DIpil Das

Introduction

What’s the Story? Coresight Research has identified inclusivity as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details). This report is the first in our Inclusive Beauty series, which explores opportunities for beauty brands and retailers to offer a range of products to better represent a broader base of consumers—outside the traditional target consumer of young Caucasian women. We explore the rise of male cosmetics, detailing five key market drivers and recent notable brand launches in the sector. Why It Matters Inclusivity is influencing long-term change within the retail industry, driving billion-dollar growth in multiple product categories, including adaptive apparel, gender-free designs, extended sizes, and beauty for all ages, races and genders. Inclusive products and corporate practices are no longer a secondary consideration but a necessity for retailers and brands to be competitive. Coresight Research believes that there is significant opportunity for beauty companies and brands to broaden the scope of their products to reach underrepresented and new consumers. We expect that US consumer spending in the inclusive beauty category for consumers of all races, gender and ages will grow by double digits in percentage terms in 2022, outpacing overall beauty spending, which we predict will grow at 5.4% year over year. Male consumers are increasingly expressing their needs and discovering new products, driving potential for the men’s personal care category to extend beyond traditional grooming to cosmetics, and advanced haircare and beard care. Social norms around the acceptance of male cosmetics are beginning to change. First, there is increasing social acceptance from Gen Z around using makeup and nail color as a form of personal expression. Second, the male cosmetics sector is advancing through products that aim to enhance appearance. These trends indicate the emergence of the male cosmetics sector, presenting white-space opportunity for entry.Inclusive Beauty—Male Cosmetics: Coresight Research Analysis

