DIpil Das

Introduction

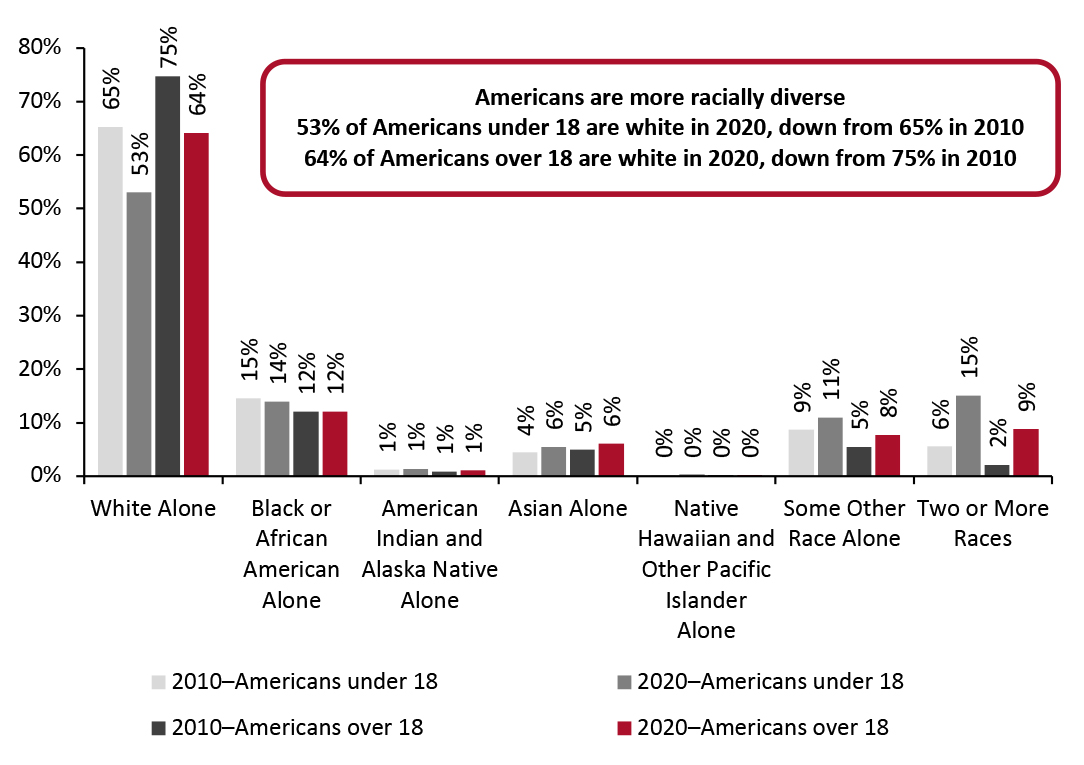

What’s the Story? Coresight Research has identified inclusivity as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details). This report continues our Inclusive Beauty series, which explores opportunities for beauty brands and retailers to offer a range of products to better represent a broader base of consumers—outside the traditional target consumer of young Caucasian women. We explore the opportunities for beauty brands and retailers to expand the diversity of their target consumer base in terms of race and ethnicity. The appendix also includes an overview of Black-owned beauty brands at major retailers. Why It Matters Inclusivity is influencing long-term change within the retail industry, driving billion-dollar growth in multiple product categories, including adaptive apparel, gender-free designs, extended sizes, and beauty for all ages, races and genders. Inclusive products and corporate practices are no longer a secondary consideration but a necessity for retailers and brands to be competitive. Coresight Research believes that there is significant opportunity for beauty companies and brands to broaden the scope of their products to reach underrepresented and new consumers. We expect that US consumer spending in the inclusive beauty category for consumers of all races, gender and ages will grow by double digits in percentage terms in 2022, outpacing overall beauty spending, which we predict will grow at 5.4% year over year. Consumers of different races have varying skincare, makeup and haircare needs. The beauty industry has traditionally been focused on Caucasian consumers, so there is opportunity to better serve diverse consumers. Nearly half (47%) of young Americans aged 7 to 18 are non-Caucasian, according to the US Census Bureau in 2020 (latest available data)—up from 35% in 2010. Young people are helping to influence and drive beauty trends of the future, so it will be essential for beauty companies and retailers to connect with diverse beauty consumers.Inclusive Beauty—Diverse Races and Ethnicities: Coresight Research Analysis

