Nitheesh NH

The ICSC (International Council of Shopping Centers) brought together a few hundred retail real estate executives in Miami, Florida, to participate in dozens of sessions and roundtable discussions at its Retail Connections conference in late October.

More Services To Be Offered in Shopping Centers in the Next 10 Years, with Increased Customer Expectation for Experiences

Melina Cordero, MD of Retail Capital Markets at CBRE, opened the conference by looking ahead to the future of retail in 2030. Building on an emerging shift in today’s marketplace, Cordero posited that consumers will prioritize their spending less on transactional products and more on experiences. By 2030, the “retailization” trend may see nonretailers expand into retail spaces, changing the tenor of shopping centers’ offerings. From education to beauty, healthcare, gyms and wellness services, shopping centers will increasingly take on the complexion of their local communities and become a more vital part of culture and society, not just a location to transact commerce. This theme was echoed in multiple roundtable discussions and presentations.

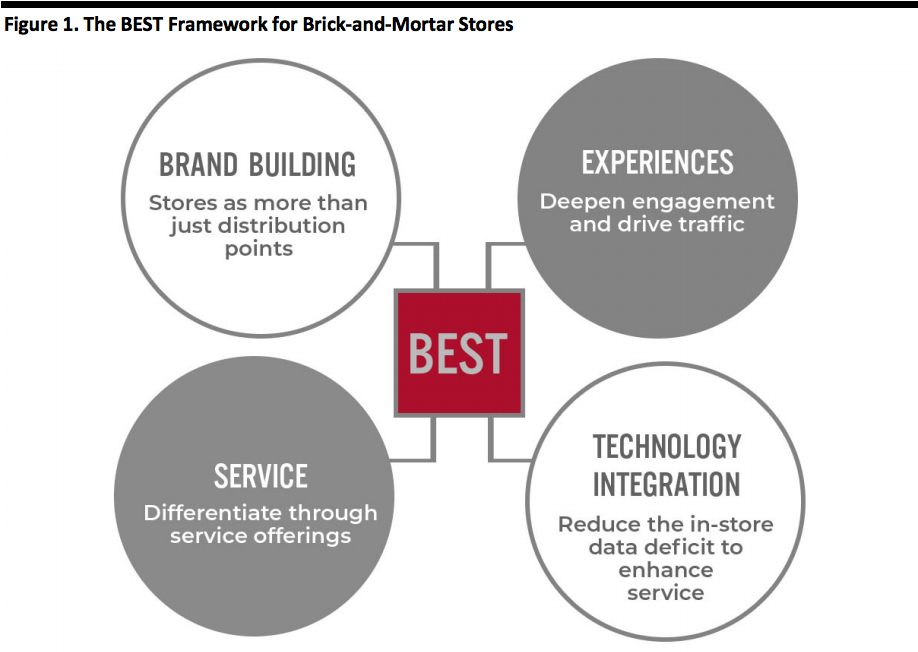

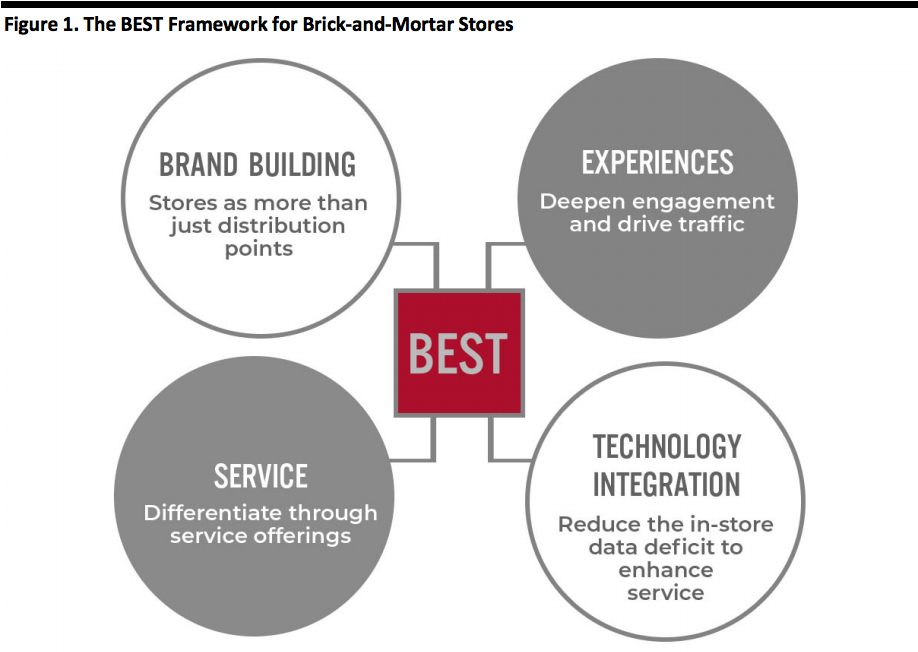

Cordero also emphasized that experience provides a competitive advantage for brands in physical retail, supporting a trend we outlined for 2019. According to our proprietary BEST framework—which was presented at the conference by Marie Driscoll, Head of US Research at Coresight Research—the nature of retail is changing as consumer preference transitions from products to services and experiences. The BEST framework is designed to help retailers strategize physical retail around four themes (see Figure 1): Brand Building, Experiences, Service and Technology Integration.

[caption id="attachment_100640" align="aligncenter" width="700"] Source: Coresight Research[/caption]

BEST-rated retailers and brands, such as Nike and Nordstrom, recognize that stores are brand houses and should be used for brand building and brand storytelling. It is important for brands to use physical retail as a touchpoint with consumers through which they can connect through brand values, as Gen Z and young millennial shoppers look for retailers whose values align with their own.

One such value is sustainability, which is increasingly becoming a focus for developers too. However, many ESG (Ethics, Social and Governance) and sustainability efforts are not customer facing. Brixmor Property Group confirmed that 25% of its investor deck is focused around sustainability. At the ICSC conference, one panel addressed the growing importance of sustainability in retail and real estate, highlighting the need for shopping-center tenants to commit alongside developers. This means that they would accept the additional costs that lower returns in the near term but save money and mitigate risk over time.