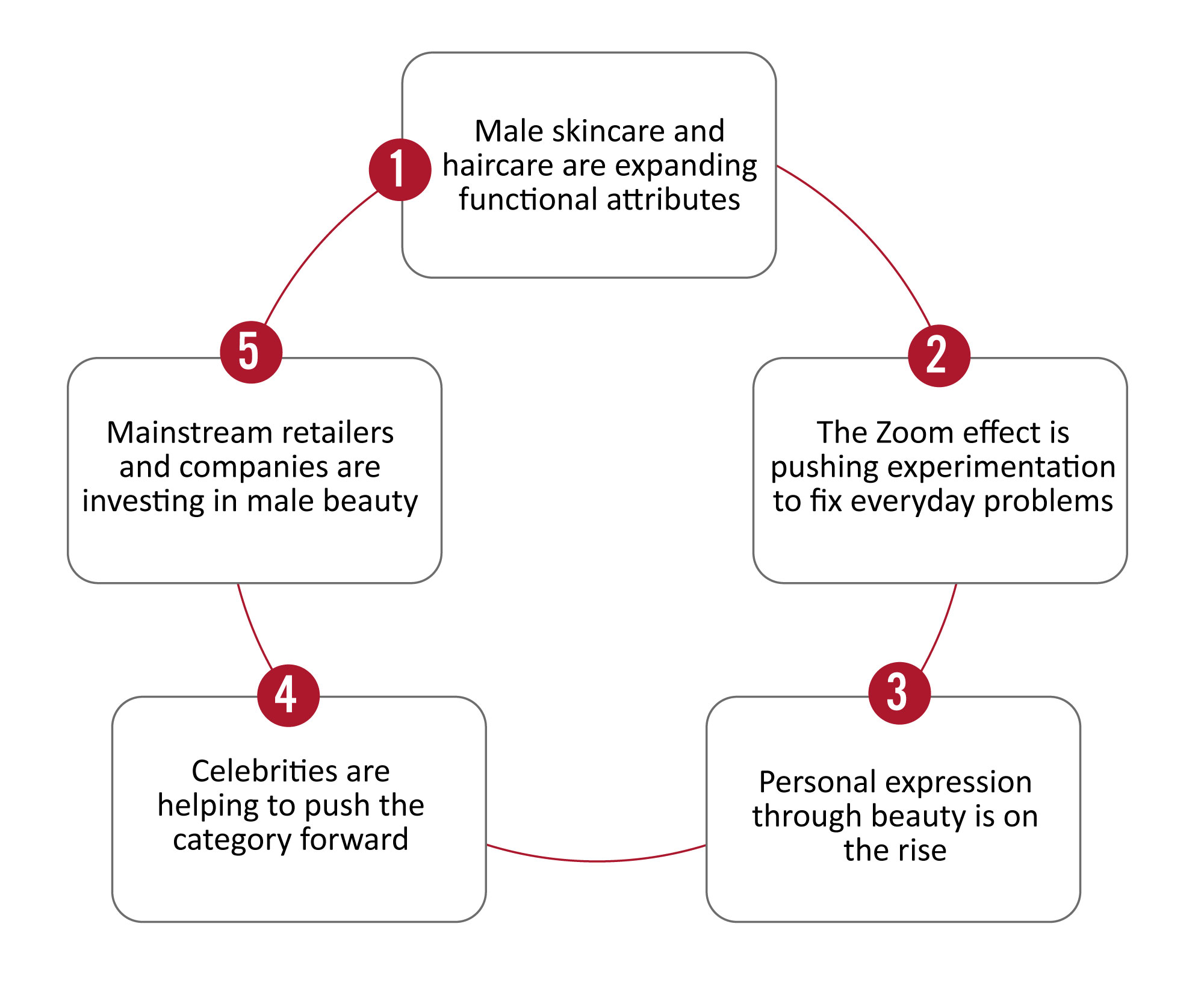

Market Drivers We identify five key trends that are driving growth in the male cosmetics market, which we present in Figure 1 and discuss in detail below, with examples of brand launches in each area. Based on these trends, we see growth opportunities across three new product categories in men’s beauty retail:- Enhanced skincare products, such as light coverage concealer, tinted moisturizer, foundation and bronzers, as well as expanded products such as serums and lip balms

- Advanced haircare products such as hair and beard gels, and eyebrow gels and pencils

- Color cosmetics, including nail color and nail art

Figure 1. Inclusive Beauty: Five Drivers of the Male Cosmetics Category [caption id="attachment_143918" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Male Skincare and Haircare Are Expanding Attributes To Include Light-Coverage Properties

Male skincare and haircare brands are expanding product attributes beyond traditional grooming to include light-coverage properties, concealers and tinting. While makeup is still an off-putting word to many men, this new category of men’s products presents a cosmetics gateway with products that help to enhance everyday appearance.

The emerging category of men’s beauty and personal care products includes makeup-like products such as tinted moisturizers, foundation, concealer sticks, bronzers, eyebrow pencils, brow gels, and beard and hair gels. Products are often designed with the intention of covering blemishes, evening out skin tones or covering dark undereye circles.

Stryx, a male cosmetics brand, launched in 2017 with its hero product, a concealer tool. The brand was conceived when CEO and Founder Devir Kahan woke up with a pimple on his face on his wedding day. He told Coresight Research that there were makeup artists for the women, but he felt too weird asking them to cover it and thought it was crazy that there were no solutions designed for men to cover a blemish.

Stryx now offers five products: a tinted moisturizer, undereye serum, gel cleanser, lip balm and accessories. The majority of Stryx’s customers are between the ages of 25 and 45, and 30% of its customers are over the age of 45, according to the brand. By talking to its customers, the brand has learned that customers are also using its products to even skin tones as a solution to skin conditions such as rosacea.

2. Men Are Experimenting with New Products, Driven by the Zoom Effect

Men are becoming more willing to experiment with facial products due to the boom in videoconferencing amid pandemic-led work-from-home measures and travel restrictions. This is perhaps driven in part by the security of being behind a screen, but consumers are focusing on their appearance more than ever before, and men are no exception.

Mel Daniel, a doctor from the American Society of Plastic Surgeons, describes the phenomenon as the “Zoom boom,” where consumers are staring at themselves on screen, analyzing wrinkles, fine lines and double chins. He said that thousands of people began seeking out solutions during the pandemic, and interest in facial procedures grew significantly, thanks to Zoom and other videoconferencing platforms. According to Daniel, patients began requesting everything from chin liposuction to facelifts with greater frequency than ever before, and there was an increased interest in med spa procedures, such as Botox and fillers, prompting many practices to increase their focus on nonsurgical offerings or even innovate their delivery methods to accommodate drive-thru procedures.

