Nitheesh NH

Coresight Research x Salsify: What’s the Story?

The US e-commerce market continues to witness significant growth, primarily due to the recent consumer shift to online. We explore the ongoing shifts in the CPG industry, highlighting three key e-commerce trends and their implications for brands and retailers.

We discuss how CPG brands and retailers are responding to changes in consumer behavior and expectations, detailing the innovative e-commerce business models that are emerging in the industry—namely, the direct-to-consumer model, livestreaming, product sampling and the subscription model.

This report is sponsored by Salsify, a commerce experience management platform that helps brand manufacturers, distributors and retailers in over 80 countries collaborate to win on the digital shelf.

Impacts of the US E-Commerce Boom on CPG Brands and Retailers: In Detail

The US CPG E-Commerce Boom

Coresight Research expects US e-commerce sales to see mid-teens year-over-year growth in percentage terms in 2021, which comes on top of a strong, 33.2% increase in 2020. Even as they have returned to in-store shopping, US consumers have continued to up their online spend in the context of very strong total retail sales growth.

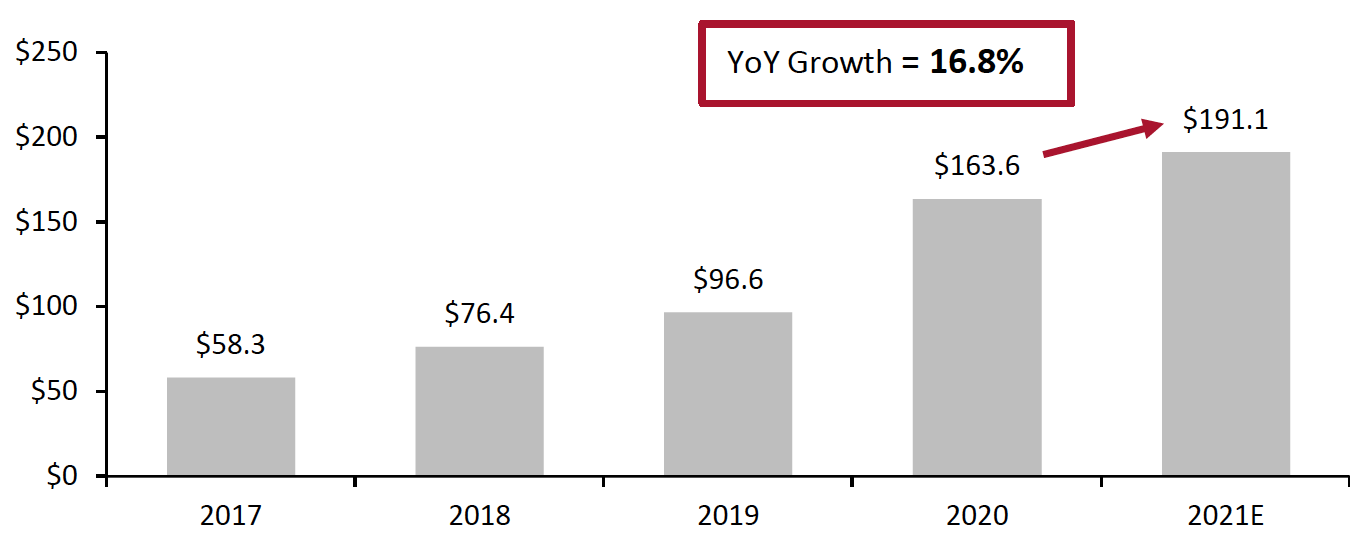

The CPG industry has contributed greatly to overall online sales growth, as consumers have shifted spending online in the previously store-focused category. The US CPG industry saw total online sales jump 69.3% year over year in 2020, reaching $163.6 billion, we estimate. With the resurgence of Covid-19 cases in the US and fear of the Delta variant causing shoppers to be wary of visiting physical stores, we expect US CPG e-commerce sales growth to continue in 2021. This is supported by findings from Coresight Research’s US online grocery survey conducted on April 1, 2021, which showed that over one-third of online grocery shoppers in the US do not expect to change their online shopping habits once the crisis eases or ends. However, compared to the boom in 2020, we expect a slower year-over-year growth rate of 16.8% in 2021, with sales set to total $191.1 billion (see Figure 1).

Figure 1. US CPG E-Commerce Sales (USD Bil.)

[caption id="attachment_135546" align="aligncenter" width="550"] Source: IRI E-Market Insights™/Coresight Research[/caption]

Source: IRI E-Market Insights™/Coresight Research[/caption]

Three Trends in US CPG E-Commerce

We present the three key digital trends in the US CPG e-commerce market, which we believe brands and retailers will need to adapt to in order to remain competitive.