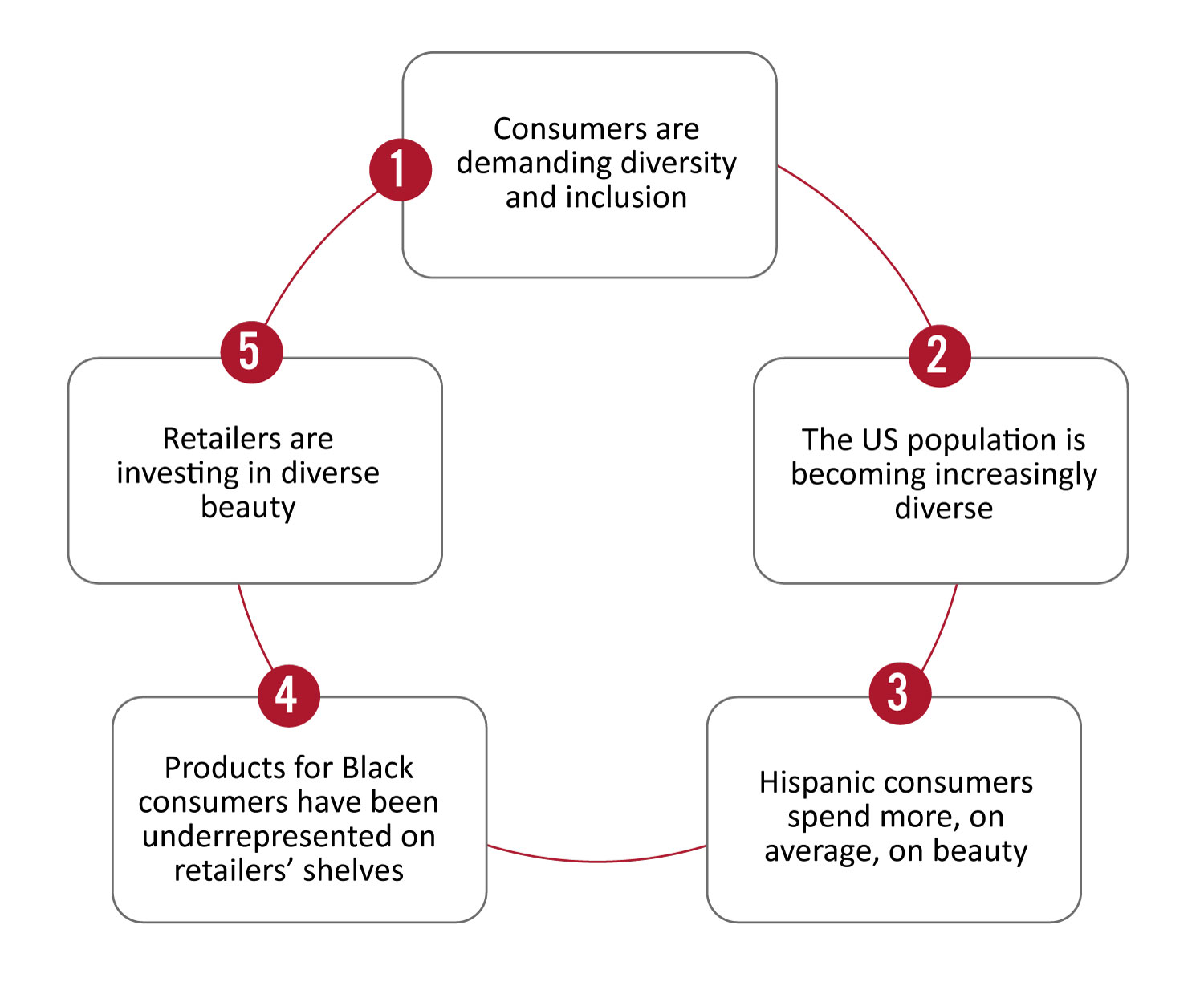

Market Drivers We identify five key trends that are driving opportunities for beauty brands and retailers to tap underrepresented races and ethnicities. We present these drivers in Figure 1 and discuss them in detail below, with examples of brand launches in each area.Figure 1. Inclusive Beauty: Five Drivers of Race Diversity in Beauty [caption id="attachment_143972" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Consumers Are Demanding Diversity and Inclusion