Similarly, this Zoom effect has contributed to a rise in demand for, and experimentation with, male beauty products. Men are seeking out skincare, haircare and coverage products to help them to look and feel better—such as covering up undereye dark circles, evening out skin tones, touching up grey beard hair, defining lashes, and grooming and highlighting brows.

Tribe Cosmetics was founded in March 2020 by Matt Rodrigues and Pergrin Pervez, who believe that Covid-19 was a catalyst for consumers to try their products because every face was always front and center on a screen; everyone was working at home with “Zoom dysmorphia,” focused on every single imperfection. Tribe Cosmetics launched its brand with a kit containing three basic products: a moisturizer, a skin-perfecting tint (skin fix) and a beard corrector.

Rodrigues told Coresight Research that one of the biggest questions that the brand receives is, “How do I use the product?” Rodrigues said he thinks there are preconceived notions that brushes and applicators must be used and that using products is complicated. The brand founders wanted their products to be simple and accessible for consumers to use with their hands—products that male consumers would want to use.

Pervez highlighted the gap in the market for products branded for male consumers in mind: He went into a major retailer to try to buy men’s makeup and the associate said, “Makeup is gender-neutral.” He said, “Fair enough. But none of the associates look like me and none of the products are geared to me.”

Rodrigues said that Tribe Cosmetics receives daily feedback from consumers on the positive impact that it is having on their lives. The brand is seeking to normalize the use of makeup for men.

3. Personal Expression Is Driving the Nail Color Category Forward

Desire for personal expression is leading some men to experiment with other forms of cosmetics, particularly nail color and nail art. In 2021, there were three launches of male and gender-neutral nail color and nail art lines catering to male consumers.

In June 2019, Fenton Jagdeo and Umar ElBably founded Faculty as a platform of self-expression, a third wave of masculinity. Faculty launched with nail color and nail stickers. The brand’s target consumer is Gen Z because the brand believes that this demographic is the future. Faculty collaborated with musician and social media influencer Chase Hudson (Lil Huddy) in July 2020; Hudson has over 52 million TikTok followers. Estée Lauder invested $3 million in Faculty in June 2021.

[caption id="attachment_143919" align="aligncenter" width="400"]

Source: Coresight Research[/caption]

1. Male Skincare and Haircare Are Expanding Attributes To Include Light-Coverage Properties

Male skincare and haircare brands are expanding product attributes beyond traditional grooming to include light-coverage properties, concealers and tinting. While makeup is still an off-putting word to many men, this new category of men’s products presents a cosmetics gateway with products that help to enhance everyday appearance.

The emerging category of men’s beauty and personal care products includes makeup-like products such as tinted moisturizers, foundation, concealer sticks, bronzers, eyebrow pencils, brow gels, and beard and hair gels. Products are often designed with the intention of covering blemishes, evening out skin tones or covering dark undereye circles.

Stryx, a male cosmetics brand, launched in 2017 with its hero product, a concealer tool. The brand was conceived when CEO and Founder Devir Kahan woke up with a pimple on his face on his wedding day. He told Coresight Research that there were makeup artists for the women, but he felt too weird asking them to cover it and thought it was crazy that there were no solutions designed for men to cover a blemish.

Stryx now offers five products: a tinted moisturizer, undereye serum, gel cleanser, lip balm and accessories. The majority of Stryx’s customers are between the ages of 25 and 45, and 30% of its customers are over the age of 45, according to the brand. By talking to its customers, the brand has learned that customers are also using its products to even skin tones as a solution to skin conditions such as rosacea.

2. Men Are Experimenting with New Products, Driven by the Zoom Effect

Men are becoming more willing to experiment with facial products due to the boom in videoconferencing amid pandemic-led work-from-home measures and travel restrictions. This is perhaps driven in part by the security of being behind a screen, but consumers are focusing on their appearance more than ever before, and men are no exception.