Sustainable packaging, energy savings, LEED (Leadership in Energy and Environmental Design) certification and initiatives to give back to the local community are some of the ways in which retailers and mall developers are looking to broaden sustainability/ESG strategies.

Valuation Metrics for Retail Real Estate Expected To Change

In order to reflect the evolving retail ecosystem in which more experiences and services are populating the shopping centers of the future, the metrics for valuing retail real estate are expected to fundamentally change. The conference highlighted that physical store metrics will evolve from a simplistic sales-per-square-foot measurement to a holistic view of what is happening in the store. This would cover brand marketing and discovery to traditional distribution-center activities and ultimately, the data exchange between landlord and tenants. Valuation metrics may also include consideration of proximate online sales and website costs.

[caption id="attachment_100641" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

BEST-rated retailers and brands, such as Nike and Nordstrom, recognize that stores are brand houses and should be used for brand building and brand storytelling. It is important for brands to use physical retail as a touchpoint with consumers through which they can connect through brand values, as Gen Z and young millennial shoppers look for retailers whose values align with their own.

One such value is sustainability, which is increasingly becoming a focus for developers too. However, many ESG (Ethics, Social and Governance) and sustainability efforts are not customer facing. Brixmor Property Group confirmed that 25% of its investor deck is focused around sustainability. At the ICSC conference, one panel addressed the growing importance of sustainability in retail and real estate, highlighting the need for shopping-center tenants to commit alongside developers. This means that they would accept the additional costs that lower returns in the near term but save money and mitigate risk over time.

Sustainable packaging, energy savings, LEED (Leadership in Energy and Environmental Design) certification and initiatives to give back to the local community are some of the ways in which retailers and mall developers are looking to broaden sustainability/ESG strategies.

Valuation Metrics for Retail Real Estate Expected To Change

In order to reflect the evolving retail ecosystem in which more experiences and services are populating the shopping centers of the future, the metrics for valuing retail real estate are expected to fundamentally change. The conference highlighted that physical store metrics will evolve from a simplistic sales-per-square-foot measurement to a holistic view of what is happening in the store. This would cover brand marketing and discovery to traditional distribution-center activities and ultimately, the data exchange between landlord and tenants. Valuation metrics may also include consideration of proximate online sales and website costs.

