DIpil Das

Introduction

What’s the Story? Coresight Research has identified inclusivity as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details). This report continues our Inclusive Beauty series, which explores opportunities for beauty brands and retailers to offer a range of products to better represent a broader base of consumers—outside the traditional target consumer of young Caucasian women. We explore the opportunities for beauty brands and retailers to expand the diversity of their target consumer base in terms of age—by targeting older consumers, specifically those aged 55–79. Why It Matters Inclusivity is influencing long-term change within the retail industry, driving billion-dollar growth in multiple product categories, including adaptive apparel, gender-free designs, extended sizes, and beauty for all ages, races and genders. Inclusive products and corporate practices are no longer a secondary consideration but a necessity for retailers and brands to be competitive. Coresight Research believes that there is significant opportunity for beauty companies and brands to broaden the scope of their products to reach underrepresented and new consumers. We expect that US consumer spending in the inclusive beauty category for consumers of all races, gender and ages will grow by double digits in percentage terms in 2022, outpacing overall beauty spending, which we predict will grow at 5.4% year over year. The beauty industry has traditionally been heavily focused on younger consumers, both in product formulation and in marketing, providing an opportunity for brands and retailers to better serve older consumers—particularly as the US female population is aging, with nearly one-third of all women aged over 55 in 2019, up from 26.7% in 2010, according to the latest data available from the US Census Bureau (which we discuss further in a later section of this report). Furthermore, several surveys highlighted in this report indicate that older consumers are seeking representation on social media, are influenced by beauty on social media, and purchase beauty online. Brands and retailers can look to meet this demand by targeting older consumers and representing this consumer in beauty advertising campaigns.Inclusive Beauty: Opportunities for Older Consumers