1. Personalized Customer ExperiencesWell-executed digital personalization helps brands drive traffic—both online and offline—and deepen consumer engagement and loyalty. Personalization primarily involves understanding the consumer through real-time contextual data—including location, purchase history, browsing data and social media data—and using this to inform relevant personalized communication in real time.

CPG brands and retailers are extensively implementing advanced technologies such as artificial intelligence (AI) and machine learning (ML) to offer personalized experiences to consumers.

- Global CPG company Kimberly-Clark uses ML to analyze real-time consumer behavior to improve the effectiveness of digital promotions, as offers are personalized. The company uses data analytics to drive engagement and boost conversion rates.

- Glossier, a US-based beauty and skincare provider, launched AI chatbot “Glossy” in 2020 to offer personalized recommendations to users of the skincare products that would suit them best based on their individual skin type.

- Procter & Gamble (P&G) partnered with Google Cloud in 2020 to leverage AI and data analytics tools to gain actionable consumer insights, primarily for its two connected devices: Lumi by Pampers and the Oral-B iOS Series toothbrush system.

In a survey of CPG executives conducted by Salesforce and Harvard Business Review in December 2020, more than half of respondents (58%) reported that their companies will invest in customer data access over the next two years, 50% will invest in integrating customer data with other systems and 48% will implement AI in customer interactions—all of which support personalization strategies.

2. Faster and Cheaper DeliveryConsumers increasingly expect faster and cheaper delivery. According to our US online grocery survey, 42.7% of online grocery shoppers had used same-day shipping services (longer than two hours) in the past 12 months, while more than one-quarter had used two-hour delivery services.

We believe that retailers that offer rapid delivery options at low cost will win market share. Retailers are exploring many innovative ways to increase delivery speeds using technology:

- Safeway, supermarket chain of Albertsons, introduced remote-controlled driverless carts in March 2021 to deliver grocery orders to neighborhood homes. The autonomous delivery carts are designed and manufactured by Tortoise, a California-based software company. The electric vehicle is capable of delivering up to four lock-secured containers and can carry a total weight of 120 pounds, according to the company.

- Walmart is strengthening its partnership with DroneUp, an on-demand drone delivery startup, through capital investment. Walmart first partnered with DroneUp in 2020 to pilot drone delivery of at-home Covid-19 self-collection kits. In a press release published on June 17, 2021, John Furner, President and CEO at Walmart US, stated, “In our ongoing effort to get customers the items they want, and fast, we know it will take a well-coordinated network of delivery solutions that span the streets, sidewalks and skies.”

Coresight Research further explores innovative delivery strategies in our recent report, US Retailers Leverage Technology To Make the Last Mile a Competitive Advantage.