Mel Daniel, a doctor from the American Society of Plastic Surgeons, describes the phenomenon as the “Zoom boom,” where consumers are staring at themselves on screen, analyzing wrinkles, fine lines and double chins. He said that thousands of people began seeking out solutions during the pandemic, and interest in facial procedures grew significantly, thanks to Zoom and other videoconferencing platforms. According to Daniel, patients began requesting everything from chin liposuction to facelifts with greater frequency than ever before, and there was an increased interest in med spa procedures, such as Botox and fillers, prompting many practices to increase their focus on nonsurgical offerings or even innovate their delivery methods to accommodate drive-thru procedures.

Similarly, this Zoom effect has contributed to a rise in demand for, and experimentation with, male beauty products. Men are seeking out skincare, haircare and coverage products to help them to look and feel better—such as covering up undereye dark circles, evening out skin tones, touching up grey beard hair, defining lashes, and grooming and highlighting brows.

Tribe Cosmetics was founded in March 2020 by Matt Rodrigues and Pergrin Pervez, who believe that Covid-19 was a catalyst for consumers to try their products because every face was always front and center on a screen; everyone was working at home with “Zoom dysmorphia,” focused on every single imperfection. Tribe Cosmetics launched its brand with a kit containing three basic products: a moisturizer, a skin-perfecting tint (skin fix) and a beard corrector.

Rodrigues told Coresight Research that one of the biggest questions that the brand receives is, “How do I use the product?” Rodrigues said he thinks there are preconceived notions that brushes and applicators must be used and that using products is complicated. The brand founders wanted their products to be simple and accessible for consumers to use with their hands—products that male consumers would want to use.

Pervez highlighted the gap in the market for products branded for male consumers in mind: He went into a major retailer to try to buy men’s makeup and the associate said, “Makeup is gender-neutral.” He said, “Fair enough. But none of the associates look like me and none of the products are geared to me.”

Rodrigues said that Tribe Cosmetics receives daily feedback from consumers on the positive impact that it is having on their lives. The brand is seeking to normalize the use of makeup for men.

3. Personal Expression Is Driving the Nail Color Category Forward

Desire for personal expression is leading some men to experiment with other forms of cosmetics, particularly nail color and nail art. In 2021, there were three launches of male and gender-neutral nail color and nail art lines catering to male consumers.

In June 2019, Fenton Jagdeo and Umar ElBably founded Faculty as a platform of self-expression, a third wave of masculinity. Faculty launched with nail color and nail stickers. The brand’s target consumer is Gen Z because the brand believes that this demographic is the future. Faculty collaborated with musician and social media influencer Chase Hudson (Lil Huddy) in July 2020; Hudson has over 52 million TikTok followers. Estée Lauder invested $3 million in Faculty in June 2021.

[caption id="attachment_143919" align="aligncenter" width="400"] Faculty nail stickers

Faculty nail stickers Source: Company website [/caption] 4. Celebrities Are Helping To Promote Male Beauty Celebrities are legitimatizing male beauty and helping to push the category into the mainstream. In 2021, four celebrities launched their own cosmetics brands, which we present below.