The social unrest during 2020 generated worldwide conversations on social justice and racial equality, helping to provide transformative and lasting changes across the industry. Consumers are demanding that brands be inclusive, transparent and representative of consumers. They are seeking organizations to not only produce products that reflect them, but that also represent them internally. This was seen through two Instagram campaigns as part of the Black Lives Matter movement:

Source: Coresight Research[/caption]

1. Consumers Are Demanding Diversity and Inclusion

The social unrest during 2020 generated worldwide conversations on social justice and racial equality, helping to provide transformative and lasting changes across the industry. Consumers are demanding that brands be inclusive, transparent and representative of consumers. They are seeking organizations to not only produce products that reflect them, but that also represent them internally. This was seen through two Instagram campaigns as part of the Black Lives Matter movement:

- The “15 Percent Pledge” created by Aurora James, Creative Director and Founder of luxury accessories brand Brother Vellies, on May 29, 2020, requires participating companies to commit to conducting an internal audit of their current spending power and contracts allocated to Black businesses, along with committing 15% shelf space to Black-owned brands.

- In June 2020, the“Pull Up or Shut Up” challenge was created to demand that big beauty companies reveal their corporate diversity metrics, as it was believed that they were promoting messages on social media that did not match their internal organizational structures.

Figure 2. US American Population, by Race, 2010 vs. 2020 (% of Population) [caption id="attachment_143992" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