[caption id="attachment_100641" align="aligncenter" width="700"] Source: Coresight Research[/caption]

ICSC’s Study, Halo Effect II, Finds that Omnichannel Strategies Drive Consumer Spending.

The ICSC’s research team leaders—Jean Lambert, Vice President of Research, and Christopher Gerlach, Director of Research—presented the findings of the council’s Halo Effect II study, which investigated the synergistic effect of online and brick-and-mortar retail. The ICSC looked at $31 billion in transactions across seven retail categories over a three-year period (2016–2018). Halo events are when a customer makes a $100 online transaction followed by an in-store purchase at the same retailer within 15 days. For all retailers sampled, consumers spend $131 in store, for an average a net spend of $231. For halo events that begin with a $100 in-store purchase followed by an online transaction, the average net spend was an even higher, at $267. This underscores the importance of physical stores in the retail ecosystem as a driver for sales.

[caption id="attachment_100642" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

ICSC’s Study, Halo Effect II, Finds that Omnichannel Strategies Drive Consumer Spending.

The ICSC’s research team leaders—Jean Lambert, Vice President of Research, and Christopher Gerlach, Director of Research—presented the findings of the council’s Halo Effect II study, which investigated the synergistic effect of online and brick-and-mortar retail. The ICSC looked at $31 billion in transactions across seven retail categories over a three-year period (2016–2018). Halo events are when a customer makes a $100 online transaction followed by an in-store purchase at the same retailer within 15 days. For all retailers sampled, consumers spend $131 in store, for an average a net spend of $231. For halo events that begin with a $100 in-store purchase followed by an online transaction, the average net spend was an even higher, at $267. This underscores the importance of physical stores in the retail ecosystem as a driver for sales.

[caption id="attachment_100642" align="aligncenter" width="700"] Source: Coresight Research[/caption]

[caption id="attachment_100643" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

[caption id="attachment_100643" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Through the Halo Effect II study, the ICSC also discovered that discount department stores had the highest average share of in-store spending over the three-year period (96%) compared to online purchases. Meanwhile, digitally native brands that have a physical presence saw their shoppers make approximately 60% of purchases at the brick-and-mortar stores. Clearly, physical retail remains a significant influence in brand engagement, resulting in a higher likelihood that customer will make further incremental purchases.

Source: Coresight Research[/caption]

Through the Halo Effect II study, the ICSC also discovered that discount department stores had the highest average share of in-store spending over the three-year period (96%) compared to online purchases. Meanwhile, digitally native brands that have a physical presence saw their shoppers make approximately 60% of purchases at the brick-and-mortar stores. Clearly, physical retail remains a significant influence in brand engagement, resulting in a higher likelihood that customer will make further incremental purchases.

Source: Coresight Research[/caption]

BEST-rated retailers and brands, such as Nike and Nordstrom, recognize that stores are brand houses and should be used for brand building and brand storytelling. It is important for brands to use physical retail as a touchpoint with consumers through which they can connect through brand values, as Gen Z and young millennial shoppers look for retailers whose values align with their own.

One such value is sustainability, which is increasingly becoming a focus for developers too. However, many ESG (Ethics, Social and Governance) and sustainability efforts are not customer facing. Brixmor Property Group confirmed that 25% of its investor deck is focused around sustainability. At the ICSC conference, one panel addressed the growing importance of sustainability in retail and real estate, highlighting the need for shopping-center tenants to commit alongside developers. This means that they would accept the additional costs that lower returns in the near term but save money and mitigate risk over time.

Sustainable packaging, energy savings, LEED (Leadership in Energy and Environmental Design) certification and initiatives to give back to the local community are some of the ways in which retailers and mall developers are looking to broaden sustainability/ESG strategies.

Valuation Metrics for Retail Real Estate Expected To Change

In order to reflect the evolving retail ecosystem in which more experiences and services are populating the shopping centers of the future, the metrics for valuing retail real estate are expected to fundamentally change. The conference highlighted that physical store metrics will evolve from a simplistic sales-per-square-foot measurement to a holistic view of what is happening in the store. This would cover brand marketing and discovery to traditional distribution-center activities and ultimately, the data exchange between landlord and tenants. Valuation metrics may also include consideration of proximate online sales and website costs.

