner to serve the Indian and the global market.

- The move will help to speed up the digital adoption in rural India and bridge the digital divide in the country.

- The high-speed and affordable Internet and broadband solutions will also help rural consumers to switch to online shopping, leading to a proliferation of e-commerce in these markets.