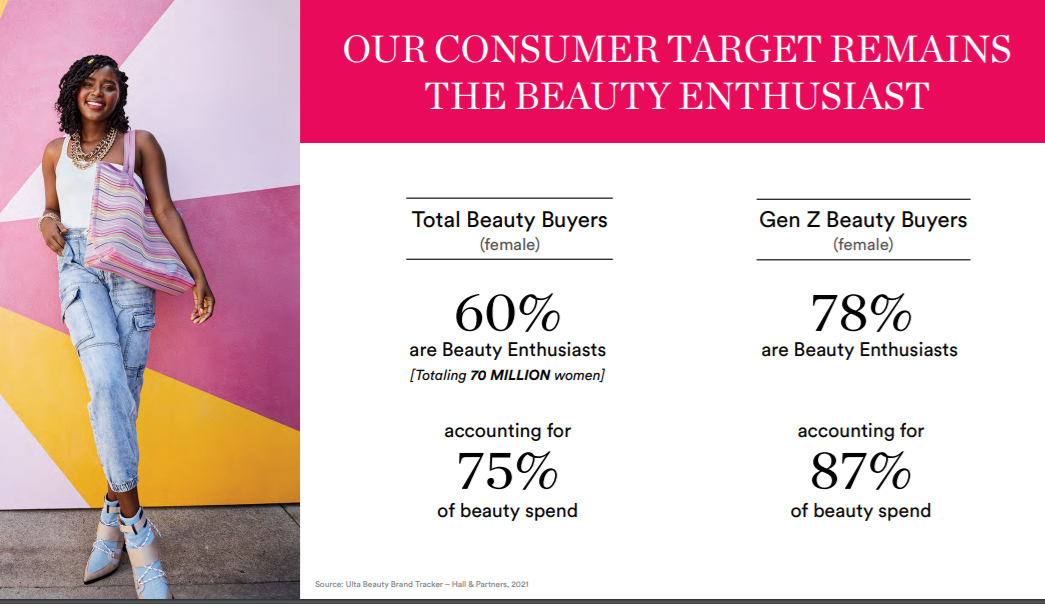

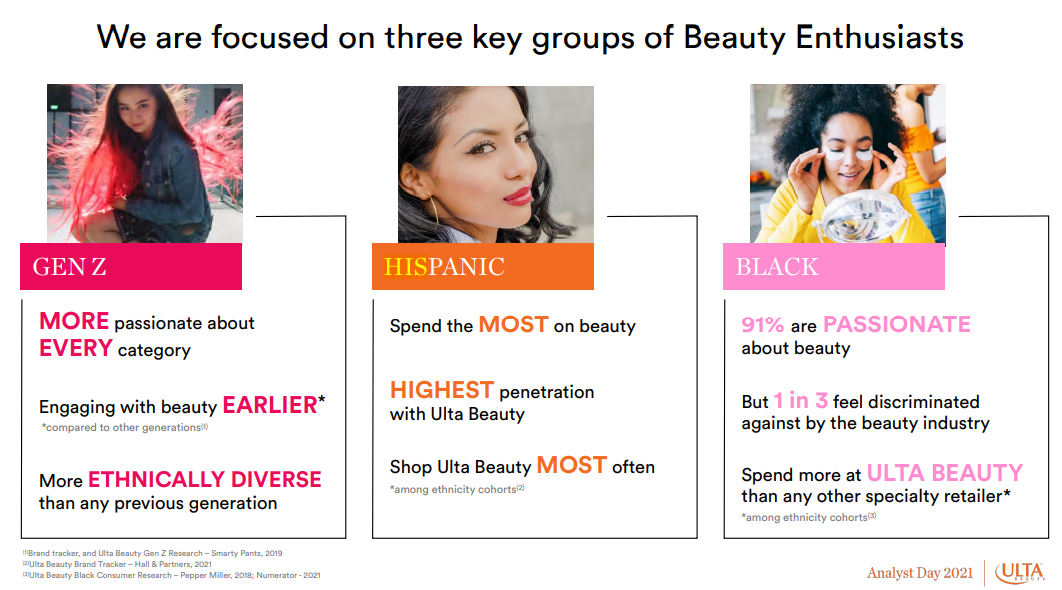

At Ulta Beauty’s Analyst Day in October 2021, management reported that it is focusing on beauty enthusiasts, consumers that are highly engaged with beauty and “live, breathe and love” beauty. These consumers see beauty as more than just a routine but a part of self-care and self-expression, and they seek joy and excitement in beauty. Ulta Beauty is targeting three key groups of beauty enthusiasts: Gen-Z, Hispanics and Blacks.

Source: US Census Bureau[/caption]

At Ulta Beauty’s Analyst Day in October 2021, management reported that it is focusing on beauty enthusiasts, consumers that are highly engaged with beauty and “live, breathe and love” beauty. These consumers see beauty as more than just a routine but a part of self-care and self-expression, and they seek joy and excitement in beauty. Ulta Beauty is targeting three key groups of beauty enthusiasts: Gen-Z, Hispanics and Blacks.

- Of its Gen Z beauty shoppers, 78% are beauty enthusiasts, accounting for 87% of beauty spending, according to the company. Management highlighted that Gen Z is the most racially diverse demographic, with almost 50% being non-white. They are influencing what beauty experiences and beauty purchases look like.

- The company believes there is a great opportunity with Black beauty enthusiasts, as 91% are “passionate” about beauty. But one in three of these consumers feels left out by the beauty industry; they are shaping beauty and looking for change, choosing carefully when it comes to brands and retailers, Ulta Beauty reported.