[caption id="attachment_100641" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

BEST-rated retailers and brands, such as Nike and Nordstrom, recognize that stores are brand houses and should be used for brand building and brand storytelling. It is important for brands to use physical retail as a touchpoint with consumers through which they can connect through brand values, as Gen Z and young millennial shoppers look for retailers whose values align with their own.

One such value is sustainability, which is increasingly becoming a focus for developers too. However, many ESG (Ethics, Social and Governance) and sustainability efforts are not customer facing. Brixmor Property Group confirmed that 25% of its investor deck is focused around sustainability. At the ICSC conference, one panel addressed the growing importance of sustainability in retail and real estate, highlighting the need for shopping-center tenants to commit alongside developers. This means that they would accept the additional costs that lower returns in the near term but save money and mitigate risk over time.

Sustainable packaging, energy savings, LEED (Leadership in Energy and Environmental Design) certification and initiatives to give back to the local community are some of the ways in which retailers and mall developers are looking to broaden sustainability/ESG strategies.

Valuation Metrics for Retail Real Estate Expected To Change

In order to reflect the evolving retail ecosystem in which more experiences and services are populating the shopping centers of the future, the metrics for valuing retail real estate are expected to fundamentally change. The conference highlighted that physical store metrics will evolve from a simplistic sales-per-square-foot measurement to a holistic view of what is happening in the store. This would cover brand marketing and discovery to traditional distribution-center activities and ultimately, the data exchange between landlord and tenants. Valuation metrics may also include consideration of proximate online sales and website costs.

[caption id="attachment_100641" align="aligncenter" width="700"] Source: Coresight Research[/caption]

ICSC’s Study, Halo Effect II, Finds that Omnichannel Strategies Drive Consumer Spending.

The ICSC’s research team leaders—Jean Lambert, Vice President of Research, and Christopher Gerlach, Director of Research—presented the findings of the council’s Halo Effect II study, which investigated the synergistic effect of online and brick-and-mortar retail. The ICSC looked at $31 billion in transactions across seven retail categories over a three-year period (2016–2018). Halo events are when a customer makes a $100 online transaction followed by an in-store purchase at the same retailer within 15 days. For all retailers sampled, consumers spend $131 in store, for an average a net spend of $231. For halo events that begin with a $100 in-store purchase followed by an online transaction, the average net spend was an even higher, at $267. This underscores the importance of physical stores in the retail ecosystem as a driver for sales.

[caption id="attachment_100642" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

ICSC’s Study, Halo Effect II, Finds that Omnichannel Strategies Drive Consumer Spending.

The ICSC’s research team leaders—Jean Lambert, Vice President of Research, and Christopher Gerlach, Director of Research—presented the findings of the council’s Halo Effect II study, which investigated the synergistic effect of online and brick-and-mortar retail. The ICSC looked at $31 billion in transactions across seven retail categories over a three-year period (2016–2018). Halo events are when a customer makes a $100 online transaction followed by an in-store purchase at the same retailer within 15 days. For all retailers sampled, consumers spend $131 in store, for an average a net spend of $231. For halo events that begin with a $100 in-store purchase followed by an online transaction, the average net spend was an even higher, at $267. This underscores the importance of physical stores in the retail ecosystem as a driver for sales.

[caption id="attachment_100642" align="aligncenter" width="700"] Source: Coresight Research[/caption]

[caption id="attachment_100643" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

[caption id="attachment_100643" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Through the Halo Effect II study, the ICSC also discovered that discount department stores had the highest average share of in-store spending over the three-year period (96%) compared to online purchases. Meanwhile, digitally native brands that have a physical presence saw their shoppers make approximately 60% of purchases at the brick-and-mortar stores. Clearly, physical retail remains a significant influence in brand engagement, resulting in a higher likelihood that customer will make further incremental purchases.

Source: Coresight Research[/caption]

Through the Halo Effect II study, the ICSC also discovered that discount department stores had the highest average share of in-store spending over the three-year period (96%) compared to online purchases. Meanwhile, digitally native brands that have a physical presence saw their shoppers make approximately 60% of purchases at the brick-and-mortar stores. Clearly, physical retail remains a significant influence in brand engagement, resulting in a higher likelihood that customer will make further incremental purchases.