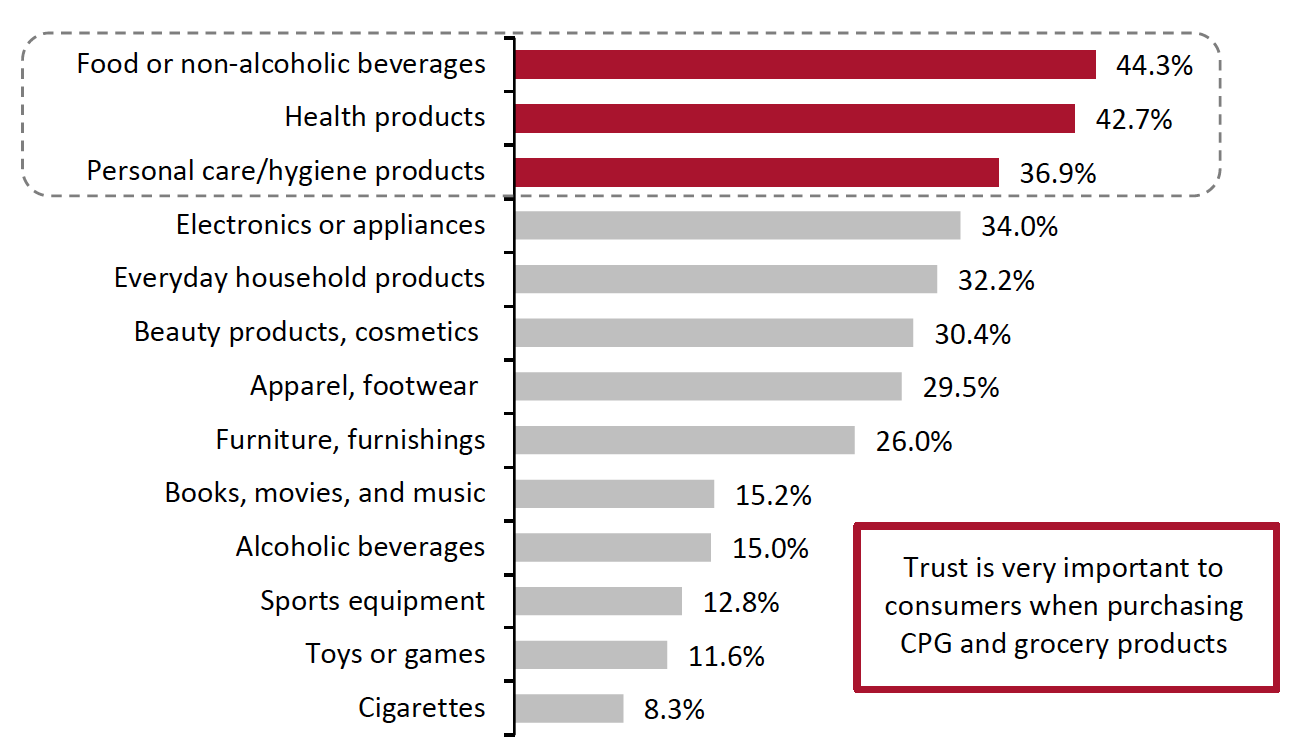

3. Consumer TrustTrust is important to shoppers in the new retail environment: According to a Coresight Research survey of US consumers conducted on June 28, 2021, the top three product categories where trust in retailers is “very important” to consumers are food, health and personal care/hygiene (see Figure 2).

Figure 2. Categories in Which Trust in a Retailer Is Very Important (% of Respondents)

[caption id="attachment_135547" align="aligncenter" width="550"] Base: 446 US respondents aged 18+; surveyed on June 28, 2021

Base: 446 US respondents aged 18+; surveyed on June 28, 2021Source: Coresight Research[/caption]

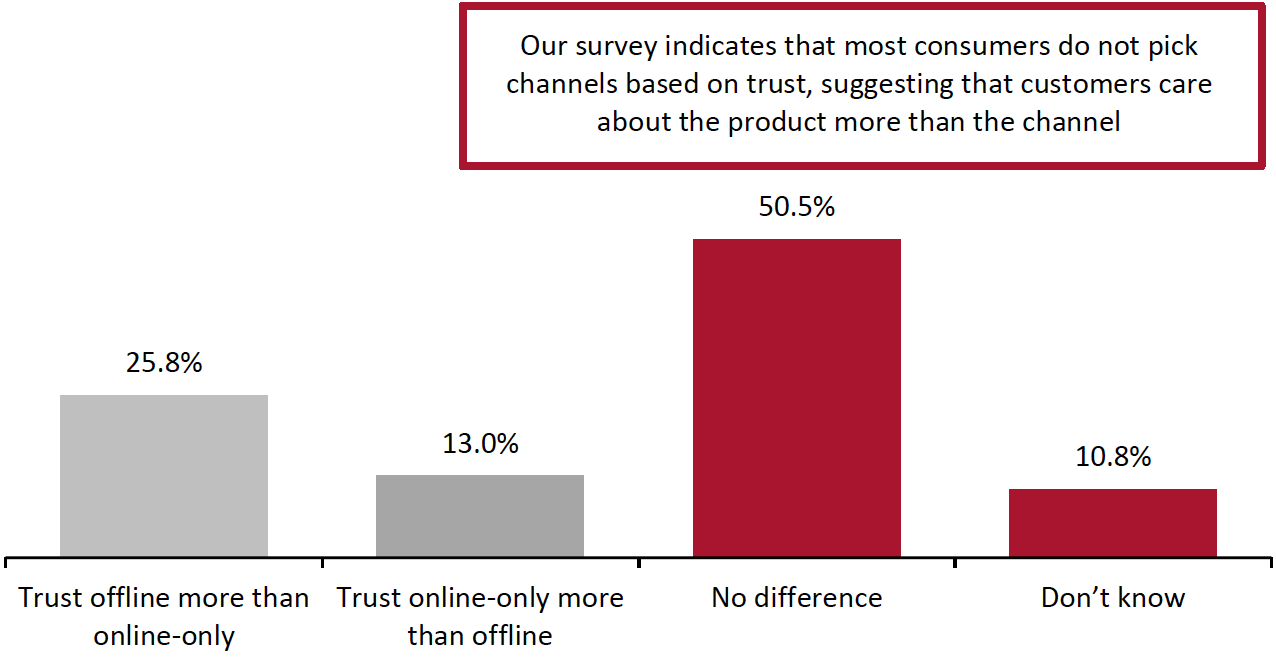

The majority of consumers make no distinction between channels when choosing a retailer to trust: According to our survey, over 60% of US consumers cited “no difference” or “don’t know” when asked about their trust in offline versus online-only retailers. However, more than one-quarter of US consumers trust offline retailers more than “online-only” retailers (see Figure 3).