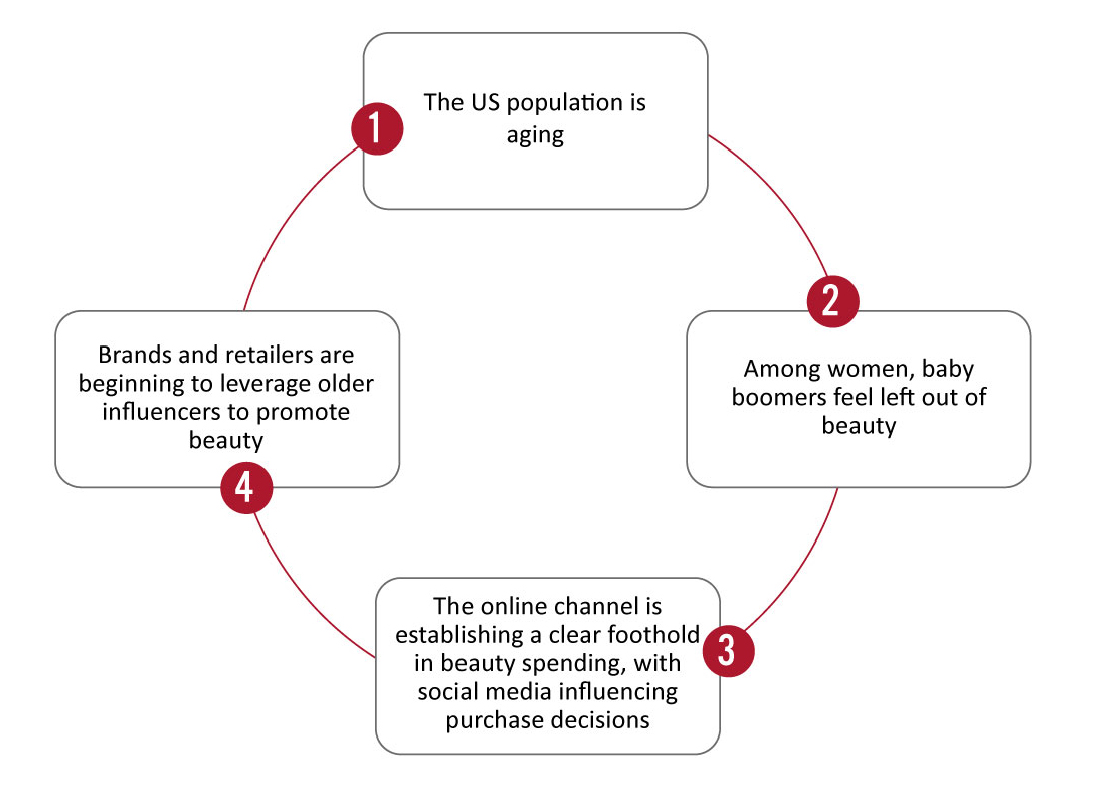

Market DriversFigure 1. Inclusive Beauty: Drivers of Age Diversity in Beauty [caption id="attachment_144048" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. The US Population Is Aging

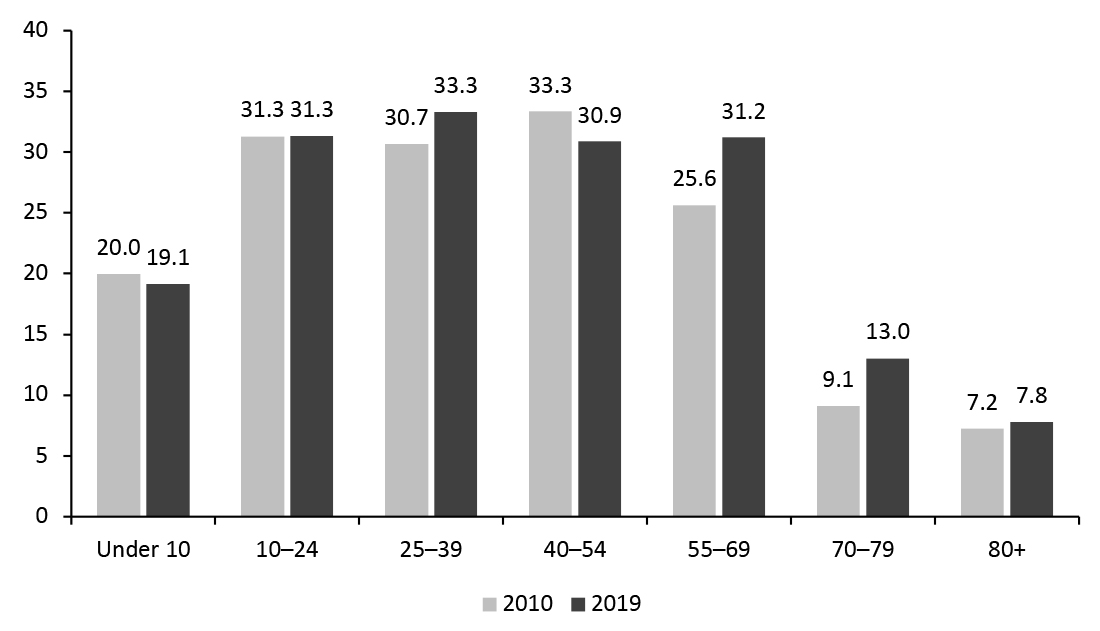

Americans are having fewer children and life expectancy is increasing, meaning that the US population is getting older. Focusing on women—the typical target consumer of the beauty sector—the US female population overall grew by 9.4 million between 2010 and 2019, according to the latest US Census Bureau data, and the proportion of women over aged 55 and above also grew to 31.2% from 26.7% in 2010. Those aged 55+ have been one of the fastest-growing age groups, reflecting the aging of “bulges” in the population.

There is therefore clear opportunity for beauty brands to focus on the older demographic—a a consumer group that beauty brands and retailers have not targeted with specialized beauty marketing or products until very recently.