Ulta Beauty Analyst Day, October 2021

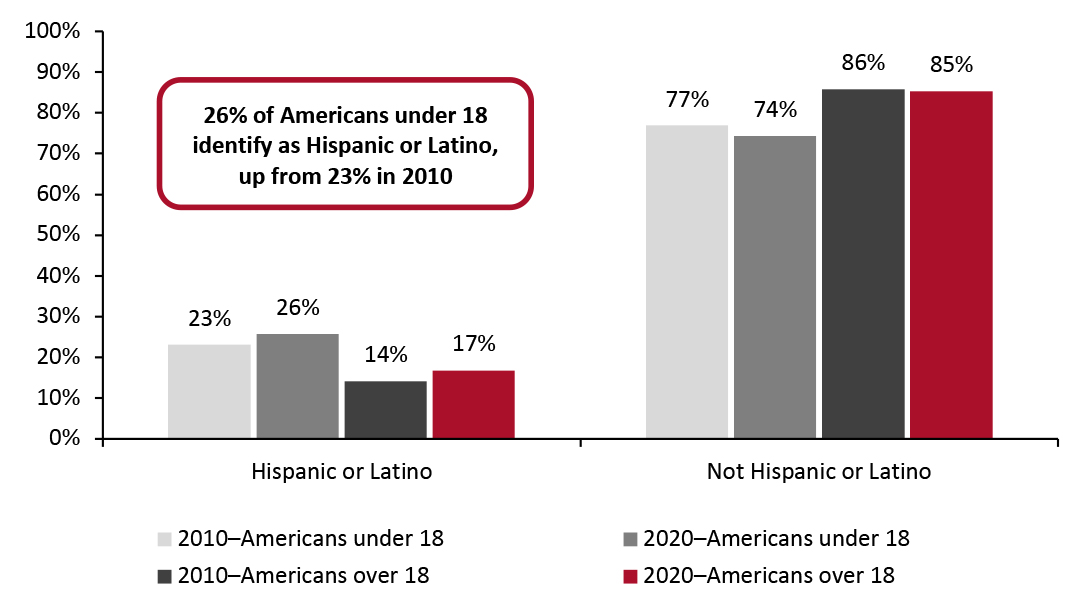

Ulta Beauty Analyst Day, October 2021 Source: Company reports [/caption] 3. Hispanic Consumers Spend More, on Average, on Beauty According to the 2020 US census, the Hispanic or Latino population grew from 50.5 million (16.3% of the US population) in 2010 to 62.1 million (18.7%) in 2020. As shown in Figure 3, 26% of consumers aged under 18 identify as Latino or Hispanic, up from 23% in 2010.

Figure 3. US American Population, Hispanic and Latino Population, 2010 and 2020 (% of Population) [caption id="attachment_143993" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

With nearly one-fifth of the population identifying as Hispanic or Latino and over one-quarter of Americans under the age of 18 being Hispanic or Latino, there are opportunities to represent the Hispanic and Latino beauty consumer, particularly as recent survey findings and beauty retailers report that Hispanic consumers spend more than the average consumer on beauty.

Source: US Census Bureau[/caption]

With nearly one-fifth of the population identifying as Hispanic or Latino and over one-quarter of Americans under the age of 18 being Hispanic or Latino, there are opportunities to represent the Hispanic and Latino beauty consumer, particularly as recent survey findings and beauty retailers report that Hispanic consumers spend more than the average consumer on beauty.

- At Ulta Beauty’s Analyst Day in October 2021, management reported that it is focusing on its Hispanic beauty enthusiasts, which total 75% of its beauty enthusiasts. They spend the most on beauty per person versus any other cohort.

- This is consistent with a report by NielsenIQ stating that in 2020, Hispanic consumers spent 13% more than the average consumer on beauty and personal care.

Ulta Beauty Analyst Day, December 2021

Ulta Beauty Analyst Day, December 2021 Source: Company reports [/caption] 4. Products for Black Consumers Have Been Underrepresented on Retailers’ Shelves Consumer demand for diversity and inclusion was a call to action for retailers. The demand for 15% shelf space for Black-owned brands represents the 15% of consumers who are Black; Black consumers are underrepresented in the beauty industry and there is an opportunity to provide products that meet their needs. Major retailers JCPenney, Macy’s, Nordstrom, Sephora, Target and Ulta Beauty launched 96 Black-owned brands across their portfolios between January 2021 and January 2022, across skincare, haircare, color cosmetics and fragrance. In Figure 4, we highlight 17 selected brands that feature in the assortment of at least two retailers; a full list of all 96 brands can be found in the appendix. Of the Black-owned brand launches across the major retailers, 36% specialize in skincare, 25% in haircare, 25% in color cosmetics, 9% in haircare and skincare, 3% in color cosmetics and skincare and 1% in fragrance. With increased category penetration and more diverse brand representation, we see the addition of more Black-owned brands supporting the overall inclusive beauty category’s double-digit growth.

Figure 4. Selected Black-Owned Beauty Brands at Major Retailers [wpdatatable id=1837 table_view=regular]

Source: Company reports 5. Retailers Are Investing in Diverse Brands As shown above, retailers made commitments in 2021 to add more Black-owned brands to shelves. Below, we highlight additional strategic initiatives and pledges that retailers are making to support diverse brands and founders. This helps demonstrate that the beauty industry is taking a long-term view to incorporating diversity into strategic goals, and their commitments are boosting diverse beauty brand representation.