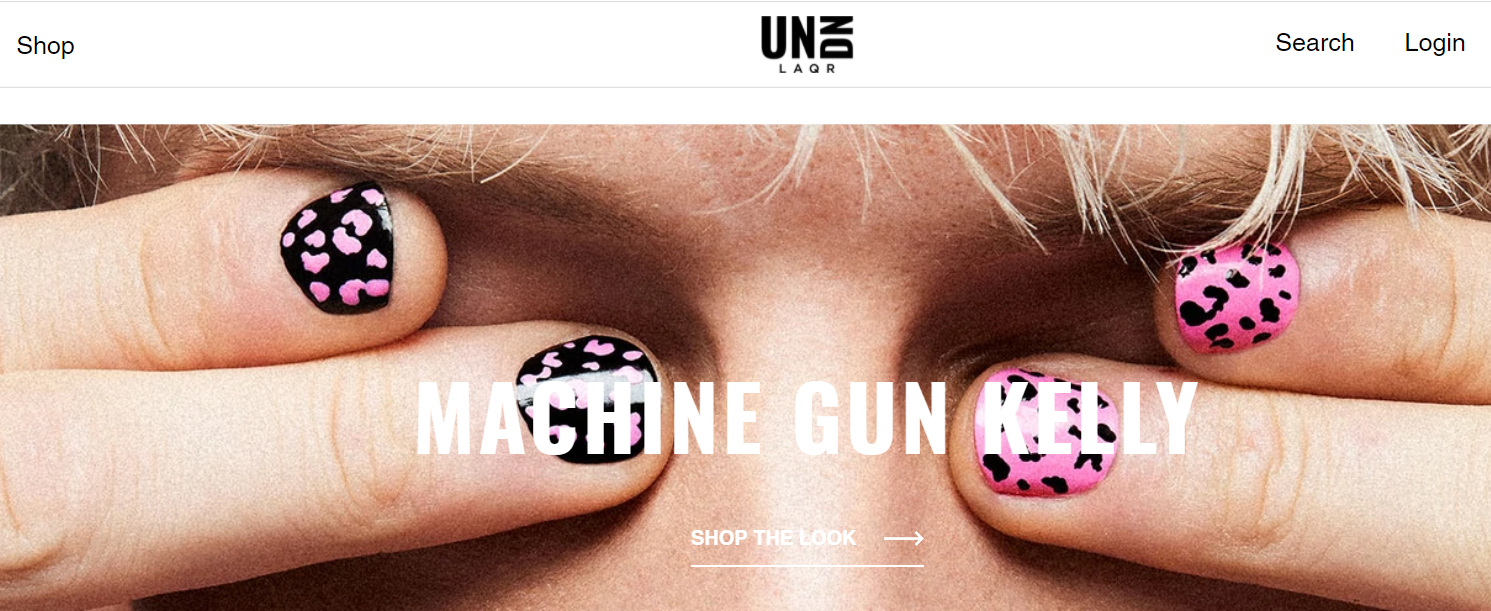

- In December 2021, musician Machine Gun Kelly launched UN/DN, a modern and industrial-designed nail color line encouraging self-expression, mixing colors and designs.

Musician Machine Gun Kelly launched the UN/DN nail color line in December 2021

Musician Machine Gun Kelly launched the UN/DN nail color line in December 2021 Source: Company website [/caption]

- In November 2021, musician Harry Styles launched vegan and cruelty-free brand Pleasing, including eye and facial serum, dual lip rollerball and nail color.

Musician Harry Styles launched Pleasing in November 2021

Musician Harry Styles launched Pleasing in November 2021 Source: Pleasing Instagram [/caption]

- In May 2021, Alex Rodriguez, former player for the New York Yankees, partnered with Hims & Hers to launch a men’s concealer stick to provide moisturizing and sweatproof coverage.

- In May 2021, rapper Lil Yachty launched Crete, a nail color brand with products designed as a pen (instead of a bottle) and nail stickers.

- CVS entered a partnership with Stryx in June 2020 for the brand to feature in CVS stores and online. Kahan reported that Stryx has had 20% month-over-month growth since August 2020, with each subsequent month being its best month to date.

- As mentioned earlier, Estée Lauder invested $3 million in the Faculty nail color brand in June 2021.

Figure 2. Notable Brand Launches in the US Male Cosmetics Category, 2010–2021 [wpdatatable id=1836 table_view=regular]

Source: Company websites and interviews

What We Think

We see white-space opportunity in the emerging male cosmetics category, as male consumers look to solve everyday challenges, such as concealing a blemish, covering undereye circles and evening out skin tones. We expect to see increasing demand in the skincare category for products that are geared to men’s skincare needs, such as moisturizers and serums. In haircare, some of the new category solutions include brow gels and pencils, beard tints and hair gels; these products are all helping men to enhance their appearance and to look their best selves. The color cosmetics category has seen growth in nail color and nail stickers over the past year, appealing mainly to Gen Z; we expect this category to expand and develop as consumers continue to explore more cosmetics options. We expect that beauty companies and retailers will conduct more research and development and will launch new products that appeal to the male consumer, combining the functionality of skincare with the coverage properties of makeup—representing the gateway into the male cosmetics market. While consumers of all ages are using male cosmetic products, we expect younger consumers to drive market growth.Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]