Source: Coresight Research[/caption]

1. The US Population Is Aging

Americans are having fewer children and life expectancy is increasing, meaning that the US population is getting older. Focusing on women—the typical target consumer of the beauty sector—the US female population overall grew by 9.4 million between 2010 and 2019, according to the latest US Census Bureau data, and the proportion of women over aged 55 and above also grew to 31.2% from 26.7% in 2010. Those aged 55+ have been one of the fastest-growing age groups, reflecting the aging of “bulges” in the population.

There is therefore clear opportunity for beauty brands to focus on the older demographic—a a consumer group that beauty brands and retailers have not targeted with specialized beauty marketing or products until very recently.

Figure 2. US Female Population, by Age Group (Mil.) [caption id="attachment_144262" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

2. Among Women, Older Women Feel Left Out of Beauty

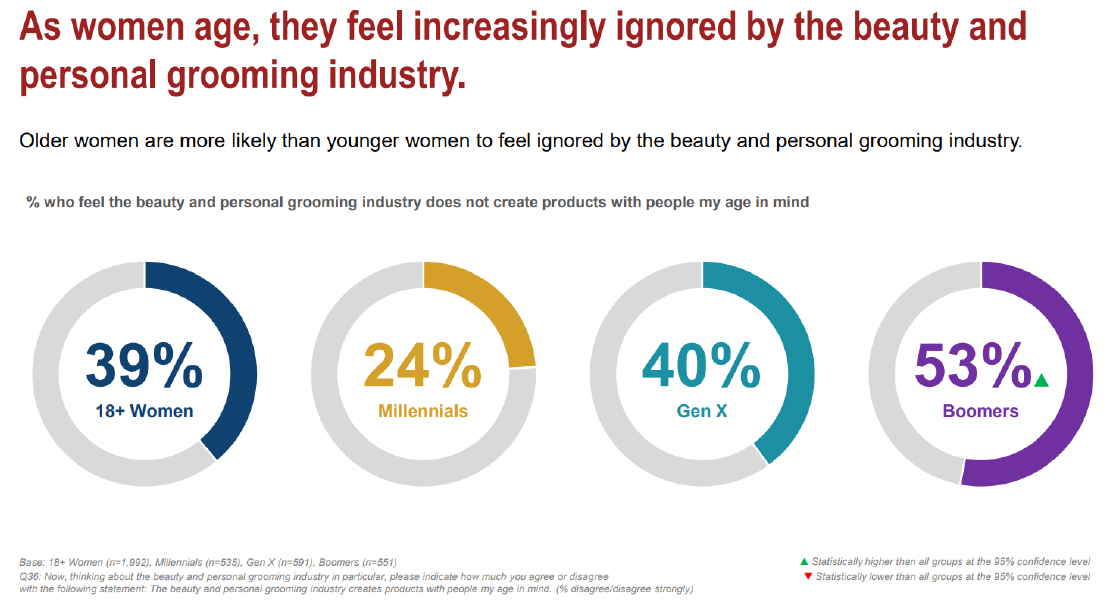

Consumer demand for beauty products tailored to older women exists: More than half (53%) of women aged 55–73 believe that the beauty and personal grooming industry “does not create products with people my age in mind,” according to a 2019 AARP Survey of Women’s Reflections on Beauty, Age and Media. Furthermore, 40% of women aged 39–54 reported the same (see image below).

In addition to developing and advertising products for older female consumers, beauty brands and retailers can improve age diversity in their advertising campaigns to represent older consumers and so expand their customer base. In the same AARP survey, 88% of women aged 55–73 reported they are underrepresented in ads, and 79% of the same age group said that they would be more willing to buy from brands that featured a mix of ages in their ads.

[caption id="attachment_144050" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

2. Among Women, Older Women Feel Left Out of Beauty

Consumer demand for beauty products tailored to older women exists: More than half (53%) of women aged 55–73 believe that the beauty and personal grooming industry “does not create products with people my age in mind,” according to a 2019 AARP Survey of Women’s Reflections on Beauty, Age and Media. Furthermore, 40% of women aged 39–54 reported the same (see image below).