Figure 3. Level of Trust Among US Consumers: Online-Only Retailers vs. Offline Retailers (% of Respondents)

[caption id="attachment_135548" align="aligncenter" width="550"] Base: 446 US respondents aged 18+, surveyed on June 28, 2021

Base: 446 US respondents aged 18+, surveyed on June 28, 2021Source: Coresight Research[/caption]

Given that shoppers can encounter products anywhere, brands and retailers must provide convenient, relevant and accurate information (descriptions, images and other detail) about available products all along the digital shelf. The digital shelf is the collection of multiple and constantly evolving digital touchpoints that are used by shoppers to engage with brands and discover, research and buy products. The digital shelf can include retailers’ websites, third-party e-commerce sites and mobile apps, as well as digital kiosks and other in-store displays.

Winning on the digital shelf requires ongoing efforts to optimize product pages and deliver differentiated experiences based on the shopper’s needs. To do this, retailers need technology to collect, centralize, list, enrich and publish the most updated product information across their assortment. Often, product data come from the brands themselves, which leverage third-party platforms to build a centralized, trusted source of information and automate the delivery of this information to every touchpoint along the digital shelf.

Below, we present two cases studies from US-based e-commerce software company Salsify that demonstrate how CPG brands and retailers are using technology to win on the digital shelf—specifically, Salsify’s commerce experience management platform.

- SMNutrition

SMNutrition, a digital-first nutritional supplement provider, needed to scale online with a small team. It had no standard process for updating content and no single source of truth for storing product data. After implementing the Salsify platform, the company was able to create clear and well-defined processes, routing all content updates and creative work for its online website through the workflow system to improve efficiency and conduct content audits more easily.

“Every process from a content-creation standpoint goes through a Salsify workflow. When we brought everything under one roof, and everything was in a single flow, efficiency skyrocketed," said Drew Lewis, COO of SMNutrition.

After two years with Salsify, SMNutrition more than doubled its gross revenue. The company now launches four new products every month and is expanding beyond the US—to the UK, Canada and four additional countries.

- Mars, Inc.

Mars, Inc. sells confectionery, pet food and other food products globally. Its specialty pet food division Royal Canin used Salsify technology to consolidate product data for its 5,000 SKUs (stock-keeping units) into a single source of truth—allowing it to deliver the right content to the right channel at the right time. The brand can access channel-specific versions of product content to ensure data quality and also support proper data governance.

Salsify’s automation features mean that Royal Canin’s digital content team can execute processes while streamlining its workflows and accelerating time to market for the brand’s pet food products. The brand has used Salsify’s PXM (Product Experience Management) platform to activate content across 16 channels— including Amazon, Costco, Chewy, Kroger and Sam’s Club—with product data validated against internal schemas to align with every retailer’s requirements and deliver brand consistency and content accuracy across channels.

Using the unified PXM platform has allowed Royal Canin to better control its brand messaging online, optimize its product content for each retailer—and their specific audience—and allowed the brand to scale its product experience easily.

CPG/Grocery Brands and Retailers: Innovative E-Commerce Business Models

CPG retailers and brands are adopting innovative strategies and re-inventing their online/digital business models to remain relevant to their existing consumers and gain new consumers. This section highlights some of the digital models that have gained popularity in the new retail world.

DTC Model

CPG brands are extensively adopting DTC e-commerce strategies, including Beyond Meat, Bimbo, Del Monte and PepsiCo.

- Alpha Foods, a California-based plant-based food provider, launched its DTC platform in November 2020 to take advantage of the growing market for plant-based products.

- In May 2020, PepsiCo launched two DTC websites for beverages and snacks—PantryShop.com and Snacks.com—to meet demand for at-home eating.

Source: Pantryshop.com/PepsiCo[/caption]

[caption id="attachment_135550" align="aligncenter" width="550"]

Source: Pantryshop.com/PepsiCo[/caption]

[caption id="attachment_135550" align="aligncenter" width="550"] Source: Snacks.com/PepsiCo[/caption]

Source: Snacks.com/PepsiCo[/caption]

The capability to quickly launch an online store and gain access to millions of potential customers is one of the biggest drivers of DTC growth over the past decade. We see three primary advantages of the DTC model for CPG brands and retailers:

- DTC allows CPG firms to own and control the supply chain, manage demand and maneuver the overall brand experience. It allows CPG companies to build direct relationships with customers through the use of first-party data.