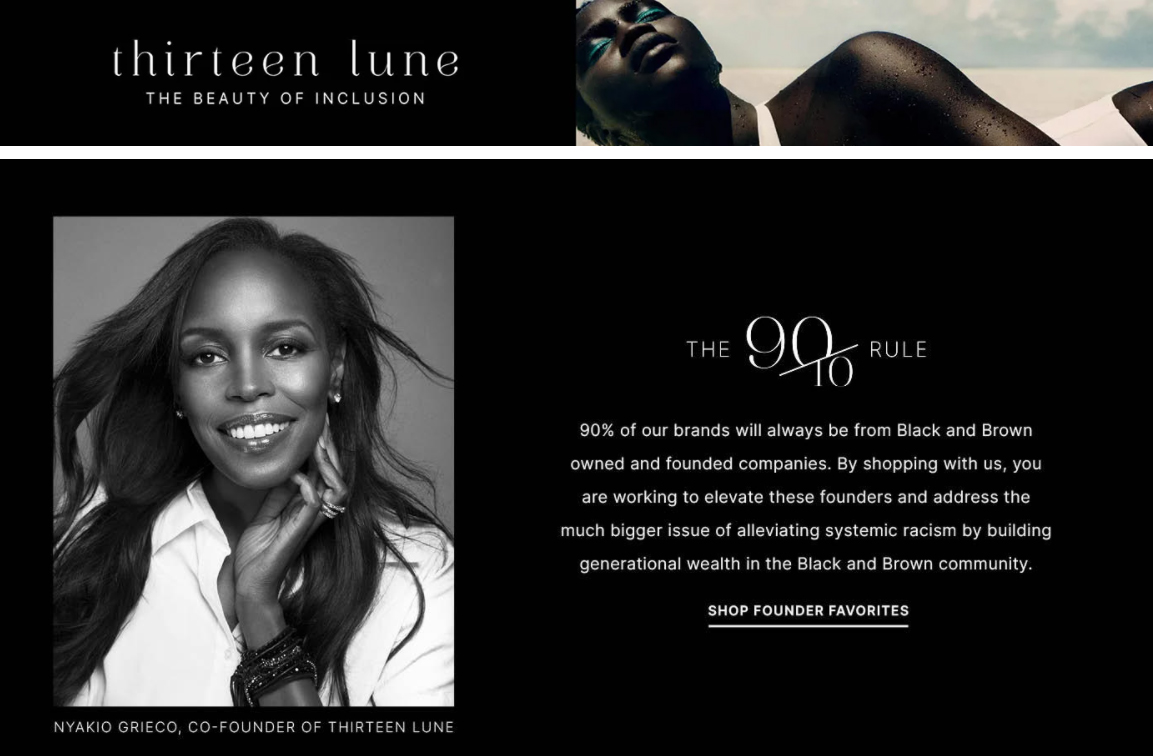

- JCPenney launches an e-commerce platform and shop-in-shop devoted to Black-founded brands.

Thirteen Lune e-commerce platform

Thirteen Lune e-commerce platform Source: Company website[/caption]

- Macy’s operates an incubator program for diverse and women-owned brands.

- Nordstrom announces plans to expand purchases from Black-owned companies by 10X by 2030.

- Sephora accelerates its brand incubator program focused on founders of color.

Sephora Black-Owned Beauty Guide on its website

Sephora Black-Owned Beauty Guide on its website Source: Company website[/caption]

- Target pledges to spend $2 billion on Black-owned suppliers by 2025.

Target Black-owned or founded brand seal

Target Black-owned or founded brand seal Source: Company website [/caption]

- Ulta Beauty awards grants to inspiring Black beauty recipients and shifts its strategic priorities.

What We Think

We expect that the inclusive beauty category, including beauty for diverse races and ethnicities, will become mainstream and will eventually not be treated as a separate category of focus. We expect the category to gain momentum in 2022 driven by several factors. First, retailers are adding more brands to their portfolios through strategic commitments and priorities. We also expect that the category will gain traction as new consumers begin spending on Black-owned brands. Finally, incubator programs and grants will also help to propel a new wave of beauty brands. As the younger population becomes increasingly diverse, we expect the beauty industry will focus more on discovering their needs and wants as well as developing and marketing products for this burgeoning consumer base. We expect that the beauty market for individuals of diverse races and ethnicities will continue growing in 2022 and beyond.Appendix

Appendix Figure 1. Black-Owned Beauty Brands at Major Retailers [wpdatatable id=1838 table_view=regular]

Source: Company reports About Coresight Research’s RESET Framework Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 2. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]