In addition to developing and advertising products for older female consumers, beauty brands and retailers can improve age diversity in their advertising campaigns to represent older consumers and so expand their customer base. In the same AARP survey, 88% of women aged 55–73 reported they are underrepresented in ads, and 79% of the same age group said that they would be more willing to buy from brands that featured a mix of ages in their ads.

[caption id="attachment_144050" align="aligncenter" width="700"] Online survey of 1,992 women, conducted July 2–16, 2019, by Hotspex, Inc., using the Dynata panel supplemented by offline intercepts among unacculturated Hispanics/Latinos. The data were weighted by age, region, education and ethnicity to reflect US women aged 18 and older.

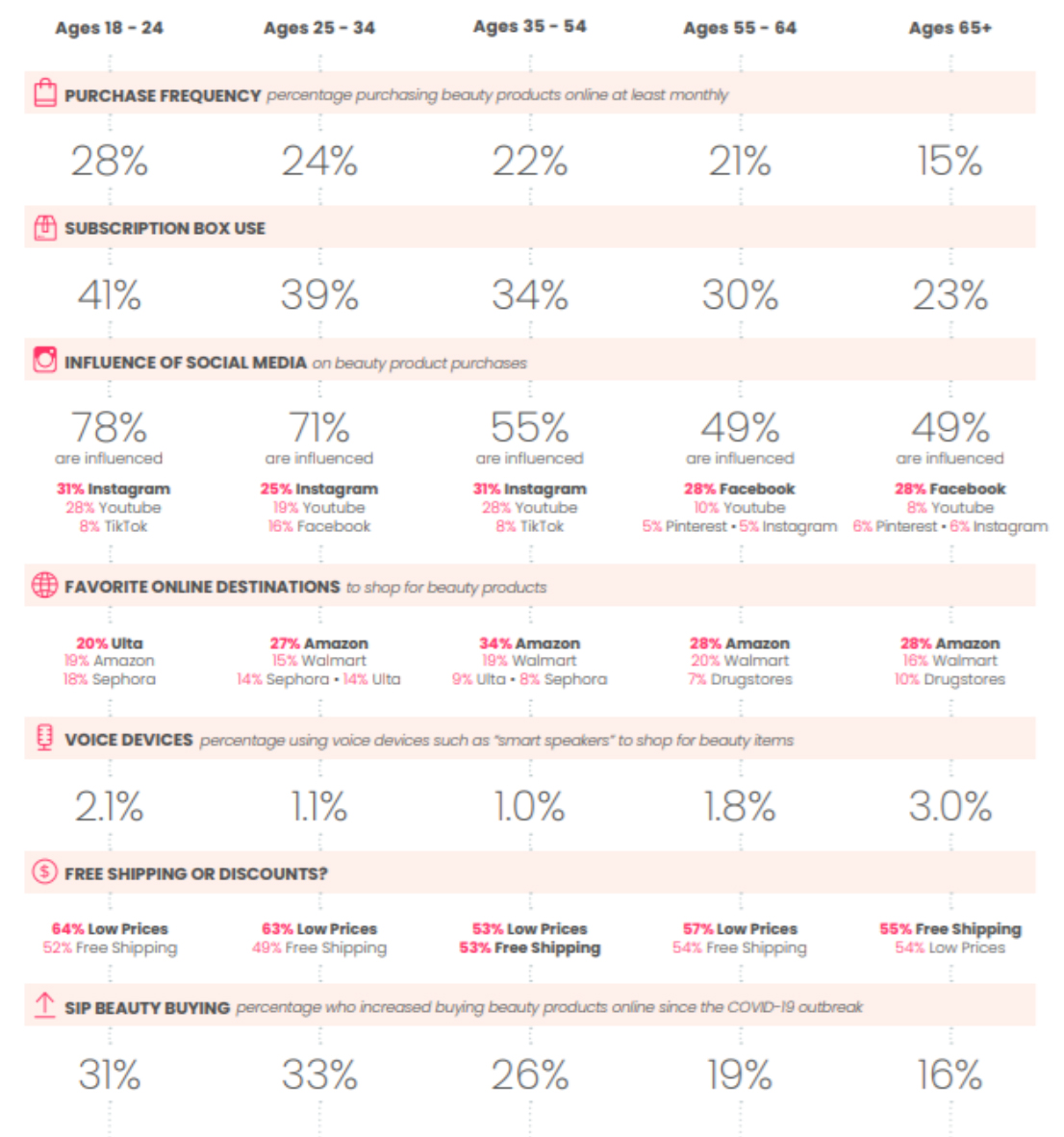

Online survey of 1,992 women, conducted July 2–16, 2019, by Hotspex, Inc., using the Dynata panel supplemented by offline intercepts among unacculturated Hispanics/Latinos. The data were weighted by age, region, education and ethnicity to reflect US women aged 18 and older. Source: Survey of Women’s Reflections on Beauty, Age and Media, AARP [/caption] 3. The Online Channel Is Establishing a Clear Foothold in Beauty Spending, with Social Media Influencing Purchase Decisions Older consumers are spending on beauty and personal care products online. Around one-fifth (21%) of consumers aged 55–64 who buy beauty products online do so at least once per month, and 15% of those aged 65 and over report the same, according to a survey commissioned by digital marketing agency Tintuiti and conducted by independent research firm Survata in April 2020. In each of the two oldest age groups, the survey found that nearly half of online beauty shoppers are influenced by social media when it comes to their purchase decisions for beauty products. Facebook is the predominant social media channel for both age groups, followed by YouTube. Another key finding is that Amazon and Walmart are the two biggest online beauty destinations for older consumers, followed by drugstores. (See the image below for a summary of the survey’s findings, broken down by age group.) E-commerce therefore presents a lucrative opportunity for beauty brands and retailers to not only reach older consumers (who are not stereotypically perceived as online shoppers) but to also drive conversion through social media. [caption id="attachment_144263" align="aligncenter" width="700"]