- The use of customer data helps brands create personalized offers for their customers and strengthen brand loyalty.

- The DTC model helps increase margin on sales, as middlemen (including retailers and wholesalers) are eliminated from the supply chain.

Livestreaming

Livestreaming e-commerce combines entertainment and shopping, enabling consumers to discover and purchase products through real-time shoppable videos. The channel has already achieved great success in the China market, and it is now gaining popularity in the US market as well. We estimate that the US livestreaming e-commerce market will total $11 billion in 2021 and grow to $35 billion by 2024.

Beauty is one of the key sectors that have adopted livestreaming e-commerce in the US. Many beauty brands have been extending their digital offerings by establishing both one-to-one and one-to-many livestreaming services, often via their websites, to serve online shoppers.

- A dedicated beauty livestreaming platform, Newness, was launched in 2019. The platform is focused on building an authentic community among its creators, viewers and brand partners.

- Ulta Beauty entered into a partnership with livestreaming shopping app, Supergreat, in July 2021. Since the deal, the company has hosted multiple daily livestreams, and it has plans to further onboard multiple influencers to host more in future. In Ulta Beauty’s first week of livestreaming, each 30-minute Supergreat session received 700-1,000 viewers and 2,500 comments, according to Christine White, Head of Content and Media Strategy at Ulta Beauty.

- Livestreaming platform Shop LIT Live partnered with skincare brand Covey in July 2021. The brand’s two founders used livestreaming to promote their startup; they held Covey’s first livestream shopping event on Shop LIT Live on July 20, 2021.

Coresight Research has identified livestreaming e-commerce as one of the key trends to watch in retail. Read our full coverage of livestreaming for insights into the growth of the market—with a focus on the US and China—as well as recommendations and best practices for brands and retailers to develop winning livestreaming e-commerce strategies.

Product Sampling

CPG and grocery brands and retailers have been giving away free samples as a way to support new product launches and delight customers. For example, Cure Hydration, a US-based beverage brand, added free samples into Walmart’s curbside-pickup orders to increase its visibility among consumers. Other big brands and retailers that have implemented such strategies include General Mills, Kroger and Target. According to Jay Picconatto, Director at General Mills, curbside product sampling is something [the company “would not have even touched two years ago or 18 months ago, [but] store traffic plummeted last spring and retailers limited in-store demos.”

Subscription Model

Subscription services are becoming more prevalent in US retail. According to the Subscription Trade Association, there were more than 7,000 subscription box companies globally in 2019, and around 70% were based in the US; the global subscription business grew about 12% in 2020. In the CPG and grocery sectors, subscription businesses are concentrated in beauty, food and health and wellness categories, as products are purchased at regular intervals.

- Birchbox sends sample beauty products, personalized based on skin tone and hair type, to its subscribers for $15 per month. The subscription box is curated to serve as a channel for customers to purchase products from the Birchbox Shop, which offers more than 500 different beauty brands, including two in-house brands.

- Coca-Cola launched its Insiders Club subscription box in 2020, through which subscribers receive monthly subscription boxes of goodies for a membership fee of $45 per month.

Source: Birchbox.com[/caption]

Source: Birchbox.com[/caption]

What We Think

Today’s consumers expect the convenience of digital touchpoints when shopping, both in-store and online. Retailers are investing in innovative ways to engage with consumers through digital channels, which will continue to change the retail landscape as consumers have more choices of how, where and what to shop.

Implications for Brands and Retailers

- Customers demand relevant and accurate information on products. Brands and retailers should focus on providing this information to shoppers as a way to build trust among shoppers.

- Retailers should focus on improving omnichannel shopping experiences for customers and remove organizational silos that prevent a single view of customers. Shoppers expect a seamless integration between online and offline shopping channels. Building an automated way to collect, list and publish product information, sourced from suppliers, enables retailers to meet customer expectations.

- Changes in customer expectations have forced retailers to adopt innovative retail models in order to remain relevant and profitable. Brands must work with each retailer to understand the latest requirements and provide the most updated product information in order to support the shopping experience and meet consumer demand.

The information contained herein is based in part on data reported by IRI through its Market Advantage service for the Coresight Research x Salsify report on the US CPG sector, as interpreted solely by Coresight Research, Inc. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgment of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.