2,009 online respondents aged 18+ who buy beauty products online, surveyed on April 23–29, 2020

2,009 online respondents aged 18+ who buy beauty products online, surveyed on April 23–29, 2020 Source: Beauty Industry Trends Report 2020, Survata/Tintuiti [/caption] 4. Brands and Retailers Are Beginning To Leverage Older Influencers To Promote Beauty As beauty brands begin to recognize the opportunity to target older female consumers, we are seeing them diversify their age representation through influencers. Brands are leveraging older influencers in three main ways: as brand ambassadors, as models in routine campaigns and to promote age-specific beauty products. We discuss each strategy below, with examples from notable beauty brands.

- Leveraging Older Consumers as Brand Ambassadors

Source: L’Oréal[/caption]

StriVectin launched a multi-year brand partnership in August 2019 with supermodel turned role model Lauren Hutton, aged 78, as Global Brand Ambassador. Products include SD advanced intensive moisturing concentrate, Star Retinol night oil and TL advanced neck cream.

[caption id="attachment_144053" align="aligncenter" width="493"]

Source: L’Oréal[/caption]

StriVectin launched a multi-year brand partnership in August 2019 with supermodel turned role model Lauren Hutton, aged 78, as Global Brand Ambassador. Products include SD advanced intensive moisturing concentrate, Star Retinol night oil and TL advanced neck cream.

[caption id="attachment_144053" align="aligncenter" width="493"] Source: StriVectin[/caption]

Source: StriVectin[/caption]

- Using Models and Influencers of All Ages in Beauty Campaigns

Source: Clarins [/caption]

Gucci featured Italian actress and model Bendetta Barzini, aged 78, as part of its Gucci Beauty Wishes campaign, which launched in December 2021 and showed that consumers of all ages can wear its color cosmetics line.

[caption id="attachment_144055" align="aligncenter" width="700"]

Source: Clarins [/caption]

Gucci featured Italian actress and model Bendetta Barzini, aged 78, as part of its Gucci Beauty Wishes campaign, which launched in December 2021 and showed that consumers of all ages can wear its color cosmetics line.

[caption id="attachment_144055" align="aligncenter" width="700"] Guccibeauty Instagram on December 26, 2021, featuring Italian actress Benedetta Barzini, aged 78

Guccibeauty Instagram on December 26, 2021, featuring Italian actress Benedetta Barzini, aged 78 Source: Instagram [/caption] Jones Road Beauty, Bobbi Brown’s clean makeup brand which launched on October 26, 2020, regularly features models aged over 50 in its Instagram content. [caption id="attachment_144056" align="aligncenter" width="700"]

Jonesroadbeauty Instagram on January 10, 2022, featuring @whitehairwisdom influencer, Lynn, aged 59

Jonesroadbeauty Instagram on January 10, 2022, featuring @whitehairwisdom influencer, Lynn, aged 59 Source: Instagram [/caption] Laura Geller, which sells foundation and lipstick, launched an ad campaign in December 2021 called “Let’s Get Old Together,” which featured 56-year-old model Paulina Porizkova. Last year, the brand announced that it would feature only women over 40 in all its marketing and social media messaging, which falls in line with the brand’s commitment to creating makeup for “real women.”

- Promoting Beauty Products Targeted to Older Consumers

Source: Cover Girl [/caption]

L’Oréal launched its “Gold Not Old” campaign in January 2021 with brand ambassador and actress Helen Mirren, aged 76, for its Age Perfect line of cosmetics and skincare (including blush, foundation, lipsticks and serum concealers).

[caption id="attachment_144058" align="aligncenter" width="618"]

Source: Cover Girl [/caption]

L’Oréal launched its “Gold Not Old” campaign in January 2021 with brand ambassador and actress Helen Mirren, aged 76, for its Age Perfect line of cosmetics and skincare (including blush, foundation, lipsticks and serum concealers).

[caption id="attachment_144058" align="aligncenter" width="618"] Source: L’Oréal[/caption]

Source: L’Oréal[/caption]

What We Think

Beauty and personal care products targeted toward baby boomers are emerging in the market as brands and retailers recognize the value of the older female consumer demographic. The category has significant opportunities for growth as the US population ages. Implications for Brands/Retailers Brands and retailers can focus their efforts in three key ways to reach older consumers: 1. Design more inclusive marketing. There are many opportunities for most brands to incorporate models of all ages into ad campaigns and on social media. More diverse representation can help brands to connect with a larger and more diverse audience. 2. Conduct research to formulate products that older consumers are interested in. While many beauty products are for consumers of all ages, some older consumers report they have unique skincare or facial color cosmetic needs, such as dry skin. We expect continued product launches as the beauty industry becomes more specialized and science-based. 3. Use influencers and targeted social media channels to reach the older beauty consumer where she shops. Older consumers are savvy, shopping online and using social media. There may be preconceived notions about how older consumers shop, but there are many opportunities to utilize influencers and targeted social media channels to reach the older beauty consumer where she shops. This is unchartered territory for beauty brands and companies. We expect beauty brands and companies to increase their influencer spending on mature consumers, which will help to drive growth in the category. Implications for Technology Vendors Here are two ways we expect technology vendors to focus on the burgeoning beauty market for older consumers. 1. Provide data analytics on older consumers. Technology vendors can work with beauty companies and retailers to provide data on analytics older consumers, which will help to inform targeting marketing and messaging. 2. Recognize older consumers as influencers. As the older consumer becomes recognized as a social media influencer, technology vendors can work in partnership with beauty retailers and brands to attract and identify influencers for products in their portfolios.Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]